false

0000081955

0000081955

2024-12-17

2024-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): December 17, 2024

RAND

CAPITAL CORPORATION

(Exact

Name of Registrant as Specified in Its Charter)

| New

York |

|

814-00235 |

|

16-0961359 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

1405

Rand Building, Buffalo, NY 14203

(Address

of Principal Executive Offices) (Zip Code)

(716)

853-0802

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.10 par value |

|

RAND |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

December 17, 2024, Rand Capital Corporation (the “Company”) began to send to its shareholders of record as of December 16,

2024 a notice regarding the election to be made by its shareholders in connection with the dividend announced by the Company on December

5, 2024 and payable by the Company on January 24, 2025 (the “Shareholder Notice”), along with the accompanying dividend election

form (the “Election Form”), copies of which are attached hereto as Exhibits 99.1 and 99.2, respectively.

The

information contained in this Current Report on Form 8-K, including the Shareholder Notice and Election Form, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section,

and shall not be incorporated by reference into any registration statement pursuant to the Securities Act of 1933, as amended.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

RAND

CAPITAL CORPORATION |

| |

|

|

| Date:

December 17, 2024 |

|

|

| |

|

|

| |

By:

|

/s/

Daniel Penberthy |

| |

Name: |

Daniel

Penberthy |

| |

Title: |

Chief

Executive Officer |

Exhibit 99.1

|

IMPORTANT

INFORMATION REGARDING CASH OR STOCK ELECTION IN CONNECTION WITH RAND CAPITAL CORPORATION’s

(Nasdaq: RAND) DIVIDEND PAYABLE ON JANUARY 24, 2025

Shareholders

can elect to receive cash or stock for Rand Capital Corporation’s Q4 2024 Dividend |

December

17, 2024

On

December 5, 2024, the Board of Directors of Rand Capital Corporation (“Rand”) declared a dividend of $4.20 per share (the

“Dividend”), which represents an aggregate dividend to shareholders of approximately $10.8 million. The Dividend will be

paid in the aggregate combination of 20% in cash and 80% in newly issued shares of our common stock on or about January 24, 2025 to shareholders

of record as of December 16, 2024.

Each

shareholder will have the right to elect to receive the Dividend in cash or shares of our common stock by completing and returning the

Election Form included with this notice. Only 20% of the total Dividend paid to all shareholders will be paid in cash. If after the shareholders

have completed their elections, the total portion of the Dividend to be paid to shareholders electing to receive cash exceeds 20% of

the total Dividend, each such shareholder electing to receive cash will receive a pro-ratable portion of the total cash to be distributed

and the remaining portion of the Dividend payable to such shareholders will be paid in our common stock.

Certain

Treasury regulations and Internal Revenue Service (the “IRS”) guidance provide that dividends paid by an entity that is treated

as a publicly offered regulated investment company for U.S. federal income tax purposes, such as us, that are payable in cash or in stock

at the election of a shareholder are taxable to the shareholder regardless of whether the dividend is paid in cash, stock or a combination

of both. Based on this guidance, for U.S. federal income tax purposes, the Dividend will generally be reported by us to the IRS as a

distribution taxable as a dividend, subject to certain amounts that may be reported as exempt from tax to the extent paid to a non-U.S.

shareholder as discussed below.

The

number of shares of our common stock to be issued to shareholders receiving all or a portion of the Dividend in shares of our common

stock will be based on the volume-weighted average price per share of our common stock on the Nasdaq Capital Market on December 11, 12

and 13, 2024, which was $22.301. As such, approximately 388,806 shares of common stock are expected to be issued by Rand pursuant

to the Dividend.

Enclosed

is an election form that you must complete and deliver to Continental Stock Transfer & Trust Company by 5:00 p.m., Eastern

Time, on January 7, 2025 (the “Election Deadline”).

Election

forms must be delivered on or before the Election Deadline to be effective. Shareholders who do not return a timely and properly completed

election form before the Election Deadline will be deemed to have made an election to receive all of the Dividend in cash, subject to

proration if the total amount of cash elected by all shareholders exceeds 20% of the total Dividend.

THE

ELECTION

You

may elect to receive the Dividend in the form of cash or shares of common stock by choosing one of the election options on the accompanying

Election Form, subject to the 20% limit on cash distributions described elsewhere in this notice:

| | ● | Cash

Election. You elect to receive payment of all of the Dividend in cash. |

| | ● | Stock

Election. You elect to receive payment of all of the Dividend in the form of shares of

our common stock. |

1

Source: FactSet

| Rand Capital Dividend Election Option |

December 17, 2024

Your

election may be limited by the cash limit described elsewhere in this notice, and you may not receive all cash to the extent these limits

require that a different allocation be made to you. We will pay cash in lieu of issuing any fractional shares of our common stock in

connection with the Dividend.

For

any given share of our common stock, an election with respect to the Dividend may be made only by the holder of record of that share

as of the close of business on December 16, 2024, which is the record date for the Dividend.

To

elect payment in cash or shares of common stock, you must complete and sign the enclosed Election Form and deliver it to Continental

Stock Transfer & Trust Company, the transfer agent, at the address below, no later than the Election Deadline. At any time before

the Election Deadline, you may change your election by timely delivery to the transfer agent of a properly completed and later-dated

Election Form.

If

you hold shares of Rand’s common stock through a bank, broker or nominee, please contact this bank, broker, or other nominee and

inform it of the election that it should make on your behalf. If you do not (or your bank, broker, or other nominee does not on your

behalf) timely return a properly completed Election Form by the Election Deadline, you will have been deemed to have made an election

to receive your Dividend in cash, subject to proration if the total amount of cash elected by all shareholders exceeds 20% of the total

Dividend.

The

method of delivery of the Election Form to Continental Stock Transfer & Trust Company, the transfer agent, is at your option and

risk, and the delivery will be deemed made only when actually received by the transfer agent. In all cases, sufficient time should be

allowed to ensure timely delivery. The submission of an Election Form with respect to the Dividend will constitute your representation

and warranty that you have full power and authority to make such election.

All

questions as to the validity, form, eligibility (including time of receipt) and acceptance by us of the Election Form will be resolved

by us, in our sole discretion and our determination as to the resolution of any such questions shall be final and binding on all parties.

We reserve the absolute right to reject, in our sole discretion, any and all Election Forms determined by us not to be in proper form,

not timely received, ineligible or otherwise invalid or the acceptance of which may, in the opinion of our counsel, be unlawful. We also

reserve the absolute right to waive any defect or irregularity in the Election Form submitted by any particular shareholder, whether

or not similar defects or irregularities are waived in the case of other shareholders. No valid election will be deemed to have been

made until all defects and irregularities have been cured or waived to our satisfaction. Neither we, nor the transfer agent, nor any

other person will be under any duty to give notification of any defects or irregularities in any Election Form or incur any liability

for failure to give any such notification. Our interpretation of the terms and conditions of the Dividend will be final and binding.

All

shares of common stock issued as part of the Dividend will be issued only in book-entry form for registered shareholders. As soon as

administratively possible after the payment date for the Dividend, the transfer agent will issue and mail to each of our shareholders

of record that is a recipient of shares of our common stock in the Dividend a statement listing the number of shares of our common stock

credited to such shareholder’s book-entry account and a payment check or direct deposit for any cash to which such shareholder

is entitled.

For

each of those shareholders who holds through a bank, broker, or other nominee, the shares of our common stock and cash to which such

shareholder is entitled will be delivered by the transfer agent through The Depository Trust Company to such shareholder’s bank,

broker, or other nominee. The bank, broker or other nominee will then allocate the shares and cash into such shareholder’s individual

account.

| Rand Capital Dividend Election Option |

December 17, 2024

Completed

Election Forms must be delivered to our transfer agent, Continental Stock Transfer & Trust Company, no later than 5:00 p.m., Eastern

Time, on January 7, 2025, in the enclosed envelope in accordance with the following delivery instructions:

By

Regular Mail, Overnight Courier or Hand Delivery:

Continental

Stock Transfer & Trust Company

ATTN: HENRY FARRELL

1 State Street, 30th Floor

New

York, N.Y. 10004

If

you are a shareholder of record and need additional information about completing the attached Election Form or other matters relating

to the Dividend, please contact Continental Stock Transfer & Trust Company by phone at 212.509.4000, or by email at cstmail@continentalstock.com,

or online at https://www.continentalstock.com/contact/.

EFFECT

OF CASH LIMIT

The

total amount of cash payable for the Dividend is limited to 20% of the aggregate amount of the total Dividend, not including any cash

payments in lieu of fractional shares. If a sufficient number of shareholders elect to receive their Dividend in the form of common stock,

all shareholders who elect cash will receive their entire Dividend in cash in accordance with their election.

However,

if satisfying all shareholder elections would result in the payment of cash in excess of the 20% cash limit, then the total amount of

cash will be allocated on a pro rata basis among those shareholders who elected to receive cash. As a result, if you elect to receive

the Dividend in the form of cash, you likely will not receive the entire Dividend in the form of cash. Instead, you will receive a portion

of the Dividend to which you are entitled in cash and the remainder of the Dividend in excess of a shareholder’s pro rata share

of the total amount of cash to be distributed in the Dividend will be paid in the form of shares of our common stock (subject to the

payment of cash in lieu of any fractional shares). If you elect to receive cash, in no event will you receive less than 20% of your aggregate

Dividend in cash.

All

cash payments to which a shareholder may be entitled will be rounded to the nearest penny. The number of shares of our common stock to

be issued to shareholders receiving all or a portion of the Dividend in shares of our common stock will be based on the volume-weighted

average price per share of our common stock on the Nasdaq Capital Market on December 11, 12 and 13, 2024.

U.S.

FEDERAL INCOME TAXATION CONSIDERATIONS

The

following summary of U.S. federal income tax considerations regarding the Dividend is based on current law and is for general information

only and is not tax advice. This discussion does not purport to deal with all aspects of taxation that may be relevant to particular

holders of our common stock in light of their personal investment or tax circumstances.

U.S.

Federal Income Tax Consequences of the Dividend

For

purposes of the following discussion, a U.S. shareholder is a beneficial owner of our common stock who, for U.S. federal income tax purposes,

is:

| | ● | a

citizen or resident of the United States; |

| Rand Capital Dividend Election Option |

December 17, 2024

| | ● | a

corporation or other entity taxable as a corporation created or organized in or under the

laws of the United States or of any state or under the laws of the District of Columbia; |

| | ● | an

estate, the income of which is subject to U.S. federal income taxation regardless of its

source; or |

| | ● | a

trust (a) whose administration is under the primary supervision of a U.S. court and with

respect to which one or more U.S. persons have the authority to control all substantial decisions

of the trust or (b) that has in force a valid election (under applicable Treasury Regulations)

to be treated as a U.S. person. |

A

“non-U.S. shareholder” is a beneficial owner of our common stock who is neither a U.S. shareholder nor a partnership for

U.S. federal income tax purposes (including an entity or arrangement treated as a partnership for U.S. federal income tax purposes).

If

a partnership (including an entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our common stock,

the U.S. federal income tax treatment of a partner of the partnership generally will depend upon the status of the partner, the activities

of the partnership and certain determinations made at the partner level. Partnerships holding our common stock, and persons holding interests

in such partnerships, should each consult their own tax advisors.

The

tax consequences of the Dividend will depend on a shareholder’s particular tax circumstances. Holders of our common stock are urged

to consult their tax advisors regarding the specific federal, state, local, and non-U.S. income and other tax consequences of the Dividend.

Taxation

of United States Shareholders

Distributions

we pay to U.S. shareholders from our ordinary income or from an excess of net short-term capital gain over net long-term capital loss

(together referred to hereinafter as “ordinary income dividends”) are generally taxable to shareholders as ordinary income

to the extent of our earnings and profits. Provided that certain holding period and other requirements are met, such distributions (if

properly reported by us) may qualify (i) for the dividends received deduction available to corporations, but only to the extent that

our income consists of dividend income from U.S. corporations and (ii) in the case of individual shareholders, as qualified dividend

income eligible to be taxed at long-term capital gain rates to the extent that we receive qualified dividend income (generally, dividend

income from taxable domestic corporations and certain qualified foreign corporations).

Distributions

made to a U.S. shareholder from an excess of net long-term capital gain over net short-term capital loss (“capital gain dividends”),

are taxable as long-term capital gain if they have been properly reported by us, regardless of the length of time the shareholder has

owned our common stock. Generally, following the end of each taxable year, shareholders will be provided with a written notice of the

amount of any ordinary income dividends and capital gain dividends or other distributions. Distributions in excess of our earnings and

profits will first reduce the adjusted tax basis of the shareholder’s shares and, after the adjusted tax basis is reduced to zero,

will constitute capital gain to the shareholder (assuming the shares are held as a capital asset).

Each

U.S. shareholder will receive a blank IRS Form W-9 along with this notice. All U.S. shareholders should provide a completed copy of IRS

Form W-9 when submitting the Election Form. Failure to provide a completed copy of the IRS Form W-9 may result in backup withholding

with respect to the Dividend at a rate of 24%. A U.S. shareholder will be subject to backup withholding if such U.S. shareholder is not

otherwise exempt and such U.S. shareholder:

| | ● | fails

to furnish the U.S. shareholder’s taxpayer identification number (“TIN”),

which, for an individual, ordinarily is his or her social security number; |

| | ● | furnishes

an incorrect TIN; |

| Rand Capital Dividend Election Option |

December 17, 2024

| | ● | is

notified by the IRS that the U.S. shareholder has failed properly to report payments of interest

or dividends; or |

| | ● | fails

to certify, under penalties of perjury, on an IRS Form W-9 (Request for Taxpayer Identification

Number and Certification) or a suitable substitute form (or other applicable certificate),

that the U.S. shareholder has furnished a correct TIN and that the IRS has not notified the

U.S. shareholder that the U.S. shareholder is subject to backup withholding. |

U.S.

shareholders should consult their tax advisors regarding their qualification for an exemption from backup withholding and the procedures

for obtaining such an exemption, if applicable. Backup withholding is not an additional tax, and taxpayers may use amounts withheld as

a credit against their U.S. federal income tax liability or may claim a refund if they timely provide certain information to the IRS.

Taxation

of Non-United States Shareholders

In

general, distributions of our “investment company taxable income” to non-U.S. shareholders generally are subject to withholding

of U.S. federal tax at a 30% rate (or lower rate provided by an applicable treaty) to the extent of our current or accumulated earnings

and profits unless an applicable exception applies. However, no withholding will be required with respect to such distributions if (i)

the distributions are properly reported to shareholders as “interest-related dividends” or “short-term capital gain

dividends,” (ii) the distributions are derived from sources specified in the Internal Revenue Code of 1986, as amended (the “Code”)

for such dividends and (iii) certain other requirements are satisfied. No assurance can be provided that any of our distributions will

qualify for this exemption. If such distributions are effectively connected with the conduct of a trade or business in the United Stated

(a “U.S. trade or business”) by the non-U.S. shareholder (and, if a treaty applies, are attributable to a permanent establishment

maintained in the United States by the non-U.S. shareholder), we will not be required to withhold U.S. federal tax if the non-U.S. shareholder

complies with applicable certification and disclosure requirements, although the distributions will be subject to U.S. federal income

tax at the rates applicable to U.S. persons. Special certification requirements apply to a non-U.S. shareholder that is a foreign partnership

or a foreign trust, and such entities are urged to consult their own tax advisers.

Distributions

of our net capital gains to a non-U.S. shareholder if properly reported by us as capital gain dividends will not be subject to U.S. federal

income tax unless the distributions are effectively connected with a U.S. trade or business of the non-U.S. shareholder (and, if an income

tax treaty applies, are attributable to a permanent establishment maintained by the non-U.S. shareholder in the United States) or, in

the case of an individual, the non-U.S. shareholder was present in the United States for 183 days or more during the taxable year and

certain other conditions are met.

The

amount of distributions that the we pay to any non-U.S. shareholder will be reported to the non-U.S. shareholder and to the IRS annually

on an IRS Form 1042-S, regardless of whether any tax was actually withheld. Copies of these information returns may also be made available

under the provisions of a specific income tax treaty or agreement to the tax authorities of the country in which the non-U.S. shareholder

resides. However, a non-U.S. shareholder generally will not be subject to backup withholding and certain other information reporting

with respect to the Dividend, provided that we do not have actual knowledge or reason to know that such non-U.S. shareholder is a “United

States person,” within the meaning of the Code, and the non-U.S. shareholder has established that it is a non-U.S. shareholder

or otherwise established an exemption from backup withholding. A non-U.S. shareholder generally will be entitled to credit any amounts

withheld under the backup withholding rules against the non-U.S. shareholder’s U.S. federal income tax liability or may claim a

refund provided that the required information is furnished to the IRS in a timely manner. Enclosed with this notice for each non-U.S.

shareholder is a copy of a blank IRS Form W-8BEN and Form W-8BEN-E. Each non-U.S. shareholder should provide a completed copy of the

appropriate Form W-8BEN, W-8BEN-E, or other appropriate Form W-8 when submitting the Election Form.

| Rand Capital Dividend Election Option |

December 17, 2024

Legislation

commonly referred to as the “Foreign Account Tax Compliance Act” of the “FATCA,” generally imposes a 30% withholding

tax on payments of certain types of income to foreign financial institutions (“FFIs”) unless such FFIs either (i) enter into

an agreement with the U.S. Treasury to report certain required information with respect to accounts held by certain specified U.S. persons

(or held by foreign entities that have certain specified U.S. persons as substantial owners) or (ii) reside in a jurisdiction that has

entered into an intergovernmental agreement (“IGA”) with the United States to collect and share such information and are

in compliance with the terms of such IGA and any enabling legislation or regulations. The types of income subject to the tax include

U.S. source interest and dividends. While the Code would also require withholding on payments of the gross proceeds from the sale of

any property that could produce U.S. source interest or dividends, the U.S. Treasury Department has indicated its intent to eliminate

this requirement in subsequent proposed regulations, which state that taxpayers may rely on the proposed regulations until final regulations

are issued. The information required to be reported includes the identity and taxpayer identification number of each account holder that

is a specified U.S. person and financial information associated with the holder’s account. In addition, subject to certain exceptions,

this legislation also imposes a 30% withholding on certain payments to certain foreign entities that are not FFIs unless the foreign

entity certifies that it does not have a greater than 10% owner that is a specified U.S. person or provides the withholding agent with

identifying information on each greater than 10% owner that is a specified U.S. person. Depending on the status of a beneficial owner

and the status of the intermediary through which it holds our common stock, a beneficial owner could be subject to this 30% withholding

tax with respect to dividends with respect to our common stock. Under certain circumstances, a non-U.S. shareholder might be eligible

for refunds or credit of such taxes.

Non-U.S.

shareholders should consult their own tax advisors with respect to the U.S. federal income tax and withholding tax consequences of the

Dividend in light of their own unique circumstances.

This

summary is general in nature and was not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding

penalties that may be imposed on the taxpayer. Each shareholder should seek advice based on such shareholder’s particular circumstances

from an independent tax advisor.

Where

You Can Find More Information

We

file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the

“SEC”). The SEC maintains a website that contains reports, proxy and information statements, and other information regarding

issuers that file electronically with the SEC, including us, that is available over at http://www.sec.gov. This information is

also available on our website at www.randcapital.com.

Exhibit

99.2

RAND

CAPITAL CORPORATION

DIVIDEND

ELECTION FORM

You

may elect to receive the Dividend, payable on January 24, 2025, in the form of cash or shares of common stock of Rand Capital Corporation

by returning this Dividend Election Form. Prior to making an election, please read carefully and in its entirety the accompanying notice

from Rand Capital Corporation, dated December 17, 2024, as all elections are subject to the terms of the Dividend as described in the

accompanying notice. Your election must be made by returning this Dividend Election Form to Continental Stock Transfer & Trust

Company by 5:00 P.M. Eastern Time on January 7, 2025. If you do not timely and properly make an election, you will be deemed not

to have made an election.

The

actual proportion of shares or cash you receive in the Dividend may be different than what you elect on this Dividend Election Form.

Your Dividend distribution will be dependent upon the pro-rata allocation that results from the combined elections of all shareholders

and is subject to the 20% cash limitation on the Dividend (each as described in greater detail in the accompanying notice).

Please

complete, sign, and date this Dividend Election Form in blue or black ink, by making a check mark or “X” in one of the boxes

provided below and return it in the enclosed self-addressed envelope to Continental Stock Transfer & Trust Company, 1 State Street,

30th Floor, New York, N.Y. 10004, ATTN: HENRY FARRELL.

You

may check ONLY one election. The number of shares of common stock of Rand Capital Corporation that are held in your account

as of the close of business on December 16, 2024, the record date for the Dividend, is indicated below.

THIS

DIVIDEND ELECTION FORM IS VALID ONLY WHEN COMPLETED, SIGNED, DATED AND RETURNED TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY BY

5:00 P.M. EASTERN TIME ON JANUARY 7, 2025.

DIVIDEND

ELECTION FORM

RAND

CAPITAL CORPORATION

| Option

1 |

|

Option

2 |

| |

|

|

| ☐

CASH ELECTION: I ELECT TO RECEIVE THE DIVIDEND ALL IN CASH, SUBJECT TO PRORATION IF THE TOTAL AMOUNT OF CASH ELECTED BY SHAREHOLDERS

EXCCEEDS THE 20% CASH LIMITATION |

|

☐

STOCK ELECTION: I ELECT TO RECEIVE THE DIVIDEND ALL IN SHARES OF RAND CAPITAL COMMON STOCK (INCLUDING CASH IN LIEU OF FRACTIONAL

SHARES OF COMMON STOCK) |

| |

|

|

| ACCOUNT

NUMBER: |

|

NUMBER

OF SHARES HELD: |

THIS

DIVIDEND ELECTION FORM IS VALID ONLY WHEN COMPLETED, SIGNED, DATED AND RETURNED TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY BY

5:00 P.M. EASTERN TIME ON JANUARY 7, 2025.

IF

YOU DO NOT TIMELY RETURN A PROPERLY COMPLETED ELECTION FORM YOU WILL BE DEEMED TO HAVE ELECTED TO RECEIVE THE DIVIDEND ALL IN CASH (SUBJECT

TO PRORATION IF THE TOTAL AMOUNT OF CASH ELECTED BY SHAREHOLDERS EXCEEDS THE 20% CASH LIMITATION)

Signature:

__________________________ Co-Owner Signature:___________________________________

Date:

________________, 202_

Note:

Please sign exactly as name(s) appear(s) hereon. Joint owners should each sign. When signing as an attorney, executor, administrator,

corporate officer, trustee, guardian, or custodian, please state your title.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

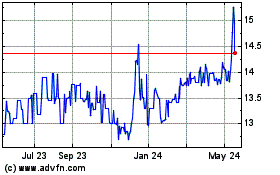

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Dec 2024 to Jan 2025

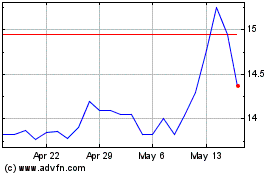

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Jan 2024 to Jan 2025