The Typical Homebuyer Pays Roughly 2% Less than the List Price–The Biggest Discount in 2 Years

February 12 2025 - 7:00AM

Business Wire

Redfin reports many listings are selling for

under asking price, and most are lingering on the market. Florida

homebuyers are seeing the biggest discount.

(NASDAQ: RDFN) — Today’s average home listing is selling for

under its asking price, and taking a long time to sell, according

to a new report from Redfin (redfin.com), the technology-powered

real estate brokerage. While that’s not ideal for sellers, it’s

good news for homebuyers who have been grappling with high housing

costs and a shortage of inventory.

Redfin data as of January shows that nationwide, buyers may have

more room for negotiation than they have in several years:

- The typical U.S. home is selling for 1.8% less than its asking

price, the biggest discount in nearly two years.

- The typical home that sells is taking 56 days to go under

contract, the longest span in nearly five years.

- More than half (56%) of listings are sitting on the market for

at least 60 days without going under contract, roughly the same

share during this time of year in 2023 and 2024. That’s down from

the prior month, when 61% of listings were on the market for at

least 60 days–the highest share in five years.

Today’s housing market is slow mostly because it’s so expensive

to buy a home. The average 30-year mortgage rate was 6.96% in

January. That’s down from the two-decade high of 7.62% hit in 2023,

but remains well above the 3% to 5% rates that were common before

and during the pandemic. The median U.S. home-sale price is up 4%

year over year; together, high prices and rates have pushed the

typical homebuyer’s monthly payment near record highs. Political

and economic uncertainty is another reason some would-be buyers are

pumping the brakes.

The upside of a slow market is that buyers have an opportunity

to negotiate on price and terms for certain homes. Redfin agents in

some parts of the country report that it feels like a buyer’s

market, with sellers of homes that have been sitting on the market

for a few weeks open to lowering the price.

Other Redfin agents note that while the pool of unsold inventory

is growing and many homes are selling for under asking price, that

doesn’t necessarily mean buyers have a big pool of desirable homes

to choose from.

“More listings are hitting the market, but they’re not always

the type of home buyers want and need,” said Charles Wheeler, a

Redfin Premier agent in San Diego. “The listings lingering on the

market tend to be in unpopular neighborhoods, or require

renovation. Relatively affordable, move-in ready homes close to

highly rated schools are selling quickly, often with multiple

offers.”

In Coastal Florida, Homes Are Selling For Roughly 5% Below

Asking Price–the Biggest Discount in the Country

Homes are selling furthest below their asking price in Florida.

In West Palm Beach, Fort Lauderdale and Miami, the typical home is

selling for roughly 5% less than its asking price, the biggest

discount among the 50 most populous U.S. metros. Next come two

other Florida metros: Tampa and Jacksonville, where the typical

home is selling for about 4% less than its asking price. Homes in

all of those metros are also selling for a bigger discount than

they were a year ago.

Coastal Florida’s housing market has taken a hit as natural

disasters become more frequent and intense, causing some would-be

buyers to have second thoughts. Climate disasters have also led to

a surge in home insurance costs, HOA fees and property taxes in

Florida. Slow homebuying demand means more sellers are open to

accepting an offer under asking price.

The typical home is selling for over its asking price in just

seven of the 50 most populous U.S. metros, led by the Bay Area. The

typical home is selling for roughly 3% above asking price in San

Jose, CA, followed by Newark, NJ (2.5%), San Francisco (2.5%),

Oakland, CA (1%) and Nassau County, NY (0.5%).

More than 60% of Miami Homes Sit on the Market For 60+

Days

There are five U.S. metros where 60%-plus of listings are

sitting on the market for at least two months without going under

contract. Three of them are in Florida. In both Miami and

Pittsburgh, 63% of listings linger on the market for at least 60

days, followed by San Antonio (62%), Fort Lauderdale (61%) and West

Palm Beach (60%).

On the other end of the spectrum is the Bay Area. Just over

one-third of home listings in San Jose (34%), Oakland (36%) and San

Francisco (38%) are sitting on the market for 60 days or more,

followed by Boston (39%) and San Diego (42%).

To view the full report, including a chart, please visit:

https://www.redfin.com/news/homebuyers-paying-under-list-price-stale-inventory

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate

company. We help people find a place to live with brokerage,

rentals, lending, and title insurance services. We run the

country's #1 real estate brokerage site. Our customers can save

thousands in fees while working with a top agent. Our home-buying

customers see homes first with on-demand tours, and our lending and

title services help them close quickly. Our rentals business

empowers millions nationwide to find apartments and houses for

rent. Since launching in 2006, we've saved customers more than $1.6

billion in commissions. We serve approximately 100 markets across

the U.S. and Canada and employ over 4,000 people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity

Home Loans®, Rent.™, Apartment Guide®, Title Forward® and

WalkScore®.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, email press@redfin.com.

To view Redfin's press center, click here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212502513/en/

Contact Redfin Redfin Journalist Services: Ally Forsell,

206-588-6863 press@redfin.com

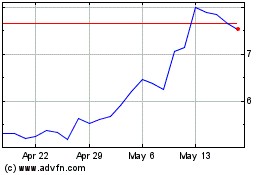

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Feb 2024 to Feb 2025