false

0001737953

0001737953

2024-05-16

2024-05-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 16, 2024

REPLIMUNE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38596 |

|

82-2082553 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

500

Unicorn Park Drive

Suite 303

Woburn, MA 01801

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including

area code: (781) 222-9600

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

REPL |

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this

chapter). Emerging growth company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On May 16, 2024, Replimune

Group, Inc. (the “Company”) issued a news release announcing its financial results for the fourth quarter and year ended

March 31, 2024 and certain corporate updates. A copy of the news release is furnished as Exhibit 99.1 to this Current Report

on Form 8-K.

In accordance with General

Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall

not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as expressly stated by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

REPLIMUNE GROUP, INC. |

| |

|

|

| Date: May 16, 2024 |

By: |

/s/ Sushil Patel |

| |

|

Sushil Patel |

| |

|

Chief Executive Officer |

Exhibit 99.1

Replimune Reports

Fiscal Fourth Quarter and Year Ended 2024 Financial Results and Provides Corporate Update

| · | Twelve-month

primary analysis results by independent central review from the IGNYTE clinical trial of

RP1 (vusolimogene oderparepvec) in anti-PD1 failed melanoma expected Q2 2024 |

| · | Recent

Type C CMC meeting with the U.S. Food and Drug Administration (FDA) supports IGNYTE Biologics

License Application (BLA) submission expected in 2H 2024 |

| · | Enrollment

of first patients in Phase 3 confirmatory trial of RP1 in advanced melanoma expected in 2H

2024 |

| · | Cash

runway to fund operations into 2H 2026 |

Woburn, MA, May 16, 2024

– Replimune Group, Inc. (Nasdaq: REPL), a clinical stage biotechnology company pioneering the development of a novel class

of oncolytic immunotherapies, today announced financial results for the fiscal fourth quarter and year ended March 31, 2024 and

provided a business update.

“We have exciting milestones in

the coming months, including sharing the investigator-assessed 12-month IGNYTE data at ASCO and then the official primary analysis by

independent central review later in the second quarter,” said Sushil Patel, Ph.D., CEO of Replimune. “Importantly, the design

of our Phase 3 confirmatory IGNYTE-3 clinical trial has been agreed with the FDA, with patient enrollment planned to initiate in the

second half of the year prior to the submission of our BLA for RP1. We also completed a successful Type C meeting with the FDA to align

on our CMC plans ahead of the intended BLA. These are all critical steps as we plan for our next phase as a commercial stage company

and, pending FDA approval, prepare to bring our first oncolytic immunotherapy to patients with advanced skin cancer.”

Corporate Updates

| · | The

following abstracts, including two oral presentations, will be presented at the 2024 American

Society of Clinical Oncology (ASCO) Annual Meeting, May 31-June 4: |

| o | Abstract

#9517 (Rapid Oral Abstract Session): Efficacy and safety of RP1 combined with nivolumab in

patients with anti-PD-1 failed melanoma from the IGNYTE clinical trial. |

| o | Abstract

#9511 (Rapid Oral Abstract Session): Safety, efficacy, and biomarker results from an open-label,

multicenter, phase 1 study of RP2 alone or combined with nivolumab in a cohort of patients

with uveal melanoma. |

| o | Abstract

#TPS9604 (Poster Session): A randomized, controlled, multicenter, phase 3 study of vusolimogene

oderparepvec (VO) combined with nivolumab vs treatment of physician’s choice in patients

with advanced melanoma that has progressed on anti–PD-1 and anti–CTLA-4 therapy

(IGNYTE-3). |

| o | Abstract

#TPS4191 (Poster Session): An open-label, multicenter study investigating RP2 oncolytic immunotherapy

in combination with second-line systemic atezolizumab combined with bevacizumab in patients

with locally advanced unresectable or metastatic hepatocellular carcinoma. |

| o | Abstract

#TPS9614 (Poster Session): Trial in progress: A phase 1/2 study of Vusolimogene oderparepvec

in primary melanoma (mel) to reduce the risk of sentinel lymph node (SLN) metastasis. |

| · | Manufacturing

progress. The Company completed a successful Type C meeting with the FDA that confirmed

alignment on our Chemistry, Manufacturing and Controls (CMC) plans to support our IGNYTE

anti-PD1 failed melanoma BLA submission in the 2H 2024. |

Program Highlights & Milestones

RP1

| · | RP1

combined with Opdivo® (nivolumab) in anti-PD1 failed melanoma |

| o | The

Company presented positive six-month follow up data by investigator assessment (N=140) from

the anti-PD1 failed melanoma cohort of the IGNYTE clinical trial late last year. The Company

is on track to present the 12-month primary analysis by independent central review in Q2

2024. |

| o | The

Company plans to enroll its first patient in the Phase 3 confirmatory IGNYTE-3 trial prior

to submitting the RP1 BLA. The Phase 3 trial design has been agreed to with the FDA and will

be a 2-arm randomized trial with a defined list of physician’s choice treatment options

as the comparator arm in advanced melanoma patients who progressed on anti-PD1 and anti-CTLA-4

therapy or are ineligible for anti-CTLA-4 treatment. |

| · | RP1

in solid organ transplant recipients with skin cancers |

| o | The

Company presented data from the ARTACUS clinical trial of RP1 monotherapy in solid organ

transplant recipients with skin cancers at the American Association of Cancer Research (AACR)

2024 Annual Meeting in April 2024. The data included 23 evaluable patients with CSCC

(n=20) and MCC (n=3). |

| o | The

data demonstrated an overall response rate (ORR) of 34.8% (8 of 23 evaluable patients, including

5 complete responses and 3 partial responses). |

| o | RP1

monotherapy was well tolerated, and the safety profile was similar to non-immunocompromised

patients with advanced skin cancers (i.e. from the IGNYTE study). No immune-mediated adverse

events or evidence of allograft rejection were observed. |

| o | The

ARTACUS clinical trial continues to enroll patients. |

| · | RP1

in combination with Libtayo® (cemiplimab-rwlc) in CSCC |

| o | The

CERPASS trial continues as planned to assess the time-based endpoints of duration of response,

progression free survival and overall survival with greater maturity. |

RP2

| o | The

protocol for the registration-directed clinical trial of RP2 combined with nivolumab in advanced

uveal melanoma is near final following input from the FDA. |

| · | RP2

in Hepatocellular Carcinoma (HCC) |

| o | The

Phase 2 clinical trial with RP2 in anti-PD1/PD-L1 progressed HCC of RP2 combined with atezolizumab

and bevacizumab is expected to initiate in 2H 2024. |

Financial Highlights

| · | Cash

Position: As of March 31, 2024, cash, cash equivalents and short-term

investments were $420.7 million, as compared to $583.4 million as of fiscal

year March 31, 2023. The decrease was primarily related to cash utilized in operating

activities in advancing the Company’s clinical development plans. |

Based

on the current operating plan, the Company believes that existing cash, cash equivalents and short-term investments, as of March 31,

2024 will enable the Company to fund operations into the second half of 2026.

| · | Debt:

As of March 31, 2024, the debt (net of discount) balance was $44.8 million,

as compared to $28.6 million as of March 31, 2023. The increase was primarily

related to the draw down of $15 million in December 2023, at the time of the closing

of the second amendment to the loan and security agreement with Hercules. |

| · | R&D

Expenses: Research and development expenses were $42.6 million for the

fourth quarter and $175.0 million for the fiscal year ended March 31,

2024, as compared to $37.9 million for the fourth quarter and $126.5 million for

the fiscal year ended March 31, 2023. This increase was primarily due to increased

clinical and manufacturing expenses driven by the Company’s lead programs and increased

personnel expenses. Research and development expenses included $3.2 million in

stock-based compensation expenses for the fourth quarter and $14.7 million in stock-based

compensation expenses for the fiscal year ended March 31, 2024. |

| · | S,G&A

Expenses: Selling, general and administrative expenses were $16.2 million for

the fourth quarter and $59.8 million for the fiscal year ended March 31,

2024, as compared to $15.0 million for the fourth quarter and $50.6 million for

the year ended March 31, 2023. The increase was primarily driven by personnel related

costs, including sales and marketing personnel associated with pre-launch planning and build

of the Company’s commercial infrastructure. Selling, general and administrative expenses

included $4.7 million in stock-based compensation expenses for the fourth quarter

and $19.4 million in stock-based compensation expenses for the fiscal year ended March 31,

2024. |

| · | Net

Loss: Net loss was $55.1 million for the fourth quarter and $215.8

million for the fiscal year ended March 31, 2024, as compared to a net loss

of $49.2 million for the fourth quarter and $174.3 million for the fiscal

year ended March 31, 2023. |

About RP1

RP1 (vusolimogene oderparepvec) is Replimune’s

lead product candidate and is based on a proprietary strain of herpes simplex virus engineered and genetically armed with a fusogenic

protein (GALV-GP R-) and GM-CSF intended to maximize tumor killing potency, the immunogenicity of tumor cell death, and the activation

of a systemic anti-tumor immune response.

About RP2

RP2 is based on a proprietary strain

of herpes simplex virus engineered and genetically armed with a fusogenic protein (GALV-GP R-) and GM-CSF to maximize tumor killing potency,

the immunogenicity of tumor cell death and the activation of a systemic anti-tumor immune response. RP2 additionally expresses an anti-CTLA-4

antibody-like molecule, as well as GALV-GP R- and GM-CSF. RP2 is intended to provide targeted and potent delivery of these proteins to

the sites of immune response initiation in the tumor and draining lymph nodes, with the goal of focusing systemic-immune-based efficacy

on tumors and limiting off-target toxicity.

About Replimune

Replimune

Group, Inc., headquartered in Woburn, MA, was founded in 2015 with the mission to transform cancer treatment by pioneering the development

of a novel portfolio of oncolytic immunotherapies. Replimune’s proprietary RPx platform is based on a potent HSV-1 backbone intended

to maximize immunogenic cell death and the induction of a systemic anti-tumor immune response. The RPx platform is designed to have a

unique dual local and systemic activity consisting of direct selective virus-mediated killing of the tumor resulting in the release of

tumor derived antigens and altering of the tumor microenvironment to ignite a strong and durable systemic response. The RPx product candidates

are expected to be synergistic with most established and experimental cancer treatment modalities, leading to the versatility to be developed

alone or combined with a variety of other treatment options. For more information, please visit www.replimune.com.

Forward Looking Statements

This press release contains forward

looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, including statements regarding our expectations about our cash runway, the design and advancement of

our clinical trials, the timing and sufficiency of our clinical trial outcomes to support potential approval of any of our product candidates,

our goals to develop and commercialize our product candidates, patient enrollments in our existing and planned clinical trials and the

timing thereof, and other statements identified by words such as “could,” “expects,” “intends,” “may,”

“plans,” “potential,” “should,” “will,” “would,” or similar expressions and

the negatives of those terms. Forward-looking statements are not promises or guarantees of future performance, and are subject to a variety

of risks and uncertainties, many of which are beyond our control, and which could cause actual results to differ materially from those

contemplated in such forward-looking statements. These factors include risks related to our limited operating history, our ability to

generate positive clinical trial results for our product candidates, the costs and timing of operating our in-house manufacturing facility,

the timing and scope of regulatory approvals, the availability of combination therapies needed to conduct our clinical trials, changes

in laws and regulations to which we are subject, competitive pressures, our ability to identify additional product candidates, political

and global macro factors including the impact of the coronavirus as a global pandemic and related public health issues and the Russian-Ukrainian

and Israel-Hamas political and military conflicts, and other risks as may be detailed from time to time in our Annual Reports on Form 10-K

and Quarterly Reports on Form 10-Q and other reports we file with the Securities and Exchange Commission. Our actual results could

differ materially from the results described in or implied by such forward-looking statements. Forward-looking statements speak only

as of the date hereof, and, except as required by law, we undertake no obligation to update or revise these forward-looking statements.

Investor Inquiries

Chris Brinzey

ICR Westwicke

339.970.2843

chris.brinzey@westwicke.com

Media Inquiries

Arleen Goldenberg

Replimune

917.548.1582

media@replimune.com

Replimune Group, Inc.

Condensed Consolidated

Statements of Operations

(Amounts in thousands,

except share and per share amounts)

(Audited)

| | |

Year

Ended March 31, | |

| | |

2024 | | |

2023 | |

| Operating

expenses: | |

| | | |

| | |

| Research

and development | |

$ | 174,963 | | |

$ | 126,527 | |

| Selling,

general and administrative | |

| 59,810 | | |

| 50,553 | |

| Total

operating expenses | |

| 234,773 | | |

| 177,080 | |

| Loss

from operations | |

| (234,773 | ) | |

| (177,080 | ) |

| Other

income (expense): | |

| | | |

| | |

| Research

and development incentives | |

| 1,920 | | |

| 2,914 | |

| Investment

income | |

| 23,356 | | |

| 10,006 | |

| Interest

expense on finance lease liability | |

| (2,163 | ) | |

| (2,197 | ) |

| Interest

expense on debt obligations | |

| (4,497 | ) | |

| (1,963 | ) |

| Other

income (expense) | |

| 771 | | |

| (5,676 | ) |

| Total

other income (expense), net | |

| 19,387 | | |

| 3,084 | |

| Loss

before income taxes | |

$ | (215,386 | ) | |

$ | (173,996 | ) |

| Income

tax provision | |

| 408 | | |

| 288 | |

| Net

loss | |

$ | (215,794 | ) | |

$ | (174,284 | ) |

| Net

loss per common share, basic and diluted | |

$ | (3.24 | ) | |

$ | (2.99 | ) |

| Weighted average

common shares outstanding, basic and | |

| | | |

| | |

| diluted | |

| 66,569,894 | | |

| 58,213,010 | |

Replimune Group, Inc.

Condensed Consolidated

Balance Sheets

(Amounts In thousands,

except share and per share amounts)

| | |

March 31, | | |

March 31, | |

| | |

2024 | | |

2023 | |

| Consolidated Balance Sheet Data: | |

| | | |

| | |

| Cash, cash equivalents and short-term investments | |

$ | 420,668 | | |

$ | 583,386 | |

| Working capital | |

| 393,229 | | |

| 558,778 | |

| Total assets | |

| 487,722 | | |

| 646,591 | |

| Total stockholders' equity | |

| 374,508 | | |

| 555,292 | |

v3.24.1.1.u2

Cover

|

May 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 16, 2024

|

| Entity File Number |

001-38596

|

| Entity Registrant Name |

REPLIMUNE GROUP, INC.

|

| Entity Central Index Key |

0001737953

|

| Entity Tax Identification Number |

82-2082553

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

500

Unicorn Park Drive

|

| Entity Address, Address Line Two |

Suite 303

|

| Entity Address, City or Town |

Woburn

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01801

|

| City Area Code |

781

|

| Local Phone Number |

222-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

REPL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

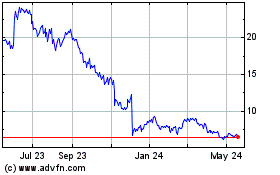

Replimune (NASDAQ:REPL)

Historical Stock Chart

From May 2024 to Jun 2024

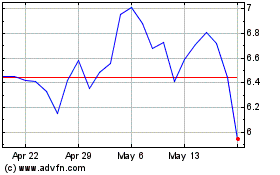

Replimune (NASDAQ:REPL)

Historical Stock Chart

From Jun 2023 to Jun 2024