As filed with the Securities and Exchange Commission on August 30,

2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

RELMADA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

3949 |

|

45-5401931 |

| (State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Classification Code Number) |

|

Identification Number) |

2222 Ponce de Leon

Blvd., Floor 3

Coral Gables, FL 33134

+1-786-629-1376

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Relmada Therapeutics, Inc.

Attention: Chief Executive Officer

2222 Ponce de Leon

Blvd., Floor 3

Coral Gables, FL 33134

+1-786-629-1376

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Please send a copy of all communications to:

Gregory Sichenzia, Esq.

Barrett DiPaolo, Esq.

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas

New York, New York 10036

+1-212-930-9700

Approximate date of commencement proposed sale

to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said

Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains two prospectuses:

| ● | a base prospectus, which covers the offering, issuance and sale by

us of up to $250,000,000 of our common stock, preferred stock, warrants, subscription rights, depositary shares, purchase contracts and/or

units representing two or more of the foregoing securities; and |

| ● | a

sale agreement prospectus supplement which covers the offering, issuance and sale by us of up to a maximum aggregate offering price of

$100,000,000 of our common stock that may be issued and sold from time to time under an Open Market Sale AgreementSM, or the

sale agreement, with Jefferies LLC. |

The base prospectus immediately follows this explanatory

note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement

to the base prospectus.

The sale agreement prospectus immediately follows

the base prospectus. The $100,000,000 of our common stock that may be offered, issued and sold under the sale agreement prospectus is

included in the $250,000,000 of securities that may be offered, issued and sold by us under the base prospectus. Any portion of the $100,000,000

of securities included in the sale agreement prospectus that has not been sold pursuant to the sale agreement will become available for

sale in other offerings pursuant to the base prospectus with a corresponding prospectus supplement.

The information in

this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities

and Exchange Commission. These securities may not be sold until the registration statement is declared effective. This prospectus is

not an offer to sell these securities and is not soliciting an offer to buy these securities, nor shall there be any sale of these securities,

in any state or other jurisdiction where such offer, solicitation or sale is not permitted or would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction.

(Subject to Completion,

dated August 30, 2024)

PROSPECTUS

RELMADA THERAPEUTICS, INC.

$250,000,000

COMMON STOCK

PREFERRED STOCK

WARRANTS

SUBSCRIPTION RIGHTS

DEPOSITARY SHARES

PURCHASE CONTRACTS

UNITS

This prospectus relates to common stock, preferred stock, warrants,

subscription rights, depositary shares, purchase contracts and units that we may sell from time to time in one or more offerings,

for an aggregate initial offering price of up to $250,000,000. We may offer and sell these securities separately or together, in

one or more series or classes and in amounts, at prices and on terms described in one or more offerings. We may offer securities through

underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or directly to purchasers. The prospectus

supplement for each offering of securities will describe in detail the plan of distribution for that offering. For general information

about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

Each time our securities are offered or sold,

we will provide a prospectus supplement containing more specific information about the terms of that particular offering and attach it

to this prospectus. The prospectus supplements may also add, update or change information contained in this prospectus. This prospectus

may not be used to offer or sell securities without a prospectus supplement which includes a description of the method and terms of this

offering.

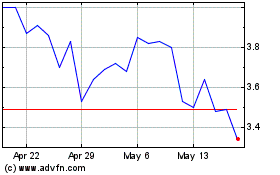

Our common stock is quoted on the Nasdaq Global Select Market under

the symbol “RLMD.” The last reported sale price of our common stock on The Nasdaq Global Select Market on August 27, 2024,

was $2.72 per share.

If we decide to seek a listing of any preferred

stock, warrants, subscriptions rights, depositary shares or units offered by this prospectus, the related prospectus supplement will disclose

the exchange or market on which the securities will be listed, if any, or where we have made an application for listing, if any.

The

securities offered by this prospectus involve a high degree of risk. Before making any investment decision, you should carefully review

and consider all the information in this prospectus and the documents incorporated by reference herein, including the risks and uncertainties

described under “Risk Factors” beginning on page 2, in addition to Risk Factors contained in the applicable prospectus

supplement. We urge you to carefully read this prospectus and the accompanying prospectus supplement, together with the documents we

incorporate by reference, describing the terms of these securities before investing.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2024.

TABLE

OF CONTENTS

The terms “Relmada,” the “Company,”

“we,” “our” or “us” in this prospectus refer to Relmada Therapeutics, Inc. and our subsidiary Relmada

Therapeutics, Inc. (Delaware), unless the context suggests otherwise.

You should rely only on the information contained

or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information

different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that

differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other

person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information

contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information

contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not

an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. Under

this shelf registration process, we may offer and sell, either individually or in combination, in one or more offerings, any of the securities

described in this prospectus, for an aggregate initial offering price of up to $250,000,000. This prospectus provides you with a general

description of the securities we may offer. Each time we offer securities under this prospectus, we will provide a prospectus supplement

to this prospectus that will contain more specific information about the terms of that offering. We may also authorize one or more free

writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement

and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information

contained in this prospectus or in the documents that we have incorporated by reference into this prospectus.

We urge you to read carefully this prospectus,

any applicable prospectus supplement and any free writing prospectuses we have authorized for use in connection with a specific offering,

together with the information incorporated herein by reference as described under the heading “Incorporation of Documents by Reference,”

before investing in any of the securities being offered. You should rely only on the information contained in, or incorporated by reference

into, this prospectus and any applicable prospectus supplement, along with the information contained in any free writing prospectuses

we have authorized for use in connection with a specific offering. We have not authorized anyone to provide you with different or additional

information. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so.

The information appearing in this prospectus,

any applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document

and any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless

of the time of delivery of this prospectus, any applicable prospectus supplement or any related free writing prospectus, or any sale of

a security.

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have

been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a

part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find Additional

Information.”

This prospectus may also contain trademarks, service

marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’

trademarks, service marks, trade names or products in this prospectus is not intended for, and does not imply a relationship with, or

endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus

may appear without the ®, SM and ™ symbols, but the omission of such references is not intended to indicate, in any way, that

we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service

marks and trade names.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This prospectus and any accompanying prospectus

supplement and the documents incorporated by reference herein may contain forward looking statements that involve risks and uncertainties.

All statements other than statements of historical fact contained in this prospectus and any accompanying prospectus supplement and the

documents incorporated by reference herein, including statements regarding future events, our future financial performance, business strategy,

and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking

statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although

we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined

under “Risk Factors” or elsewhere in this prospectus and the documents incorporated by reference herein, which may cause our

or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements. Moreover, we operate in a highly regulated, very competitive, and rapidly changing environment. New risks emerge from time

to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking

statements.

You should read these

forward-looking statements carefully because they discuss our expectations about our future performance, our future operating results

or our future financial condition, or state other “forward-looking” information. Before you invest, you should be aware that

the occurrence of any of the events described in “Risk Factors” or “Item 1A. Risk Factors” in our most recent

Annual Report on Form 10-K, any subsequently filed Quarterly Reports on Form 10-Q, any subsequently filed Current Reports on Form 8-K

(other than, in each case, information furnished rather than filed), all of which are incorporated by reference herein, and any risk factors

included in any applicable prospectus supplement could substantially harm our business, results of operations and financial condition.

In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might

occur to a different extent or at a different time than we have described. Should one or more of the risks or uncertainties described

in this prospectus or the documents incorporated by reference herein occur, or should underlying assumptions prove incorrect, our actual

results and plans could differ materially from those expressed in any forward-looking statements.

Forward-looking statements

contained in this prospectus and all subsequent written and oral forward-looking statements attributable to us or persons acting on our

behalf are expressly qualified in their entirety by this cautionary statement.

Except as otherwise required

by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements

in this section, to reflect events or circumstances after the date of this prospectus.

PROSPECTUS SUMMARY

This

summary highlights selected information contained elsewhere

in this prospectus. This summary does not contain all the information that you should consider before investing in our Company. You should

carefully read the entire prospectus, including all documents incorporated by reference herein. In particular, attention should be directed

to our “Risk Factors,” “Information with Respect to the Company,” “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and the financial statements and related notes thereto contained herein or otherwise

incorporated by reference hereto, before making an investment decision.

All references to

“we,” “us,” “our,” “Relmada” and the “Company” mean Relmada Therapeutics,

Inc. and its subsidiary Relmada Therapeutics, Inc. (Delaware).

Business Overview

Relmada

Therapeutics, Inc., a Nevada corporation, is a clinical-stage biotechnology company addressing diseases of the central nervous system

(CNS).

Esmethadone

Program (REL-1017)

We

have focused on the development of our lead product candidate, esmethadone (d-methadone, dextromethadone, REL-1017), an N-methyl-D-aspartate

(NMDA) receptor antagonist. Esmethadone, an isomer of methadone, is a new chemical entity (NCE) that potentially addresses areas of high

unmet medical need in the treatment of CNS diseases and other disorders. Esmethadone, is being developed as a rapidly acting, oral agent

for the treatment of depression and other potential indications.

| ● | During

late 2022, we announced that our Phase 3 clinical trials, RELIANCE I, a trial of REL-1017

as an adjunctive treatment for Major Depressive Disorder (MDD), and RELIANCE III, a monotherapy

trial of REL-1017 for MDD, did not achieve their primary endpoints. |

| ● | For

our long-term open label study of REL-1017 in patients with MDD, Study 310, which included

both patients who completed the RELIANCE trials and subjects who had not previously participated

in a REL-1017 clinical trial, in September 20, 2023, we announced efficacy results for the

de novo (or new to treatment) patients and safety results for all subjects. Patients treated

daily with REL-1017 for up to one year experienced rapid, clinically meaningful, and sustained

improvements in depressive symptoms and associated functional impairment. REL-1017 was well-tolerated

with long-term dosing, showing low rates of adverse events and discontinuations due to adverse

events. The most commonly reported adverse events deemed to be treatment-related

all occurred included headache, nausea and dizziness. No new safety signals were detected. |

| ● | We

plan to complete two additional ongoing adjunctive Phase 3 trials (RELIANCE II and RELIGHT)

that build on the knowledge obtained from RELIANCE I,. |

Psilocybin

Program (REL-P11)

We

also intend to enter human studies of our proprietary, modified-release formulation of psilocybin (REL-P11) for metabolic

indications in doses that we believe are lower than those associated with psychedelic effects. The Company plans to commence a

single-ascending dose Phase 1 trial in obese subjects in Canada in 2024 to define the pharmacokinetic, safety and tolerability

profile of REL-P11 in this population, followed by a Phase 2a trial to establish clinical proof-of-concept.

Pre-clinical

data in a rodent model of metabolic dysfunction-associated steatotic liver disease demonstrated beneficial effects of psilocybin on multiple

metabolic parameters, including reduced hepatic steatosis, reduced body weight gain, and fasting blood glucose levels.

Stock Listing

Our common stock is listed on The Nasdaq Global

Select Market under the symbol “RLMD.”

Corporate Information

Our principal executive offices are located at

2222 Ponce de Leon Blvd., Floor 3, Coral Gables, Florida 33134 and our telephone number is +1-786-629-1376. Our website address is www.relmada.com.

The information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus or the registration

statement of which it forms a part. The information on our website is not part of this prospectus.

For additional information about us, please refer

to other documents we have filed with the SEC and that are incorporated by reference into this prospectus, as listed under the heading

“Incorporation of Certain Information by Reference.”

RISK FACTORS

Investing in our securities involves a high degree

of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and other factors, if any, described

under the caption “Risk Factors” in the applicable prospectus supplement, together with all the other information contained

in the prospectus supplement or appearing or incorporated by reference into this prospectus. You should also consider the risks, uncertainties

and assumptions discussed under the caption “Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K,

as supplemented and updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we have filed or will file

with the SEC, all of which (other than information furnished therein rather than filed) are deemed incorporated by reference into this

prospectus.

Our business, affairs, prospects, assets, financial

condition, results of operations and cash flows could be materially and adversely affected by these risks. For more information about

our SEC filings, please see “Where You Can Find More Information.”

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement,

we intend to use the net proceeds from these sales for working capital and general corporate purposes, which includes, without limitation,

clinical studies required to gain regulatory approvals, implementation of adequate systems and controls to allow for regulatory approvals,

further development of our product candidates, investing in or acquiring companies that are synergistic with or complimentary to our technologies,

licensing activities related to our current and future product candidates and working capital, the development of emerging technologies,

investing in or acquiring companies that are developing emerging technologies, licensing activities, or the acquisition of other businesses.

We will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. The amounts and timing

of these expenditures will depend on numerous factors, including the development of our current business initiatives.

PLAN OF DISTRIBUTION

We may sell the securities from time to time pursuant

to underwritten public offerings, direct sales to the public, “at the market” offerings, negotiated transactions, block trades

or a combination of these methods. We may sell the securities from time to time to or through underwriters or dealers, through agents,

or directly to one or more purchasers. A distribution of the securities offered by this prospectus may also be effected through the issuance

of derivative securities, including without limitation, warrants, rights to purchase and subscriptions. In addition, the manner in which

we may sell some or all of the securities covered by this prospectus includes, without limitation, through:

| |

● |

a block trade in which a broker-dealer will attempt to sell as agent, but may position or resell a portion of the block, as principal, in order to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account; or |

| |

|

|

| |

● |

ordinary brokerage transactions and transactions in which a broker solicits purchasers. |

A prospectus supplement or supplements with respect

to each series of securities will describe the terms of the offering, including, to the extent applicable:

| |

● |

the terms of the offering; |

| |

|

|

| |

● |

the name or names of the underwriters or agents and the amounts of securities underwritten or purchased by each of them, if any; |

| |

|

|

| |

● |

the public offering price or purchase price of the securities or other consideration therefor, and the proceeds to be received by us from the sale; |

| |

|

|

| |

● |

any delayed delivery requirements; |

| |

|

|

| |

● |

any over-allotment options under which underwriters may purchase additional securities from us; |

| |

|

|

| |

● |

any underwriting discounts or agency fees and other items constituting underwriters’ or agents’ compensation |

| |

|

|

| |

● |

any discounts or concessions allowed or re-allowed or paid to dealers; and |

| |

|

|

| |

● |

any securities exchange or market on which the securities may be listed. |

The offer and sale of the securities described

in this prospectus by us, the underwriters or the third parties described above may be effected from time to time in one or more transactions,

including privately negotiated transactions, either:

| |

● |

at a fixed price or prices, which may be changed; |

| |

|

|

| |

● |

in an “at the market offering” within the meaning of Rule 415(a)(4) of the Securities Act; |

| |

|

|

| |

● |

at prices related to such prevailing market prices; or |

| |

|

|

| |

● |

at negotiated prices. |

Only underwriters named in the prospectus supplement

will be underwriters of the securities offered by the prospectus supplement.

Underwriters and Agents; Direct Sales

If underwriters are used in a sale, they will

acquire the offered securities for their own account and may resell the offered securities from time to time in one or more transactions,

including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. We may offer

the securities to the public through underwriting syndicates represented by managing underwriters or by underwriters without a syndicate.

Unless the prospectus supplement states otherwise,

the obligations of the underwriters to purchase the securities will be subject to the conditions set forth in the applicable underwriting

agreement. Subject to certain conditions, the underwriters will be obligated to purchase all of the securities offered by the prospectus

supplement, other than securities covered by any over-allotment option. Any public offering price and any discounts or concessions allowed

or re-allowed or paid to dealers may change from time to time. We may use underwriters with whom we have a material relationship. We will

describe in the prospectus supplement, naming the underwriter, the nature of any such relationship.

We may sell securities directly or through agents

we designate from time to time. We will name any agent involved in the offering and sale of securities, and we will describe any commissions

we will pay the agent in the prospectus supplement. Unless the prospectus supplement states otherwise, our agent will act on a best-efforts

basis for the period of its appointment.

We may authorize agents or underwriters to solicit

offers by certain types of institutional investors to purchase securities from us at the public offering price set forth in the prospectus

supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. We will describe

the conditions to these contracts and the commissions we must pay for solicitation of these contracts in the prospectus supplement.

Dealers

We may sell the offered securities to dealers

as principals. The dealer may then resell such securities to the public either at varying prices to be determined by the dealer or at

a fixed offering price agreed to with us at the time of resale.

Institutional Purchasers

We may authorize agents, dealers or underwriters

to solicit certain institutional investors to purchase offered securities on a delayed delivery basis pursuant to delayed delivery contracts

providing for payment and delivery on a specified future date. The applicable prospectus supplement or other offering materials, as the

case may be, will provide the details of any such arrangement, including the offering price and commissions payable on the solicitations.

We will enter into such delayed contracts only

with institutional purchasers that we approve. These institutions may include commercial and savings banks, insurance companies, pension

funds, investment companies and educational and charitable institutions.

Indemnification; Other Relationships

We may provide agents, underwriters, dealers and

remarketing firms with indemnification against certain civil liabilities, including liabilities under the Securities Act, or contribution

with respect to payments that the agents or underwriters may make with respect to these liabilities. Agents, underwriters, dealers and

remarketing firms, and their affiliates, may engage in transactions with, or perform services for, us in the ordinary course of business.

This includes commercial banking and investment banking transactions.

Market-Making; Stabilization and Other Transactions

There is currently no market for any of the offered

securities, other than our common stock, which is quoted on the Nasdaq Global Select Market. If the offered securities are traded after

their initial issuance, they may trade at a discount from their initial offering price, depending upon prevailing interest rates, the

market for similar securities and other factors. While it is possible that an underwriter could inform us that it intends to make a market

in the offered securities, such underwriter would not be obligated to do so, and any such market-making could be discontinued at any time

without notice. Therefore, no assurance can be given as to whether an active trading market will develop for the offered securities. We

have no current plans for listing of the preferred stock, warrants or subscription rights on any securities exchange or quotation system;

any such listing with respect to any particular preferred stock, warrants or subscription rights will be described in the applicable prospectus

supplement or other offering materials, as the case may be.

Any underwriter may engage in over-allotment,

stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Securities Exchange Act

of 1934, as amended, or the Exchange Act. Over-allotment involves sales in excess of the offering size, which create a short position.

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum

price. Syndicate-covering or other short-covering transactions involve purchases of the securities, either through exercise of the over-allotment

option or in the open market after the distribution is completed, to cover short positions. Penalty bids permit the underwriters to reclaim

a selling concession from a dealer when the securities originally sold by the dealer are purchased in a stabilizing or covering transaction

to cover short positions. Those activities may cause the price of the securities to be higher than it would otherwise be. If commenced,

the underwriters may discontinue any of the activities at any time.

Any underwriters or agents that are qualified

market makers on the Nasdaq Global Select Market may engage in passive market making transactions in our common stock on the Nasdaq Global

Select Market in accordance with Regulation M under the Exchange Act, during the business day prior to the pricing of the offering, before

the commencement of offers or sales of our common stock. Passive market makers must comply with applicable volume and price limitations

and must be identified as passive market makers. In general, a passive market maker must display its bid at a price not in excess of the

highest independent bid for such security; if all independent bids are lowered below the passive market maker’s bid, however, the

passive market maker’s bid must then be lowered when certain purchase limits are exceeded. Passive market making may stabilize the

market price of the securities at a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued

at any time.

Fees and Commissions

If 5% or more of the net proceeds, not including

underwriting compensation, of any offering of securities made under this base prospectus and accompanying prospectus supplement will be

(i) used to reduce or retire the balance of a loan or credit facility extended by a FINRA member participating in the offering, its affiliates

and its associated persons, in the aggregate; or (ii) otherwise directed to such a FINRA member, its affiliates and associated persons,

in the aggregate, the offering pursuant to such prospectus supplement will be conducted in accordance with FINRA Rule 5121.

DESCRIPTION OF SECURITIES WE MAY OFFER

General

This prospectus describes the general terms of

our capital stock. The following description is not complete and may not contain all the information you should consider before investing

in our capital stock. For a more detailed description of these securities, you should read the applicable provisions of Nevada law and

our amended and restated certificate of incorporation, referred to herein as our certificate of incorporation, and our amended and restated

bylaws, referred to herein as our bylaws. The description below is based on and is qualified in its entirety by reference to our certificate

of incorporation and bylaws. When we offer to sell a particular series of these securities, we will describe the specific terms of the

series in a supplement to this prospectus. Accordingly, for a description of the terms of any series of securities, you must refer to

both the prospectus supplement relating to that series and the description of the securities described in this prospectus. To the extent

the information contained in the prospectus supplement differs from this summary description, you should rely on the information in the

prospectus supplement.

We, directly or through agents, dealers or underwriters

designated from time to time, may offer, issue and sell, together or separately:

| |

● |

common stock; |

| |

|

|

| |

● |

preferred stock; |

| |

|

|

| |

● |

warrants to purchase our securities; |

| |

|

|

| |

● |

subscription rights to purchase our securities; |

| |

|

|

| |

● |

depositary shares; |

| |

|

|

| |

● |

purchase contracts; or |

| |

|

|

| |

● |

units comprised of, or other combinations of, the foregoing securities. |

The preferred stock may also be exchangeable for

and/or convertible into shares of common stock, another series of preferred stock or other securities that may be sold by us pursuant

to this prospectus or any combination of the foregoing. When a particular series of securities is offered, a supplement to this prospectus

will be delivered with this prospectus, which will set forth the terms of the offering and sale of the offered securities.

Authorized Capital Stock; Issued and Outstanding

Capital Stock

We have authorized 350,000,000 shares of capital

stock, par value $0.001 per share, of which 150,000,000 are shares of common stock and 200,000,000 are shares of preferred stock, 3,500,000

of which are designated Class A Convertible Preferred Stock. As of August 27, 2024, there were 30,174,202 shares of common stock issued

and outstanding. There are no shares of preferred stock issued and outstanding.

The authorized and unissued shares of common stock

and the authorized and undesignated shares of preferred stock are available for issuance without further action by our stockholders, unless

such action is required by applicable law or the rules of any stock exchange on which our securities may be listed. Unless approval of

our stockholders is so required, our board of directors does not intend to seek stockholder approval for the issuance and sale of our

common stock or preferred stock.

Common Stock

The holders of our common stock are entitled to

one vote per share. Our certificate of incorporation does not provide for cumulative voting. Our directors are divided into three classes,

with staggered three-year terms. Only one class of directors will be elected at each annual meeting of stockholders, with the other classes

continuing for the remainder of their respective three-year terms. At each annual meeting of stockholders, directors elected to succeed

those directors whose terms expire are elected for a term of office to expire at the third succeeding annual meeting of stockholders after

their election. The holders of our common stock are entitled to receive ratably such dividends, if any, as may be declared by our board

of directors out of legally available funds. However, the current policy of our board of directors is to retain earnings, if any, for

operations and growth. Upon liquidation, dissolution or winding-up, the holders of our common stock are entitled to share ratably in all

assets that are legally available for distribution. The holders of our common stock have no preemptive, subscription or conversion rights

and there are no redemption or sinking fund provisions applicable to the common stock. The rights, preferences and privileges of holders

of our common stock are subject to, and may be adversely affected by, the rights of the holders of any series of preferred stock, which

may be designated solely by action of our board of directors and issued in the future.

Preferred Stock

Authorized Preferred Stock

As of August 27, 2024, there were no shares of

Class A Convertible Preferred Stock issued and outstanding.

The rights and preferences of our Class A Convertible

Preferred Stock include the following:

Liquidation Preference

In the event of any dissolution, liquidation or

winding up of our Company, whether voluntary or involuntary, the holders of our Class A Convertible Preferred Stock are entitled to participate

in any distribution out of our assets of on an equal basis per share with the holders of our common stock.

Dividends

The Class A Convertible Preferred Stock is, with

respect to dividend rights, entitled to two times the amount of any dividend granted by our board of directors to the holders of our common

stock.

Conversion

Optional Conversion. Subject to certain

exceptions, each share of Class A Convertible Preferred Stock is convertible at the option of the holder and without the payment of additional

consideration by the holder, at any time, into shares of our common stock at a conversion rate of one share of our common stock for every

one share of our Class A Convertible Preferred Stock. However, a holder of our Class A Convertible Preferred Stock cannot convert shares

of our Class A Convertible Preferred Stock to shares of our common stock if such conversion would cause the holder or any “group”

(within the meaning of Section 13(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) of which such holder is or

deemed to be a part, to “beneficially own” (within the meaning of Rule 13d-3 under the Exchange Act) more than 9.9% of the

number of shares of our common stock listed as outstanding by in our most recent public filing with the Commission prior to us receiving

the conversion demand.

Automatic Conversion. Subject to the

limitation on conversion described above, on the first day of each month until there are no shares of our Class A Convertible Preferred

Stock outstanding, each share of our Class A Convertible Preferred Stock will convert without the payment of additional consideration

by a holder into shares of our common stock on the automatic conversion date at a conversion rate of one share of our common stock for

every one share of our Class A Convertible Preferred Stock.

Voting

The holders of our Class A Convertible Preferred

Stock are not entitled to vote on any matter submitted to a vote of the holders of our common stock, including the election of directors.

Other Series of Preferred Stock We May Issue

The board of directors is authorized, subject

to any limitations prescribed by law, without further vote or action by our stockholders, to issue from time to time shares of preferred

stock in one or more series. Each such series of preferred stock shall have such number of shares, designations, preferences, voting powers,

qualifications and special or relative rights or privileges as determined by our board of directors, which may include, among others,

dividend rights, voting rights, liquidation preferences, conversion rights and preemptive rights. Issuance of preferred stock by our board

of directors may result in such shares having dividend and/or liquidation preferences senior to the rights of the holders of our common

stock and could dilute the voting rights of the holders of our common stock.

Prior to the issuance of shares of each series

of preferred stock, our board of directors is required by the Nevada Revised Law and our amended and restated certificate of incorporation

to adopt resolutions and file a certificate of designations with the Secretary of State of the State of Nevada, which fixes for each class

or series the designations, powers, preferences, rights, qualifications, limitations and restrictions. We will file as an exhibit to the

registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that we

file with the Commission, the form of any certificate of designations for the series of preferred stock we are offering before the issuance

of the related series of preferred stock. The prospectus supplement relating to any preferred stock that we may offer will contain the

specific terms of the class or series and of the offering, which terms may include the following:

| |

● |

the title and stated value; |

| |

|

|

| |

● |

the number of shares we are offering; |

| |

|

|

| |

● |

the offering price; |

| |

|

|

| |

● |

the number of shares constituting that series, which number may be increased or decreased (but not below the number of shares then outstanding) from time to time by action of our board of directors; |

| |

|

|

| |

● |

the dividend rate and the manner and frequency of payment of dividends on the shares of that series, whether dividends will be cumulative, and, if so, from which date; |

| |

|

|

| |

● |

whether that series will have voting rights, in addition to any voting rights provided by law, and, if so, the terms of such voting rights; |

| |

|

|

| |

● |

whether that series will have conversion privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as our board of directors may determine; |

| |

|

|

| |

● |

whether or not the shares of that series will be redeemable, and, if so, the terms and conditions of such redemption; |

| |

|

|

| |

● |

whether that series will have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund; |

| |

|

|

| |

● |

whether or not the shares of the series will have priority over or be on a parity with or be junior to the shares of any other series or class in any respect; |

| |

|

|

| |

● |

the rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, and the relative rights or priority, if any, of payment of shares of that series; |

| |

|

|

| |

● |

preemptive rights, if any; |

| |

|

|

| |

● |

restrictions on transfer, sale or other assignment, if any; |

| |

|

|

| |

● |

whether interests in the preferred stock will be represented by depositary shares; |

| |

|

|

| |

● |

a discussion of any material or special United States federal income tax considerations applicable to the preferred stock; |

| |

|

|

| |

● |

any limitations on issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and |

| |

|

|

| |

● |

any other relative rights, preferences and limitations of that series. |

Once designated by our board of directors, each

series of preferred stock may have specific financial and other terms that will be described in a prospectus supplement. The description

of the preferred stock that is set forth in any prospectus supplement is not complete without reference to the documents that govern the

preferred stock. These include our amended and restated certificate of incorporation and any certificates of designation that our board

of directors may adopt.

All shares of our preferred stock will, when issued,

be fully paid and non-assessable, including shares of our preferred stock issued upon the exercise of preferred stock warrants or subscription

rights, if any.

Our board of directors may authorize the issuance

of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our

common stock. Preferred stock could be issued quickly with terms designed to delay or prevent a change in control of our Company or make

removal of management more difficult. Additionally, the issuance of preferred stock could have the effect of decreasing the market price

of our common stock.

Although our board of directors has no intention

at the present time of doing so, it could authorize the issuance of a series of preferred stock that could, depending on the terms of

such series, impede the completion of a merger, tender offer or other takeover attempt.

Warrants

We may issue warrants

to purchase our securities or other rights, including rights to receive payment in cash or securities based on the value, rate or price

of one or more specified commodities, currencies, securities or indices, or any combination of the foregoing. Warrants may be issued independently

or together with any other securities that may be sold by us pursuant to this prospectus or any combination of the foregoing and may be

attached to, or separate from, such securities. To the extent warrants that we issue are to be publicly-traded, each series of such warrants

will be issued under a separate warrant agreement to be entered into between us and a warrant agent.

We will file as exhibits

to the registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that

we file with the Commission, forms of the warrant and warrant agreement, if any. The prospectus supplement relating to any warrants that

we may offer will contain the specific terms of the warrants and a description of the material provisions of the applicable warrant agreement,

if any. These terms may include the following:

| |

● |

the title of the warrants; |

| |

|

|

| |

● |

the aggregate number of warrants; |

| |

|

|

| |

● |

the price or prices at which the warrants will be offered; |

| |

|

|

| |

● |

the designation, amount and terms of the securities or other rights for which the warrants are exercisable; |

| |

|

|

| |

● |

the designation and terms of the other securities, if any, with which the warrants are to be issued and the number of warrants issued with each other security; |

| |

|

|

| |

● |

if applicable, the date on and after which the warrants and the related securities will be separately transferable; |

| |

|

|

| |

● |

the price or prices at which the securities or other rights purchasable upon exercise of the warrants may be purchased; |

| |

|

|

| |

● |

any provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of the warrants; |

| |

|

|

| |

● |

the manner of exercise of the warrants, including any cashless exercise rights; |

| |

|

|

| |

● |

the terms of any rights of us to redeem or call the warrants; |

| |

|

|

| |

● |

the identities of any warrant agent and any calculation or other agent for the warrants; |

| |

|

|

| |

● |

a discussion of any material U.S. federal income tax considerations applicable to the exercise of the warrants; |

| |

|

|

| |

● |

the date on which the right to exercise the warrants will commence, and the date on which the right will expire; |

| |

|

|

| |

● |

If any, the maximum or minimum number of warrants that may be exercised at any time; |

| |

|

|

| |

● |

information with respect to book-entry procedures, if any; and |

| |

|

|

| |

● |

any other terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

Exercise of Warrants. Each

warrant will entitle the holder of warrants to purchase the amount of securities or other rights, at the exercise price stated or determinable

in the prospectus supplement for the warrants. Warrants may be exercised at any time up to the close of business on the expiration date

shown in the applicable prospectus supplement, unless otherwise specified in such prospectus supplement. After the close of business on

the expiration date, if applicable, unexercised warrants will become void. Warrants may be exercised in the manner described in the applicable

prospectus supplement. When the warrant holder makes the payment and properly completes and signs the warrant certificate at the corporate

trust office of the warrant agent, if any, or any other office indicated in the prospectus supplement, we will, as soon as possible, forward

the securities or other rights that the warrant holder has purchased. If the warrant holder exercises less than all of the warrants represented

by the warrant certificate, we will issue a new warrant certificate for the remaining warrants.

Enforceability of

Rights By Holders of Warrants. Any warrant agent will act solely as our agent under the applicable warrant agreement and will

not assume any obligation or relationship of agency or trust with any holder of any warrant. A single bank or trust company may act as

warrant agent for more than one issue of warrants. A warrant agent will have no duty or responsibility in case of any default by us under

the applicable warrant agreement or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or

to make any demand upon us. Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant,

enforce by appropriate legal action the holder’s right to exercise, and receive the securities purchasable upon exercise of, its

warrants in accordance with their terms.

Warrant Agreement

Will Not Be Qualified Under Trust Indenture Act. No warrant agreement will be qualified as an indenture, and no warrant agent

will be required to qualify as a trustee, under the Trust Indenture Act. Therefore, holders of warrants issued under a warrant agreement

will not have the protection of the Trust Indenture Act with respect to their warrants.

Outstanding Warrants

As of August 27, 2024, we have outstanding warrants

to purchase up to 1,813,455 shares of our common stock, at a weighted average exercise price of $23.72 per share, with remaining terms

of approximately between 1 month and 7.2 years.

Subscription Rights

We may issue rights to

purchase our securities. The rights may or may not be transferable by the persons purchasing or receiving the rights. In connection with

any rights offering, we may enter into a standby underwriting or other arrangement with one or more underwriters or other persons pursuant

to which such underwriters or other persons would purchase any offered securities remaining unsubscribed for after such rights offering.

In connection with a rights offering to holders of our capital stock a prospectus supplement will be distributed to such holders on the

record date for receiving rights in the rights offering set by us.

We will file as exhibits

to the registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that

we file with the Commission, forms of the subscription rights, standby underwriting agreement or other agreements, if any. The prospectus

supplement relating to any rights that we offer will include specific terms relating to the offering, including, among other matters:

| |

● |

the date of determining the security holders entitled to the rights distribution; |

| |

|

|

| |

● |

the aggregate number of rights issued and the aggregate amount of securities purchasable upon exercise of the rights; |

| |

|

|

| |

● |

the exercise price; |

| |

|

|

| |

● |

the aggregate number of rights to be issued; |

| |

|

|

| |

● |

the date, if any, on and after which the rights will be separately transferable; |

| |

|

|

| |

● |

the conditions to completion of the rights offering; |

| |

|

|

| |

● |

the date on which the right to exercise the rights will commence and the date on which the rights will expire; |

| |

|

|

| |

● |

any applicable federal income tax considerations; and |

| |

|

|

| |

● |

any other terms of the rights, including terms, procedures and limitations relating to the distribution, exchange and exercise of the rights. |

Each right would entitle

the holder of the rights to purchase the principal amount of securities at the exercise price set forth in the applicable prospectus supplement.

Rights may be exercised at any time up to the close of business on the expiration date for the rights provided in the applicable prospectus

supplement. After the close of business on the expiration date, all unexercised rights will become void.

Holders may exercise

rights as described in the applicable prospectus supplement. Upon receipt of payment and the rights certificate properly completed and

duly executed at the corporate trust office of the rights agent, if any, or any other office indicated in the prospectus supplement, we

will, as soon as practicable, forward the securities purchasable upon exercise of the rights. If less than all of the rights issued in

any rights offering are exercised, we may offer any unsubscribed securities directly to persons other than stockholders, to or through

agents, underwriters or dealers or through a combination of such methods, including pursuant to standby underwriting arrangements, as

described in the applicable prospectus supplement.

Depositary Shares

General. We

may offer fractional shares of preferred stock, rather than full shares of preferred stock. If we decide to offer fractional shares of

our preferred stock, we will issue receipts for depositary shares. Each depositary share will represent a fraction of a share of a particular

series of our preferred stock, and the applicable prospectus supplement will indicate that fraction. The shares of preferred stock represented

by depositary shares will be deposited under a deposit agreement between us and a depositary that is a bank or trust company that meets

certain requirements and is selected by us. The depositary will be specified in the applicable prospectus supplement. Each owner of a

depositary share will be entitled to all of the rights and preferences of the preferred stock represented by the depositary share. The

depositary shares will be evidenced by depositary receipts issued pursuant to the deposit agreement. Depositary receipts will be distributed

to those persons purchasing the fractional shares of our preferred stock in accordance with the terms of the offering. We will file as

exhibits to the registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form

8-K that we file with the Commission, forms of the deposit agreement, form of certificate of designation of underlying preferred stock,

form of depositary receipts and any other related agreements.

Dividends and Other

Distributions. The depositary will distribute all cash dividends or other cash distributions received by it in respect

of the preferred stock to the record holders of depositary shares relating to such preferred shares in proportion to the numbers of depositary

shares held on the relevant record date.

In the event of a distribution

other than in cash, the depositary will distribute securities or property received by it to the record holders of depositary shares in

proportion to the numbers of depositary shares held on the relevant record date, unless the depositary determines that it is not feasible

to make such distribution. In that case, the depositary may make the distribution by such method as it deems equitable and practicable.

One such possible method is for the depositary to sell the securities or property and then distribute the net proceeds from the sale as

provided in the case of a cash distribution.

Redemption of Depositary

Shares. Whenever we redeem the preferred stock, the depositary will redeem a number of depositary shares representing

the same number of shares of preferred stock so redeemed. If fewer than all of the depositary shares are to be redeemed, the depositary

shares to be redeemed will be selected by lot, pro rata or by any other equitable method as the depositary may determine.

Voting of Underlying

Shares. Upon receipt of notice of any meeting at which the holders of our preferred stock of any series are entitled to vote, the

depositary will mail the information contained in the notice of the meeting to the record holders of the depositary shares relating to

that series of preferred stock. Each record holder of the depositary shares on the record date will be entitled to instruct the depositary

as to the exercise of the voting rights represented by the number of shares of preferred stock underlying the holder’s depositary

shares. The depositary will endeavor, to the extent it is practical to do so, to vote the number of whole shares of preferred stock underlying

such depositary shares in accordance with such instructions. We will agree to take all action that the depositary may deem reasonably

necessary in order to enable the depositary to do so. To the extent the depositary does not receive specific instructions from the holders

of depositary shares relating to such preferred shares, it will abstain from voting such shares of preferred stock.

Withdrawal of Shares.

Upon surrender of depositary receipts representing any number of whole shares at the depositary’s office, unless the related depositary

shares previously have been called for redemption, the holder of the depositary shares evidenced by the depositary receipts will be entitled

to delivery of the number of whole shares of the related series of preferred stock and all money and other property, if any, underlying

such depositary shares. However, once such an exchange is made, the preferred stock cannot thereafter be re-deposited in exchange for

depositary shares. Holders of depositary shares will be entitled to receive whole shares of the related series of preferred stock on the

basis set forth in the applicable prospectus supplement. If the depositary receipts delivered by the holder evidence a number of depositary

shares representing more than the number of whole shares of preferred stock of the related series to be withdrawn, the depositary will

deliver to the holder at the same time a new depositary receipt evidencing the excess number of depositary shares.

Amendment and Termination

of Depositary Agreement. The form of depositary receipt evidencing the depositary shares and any provision of the applicable

depositary agreement may at any time be amended by agreement between us and the depositary. We may, with the consent of the depositary,

amend the depositary agreement from time to time in any manner that we desire. However, if the amendment would materially and adversely

alter the rights of the existing holders of depositary shares, the amendment would need to be approved by the holders of at least a majority

of the depositary shares then outstanding.

The depositary agreement

may be terminated by us or the depositary if:

| |

● |

all outstanding depositary shares have been redeemed; or |

| |

|

|

| |

● |

there has been a final distribution in respect of the shares of preferred stock of the applicable series in connection with our liquidation, dissolution or winding up and such distribution has been made to the holders of depositary receipts. |

Resignation and Removal

of Depositary. The depositary may resign at any time by delivering to us notice of its election to do so. We may remove a depositary

at any time. Any resignation or removal will take effect upon the appointment of a successor depositary and its acceptance of appointment.

Charges of Depositary. We

will pay all transfer and other taxes and governmental charges arising solely from the existence of any depositary arrangements. We will

pay all charges of each depositary in connection with the initial deposit of the preferred shares of any series, the initial issuance

of the depositary shares, any redemption of such preferred shares and any withdrawals of such preferred shares by holders of depositary

shares. Holders of depositary shares will be required to pay any other transfer taxes.

Notices. Each

depositary will forward to the holders of the applicable depositary shares all notices, reports and communications from us which are delivered

to such depositary and which we are required to furnish the holders of the preferred stock represented by such depositary shares.

Miscellaneous.

The depositary agreement may contain provisions that limit our liability and the liability of the depositary to the holders of depositary

shares. Both the depositary and we are also entitled to an indemnity from the holders of the depositary shares prior to bringing, or defending

against, any legal proceeding. We or any depositary may rely upon written advice of counsel or accountants, or information provided by

persons presenting preferred shares for deposit, holders of depositary shares or other persons believed by us to be competent and on documents

believed by us or them to be genuine.

Purchase Contracts

We may issue purchase

contracts, representing contracts obligating holders to purchase from us, and us to sell to the holders, a specific or varying number

of common stock, preferred stock, warrants, depositary shares or any combination of the above, at a future date or dates. Alternatively,

the purchase contracts may obligate us to purchase from holders, and obligate holders to sell to us, a specific or varying number of common

stock, preferred stock, warrants, depositary shares, or any combination of the above. The price of the securities and other property subject

to the purchase contracts may be fixed at the time the purchase contracts are issued or may be determined by reference to a specific formula

set forth in the purchase contracts. The purchase contracts may be issued separately or as a part of a unit that consists of (a) a purchase

contract and (b) one or more of the other securities that may be sold by us pursuant to this prospectus or any combination of the foregoing,

which may secure the holders’ obligations to purchase the securities under the purchase contract. The purchase contracts may require

us to make periodic payments to the holders or require the holders to make periodic payments to us. These payments may be unsecured or

prefunded and may be paid on a current or on a deferred basis. The purchase contracts may require holders to secure their obligations

under the contracts in a manner specified in the applicable prospectus supplement.

We will file as exhibits

to the registration statement of which this prospectus is a part, or will incorporate by reference from a current report on Form 8-K that

we file with the Commission, forms of the purchase contracts and purchase contract agreement, if any. The applicable prospectus supplement

will describe the terms of any purchase contracts in respect of which this prospectus is being delivered, including, to the extent applicable,

the following:

| |

● |

whether the purchase contracts obligate the holder or us to purchase or sell, or both purchase and sell, the securities subject to purchase under the purchase contract, and the nature and amount of each of those securities, or the method of determining those amounts; |

| |

|

|

| |

● |

whether the purchase contracts are to be prepaid or not; |

| |

|

|

| |

● |

whether the purchase contracts are to be settled by delivery, or by reference or linkage to the value, performance or level of the securities subject to purchase under the purchase contract; |

| |

|

|

| |

● |

any acceleration, cancellation, termination or other provisions relating to the settlement of the purchase contracts; |

| |

|

|

| |

● |

whether the purchase contracts will be issued in fully registered or global form; and |

| |

|

|

| |

● |

any applicable federal income tax considerations; and |

Units

We may issue units consisting

of any combination of the other types of securities offered under this prospectus in one or more series. We may evidence each series of

units by unit certificates that we may issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit

agent, if any, may be a bank or trust company that we select. We will indicate the name and address of the unit agent, if any, in the

applicable prospectus supplement relating to a particular series of units. Specific unit agreements, if any, will contain additional important

terms and provisions. We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate

by reference from a current report that we file with the Commission, the form of unit and the form of each unit agreement, if any, relating

to units offered under this prospectus.

If we offer any units,

certain terms of that series of units will be described in the applicable prospectus supplement, including, without limitation, the following,

as applicable

| |

● |

the title of the series of units; |

| |

|

|

| |

● |

identification and description of the separate constituent securities comprising the units; |

| |

|

|

| |

● |

the price or prices at which the units will be issued; |

| |

|

|

| |

● |

the date, if any, on and after which the constituent securities comprising the units will be separately transferable; |

| |

|

|

| |

● |

a discussion of certain United States federal income tax considerations applicable to the units; and |

| |

|

|

| |

● |

any other material terms of the units and their constituent securities. |

Forum for Adjudication of Disputes

Pursuant to our bylaws, to the fullest extent

permitted by law, and unless we consent in writing to the selection of an alternative forum, the Eighth Judicial District Court of Clark

County, Nevada, shall be the sole and exclusive forum for any stockholder (including a beneficial owner of stock) to bring (a) any derivative

action or proceeding brought in the name or right of the Company or on our behalf, (b) any action asserting a claim of, or a claim based

on, breach of any fiduciary duty owed by any current or former director, officer, employee, agent or stockholder of the Company to the

Company or the Company’s stockholders, (c) any action arising or asserting a claim arising pursuant to any provision of NRS Chapters

78 or 92A or any provision of the certificate of incorporation or our bylaws or (d) any action asserting a claim against us or any current

or former director, officer, employee or stockholder (including a beneficial owner of stock) governed by the internal affairs doctrine,

including, without limitation, any action to interpret, apply, enforce or determine the validity of the certificate of incorporation or

our bylaws. To the fullest extent permitted by law, our forum selection provision applies to actions arising under the Securities Act

or Exchange Act. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability

created by the Exchange Act or the rules and regulations thereunder. The Company does not intend for its exclusive forum jurisdiction

provision to apply to Exchange Act claims. Furthermore, Section 22 of the Securities Act creates concurrent jurisdiction for federal and

state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder.

Although our certificate of incorporation contain the choice of forum provision described above, it is possible that a court could rule

that such a provision is inapplicable for a particular claim or action or that such provision is unenforceable.

Anti-takeover Effects of Our Certificate of

Incorporation and By-laws

Our certificate of incorporation and bylaws contain

certain provisions that may have anti-takeover effects, making it more difficult for or preventing a third party from acquiring control

of our Company or changing our Board of Directors and management. According to our bylaws and certificate of incorporation, neither the

holders of our common stock nor the holders of our preferred stock have cumulative voting rights in the election of our directors. The

combination of the present ownership by a few stockholders of a significant portion of our issued and outstanding common stock and lack

of cumulative voting makes it more difficult for other stockholders to replace our Board of Directors or for a third party to obtain control

of our Company by replacing our Board of Directors.

Anti-takeover Effects of Nevada Law

Business Combinations

The “business combination” provisions

of Sections 78.411 to 78.444, inclusive, of the Nevada Revised Statutes, or NRS, generally prohibit a Nevada corporation with at least

200 stockholders of record, a “resident domestic corporation,” from engaging in various “combination” transactions

with any “interested stockholder” unless certain conditions are met or the corporation has elected in its articles of incorporation

to not be subject to these provisions.

A “combination” is generally defined

to include (a) a merger or consolidation of the resident domestic corporation or any subsidiary of the resident domestic corporation with

the interested stockholder or affiliate or associate of the interested stockholder; (b) any sale, lease, exchange, mortgage, pledge, transfer,

or other disposition, in one transaction or a series of transactions, by the resident domestic corporation or any subsidiary of the resident

domestic corporation to or with the interested stockholder or affiliate or associate of the interested stockholder having: (i) an aggregate

market value equal to 5% or more of the aggregate market value of the assets of the resident domestic corporation, (ii) an aggregate market

value equal to 5% or more of the aggregate market value of all outstanding shares of the resident domestic corporation, or (iii) representing

10% or more of the earning power or net income of the resident domestic corporation; (c) the issuance or transfer in one transaction or

series of transactions of shares of the resident domestic corporation or any subsidiary of the resident domestic corporation having an

aggregate market value equal to 5% or more of the resident domestic corporation to the interested stockholder or affiliate or associate