false

0001553643

0001553643

2025-02-03

2025-02-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 3, 2025

RELMADA THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39082 |

|

45-5401931 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

2222 Ponce de Leon Blvd., Floor 3

Coral Gables, FL |

|

33134 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code (212)

547-9591

| |

| (Former name or former address,

if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common stock, $0.001 par value per share |

|

RLMD |

|

The Nasdaq Global Select

Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

February 3, 2025, Relmada Therapeutics, Inc. (the “Company”) entered into an Asset Purchase Agreement (the “Purchase

Agreement”) with Asarina Pharma AB (“Asarina” or the “Seller”), a Swedish corporation, pursuant to which

the Company has agreed, subject to the terms and conditions set forth therein, to purchase from Asarina all right, title, and interest

in Sepranolone (the “Asset”), a phase 2b ready neurosteroid being developed for the treatment of Tourette Syndrome and other

compulsive disorders. The total purchase price for the Asset is €3,000,000. The Company will pay Asarina €2,756,000 within

ten (10) business days after the effective date of the Purchase Agreement, which includes a credit of $250,000 for a previous payment

made by the Company to Asarina pursuant to an exclusivity agreement dated October 25, 2024.

The

Company will only assume liabilities arising after the effective date of the Purchase Agreement. All other liabilities, including those

arising before the effective date of the Purchase Agreement, taxes, employment-related liabilities, and those related to the negotiation

and consummation of the Purchase Agreement, will remain with Asarina.

The

Purchase Agreement provides for customary indemnification rights related to breaches of certain representations of each of the parties,

and certain other matters. The indemnification obligations of the Company and Asarina are subject to the limitations set forth in the

Purchase Agreement.

The

Purchase Agreement contains customary representations, warranties and covenants that are subject, in some cases, to specified exceptions

and qualifications contained in the Purchase Agreement.

The

foregoing description of the material terms of the Purchase Agreement is qualified in its entirety by reference to the text of the Purchase

Agreement as attached hereto as Exhibit 10.1.

Item

7.01 Regulation FD Disclosure.

On

February 6, 2025, the Company issued a press release announcing that it had entered into the Purchase Agreement. A copy of

the press release is attached to this Current Report as Exhibit 99.1 and incorporated herein by reference.

The

information in this Current Report on Form 8-K under Item 7.01, including the information contained in Exhibit 99.1, is being furnished

to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by a specific reference in such filing.

Item

8.01 Other Events.

Clinical

Data on Sepranolone

Sepranolone

(isoallopregnanolone) is a GABAA Modulating Steroid Antagonist (GAMSA), which selectively targets the GABAA pathway to counteract the

effects of Allopregnanolone, a neurosteroid implicated in Tourette Syndrome and compulsive disorders. In an open-label, Phase 2a randomized,

12-week, dual-center, parallel-group study, 26 subjects were treated with Sepranolone (10 mg, administered by subcutaneous injection

twice weekly) in addition to standard of care (SOC) versus standard of care alone.

The

Phase 2a results showed competitive tic reduction and improved quality of life while displaying no CNS off-target effects. Sepranolone

reduced tic severity in its primary clinical endpoint as measured by YGTSS by 28% (p=0.051) – and also achieved positive results

in four secondary endpoints compared with standard of care:

| ● | 69%

greater increase of Quality of Life (using the Gilles de la Tourette Syndrome Quality of Life total score (GTS-QOL); |

| ● | 50%

greater reduction in impairment (YGTSS); |

| ● | 44%

greater reduction of the premonitory urge to tic (PUTS – the Premonitory Urge to Tic scale); and |

| ● | No

off-target CNS effects or systemic side effects. |

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| # | Certain

identified information has been excluded from this exhibit (indicated by asterisks) because it is both not material and the type of information

that the Company treats as private or confidential, in accordance with the rules of the SEC. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated: February 6, 2025 |

RELMADA THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/

Sergio Traversa |

| |

Name: |

Sergio Traversa |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THIS EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. INFORMATION

THAT WAS OMITTED HAS BEEN NOTED IN THIS DOCUMENT WITH A PLACEHOLDER IDENTIFIED BY THE MARK “[***]”.

ASSET PURCHASE AGREEMENT

This ASSET PURCHASE AGREEMENT

(“Agreement”), dated February 3, 2025 (the “Effective Date”), is entered into by and between Asarina

Pharma AB, a Swedish corporation (“Asarina” or “Seller”), and Relmada Therapeutics, Inc. a Nevada

corporation (“Relmada” or “Buyer”).

Background

WHEREAS, Seller is

the sole owner of the Purchased Assets (as defined below); and

WHEREAS, Seller and

Buyer are parties to that certain exclusivity agreement dated October 25, 2024 pursuant to which Buyer paid Seller an exclusivity fee

of Two Hundred Fifty Thousand Dollars ($ 250,000) (the “Exclusivity Fee”) which Exclusivity Fee shall be creditable

against the Purchase Price (as hereinafter defined);

WHEREAS, Seller desires

to sell, transfer and assign to Buyer, and Buyer desires to acquire and assume from Seller, all of the Purchased Assets and Assumed Liabilities,

all as more specifically provided herein;

NOW, THEREFORE,

in consideration of the foregoing and the representations, warranties, covenants and agreements contained herein, and for other good and

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound, hereby

agree as follows:

ARTICLE

1

DEFINITIONS

Section 1.1 Definitions

All terms not defined below

are as defined elsewhere in this Agreement.

“Affiliate”

means any Person that directly or indirectly Controls, is Controlled by or is under common Control with another Person. A Person will

be deemed to “Control” another Person if it has the power to direct or cause the direction of the other Person, whether

through ownership of securities, by contract or otherwise.

“Applicable Laws”

means, in respect of any Person, property, transaction, event or course of conduct, all applicable laws, statutes, regulations, rules,

ordinances, regulatory policies, codes, guidelines, official directives, orders, rulings, judgments and decrees of any Governmental Authority.

“Assumed Liabilities”

means only Liabilities of the Seller arising after the Effective Date under the Transferred Contracts or such other liabilities expressly

set forth in Exhibit A hereto.

“Business Day”

means any day other than a Saturday, Sunday or other day on which banks in New York, New York, USA, are permitted or required to close

by law or regulation.

“Compound”

means Sepranolone (isoallopregnanolone) and any metabolite, salt, ester, hydrate, solvate, isomer, enantiomer, free acid form, crystalline

form, co-crystalline form, amorphous form, prodrug form, racemate, polymorph, chelate, stereoisomer, tautomer or optically active form

of any of the foregoing.

“Encumbrance”

means any mortgage, charge, lien, security interest, easement, right of way, pledge or encumbrance of any nature whatsoever.

“Excluded Liabilities”

means any and all Liabilities of Seller that are not expressly included in the definition of Assumed Liabilities, including, but not limited

to:

| (a) | any and all Liabilities arising prior to or on the Effective

Date under the Transferred Contracts; |

| (b) | any and all Liabilities of Seller with respect to taxes; |

| (c) | any and all Liabilities arising out of or otherwise relating

to the employment or service of any person by Seller; |

| (d) | any and all Liabilities of Seller under this Agreement or incurred

in connection with the negotiation or consummation of this Agreement; and |

| (e) | any and all Liabilities of the Seller arising out of events,

transactions, facts, acts or omissions which occurred prior to or on the Effective Date. |

“FDA” means

the United States Food and Drug Administration or any successor agency performing similar functions.

“Governmental Authority”

means any court, governmental agency, department or commission or other governmental authority or instrumentality, including, but not

limited to, the FDA.

“Intellectual Property

Rights” means all right, title and interest of Seller or any of its Affiliates (including, but not limited to, rights held under

any other Transferred Contract) in and to (a) the Patent Rights, (b) the Trademarks, (c) the Know-How, (d) the Technical Information and

(e) any copyrights and other intellectual property related to any of the foregoing, the Technology and/or any of the Compounds.

“Know-How”

means any know-how, show-how, technical and non-technical information, trade secrets, formulae, techniques, sketches, drawings, materials,

models, inventions, designs, specifications, processes, apparatus, equipment, databases, research, experimental work, development, pharmacology

and clinical data, software programs and applications, software source documents, third-party licenses, and any other type of intellectual

property right (other than the Patent Rights) and any manufacturing technology and data (including formulation and Chemistry, Manufacturing

and Controls (CMC) data), in each case related to the Technology or the Compound.

“Liabilities”

means any and all debts, liabilities and obligations, whether accrued or fixed, absolute or contingent, matured or unmatured, or determined

or determinable, including those arising under any law, action or governmental order and those arising under any contract, agreement,

arrangement, commitment or undertaking, or otherwise.

“Losses”

means, in relation to representations and warranties under Article 4 in this Agreement, any direct and any reasonably foreseeable

indirect claims, losses, damages, Liabilities, taxes, judgments, penalties, costs and expenses (including reasonable legal fees and expenses)

on a Euro to Euro basis and, in relation to covenants, agreements and obligations contained in this Agreement, any and all claims, losses,

damages, Liabilities, taxes, judgments, penalties, costs and expenses (including reasonable legal fees and expenses).

“Parties”

means collectively the Seller and Buyer.

“Party”

means either the Seller or Buyer.

“Patent Rights”

means all patents and patent applications owned by or licensed to Seller or any of its Affiliates related to the Compound and/or manufacture,

use or administration thereof as listed on Exhibit B.

“Person”

means any individual, corporation, partnership, limited liability company, joint venture, trust, business association, organization, Governmental

Authority or other entity.

“Potential Suppliers”

means those potential suppliers of interest to Buyer set forth on Exhibit D.

“Purchased Assets”

means:

| (a) | the Intellectual Property Rights; |

| (b) | the Transferred Contracts; |

| (c) | any inventories of Compound or other supplies, equipment and other tangible assets used in connection

with the development of the Compound; |

| (d) | all authorizations, consents, approvals, licenses, orders, permits and exemptions of, and filings or registrations

with, any Governmental Authority including any INDs, to the extent transferable by the Seller; |

| (e) | all books, records, files and papers relating or necessary to the conduct of any of the other Purchased

Assets or the business of the Seller or any of its Affiliates related to the Technology or the Compound; |

| (f) | all rights and claims of the Seller or any of its Affiliates, whether mature, contingent or otherwise,

against any Person, whether in tort, contract or otherwise, including, without limitation, causes of action, unliquidated rights and claims

under or pursuant to all warranties, representations and guarantees made by manufacturers, suppliers or vendors, claims for refunds, rights

of off-set and credits of all kinds and all other general intangibles; provided, however, that such rights and claims shall

not include any rights and claims of Seller under this Agreement; |

| (g) | the benefit of coverage provided by all current and expired insurance policies of Seller and its Affiliates

to the extent they relate to any of the Purchased Assets or Assumed Liabilities; and |

| (h) | all other assets used or useful in the development of the Compound, whether or not reflected on the books

and records of the Seller or any of its Affiliates. |

“Purchase Price”

means €3,000,000

“Technical Information”

means any and all data and other information that exists as of the Effective Date and relates to the Technology and/or the Compound or

is otherwise necessary or useful for the further development or commercialization of the Compound, including, but not limited to, any

investigational new drug applications, correspondence with FDA or other governmental authorities, clinical data, pre-clinical data, adverse

event data, pharmaceutical development reports, formulations and any and all other medical and technical information.

“Technology”

means the inventions described in the Patent Rights and any and all other technology under development by Seller or any of its Affiliates

related to the Compounds and/or any products incorporating the Compound.

“Territory”

means worldwide

“Third Party”

means any legal person, entity or organization other than Buyer, Seller or an Affiliate of either Party.

“Trademarks”

means all rights with respect to (a) the “Sepranolone” name and (b) any and all other trademarks, service marks, service names,

trade names, internet domain names, brand marks, brands, trade dress, package designs, product inserts, labels, logos and associated artwork

owned by Seller or any of its Affiliates related to the Technology or Compound, including any and all applications or registrations for

any of the foregoing, and extensions, renewals, continuations or re-issues thereof, or amendments or modifications thereto.

“Transferred Contracts”

means the contracts (if any) listed on Exhibit C.

Section 1.2 Interpretation.

When used in this Agreement the words “include”, “includes” and “including” will be deemed to be followed

by the words “without limitation.” Any terms defined in the singular will have a comparable meaning when used in the plural,

and vice-versa.

Section 1.3 Currency.

All currency amounts referred to in this Agreement are in Euros, unless otherwise specified.

ARTICLE

2

PURCHASE AND SALE OF ASSETS

Section 2.1 Purchase

and Sale. Seller (on behalf of itself and its Affiliates) hereby sells, assigns, transfers, conveys and delivers to Buyer, and Buyer

hereby purchases, acquires and accepts, all right, title and interest in and to the Purchased Assets, free and clear of all Encumbrances.

Section 2.2 Assumption

of Assumed Liabilities; Excluded Liabilities. Buyer hereby assumes only the Assumed Liabilities. Buyer will not assume or be liable

for any of the Excluded Liabilities. Seller shall pay, discharge and satisfy, as they become due, all Excluded Liabilities.

Section 2.3 Deliveries.

Within ten (10) business days after the Effective Date and after receiving the payment in accordance with Section 3.1, Seller will deliver

to Buyer (a) any tangible materials included in the Purchased Assets and (b) copies (in the format in which they are maintained by Seller)

of all books, records, data, contracts, files and other information included in the Purchased Assets.

ARTICLE

3

FINANCIAL TERMS

Section 3.1 Payment.

Within ten (10) business days after the Effective Date, Relmada shall pay Asarina a payment of Two Million and Seven Hundred Fifty Six

Thousand Euros (€2,756,000) payable by wire transfer of immediately available funds to an account designated by Asarina which payment

equals the Purchase Price less the Exclusivity Fee.

Section 3.2 Taxes.

Each Party agrees to report (and to cause its Affiliates to report) the transactions contemplated by this Agreement in a manner consistent

with applicable law and with the terms of this Agreement and agrees not to take any position inconsistent therewith on any tax return,

in any tax refund claim, in any litigation or otherwise. Each Party will bear its own taxes payable in connection with the transactions

contemplated hereby. Buyer shall have no obligation for any capital gains or other income taxes owed by Seller as a result of the transaction.

Section

3.3 Transfer costs. All external shipping expenses for the delivery or requested movement of tangible material included

in the Purchased Assets as well as all fees and other external expenses directly related to the transfer of the IP to the Buyer shall

be paid by Buyer or fully reimbursed by Buyer if such expenses have been paid by Seller.

Section 3.4 IP Costs.

Buyer shall reimburse Seller for any reasonable documented IP costs related to the Purchased Assets which Seller has incurred or may incur

after December 1, 2024.

ARTICLE

4

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller hereby represents and

warrants to Buyer as follows:

Section 4.1 Organization;

Authority; Execution and Delivery. Seller is a corporation, duly organized, validity existing and in good standing under the laws

of Sweden. Seller has the requisite corporate power and authority to enter into this Agreement and to consummate the transaction contemplated

hereby. The execution and delivery of this Agreement by Seller and the consummation of the transactions contemplated hereby have been

validly authorized. This Agreement has been executed and delivered by Seller and, assuming the due authorization, execution and delivery

of this Agreement by Buyer, will constitute the legal and binding obligation of Seller, enforceable against it in accordance with its

terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting

creditors’ rights generally from time to time in effect and to general principles of equity (including concepts of materiality,

reasonableness, good faith and fair dealing) regardless of whether considered in a proceeding in equity or at law. Seller intends to initiate

a liquidation of the Seller and its Affiliate before the end of 2025.

Section 4.2 Consents;

No Violation, Etc. The execution and delivery of this Agreement do not, and the consummation of the transactions contemplated hereby

(including the transfer of the Purchased Assets to Buyer) and the compliance with the terms hereof will not: (i) violate any Applicable

Law applicable to Seller or any of its Affiliates, (ii) conflict with any provision of the certificate of incorporation or by-laws (or

similar organizational document) of Seller or any of its Affiliates, (iii) conflict with or violate any Transferred Contract or any other

contract to which Seller or any of its Affiliates is a party or by which it is otherwise bound or (iv) require Seller or any of its Affiliates

to obtain any approval, authorization, consent, license, exemption, filing or registration from or with any court, arbitrator, Governmental

Authority or pursuant to any contract by which Seller or any of its Affiliates is bound or that otherwise relates to any of the Purchased

Assets or the Compound.

Section 4.3 Litigation.

There are no claims, suits, actions or other proceedings pending or threatened in writing against Seller or any of its Affiliates at law

or in equity before or by any Governmental Authority, domestic or foreign, involving or related to the Purchased Assets or which may in

any way adversely affect the performance of Seller’s obligations under this Agreement or the transactions contemplated hereby.

Section 4.4 Title to

Purchased Assets. Immediately prior to the transfer of the Purchased Assets to Buyer, Seller is the sole and exclusive owner of, has

good and valid title to all of the Purchased Assets, free and clear of all Encumbrances, and has the right to convey the same to Buyer

without conflicting with the terms of any contract to which Seller or any of its Affiliates is bound. No Third Party holds any license,

option, reversionary interest or other right with respect to any of the Purchased Assets or the Compound.

Section 4.5 No Undisclosed

Liabilities. Seller does not have any Liabilities in relation to Purchased Assets, except (i) as disclosed, reflected or reserved

against in the balance sheet of Seller as of December 31, 2024 (a true and complete copy of which has been provided by Seller to Buyer)

and (ii) for immaterial Liabilities incurred since December 31, 2024, in the ordinary course of the business of Seller that do not exceed

€25,000 in the aggregate (none of which results from, arises out of or relates to any breach or violation of, or default under, any

Transferred Contract or Applicable Law).

Section 4.6 Transferred

Contracts. Seller has delivered to Buyer complete copies of each of the Transferred Contracts, including any and all amendments thereto

and (i) each Transferred Contract is valid, binding and enforceable on Seller and to Seller’s knowledge to each party thereto (subject

to applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’

rights generally from time to time in effect and to general principles of equity regardless of whether considered in a proceeding in equity

or at law) and is in full force and effect, (ii) neither Seller or any of its Affiliates (nor to Seller’s knowledge, any other party

to a Transferred Contract) is in material breach or violation of, or default under, any Transferred Contract and (iii) no consent of any

Person is required in connection with the assignment of the Transferred Contracts to Buyer pursuant to this Agreement. A list of potential

Suppliers including address, phone # and contact related to the Purchased Assets is set forth on Exhibit D.

Section 4.7 Compliance

with Applicable Law. The research and development of the Compounds and the Technology has at all times been conducted in compliance

with all Applicable Laws.

Section 4.8 Product

Intellectual Property. There are no patents or patent applications owned by or licensed to Seller or any of its Affiliates related

to the Compound and/or manufacture, use or administration thereof, other than the Patent Rights listed on Exhibit B hereto. The

Intellectual Property Rights for the three patent families listed on Exhibit B in the US, Japan and the EU are all valid, enforceable

and in full force and effect. Exhibit B also includes a list of countries where patents or patent applications have been abandoned

by Asarina but in some cases may be resurrected. The decision to resurrect and the cost associated with resurrection of any of these patents

or patent applications are the full responsibility of Buyer. To Seller’s knowledge, the use of the Compound and the Technology in

connection with the development, manufacture, use, sale and commercialization of any Compound (or any products incorporating any Compound)

does not and will not infringe, misappropriate or violate any patent, copyright, trade secret or other intellectual property or contractual

right of any Third Party. Neither Seller nor any of its Affiliates has received any charge, complaint, claim, demand, or notice alleging

any such infringement, misappropriation, or violation in the Territory (including any claim that Seller or any of its Affiliates must

license or refrain from using any intellectual property rights relating to the Compound or any Technology).

Section 4.9 No Other

Compound-Related Assets. The Purchased Assets constitute substantially all of the assets of Seller and its Affiliates related to the

Compound. Except for the Purchased Assets, neither Seller nor any of its Affiliates nor any other Person holds any ownership, license,

option, right of reference or other right or interest in or to any patent, copyright, trade secret, trademark, data, know-how, contractual

right or other tangible or intangible asset that is necessary or useful for the development or commercialization of the Technology or

the Compound.

Section 4.10 Taxes.

Neither Seller nor any of its Affiliates has any Liability with respect to any taxes for which Buyer would reasonably be expected to become

liable or that would reasonably be expected to adversely affect Buyer’s right to use and enjoy any of the Purchased Assets, free

and clear of any Encumbrances, including liens for Taxes.

Section 4.11 No Brokers.

Neither Seller nor any of its Affiliates has any liability or obligation to pay any fees or commissions to any broker, finder or other

agent with respect to this Agreement for which Buyer could become liable or obligated or which could result in an Encumbrance being filed

against any of the Purchased Assets.

Section 4.12 No Other

Representations or Warranties. Except for the representations and warranties of Seller expressly set forth in this Article 4,

neither Seller nor any other Person makes any other express or implied representation or warranty on behalf of Seller. Accordingly, the

Seller makes no representations or warranties, express or implied, regarding the commercial viability, marketability, or profitability

of the Purchased Assets. The Buyer acknowledges and agrees that the Seller does not guarantee that the Purchased Assets can be successfully

commercialized or that it will generate any revenue or profit.

ARTICLE

5

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer hereby represents and

warrants to Seller as follows:

Section 5.1 Organization;

Authority; Execution and Delivery. Buyer is a corporation duly organized, validly existing and in good standing under the laws of

the State of Nevada. Buyer has the company power and authority to enter into this Agreement and to consummate the transactions contemplated

hereby. The execution and delivery of this Agreement by Buyer and the consummation of the transactions contemplated hereby have been authorized.

This Agreement has been executed and delivered by Buyer and, assuming the due authorization, execution and delivery of this Agreement

by Seller, constitutes the legal and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, subject to applicable

bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors’ rights generally

from time to time in effect and to general principles of equity (including concepts of materiality, reasonableness, good faith and fair

dealing regardless) of whether considered in a proceeding in equity or at law.

Section 5.2 Consents;

No Violations, Etc. The execution and delivery of this Agreement do not, and the consummation of the transactions contemplated hereby

(including the transfer of the Purchased Assets to Buyer) and the compliance with the terms hereof will not: (i) violate any Applicable

Law applicable to Buyer, (ii) conflict with any provision of the Company’s charter (or similar organizational document) of Buyer,

(iii) conflict with or violate any contract to which Buyer or any of its Affiliates is a party or by which it is otherwise bound or (iv)

require Buyer or any of its Affiliates to obtain any approval, authorization, consent, license, exemption, filing or registration from

or with any court, arbitrator, Governmental Authority or pursuant to any contract by which Buyer or any of its Affiliates is bound.

Section 5.3 No Brokers.

Neither Buyer nor any of its Affiliates has any liability or obligation to pay any fees or commissions to any broker, finder or other

agent with respect to this Agreement for which Seller could become liable or obligated.

Section 5.4 Finances.

The Buyer has secured sufficient and unconditional financing or has available internal funds to enable it to complete, fully and in a

timely manner, the purchase and to make any payments that the Buyer is or may become required to make pursuant to this Agreement.

Section 5.5 No Other

Representations or Warranties. Except for the representations and warranties of Buyer expressly set forth in this Article 5,

neither Buyer nor any other Person makes any other express or implied representation or warranty on behalf of Buyer.

ARTICLE

6

OTHER AGREEMENTS

Section 6.1 Restrictive

Covenants. As a material inducement for Buyer to enter into this Agreement, Seller agrees to the covenants and restrictions set forth

below in this Section 6.1, and Seller hereby acknowledges and agrees that Buyer would not execute and deliver this Agreement and

consummate the transactions contemplated hereby in the absence of such covenants by Seller and the Seller Shareholders.

| (a) | Seller (i) shall not (and shall ensure that its Affiliate do not), directly or indirectly, disclose or

use or otherwise exploit for their own benefit or for the benefit of any other Person, any of the Know-How, Technical Information or other

non-public information included in the Purchased Assets (collectively, “Confidential Information”) and (ii) shall safeguard

any Confidential Information in their possession or control by all reasonable measures. However, the Buyer acknowledges and accepts that

the Seller may have disclosed some Confidential Information before the Effective Date (subject to the terms of confidentiality agreements

which are included in the Transferred Contracts) if required during the ordinary course of business of the Seller. Seller acknowledges

and agrees that any and all Confidential Information will be, as of the Effective Date and subject to the payment in accordance with Section

3.1, the exclusive property of Buyer. |

| (b) | For a period of three (3) years from the Effective Date (the “Restricted Period”),

Seller shall not (whether directly or through any Affiliate, licensee or other Third Party) engage the development or commercialization

of any therapeutic containing any compound targeting the GABA receptor for the treatment of [***] (the “Restricted Field”). |

| (c) | During the Restricted Period, neither Seller nor any of its Affiliates shall solicit for employment or

other engagement any employee or agent of Buyer or any of its Affiliates. |

Section 6.2 Bulk Sales.

Seller shall use best efforts to comply with the provisions of any bulk sales, bulk transfer or similar Applicable Laws of any jurisdiction

that may otherwise be applicable with respect to the sale of any or all of the Purchased Assets to Buyer; it being understood that any

Liabilities arising out of the failure of Seller to comply with the requirements and provisions of any bulk sales, bulk transfer or similar

Applicable Laws of any jurisdiction shall be treated as Excluded Liabilities.

Section 6.3 Further

Assurances. Each Party, upon the request of the other Party and without further consideration,

will do, execute, acknowledge and deliver or cause to be done, executed, acknowledged or delivered all such further acts, deeds, documents,

assignments, transfers, conveyances, powers of attorney and assurances as may be reasonably necessary to effect complete consummation

of the transactions contemplated by this Agreement. The Seller is not obliged to fulfil any obligations in relation to this Section 6.3

if payment in accordance with Section 3.1 is not received. The recordal of the change of name and title of the holder with the proper

authorities is the responsibility of the Buyer. The costs (including official fees and attorney fees) in relation to these recordals shall

be borne solely by the Buyer. The Parties acknowledge and agree that all IP expenses related to the Purchased Assets incurred as from

1 December 2024 shall be paid by the Buyer in accordance with section 3.4.

ARTICLE

7

INDEMNIFICATION; LIABILITY

Section 7.1 Indemnification

by Seller. Seller hereby agrees to indemnify and defend Buyer and its Affiliates, and their respective officers, directors and employees

(the “Buyer Indemnified Parties”) against, and agrees to hold them harmless from, any Losses to the extent such Losses

arise from or in connection with the following:

| (a) | any breach by Seller of any representation or warranty made

by Seller under this Agreement; |

| (b) | any breach by Seller of any of its covenants, agreements or

obligations contained in this Agreement; |

| (c) | any taxes of Seller; and |

| (d) | any of the Excluded Liabilities. |

Section 7.2 Indemnification

by Buyer. Buyer hereby agrees to indemnify and defend Seller and its officers, directors and employees (the “Seller Indemnified

Parties”) against, and agrees to hold them harmless from, any Losses to the extent such Losses arise from or in connection with

the following:

| (a) | any breach by Buyer of any representation or warranty made by

Buyer under this Agreement; |

| (b) | any breach by Buyer of any of its covenants, agreements or obligations

contained in this Agreement; and |

| (c) | any of the Assumed Liabilities. |

Section 7.3 Limitation

of indemnification. The Seller’s liability in respect of any breach of any of the representations and warranties made by the

Seller under this Agreement is subject to the limitations set out below:

| (a) | A liability which is contingent shall not constitute a Loss

unless and until such contingent liability becomes an actual liability and is due and payable, it being noted that this shall not prevent

the Buyer from raising a claim for such Loss and will therefore not operate to exclude liability in relation to a claim made for a contingent

liability within the time limit set out in Section 7.5. |

| (b) | If any Loss is a tax-deductible item, or relates to an untaxed

reserve, the recoverable Loss shall be reduced by an amount equivalent to the Loss multiplied by the actual corporate tax rate applicable

in the relevant jurisdiction of the Buyer during the relevant fiscal year. |

| (c) | The Buyer shall not be entitled to recover from the Seller more

than once in respect of the same Losses suffered. In particular, without limitation, the foregoing shall apply where one and the same

set of facts qualifies under more than one provision entitling the Buyer to a claim or remedy under or in connection with this Agreement. |

| (d) | No claim may be made, and no liability shall arise if and to

the extent that: |

| i. | such claim is based on facts or circumstances which have been actually disclosed to the Buyer in this

Agreement, or the due diligence documents or which were otherwise known to the Buyer on or prior to the Effective Date; |

| iii. | such claim occurs as a result of the passing of any legislation not in force at the Effective Date, or

which takes effect retroactively, or occurs as a result of any increase in the tax rate in force on the Effective Date or any change in

the generally established practice of the relevant tax authorities; |

| iv. | Buyer actually receives proceeds with respect to such claim under an insurance policy of the Buyer; |

| v. | such claim has been recovered by the Buyer from any Third Party, or is otherwise compensated for or would

have been compensated for if the Buyer had taken reasonable steps to mitigate the Loss; and |

Section 7.4 Certain

Limitations. The aggregate amount of all Losses that may be recovered by the Buyer Indemnified Parties from Seller pursuant to all

claims for indemnification for breaches of representations and/or warranties under Section 7.1(a) (other than with respect to (A)

fraud and/or (B) Seller’s breach of any of the representations or warranties in Section 4.1 (“Organization; Authority;

Execution and Delivery”), Section 4.2 (“Consents; No Violation, Etc.”) or Section 4.4 (“Title to

Purchased Assets”) (collectively, the “Fundamental Representations”)), shall not exceed, in total, one million

five hundred thousand euros (€1,500,000.00) (the “Cap”). The aggregate amount of all Losses that may be recovered

by the Seller Indemnified Parties from Buyer pursuant to all claims for indemnification for breaches of representations and/or warranties

under Section 7.2(a), shall not exceed the Cap. For the avoidance of doubt, the Cap shall not apply to either Party’s indemnity

obligations under Section 7.1(b), Section 7.1(c), Section 7.1(d), Section 7.2(b), or Section 7.2(c).

The Buyer shall not be entitled to compensation for any Loss resulting from a breach of Seller’s representations or warranties unless

the aggregate amount of all recoverable Losses in total equals to or exceeds an amount corresponding to thirty thousand euros (€30,000.00),

in which case the entire amount of the Losses shall be recoverable. The Seller shall not be entitled to compensation for any Loss resulting

from a breach of Buyer’s representations or warranties unless the aggregate amount of all recoverable Losses in total equals to

or exceeds an amount corresponding to thirty thousand euros(€30,000) in which case the entire amount shall be recoverable.

Section 7.5 Survival

of Representations and Warranties. Except for the Fundamental Representations (which shall survive and remain in full force and effect

at all times after the Effective Date), the representations and warranties set forth in Article 4 and Article 5 shall survive

and remain in full force and effect until December 31, 2025.

Section 7.6 Sole Remedy.

Except in the event of fraud, the Parties acknowledge and agree that their sole and exclusive remedy with respect to any and all claims

with respect to breaches of any representation or warranty stated in Article 4 or Article 5 shall be pursuant to the rights

to indemnification set forth in this Article 7.

Section 7.7 Indemnity

Procedures.

(a) In

order for an indemnified party under this Article 7 (an “Indemnified Party”) to be entitled to any indemnification

provided for under this Agreement, the Indemnified Party will, within a reasonable period of time following the discovery of the matters

giving rise to any Losses, notify its applicable insurer and the indemnifying party under this Article 7 (the “Indemnifying

Party”) in writing of its claim for indemnification for such Losses, specifying in reasonable detail the nature of the Losses

and the amount of the liability estimated to accrue therefrom; provided, however, that failure to give notification will

not affect the indemnification provided hereunder, except to the extent the Indemnifying Party will have been actually prejudiced as a

result of the failure. Thereafter, the Indemnified Party will deliver to the Indemnifying Party, within a reasonable period of time after

the Indemnified Party’s receipt of such request, all information, records and documentation reasonably requested by the Indemnifying

Party with respect to such Losses

(b) If

the indemnification sought pursuant hereto involves a claim made by a Third Party against the Indemnified Party (a “Third Party

Claim”), the Indemnifying Party will be entitled to participate in the defense of such Third Party Claim and, if it so chooses,

to assume the defense of such Third Party Claim with counsel selected by the Indemnifying Party. Should the Indemnifying Party so elect

to assume the defense of a Third Party Claim, the Indemnifying Party will not be liable to the Indemnified Party for any legal expenses

subsequently incurred by the Indemnified Party in connection with the defense thereof. If the Indemnifying Party assumes such defense,

the Indemnifying Party will control such defense. The Indemnifying Party will be liable for the reasonable fees and expenses of counsel

employed by the Indemnified Party for any period during which the Indemnifying Party has not assumed the defense thereof (other than during

any period in which the Indemnified Party will have failed to give notice of the Third Party Claim as provided above). If the Indemnifying

Party chooses to defend or prosecute a Third Party Claim, all of the parties hereto will cooperate in the defense or prosecution thereof.

Such cooperation will include the retention and (upon the Indemnifying Party’s request) the provision to the Indemnifying Party

of records and information, which are reasonably relevant to such Third Party Claim, and making employees available on a mutually convenient

basis to provide additional information and explanation of any material provided hereunder. If the indemnifying Party chooses to defend

or prosecute any Third Party Claim, the Indemnifying Party will seek the approval of the Indemnified Party (not to be unreasonably withheld)

to any settlement, compromise or discharge of such Third Party Claim the Indemnifying Party may recommend and which by its terms obligates

the Indemnifying Party to pay the full amount of the liability in connection with such Third Party Claim. Whether or not the Indemnifying

Party will have assumed the defense of a Third Party Claim, the Indemnified Party will not admit any liability with respect to, or settle,

compromise or discharge, such Third Party Claim without the Indemnifying Party’s prior written consent). The Indemnifying Party

shall reimburse upon demand, all reasonable costs and expenses incurred by the Indemnified Party in cooperation with the defense or prosecution

of the Third Party Claim.

ARTICLE

8

GENERAL PROVISIONS

Section 8.1 Expenses.

Except as otherwise specified in this Agreement, all costs and expenses, including fees and disbursements of counsel, financial advisors

and accountants, incurred in connection with this Agreement and the transactions contemplated hereby will be paid by the Party incurring

such costs and expenses.

Section 8.2 Notices.

All notices and other communications required or permitted to be given or made pursuant to this Agreement shall be in writing signed by

the sender and shall be deemed duly given: (a) on the date delivered, if personally delivered, (b) upon sending, if by email with delivery

receipt, (c) three (3) Business Days after being sent by Federal Express or another internationally recognized express mail service which

utilizes a written form of receipt in each case addressed to the applicable party at the address set forth below; provided that a Party

may change its address for receiving notice by the proper giving of notice hereunder:

if to Buyer, to:

Relmada Therapeutics, Inc

2222 Ponce de Leon Blvd., Floor 3

Coral Gables, FL 33134

Attention: Sergio Traversa, CEO

with a copy to:

Lowenstein Sandler LLP

One Lowenstein Drive

Roseland, New Jersey 07068

Facsimile: [***]

Attn: Michael J. Lerner, Esq.

if Seller, to:

Asarina Pharma AB

c/o Peter Nordkild

Rigensgade 11A, 2

DK-1316 Copenhagen K

Attention: Jakob Dynnes Hansen

[***]

with a copy to:

Fredersen Advokatbyrå AB

Birger Jarlsgatan 8

SE-114 34 Stockholm

Attention: Hannes Mellberg

[***]

Section 8.3 Headings.

The table of contents and headings contained in this Agreement are for reference purposes only and will not affect in any way the meaning

or interpretation of this Agreement.

Section 8.4 Severability.

If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced under any law or public policy, all

other terms and provisions of this Agreement will nevertheless remain in full force and effect so long as the economic or legal substance

of the transactions contemplated hereby is not affected in any manner materially adverse to any Party. Upon such determination that any

term or other provision is invalid, illegal or incapable of being enforced, the Parties will negotiate in good faith to modify this Agreement

so as to effect the original intent of the Parties as closely as possible in an acceptable manner in order to ensure that the transactions

contemplated hereby are consummated as originally contemplated to the greatest extent possible.

Section 8.5 Counterparts.

This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, and all of which together shall

constitute one and the same instrument. Signatures provided by electronic means (including Docusign or in Adobe Portable Document Format

(PDF) sent by electronic mail) shall be deemed to be original signatures.

Section 8.6 Entire Agreement;

No Third Party Beneficiaries. This Agreement constitutes the entire agreement and supersede all prior agreements and understandings

both written and oral (including any letter of intent, memorandum of understanding electronic communicators, e-mail or term sheet), between

the Parties with respect to the subject matter hereof. Except as specifically provided herein, this Agreements is not intended to confer

upon any Person other than the Parties any rights or remedies hereunder.

Section 8.7 Governing

Law. This Agreement and all matters arising directly or indirectly herefrom shall be governed by and construed and enforced in accordance

with the laws of the State of New York applicable to agreements made and to be performed entirely in such state, without giving effect

to the conflict of law principles thereof.

Section 8.8 Jurisdiction;

Venue, Service of Process. Buyer and Seller each agrees to irrevocably submit to the sole and exclusive jurisdiction of the state

and federal courts located in New York County, New York for any suit, action or other proceeding arising out of this Agreement or any

transaction contemplated hereby, and hereby waives any objection to the laying of venue in such courts. Each Party agrees that service

of any process, summons, notice or document by international courier service in accordance with Section 8.2 shall be effective service

of process.

Section 8.9 Publicity.

Neither Party will make any public announcement concerning, or otherwise publicly disclose, any information with respect to the transactions

contemplated by this Agreement or any of the terms and conditions hereof without the prior written consent of the other Party. Notwithstanding

the foregoing (a) either Party may make any public disclosure concerning the transactions contemplated hereby that in the opinion of such

Party’s counsel may be required by any Applicable Law or the rules of any stock exchange on which such Party’s or any of its

Affiliates’ securities trade and (b) Buyer may publicize its development of the Compounds, the Technology and/or any resulting Products

without approval from Seller.

Section 8.10 Assignment.

Neither Party may assign its rights or obligations under this Agreement without the prior, written consent of the other Party; provided,

however, that notwithstanding the foregoing, either Party may assign its rights and obligations under this Agreement, without any

obligation to obtain the other Party’s consent, to (i) any of its Affiliates or (ii) in connection with any merger, consolidation,

sale of all or substantially all of the assets of such Party (or, in the case of Buyer, Buyer’s business related to the Compound

or any resulting product) or any similar transaction. Any permitted assignee or successor-in-interest will assume all obligations of its

assignor under this Agreement. No assignment will relieve either Party of its responsibility for the performance of any obligation. This

Agreement will be binding upon and inure to the benefit of the Parties hereto and their respective successors and permitted assigns.

Section 8.11 Amendments

and Waivers. This Agreement may not be amended except by an instrument in writing signed by both Parties. Each Party may, by a signed

written instrument, waive compliance by the other Party with any term or provision of this Agreement that such other Party was obligated

to comply with or perform.

[Remainder of Page Intentionally Left Blank-

Signature Page to Follow]

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THIS EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. INFORMATION

THAT WAS OMITTED HAS BEEN NOTED IN THIS DOCUMENT WITH A PLACEHOLDER IDENTIFIED BY THE MARK “[***]”.

IN WITNESS WHEREOF, the Parties

have caused this Agreement to be signed by their respective representatives thereunto duly authorized, all as of the date first written

above.

| RELMADA THERAPEUTICS, INC. |

|

ASARINA PHARMA AB |

| |

|

|

|

|

| By: |

/s/ Sergio Traversa |

|

By: |

/s/ Paul de Potocki |

| Name: |

Sergio Traversa |

|

Name: |

Paul de Potocki |

| Title: |

Chief Executive Officer |

|

Title: |

Chairman |

| |

|

|

|

|

| |

|

|

By: |

/s/ Peter Hviid Nordkild |

| |

|

|

Name: |

Peter Hviid Nordkild |

| |

|

|

Title: |

CEO |

[signature page to Asset Purchase Agreement]

Exhibit 99.1

Relmada Therapeutics Acquires Potential Therapy

for Tourette Syndrome from Asarina Pharma AB

Relmada purchases Sepranolone, a Phase 2b ready

asset, for the treatment of Tourette syndrome (TS) and other compulsion-related conditions from Asarina Pharma AB

Phase 2a results signaled improvement in Tourette

symptoms, quality of life and robust overall safety, supporting Sepranolone as a new potential first line treatment option for TS

Sepranolone (isoallopregnanolone) is a first-in-class

compound from new subgroup of neurosteroids known as GAMSAs- GABAA Modulating Steroid Antagonists - acting selectively on the

GABAA pathway, potentially alleviating the negative effect of Allopregnanolone in Tourette syndrome and other compulsive disorders

CORAL GABLES, FL, February 06, 2025 (GlobeNewswire)

-- Relmada Therapeutics, Inc. (Nasdaq: RLMD, “Relmada”, “the Company”), a clinical-stage biotechnology company,

today announced the acquisition of Sepranolone, a Phase 2b ready neurosteroid, from Asarina Pharma AB (Asarina), being developed for the

potential treatment of Tourette syndrome (TS) and other compulsive disorders.

“We are very pleased to announce this agreement

with Asarina. Sepranolone aligns with our Company’s mission to find solutions for difficult-to-treat central nervous system (CNS)

disorders. There is a serious unmet need for improved TS therapies not only reducing tics but also improving quality of life without serious

side effects. We have been impressed by the encouraging Phase 2a efficacy signal with clinically meaningful tic reductions and quality-of-life

improvements, combined with a robust safety data package showing no CNS off-target effects, that we believe reflect the compound’s

selective binding properties,” said Sergio Traversa, Chief Executive Officer of Relmada.

Luca Pani, MD, Professor of Clinical Psychiatry

at the University of Miami Miller School of Medicine, commented, “While current treatments for Tourette syndrome provide only modest

tic reduction and are often accompanied by significant side effects, the Phase 2a data suggest that Sepranolone has the potential to offer

meaningful symptom relief with a more favorable safety profile. These findings are promising, and I look forward to seeing further clinical

development of this novel therapy.”

“Late last year we announced that Relmada

would explore strategic assets and strategic options. We believe the Sepranolone transaction is an excellent fit with our objective to

build shareholder value by leveraging our core competencies of identifying and developing innovative compounds,” commented Maged

Shenouda, Chief Financial Officer of Relmada. “Based on our extensive due diligence, including a carefully conducted review of the

clinical and regulatory data, and consultation with well-respected outside experts, we believe the promising Phase 2a data suggest that

Sepranolone has the potential to become first line treatment for TS.”

Clinical Data on Sepranolone

Sepranolone (isoallopregnanolone) is a first-in-class

GABAA Modulating Steroid Antagonist (GAMSA), which selectively targets the GABAA (GABAA) pathway to counteract the effects

of Allopregnanolone, a neurosteroid implicated in TS and other compulsive disorders.

Data from an open-label Phase 2a randomized study

demonstrated that Sepranolone has the potential to improve TS symptoms versus standard of care alone, as measured by changes in the YGTSS

scoring system (the world-standard Yale Global Tic Severity Scale) compared to baseline. In the 12-week, dual-center, parallel-group study,

26 subjects were treated with Sepranolone (10 mg, administered by subcutaneous injection twice weekly in addition to standard of care

(SOC) versus standard of care alone.

The Phase 2a results

showed competitive tic reduction and improved quality of life while displaying no CNS off-target effects. Sepranolone not only reduced

tic severity in its primary clinical endpoint as measured by YGTSS by 28% (p=0.051) – but also achieved positive results in four

key secondary endpoints compared with standard of care:

69% greater increase of Quality of Life (using

the Gilles de la Tourette Syndrome Quality of Life total score (GTS-QOL)

50% greater reduction in impairment (YGTSS)

44% greater reduction of the premonitory

urge to tic (PUTS – the Premonitory Urge to Tic scale)

no off-target CNS effects or systemic side

effects – a crucial metric for CNS drugs in an indication where legacy and new treatments in developments involve sometimes

severe side effects

Strategic Outlook

Relmada continues to evaluate additional product

and strategic opportunities. The Company anticipates hosting an investor update on Sepranolone’s next development steps later in

2025.

About the Asarina Agreement

Under the terms of the agreement, Relmada acquired

full global ownership rights to Sepranolone from Asarina Pharma AB, a Swedish biopharmaceutical company through an asset purchase agreement

for EUR 3 Million.

About Neurotransmitter Modulators and Sepranolone

Sepranolone is a pioneering GAMSA that selectively

inhibits the effects of Allopregnanolone, a neurosteroid linked to compulsive disorders such as TS and obsessive-compulsive disorder (OCD).

Evaluated in multiple clinical neuro/hormonal studies involving over 335 participants, Sepranolone has demonstrated a favorable safety

profile.

GABA (γ-aminobutyric acid) is the brain’s

primary inhibitory neurotransmitter, helping to regulate anxiety and compulsive disorders. While Allopregnanolone typically enhances GABA’s

calming effects, in some individuals it paradoxically exacerbates anxiety and compulsive. Sepranolone normalizes GABAA receptor activity

by targeting two specific receptor subtypes (alpha-2 and alpha-4) without directly interfering with GABA signaling, making it a novel

and selective treatment approach for TS and related disorders.

Sepranolone is protected by multiple issued patents

until 2038.

About Tourette syndrome (TS)

Tourette syndrome is a complex neurological condition

characterized by involuntary tics. The Centers for Disease Control and Prevention (CDC) estimates that more than 350,000 children in the

U.S. have TS, with onset typically occurring between ages five and ten. Though symptoms often improve in adulthood, many individuals experience

chronic tics and associated psychosocial challenges. Existing treatments include dopamine D2 blockers, atypical antipsychotics, botulinum

toxin injections, cognitive behavioral therapy (CBIT), and deep brain stimulation, but these options are often limited by significant

side effects.

TS is believed to be influenced by genetic, environmental,

and neurochemical factors, including the role of Allopregnanolone in triggering compulsive behaviors. Current treatments target dopamine

and other neurotransmitters, but the Company believes Sepranolone’s modulation of Allopregnanolone offers a novel and potentially

safer alternative.

About Relmada Therapeutics, Inc.

Relmada Therapeutics is a clinical-stage biotechnology

company focused on developing innovative therapies for central nervous system (CNS) and metabolic disorders. With a commitment to advancing

breakthrough treatments, Relmada strives to improve patient outcomes and quality of life. For more information, visit www.relmada.com.

Forward-Looking Statements

The Private Securities Litigation Reform Act of

1995 provides a safe harbor for forward-looking statements made by us or on our behalf. This press release contains statements which constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of

words and phrases such as “expects”, “anticipates”, “believes”, “will”, “will likely

result”, “will continue”, “plans to”, “potential”, “promising”, and similar expressions.

These statements are based on management’s current expectations and beliefs and are subject to a number of risks, uncertainties

and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including

potential failure of clinical trial results to demonstrate statistically and/or clinically significant evidence of efficacy and/or safety,

failure of top-line results to accurately reflect the complete results of the trial, failure of planned or ongoing preclinical and clinical

studies to recapitulate the results of prior studies, potential failure to secure FDA agreement on the regulatory path for Sepranolone

or that future Sepranolone clinical results will be acceptable to the FDA, failure to secure adequate Sepranolone drug supply and the

other risk factors described under the heading “Risk Factors” set forth in the Company’s reports filed with the SEC

from time to time. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Relmada

undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Readers are cautioned that it is not possible to predict or identify all the risks, uncertainties and other factors that may affect future

results and that the risks described herein should not be a complete list.

Investor Contact:

Tim McCarthy

LifeSci Advisors

Tim@lifesciadvisors.com

Media Inquiries:

Corporate Communications

media@relmada.com

v3.25.0.1

Cover

|

Feb. 03, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 03, 2025

|

| Entity File Number |

001-39082

|

| Entity Registrant Name |

RELMADA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001553643

|

| Entity Tax Identification Number |

45-5401931

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2222 Ponce de Leon Blvd.

|

| Entity Address, Address Line Two |

Floor 3

|

| Entity Address, City or Town |

Coral Gables

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33134

|

| City Area Code |

212

|

| Local Phone Number |

547-9591

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

RLMD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

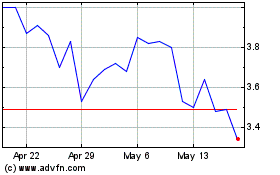

Relmada Therapeutics (NASDAQ:RLMD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Relmada Therapeutics (NASDAQ:RLMD)

Historical Stock Chart

From Mar 2024 to Mar 2025