RumbleOn Shares Details of Company's Vision 2026 Strategic Plan

March 14 2024 - 6:01AM

Business Wire

RumbleOn (NASDAQ: RMBL), today unveiled its new three-year

operating plan, Vision 2026, aimed to deliver annual revenue

exceeding $1.7 billion, annual adjusted EBITDA of greater than $150

million and annual adjusted free cash flow of $90 million or more

by calendar year 2026.

The three strategic pillars of Vision 2026 are:

- Operate the best performing dealerships in America.

- Leverage the RideNow Cash Offer Tool to accelerate growth of

the pre-owned vehicle business.

- Allocate capital to maximize long-term per share

value.

"The first pillar is simple in its measurement, but broad in its

execution," said Mike Kennedy, RumbleOn’s Chief Executive Officer.

"Our plan to operate the best performing dealerships in America

will be measured on Net Profit and Customer Satisfaction.

There's a lot that goes into delivering on these metrics, from

simplifying and focusing our organization, attracting, retaining

and properly incentivizing team members, and strengthening

relationships with our OEM's. I'm excited about the progress we've

already made. I've met with our largest OEM partners and they share

my enthusiasm about the direction in which we're moving."

"The RideNow Cash Offer Tool directly connects us with riders

and allows us to acquire high quality, pre-owned powersports

vehicles at scale. It can work even harder for us and for all

our dealership locations,” continued Kennedy. “Integrating more

deeply with the tool, both online and in-store, will help us grow

our pre-owned retail business, and align our RideNow Powersports

dealerships around this opportunity. That's why the second pillar

of Vision 2026 is to grow our pre-owned business by leveraging this

unique and impactful resource. That’s why, in 2024, we plan to

pilot our first standalone brick & mortar pre-owned

dealership."

"The third pillar of Vision 2026 is to make certain we

strategically allocate capital to its highest and best use to

maximize long-term per share value,” continued Kennedy.

“We have lots of options when it comes to capital allocation. Our

current priorities for capital are investing in our business and

acquiring additional dealerships. As we think about capital

allocation, we will never take our eye off of our first principle

at every stage of the journey; creating long-term per-share value

for our shareholders."

"This three-year operating plan reflects input from our board,

our team and my observations over the past few months," explained

Kennedy. "The plan's three strategic pillars will ultimately

create a better experience for riders and a better environment for

our team members while always focusing on maximizing long-term per

share value. That's a 'triple win.' Now it's time to get to

work and make it happen."

RumbleOn CEO Mike Kennedy, who took the reins of the company in

November 2023, used his first year-end earnings announcement to

roll out the Vision 2026 plan in detail to analysts and employees

today.

About RumbleOn

RumbleOn, Inc. (NASDAQ: RMBL), operates through two operating

segments: the RideNow Powersports dealership group and Wholesale

Express, LLC, an asset-light transportation services provider

focused on the automotive industry. RideNow Powersports is the

largest powersports retail group in the United States (as measured

by reported revenue, major unit sales and dealership locations),

offering over 500 powersports franchises representing 52 different

brands of products. RideNow Powersports sells a wide selection of

new and pre-owned products, including parts, apparel, accessories,

finance & insurance products and services, and aftermarket

products. We are the largest purchaser of pre-owned powersports

vehicles in the United States and utilize our proprietary Cash

Offer technology to acquire vehicles directly from consumers. To

learn more, please visit us online at https://www.rumbleon.com.

Cautionary Note on Forward-Looking Statements

This press release may contain “forward-looking statements” as

that term is defined under the Private Securities Litigation Reform

Act of 1995, which statements may be identified by words such as

“expects,” “plans”, “projects,” “will,” “may,” “anticipates,”

“believes,” “should,” “intends,” “estimates,” and other words of

similar meaning. Readers are cautioned not to place undue reliance

on these forward-looking statements, which are based on our

expectations as of the date of this press release and speak only as

of the date of this press release and are advised to consider the

factors listed under the heading "Forward-Looking Statements” and

“Risk Factors” in the Company’s SEC filings, as may be updated and

amended from time to time. We undertake no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise, except as

required by law.

Use of Non-GAAP Financial Measures

Adjusted EBITDA and Adjusted Free Cash Flow are non-GAAP

financial measures and should not be considered as alternatives to

operating income or net income as a measure of operating

performance or cash flows or as a measure of liquidity. Non-GAAP

financial measures are not necessarily calculated the same way by

different companies and should not be considered a substitute for

or superior to U.S. GAAP.

We define Adjusted EBITDA as net income (loss) adjusted to add

back interest expense, depreciation and amortization, the impact of

income taxes, discontinued operations, non-cash stock-based

compensation costs, the non-cash impairment of goodwill and

franchise rights, transaction costs, certain litigation expenses

not associated with our ongoing operations, and other non-recurring

costs and credits, such as the gain on the sale of a dealership,

insurance proceeds and costs attributable to an abandoned project,

as such we do not consider such recoveries, charges and expenses to

be a part of our core business operations, and they not necessarily

an indicator of ongoing, future company performance.

We define Adjusted Free Cash Flow as cash flows from operating

activities of continuing operations less capital expenditures

(excluding acquisitions).

With respect to our 2026 Adjusted EBITDA and Adjusted Free Cash

Flow targets, a reconciliation of these non-GAAP measures to the

corresponding GAAP measures is not available without unreasonable

effort due to the complexity of the reconciling items that we

exclude from the non-GAAP measure or the variables going into the

calculation of operating cash flows.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240314704086/en/

Investor Relations Contact: investors@rumbleon.com

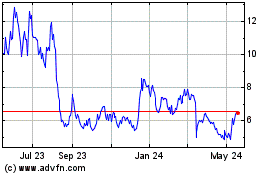

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Oct 2024 to Nov 2024

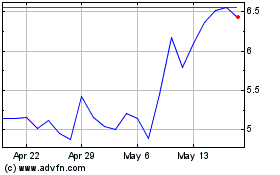

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Nov 2023 to Nov 2024