false0001596961--12-312024Q3http://fasb.org/us-gaap/2024#AccountingStandardsUpdate202006Memberxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesrmbl:segmentrmbl:storexbrli:purermbl:dayrmbl:leasermbl:familyMember00015969612024-01-012024-09-300001596961us-gaap:CommonClassBMember2024-11-010001596961us-gaap:CommonClassAMember2024-11-0100015969612024-09-3000015969612023-12-310001596961us-gaap:CommonClassAMember2023-12-310001596961us-gaap:CommonClassAMember2024-09-300001596961us-gaap:CommonClassBMember2024-09-300001596961us-gaap:CommonClassBMember2023-12-310001596961rmbl:PowersportsVehiclesMember2024-07-012024-09-300001596961rmbl:PowersportsVehiclesMember2023-07-012023-09-300001596961rmbl:PowersportsVehiclesMember2024-01-012024-09-300001596961rmbl:PowersportsVehiclesMember2023-01-012023-09-300001596961rmbl:PartsAndOtherRevenueMember2024-07-012024-09-300001596961rmbl:PartsAndOtherRevenueMember2023-07-012023-09-300001596961rmbl:PartsAndOtherRevenueMember2024-01-012024-09-300001596961rmbl:PartsAndOtherRevenueMember2023-01-012023-09-300001596961rmbl:FinanceAndInsuranceMember2024-07-012024-09-300001596961rmbl:FinanceAndInsuranceMember2023-07-012023-09-300001596961rmbl:FinanceAndInsuranceMember2024-01-012024-09-300001596961rmbl:FinanceAndInsuranceMember2023-01-012023-09-300001596961rmbl:VehicleTransportationServicesMember2024-07-012024-09-300001596961rmbl:VehicleTransportationServicesMember2023-07-012023-09-300001596961rmbl:VehicleTransportationServicesMember2024-01-012024-09-300001596961rmbl:VehicleTransportationServicesMember2023-01-012023-09-3000015969612024-07-012024-09-3000015969612023-07-012023-09-3000015969612023-01-012023-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-06-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-06-300001596961us-gaap:AdditionalPaidInCapitalMember2024-06-300001596961us-gaap:RetainedEarningsMember2024-06-300001596961us-gaap:TreasuryStockCommonMember2024-06-3000015969612024-06-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-07-012024-09-300001596961us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001596961us-gaap:RetainedEarningsMember2024-07-012024-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-09-300001596961us-gaap:AdditionalPaidInCapitalMember2024-09-300001596961us-gaap:RetainedEarningsMember2024-09-300001596961us-gaap:TreasuryStockCommonMember2024-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001596961us-gaap:AdditionalPaidInCapitalMember2023-12-310001596961us-gaap:RetainedEarningsMember2023-12-310001596961us-gaap:TreasuryStockCommonMember2023-12-3100015969612023-01-012023-12-310001596961srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2023-12-310001596961srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2023-12-310001596961srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-12-310001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-01-012024-09-300001596961us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001596961us-gaap:RetainedEarningsMember2024-01-012024-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-06-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300001596961us-gaap:AdditionalPaidInCapitalMember2023-06-300001596961us-gaap:RetainedEarningsMember2023-06-300001596961us-gaap:TreasuryStockCommonMember2023-06-3000015969612023-06-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-07-012023-09-300001596961us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001596961us-gaap:RetainedEarningsMember2023-07-012023-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-09-300001596961us-gaap:AdditionalPaidInCapitalMember2023-09-300001596961us-gaap:RetainedEarningsMember2023-09-300001596961us-gaap:TreasuryStockCommonMember2023-09-3000015969612023-09-300001596961us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001596961us-gaap:AdditionalPaidInCapitalMember2022-12-310001596961us-gaap:RetainedEarningsMember2022-12-310001596961us-gaap:TreasuryStockCommonMember2022-12-3100015969612022-12-310001596961us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-01-012023-09-300001596961us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001596961us-gaap:RetainedEarningsMember2023-01-012023-09-300001596961rmbl:ConvertibleSeniorNotesMember2024-09-300001596961rmbl:TermLoanCreditAgreementMember2024-06-300001596961rmbl:J.P.MorganCreditLineMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2024-10-232024-10-230001596961rmbl:J.P.MorganCreditLineMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2024-11-010001596961srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberrmbl:ConvertibleSeniorNotesMember2024-01-010001596961rmbl:ConvertibleSeniorNotesMember2024-01-010001596961srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2024-01-010001596961srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2024-01-012024-09-300001596961rmbl:PowersportsNewVehiclesMember2024-07-012024-09-300001596961rmbl:PowersportsNewVehiclesMember2023-07-012023-09-300001596961rmbl:PowersportsNewVehiclesMember2024-01-012024-09-300001596961rmbl:PowersportsNewVehiclesMember2023-01-012023-09-300001596961rmbl:PowersportsPreOwnedVehiclesMember2024-07-012024-09-300001596961rmbl:PowersportsPreOwnedVehiclesMember2023-07-012023-09-300001596961rmbl:PowersportsPreOwnedVehiclesMember2024-01-012024-09-300001596961rmbl:PowersportsPreOwnedVehiclesMember2023-01-012023-09-300001596961us-gaap:TransferredAtPointInTimeMember2024-07-012024-09-300001596961us-gaap:TransferredAtPointInTimeMember2023-07-012023-09-300001596961us-gaap:TransferredAtPointInTimeMember2024-01-012024-09-300001596961us-gaap:TransferredAtPointInTimeMember2023-01-012023-09-300001596961us-gaap:TransferredOverTimeMember2024-07-012024-09-300001596961us-gaap:TransferredOverTimeMember2023-07-012023-09-300001596961us-gaap:TransferredOverTimeMember2024-01-012024-09-300001596961us-gaap:TransferredOverTimeMember2023-01-012023-09-300001596961rmbl:ContractsInTransitMember2024-09-300001596961rmbl:ContractsInTransitMember2023-12-310001596961us-gaap:TradeAccountsReceivableMember2024-09-300001596961us-gaap:TradeAccountsReceivableMember2023-12-310001596961rmbl:FactoryReceivablesMember2024-09-300001596961rmbl:FactoryReceivablesMember2023-12-310001596961us-gaap:FinanceReceivablesMember2024-09-300001596961us-gaap:FinanceReceivablesMember2023-12-310001596961rmbl:TermLoanCreditAgreementMember2024-09-300001596961rmbl:TermLoanCreditAgreementMember2023-12-310001596961rmbl:ConvertibleSeniorNotesMember2023-12-310001596961rmbl:LineOfCreditRumbleOnFinanceMember2024-09-300001596961rmbl:LineOfCreditRumbleOnFinanceMember2023-12-310001596961rmbl:FleetNotesAndOtherMember2024-09-300001596961rmbl:FleetNotesAndOtherMember2023-12-310001596961srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberrmbl:ConvertibleSeniorNotesMember2023-12-310001596961rmbl:TradeFloorPlanNotesPayableMember2024-09-300001596961rmbl:TradeFloorPlanNotesPayableMember2023-12-310001596961rmbl:NonTradeFloorPlanNotesPayableMember2024-09-300001596961rmbl:NonTradeFloorPlanNotesPayableMember2023-12-310001596961rmbl:TermLoanCreditAgreementMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-09-300001596961rmbl:TermLoanCreditAgreementMemberus-gaap:BaseRateMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-01-012024-09-300001596961rmbl:TermLoanCreditAgreementMemberus-gaap:BaseRateMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2024-01-012024-09-300001596961rmbl:TermLoanCreditAgreementMember2024-01-012024-09-300001596961rmbl:TermLoanCreditAgreementMemberus-gaap:BaseRateMember2024-09-300001596961rmbl:TermLoanCreditAgreementMember2024-06-290001596961rmbl:ConvertibleSeniorNotesMember2024-01-012024-09-300001596961rmbl:FloorPlanNotesPayableMember2024-09-300001596961rmbl:J.P.MorganCreditLineMemberus-gaap:LineOfCreditMember2024-09-3000015969612024-03-192024-03-190001596961rmbl:TimeBasedRestrictedStockUnitsRSUMember2024-03-192024-03-190001596961rmbl:PerformanceBasedRestrictedStockUnitsPSUsMember2024-03-192024-03-190001596961us-gaap:CommonClassBMember2024-03-180001596961rmbl:PerformanceBasedRestrictedStockUnitsPSUsMember2024-03-190001596961us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001596961us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001596961rmbl:PerformanceBasedRestrictedStockUnitsPSUsMember2024-01-012024-09-300001596961rmbl:PerformanceBasedRestrictedStockUnitsPSUsMember2023-01-012023-09-300001596961us-gaap:WarrantMember2024-01-012024-09-300001596961us-gaap:WarrantMember2023-01-012023-09-300001596961us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-09-300001596961us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-09-300001596961rmbl:VestedStockOptionsMember2024-01-012024-09-300001596961rmbl:VestedStockOptionsMember2023-01-012023-09-300001596961rmbl:PerformanceStockOptionsMember2024-01-012024-09-300001596961rmbl:PerformanceStockOptionsMember2023-01-012023-09-300001596961us-gaap:RelatedPartyMember2024-09-300001596961rmbl:OptionToPurchasePropertyAtOrAboveFairMarketValueMemberus-gaap:RelatedPartyMember2024-09-300001596961us-gaap:RelatedPartyMember2024-01-012024-09-300001596961us-gaap:RelatedPartyMember2024-07-012024-09-300001596961us-gaap:RelatedPartyMember2023-07-012023-09-300001596961us-gaap:RelatedPartyMember2023-01-012023-09-300001596961us-gaap:RelatedPartyMember2023-12-310001596961us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2024-09-300001596961srt:VicePresidentMemberus-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2024-07-012024-09-300001596961srt:VicePresidentMemberus-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2024-01-012024-09-300001596961srt:VicePresidentMemberus-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2023-07-012023-09-300001596961srt:VicePresidentMemberus-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2023-01-012023-09-300001596961us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2023-12-310001596961us-gaap:OperatingSegmentsMemberrmbl:PowersportsVehiclesMember2024-07-012024-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:VehicleTransportationServicesMember2024-07-012024-09-300001596961srt:ConsolidationEliminationsMember2024-07-012024-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:PowersportsVehiclesMember2023-07-012023-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:VehicleTransportationServicesMember2023-07-012023-09-300001596961srt:ConsolidationEliminationsMember2023-07-012023-09-300001596961us-gaap:IntersegmentEliminationMemberrmbl:PowersportsVehiclesMember2023-07-012023-09-300001596961us-gaap:IntersegmentEliminationMemberrmbl:VehicleTransportationServicesMember2023-07-012023-09-300001596961us-gaap:IntersegmentEliminationMember2023-07-012023-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:PowersportsVehiclesMember2024-01-012024-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:VehicleTransportationServicesMember2024-01-012024-09-300001596961srt:ConsolidationEliminationsMember2024-01-012024-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:PowersportsVehiclesMember2023-01-012023-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:VehicleTransportationServicesMember2023-01-012023-09-300001596961srt:ConsolidationEliminationsMember2023-01-012023-09-300001596961us-gaap:IntersegmentEliminationMemberrmbl:PowersportsVehiclesMember2023-01-012023-09-300001596961us-gaap:IntersegmentEliminationMemberrmbl:VehicleTransportationServicesMember2023-01-012023-09-300001596961us-gaap:IntersegmentEliminationMember2023-01-012023-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:PowersportsVehiclesMember2024-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:VehicleTransportationServicesMember2024-09-300001596961srt:ConsolidationEliminationsMember2024-09-300001596961us-gaap:OperatingSegmentsMemberrmbl:PowersportsVehiclesMember2023-12-310001596961us-gaap:OperatingSegmentsMemberrmbl:VehicleTransportationServicesMember2023-12-310001596961srt:ConsolidationEliminationsMember2023-12-3100015969612024-03-132024-03-130001596961us-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMember2024-11-112024-11-110001596961us-gaap:SubsequentEventMemberus-gaap:PrivatePlacementMember2024-12-012024-12-010001596961us-gaap:RelatedPartyMemberus-gaap:SubsequentEventMemberrmbl:BindingCommitmentToProvideCreditMember2024-11-112024-11-110001596961us-gaap:SubsequentEventMember2024-11-110001596961us-gaap:SubsequentEventMember2024-11-112024-11-110001596961us-gaap:SubsequentEventMembersrt:MinimumMember2024-11-112024-11-110001596961rmbl:TermLoanCreditAgreementMembersrt:ScenarioForecastMember2025-01-022025-01-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

or

| | | | | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-38248

| | | | | | | | | | | | | | |

| RumbleOn, Inc. (Exact name of registrant as specified in its charter) | |

| Nevada | | 46-3951329 | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

| | | | |

| 901 W Walnut Hill Lane, Suite 110A Irving, Texas | | 75038 | |

| (Address of principal executive offices) | | (Zip Code) | |

| | |

(214) 771-9952 |

| (Registrant's telephone number, including area code) |

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class B Common Stock, $0.001 par value | | RMBL | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "a smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | x |

| Non-accelerated filer | o | Smaller reporting company | x |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

The number of shares of Class B Common Stock, $0.001 par value, outstanding on November 1, 2024 was 35,320,954 shares. In addition, 50,000 shares of Class A Common Stock, $0.001 par value, were outstanding on November 1, 2024.

QUARTERLY PERIOD ENDED SEPTEMBER 30, 2024

Table of Contents to Report on Form 10-Q

| | | | | | | | |

| FINANCIAL INFORMATION | |

| | |

| Financial Statements | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Quantitative and Qualitative Disclosures About Market Risk | |

| Controls and Procedures | |

| | |

| OTHER INFORMATION | |

| | |

| Legal Proceedings | |

| Risk Factors | |

| | |

| | |

| | |

| Other Information | |

| Exhibits | |

| |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

RumbleOn, Inc.

Condensed Consolidated Balance Sheets

($ in millions, except per share amounts)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | (Unaudited) | | |

| Current assets: | | | |

| Cash | $ | 50.1 | | | $ | 58.9 | |

| Restricted cash | 16.6 | | | 18.1 | |

| Accounts receivable, net | 30.0 | | | 50.3 | |

| Inventory, net | 293.7 | | | 347.5 | |

| Prepaid expense and other current assets | 4.2 | | | 6.0 | |

| Total current assets | 394.6 | | | 480.8 | |

| Property and equipment, net | 71.5 | | | 76.8 | |

| Right-of-use assets | 161.4 | | | 163.9 | |

| Franchise rights and other intangible assets | 201.5 | | | 203.3 | |

| Other assets | 1.5 | | | 1.5 | |

| Total assets | $ | 830.5 | | | $ | 926.3 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and other current liabilities | $ | 70.2 | | | $ | 68.1 | |

| Vehicle floor plan notes payable | 242.5 | | | 291.3 | |

| Current portion of long-term debt | 39.2 | | | 35.6 | |

| Total current liabilities | 351.9 | | | 395.0 | |

| Long-term liabilities: | | | |

| Long-term debt, net of current maturities | 209.8 | | | 238.7 | |

| Operating lease liabilities | 133.2 | | | 134.1 | |

| Other long-term liabilities, including finance lease obligation | 52.3 | | | 52.9 | |

| Total long-term liabilities | 395.3 | | | 425.7 | |

| Total liabilities | 747.2 | | | 820.7 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Class A common stock, $0.001 par value, 50,000 shares authorized, 50,000 shares issued and outstanding | — | | | — | |

Class B common stock, $0.001 par value, 100,000,000 shares authorized, 35,300,694 and 35,071,955 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | — | | | — | |

| Additional paid-in capital | 691.1 | | | 701.0 | |

| Accumulated deficit | (603.5) | | | (591.1) | |

Class B common stock in treasury, at cost, 123,089 shares | (4.3) | | | (4.3) | |

| Total stockholders' equity | 83.3 | | | 105.6 | |

| Total liabilities and stockholders' equity | $ | 830.5 | | | $ | 926.3 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

RumbleOn, Inc.

Condensed Consolidated Statements of Operations

($ in millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Powersports vehicles | $ | 206.4 | | | $ | 235.1 | | | $ | 656.2 | | | $ | 738.1 | |

| Parts, service and accessories | 49.2 | | | 59.7 | | | 159.0 | | | 184.2 | |

| Finance and insurance, net | 24.3 | | | 29.3 | | | 79.8 | | | 89.7 | |

| Vehicle transportation services | 15.1 | | | 14.0 | | | 44.6 | | | 43.2 | |

| Total revenue | 295.0 | | | 338.1 | | | 939.6 | | | 1,055.2 | |

| | | | | | | |

| Cost of revenue: | | | | | | | |

| Powersports vehicles | 182.6 | | | 202.8 | | | 571.8 | | | 634.1 | |

| Parts, service and accessories | 26.5 | | | 32.7 | | | 86.5 | | | 99.5 | |

| Vehicle transportation services | 11.6 | | | 10.6 | | | 34.5 | | | 32.9 | |

| Total cost of revenue | 220.7 | | | 246.1 | | | 692.8 | | | 766.5 | |

| | | | | | | |

| Gross profit | 74.3 | | | 92.0 | | | 246.8 | | | 288.7 | |

| | | | | | | |

| Selling, general and administrative | 65.9 | | | 85.0 | | | 211.2 | | | 271.6 | |

| Depreciation and amortization | 3.1 | | | 7.2 | | | 9.7 | | | 17.2 | |

| | | | | | | |

| Operating income (loss) | 5.3 | | | (0.2) | | | 25.9 | | | (0.1) | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Floor plan interest expense | (4.4) | | | (3.9) | | | (12.7) | | | (9.8) | |

| Other interest expense | (12.2) | | | (16.0) | | | (36.2) | | | (46.0) | |

| Other income | 0.1 | | | 0.1 | | | 0.4 | | | 0.2 | |

| Total other expense | (16.5) | | | (19.8) | | | (48.5) | | | (55.6) | |

| | | | | | | |

| Loss from continuing operations before income taxes | (11.2) | | | (20.0) | | | (22.6) | | | (55.7) | |

| Income tax benefit | — | | | (3.5) | | | (0.4) | | | (9.7) | |

| Loss from continuing operations | (11.2) | | | (16.5) | | | (22.2) | | | (46.0) | |

| Loss from discontinued operations | — | | | — | | | — | | | (1.0) | |

| Net loss | $ | (11.2) | | | $ | (16.5) | | | $ | (22.2) | | | $ | (47.0) | |

| | | | | | | |

| Weighted average shares - basic and diluted | 35,283,033 | | | 16,665,709 | | | 35,209,785 | | | 16,452,254 | |

| | | | | | | |

| Loss from continuing operations per share - basic and diluted | $ | (0.32) | | | $ | (0.99) | | | $ | (0.63) | | | $ | (2.80) | |

| Loss from discontinued operations per share - basic and diluted | $ | — | | | $ | — | | | $ | — | | | $ | (0.06) | |

| Net loss per share - basic and diluted | $ | (0.32) | | | $ | (0.99) | | | $ | (0.63) | | | $ | (2.86) | |

See accompanying notes to the unaudited condensed consolidated financial statements.

RumbleOn, Inc.

Consolidated Statements of Stockholders' Equity

($ in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares | | Additional Paid-in Capital | | Accumulated Deficit | | Treasury Shares | | Total Stockholders’ Equity |

| Class A | | Class B | | | | Shares | | Amount | |

| June 30, 2024 | 50,000 | | | 35,226,730 | | | $ | 690.0 | | | $ | (592.3) | | | 123,089 | | | $ | (4.3) | | | $ | 93.4 | |

| Stock-based compensation | — | | | 73,964 | | | 1.1 | | | — | | | — | | | — | | | 1.1 | |

| Net loss | — | | | — | | | — | | | (11.2) | | | — | | | — | | | (11.2) | |

| September 30, 2024 | 50,000 | | | 35,300,694 | | | $ | 691.1 | | | $ | (603.5) | | | 123,089 | | | $ | (4.3) | | | $ | 83.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares | | Additional Paid-in Capital | | Accumulated Deficit | | Treasury Shares | | Total Stockholders’ Equity |

| Class A | | Class B | | | | Shares | | Amount | |

| December 31, 2023 | 50,000 | | | 35,071,955 | | | $ | 701.0 | | | $ | (591.1) | | | 123,089 | | | $ | (4.3) | | | $ | 105.6 | |

| Cumulative effect adjustment from adoption of ASU 2020-06 | — | | | — | | | (13.5) | | | 9.8 | | | — | | | — | | | (3.7) | |

| Stock-based compensation | — | | | 228,739 | | | 3.9 | | | — | | | — | | | — | | | 3.9 | |

| Other | — | | | — | | | (0.3) | | | — | | | — | | | — | | | (0.3) | |

| Net loss | — | | | — | | | — | | | (22.2) | | | — | | | — | | | (22.2) | |

| September 30, 2024 | 50,000 | | | 35,300,694 | | | $ | 691.1 | | | $ | (603.5) | | | 123,089 | | | $ | (4.3) | | | $ | 83.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares | | Additional Paid-in Capital | | Accumulated Deficit | | Treasury Shares | | Total Stockholders’ Equity |

| Class A | | Class B | | | | Shares | | Amount | |

| June 30, 2023 | 50,000 | | | 16,565,389 | | | $ | 593.0 | | | $ | (406.1) | | | 123,089 | | | $ | (4.3) | | | $ | 182.6 | |

| Stock-based compensation | — | | | 170,002 | | | 3.1 | | | — | | | — | | | — | | | 3.1 | |

| Tax withholding for vesting of RSUs | — | | | — | | | (0.2) | | | — | | | — | | | — | | | (0.2) | |

| Issuance of warrant | — | | | — | | | 6.1 | | | — | | | — | | | — | | | 6.1 | |

| Net loss | — | | | — | | | — | | | (16.5) | | | — | | | — | | | (16.5) | |

| September 30, 2023 | 50,000 | | | 16,735,391 | | | $ | 602.0 | | | $ | (422.6) | | | 123,089 | | | $ | (4.3) | | | $ | 175.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares | | Additional Paid-in Capital | | Accumulated Deficit | | Treasury Shares | | Total Stockholders’ Equity |

| Class A | | Class B | | | | Shares | | Amount | |

| December 31, 2022 | 50,000 | | | 16,184,264 | | | $ | 585.9 | | | $ | (375.6) | | | 123,089 | | | $ | (4.3) | | | $ | 206.0 | |

| Stock-based compensation | — | | | 551,127 | | | 10.9 | | | — | | | — | | | — | | | 10.9 | |

| Tax withholding for vesting of RSUs | — | | | — | | | (0.9) | | | — | | | — | | | — | | | (0.9) | |

| Issuance of warrant | — | | | — | | | 6.1 | | | — | | | — | | | — | | | 6.1 | |

| Net loss | — | | | — | | | — | | | (47.0) | | | — | | | — | | | (47.0) | |

| September 30, 2023 | 50,000 | | | 16,735,391 | | | $ | 602.0 | | | $ | (422.6) | | | 123,089 | | | $ | (4.3) | | | $ | 175.1 | |

RumbleOn, Inc.

Condensed Consolidated Statements of Cash Flows

($ in millions)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net loss | $ | (22.2) | | | $ | (47.0) | |

| Less: Loss from discontinued operations | — | | | (1.0) | |

| Loss from continuing operations | (22.2) | | | (46.0) | |

| Adjustments to reconcile loss from continuing operations to net cash provided by operating activities: | | | |

| Depreciation and amortization | 9.7 | | | 17.2 | |

| Amortization of debt issuance costs | 6.9 | | | 7.3 | |

| Stock-based compensation | 3.9 | | | 10.9 | |

| Deferred taxes | (0.4) | | | (10.1) | |

| Interest paid-in-kind capitalized to debt principal | 0.7 | | | — | |

| Gain on partial termination of warehouse lease | (0.9) | | | — | |

| Valuation allowance charge for loans receivable held for sale | — | | | 6.0 | |

Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | 20.3 | | | (0.7) | |

| Inventory | 54.7 | | | (30.0) | |

| Prepaid expenses and other assets | 1.8 | | | 2.0 | |

| Other liabilities | 2.8 | | | 1.5 | |

| Accounts payable and accrued liabilities | 1.7 | | | 4.6 | |

| Floor plan trade note borrowings | (10.4) | | | 18.8 | |

| Net cash provided by (used in) operating activities | 68.6 | | | (18.5) | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Acquisitions, net of cash received | (0.7) | | | (3.3) | |

| Purchase of property and equipment | (1.6) | | | (7.8) | |

| Technology development | (0.4) | | | (1.7) | |

| Net cash used in investing activities | (2.7) | | | (12.8) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Repayments of debt | (35.5) | | | (59.0) | |

Net increase (decrease) in borrowings from non-trade floor plans | (39.3) | | | 46.0 | |

| Proceeds from sale leaseback transaction | — | | | 49.7 | |

| Shares redeemed for employee tax obligations | — | | | (0.9) | |

| Debt issuance costs | (1.1) | | | (1.8) | |

Other financing costs | (0.3) | | | — | |

| Net cash provided by (used in) financing activities | (76.2) | | | 34.0 | |

| CASH FLOWS FROM DISCONTINUED OPERATIONS | | | |

| Net cash provided by operating activities | — | | | 3.4 | |

| Net cash used in financing activities | — | | | (5.2) | |

| Net cash used in discontinued operations | — | | | (1.8) | |

| NET CHANGE IN CASH AND RESTRICTED CASH | (10.3) | | | 0.9 | |

| Cash and restricted cash at beginning of period | 77.0 | | | 58.6 | |

| Cash and restricted cash at end of period | $ | 66.7 | | | $ | 59.5 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 –DESCRIPTION OF BUSINESS AND SIGNIFICANT ACCOUNTING POLICIES

Description of Business

Unless the context requires otherwise, references in these financial statements to “RumbleOn,” the “Company,” “we,” “us,” and “our” refer to RumbleOn, Inc. and its consolidated subsidiaries.

RumbleOn, Inc. is headquartered in the Dallas Metroplex and completed its initial public offering in 2017. We operate primarily through two operating segments, which are also our reportable segments for segment reporting: our powersports dealership group and Wholesale Express, LLC (“Express”), a transportation services provider. We were incorporated in 2013. We have grown primarily through acquisition, the largest to date being our 2021 acquisition of the RideNow business followed by our 2022 acquisition of the Freedom Powersports business. These acquisitions added 54 powersports dealerships to our Company.

We offer a wide selection of new and pre-owned motorcycles, all-terrain vehicles (“ATV”), utility terrain or side-by-side vehicles (“SXS”), personal watercraft (“PWC”), snowmobiles, and other powersports products, including parts, apparel, accessories, finance & insurance products and services (“F&I”), and aftermarket products from a wide range of manufacturers. Additionally, we offer a full suite of repair and maintenance services. As of September 30, 2024, we operated 56 retail locations with powersports franchises (motorcycles, ATVs, SXSs, PWCs, snowmobiles, and other powersports products) in Alabama, Arizona, California, Florida, Georgia, Kansas, Massachusetts, Nevada, North Carolina, Ohio, Oklahoma, South Dakota, Texas, and Washington.

We source high quality pre-owned inventory via our proprietary Cash Offer technology, which allows us to purchase pre-owned units directly from consumers.

Express provides asset-light brokerage services facilitating automobile transportation primarily between and among dealers. We provide services focused on pre-owned vehicles to clients in all 50 states through our established network of pre-qualified carriers.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim information and with the instructions on Form 10-Q and Rule 8-03 of Regulation S-X pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for smaller reporting companies. The condensed consolidated financial statements include the accounts of RumbleOn, Inc. and its subsidiaries, which are all wholly owned. In accordance with those rules and regulations, the Company has omitted certain information and notes required by GAAP for annual consolidated financial statements. In the opinion of management, these condensed consolidated financial statements contain all normal, recurring adjustments necessary for the fair presentation of the Company’s financial position and results of operations for the periods presented. The year-end balance sheet data was derived from audited financial statements. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”). The results of operations for the three and nine months ended September 30, 2024 are not necessarily indicative of the results expected for the entire fiscal year. Intercompany accounts and material intercompany transactions have been eliminated.

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year's presentation. In particular, the financing lease obligation was reclassified from debt to other long-term liabilities on the consolidated balance sheet.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. These estimates are based on management's best knowledge of current events, historical experience, actions that the Company may undertake in the future and on various other assumptions that are believed to be reasonable under the circumstances. As additional information becomes available, or actual amounts are determinable, the recorded estimates are revised. Consequently, operating results can be affected by revisions to prior accounting estimates.

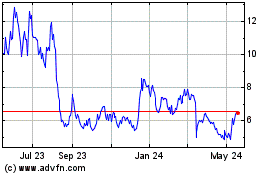

Franchise Rights and Other Intangible Assets

Franchise rights and other intangible assets are tested for impairment annually as of October 1, or whenever events or changes in circumstances indicate that an impairment may exist. During the quarter ended September 30, 2024, the Company considered a number of factors including, but not limited to, current macroeconomic conditions such as inflation, economic growth, and interest rate movements, industry and market considerations, stock price performance (including performance relative to peers), overall financial performance of the Company, and the Company’s market capitalization relative to its net assets. Based on the analysis of relevant factors, the Company concluded a triggering event had not occurred as of September 30, 2024. The Company has commenced its annual impairment process as of October 1, 2024, which includes engaging a third party valuation specialist to assist in determining the fair value of the franchise rights. The Company’s annual impairment analysis as of October 1 is incomplete at this time, and management expects to finalize this assessment in the fourth quarter.

Liquidity and Management’s Plans

The Company’s convertible senior 6.75% promissory notes are due January 1, 2025. As described more fully in Note 12, the Company recently took steps to improve its liquidity and temporarily make certain debt covenants more favorable to the Company.

As of September 30, 2024, the Company was in compliance with the financial covenants under Amendment No. 8 to the Credit Agreement (as defined in Note 4) but determined it may need additional capital and/or relief from the financial covenants in the future. On November 11, 2024, the Company and Oaktree (as defined in Note 4) executed Amendment No. 9 to the Credit Agreement (as defined in Note 12), which provided the Company with revised financial covenants through June 30, 2026, permitted the Company to enter into the Rights Offering Term Sheet, and the Pre-Owned Floor Plan Facility and SLB Commitment Letter (each as defined in Note 12), and permit the Company to pay the convertible senior 6.75% promissory notes due January 1, 2025.

As a result of the Rights Offering Term Sheet and the Pre-Owned Floor Plan Facility and SLB Commitment Letter, which collectively represent $30 million of incremental capital, and Amendment No. 9, the Company believes that it will be in compliance with all covenants under the Credit Agreement, as amended by Amendment No. 9, for the next one-year period. As of September 30, 2024, the Company has classified obligations under the Credit Agreement as non-current liabilities.

On September 30, 2024, the Company was not in compliance with the “Minimum EBITDA” financial covenant associated with its JPM Credit Line (as defined in Note 4). On October 23, 2024, the Company paid the outstanding balance under its JPM Credit Line, which was $5.7 million as of September 30, 2024. As of November 1, 2024, pursuant to the terms of the agreement, no amounts may be borrowed under this credit line.

Adoption of New Accounting Standards

Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40)

On January 1, 2024, the Company adopted ASU 2020-06, Debt - Debt with Conversion and Other Options and Derivatives and Hedging - Contracts in Entity’s Own Equity, using the modified retrospective method. As a result of this adoption, the Company derecognized the remaining unamortized debt discount of $3.7 million on its 6.75% convertible secured senior notes and therefore no longer recognizes any amortization of such debt discount as interest expense. Upon adoption of ASU 2020-06, the Company reclassified the $3.7 million unamortized debt discount from additional paid-in-capital to long-term debt and also recorded a $9.8 million cumulative adjustment credit to retained earnings for amortization from the issuance date through January 1, 2024 with an offset to additional paid-in-capital. The impact of our adoption of this standard was approximately $0.08 per share for the nine months ended September 30, 2024, which reflected the reduction of non-cash interest expense. The prior period consolidated financial statements have not been retrospectively adjusted and continue to be reported under the accounting standards in effect for those periods.

Recent Pronouncements Not Yet Adopted

Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures

Issued in November 2023, ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, requires a public entity to disclose significant segment expenses and other segment items on an annual and interim basis and provide in interim periods all disclosures about a reportable segment’s profit or loss and assets that are currently required annually. Additionally, it requires a public entity to disclose the title and position of the Chief Operating Decision Maker (“CODM”). The ASU does not change how a public entity identifies its operating segments, aggregates them, or applies the quantitative thresholds to determine its reportable segments. The new standard is effective for the Company for fiscal year 2024 and interim periods beginning in 2025, with early adoption permitted. We will adopt this standard beginning with our 2024 Annual Report on Form 10-K, and we expect only an impact to our disclosures, which will be made on a retrospective basis, with no impact to our results of operations, cash flows or financial condition.

Income Taxes (Topic 740): Improvements to Income Tax Disclosures

Issued in December 2023, ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, focuses on the rate reconciliation and income taxes paid. This ASU requires disclosure, on an annual basis, a tabular rate reconciliation using both percentages and currency amounts, broken out into specified categories with certain reconciling items further broken out by nature and jurisdiction to the extent those items exceed a specified threshold. In addition, the ASU requires disclosure of income taxes paid, net of refunds received disaggregated by federal, state/local, and foreign and by jurisdiction if the amount is at least 5% of total income tax payments, net of refunds received. The new standard is effective for the Company for 2025, with early adoption permitted. An entity may apply the amendments in this ASU prospectively by providing the revised disclosures for the period ending December 31, 2025 and continuing to provide the pre-ASU disclosures for the prior periods, or may apply the amendments retrospectively by providing the revised disclosures for all periods presented. We expect this ASU to only impact our disclosures with no impacts to our results of operations, cash flows, and financial condition.

NOTE 2 –REVENUE

The significant majority of the Company’s revenue is from contracts with customers. In the following tables, revenue is disaggregated by major lines of goods and services and timing of transfer of goods and services. We have determined that these categories depict how the nature, amount, timing, and uncertainty of our revenue and cash flows are affected by economic factors.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| ($ in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | |

| New vehicles | $ | 147.1 | | | $ | 159.6 | | | $ | 477.9 | | | $ | 501.5 | |

| Pre-owned vehicles | 59.3 | | | 75.5 | | | 178.3 | | | 236.6 | |

| Total powersports vehicles | 206.4 | | | 235.1 | | | 656.2 | | | 738.1 | |

| | | | | | | |

| Parts, service and accessories | 49.2 | | | 59.7 | | | 159.0 | | | 184.2 | |

| Finance and insurance, net | 24.3 | | | 29.3 | | | 79.8 | | | 89.7 | |

| Vehicle transportation services | 15.1 | | | 14.0 | | | 44.6 | | | 43.2 | |

| Total revenue | $ | 295.0 | | | $ | 338.1 | | | $ | 939.6 | | | $ | 1,055.2 | |

| | | | | | | |

| Timing of revenue recognition | | | | | | | |

| Goods and services transferred at a point in time | $ | 260.8 | | | $ | 301.8 | | | 827.5 | | | 941.1 | |

| Goods and services transferred over time | 34.2 | | | 36.3 | | | 112.1 | | | 114.1 | |

| Total revenue | $ | 295.0 | | | $ | 338.1 | | | $ | 939.6 | | | $ | 1,055.2 | |

NOTE 3 –ACCOUNTS RECEIVABLE, NET

Accounts receivable consisted of the following:

| | | | | | | | | | | |

| ($ in millions) | September 30, 2024 | | December 31, 2023 |

| Contracts in transit | $ | 11.1 | | | $ | 16.0 | |

| Trade receivables | 12.1 | | | 9.8 | |

Factory receivables(1) | 7.4 | | | 9.6 | |

Receivable from the sale of the ROF loan portfolio(2) | — | | | 15.4 | |

| 30.6 | | | 50.8 | |

| Less: allowance for doubtful accounts | 0.6 | | | 0.5 | |

| $ | 30.0 | | | $ | 50.3 | |

(1) Primarily amounts due from manufacturers for holdbacks, rebates, co-op advertising, warranty and supplies returns.

(2) Represents the selling price for the RumbleOn Finance loan portfolio that was sold in the fourth quarter of 2023 but settled in January 2024. The loans in the portfolio were originated in connection with certain sales of the Company’s inventory.

NOTE 4 – DEBT

Long-term debt consisted of the following as of September 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | |

| ($ in millions) | | September 30, 2024 | | December 31, 2023 |

| Term Loan Credit Agreement due August 2026 | | $ | 226.4 | | | $ | 248.7 | |

Convertible senior 6.75% promissory notes due January 2025 | | 38.8 | | | 38.8 | |

RumbleOn Finance line of credit(1) | | — | | | 12.2 | |

| Fleet notes and other | | 1.9 | | | 2.1 | |

| Total principal amount | | 267.1 | | | 301.8 | |

Less: unamortized debt issuance costs(2) | | (18.1) | | | (27.5) | |

| Total long-term debt | | 249.0 | | | 274.3 | |

| Less: Current portion of long-term debt | | (39.2) | | | (35.6) | |

| Long-term debt, net of current portion | | $ | 209.8 | | | $ | 238.7 | |

(1) Terminated after it was paid in full in January 2024 from the proceeds of the sale of the RumbleOn Finance loan portfolio.

(2) Amount at December 31, 2023 included $3.7 million of unamortized debt discount associated with the convertible senior 6.75% promissory notes that was derecognized in conjunction with the Company's adoption of ASU 2020-06 as of January 1, 2024. See Note 1.

Vehicle floor plan notes payable as of September 30, 2024 and December 31, 2023 were as follows:

| | | | | | | | | | | |

| ($ in millions) | September 30, 2024 | | December 31, 2023 |

| Floor plan notes payable - trade | $ | 92.4 | | | $ | 101.9 | |

| Floor plan notes payable - non-trade | 150.1 | | | 189.4 | |

| Floor plan notes payable | $ | 242.5 | | | $ | 291.3 | |

Term Loan Credit Agreement

The Company has a term loan credit agreement (as amended, the “Credit Agreement”) among the Company, as borrower, the lenders party thereto, and Oaktree Fund Administration, LLC, as administrative agent and collateral agent (“Oaktree”). Other than certain interest that is payable in kind (“PIK”) at the Company's option, no additional amounts are available to be borrowed under the Credit Agreement.

Borrowings under the Credit Agreement bear interest at a rate per annum equal, at the Company’s option, to either (a) SOFR (with a floor of 1.00%), plus an applicable margin of 8.25% or (b) a fluctuating adjusted base rate in effect from time to time, plus an applicable margin of 7.25%, provided that Amendment No. 8 (as defined below) extended the additional 0.5% of interest that was put in place as part of Amendment No. 5 to the Credit Agreement through March 31, 2025. At the Company’s option, up to 1.50% of interest, including the 0.5% of additional interest, may be payable in kind. The interest rate on September 30, 2024, was 14.27%, including the additional 0.5% of interest that the Company has elected to pay in kind.

Obligations under the Credit Agreement are secured by a first-priority lien on substantially all of the assets of the Company and its wholly owned subsidiaries (the “Subsidiary Guarantors”), although certain assets of the Company and Subsidiary Guarantors are subject to a first-priority lien in favor of floor plan lenders, and such liens and priority are subject to certain other exceptions. The Subsidiary Guarantors also guarantee the obligations of the Company under the Credit Agreement.

During the nine months ended September 30, 2024, the Company repaid $23.0 million in principal under the Credit Agreement. The Company provided customary representations and covenants under the Credit Agreement, which include financial covenants and collateral performance covenants.

At June 30, 2024, the Company was not in compliance with certain leverage ratio financial covenants under the Credit Agreement as of such date. On August 6, 2024, the Company, the Subsidiary Guarantors party thereto, Oaktree and the lenders party thereto executed Amendment No. 8 to the Credit Agreement (“Amendment No. 8”), pursuant to which, among other things: (i) the leverage ratios were revised and made less restrictive through December 31, 2024, (ii) the level of liquidity required by the minimum liquidity covenant was increased from $25.0 million to $30.0 million starting June 30, 2024 and continuing through the maturity of the term loan, and (iii) a compliance certificate is required to be submitted affirming compliance with the then effective leverage and liquidity tests upon any full or partial cash settlement of the convertible senior 6.75% promissory notes due January 1, 2025.

Amendment No. 8 was made effective as of June 30, 2024, and the lenders agreed in Amendment No. 8 that no event of default exists or arises from such financial covenants as of such date. The Company agreed to pay a one-time fee of 0.5% of the loan amount in cash, and the additional 0.5% of interest was extended through March 31, 2025.

The Company was in compliance with the Credit Agreement as of September 30, 2024; however, financial projections indicated that more liquidity may be needed to ensure that the Company maintains compliance with the minimum liquidity covenant. As more fully discussed in Note 12, on November 11, 2024, the Company, the Subsidiary Guarantors party thereto, Oaktree and the lenders party thereto executed Amendment No. 9 to the Credit Agreement, which among other things, revised applicable leverage ratios, permitted the Company to enter into the Rights Offering Term Sheet and the Pre-Owned Floor Plan Facility and SLB Commitment Letter (each as defined in Note 12), and permit the Company to pay the convertible senior 6.75% promissory notes due January 1, 2025. The additional 0.5% of interest previously extended through March 31, 2025 will terminate on December 31, 2024.

Based on the amended terms of the Credit Agreement and the $30 million of capital commitments made by certain related parties as discussed in Note 1, the Company believes that it will be in compliance with all covenants under the Credit Agreement, as amended by Amendment No. 9, for the next one-year period. As of September 30, 2024, the Company has classified obligations under the Credit Agreement as non-current liabilities.

RumbleOn Finance Line of Credit

As disclosed in the consolidated financial statements in our 2023 Form 10-K, on January 2, 2024, the Company repaid the entire balance due under this loan from cash proceeds from the 2023 sale of the loan portfolio held at RumbleOn Finance. This line of credit was then terminated.

Vehicle Floor Plan Notes Payable

Vehicle floor plan notes payable are classified as current liabilities. Floor plan notes payable (trade) reflects amounts borrowed to finance the purchase of specific new and, to a lesser extent, pre-owned powersports vehicle inventory with corresponding manufacturers’ captive finance subsidiaries (“trade lenders”). Floor plan notes payable (non-trade) represents amounts borrowed to finance the purchase of specific new and pre-owned powersports vehicle inventories with non-trade lenders. Changes in vehicle floor plan notes payable (trade) are reported as operating cash flows, and changes in floor plan notes payable (non-trade) are reported as financing cash flows in the accompanying Consolidated Statements of Cash Flows. Inventory serves as collateral under vehicle floor plan notes payable borrowings.

New inventory costs are generally reduced by manufacturer holdbacks, incentives, floor plan assistance, and non-reimbursement-based manufacturer advertising rebates, while the related vehicle floor plan payables are reflective of the gross cost of the powersports vehicle. The vehicle floor plan payables will generally also be higher than the inventory cost due to the timing of the sale of a vehicle and payment of the related liability. Vehicle floor plan facilities are due on demand, but in the case of new vehicle inventories, are generally paid within a few business days after the related vehicles are sold.

New vehicle floor plan facilities generally utilize SOFR or ADB (Average Daily Balance)-based interest rates while pre-owned vehicle floor plan facilities are based on prime or SOFR. The aggregate capacity to finance our inventory under the new and pre-owned vehicle floor plan facilities as of September 30, 2024 was $364.0 million, of which $242.5 million was used.

At September 30, 2024, the Company had a Floor Plan Line with J.P. Morgan (the “JPM Credit Line”) with an advance limit of $8.0 million, of which $5.7 million was used. The JPM Credit Line was amended on August 6, 2024 after the Company was not in compliance with the “Minimum EBITDA” financial covenant as of June 30, 2024. This amendment revised the applicable financial covenants for the remainder of its term, and the term was extended from October 25, 2024 to December 31, 2024. As of September 30, 2024, the Company was not in compliance with the new “Minimum EBITDA” financing covenant. On October 23, 2024, the Company paid off the outstanding balance under the JPM Credit Line. As of November 1, 2024, no amounts may be borrowed under the JPM Credit Line.

The following table sets forth the Company’s interest expense:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| ($ in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Floor plan interest expense | $ | 4.4 | | | $ | 3.9 | | | $ | 12.7 | | | $ | 9.8 | |

| | | | | | | |

| Other interest expense: | | | | | | | |

| Interest expense on term loan | $ | 10.8 | | | $ | 13.6 | | | $ | 31.8 | | | $ | 39.9 | |

| Interest expense on convertible debt | 0.7 | | | 1.5 | | | 2.0 | | | 4.3 | |

Interest on finance lease obligation(1) | 1.1 | | | 0.2 | | | 3.4 | | | 0.2 | |

| Other interest expense (income), net | $ | (0.4) | | | $ | 0.7 | | | $ | (1.0) | | | $ | 1.6 | |

| Total other interest expense | $ | 12.2 | | | $ | 16.0 | | | $ | 36.2 | | | $ | 46.0 | |

| | | | | | | |

| Total interest expense | $ | 16.6 | | | $ | 19.9 | | | $ | 48.9 | | | $ | 55.8 | |

(1) Finance lease obligation is reported in other long-term liabilities on our consolidated balance sheets.

NOTE 5 – STOCK-BASED COMPENSATION

The following table reflects the Company's stock-based compensation expense:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| ($ in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Restricted Stock Units | $ | 0.9 | | | $ | 3.1 | | | $ | 3.3 | | | $ | 10.9 | |

| Stock Options | 0.2 | | | — | | | 0.6 | | | — | |

| Total stock-based compensation | $ | 1.1 | | | $ | 3.1 | | | $ | 3.9 | | | $ | 10.9 | |

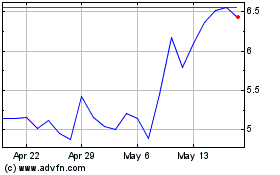

On March 19, 2024, the Company made its annual grant with a total fair value of $2.3 million to eligible employees consisting of 238,577 time-based restricted stock units (“RSUs”) and 228,042 performance-based restricted stock units (“PSUs”). The RSUs vest annually over a three-year period and were valued at the prior day's closing price of RMBL Class B Common Stock of $5.71 per share. The PSUs vest if and when certain target stock prices are reached and maintained for a minimum 30 trading days within three years from the grant date. The $3.91 average per-share fair value of the PSUs was determined using a Monte Carlo model.

NOTE 6 – INCOME TAXES

The Company recognized a tax benefit of $0.4 million for the nine months ended September 30, 2024, representing an effective income tax rate of 1.8%. The Company did not recognize a tax benefit for the three months ended September 30, 2024. The difference between the U.S. federal income tax rate of 21.0% and the Company's overall income tax rate was primarily due to state income tax and a change in the valuation allowance for federal and state tax purposes.

The Company recognized tax benefits of $3.5 million and $9.7 million for the three and nine months ended September 30, 2023, respectively, representing effective income tax rates of 17.5% and 17.4%, respectively. The difference between the U.S. federal income tax rate of 21.0% and the Company’s overall income tax rate for both periods in 2023 was primarily due to the tax effect of non-deductible executive compensation, non-deductible interest expense, and discrete tax impacts of stock compensation that vested during the period.

NOTE 7 – LOSS PER SHARE

The following common stock equivalents were outstanding as of September 30, and they were excluded from the calculations of loss per share because they were anti-dilutive or because their market condition had not been met:

| | | | | | | | | | | | | | |

| | 2024 | | 2023 |

| Unvested RSUs | | 493,663 | | | 820,916 | |

| Unvested PSUs | | 204,503 | | | — | |

| Warrants to purchase shares of Class B Common Stock | | 1,212,121 | | | 1,213,647 | |

Shares issuable in connection with 6.75% convertible senior notes | | 1,302,000 | | | 982,107 | |

| Vested stock options | | 527 | | | 2,340 | |

| Performance stock options | | 825,000 | | | — | |

NOTE 8 – SUPPLEMENTAL CASH FLOW INFORMATION

The following table includes supplemental cash flow information, including non-cash investing and financing activity for the nine months ended September 30, 2024 and 2023:

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| ($ in millions) | 2024 | | 2023 |

| Cash paid for interest | $ | 36.8 | | | $ | 54.5 | |

| Cash paid for (refunds from) taxes, net | (1.0) | | | 0.9 | |

| Cash payments for operating leases | 23.0 | | | 21.9 | |

| Right-of-use assets obtained in exchange for operating lease liabilities | 6.8 | | | 14.4 | |

| Capital expenditures and technology development costs included in accounts payable and other current liabilities | — | | | 0.1 | |

| Fair value of warrants issued as financing costs | — | | | 6.1 | |

| Capital expenditures included in debt | 0.2 | | | — | |

The following table shows the cash and restricted cash balances:

| | | | | | | | | | | | | | | | | |

| ($ in millions) | September 30, 2024 | | December 31, 2023 | | September 30, 2023 |

| Cash | $ | 50.1 | | | $ | 58.9 | | | $ | 41.4 | |

Restricted cash(1) | 16.6 | | | 18.1 | | | 18.1 | |

| Total cash and restricted cash | $ | 66.7 | | | $ | 77.0 | | | $ | 59.5 | |

(1) Amounts included in restricted cash are primarily comprised of the deposits required under the Company's various floor plan lines of credit.

NOTE 9 – RELATED-PARTY TRANSACTIONS

Leases

The Company has operating leases from related parties for 25 properties consisting of dealerships and offices, one of which was entered into in 2024 and contains an option to purchase a property at or above its fair market value subject to the terms of the lease. Each of these related-party leases is with a wholly owned subsidiary of the Company as the tenant and an entity controlled by William Coulter and/or Mark Tkach, as the landlord. Mr. Coulter and Mr. Tkach are directors and former executive officers of the Company. Most of these leases have an initial 20-year term and contain annual 2% increases on base rent. Rent expense associated with the related-party operating leases was $4.8 million and $4.6 million for the three months ended September 30, 2024 and 2023, respectively, and $14.3 million and $13.9 million for the nine months ended September 30, 2024 and 2023, respectively, and is included in selling, general and administrative expenses on the consolidated statements of operations.

The following table provides the amounts for related party leases that are included on the balance sheets:

| | | | | | | | | | | |

| ($ in millions) | September 30, 2024 | | December 31, 2023 |

| Right-of-use assets | $ | 105.0 | | | $ | 108.5 | |

Current portion of operating lease liabilities(1) | 14.3 | | | 14.2 | |

| Long-term portion of operating lease liabilities | 99.7 | | | 96.2 | |

(1) Included in accounts payable and other current liabilities.

Employment of Immediate Family Members

Mr. Tkach has two immediate family members that are employed by the Company: one as a vice president and one as a commissioned sales representative. The vice president received aggregate gross pay, including grants of restricted stock, of $0.1 million and $0.3 million for the three and nine months ended September 30, 2024, and $0.2 million and $0.4 million for the three and nine months ended September 30, 2023. The commissioned sales representative earned in excess of $0.1 million in 2023. All compensation-related decisions were made in a manner that is consistent with internal practices and policies for both employees.

Other Transactions

See Note 12 for subsequent events involving related parties.

NOTE 10 - SEGMENT INFORMATION

The following tables provide information related to our two segments. The powersports dealership group segment is significantly larger and requires more investment than the vehicle transportation services segment. As a result, substantially all of the Company’s interest expense and depreciation and amortization is attributed to the powersports dealership group segment.

| | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions) | Powersports Dealership Group | | Vehicle Transportation Services | | Eliminations | | Total |

| Three Months Ended September 30, 2024 | | | | | | | |

| | | | | | | |

| Revenue from external customers | $ | 279.9 | | | $ | 15.1 | | | $ | — | | | $ | 295.0 | |

| Operating income | 4.0 | | | 1.3 | | | — | | | 5.3 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Three Months Ended September 30, 2023 | | | | | | | |

| | | | | | | |

| Revenue from external customers | $ | 324.1 | | | $ | 14.0 | | | $ | — | | | $ | 338.1 | |

| Revenue from discontinued operating segment | — | | | 0.1 | | | (0.1) | | | — | |

| Operating income (loss) | (1.7) | | | 1.5 | | | — | | | (0.2) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Nine Months Ended September 30, 2024 | | | | | | | |

| Revenue from external customers | $ | 895.0 | | | $ | 44.6 | | | $ | — | | | $ | 939.6 | |

| Operating income | 21.9 | | | 4.0 | | | — | | | 25.9 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Nine Months Ended September 30, 2023 | | | | | | | |

| Revenue from external customers | $ | 1,012.0 | | | $ | 43.2 | | | $ | — | | | $ | 1,055.2 | |

| Revenue from discontinued operating segment | — | | | 0.4 | | | (0.4) | | | — | |

| Operating income (loss) | (4.5) | | | 4.4 | | | — | | | (0.1) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Total Assets by Segment(1) | | | | | | | |

| September 30, 2024 | $ | 1,632.8 | | | $ | 5.0 | | | $ | (807.3) | | | $ | 830.5 | |

| December 31, 2023 | 1,766.3 | | | 4.0 | | | (844.0) | | | 926.3 | |

(1) Eliminations relate to investments of various acquisitions and receivables and other balances for intercompany activities.

NOTE 11 – COMMITMENTS AND CONTINGENCIES

Legal Matters

From time to time, the Company is involved in various claims and legal actions that arise in the ordinary course of business. Although the results of litigation and claims cannot be predicted with certainty, as of September 30, 2024, the Company does not believe that the ultimate resolution of any legal actions, either individually or in the aggregate, will have a material adverse effect on its financial position, results of operations, liquidity, and capital resources.

Future litigation may be necessary to defend the Company by determining the scope, enforceability and validity of third-party proprietary rights or to establish its own proprietary rights. The results of any current or future litigation cannot be predicted with certainty, and regardless of the outcome, litigation can have an adverse impact on the Company because of defense and settlement costs, diversion of management resources, and other factors.

SEC Investigation

On June 28, 2024, the Company received a subpoena from the SEC requesting documents created during or relating to the period from January 1, 2021 through the date of the subpoena. The subpoena covers documents relating to, among other matters, the Company’s previously disclosed internal investigation into the use of Company resources by Marshall Chesrown; the Company’s review, consideration and approval, and the underlying terms of, related party transactions; employment, compensation, reimbursement and severance arrangements; and

disclosures and communications to customers and investors regarding the Company’s cash offer tool and certain of its technology. The Company continues to cooperate with the SEC’s inquiry.

The Company cannot predict the ultimate outcome or timing of the SEC investigation, what, if any, actions may be taken by the SEC, or the effect that such actions may have on the business, prospects, operating results and financial condition of the Company.

Internal Investigation and Delaware Litigation

As previously disclosed, the Company began an investigation of certain allegations surrounding Marshall Chesrown’s use of Company resources in 2023. On July 7, 2023, Mr. Chesrown provided the Board a letter of resignation (the “Resignation Letter”) describing Mr. Chesrown’s disagreement with several recent corporate governance, disclosure and other actions taken by the Company, the Board and certain of its members, and indicated his intent to pursue legal claims. The Company disagrees with the characterization of the allegations and assertions described in the Resignation Letter. The Company and Mr. Chesrown conducted a pre-suit mediation in October 2023, as required in his employment agreement, but did not resolve the matter. On March 13, 2024, Mr. Chesrown filed suit against the Company in Delaware Superior Court for the claims asserted in his Resignation Letter. Mr. Chesrown is seeking a declaratory judgment that he resigned with good reason, termination compensation damages in the amount of $7.5 million, general and reputational damages in the amount of $50 million, punitive damages, attorney's fees and litigation costs. The parties are now engaged in the initial stages of discovery. The subject matter of the litigation overlaps with the investigation begun by the Company in 2023. As of the date of this filing, the Company has not decided what actions, if any, may be taken with regard to the investigation allegations. We intend to defend the litigation claims vigorously; however, we can provide no assurance regarding the outcome of this matter.

Letters of Credit

We issue letters of credit to secure the Company’s various financial obligations, including floor plan financing arrangements and insurance policy deductibles and other claims. The total amount of outstanding letters of credit as of September 30, 2024 was $12.0 million. We do not believe that it is probable that any of the letters of credit will be drawn upon.

NOTE 12 – SUBSEQUENT EVENTS

Rights Offering Term Sheet

On November 11, 2024, the Company, Stone House Capital Management, LLC, a Delaware limited liability company (“Stone House”, and, together with its affiliates, the “Backstop Investor”), and Mark Tkach and William Coulter (each, a “Supporting Investor,” and together with the Backstop Investor, the “Investors”) entered into a binding term sheet for a fully backstopped rights offering (the “Rights Offering Term Sheet”). Pursuant to and subject to the terms and conditions contained in the Rights Offering Term Sheet, the Company shall pursue a rights offering (the “Rights Offering”) whereby holders of record of Class A Common Stock and Class B Common Stock as of the record date for the Rights Offering will be granted pro rata subscription rights to purchase an aggregate of $10.0 million of shares of Class B Common Stock to be priced at the lower of (i) 20% discount to the 30-day volume-weighted average price (“VWAP”) per share of the Company’s Class B Common Stock immediately prior to the date of the Rights Offering Term Sheet and (ii) 20% discount to the 10-day VWAP per share of the Company’s Class B Common Stock immediately prior to the date of execution of the Backstop Agreement (as defined below) (the “Subscription Price”).

Pursuant to the Rights Offering Term Sheet, the Backstop Investor has agreed to enter into a standby purchase agreement with the Company on or before December 1, 2024 (the “Backstop Agreement”) pursuant to which the Backstop Investor will be required to (i) exercise its right to purchase all shares of Class B Common Stock available from the full exercise of the Backstop Investor’s (or its affiliates’ and related parties’) pro rata subscription rights prior to the expiration date of the Rights Offering and (ii) if and only if the Rights Offering is not fully subscribed at the expiration date, all shares of Class B Common Stock included in the Rights Offering that remain unsubscribed for at the expiration date at the same Subscription Price and on the same terms and conditions as other subscribers in the Rights Offering. In addition, the Backstop Agreement will include customary representations and warranties.

Pursuant to the Rights Offering Term Sheet, each of the Supporting Investors has agreed to enter into support agreements (each a “Support Agreement”) with the Company at substantially the same time as the Backstop Agreement. Pursuant to the Support Agreements, which will include customary representations and warranties, each Supporting Investor will agree to exercise its right to purchase all shares of Class B Common Stock available from the full exercise of such Supporting Investor’s (or its affiliates’ and related parties’) pro rata subscription rights in the Rights Offering.

The foregoing information regarding the Rights Offering is not complete and is subject to change. The foregoing information regarding the Rights Offering shall not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any offer, solicitation or sale of the securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of such state or jurisdiction.

Each of Stone House, Mr. Coulter and Mr. Tkach are holders of greater than 10% of our outstanding Class B Common Stock. Mark Cohen is managing member of Stone House. Each of Messrs. Cohen, Coulter and Tkach are directors of the Company.

Pre-Owned Floor Plan Facility and SLB Commitment Letter

On November 11, 2024, the Company and Messrs. Coulter and Tkach (collectively, the “Commitment Parties”) entered into a commitment letter (the “Pre-Owned Floor Plan Facility and SLB Commitment Letter”), pursuant to which the Commitment Parties have firmly committed to (i) provide a floor plan financing facility of not less than $16.0 million of total committed availability for pre-owned powersports vehicle inventory (the “Pre-Owned Floor Plan Facility”) and (ii) enter into a sale leaseback transaction with the Company (the “SLB Transaction”).

Messrs. Coulter and Tkach are related parties.

Pre-Owned Floor Plan Facility

The Pre-Owned Floor Plan Facility will consist of not less than $16.0 million total committed revolving availability made by the Commitment Parties or an entity or entities controlled by either or both of them, which may be borrowed, repaid and reborrowed from time to time in order to finance pre-owned powersports vehicle inventory. Any borrowings pursuant to the Pre-Owned Floor Plan Facility shall bear interest based on SOFR plus 5.00%. The Pre-Owned Floor Plan Facility will terminate on March 31, 2026, unless extended by agreement of the parties. The Company will use the net proceeds of the Pre-Owned Floor Plan Facility to finance the acquisition and carrying cost of pre-owned powersports vehicle inventory. The Pre-Owned Floor Plan Facility will be secured by a first priority security interest in the pre-owned powersports vehicle inventory financed thereunder. The Pre-Owned Floor Plan Facility will include customary representations, covenants and events of default for financing transactions of this nature.

SLB Transaction

The SLB Transaction will consist of a sale by the Company of certain real property located in Daytona, Florida for $4.0 million and a subsequent triple-net lease back from the buyer at a lease rate of $0.3 million per year of base rent plus a pass-through of triple-net charges, including property taxes, insurance, and maintenance and repair costs. The base rent will increase two percent annually. The term of the lease shall be for not less than ten years.

Ninth Amendment to Credit Agreement

The Company has a term loan credit agreement (as amended, the “Credit Agreement”) among the Company, as borrower, the lenders party thereto, and Oaktree Fund Administration, LLC, as administrative agent and collateral agent. On November 11, 2024, the parties to the Credit Agreement executed Amendment No. 9 to the Credit Agreement (“Amendment No. 9”), pursuant to which, among other things: (i) the leverage ratios were revised and made less restrictive through June 30, 2026, (ii) the Company is permitted to consummate the transactions contemplated by each of the Rights Offering Term Sheet and Pre-Owned Floor Plan Facility and SLB Commitment Letter and (iii) the Company is permitted to consummate full cash settlement of the convertible senior 6.75% promissory notes due January 1, 2025.

After giving effect to Amendment No. 9, borrowings under the Credit Agreement will bear interest at a rate per annum equal, at the Company’s option, to either (a) SOFR (with a floor of 1.00%), plus an applicable margin of 8.25% per annum or (b) a fluctuating adjusted base rate in effect from time to time, plus an applicable margin of 7.25% per annum. The incremental interest amount of 0.5% per annum that was put in place as part of Amendment No. 5 to the Credit Agreement, which was previously agreed to be in place through March 31, 2025, will terminate on December 31, 2024. In addition, the Company has agreed to make a one-time payment in cash on January 2, 2025 of additional interest in an amount equal to 0.25% of the loan amount as of the effective date of Amendment No. 9.

JPM Credit Line

As discussed in Note 4, on October 23, 2024, the Company paid off the outstanding balance under the JPM Credit Line. Pursuant to the terms of the JPM Credit Line, no new amounts may be borrowed after November 1, 2024, and the line expires on December 31, 2024.

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is provided as a supplement to, and should be read in conjunction with, our audited consolidated financial statements, the accompanying notes, and the MD&A included in our 2023 Form 10-K, as well as our unaudited condensed consolidated financial statements and the accompanying notes included in Item 1 of this Quarterly Report on Form 10-Q. Terms not defined in this MD&A have the meanings ascribed to them in the condensed consolidated financial statements. Unless otherwise noted, comparisons are of results for the quarter ended September 30, 2024, or third quarter, to the quarter ended September 30, 2023.

Overview

RumbleOn, Inc. operates primarily through two operating segments: our powersports dealership group and Wholesale Express, LLC (“Express”), a vehicle transportation services provider. We were incorporated in 2013. We have grown primarily through acquisitions, the largest to date being our 2021 acquisition of the RideNow business followed by our 2022 acquisition of the Freedom Powersports business. These acquisitions added 54 powersports dealerships to our Company.

Powersports Segment

Our powersports segment is the largest powersports retail group in the United States (as measured by reported revenue, major unit sales and dealership locations), offering a wide selection of new and pre-owned motorcycles, all-terrain vehicles (“ATV”), utility terrain or side-by-side vehicles (“SXS”), personal watercraft (“PWC”), snowmobiles, and other powersports products. We also offer parts, apparel, accessories, finance & insurance products and services (“F&I”), and aftermarket products from a wide range of manufacturers. Additionally, we offer a full suite of repair and maintenance services. As of September 30, 2024, we operated 56 retail locations consisting of hundreds of powersports franchises (representing various brands of motorcycles, ATVs, SXSs, PWCs, snowmobiles, and other powersports products) in Alabama, Arizona, California, Florida, Georgia, Kansas, Massachusetts, Nevada, North Carolina, Ohio, Oklahoma, South Dakota, Texas, and Washington.

We source high quality pre-owned inventory online via our proprietary Cash Offer technology, which allows us to purchase pre-owned units directly from consumers.

Our powersports retail distribution locations represent all major manufacturers, or OEMs, and their representative brands, including those listed below.

| | | | | | | | |

| Powersports’ Representative Brands |

| Benelli | Karavan Trailers | Segway Powersports |

| BMW | Kawasaki | Ski-Doo |

| Can-Am | Kayo | SSR |

| CF Moto | KTM | Suzuki |

| Club Car | Lynx (snowmobiles) | Tidewater Boats |

| Continental Trailers | MAGICTILT Trailers | Timbersled (snow bikes) |

| Ducati | Manitou | Triton Trailers |

| Harley-Davidson | Mercury (boat engines) | Yamaha |

| Honda | Polaris | Yamaha Marine |

| Husqvarna | Royal Enfield | Zieman Trailers |

| Indian Motorcycles | Sea-Doo | |

| | |

Vehicle Transportation Services Segment

Express provides asset-light transportation brokerage services facilitating automobile transportation primarily between and among dealers.

Recent Developments

As of September 30, 2024, the Company was in compliance with the financial covenants under Amendment No.8 to the Credit Agreement (defined in Note 4) but determined it may need additional capital and/or relief from the financial covenants in the future. On November 11, 2024, the Company and Oaktree executed Amendment No. 9 to the Credit Agreement (each as defined in Note 12), which provided the Company with revised financial covenants through June 30, 2026, and permitted the Company to enter into the Rights Offering Term Sheet and the Pre-Owned Floor Plan Facility and SLB Commitment Letter (each as defined in Note 12), representing a total of approximately $30.0 million of incremental capital.

J.P. Morgan Floor Plan Line

On September 30, 2024, the Company was not in compliance with the “Minimum EBITDA” financial covenant associated with its JPM Credit Line (as defined in Note 4). On October 23, 2024, the Company paid off the outstanding balance under this floor plan line, which was $5.7 million as of September 30, 2024. This floor plan line terminates on December 31, 2024, and no amounts may be drawn under the line after November 1, 2024.

Key Operating Metrics

We regularly review a number of key operating metrics to evaluate our segments, measure our progress, and make operating decisions. Our key operating metrics reflect what we believe will be the primary drivers of our business, including increasing brand awareness, maximizing the opportunity to source vehicles from consumers and dealers, and enhancing the selection and timing of vehicles we make available for sale to our customers.

Powersports Segment

Revenue