FALSE000159696100015969612024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

RumbleOn, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Nevada (State or Other Jurisdiction of Incorporation) | 001-38248 (Commission File Number) | 46-3951329 (I.R.S. Employer Identification No.) |

| |

|

901 W. Walnut Hill Lane, Suite 110A Irving, Texas (Address of Principal Executive Offices) | | 75038 (Zip Code) |

Registrant’s telephone number, including area code (214) 771-9952

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class B Common Stock, $0.001 par value | RMBL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2024, RumbleOn, Inc. (the “Company”) issued a press release reporting its results for the quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press Release, dated August 7, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| RUMBLEON, INC. |

| | |

| | |

| Date: August 7, 2024 | By: | /s/ Tiffany Kice |

| | Tiffany Kice

Chief Financial Officer |

Exhibit 99.1

RumbleOn Reports Second Quarter 2024 Financial Results

IRVING, Texas – August 7, 2024 – RumbleOn, Inc. (NASDAQ: RMBL), the "Company" or "RumbleOn", today announced results for the second quarter ended June 30, 2024.

Key Second Quarter 2024 Highlights (Compared to Second Quarter 2023):

•Revenue of $336.8 million decreased 12.0%

•Net loss totaled $0.7 million compared to net loss of $13.6 million

•Selling, general & administrative expense (SG&A) was $71.4 million compared to $100.3 million. Adjusted SG&A(1) decreased 19.4% to $70.8 million, or 78.7% of gross profit (GP), from $87.8 million, or 82.5% of GP

•Adjusted EBITDA(1)(2) of $16.2 million decreased 19.8%

Other Highlights:

•Operating cash flows for the first half of 2024 totaled $29.2 million compared to $(5.6) million in 2023. Free Cash Flow(1) for the first half of 2024 was $28.2 million compared to $(11.6) million in the 2023 period

•The Company reduced Non-Vehicle Net Debt by $33.8 million in the first half of 2024

•Executed an amendment with Term Loan Lender

•Executed the initial phase of Vision 2026 strategy to run the best dealerships in America, which is expected to yield $30 million of annualized savings

•In June, the Company opened RideNow Powersports Houston, a dedicated pre-owned vehicle dealership

"Our second quarter performance reflects the strength of our powersports dealership group as we continue to progress on our turnaround. It is a challenging time for the powersports industry, as we navigate a high interest environment, a cautious consumer, and inflated new major unit inventories. Despite these challenges, I'm proud of the way our team has responded. The team's efforts delivered positive free cash flow during the first half of 2024, and we expect to continue to deliver positive free cash flow in the back half of 2024. We remain laser focused on achieving our Vision 2026 goals and creating per-share value," stated Mike Kennedy, RumbleOn's CEO.

Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | |

| Second Quarter |

| ($ in millions) | 2024 | | 2023 | | | | YOY Change |

| Revenue | $ | 336.8 | | | $ | 382.7 | | | | | (12.0) | % |

| Gross Profit | $ | 89.9 | | | $ | 106.4 | | | | | (15.5) | % |

| SG&A | $ | 71.4 | | | $ | 100.3 | | | | | (28.8) | % |

Adjusted SG&A(1) | $ | 70.8 | | | $ | 87.8 | | | | | (19.4) | % |

| Operating Income | $ | 15.4 | | | $ | 0.8 | | | | | NM |

| Loss from Continuing Operations | $ | (0.7) | | | $ | (12.8) | | | | | 94.5 | % |

Adjusted EBITDA(1)(2) | $ | 16.2 | | | $ | 20.2 | | | | | (19.8) | % |

| | | | | | | |

| Unit Retail Sales: | | | | | | | |

| New Powersports | 12,004 | | | 13,126 | | | | | (8.5) | % |

| Pre-owned Powersports | 4,796 | | | 6,137 | | | | | (21.9) | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| First Half |

| ($ in millions) | 2024 | | 2023 | | | | YOY Change |

| Operating Cash Flow | $ | 29.2 | | | $ | (5.6) | | | | | 621.4 | % |

| Capital Expenditures | $ | (1.0) | | | $ | (6.0) | | | | | (83.3) | % |

Free Cash Flow(1) | $ | 28.2 | | | $ | (11.6) | | | | | 343.1 | % |

| June 30, 2024 | | Dec. 31, 2023 | | | | Change |

| Cash | $ | 58.1 | | | $ | 58.9 | | | | | (1.4) | % |

| Long-term Debt, including current maturities | $ | 247.7 | | | $ | 274.3 | | | | | (9.7) | % |

| Non-Vehicle Debt | $ | 267.2 | | | $ | 301.8 | | | | | (11.5) | % |

Non-Vehicle Net Debt(1) | $ | 209.1 | | | $ | 242.9 | | | | | (13.9) | % |

(1) Adjusted SG&A, EBITDA, Adjusted EBITDA, Free Cash Flow, and Non-Vehicle Net Debt are non-GAAP measures. Reconciliations of GAAP to non-GAAP financial measures are provided in accompanying financial schedules.

(2) This quarter we updated our definition of Adjusted EBITDA to align with dealership industry.

NM = Not meaningful.

Second Quarter 2024 — Segment Results

Powersports Segment

| | | | | | | | | | | | | | | | | |

| Second Quarter |

| $ in millions, except per unit | 2024 | | 2023 | | YOY Change |

| Unit Sales (#) | | | | | |

| Retail | | | | | |

| New | 12,004 | | | 13,126 | | | (8.5) | % |

| Pre-owned | 4,796 | | | 6,137 | | | (21.9) | % |

| Total retail | 16,800 | | | 19,263 | | | (12.8) | % |

| Pre-owned wholesale | 907 | | | 1,014 | | | (10.6) | % |

| Total Powersports Unit Sales | 17,707 | | | 20,277 | | | (12.7) | % |

| | | | | |

| Revenue | | | | | |

| New | $ | 175.8 | | | $ | 185.5 | | | (5.2) | % |

| Pre-owned | 59.2 | | | 84.2 | | | (29.7) | % |

| Finance & Insurance, net | 29.7 | | | 33.2 | | | (10.5) | % |

| Parts, Services, and Accessories | 56.9 | | | 65.4 | | | (13.0) | % |

| Total Powersports Revenue | $ | 321.6 | | | $ | 368.3 | | | (12.7) | % |

| | | | | |

| Gross Profit | | | | | |

| New | $ | 21.6 | | | $ | 28.6 | | | (24.5) | % |

| Pre-owned | 9.3 | | | 10.9 | | | (14.7) | % |

| Finance & Insurance, net | 29.7 | | | 33.2 | | | (10.5) | % |

| Parts, Services, and Accessories | 26.2 | | | 30.4 | | | (13.8) | % |

| Total Powersports Gross Profit | $ | 86.8 | | | $ | 103.1 | | | (15.8) | % |

Powersports GPU(1) | $ | 5,167 | | | $ | 5,349 | | | (3.4) | % |

(1)Calculated as total powersports gross profit divided by total retail units sold.

Vehicle Transportation Services Segment

| | | | | | | | | | | | | | | | | |

| Second Quarter |

| ($ in millions) | 2024 | | 2023 | | Change |

| Vehicles Transported (#) | 23,334 | | | 23,637 | | | (1.3) | % |

| Vehicle Transportation Services Revenue | $ | 15.2 | | | $ | 14.4 | | | 5.6 | % |

| Vehicle Transportation Services Gross Profit | $ | 3.1 | | | $ | 3.4 | | | (8.8) | % |

Investor Conference Call

RumbleOn's management will host a conference call to discuss these results on August 7, 2024 at 7:00 a.m. Central Time (8:00 a.m. Eastern Time). To access the conference call, callers may dial 1-646-307-1865 (or 1-800-717-1738 for callers outside of the United States) and enter conference ID 16525. A live and archived webcast will be accessible from RumbleOn's Investor Relations website at https://investors.rumbleon.com.

About RumbleOn

RumbleOn, Inc. (NASDAQ: RMBL), operates through two operating segments: our Powersports dealership group and Wholesale Express, LLC, an asset-light transportation services provider focused on the automotive industry. Our Powersports group is the largest powersports retail group in the United States (as measured by reported revenue, major unit sales and dealership locations), offering over 500 powersports franchises representing 50 different brands of products. Our Powersports group sells a wide selection of new and pre-owned products, including parts, apparel, accessories, finance & insurance products and services, and aftermarket products. We are the largest purchaser of pre-owned powersports vehicles in the United States and utilize RideNow's Cash Offer to acquire vehicles directly from consumers.

For more information on RumbleOn, please visit rumbleon.com.

Forward-Looking Statements

This press release contains "forward-looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995, which statements may be identified by words such as "expects," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this press release and speak only as of the date of this press release and are advised to consider the factors listed under the heading "Forward-Looking Statements" and "Risk Factors" in the Company's SEC filings, as may be updated and amended from time to time. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Relations Contact:

investors@rumbleon.com

Non-GAAP Measures

To supplement its consolidated financial statements, which are prepared and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), the Company uses the following non-GAAP financial measures: EBITDA, Adjusted EBITDA, Free Cash Flow, Non-Vehicle Net Debt, and Adjusted SG&A (collectively the “non-GAAP financial measures”). The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company uses these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. The Company believes that they provide useful information about operating results, enhance the overall understanding of our operating performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. The non-GAAP measures used by the Company in this press release may be different from the measures used by other companies.

RumbleOn, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Powersports vehicles | $ | 235.0 | | | $ | 269.7 | | | $ | 449.8 | | | $ | 503.0 | |

| Parts, service and accessories | 56.9 | | | 65.4 | | | 109.8 | | | 124.5 | |

| Finance and insurance, net | 29.7 | | | 33.2 | | | 55.5 | | | 60.4 | |

| Vehicle transportation services | 15.2 | | | 14.4 | | | 29.5 | | | 29.2 | |

| Total revenue | 336.8 | | | 382.7 | | | 644.6 | | | 717.1 | |

Cost of revenue: | | | | | | | |

| Powersports vehicles | 204.1 | | | 230.3 | | | 389.2 | | | 431.3 | |

Parts, service and accessories | 30.7 | | | 35.0 | | | 60.0 | | | 66.8 | |

| Vehicle transportation services | 12.1 | | | 11.0 | | | 22.9 | | | 22.3 | |

| Total cost of revenue | 246.9 | | | 276.3 | | | 472.1 | | | 520.4 | |

Gross profit | 89.9 | | | 106.4 | | | 172.5 | | | 196.7 | |

Selling, general and administrative | 71.4 | | | 100.3 | | | 145.3 | | | 186.6 | |

Depreciation and amortization | 3.1 | | | 5.3 | | | 6.6 | | | 10.0 | |

Operating income | 15.4 | | | 0.8 | | | 20.6 | | | 0.1 | |

| Other income (expense): | | | | | | | |

| Floor plan interest expense | (4.3) | | | (3.4) | | | (8.3) | | | (5.9) | |

Other interest expense, net | (11.9) | | | (14.9) | | | (24.0) | | | (30.0) | |

| Other income | — | | | 0.1 | | | 0.3 | | | 0.1 | |

| Total other expense | (16.2) | | | (18.2) | | | (32.0) | | | (35.8) | |

| Loss from continuing operations before income taxes | (0.8) | | | (17.4) | | | (11.4) | | | (35.7) | |

Income tax benefit | (0.1) | | | (4.6) | | | (0.4) | | | (6.2) | |

| Loss from continuing operations | $ | (0.7) | | | $ | (12.8) | | | $ | (11.0) | | | $ | (29.5) | |

| Loss from discontinued operations | — | | | (0.8) | | | — | | | (1.0) | |

Net loss | $ | (0.7) | | | $ | (13.6) | | | $ | (11.0) | | | $ | (30.5) | |

| | | | | | | |

Weighted average shares-basic and diluted | 35.2 | | 16.5 | | 35.2 | | 16.3 |

Loss from continuing operations per share - basic and diluted | $ | (0.02) | | | $ | (0.78) | | | $ | (0.31) | | | $ | (1.81) | |

| | | | | | | |

| Net loss per share - basic and diluted | $ | (0.02) | | | $ | (0.83) | | | $ | (0.31) | | | $ | (1.87) | |

| Common shares outstanding, net of treasury stock, at period end | 35.3 | | 16.6 | | 35.3 | | 16.6 |

| | | | | | | |

| | | | | | | |

RumbleOn, Inc.

Condensed Consolidated Balance Sheets

($ in millions)

| | | | | | | | | | | | | | |

| | (Unaudited) | | |

| | June 30, 2024 | | December 31, 2023 |

| ASSETS | | | | |

| Current assets: | | | | |

Cash | | $ | 58.1 | | | $ | 58.9 | |

Restricted cash | | 13.0 | | | 18.1 | |

Accounts receivable, net | | 35.4 | | | 50.3 | |

Inventory | | 347.6 | | | 347.5 | |

Prepaid expense and other current assets | | 2.6 | | | 6.0 | |

Total current assets | | 456.7 | | | 480.8 | |

Property and equipment, net | | 73.4 | | | 76.8 | |

Right-of-use assets | | 162.8 | | | 163.9 | |

Franchise rights and other intangible assets | | 201.6 | | | 203.3 | |

Other assets | | 1.5 | | | 1.5 | |

Total assets | | $ | 896.0 | | | $ | 926.3 | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

Current liabilities: | | | | |

Accounts payable and other current liabilities | | 73.2 | | | $ | 68.1 | |

Vehicle floor plan notes payable | | 295.4 | | | 291.3 | |

Current portion of long-term debt | | 39.2 | | | 35.6 | |

Total current liabilities | | 407.8 | | | 395.0 | |

Long-term liabilities: | | | | |

Long-term debt | | 208.5 | | | 238.7 | |

Operating lease liabilities | | 134.1 | | | 134.1 | |

Other long-term liabilities, including finance lease obligation | | 52.2 | | | 52.9 | |

Total long-term liabilities | | 394.8 | | | 425.7 | |

Total liabilities | | 802.6 | | | 820.7 | |

Commitments and contingencies | | | | |

Stockholders’ equity: | | | | |

| | | | |

| | | | |

Additional paid-in capital | | 690.0 | | | 701.0 | |

Accumulated deficit | | (592.3) | | | (591.1) | |

Treasury stock | | (4.3) | | | (4.3) | |

Total stockholders’ equity | | 93.4 | | | 105.6 | |

Total liabilities and stockholders’ equity | | $ | 896.0 | | | $ | 926.3 | |

RumbleOn, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

($ in millions)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

Net loss | $ | (11.0) | | | $ | (30.5) | |

| Loss from discontinued operations | — | | (1.0) | |

| Loss from continuing operations | (11.0) | | | (29.5) | |

Adjustments to reconcile loss from continuing operations to net cash provided by operating activities: | | | |

Depreciation and amortization | 6.6 | | | 10.0 | |

Amortization of debt issuance costs | 4.4 | | | 4.8 | |

Stock-based compensation | 2.8 | | | 7.8 | |

Deferred taxes | (0.4) | | | (6.5) | |

| Gain on partial termination of warehouse lease | (0.9) | | | — | |

| Interest paid-in-kind capitalized in debt principal | 0.6 | | | — | |

Valuation allowance charge for loan receivable assets | — | | | 6.2 | |

Changes in operating assets and liabilities, net of acquisitions: | | | |

Accounts receivable | 14.9 | | | (6.8) | |

Inventory | (0.1) | | | 3.1 | |

| Prepaid expenses and other assets | 3.4 | | | 0.3 | |

Other liabilities | 1.9 | | | 4.0 | |

| Accounts payable and accrued liabilities | 5.0 | | | 2.1 | |

Floor plan trade note borrowings | 2.0 | | | (1.1) | |

Net cash provided by (used in) operating activities | 29.2 | | | (5.6) | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | |

Acquisitions, net of cash received | — | | | (3.3) | |

Purchase of property and equipment | (1.0) | | | (6.0) | |

| Technology development | (0.4) | | | (1.1) | |

Net cash used in investing activities | (1.4) | | | (10.4) | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Repayment of debt, including finance leases | (35.5) | | | (8.4) | |

| Increase (decrease) in borrowings from non-trade floor plans | 2.1 | | | 25.2 | |

| Shares redeemed for employee tax obligations | — | | | (0.7) | |

| Other financing | (0.3) | | | — | |

Net cash provided by (used in) financing activities | (33.7) | | | 16.1 | |

| CASH FLOWS FROM DISCONTINUED OPERATIONS | | | |

| Net cash provided by operating activities | — | | | 3.7 | |

| Net cash used in financing activities | — | | | (5.3) | |

| Net cash used in discontinued operations | — | | | (1.6) | |

NET CHANGE IN CASH | (5.9) | | | (1.5) | |

| Cash and restricted cash at beginning of period | 77.0 | | | 58.6 | |

| Cash and restricted cash at end of period | $ | 71.1 | | | $ | 57.1 | |

RumbleOn, Inc.

Non-GAAP Measures

(Unaudited)

($ in millions)

EBITDA and Adjusted EBITDA

We define EBITDA as net loss adjusted to add back interest expense, the impact of income taxes, depreciation and amortization and discontinued operations. Adjusted EBITDA further adds back non-cash stock-based compensation costs, transaction costs, certain litigation expenses not associated with our ongoing operations, charges related to the 2023 proxy contest and reorganization of our Board of Directors, and other non-recurring costs and credits, as these recoveries, charges and expenses are not considered a part of our core business operations and are not necessarily an indicator of ongoing, future company performance. Beginning with this quarter and to align with industry practice, Adjusted EBITDA is reduced by floor plan interest expense. Our industry typically treats Interest expense on vehicle floor plan debt as operating expense, as vehicle floor plan debt is integral to our operations and is collateralized by our powersports vehicles. For prior period Adjusted EBITDA under this revised definition, see the schedule at the end of this release.

Adjusted EBITDA is one of the primary metrics we use to evaluate the financial performance of our business. We present Adjusted EBITDA because we believe it is helpful in highlighting trends in our operating results and it is frequently used by analysts, investors and other interested parties to evaluate companies in our industry.

A reconciliation of net loss to EBITDA and Adjusted EBITDA is provided below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Second Quarter | | First Half | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

Net loss (GAAP) | $ | (0.7) | | | $ | (13.6) | | | $ | (11.0) | | | $ | (30.5) | | | | | |

| Loss from discontinued operations | — | | | (0.8) | | | — | | | (1.0) | | | | | |

| Loss from continuing operations | (0.7) | | | (12.8) | | | (11.0) | | | (29.5) | | | | | |

Add back: | | | | | | | | | | | |

| Floor plan interest expense | 4.3 | | | 3.4 | | | 8.3 | | | 5.9 | | | | | |

Other interest expense | 11.9 | | | 14.9 | | | 24.0 | | | 30.0 | | | | | |

Depreciation and amortization | 3.1 | | | 5.3 | | | 6.6 | | | 10.0 | | | | | |

| Income tax provision (benefit) | (0.1) | | | (4.6) | | | (0.4) | | | (6.2) | | | | | |

EBITDA (non-GAAP) | 18.5 | | | 6.2 | | | 27.5 | | | 10.2 | | | | | |

Adjustments: | | | | | | | | | | | |

| Floor plan interest expense | (4.3) | | | (3.4) | | | (8.3) | | | (5.9) | | | | | |

| Stock-based compensation | 1.4 | | | 4.9 | | | 2.8 | | | 7.8 | | | | | |

| Lease expense associated with favorable related party leases in excess of contractual lease payments | 0.2 | | | 0.3 | | | 0.5 | | | 0.6 | | | | | |

Other non-recurring costs(1) | 0.4 | | | 0.3 | | | 1.3 | | | 1.0 | | | | | |

Personnel restructuring costs(2) | — | | | 3.8 | | | 0.1 | | | 4.7 | | | | | |

| Proxy contest and Board reorganization charges | — | | | 4.7 | | | — | | | 4.7 | | | | | |

Loss associated with ROF loan receivables(3) | — | | | 3.4 | | | — | | | 5.4 | | | | | |

Adjusted EBITDA (non-GAAP) | $ | 16.2 | | | $ | 20.2 | | | $ | 23.9 | | | $ | 28.5 | | | | | |

(1) Other non-recurring costs, which include one-time expenses incurred. For 2024 period, this was primarily costs for a canceled service contract and litigation settlement expenses. Balance in 2023 was comprised primarily of integration costs and professional fees associated with acquisitions and a death benefit to the estate of a former Company officer and director.

(2) Amount in 2023 is primarily comprised of expenses associated with the separation of a former officer of the Company.

(3) Loss associated with the fair value of the RumbleOn Finance loan receivables portfolio, which was sold during the fourth quarter of 2023.

RumbleOn, Inc.

Non-GAAP Measures

(Unaudited)

($ in millions)

Free Cash Flow

We define Free Cash Flow as cash flows from operating activities less capital expenditures of property and equipment (not including acquisitions). We view free cash flow when assessing the Company's sources of liquidity and capital resources. We believe that free cash flow is helpful in understanding the Company's capital requirements and provides an additional means to reflect the cash flow trends in the Company's business. We believe Free Cash Flow is useful to investors because it represents the cash that our operating businesses generate, before taking into account non-operational cash movements. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, we think it is important to evaluate Free Cash Flow along with our consolidated statement of cash flows.

A reconciliation of cash flows from operating activities to Free Cash Flow is provided below:

| | | | | | | | | | | |

| First Half |

| 2024 | | 2023 |

Cash flows from operating activities (GAAP) | $ | 29.2 | | | $ | (5.6) | |

| Less: | | | |

| Capital expenditures | (1.0) | | | (6.0) | |

Free Cash Flow (non-GAAP) | $ | 28.2 | | | $ | (11.6) | |

Non-Vehicle Net Debt

We define Non-Vehicle Net Debt as total principal of long-term debt, including current maturities, less unrestricted cash. While restricted cash was previously included in our calculation, beginning with this earnings release we revised this definition to exclude restricted cash. Our restricted cash is principally related to vehicle floor plan debt. Vehicle floor plan debt and finance lease obligations are not included in this measure. Previously reported amounts of this non-GAAP measure included within this earnings release have been revised to exclude restricted cash. We believe that Non-Vehicle Net Debt is useful to investors and analysts as a measure of our financial position. We use Non-Vehicle Net Debt to monitor and compare our financial position from period to period.

A reconciliation of total long-term debt, including current maturities to Non-Vehicle Net Debt is provided below:

| | | | | | | | | | | |

| As of June 30, 2024 | | As of

December 31, 2023 |

| Long-term debt, including current maturities (GAAP) | $ | 247.7 | | | $ | 274.3 | |

| Add back: unamortized debt discount and debt issuance costs | 19.5 | | | 27.5 | |

| Principal of long-term debt, including current maturities | 267.2 | | | 301.8 | |

| Less: unrestricted cash | (58.1) | | | (58.9) | |

| Non-Vehicle Net Debt (non-GAAP) | $ | 209.1 | | | $ | 242.9 | |

| | | |

RumbleOn, Inc.

Non-GAAP Measures

(Unaudited)

($ in millions)

Adjusted SG&A

We define Adjusted SG&A as SG&A adjusted to deduct transaction costs, certain litigation expenses not associated with our ongoing operations, charges related to the 2023 proxy contest and reorganization of our Board of Directors, and other non-recurring costs, as these charges and expenses are not considered a part of our core business operations and are not necessarily an indicator of the ongoing run rate of our SG&A. We use Adjusted SG&A to measure our progress toward achieving our Vision 2026 goals. Adjusted SG&A is a non-GAAP financial measure and should not be used as a replacement for SG&A reported in compliance with GAAP. Adjusted SG&A has certain limitations in that it does not represent the total SG&A for the period. Therefore, we think it is important to evaluate Adjusted SG&A along with SG&A and our overall statement of operations.

A reconciliation of SG&A to Adjusted SG&A is below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Second Quarter | | First Half | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

SG&A (GAAP) | $ | 71.4 | | | $ | 100.3 | | | $ | 145.3 | | | $ | 186.6 | | | | | |

| % of Gross Profit | 79.4 | % | | 94.3 | % | | 84.2 | % | | 94.9 | % | | | | |

| Adjustments: | | | | | | | | | | | |

| Lease expense associated with favorable related party leases in excess of contractual lease payments | (0.2) | | | (0.3) | | | (0.5) | | | (0.6) | | | | | |

Other non-recurring costs(1) | (0.4) | | | (0.3) | | | (1.3) | | | (1.0) | | | | | |

Personnel restructuring costs(2) | — | | | (3.8) | | | (0.1) | | | (4.7) | | | | | |

| Charges related to proxy contest and Board of Directors reorganization | — | | | (4.7) | | | — | | | (4.7) | | | | | |

Loss associated with RumbleOn Finance loan receivables(3) | — | | | (3.4) | | | — | | | (5.4) | | | | | |

Adjusted SG&A (non-GAAP) | $ | 70.8 | | | $ | 87.8 | | | $ | 143.4 | | | $ | 170.2 | | | | | |

| % of Gross Profit | 78.7 | % | | 82.5 | % | | 83.1 | % | | 86.5 | % | | | | |

(1) Other non-recurring costs, which include one-time expenses incurred. For the 2024 period, amount consisted primarily of costs for a canceled service contract, and litigation settlement expenses. For the 2023 period, the balance was comprised primarily of integration costs and professional fees associated with acquisitions and a death benefit to the estate of a former Company officer and director.

(2) Amount in 2023 is primarily comprised of expenses associated with the separation of a former officer of the Company.

(3) Loss associated with the fair value of the RumbleOn Finance loan receivables portfolio, which was sold during the fourth quarter of 2023.

RumbleOn, Inc.

Supplementary Data

(Unaudited)

Key Term Loan Credit Agreement Covenant Compliance Calculations as of June 30, 2024(1)

| | | | | | | | |

| Consolidated Total Net Leverage Ratio | | 4.6x |

| Covenant | Maximum Allowed | 5.5x |

| | |

| Consolidated Senior Secured Net Leverage Ratio | | 4.6x |

| Covenant | Maximum Allowed | 5.0x |

(1) Calculated in accordance with our credit agreement.

RumbleOn, Inc.

Supplementary Schedule

(Unaudited)

($ in millions)

EBITDA and Adjusted EBITDA (as revised)

A reconciliation of net loss to EBITDA and Adjusted EBITDA for prior periods under the definition revised beginning with our earnings release for the second quarter of 2024 is provided below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2024 | | |

| Q1 | | Q2 | | Q3 | | Q4 | | Full Year | | Q1 | | | | |

Net loss (GAAP) | $ | (16.9) | | | $ | (13.6) | | | $ | (16.5) | | | $ | (168.5) | | | $ | (215.5) | | | $ | (10.3) | | | | | |

| Loss from discontinued operations | (0.2) | | | (0.8) | | | — | | | (0.1) | | | (1.1) | | | — | | | | | |

| Loss from continuing operations | (16.7) | | | (12.8) | | | (16.5) | | | (168.4) | | | (214.4) | | | (10.3) | | | | | |

Add back: | | | | | | | | | | | | | | | |

| Floor plan interest expense | 2.5 | | | 3.4 | | | 3.9 | | | 3.4 | | | 13.2 | | | 4.0 | | | | | |

Other interest expense | 15.1 | | | 14.9 | | | 16.0 | | | 18.0 | | | 64.0 | | | 12.1 | | | | | |

Depreciation and amortization | 4.7 | | | 5.3 | | | 7.2 | | | 4.8 | | | 22.0 | | | 3.5 | | | | | |

| Income tax provision (benefit) | (1.6) | | | (4.6) | | | (3.5) | | | 69.0 | | | 59.3 | | | (0.3) | | | | | |

EBITDA (non-GAAP) | 4.0 | | | 6.2 | | | 7.1 | | | (73.2) | | | (55.9) | | | 9.0 | | | | | |

Adjustments: | | | | | | | | | | | | | | | |

| Floor plan interest expense | (2.5) | | | (3.4) | | | (3.9) | | | (3.4) | | | (13.2) | | | (4.0) | | | | | |

| Stock-based compensation | 2.9 | | | 4.9 | | | 3.1 | | | 1.1 | | | 12.0 | | | 1.4 | | | | | |

| Lease expense associated with favorable related party leases in excess of contractual lease payments | 0.3 | | | 0.3 | | | 0.2 | | | 0.3 | | | 1.1 | | | 0.3 | | | | | |

Other non-recurring costs(1) | 0.7 | | | 0.3 | | | 1.1 | | | 0.6 | | | 2.7 | | | 0.9 | | | | | |

Personnel restructuring costs(2) | 0.9 | | | 3.8 | | | 0.6 | | | — | | | 5.3 | | | 0.1 | | | | | |

| Charges related to proxy contest and Board of Directors reorganization | — | | | 4.7 | | | 0.4 | | | — | | | 5.1 | | | — | | | | | |

Loss associated with RumbleOn Finance loan receivables(3) | 2.0 | | | 3.4 | | | 0.6 | | | 1.6 | | | 7.6 | | | — | | | | | |

Pre-owned vehicle inventory valuation adjustment(4) | — | | | — | | | — | | | 12.6 | | | 12.6 | | | — | | | | | |

| Impairment of goodwill and franchise rights | — | | | — | | | — | | | 60.1 | | | 60.1 | | | — | | | | | |

Adjusted EBITDA (non-GAAP) | $ | 8.3 | | | $ | 20.2 | | | $ | 9.2 | | | $ | (0.3) | | | 37.4 | | | 7.7 | | | | | |

(1) Other non-recurring costs, which include one-time expenses incurred. For the 2024 period, amount consisted primarily of costs for a canceled service contract and litigation settlement expenses. For the 2023 period, the balance was comprised primarily of integration costs and professional fees associated with acquisitions and a death benefit to the estate of a former Company officer and director.

(2) Amount in 2023 is primarily comprised of expenses associated with the separation of a former officer of the Company.

(3) Loss associated with the fair value of the RumbleOn Finance loan receivables portfolio, which was sold during the fourth quarter of 2023.

(4) Reflects write-down to net realizable value for pre-owned inventory purchased at elevated pandemic prices that are no longer supported.

v3.24.2.u1

Cover

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity Registrant Name |

RumbleOn, Inc.

|

| Entity Tax Identification Number |

46-3951329

|

| Entity Address, City or Town |

Irving,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75038

|

| City Area Code |

214

|

| Local Phone Number |

771-9952

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class B Common Stock, $0.001 par value

|

| Trading Symbol |

RMBL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001596961

|

| Entity File Number |

001-38248

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line Two |

Suite 110A

|

| Entity Address, Address Line One |

901 W. Walnut Hill Lane,

|

| Document Information [Line Items] |

|

| Document Period End Date |

Aug. 07, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

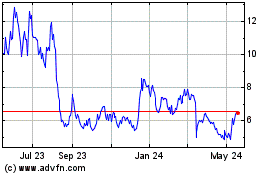

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Oct 2024 to Nov 2024

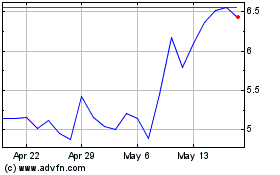

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Nov 2023 to Nov 2024