FALSE000159696100015969612025-01-132025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2025

RumbleOn, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Nevada (State or other jurisdiction of incorporation) | 001-38248 (Commission File Number) | 46-3951329 (I.R.S. Employer Identification No.) |

| |

|

901 W. Walnut Hill Lane, Suite 110A | | |

Irving, Texas | | 75038 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (214) 771-9952

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class B Common Stock, $0.001 par value | RMBL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 14, 2025, RumbleOn, Inc. (the “Company”) notified the Nasdaq Stock Market, LLC (“Nasdaq”) that the Company is temporarily not in compliance with continued listing requirements as set forth in Nasdaq Listing Rules 5605(b)(1) regarding the composition of the board of directors of the Company (the “Board”) because a majority of the Board is not comprised of Independent Directors (as defined in Nasdaq Listing Rule 5605(a)(2)) solely due to a vacancy on the Board resulting from the leadership transition described in Item 5.02 of this Current Report on Form 8-K.

On January 16, 2025, the Company received a response letter (the “Response”) from Nasdaq acknowledging the fact that the Company does not meet the requirements of such rules. The Response has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq and the Company’s common stock will continue to trade under the symbol “RMBL”. In accordance with Nasdaq Listing Rules, the Company has a cure period to regain compliance until the earlier to occur of its next annual stockholders meeting or January 13, 2026; provided, however, that if the next annual stockholders meeting is held before July 14, 2025, then the Company must evidence compliance no later than July 14, 2025.

The Board is seeking to regain compliance with Nasdaq Listing Rules 5605(b)(1) prior to the expiration of the applicable period granted under Nasdaq Listing Rules 5605(b)(1)(A).

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

CEO Departure

On January 13, 2025, the Company announced that Michael Kennedy is no longer Chief Executive Officer (“CEO”) or a member of the Board of the Company.

The Company expects to enter into a separation agreement with Mr. Kennedy once the terms of such agreement are finalized and will file an amendment to this Current Report on Form 8-K to report any additional information required by Item 5.02 of Form 8-K within four business days after such information is determined or becomes available.

CEO Appointment

The Board appointed Michael Quartieri as CEO of the Company, effective as of January 13, 2025.

Mr. Quartieri, age 56, has served as a director of the Company since April 2024 and chairman of the Board since November 2024. He was the Senior Vice President and Chief Financial Officer of Dave & Buster’s Entertainment, Inc. (NASDAQ: PLAY) from January 2022 to June 2024. Mr. Quartieri served as Executive Vice President, Chief Financial Officer and Secretary of LiveOne, Inc. (NASDAQ: LVO) from November 2020 until December 2021. He served as Executive Vice President, Chief Financial Officer, Treasurer and Secretary at Scientific Games Corporation from November 2015 until June 2020. Mr. Quartieri held various positions at Las Vegas Sands, Corp. (NYSE: LVS) from October 2006 until November 2015, including Senior Vice President, Chief Accounting Officer and Global Controller. He previously spent thirteen years in various positions at Deloitte & Touche. He has served on the board of directors of Gambling.com Group (NASDAQ: GAMB) since July 2022. Mr. Quartieri holds a B.S. Accounting and a M. Acc. from the University of Southern California and maintains a CPA certificate from the State of California.

The Company expects to enter into an employment agreement with Mr. Quartieri once the terms of such agreement are finalized and will file an amendment to this Current Report on Form 8-K to report any additional information required by Item 5.02 of Form 8-K within four business days after such information is determined or becomes available.

EVP and COO Appointment

The Board appointed Cameron Tkach, who had been Vice President, Dealership Operations, as Executive Vice President (“EVP”) and Chief Operating Officer (“COO”) of the Company effective as of January 13, 2025.

Mr. Tkach, age 34, has more than 15 years of experience in the powersports industry and began his career with RideNow Powersports (“RideNow”) that was acquired by the Company in 2021. Prior to his current position, he served as Vice President of Pre-Owned Inventory from April 2024 until June 2024, Director of Pre-Owned Inventory from December 2023 until April 2024, Director of National Retail Operations from November 2022 until December 2023, Director of Special Projects from March 2022 until November 2022 and Executive Team Leader from January 2019 until March 2022. He previously held multiple positions at RideNow including Sales Manager, Finance Manager, General Manager and Operations Director.

The Company expects to enter into an employment agreement with Mr. Tkach once the terms of such agreement are finalized and will file an amendment to this Current Report on Form 8-K to report any additional information required by Item 5.02 of Form 8-K within four business days after such information is determined or becomes available.

There are no arrangements or understandings between Mr. Tkach and any other persons pursuant to which Mr. Tkach was appointed COO. Samantha Tkach, spouse of Mr. Tkach, has been employed by Wholesale Express, LLC, a subsidiary of the Company since 2019. Ms. Tkach serves as a Sales Representative. Since the beginning of the last fiscal year, Ms. Tkach has had total cash and other compensation of approximately $130,000. Mr. Tkach is the son of Mark Tkach, who is a holder of Class B common stock of the Company and a member of the Board. Mark Tkach is party to certain transactions with the Company as described in the Company’s Form 8-K dated December 19, 2024, the Company’s Form 8-K dated December 6, 2024, the Company’s Form 8-K dated November 26, 2024, the Company’s Form 8-K dated November 12, 2024, the Company’s 2024 Proxy Statement and the Company’s Form 10-K dated March 28, 2024 (collectively, the “Mark Tkach Related Party Transactions”). Cameron Tkach does not have any interest in the Mark Tkach Related Party Transactions. Other than Ms. Tkach’s compensation disclosed above and the Mark Tkach Related Party Transactions, there are no transactions since the beginning of the last fiscal year, or any currently proposed transaction, in which the Company was or is to be a participant, the amount involved exceeds the lesser of $120,000 or one percent of the average of the Company’s total assets at year end for the last two completed fiscal years, and in which Cameron Tkach had, or will have, a direct or indirect material interest. There are no other family relationships between Cameron Tkach and any other director or executive officer of the Company, or any persons nominated or chosen by the Company to be a director or executive officer. There are no other transactions to which the Company is a party and in which Cameron Tkach has a direct or indirect material interest that would be required to be disclosed under Item 404(a) of Regulation S-K.

Item 8.01. Other Event.

On January 13, 2025, the Company issued a press release announcing the departure of Mr. Kennedy and the appointments of Mr. Quartieri as CEO, Mr. Tkach as COO, and Ms. Becca Polak as Vice Chairman and Lead Independent Director. A copy of the press release is furnished hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| RUMBLEON, INC. |

| | |

| Date: January 16, 2025 | By: | /s/ Brandy Treadway |

| | Brandy Treadway |

| | Chief Legal Officer |

RUMBLEON, INC. ANNOUNCES LEADERSHIP CHANGES

Michael Quartieri, Chairman of the Board, Appointed as Chief Executive Officer

Cameron Tkach Promoted to Executive Vice President and Chief Operating Officer

Becca Polak Named as Vice Chairman and Lead Independent Director

IRVING, Texas – January 13, 2025 - RumbleOn, Inc. (NASDAQ: RMBL) (the “Company” or “RumbleOn”), the largest powersports retailer in North America, today announced the following leadership changes, each effective as of January 13, 2025:

•Michael Quartieri, Chairman of the Board of Directors, has been appointed Chief Executive Officer;

•Cameron Tkach, Vice President of Dealership Operations, has been promoted to Executive Vice President and Chief Operating Officer of the Company;

•Becca Polak, Chair of the Compensation Committee of the Board of Directors, has been named Vice Chairman and Lead Independent Director; and

•Michael Kennedy is no longer Chief Executive Officer or a member of the Board of Directors of the Company.

Mr. Quartieri is a tenured C-suite executive with significant leadership and strategic planning experience, in addition to having strong financial acumen and corporate governance expertise. Ms. Polak is a seasoned executive and board advisor who brings a demonstrable record of driving business strategy and execution, as well as technology transformation. Ms. Polak stated, “On behalf of the Board, I am extremely excited to have Mike Quartieri serve as RumbleOn's next CEO. As a key member of the Board, Mike has had a tremendous impact on our financial planning, recent recapitalization efforts and the continuation of the development of our business strategy. Together with Cameron, an industry veteran with operational expertise, we believe that they have the experience, capabilities and strategic vision to accelerate RumbleOn's success into the future."

Cameron Tkach has more than 15 years of experience in the powersports industry and is a life-long enthusiast having grown up in the dealership environment. He rose through the ranks at RideNow Powersports, holding key operational positions such as Sales Manager, Finance Manager, General Manager and Operations Director, where he ensured high standards in customer service, sales and operational efficiency. After RumbleOn’s acquisition of RideNow in 2021, Mr. Tkach continued to hold a variety of leadership positions, including Vice President of Retail Operations where he focused on optimizing retail performance through business strategy and customer focus. Mr. Tkach said, “I am excited to serve as Chief Operating Officer of the Company and leverage my unique operational and strategic expertise. I look forward to working with Mike Quartieri and the leadership team as we continue striving towards operational excellence and market leadership in the powersports industry.”

“On behalf of the Board, I want to thank Mike Kennedy for his contributions and dedication to RumbleOn. We are grateful for his leadership and wish him well in all of his future endeavors.” said Mr. Quartieri. “With the payoff of our convertible notes earlier this month, we have made significant progress in strengthening our balance sheet. As we move forward, my focus will be on driving growth, improving profitability and producing strong cash flow.”

About RumbleOn

RumbleOn, Inc. (NASDAQ: RMBL), operates through two operating segments: our Powersports dealership group and Wholesale Express, LLC, an asset-light transportation services provider focused on the automotive industry. Our Powersports group is the largest powersports retail group in the United States (as measured by reported revenue, major unit sales and dealership locations), offering over 500 powersports franchises representing 50 different brands of products. Our Powersports group sells a wide selection of new and pre-owned products, including parts, apparel, accessories, finance & insurance products and services, and aftermarket products. We are the largest purchaser of pre-owned powersports vehicles in the United States and utilize RideNow’s Cash Offer to acquire vehicles directly from consumers.

For more information on RumbleOn, please visit rumbleon.com.

Cautionary Note on Forward-Looking Statements

The Company’s press release contains statements that constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements regarding the Company’s leadership transition. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “hopes,” “may,” “plan,” “possible,” “potential,” “predicts,” “projects,” “should,” “targets,” “would” and similar expressions, although not all forward-looking statements contain these identifying words. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from current expectations and beliefs, including, but not limited to, risks and uncertainties related to: the Company’s ability to implement a smooth leadership transition; the impact of general economic, industry or political conditions in the United States or internationally, as well as the other risk factors set forth under the caption “Risk Factors” in the registration statement, as amended, and in RumbleOn’s Annual Report for the year ended December 31, 2023 and Quarterly Reports on Form 10-Q for the quarters ended March 30, 2024, June 30, 2024 and September 30, 2024 and in any other subsequent filings made with the SEC by RumbleOn. Any forward-looking statements contained in this press release speak only as of the date hereof, and RumbleOn specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Investor Relations Contact:

investors@rumbleon.com

v3.24.4

Cover

|

Jan. 13, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 13, 2025

|

| Entity Registrant Name |

RumbleOn, Inc.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-38248

|

| Entity Tax Identification Number |

46-3951329

|

| Entity Address, Address Line Two |

Suite 110A

|

| Entity Address, Address Line One |

901 W. Walnut Hill Lane,

|

| Entity Address, City or Town |

Irving,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75038

|

| City Area Code |

214

|

| Local Phone Number |

771-9952

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class B Common Stock, $0.001 par value

|

| Trading Symbol |

RMBL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001596961

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

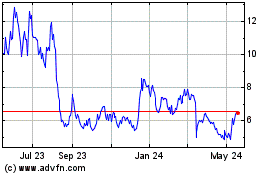

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

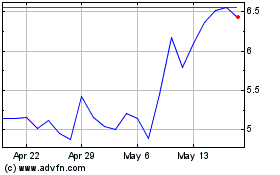

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025