Rumble (NASDAQ:RUM), the video-sharing platform and cloud services

provider, announced today that its Board of Directors has approved

a corporate treasury diversification strategy of allocating a

portion of the company’s excess cash reserves to Bitcoin. This move

emphasizes Rumble’s belief in Bitcoin as a valuable tool for

strategic planning and is designed to accelerate the company’s

expansion into cryptocurrency. Rumble’s Bitcoin allocation strategy

will include purchases, at the discretion of the company, of up to

$20 million.

“We believe that the world is still in the early stages of the

adoption of Bitcoin, which has recently accelerated with the

election of a crypto-friendly U.S. presidential administration and

increased institutional adoption. Unlike any government-issued

currency, Bitcoin is not subject to dilution through endless

money-printing, enabling it to be a valuable inflation hedge and an

excellent addition to our treasury,” said Rumble Chairman and CEO

Chris Pavlovski. “We are also excited to strengthen our ties with

crypto and to bolster our efforts to become the leading video and

cloud services platform for the crypto community,” Pavlovski

added.

The actual timing and value of Bitcoin purchases, if any, under

the allocation strategy will be determined by management in its

discretion and will depend on several factors, including, among

others, general market and business conditions, the trading price

of Bitcoin and the anticipated cash needs of Rumble. The

allocation strategy may be suspended, discontinued or modified at

any time for any reason.

ABOUT RUMBLE

Rumble is a high-growth video platform and cloud services

provider that is creating an independent infrastructure. Rumble’s

mission is to restore the internet to its roots by making it free

and open once again. For more information, visit:

corp.rumble.com.

Contact: press@rumble.com

Forward-Looking Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. Statements contained in

this press release that are not historical facts are

forward-looking statements and include, for example, statements

regarding our new corporate treasury diversification strategy of

allocating a portion of the company’s excess cash reserves to

Bitcoin and the acceleration of our expansion into cryptocurrency.

Certain of these forward-looking statements can be identified by

using words such as “anticipates,” “believes,” “intends,”

“estimates,” “targets,” “expects,” “endeavors,” “forecasts,” “well

underway,” “could,” “will,” “may,” “future,” “likely,” “on track to

deliver,” “on a trajectory,” “continues to,” “looks forward to,”

“is primed to,” “plans,” “projects,” “assumes,” “should” or other

similar expressions. Such forward-looking statements involve known

and unknown risks and uncertainties, and our actual results could

differ materially from future results expressed or implied in these

forward-looking statements. The forward-looking statements included

in this release are based on our current beliefs and expectations

of our management as of the date of this release. These statements

are not guarantees or indicative of future performance. Important

assumptions and other important factors that could cause actual

results to differ materially from those forward-looking statements

include risks inherent with investing in Bitcoin, including

Bitcoin’s volatility; the risks of implementing a new treasury

diversification strategy; our ability to grow and manage future

growth profitably over time, maintain relationships with customers,

compete within our industry and retain key employees; the

possibility that we may be adversely impacted by economic,

business, and/or competitive factors; our limited operating history

makes it difficult to evaluate our business and prospects; our

recent and rapid growth may not be indicative of future

performance; we may not continue to grow or maintain our active

user base, and may not be able to achieve or maintain

profitability; risks relating to our ability to attract new

advertisers, or the potential loss of existing advertisers or the

reduction of or failure by existing advertisers to maintain or

increase their advertising budgets; Rumble Cloud, our recently

launched cloud services business, may not achieve success and, as a

result, our business, financial condition and results of operations

could be adversely affected; negative media campaigns may adversely

impact our financial performance, results of operations, and

relationships with our business partners, including content

creators and advertisers; spam activity, including inauthentic and

fraudulent user activity, if undetected, may contribute, from time

to time, to some amount of overstatement of our performance

indicators; we collect, store, and process large amounts of user

video content and personal information of our users and subscribers

and, if our security measures are breached, our sites and

applications may be perceived as not being secure, traffic and

advertisers may curtail or stop viewing our content or using our

services, our business and operating results could be harmed, and

we could face governmental investigations and legal claims from

users and subscribers; we may fail to comply with applicable

privacy laws; we are subject to cybersecurity risks and

interruptions or failures in our information technology systems

and, notwithstanding our efforts to enhance our protection from

such risks, a cyber incident could occur and result in information

theft, data corruption, operational disruption and/or financial

loss; we may be found to have infringed on the intellectual

property of others, which could expose us to substantial losses or

restrict our operations; we may face liability for hosting a

variety of tortious or unlawful materials uploaded by third

parties, notwithstanding the liability protections of Section 230

of the Communications Decency Act of 1996; we may face negative

publicity for removing, or declining to remove, certain content,

regardless of whether such content violated any law; paid

endorsements by our content creators may expose us to regulatory

risk, liability, and compliance costs, and, as a result, may

adversely affect our business, financial condition and results of

operations; our traffic growth, engagement, and monetization depend

upon effective operation within and compatibility with operating

systems, networks, devices, web browsers and standards, including

mobile operating systems, networks, and standards that we do not

control; our business depends on continued and unimpeded access to

our content and services on the internet and, if we or those who

engage with our content experience disruptions in internet service,

or if internet service providers are able to block, degrade or

charge for access to our content and services, we could incur

additional expenses and the loss of traffic and advertisers; we

face significant market competition, and if we are unable to

compete effectively with our competitors for traffic and

advertising spend, our business and operating results could be

harmed; we rely on data from third parties to calculate certain of

our performance metrics and real or perceived inaccuracies in such

metrics may harm our reputation and negatively affect our business;

changes to our existing content and services could fail to attract

traffic and advertisers or fail to generate revenue; we derive the

majority of our revenue from advertising and the failure to attract

new advertisers, the loss of existing advertisers, or the reduction

of or failure by existing advertisers to maintain or increase their

advertising budgets would adversely affect our business; we depend

on third-party vendors, including internet service providers,

advertising networks, and data centers, to provide core services;

hosting and delivery costs may increase unexpectedly; we have

offered and intend to continue to offer incentives, including

economic incentives, to content creators to join our platform, and

these arrangements may involve fixed payment obligations that are

not contingent on actual revenue or performance metrics generated

by the applicable content creator but rather are based on our

modeled financial projections for that creator, which if not

satisfied may adversely impact our financial performance, results

of operations and liquidity; we may be unable to develop or

maintain effective internal controls; potential diversion of

management’s attention and consumption of resources as a result of

acquisitions of other companies and success in integrating and

otherwise achieving the benefits of recent and potential

acquisitions; we may fail to maintain adequate operational and

financial resources or raise additional capital or generate

sufficient cash flows; changes in tax rates, changes in tax

treatment of companies engaged in e-commerce, the adoption of new

tax legislation, or exposure to additional tax liabilities may

adversely impact our financial results; compliance obligations

imposed by new privacy laws, laws regulating social media platforms

and online speech in certain jurisdictions in which we operate, or

industry practices may adversely affect our business; and those

additional risks, uncertainties and factors described in more

detail under the caption “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2023, and in our other

filings with the Securities and Exchange Commission. We do not

intend, and, except as required by law, we undertake no obligation,

to update any of our forward-looking statements after the issuance

of this release to reflect any future events or circumstances.

Given these risks and uncertainties, readers are cautioned not to

place undue reliance on such forward-looking statements.

Rumble on Social Media

Investors and others should note that we announce material

financial and operational information to our investors using our

investor relations website (investors.rumble.com), press releases,

SEC filings and public conference calls and webcasts. We also

intend to use certain social media accounts as a means of

disclosing information about us and our services and for complying

with our disclosure obligations under Regulation FD: the

@rumblevideo X (formerly Twitter) account (x.com/rumblevideo), the

@gamingonrumble X (formerly Twitter) account

(x.com/gamingonrumble), the @rumble TRUTH Social account

(truthsocial.com/@rumble), the @chrispavlovski X (formerly Twitter)

account (x.com/chrispavlovski), and the @chris TRUTH Social account

(truthsocial.com/@chris), which Chris Pavlovski, our Chairman and

Chief Executive Officer, also uses as a means for personal

communications and observations. The information we post through

these social media channels may be deemed material. Accordingly,

investors should monitor these social media channels in addition to

following our press releases, SEC filings and public conference

calls and webcasts. The social media channels that we intend to use

as a means of disclosing the information described above may be

updated from time to time as listed on our investor relations

website.

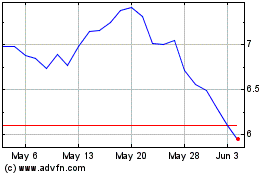

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rumble (NASDAQ:RUM)

Historical Stock Chart

From Nov 2023 to Nov 2024