Rush Enterprises, Inc. (NASDAQ: RUSHA & RUSHB), which operates

the largest network of commercial vehicle dealerships in North

America, today announced that for the quarter ended March 31, 2024,

the Company achieved revenues of $1.872 billion and net income of

$71.6 million, or $0.88 per diluted share, compared with revenues

of $1.912 billion and net income of $90.5 million, or $1.07 per

diluted share, in the quarter ended March 31, 2023. Additionally,

the Company’s Board of Directors declared a cash dividend of $0.17

per share of Class A and Class B Common Stock, to be paid on June

10, 2024, to all shareholders of record as of May 9, 2024.

On July 25, 2023, the Company’s Board of Directors declared a

three-for-two stock split with respect to both the Company’s Class

A and Class B common stock which was effected in the form of a

stock dividend. On August 28, 2023, the Company distributed one

additional share of stock for every two shares of Class A common

stock, par value $0.01 per share, and Class B common stock, par

value $0.01 per share, held by shareholders of record as of August

7, 2023. All share and per share data in this earnings

release have been adjusted and restated to reflect the stock split

as if it occurred on the first day of the earliest period

presented.

“As we expected, with new Class 8 truck production having caught

up to the pent-up market demand and persistent low freight rates

and high interest rates, we experienced a decline in our new Class

8 truck sales in the first quarter,” said W.M. “Rusty” Rush,

Chairman, Chief Executive Officer, and President of Rush

Enterprises. “Demand for aftermarket parts and services was flat

compared to the first quarter of 2023, largely resulting from those

previously noted economic factors, which directly affect

over-the-road customers, our largest customer segment. All of these

factors had a negative impact on our revenues and profitability

this quarter,” he said. “However, we experienced healthy growth in

aftermarket demand from public sector, refuse, and medium-duty

leasing customers. In addition, we outpaced industry with respect

to the medium-duty truck sales market, growing 9.6% in new Class

4-7 truck sales compared to the first quarter of 2023, and we

executed well on our used truck inventory and sales strategy,

though we believe used truck values may decline further,” he

added.

“As we look ahead, over-the-road carriers continue to be plagued

by challenging economic factors and the current freight recession,

which we currently believe will extend into at least late 2024. In

the second quarter, we expect that new Class 8 and new Class 4-7

truck sales will improve compared to the first quarter, primarily

due to the timing of deliveries to certain of our larger customers,

and we believe that demand should remain steady for new Class 4-7

trucks for the remainder of the year. In the aftermarket, difficult

operating conditions are likely to continue, but we expect some

normal seasonal lift in the warmer months, as well as strong demand

from vocational customers throughout the year. Considering these

factors and the uncertainty regarding inflation and interest rates

and the timing of a recovery in freight rates, we have decided to

take immediate action to reduce expenses to partially offset

anticipated reductions in revenue caused by the softening

commercial vehicle market. With the strategic decisions we made

several years ago to diversify our customer base and focus on

supporting large national fleets, and our efforts to reduce

expenses across all areas of the company, we believe we will be

able to successfully navigate this difficult market cycle,” he

said.

“It is important that I sincerely thank all of our employees for

their hard work this quarter. I am especially grateful for their

ability to remain focused on our long-term goals despite

challenging market conditions while also continuing to provide

best-in-class service to our customers,” Rush said.

Operations

Aftermarket Products and

Services

Aftermarket products and services accounted for approximately

60.8% of the Company’s total gross profit in the first quarter of

2024, with parts, service and collision center revenues reaching

$649.2 million, up 0.1% compared to the first quarter of 2023. The

Company achieved a quarterly absorption ratio of 130.1% in the

first quarter of 2024, compared to 136.5% in the first quarter of

2023. “In the first quarter, our aftermarket results

were flat year-over-year, and our performance was in-line with the

industry. The sluggish freight market and other economic factors

continue to negatively impact over-the-road customers including

both small carriers and larger fleets. On a positive note, we did

experience growth from our public sector, refuse and medium-duty

leasing customers, which helped us partially offset the challenges

facing the industry this quarter,” Rush said.

“As we look to the second quarter, we expect demand for

aftermarket parts and services will remain consistent with the

first quarter, with some seasonal increases as we enter the summer

months, and we believe our second quarter results will be fairly

consistent with our first quarter performance. However, the current

freight recession will continue to negatively impact our customers,

including larger fleets. Despite the challenging operating

environment, we remain committed to executing on our strategic

initiatives, especially with respect to Xpress services, contract

maintenance and mobile service.,” he said.Commercial

Vehicle Sales

New U.S. Class 8 retail truck sales totaled 57,181 units in the

first quarter of 2024, down 13.1% over the same period last year,

according to ACT Research. The Company sold 3,494 new Class 8

trucks in the first quarter, a decrease of 20.0% compared to the

first quarter of 2023, which accounted for 6.0% of the new U.S.

Class 8 truck market and 1.4% of the new Canada Class 8 truck

market. ACT Research forecasts U.S. retail sales of new Class 8

trucks to total 228,000 units in 2024, a 16.0% decrease compared to

2023. “Production levels of new Class 8 trucks have now caught up

to the pent-up demand caused by limited production over the past

few years. Additionally, other economic and industry factors such

as low freight volumes and high interest rates, are negatively

impacting the new Class 8 truck market and causing a significant

decrease in demand for new Class 8 trucks,” said Rush. “While our

results were down slightly compared to the industry, we did

experience strong demand from vocational customers, which we

believe will continue through the year,” he added. “Looking ahead,

we are closely monitoring production issues with body companies,

which are currently delaying new truck deliveries. We are also

monitoring certain component part shortages, which could also cause

delivery delays. In addition, we expect the current freight

recession to continue until at the least the end of 2024, which we

believe will cause retail sales of new Class 8 trucks to decrease

in the second half of 2024 compared to the first half of the year.

As a result of our commitment to supporting large vocational

fleets, along with the timing of some large deliveries, we believe

our second quarter performance will improve compared to our first

quarter results, and that we are well positioned to take advantages

of sales opportunities that may present themselves in the third and

fourth quarters,” he said. New U.S. Class 4 through 7

retail commercial vehicle sales totaled 59,786 units in the first

quarter of 2024, up 6.5% over the same period last year, according

to ACT Research. The Company sold 3,331 Class 4 through 7

medium-duty commercial vehicles in the first quarter, an increase

of 9.6% compared to the first quarter of 2023, which accounted for

5.4% of the total new U.S. Class 4 through 7 commercial vehicle

market and 2.7% of the new Canada Class 5 through 7 commercial

vehicle market. ACT Research forecasts U.S. retail sales for new

Class 4 through 7 commercial vehicles to be approximately 262,000

units in 2024, a 3.7% increase compared to 2023.

“While we were still operating within the confines of truck

allocation in the first quarter, new Class 4-7 commercial vehicle

production continued to increase, lead times for new vehicles

decreased and supply was less constrained,” said Rush. “The timing

of deliveries continues to be impacted by delays at body

manufacturers, but we are seeing those delays subside in many key

areas. Demand was steady throughout our customer base, and we were

pleased to significantly outpace the industry in the first

quarter,” he added.

“As we look forward, new Class 4-7 commercial vehicle production

is still somewhat constrained, but we believe it will continue to

improve, and we expect demand to remain steady as customers replace

older equipment with new vehicles. We will continue to monitor

concerns regarding consumer spending and higher interest rates and

their potential impact on Class 4-7 truck demand. Currently, we

believe Class 4-7 commercial vehicle sales will improve in the

second quarter compared to the first quarter and remain strong for

the remainder of the year,” Rush added.

The Company sold 1,818 used commercial vehicles in the first

quarter of 2024, an 8.0% increase compared to the first quarter of

2023. “Though depressed freight rates and high interest rates

continued to cause weak demand and lower-than-normal values for

used trucks in our industry, we executed well on our used truck

inventory and sales strategy and achieved positive results despite

the challenging environment,” said Rush. “Looking ahead, while the

rate of the decline in used truck values is slowing, we do not

believe it has hit bottom yet. Further, we are closely monitoring

fuel prices, as any significant increase will put additional

pressures on an already challenging used truck market. However, due

to the diversity of our product mix and network, we are confident

we can support customer demand and we believe our second quarter

results will be on par with our first quarter performance,” Rush

said.Leasing and Rental

“Revenues from our Rush Truck Leasing division were up slightly

compared to the first quarter of 2023, and the financial results

from our lease and rental operations remained strong,” said Rush.

“Our positive results were largely due to the delivery of new

leased vehicles, as manufacturers were able to increase production

and catch up to leasing demand. Our rental utilization continued to

decline slightly from the peak levels we experienced in 2023 and

are now in line with historical utilization rates. We expect rental

utilization rates to improve slightly in the second quarter. The

age of our leasing and rental fleet continues to decrease as new

vehicle production increases, and therefore, we expect our

operating costs to moderate this year. We believe that our leasing

and rental financial results will remain solid for the remainder of

2024,” Rush said.

Financial Highlights

In the first quarter of 2024, the Company’s gross revenues

totaled $1.872 billion, a 2.1% decrease from $1.912 billion in the

first quarter of 2023. Net income for the quarter was $71.6

million, or $0.88 per diluted share, compared to net income of

$90.5 million, or $1.07 per diluted share, in the quarter ended

March 31, 2023.

Aftermarket products and services revenues were $649.2 million

in the first quarter of 2024, compared to $648.2 million in the

first quarter of 2023. The Company delivered 3,494 new heavy-duty

trucks, 3,331 new medium-duty commercial vehicles, 456 new

light-duty commercial vehicles and 1,818 used commercial vehicles

during the first quarter of 2024, compared to 4,365 new heavy-duty

trucks, 3,038 new medium-duty commercial vehicles, 504 new

light-duty commercial vehicles and 1,684 used commercial vehicles

during the first quarter of 2023.

Rush Truck Leasing operates 57 PacLease and Idealease franchises

across the United States and Canada with more than 9,800 trucks in

its lease and rental fleet and more than 2,100 trucks under

contract maintenance agreements. Lease and rental revenue increased

1.4% in the first quarter of 2024 compared to the first quarter of

2023.

During the first quarter of 2024, the Company repurchased $5.6

million of its common stock pursuant to its stock repurchase plan

and has repurchased a total of $73.2 million of the $150.0 million

that was authorized by the board of directors. In addition, the

Company paid a cash dividend of $13.9 million during the first

quarter.

“Despite the challenging economic conditions that negatively

impacted our industry in the first quarter, we are proud to

continue to return value to our shareholders through our quarterly

dividends and stock repurchase program. We remain confident that

our long-term initiatives and the investments we have made in our

business over the last several years will help us to navigate a

difficult market while keeping our balance sheet strong,” Rush

added.

Conference Call Information

Rush Enterprises will host its quarterly

conference call to discuss earnings for the first quarter of 2024

on Wednesday, April 24, 2024, at 10 a.m. Eastern/9 a.m.

Central. The call can be heard live via the Internet at

http://investor.rushenterprises.com/events.cfm.

Participants may register for

the call

at:https://register.vevent.com/register/BIef2b5a2670d548bc9fa124a7078c5d98While

not required, it is recommended that you join the event 10 minutes

prior to the start.

For those who cannot listen to the live

broadcast, the webcast replay will be available

athttp://investor.rushenterprises.com/events.cfm.

Rush Enterprises, Inc. is the premier solutions

provider to the commercial vehicle industry. The Company owns and

operates Rush Truck Centers, the largest network of commercial

vehicle dealerships in North America, with more than 150 locations

in 22 states and Ontario, Canada, including 125 franchised

dealership locations. These vehicle centers, strategically located

in high traffic areas on or near major highways throughout the

United States and Ontario, Canada, represent truck and bus

manufacturers, including Peterbilt, International, Hino, Isuzu,

Ford, Dennis Eagle, IC Bus and Blue Bird. They offer an integrated

approach to meeting customer needs – from sales of new and used

vehicles to aftermarket parts, service and body shop operations

plus financing, insurance, leasing and rental. Rush Enterprises'

operations also provide CNG fuel systems (through its investment in

Cummins Clean Fuel Technologies, Inc.), telematics products and

other vehicle technologies, as well as vehicle up-fitting, chrome

accessories and tires. For more information, please visit us at

www.rushtruckcenters.com www.rushenterprises.com and

www.rushtruckcentersracing.com, on Twitter @rushtruckcenter and

Facebook.com/rushtruckcenters.

Certain statements contained in this release,

including those concerning current and projected market conditions,

sales forecasts, market share forecasts s and anticipated demand

for the Company’s services, are “forward-looking” statements (as

such term is defined in the Private Securities Litigation Reform

Act of 1995). Such forward-looking statements only speak as of the

date of this release and the Company assumes no obligation to

update the information included in this release. Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Important factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements include, but are not limited to,

competitive factors, general U.S. economic conditions, economic

conditions in the new and used commercial vehicle markets, customer

relations, relationships with vendors, inflation and the interest

rate environment, governmental regulation and supervision, product

introductions and acceptance, changes in industry practices,

one-time events and other factors described herein and in filings

made by the Company with the Securities and Exchange Commission,

including in our annual report on Form 10-K for the fiscal year

ended December 31, 2023. In addition, the declaration and payment

of cash dividends and authorization of future share repurchase

programs remains at the sole discretion of the Company’s Board of

Directors and the issuance of future dividends and authorization of

future share repurchase programs will depend upon the Company’s

financial results, cash requirements, future prospects, applicable

law and other factors that may be deemed relevant by the Company’s

Board of Directors. Although we believe that these forward-looking

statements are based on reasonable assumptions, there are many

factors that could affect our actual business and financial results

and could cause actual results to differ materially from those in

the forward-looking statements. All future written and oral

forward-looking statements by us or persons acting on our behalf

are expressly qualified in their entirety by the cautionary

statements contained or referred to above. Except for our ongoing

obligations to disclose material information as required by the

federal securities laws, we do not have any obligations or

intention to release publicly any revisions to any forward-looking

statements to reflect events or circumstances in the future or to

reflect the occurrence of unanticipated events.

-Tables and Additional Information to Follow-

|

RUSH ENTERPRISES, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In Thousands, Except Shares and Per Share

Amounts) |

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

| |

|

(unaudited) |

|

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

155,905 |

|

$ |

183,725 |

|

|

Accounts receivable, net |

|

303,444 |

|

|

259,353 |

|

|

Note Receivable, affiliate |

|

5,500 |

|

|

|

|

Inventories, net |

|

2,031,775 |

|

|

1,801,447 |

|

|

Prepaid expenses and other |

|

20,377 |

|

|

15,779 |

|

| Total current assets |

|

2,517,001 |

|

|

2,260,304 |

|

| Property and equipment,

net |

|

1,501,066 |

|

|

1,488,086 |

|

| Operating lease right-of-use

assets, net |

|

119,329 |

|

|

120,162 |

|

| Goodwill, net |

|

419,728 |

|

|

420,708 |

|

| Other assets, net |

|

71,882 |

|

|

74,981 |

|

| Total

assets |

$ |

4,629,006 |

|

$ |

4,364,241 |

|

| |

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Floor plan notes payable |

$ |

1,248,853 |

|

$ |

1,139,744 |

|

|

Current maturities of finance lease obligations |

|

38,210 |

|

|

36,119 |

|

|

Current maturities of operating lease obligations |

|

16,716 |

|

|

17,438 |

|

|

Trade accounts payable |

|

181,079 |

|

|

162,134 |

|

|

Customer deposits |

|

127,400 |

|

|

145,326 |

|

|

Accrued expenses |

|

145,071 |

|

|

172,549 |

|

| Total current liabilities |

|

1,757,329 |

|

|

1,673,310 |

|

| Long-term debt, net of current

maturities |

|

524,450 |

|

|

414,002 |

|

| Finance lease obligations, net

of current maturities |

|

99,394 |

|

|

97,617 |

|

| Operating lease obligations,

net of current maturities |

|

104,600 |

|

|

104,514 |

|

| Other long-term

liabilities |

|

28,788 |

|

|

24,811 |

|

| Deferred income taxes,

net |

|

159,525 |

|

|

159,571 |

|

| Shareholders’ equity: |

|

|

|

|

|

Preferred stock, par value $.01 per share; 1,000,000 shares

authorized; 0 shares outstanding in 2024 and 2023 |

|

– |

|

|

– |

|

|

Common stock, par value $.01 per share; 105,000,000 Class A

shares and 35,000,000 Class B shares authorized; 61,813,022 Class A

shares and 16,715,277 Class B shares outstanding in 2024; and

61,461,281 Class A shares and 16,364,158 Class B shares outstanding

in 2023 |

|

815 |

|

|

806 |

|

|

Additional paid-in capital |

|

556,001 |

|

|

542,046 |

|

|

Treasury stock, at cost: 1,220,155 Class A shares and 1,731,162

Class B shares in 2024; and 1,092,142 Class A shares and

1,731,157 Class B shares in 2023 |

|

(125,462 |

) |

|

(119,835 |

) |

|

Retained earnings |

|

1,508,202 |

|

|

1,450,025 |

|

|

Accumulated other comprehensive income (loss) |

|

(4,054 |

) |

|

(2,163 |

) |

|

Total Rush Enterprises, Inc. shareholders’ equity |

|

1,935,502 |

|

|

1,870,879 |

|

|

Noncontrolling interest |

|

19,418 |

|

|

19,537 |

|

|

Total shareholders’ equity |

|

1,954,920 |

|

|

1,890,416 |

|

|

Total liabilities and shareholders’ equity |

$ |

4,629,006 |

|

$ |

4,364,241 |

|

The accompanying notes are an integral part of

these consolidated financial statements.

|

RUSH ENTERPRISES, INC. AND SUBSIDIARIESCONSOLIDATED STATEMENTS OF

INCOME (In Thousands, Except Per Share Amounts)(Unaudited) |

|

|

|

|

|

|

|

Three Months EndedMarch 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

New and used commercial vehicle sales |

$ |

1,123,319 |

|

$ |

1,161,725 |

|

Aftermarket products and services sales |

|

649,196 |

|

|

648,226 |

|

Lease and rental sales |

|

87,921 |

|

|

86,666 |

|

Finance and insurance |

|

5,394 |

|

|

6,571 |

|

Other |

|

6,169 |

|

|

8,579 |

|

Total revenue |

|

1,871,999 |

|

|

1,911,767 |

| Cost of products

sold |

|

|

|

|

|

New and used commercial vehicle sales |

|

1,006,100 |

|

|

1,050,365 |

|

Aftermarket products and services sales |

|

412,254 |

|

|

402,155 |

|

Lease and rental sales |

|

63,770 |

|

|

60,478 |

|

Total cost of products sold |

|

1,482,124 |

|

|

1,512,998 |

| Gross

profit |

|

389,875 |

|

|

398,769 |

| Selling, general and

administrative expense |

|

263,665 |

|

|

256,808 |

| Depreciation and amortization

expense |

|

15,750 |

|

|

14,314 |

| Gain on sale of assets |

|

150 |

|

|

129 |

| Operating

income |

|

110,610 |

|

|

127,776 |

| Other income |

|

177 |

|

|

2,347 |

| Interest expense, net |

|

17,973 |

|

|

10,983 |

| Income before

taxes |

|

92,814 |

|

|

119,140 |

| Income tax provision |

|

21,325 |

|

|

28,350 |

| Net

income |

|

71,489 |

|

|

90,790 |

| Less: Net income (loss)

attributable to noncontrolling interest |

|

(119 |

) |

|

335 |

| Net income

attributable to Rush Enterprises, Inc. |

$ |

71,608 |

|

$ |

90,455 |

|

|

|

|

|

|

| Net income

attributable to Rush Enterprises, Inc. per

share of common stock: |

|

|

|

|

| Basic |

$ |

0.91 |

|

$ |

1.10 |

| Diluted |

$ |

0.88 |

|

$ |

1.07 |

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

| Basic |

|

78,483 |

|

|

82,150 |

| Diluted |

|

81,454 |

|

|

84,846 |

|

|

|

|

|

|

| Dividends declared per

common share |

$ |

0.17 |

|

$ |

0.14 |

The accompanying notes are an integral part of

these consolidated financial statements.

This press release and the attached financial

tables contain certain non-GAAP financial measures as defined under

SEC rules, such as Adjusted Net Income, Adjusted Total Debt,

Adjusted Net (cash) Debt, EBITDA, Adjusted EBITDA, Free Cash Flow,

Adjusted Free Cash Flow and Adjusted Invested Capital, which

exclude certain items disclosed in the attached financial tables.

The Company provides reconciliations of these measures to the most

directly comparable GAAP measures.

Management believes the presentation of these

non-GAAP financial measures provides useful information about the

results of operations of the Company for the current and past

periods. Management believes that investors should have the same

information available to them that management uses to assess the

Company’s operating performance and capital structure. These

non-GAAP financial measures should not be considered in isolation

or as a substitute for the most comparable GAAP financial measures.

Investors are cautioned that non-GAAP financial measures utilized

by the Company may not be comparable to similarly titled non-GAAP

financial measures used by other companies.

| |

|

Three Months Ended |

|

Commercial Vehicle Sales Revenue

(in thousands) |

|

March 31, 2024 |

|

March 31, 2023 |

|

New heavy-duty vehicles |

$ |

666,339 |

|

$ |

736,710 |

|

| New medium-duty vehicles

(including bus sales revenue) |

|

333,634 |

|

|

286,947 |

|

| New light-duty vehicles |

|

27,471 |

|

|

27,992 |

|

| Used vehicles |

|

88,009 |

|

|

102,656 |

|

| Other vehicles |

|

7,866 |

|

|

7,420 |

|

| |

|

|

|

|

| Absorption

Ratio |

|

130.1 |

% |

|

136.5 |

% |

Absorption RatioManagement uses

several performance metrics to evaluate the performance of its

commercial vehicle dealerships and considers Rush Truck Centers’

“absorption ratio” to be of critical importance. Absorption ratio

is calculated by dividing the gross profit from the parts, service

and collision center departments by the overhead expenses of all of

a dealership’s departments, except for the selling expenses of the

new and used commercial vehicle departments and carrying costs of

new and used commercial vehicle inventory. When 100% absorption is

achieved, then gross profit from the sale of a commercial vehicle,

after sales commissions and inventory carrying costs, directly

impacts operating profit.

|

Debt

Analysis

(in

thousands) |

|

March 31, 2024 |

|

March 31, 2023 |

|

Floor plan notes payable |

$ |

1,248,853 |

|

$ |

1,015,971 |

|

| Current maturities of finance

lease obligations |

|

38,210 |

|

|

31,894 |

|

| Long-term debt, net of current

maturities |

|

524,450 |

|

|

262,467 |

|

| Finance lease obligations, net

of current maturities |

|

99,394 |

|

|

100,240 |

|

| Total Debt

(GAAP) |

|

1,910,907 |

|

|

1,410,572 |

|

|

Adjustments: |

|

|

|

|

|

Debt related to lease & rental fleet |

|

(657,980 |

) |

|

(390,385 |

) |

|

Floor plan notes payable |

|

(1,248,853 |

) |

|

(1,015,971 |

) |

| Adjusted Total Debt

(Non-GAAP) |

|

4,074 |

|

|

4,216 |

|

|

Adjustment: |

|

|

|

|

|

Cash and cash equivalents |

|

(155,905 |

) |

|

(226,292 |

) |

| Adjusted Net Debt

(Cash) (Non-GAAP) |

$ |

(151,831 |

) |

$ |

(222,076 |

) |

Management uses “Adjusted Total Debt” to reflect the Company’s

estimated financial obligations less debt related to lease and

rental fleet (L&RFD) and floor plan notes payable (FPNP), and

“Adjusted Net (Cash) Debt” to present the amount of Adjusted Total

Debt net of cash and cash equivalents on the Company’s balance

sheet. The FPNP is used to finance the Company’s new and used

inventory, with its principal balance changing daily as vehicles

are purchased and sold and the sale proceeds are used to repay the

notes. Consequently, in managing the business, management views the

FPNP as interest bearing accounts payable, representing the cost of

acquiring the vehicle that is then repaid when the vehicle is sold,

as the Company’s floor plan credit agreements require it to repay

loans used to purchase vehicles when such vehicles are sold. The

Company has the capacity to finance all of its lease and rental

fleet under its lines of credit established for this purpose, but

may choose to only partially finance the lease and rental fleet

depending on business conditions and its management of cash and

interest expense. The Company’s lease and rental fleet inventory

are either: (i) leased to customers under long-term lease

arrangements; or (ii) to a lesser extent, dedicated to the

Company’s rental business. In both cases, the lease and rental

payments received fully cover the capital costs of the lease and

rental fleet (i.e., the interest expense on the borrowings used to

acquire the vehicles and the depreciation expense associated with

the vehicles), plus a profit margin for the Company. The Company

believes excluding the FPNP and L&RFD from the Company’s total

debt for this purpose provides management with supplemental

information regarding the Company’s capital structure and leverage

profile and assists investors in performing analysis that is

consistent with financial models developed by Company management

and research analysts. “Adjusted Total Debt” and “Adjusted Net

(Cash) Debt” are both non-GAAP financial measures and should be

considered in addition to, and not as a substitute for, the

Company’s debt obligations, as reported in the Company’s

consolidated balance sheet in accordance with U.S. GAAP.

Additionally, these non-GAAP measures may vary among companies and

may not be comparable to similarly titled non-GAAP measures used by

other companies.

| |

|

Twelve Months Ended |

|

EBITDA (in thousands) |

|

March 31, 2024 |

|

March 31, 2023 |

|

Net Income (GAAP) |

$ |

328,208 |

|

$ |

389,384 |

|

| Provision for income

taxes |

|

106,975 |

|

|

117,701 |

|

| Interest expense |

|

59,907 |

|

|

28,888 |

|

| Depreciation and

amortization |

|

61,266 |

|

|

56,305 |

|

| (Gain) loss on sale of

assets |

|

864 |

|

|

(2,404 |

) |

| EBITDA

(Non-GAAP) |

|

557,220 |

|

|

589,874 |

|

| Adjustment: |

|

|

|

|

| Less Interest expense

associated with FPNP and L&RFD |

|

(60,965 |

) |

|

(29,484 |

) |

| Adjusted EBITDA

(Non-GAAP) |

$ |

496,255 |

|

$ |

560,390 |

|

The Company presents EBITDA and Adjusted EBITDA,

for the twelve months ended each period presented, as additional

information about its operating results. The presentation of

Adjusted EBITDA that excludes the addition of interest expense

associated with FPNP and the L&RFD to EBITDA is consistent with

management’s presentation of Adjusted Total Debt, in each case

reflecting management’s view of interest expense associated with

the FPNP and L&RFD as an operating expense of the Company, and

to provide management with supplemental information regarding

operating results and to assist investors in performing analysis

that is consistent with financial models developed by management

and research analyst. “EBITDA” and “Adjusted EBITDA” are both

non-GAAP financial measures and should be considered in addition

to, and not as a substitute for, net income of the Company, as

reported in the Company’s consolidated statements of income in

accordance with U.S. GAAP. Additionally, these non-GAAP measures

may vary among companies and may not be comparable to similarly

titled non-GAAP measures used by other companies.

| |

|

Twelve Months Ended |

|

Free Cash Flow (in

thousands) |

|

March 31, 2024 |

|

March 31, 2023 |

|

Net cash provided by operations (GAAP) |

$ |

48,194 |

|

$ |

352,610 |

|

| Acquisition of property and

equipment |

|

(357,571 |

) |

|

(287,817 |

) |

| Free cash flow

(Non-GAAP) |

|

(309,377 |

) |

|

64,793 |

|

|

Adjustments: |

|

|

|

|

|

Draws on floor plan financing, net |

|

233,017 |

|

|

285,070 |

|

|

Payments on L&RFD, net |

|

243,227 |

|

|

(157,979 |

) |

|

Cash used for L&RF purchases |

|

233,978 |

|

|

213,029 |

|

|

Non-maintenance capital expenditures |

|

29,617 |

|

|

16,518 |

|

| Adjusted Free Cash

Flow (Non-GAAP) |

$ |

430,462 |

|

$ |

421,431 |

|

“Free Cash Flow” and “Adjusted Free Cash Flow”

are key financial measures of the Company’s ability to generate

cash from operating its business. Free Cash Flow is calculated by

subtracting the acquisition of property and equipment included in

the Cash flows from investing activities from Net cash provided by

(used in) operating activities. For purposes of deriving Adjusted

Free Cash Flow from the Company’s operating cash flow, Company

management makes the following adjustments: (i) adds back draws (or

subtracts payments) on the floor plan financing that are included

in Cash flows from financing activities, as their purpose is to

finance the vehicle inventory that is included in Cash flows from

operating activities; (ii) adds back proceeds from notes payable

related specifically to the financing of the lease and rental fleet

that are reflected in Cash flows from financing activities; (iii)

subtracts draws on floor plan financing, net and proceeds from

L&RFD related to business acquisition assets that are included

in Cash flows from investing activities; (iv) subtracts scheduled

principal payments on fixed rate notes payable related specifically

to the financing of the lease and rental fleet that are included in

Cash flows from financing activities; (v) subtracts lease and

rental fleet purchases that are included in acquisition of property

and equipment and not financed under the lines of credit for cash

and interest expense management purposes; and (vi) adds back

non-maintenance capital expenditures that are for growth and

expansion (i.e. building of new dealership facilities) that are not

considered necessary to maintain the current level of cash

generated by the business. “Free Cash Flow” and “Adjusted Free Cash

Flow” are both presented so that investors have the same financial

data that management uses in evaluating the Company’s cash flows

from operating activities. “Free Cash Flow” and “Adjusted Free Cash

Flow” are both non-GAAP financial measures and should be considered

in addition to, and not as a substitute for, net cash provided by

(used in) operations of the Company, as reported in the Company’s

consolidated statement of cash flows in accordance with U.S. GAAP.

Additionally, these non-GAAP measures may vary among companies and

may not be comparable to similarly titled non-GAAP measures used by

other companies.

|

Invested Capital (in thousands) |

|

March 31, 2024 |

|

March 31, 2023 |

|

Total Rush Enterprises, Inc. shareholders’ equity (GAAP) |

$ |

1,935,502 |

|

$ |

1,810,670 |

|

| Adjusted net debt (cash)

(Non-GAAP) |

|

(151,831 |

) |

|

(222,076 |

) |

| Adjusted Invested

Capital (Non-GAAP) |

$ |

1,783,671 |

|

$ |

1,588,594 |

|

“Adjusted Invested Capital” is a key financial

measure used by the Company to calculate its return on invested

capital. For purposes of this analysis, management excludes

L&RFD, FPNP, and cash and cash equivalents, for the reasons

provided in the debt analysis above and uses Adjusted Net Debt in

the calculation. The Company believes this approach provides

management a more accurate picture of the Company’s leverage

profile and capital structure and assists investors in performing

analysis that is consistent with financial models developed by

Company management and research analysts. “Adjusted Net (Cash)

Debt” and “Adjusted Invested Capital” are both non-GAAP financial

measures. Additionally, these non-GAAP measures may vary among

companies and may not be comparable to similarly titled non-GAAP

measures used by other companies.

Contact:

Rush Enterprises, Inc., San AntonioSteven L. Keller,

830-302-5226

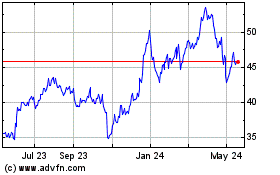

Rush Enterprises (NASDAQ:RUSHA)

Historical Stock Chart

From Jan 2025 to Feb 2025

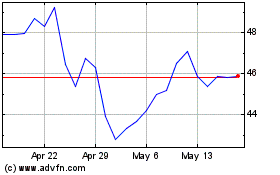

Rush Enterprises (NASDAQ:RUSHA)

Historical Stock Chart

From Feb 2024 to Feb 2025