Revolution Medicines, Inc. (Nasdaq: RVMD), a clinical-stage

oncology company developing targeted therapies for patients with

RAS-addicted cancers, today announced its financial results for the

quarter ended September 30, 2024, and provided an update on

corporate progress.

The company is committed to revolutionizing

treatment for patients with RAS-addicted cancers through the

discovery, development and delivery of innovative, targeted

medicines across lines of therapy and tumor types.

“We’ve made enormous progress on behalf of

patients against this year’s strategic priorities, having now

demonstrated encouraging clinical results for our three pioneering

clinical-stage RAS(ON) inhibitors. Recently updated data for

RMC-6236 continued to elaborate its compelling clinical profile,

including highly encouraging progression-free survival and overall

survival in patients with previously treated pancreatic cancer, and

a Phase 3 pivotal study is now underway. A first report on RMC-9805

showcased its encouraging initial clinical profile in patients with

KRAS G12D pancreatic cancer, marking the first oral, covalent,

mutant-selective investigational drug to show initial promise in

patients with tumors harboring this common mutation,” said Mark A.

Goldsmith, M.D., Ph.D., chief executive officer and chairman of

Revolution Medicines. “We believe these are major milestones on our

path toward serving patients with RAS-addicted cancers, and we

expect to provide additional updates before year-end that should

help set the stage for continued pipeline progress in our

multilayered approach in 2025.”

Recent Clinical Highlights &

Upcoming Milestones

Pancreatic Cancer The company

currently has two RAS(ON) inhibitors being developed for patients

with advanced or metastatic PDAC, RMC-6236, a RAS(ON)

multi-selective inhibitor, and RMC-9805, a RAS(ON) G12D-selective

inhibitor. The company is currently evaluating both compounds as

monotherapy and in combination regimens.

RMC-6236 Clinical Updates

- On October 21, 2024, the company reported that the first

patient was dosed in RASolute 302, a Phase 3 registrational study

evaluating RMC-6236 compared with standard-of-care chemotherapy in

patients with previously treated metastatic PDAC. Timing

of RASolute 302 data readout will be event-driven

after the study is fully enrolled.

- On October 23, 2024, the company reported updated clinical

safety/tolerability and efficacy data from its ongoing RMC-6236

monotherapy study at the EORTC-NCI-AACR Symposium on Molecular

Targets and Cancer Therapeutics (Triple meeting) in Barcelona. As

of the July 23, 2024 data cutoff date, RMC-6236 demonstrated

compelling antitumor activity, including encouraging

progression-free survival (median 8.5 months) and overall survival

(median 14.5 months) among second-line PDAC patients with tumors

harboring a KRAS G12X mutation who received doses from 160 mg to

300 mg daily. The safety/tolerability findings were generally

consistent with previously reported data, and no new safety signals

were observed.

RMC-9805 Clinical Updates

- On October 25, 2024, the company reported initial

safety/tolerability and antitumor activity data from the RMC-9805

monotherapy dose-escalation study in patients with KRAS G12D tumors

at the Triple meeting. As of the September 2, 2024 data cutoff

date, RMC-9805 demonstrated an encouraging safety and tolerability

profile among patients treated at all dose levels and across tumor

types and showed encouraging initial antitumor activity in patients

with PDAC treated at multiple dose levels and particularly among

those who received 1200 mg once daily or 600 mg twice daily; 1200

mg once daily is a candidate recommended Phase 2 dose and

schedule.

- Evaluation of RMC-9805 in combination with RMC-6236 in a Phase

1 study is ongoing in patients with KRAS G12D solid tumors.

Beyond Pancreatic Cancer: The

company is currently evaluating its clinical-stage RAS(ON)

inhibitors as monotherapy and/or combinations in patients with

additional solid tumors carrying RAS mutations.

Upcoming Milestones

- The company plans to provide updated data from its ongoing

study of RMC-6236 monotherapy in patients with NSCLC in the fourth

quarter of 2024. The company currently expects to reach

regulatory alignment and initiate a Phase 3 registrational

study evaluating RMC-6236 as monotherapy in patients with

previously treated, advanced RAS-mutant NSCLC in the

first quarter of 2025.

- The company also plans to share initial clinical

pharmacokinetics (PK), safety/tolerability and antitumor activity

data from a combination study evaluating RMC-6236 with

pembrolizumab in the fourth quarter of 2024.

- Evaluation of the company’s RAS(ON) doublet combination of

RMC-6291 with RMC-6236 is ongoing, and the company currently

expects to disclose initial clinical PK, safety/tolerability and

antitumor activity data from this combination study in the fourth

quarter of 2024.

- The company is evaluating the combination of RMC-6291 with

pembrolizumab, with or without chemotherapy, in patients with

advanced NSCLC, and currently expects to disclose initial clinical

PK, safety/tolerability and antitumor activity data from this

combination study in the first half of 2025.

Financial Highlights

Third Quarter Results

Cash Position: Cash, cash

equivalents and marketable securities were $1.55 billion as of

September 30, 2024.

R&D Expenses: Research and

development expenses were $151.8 million for the quarter ended

September 30, 2024, compared to $107.7 million for the quarter

ended September 30, 2023. The increase in expense was primarily due

to increases in clinical trial expenses for RMC-6236, RMC-6291 and

RMC-9805, personnel-related expenses related to additional

headcount and stock-based compensation expense.

G&A Expenses: General and

administrative expenses were $24.0 million for the quarter ended

September 30, 2024, compared to $15.5 million for the quarter ended

September 30, 2023. The increase was primarily due to increases in

personnel-related expenses associated with additional headcount,

commercial preparation activities and stock-based compensation

expense.

Net Loss: Net loss was $156.3

million for the quarter ended September 30, 2024, compared to net

loss of $108.4 million for the quarter ended September 30,

2023.

Financial GuidanceRevolution

Medicines is reiterating projected full year 2024 GAAP net loss

guidance of between $560 million and $600 million, which includes

estimated non-cash stock-based compensation expense of between $70

million and $80 million. Based on the company’s current operating

plan, the company projects current cash, cash equivalents and

marketable securities can fund planned operations into 2027.

WebcastRevolution Medicines

will host a webcast this afternoon, November 6, 2024, at 4:30 p.m.

Eastern Time (1:30 p.m. Pacific Time). To listen to the live

webcast, or access the archived webcast, please visit:

https://ir.revmed.com/events-and-presentations. Following the live

webcast, a replay will be available on the company’s website for at

least 14 days.

About Revolution Medicines,

Inc.Revolution Medicines is a clinical-stage oncology

company developing novel targeted therapies for RAS-addicted

cancers. The company’s R&D pipeline comprises RAS(ON)

inhibitors designed to suppress diverse oncogenic variants of RAS

proteins. The company’s RAS(ON) inhibitors RMC-6236, a RAS(ON)

multi-selective inhibitor, RMC-6291, a RAS(ON) G12C-selective

inhibitor, and RMC-9805, a RAS(ON) G12D-selective inhibitor, are

currently in clinical development. Additional development

opportunities in the company’s pipeline focus on RAS(ON)

mutant-selective inhibitors, including RMC-5127 (G12V), RMC-0708

(Q61H) and RMC-8839 (G13C), in addition to RAS companion inhibitors

RMC-4630 and RMC-5552.

Forward-Looking Statements This

press release contains forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. Any statements in this press release that are not

historical facts may be considered "forward-looking statements,"

including without limitation statements regarding the company’s

financial projections and expectations related to the company’s

capital resources; the company’s development plans and timelines

and its ability to advance its portfolio and R&D pipeline; the

potential advantages and effectiveness of the company’s clinical

and preclinical candidates, including its RAS(ON) inhibitors;

progression of clinical studies and findings from these studies,

including the safety, tolerability, potential efficacy and

durability of the company’s candidates being studied; the company’s

expectations regarding timing of data disclosures, regulatory

alignment and clinical study initiation; the company’s plans to

revolutionize treatment for patients with RAS-addicted cancers;

readout of the company’s clinical trials; and the company’s

commercial plans. Forward-looking statements are typically, but not

always, identified by the use of words such as "may," "will,"

"would," "believe," "intend," "plan," "anticipate," "estimate,"

"expect," and other similar terminology indicating future results.

Such forward-looking statements are subject to substantial risks

and uncertainties that could cause the company’s development

programs, future results, performance or achievements to differ

materially from those anticipated in the forward-looking

statements. Such risks and uncertainties include without limitation

risks and uncertainties inherent in the drug development process,

including the company’s programs’ current stage of development, the

process of designing and conducting preclinical and clinical

trials, risks that the results of prior clinical trials may not be

predictive of future clinical trials, clinical efficacy, or other

future results, the regulatory approval processes, the timing of

regulatory filings, the challenges associated with manufacturing

drug products, the company’s ability to successfully establish,

protect and defend its intellectual property, other matters that

could affect the sufficiency of the company’s capital resources to

fund operations, reliance on third parties for manufacturing and

development efforts, changes in the competitive landscape, and the

effects on the company’s business of the global events, such as

international conflicts or global pandemics. For a further

description of the risks and uncertainties that could cause actual

results to differ from those anticipated in these forward-looking

statements, as well as risks relating to the business of Revolution

Medicines in general, see Revolution Medicines’ Quarterly Report on

Form 10-Q filed with the Securities and Exchange Commission (the

“SEC”) on November 6, 2024, and its future periodic reports to be

filed with the SEC. Except as required by law, Revolution Medicines

undertakes no obligation to update any forward-looking statements

to reflect new information, events or circumstances, or to reflect

the occurrence of unanticipated events.

REVOLUTION MEDICINES,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except share and per

share data)(unaudited)

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenue |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

10,838 |

|

|

Total revenue |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,838 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

151,752 |

|

|

|

107,735 |

|

|

|

404,129 |

|

|

|

274,663 |

|

|

General and administrative |

|

23,960 |

|

|

|

15,513 |

|

|

|

69,085 |

|

|

|

43,377 |

|

|

Total operating expenses |

|

175,712 |

|

|

|

123,248 |

|

|

|

473,214 |

|

|

|

318,040 |

|

| Loss

from operations |

|

(175,712 |

) |

|

|

(123,248 |

) |

|

|

(473,214 |

) |

|

|

(307,202 |

) |

| Other

income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

20,411 |

|

|

|

10,947 |

|

|

|

65,658 |

|

|

|

28,505 |

|

|

Other income (expense), net |

|

282 |

|

|

|

— |

|

|

|

(2,511 |

) |

|

|

— |

|

|

Change in fair value of warrant liabilities and contingent earn-out

shares |

|

(1,269 |

) |

|

|

— |

|

|

|

4,543 |

|

|

|

— |

|

|

Total other income, net |

|

19,424 |

|

|

|

10,947 |

|

|

|

67,690 |

|

|

|

28,505 |

|

| Loss

before income taxes |

|

(156,288 |

) |

|

|

(112,301 |

) |

|

|

(405,524 |

) |

|

|

(278,697 |

) |

| Benefit

from income taxes |

|

— |

|

|

|

3,867 |

|

|

|

— |

|

|

|

3,867 |

|

| Net

loss |

$ |

(156,288 |

) |

|

$ |

(108,434 |

) |

|

$ |

(405,524 |

) |

|

$ |

(274,830 |

) |

| Net loss

per share attributable to common stockholders, basic and

diluted |

$ |

(0.94 |

) |

|

$ |

(0.99 |

) |

|

|

(2.45 |

) |

|

$ |

(2.65 |

) |

|

Weighted-average common shares used to compute net loss per share,

basic and diluted |

|

166,843,984 |

|

|

|

109,233,084 |

|

|

|

165,576,333 |

|

|

|

103,702,501 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

REVOLUTION MEDICINES,

INC.SELECTED CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, unaudited)

|

|

September 30,2024 |

|

December 31,2023 |

|

|

|

|

|

|

|

|

|

| Cash,

cash equivalents and marketable securities |

$ |

1,549,481 |

|

|

$ |

1,852,955 |

|

|

Working capital (1) |

|

1,468,276 |

|

|

|

1,735,430 |

|

|

Total assets |

|

1,762,999 |

|

|

|

2,061,705 |

|

|

Total liabilities |

|

196,695 |

|

|

|

235,511 |

|

|

Total stockholders' equity |

|

1,566,304 |

|

|

|

1,826,194 |

|

|

|

|

|

|

|

|

|

|

(1) Working capital

is defined as current assets less current liabilities.

Media & Investor Contacts

media@revmed.com

investors@revmed.com

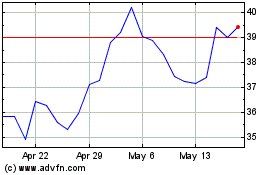

Revolution Medicines (NASDAQ:RVMD)

Historical Stock Chart

From Dec 2024 to Jan 2025

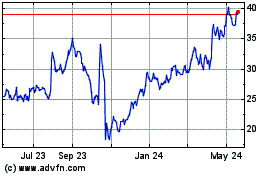

Revolution Medicines (NASDAQ:RVMD)

Historical Stock Chart

From Jan 2024 to Jan 2025