Rail Vision Announces First Half 2024 Financial Results

August 29 2024 - 3:15PM

Rail Vision Ltd. (Nasdaq: RVSN) (“Rail Vision” or the

“Company”), a development stage technology company seeking to

revolutionize railway safety and the data-related market, today

reported financial results for the first half ended June 30, 2024.

“We continued to strengthen our foundation

during 2024, completing a series of financing transactions that

raised gross proceeds of over $12 million. On a business level,

securing orders from global leaders and successfully delivering our

advanced systems have been important milestones for us. I’m proud

to say that all installations have been carried out with

industry-leading partners, further strengthening our presence in

the U.S. market. The positive feedback we’re receiving from these

esteemed customers aligns with our commitment to excellence and

innovation, as we continue to implement solutions that meet and

exceed customer expectations. We have also started providing fleet

management and data and cloud services that allow our customers to

see the actual system performance,” commented Shahar Hania, CEO of

Rail Vision.

First Half 2024 & Recent Highlights:

Cash position

Rail Vision started 2024 by securing

over $12 million in proceeds to fuel its business through

a pair of financing transactions, including a private placement of

its shares and warrants, a convertible loan credit facility and

exercise of warrants.

Executing on sales:

- Received $1

million order out of a contract valued at up to $5

million in potential follow-on orders with leading US-based

rail and leasing services company: In April, Rail Vision

received an initial purchase order amounting to

approximately $1 million as part of a contract valued at

up to $5 million in potential follow-on orders with a

leading US-based rail and leasing services company that the Company

initially announced in January 2024.

- In June 2024 Rail Vision

received a follow-on order from the same customer,

in the amount of approximately $200,000, which is in addition to

the original agreement and refers to additional services requested

by the customer.

Engaging with US and global industry

leaders:

- Rail Vision Successfully

Installed its AI-Driven System for Class 1 US Operator:

In June 2024, Rail Vision completed the successful

installation of its AI-driven Shunting Yard product for a Class 1

freight rail US-based company. The North American Class 1 rail

company will use the system on its locomotives for evaluation in

different scenarios related to safety and efficiency. This

installation follows the purchase order, which was announced

in March 2024.

- Rail Vision Installed its

AI-Driven Product with Loram, a Top US-Based Railway Track

Maintenance Supplier: In June 2024, Rail Vision

completed the successful delivery and installation of its AI-driven

Shunting Yard product to Loram, a leading US-based provider of

railway track maintenance equipment and services. This installation

fulfills the purchase order that was announced in April

2024.

- Rail Vision Successfully

Installed its AI-based Product at a Leading Global Mining

Company: In June 2024, Rail Vision successfully installed

its product at one of Latin America’s leading mining companies.

Following a successful delivery, Rail Vision’s team arrived at the

mining company’s installation site, where both sides installed the

AI-based MainLine product and Rail Vision led training sessions for

the mining company’s team.

- Announced first-ever

commercial installation of its AI-driven systems in a national

railways line: In February 2024, Rail Vision

announced the first ever commercial installation of its AI-driven

Main Line Systems in a national railways line, marking a

significant milestone in the Company’s journey towards

revolutionizing railway safety and efficiency. A successful

evaluation process resulted in the purchase of ten Rail Vision Main

Line Systems for $1.4 million by Israel

Railways.

Strengthening IP

protection:

In August 2024, Rail Vision was granted patent

approval from the United States Patent and Trademark Office for its

innovative AI-based railway obstacle detection system, which

followed the Company receiving a notice of allowance from the Japan

Patent Office for the same patent application in June

2024.

First Half 2024 Financial

Results

- Revenues

were $761,000 for the six months ended June 30, 2024,

comprised from the mining company that purchased a Rail Vision Main

Line System, first installation of Rail Vision’s Main Line Systems

in Israel Railways and the successful delivery and installation of

Rail Vision’s Shunting Yard product to Loram.

- Research and development

(“R&D”) expenses for the six months ended June 30, 2024, were

$2,458,000, compared to R&D expenses of $3,682,000 in the six

months ended June 30, 2023. The decrease in R&D expenses was

primarily attributable to a decrease in R&D salaries due to a

reduction in workforce, including a reduction in the Company

employee base by 12 R&D employees and R&D equipment

purchases.

- General and administrative expenses

for the six months ended June 30, 2024, were $2,116,000, compared

to $2,303,000 in the six months ended June 30, 2023. The decrease

is primarily attributed to a decrease in salaries and other

administrative and operational costs, as part of the process of

reducing costs as mentioned above.

- As a result of the foregoing, the

Company’s operating loss for the six months ended June 30, 2024,

was $4,185,000 compared to an operating loss of $5,985,000 for the

six months ended June 30, 2023.

- Financial expenses amounted to

$1,304,000 for the six months ended June 30, 2024, a decrease of

$1,454,000, compared to $150,000 financial income for the six

months ended June 30, 2023. The decrease was primarily attributable

to the amortization of discount related to a convertible loan

credit facility that the Company entered into in January 2024.

- GAAP net loss for the six months

ended June 30, 2024, was $24,324,000, or $1.99 per ordinary share,

compared to a GAAP net loss of $5,835,000, or $2.69 per ordinary

share, in the six months ended June 30, 2023.

- Non-GAAP net loss for the six

months ended June 30, 2024, was $5,394,000 or $0.44 per ordinary

share, compared to a non-GAAP net loss of $5,671,000, or $2.62 per

ordinary share, in the six months ended June 30, 2023.

| |

|

Six months endedJune 30, |

|

| (U.S. dollars in thousands,

except share data and per share data) |

|

2024 |

|

|

2023 |

|

| GAAP

Results |

|

|

|

|

|

|

|

Net loss |

|

|

(24,324 |

) |

|

|

(5,835 |

) |

| Basic and diluted loss per

share |

|

|

(1.99 |

) |

|

|

(2.69 |

) |

| Non-GAAP

Results |

|

|

|

|

|

|

|

|

| Net loss |

|

|

(5,394 |

) |

|

|

(5,671 |

) |

| Basic and diluted loss per

share |

|

|

(0.44 |

) |

|

|

(2.62 |

) |

| |

|

|

|

|

|

|

|

|

A reconciliation

between GAAP operating results and non-GAAP operating results is

provided in the financial statements that are part of this release.

Non-GAAP results exclude stock-based compensation expenses and

revaluation of derivative warrant liabilities.

- As of June 30, 2024, cash and cash

equivalents were $9.7 million, compared to $3.1 million as of

December 31, 2023. The increase compared to December 31, 2023, is

mainly due to the proceeds received from a private placement and

credit facility and from warrants exercised by shareholders that

occurred in the first half of 2024, totaling $11.5 million gross

($11.3 net proceeds), less cash used during the first half of

2024.

Use of Non-GAAP Financial

Results

In addition to disclosing financial results

calculated in accordance with United States generally accepted

accounting principles (GAAP), the company’s earnings release

contains non-GAAP financial measures of net loss for the period

that excludes the effect of stock-based compensation expenses and

revaluation of derivative warrant liabilities. The company’s

management believes the non-GAAP financial information provided in

this release is useful to investors’ understanding and assessment

of the company’s on-going operations. Management also uses both

GAAP and non-GAAP information in evaluating and operating business

internally and as such deemed it important to provide all this

information to investors. The non-GAAP financial measures disclosed

by the company should not be considered in isolation or as a

substitute for, or superior to, financial measures calculated in

accordance with GAAP, and the financial results calculated in

accordance with GAAP and reconciliations to those financial

statements should be carefully evaluated. Investors are encouraged

to review the related U.S. GAAP financial measures and the

reconciliation of these Non-GAAP financial measures to their most

directly comparable U.S. GAAP financial measures and not rely on

any single financial measure to evaluate the company’s business.

For more information on the non-GAAP financial measures, please see

the “Reconciliation of GAAP to Non-GAAP Financial Measures” later

in this release. This accompanying table has more details on the

GAAP financial measures that are most directly comparable to

non-GAAP financial measures and the related reconciliations between

these financial measures.

About Rail Vision Ltd.

Rail Vision is a development stage technology

company that is seeking to revolutionize railway safety and the

data-related market. The company has developed cutting edge,

artificial intelligence based, industry-leading technology

specifically designed for railways. The company has developed its

railway detection and systems to save lives, increase efficiency,

and dramatically reduce expenses for the railway operators. Rail

Vision believes that its technology will significantly increase

railway safety around the world, while creating significant

benefits and adding value to everyone who relies on the train

ecosystem: from passengers using trains for transportation to

companies that use railways to deliver goods and services. In

addition, the company believes that its technology has the

potential to advance the revolutionary concept of autonomous trains

into a practical reality. For more information, please visit

https://www.railvision.io/

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act and other securities laws. Words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates”

and similar expressions or variations of such words are intended to

identify forward-looking statements. For example, the Company is

using forward-looking statements when it discusses its commitment

to excellence and innovation, as it continues to implement

solutions that meet and exceed customer expectations.

Forward-looking statements are not historical facts, and are based

upon management’s current expectations, beliefs and projections,

many of which, by their nature, are inherently uncertain. Such

expectations, beliefs and projections are expressed in good faith.

However, there can be no assurance that management’s expectations,

beliefs and projections will be achieved, and actual results may

differ materially from what is expressed in or indicated by the

forward-looking statements. Forward-looking statements are subject

to risks and uncertainties that could cause actual performance or

results to differ materially from those expressed in the

forward-looking statements. For a more detailed description of the

risks and uncertainties affecting the Company, reference is made to

the Company’s reports filed from time to time with the Securities

and Exchange Commission (“SEC”), including, but not limited to, the

risks detailed in the Company’s annual report on Form 20-F filed

with the SEC on March 28, 2024. Forward-looking statements speak

only as of the date the statements are made. The Company assumes no

obligation to update forward-looking statements to reflect actual

results, subsequent events or circumstances, changes in assumptions

or changes in other factors affecting forward-looking information

except to the extent required by applicable securities laws. If the

Company does update one or more forward-looking statements, no

inference should be drawn that the Company will make additional

updates with respect thereto or with respect to other

forward-looking statements. References and links to websites have

been provided as a convenience, and the information contained on

such websites is not incorporated by reference into this press

release. Rail Vision is not responsible for the contents of

third-party websites.

Contacts

Shahar HaniaChief Executive OfficerRail Vision Ltd.15 Ha’Tidhar

StRa’anana, 4366517 IsraelTelephone: +972- 9-957-7706

Investor Relations:

Michal Efratyinvestors@railvision.io

|

|

|

Rail Vision Ltd.INTERIM CONDENSED BALANCE

SHEETS(U.S. dollars in thousands, except share

data and per share data) |

|

|

|

|

|

June 30,2024 |

|

|

December 31,2023 |

|

|

|

|

Unaudited |

|

|

Audited |

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,691 |

|

|

$ |

3,066 |

|

|

Restricted cash |

|

|

215 |

|

|

|

223 |

|

|

Accounts receivable |

|

|

135 |

|

|

|

-- |

|

|

Inventories |

|

|

968 |

|

|

|

977 |

|

|

Other current assets |

|

|

354 |

|

|

|

336 |

|

|

Total current assets |

|

|

11,363 |

|

|

|

4,602 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current Assets: |

|

|

|

|

|

|

|

|

|

Operating lease - right of use asset |

|

|

738 |

|

|

|

889 |

|

|

Fixed assets, net |

|

|

351 |

|

|

|

430 |

|

|

|

|

|

1,089 |

|

|

|

1,319 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

12,452 |

|

|

|

5,921 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Trade accounts payables |

|

|

88 |

|

|

|

185 |

|

|

Current operating lease liability |

|

|

282 |

|

|

|

285 |

|

|

Other accounts payable |

|

|

1,823 |

|

|

|

2,140 |

|

|

Total current liabilities |

|

|

2,193 |

|

|

|

2,610 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current operating lease liability |

|

|

363 |

|

|

|

524 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

2,556 |

|

|

|

3,134 |

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

|

|

| Ordinary shares |

|

|

-- |

|

|

|

68 |

|

| Additional paid in

capital |

|

|

100,182 |

|

|

|

68,681 |

|

| Accumulated deficit |

|

|

(90,286 |

) |

|

|

(65,962 |

) |

| Total shareholders’

equity |

|

|

9,896 |

|

|

|

2,787 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and

shareholders’ equity |

|

|

12,452 |

|

|

|

5,921 |

|

|

|

|

Rail Vision Ltd.UNAUDITED INTERIM

CONDENSED STATEMENTS OF COMPREHENSIVE LOSS(U.S.

dollars in thousands, except share data and per share

data) |

|

|

|

|

|

Six months ended |

|

|

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

761 |

|

|

$ |

-- |

|

|

Cost of revenues |

|

|

(372 |

) |

|

|

-- |

|

|

Gross profit |

|

|

389 |

|

|

|

-- |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

(2,458 |

) |

|

|

(3,682 |

) |

|

General and administrative expenses |

|

|

(2,116 |

) |

|

|

(2,303 |

) |

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(4,185 |

) |

|

|

(5,985 |

) |

|

|

|

|

|

|

|

|

|

|

|

Financial (expenses) income: |

|

|

|

|

|

|

|

|

|

Revaluation of derivative warrant liabilities |

|

|

(18,835 |

) |

|

|

-- |

|

|

Other financing income (expenses), net |

|

|

(1,304 |

) |

|

|

150 |

|

|

Net loss for the period |

|

|

(24,324 |

) |

|

|

(5,835 |

) |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

|

(1.99 |

) |

|

|

(2.69 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding used to

compute basic and diluted loss per ordinary share |

|

|

12,193,918 |

|

|

|

2,167,170 |

|

|

|

|

Rail Vision Ltd. UNAUDITED INTERIM

CONDENSED STATEMENTS OF CHANGES IN TEMPORARY EQUITY AND

SHAREHOLDERS’ EQUITY(U.S. dollars in thousands,

except share data and per share data) |

|

|

| |

|

Ordinary Shares |

|

|

Additional |

|

|

|

|

|

Total |

|

|

|

|

Number ofshares |

|

|

USD |

|

|

paid incapital |

|

|

AccumulatedDeficit |

|

|

shareholders’equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2024 |

|

2,998,278 |

|

|

68 |

|

|

68,681 |

|

|

(65,962 |

) |

|

2,787 |

|

|

Cancelation of the par value of ordinary shares |

|

-- |

|

|

(68 |

) |

|

68 |

|

|

-- |

|

|

-- |

|

|

Issuance of units of ordinary shares and pre-funded warrants, net

of issuance costs (*) |

|

3,554,200 |

(**) |

|

-- |

|

|

1,404 |

|

|

-- |

|

|

1,404 |

|

|

Exercise of warrants to ordinary shares, net of issuance costs

(***) |

|

12,258,487 |

|

|

-- |

|

|

23,791 |

|

|

-- |

|

|

23,791 |

|

|

Classification of warrant liabilities to equity warrants |

|

-- |

|

|

-- |

|

|

6,143 |

|

|

-- |

|

|

6,143 |

|

|

Share-based payment |

|

-- |

|

|

-- |

|

|

95 |

|

|

-- |

|

|

95 |

|

|

Net loss for the period |

|

-- |

|

|

-- |

|

|

-- |

|

|

(24,324 |

) |

|

(24,324 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30, 2024 |

|

18,810,965 |

|

|

-- |

|

|

100,182 |

|

|

(90,286 |

) |

|

9,896 |

|

|

(*) |

Issuance costs in the amount of approximately $39. |

| (**) |

Including 1,902,742 Pre-funded Warrants which were exercised to

1,902,742 ordinary shares during February and March 2024. |

| (***) |

Issuance costs in the amount of approximately $187. |

| |

|

Rail Vision Ltd.UNAUDITED INTERIM

CONDENSED STATEMENTS OF CHANGES IN TEMPORARY EQUITY

AND SHAREHOLDERS’ EQUITY

(Cont.)(U.S. dollars in thousands, except share

data and per share data) |

| |

| |

|

Ordinary Shares |

|

|

Additional |

|

|

|

|

|

Total |

|

|

|

|

Number ofshares |

|

|

USD |

|

|

paid incapital |

|

|

AccumulatedDeficit |

|

|

shareholders’equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2023 |

|

1,987,005 |

|

|

46 |

|

|

63,033 |

|

|

(54,814 |

) |

|

8,265 |

|

|

Issuance of shares as a result of exercise of warrants |

|

24,431 |

|

|

1 |

|

|

(1 |

) |

|

-- |

|

|

-- |

|

|

Issuance of units of ordinary shares and warrants, net of issuance

costs (*) |

|

986,842 |

|

|

21 |

|

|

5,374 |

|

|

-- |

|

|

5,395 |

|

|

Share-based payment |

|

-- |

|

|

-- |

|

|

165 |

|

|

-- |

|

|

165 |

|

|

Net loss for the period |

|

-- |

|

|

-- |

|

|

-- |

|

|

(5,835 |

) |

|

(5,835 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30, 2023 |

|

2,998,278 |

|

|

68 |

|

|

68,571 |

|

|

(60,649 |

) |

|

7,990 |

|

|

(*) |

Issuance expenses in the amount of approximately $603. |

| |

|

Rail Vision Ltd.INTERIM CONDENSED

STATEMENTS OF CASH FLOWS (UNAUDITED)(U.S. dollars

in thousands) |

| |

| |

|

Six months ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

Net loss for the period |

|

$ |

(24,324 |

) |

|

$ |

(5,835 |

) |

| |

|

|

|

|

|

|

|

|

| Adjustments to

reconcile loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

85 |

|

|

|

80 |

|

| Share-based payment |

|

|

95 |

|

|

|

165 |

|

| Change in operating lease

liability |

|

|

(13 |

) |

|

|

(39 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

56 |

|

|

|

-- |

|

| Revaluation of derivative

warrant liabilities |

|

|

18,835 |

|

|

|

-- |

|

| Amortization of a discount

related to a convertible loan credit facility |

|

|

1,229 |

|

|

|

-- |

|

| |

|

|

|

|

|

|

|

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Increase in accounts

receivables |

|

|

(135 |

) |

|

|

-- |

|

| Increase in other current

assets |

|

|

(18 |

) |

|

|

(80 |

) |

| Decrease (increase) in

Inventories |

|

|

9 |

|

|

|

(491 |

) |

| Increase (decrease) in trade

accounts payable |

|

|

(97 |

) |

|

|

167 |

|

| Increase (decrease) in other

accounts payable |

|

|

(317 |

) |

|

|

624 |

|

| |

|

|

|

|

|

|

|

|

| Net cash used in

operating activities |

|

|

(4,595 |

) |

|

|

(5,409 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

| Purchase of fixed assets |

|

|

(6 |

) |

|

|

(137 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash used in

investing activities |

|

|

(6 |

) |

|

|

(137 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from a convertible

loan credit facility and issuance of warrants |

|

|

1,500 |

|

|

|

-- |

|

| Payments on convertible loan

credit facility |

|

|

(1,000 |

) |

|

|

-- |

|

| Proceeds from exercise of

warrants, net of issuance expenses |

|

|

7,813 |

|

|

|

-- |

|

| Proceeds from issuance of

shares and warrants, net of issuance expenses |

|

|

2,961 |

|

|

|

5,460 |

|

| |

|

|

|

|

|

|

|

|

| Net cash provided by

financing activities |

|

|

11,274 |

|

|

|

5,460 |

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

(56 |

) |

|

|

-- |

|

| Increase (Decrease) in cash,

cash equivalents and restricted cash |

|

|

6,617 |

|

|

|

(86 |

) |

| Cash, cash equivalents and

restricted cash at the beginning of the period |

|

|

3,289 |

|

|

|

8,492 |

|

| |

|

|

|

|

|

|

|

|

| Cash, cash equivalents

and restricted cash at the end of the period |

|

$ |

9,906 |

|

|

$ |

8,406 |

|

| Non Cash

Activities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Conversion of a convertible

loan credit facility to ordinary shares |

|

|

500 |

|

|

|

-- |

|

| Issuance expenses recorded in

other accounts payables |

|

|

-- |

|

|

|

65 |

|

| |

|

Rail Vision Ltd.RECONCILIATION OF GAAP TO

NON-GAAP Financial Measures(U.S. dollars in

thousands, except share data and per share data) |

| |

| |

|

Six months endedJune 30, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

GAAP operating loss |

|

|

(4,185 |

) |

|

|

(5,985 |

) |

| Stock-based compensation in

research and development expenses |

|

|

18 |

|

|

|

28 |

|

| Stock-based compensation in

general and administrative expenses |

|

|

77 |

|

|

|

136 |

|

| Non-GAAP operating

loss |

|

|

(4,090 |

) |

|

|

(5,821 |

) |

| |

|

|

|

|

|

|

|

|

| GAAP Revaluation of

derivative warrant liability expenses |

|

|

(18,835 |

) |

|

|

-- |

|

| Revaluation of derivative

warrant liabilities |

|

|

18,835 |

|

|

|

-- |

|

| Non-GAAP Revaluation

of derivative warrant liabilities expenses |

|

|

-- |

|

|

|

-- |

|

| |

|

|

|

|

|

|

|

|

| GAAP net

loss |

|

|

(24,324 |

) |

|

|

(5,835 |

) |

| Stock-based compensation

expenses |

|

|

95 |

|

|

|

164 |

|

| Revaluation of derivative

warrant liability expenses |

|

|

18,835 |

|

|

|

-- |

|

| Non-GAAP net

loss |

|

|

(5,394 |

) |

|

|

(5,671 |

) |

| |

|

|

|

|

|

|

|

|

| GAAP Basic and diluted

loss per share |

|

|

(1.99 |

) |

|

|

(2.69 |

) |

| Non-GAAP Basic and

diluted loss per share |

|

|

(0.44 |

) |

|

|

(2.62 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

number of shares outstanding used to compute basic and diluted loss

per ordinary share |

|

|

12,193,918 |

|

|

|

2,167,170 |

|

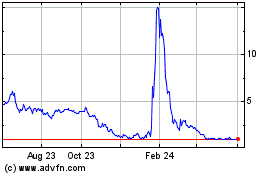

Rail Vision (NASDAQ:RVSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

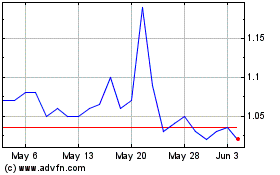

Rail Vision (NASDAQ:RVSN)

Historical Stock Chart

From Dec 2023 to Dec 2024