UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of August 2024

Commission file number: 001-41334

RAIL VISION LTD.

(Translation of registrant’s name into English)

15 Ha’Tidhar St

Ra’anana, 4366517 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

CONTENTS

This Report of Foreign Private Issuer on Form

6-K consists of (i) the Registrant’s press release issued on August 29, 2024, titled “Rail Vision Announces First Half 2024

Financial Results,” which is attached hereto as Exhibit 99.1; (ii) the Registrant’s Interim Condensed Financial Statements

as of June 30, 2024, which is attached hereto as Exhibit 99.2; and (iii) the Registrant’s Management’s Discussion and Analysis

of Financial Condition and Results of Operations for the six months ended June 30, 2024, which is attached hereto as Exhibit 99.3.

The first paragraph, the sections titled

“First Half 2024 & Recent Highlights,” “Forward-Looking Statements,” “First Half 2024 Financial

Results,” the GAAP financial statements and the Reconciliation of GAAP to Non-GAAP Financial Measures table in the press

release attached as Exhibit 99.1, Exhibit 99.2, Exhibit 99.3, are incorporated by reference into the Registrant’s Registration

Statements on Form F-3 (File Nos. 333-271068,

333-278645, 333-272933, 333-276869, 333-277963)

and Form S-8 (File Nos. 333-265968

and 333-281329),

to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports

subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Rail Vision Ltd. |

| |

|

| Date: August 29, 2024 |

By: |

/s/ Ofer Naveh |

| |

|

Name: |

Ofer Naveh |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

Rail Vision Announces

First Half 2024 Financial Results

Ra’anana, Israel,

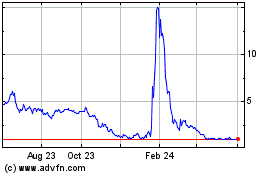

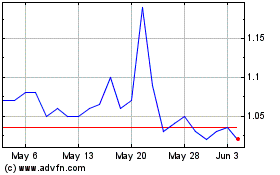

August 29, 2024 (GLOBE NEWSWIRE) – Rail Vision Ltd. (Nasdaq: RVSN) (“Rail Vision”

or the “Company”), a development stage technology company seeking to revolutionize railway safety and the data-related

market, today reported financial results for the first half ended June 30, 2024.

“We continued

to strengthen our foundation during 2024, completing a series of financing transactions that raised gross proceeds of over $12 million.

On a business level, securing orders from global leaders and successfully delivering our advanced systems have been important milestones

for us. I’m proud to say that all installations have been carried out with industry-leading partners, further strengthening our

presence in the U.S. market. The positive feedback we’re receiving from these esteemed customers aligns with our commitment to excellence

and innovation, as we continue to implement solutions that meet and exceed customer expectations. We have also started providing fleet

management and data and cloud services that allow our customers to see the actual system performance.” commented Shahar Hania, CEO

of Rail Vision.

First Half 2024 & Recent Highlights:

Cash position

Rail Vision started

2024 by securing over $12 million in proceeds to fuel its business through a pair of financing transactions, including a private

placement of its shares and warrants, a convertible loan credit facility and exercise of warrants.

Executing on

sales:

| ● | Received $1

million order out of a contract valued at up to $5 million in potential follow-on orders with leading US-based rail and

leasing services company: In April, Rail Vision received an initial purchase order amounting to approximately $1 million as

part of a contract valued at up to $5 million in potential follow-on orders with a leading US-based rail and leasing services

company that the Company initially announced in January 2024. |

| ● | In

June 2024 Rail Vision received a follow-on order from the same customer, in the amount of approximately $200,000, which is in

addition to the original agreement and refers to additional services requested by the customer. |

Engaging

with US and global industry leaders:

| ● | Rail

Vision Successfully Installed its AI-Driven System for Class 1 US Operator: In June 2024, Rail Vision completed the successful

installation of its AI-driven Shunting Yard product for a Class 1 freight rail US-based company. The North American Class 1 rail company

will use the system on its locomotives for evaluation in different scenarios related to safety and efficiency. This installation follows

the purchase order, which was announced in March 2024. |

| ● | Rail

Vision Installed its AI-Driven Product with Loram, a Top US-Based Railway Track Maintenance Supplier: In June 2024, Rail

Vision completed the successful delivery and installation of its AI-driven Shunting Yard product to Loram, a leading US-based provider

of railway track maintenance equipment and services. This installation fulfills the purchase order that was announced in April 2024. |

| ● | Rail

Vision Successfully Installed its AI-based Product at a Leading Global Mining Company: In June 2024, Rail Vision successfully installed

its product at one of Latin America’s leading mining companies. Following a successful delivery, Rail Vision’s team arrived

at the mining company’s installation site, where both sides installed the AI-based MainLine product and Rail Vision led training

sessions for the mining company’s team. |

| ● | Announced

first-ever commercial installation of its AI-driven systems in a national railways line: In February 2024, Rail Vision announced

the first ever commercial installation of its AI-driven Main Line Systems in a national railways line, marking a significant milestone

in the Company’s journey towards revolutionizing railway safety and efficiency. A successful evaluation process resulted

in the purchase of ten Rail Vision Main Line Systems for $1.4 million by Israel Railways. |

Strengthening

IP protection:

In August 2024, Rail

Vision was granted patent approval from the United States Patent and Trademark Office for its innovative AI-based railway obstacle detection

system, which followed the Company receiving a notice of allowance from the Japan Patent Office for the same patent application in June

2024.

First Half 2024

Financial Results

| ● | Revenues

were $761,000 for the six months ended June 30, 2024, comprised from the mining

company that purchased a Rail Vision Main Line System, first installation of Rail Vision’s

Main Line Systems in Israel Railways and the successful delivery and installation of Rail

Vision’s Shunting Yard product to Loram. |

| ● | Research

and development (“R&D”) expenses for the six months ended June 30, 2024,

were $2,458,000, compared to R&D expenses of $3,682,000 in the six months ended June

30, 2023. The decrease in R&D expenses was primarily attributable to a decrease in R&D

salaries due to a reduction in workforce, including a reduction in the Company employee base

by 12 R&D employees and R&D equipment purchases. |

| ● | General

and administrative expenses for the six months ended June 30, 2024, were $2,116,000, compared

to $2,303,000 in the six months ended June 30, 2023. The decrease is primarily attributed

to a decrease in salaries and other administrative and operational costs, as part of the

process of reducing costs as mentioned above. |

| ● | As

a result of the foregoing, the Company’s operating loss for the six months ended June

30, 2024, was $4,185,000 compared to an operating loss of $5,985,000 for the six months ended

June 30, 2023. |

| ● | Financial

expenses amounted to $1,304,000 for the six months ended June 30, 2024, a decrease of $1,454,000,

compared to $150,000 financial income for the six months ended June 30, 2023. The decrease

was primarily attributable to the amortization of discount related to a convertible loan

credit facility that the Company entered into in January 2024. |

| ● | GAAP

net loss for the six months ended June 30, 2024, was $24,324,000, or $1.99 per ordinary share,

compared to a GAAP net loss of $5,835,000, or $2.69 per ordinary share, in the six months

ended June 30, 2023. |

| ● | Non-GAAP

net loss for the six months ended June 30, 2024, was $5,394,000 or $0.44 per ordinary share,

compared to a non-GAAP net loss of $5,671,000, or $2.62 per ordinary share, in the six months

ended June 30, 2023. |

| |

|

Six months ended

June 30, |

|

| (U.S. dollars in thousands, except share data and per share data) |

|

2024 |

|

|

2023 |

|

| GAAP Results |

|

|

|

|

|

|

| Net loss |

|

|

(24,324 |

) |

|

|

(5,835 |

) |

| Basic and diluted loss per share |

|

|

(1.99 |

) |

|

|

(2.69 |

) |

| Non-GAAP Results |

|

|

|

|

|

|

|

|

| Net loss |

|

|

(5,394 |

) |

|

|

(5,671 |

) |

| Basic and diluted loss per share |

|

|

(0.44 |

) |

|

|

(2.62 |

) |

A reconciliation between GAAP operating

results and non-GAAP operating results is provided in the financial statements that are part of this release. Non-GAAP results exclude

stock-based compensation expenses and revaluation of derivative warrant liabilities.

| ● | As

of June 30, 2024, cash and cash equivalents were $9.7 million, compared to $3.1 million as

of December 31, 2023. The increase compared to December 31, 2023, is mainly due to the proceeds

received from a private placement and credit facility and from warrants exercised by shareholders

that occurred in the first half of 2024, totaling $11.5 million gross ($11.3 net proceeds),

less cash used during the first half of 2024. |

Use of Non-GAAP

Financial Results

In addition to disclosing financial results calculated

in accordance with United States generally accepted accounting principles (GAAP), the company’s earnings release contains non-GAAP financial

measures of net loss for the period that excludes the effect of stock-based compensation expenses and revaluation of derivative warrant

liabilities. The company’s management believes the non-GAAP financial information provided in this release is useful to investors’

understanding and assessment of the company’s on-going operations. Management also uses both GAAP and non-GAAP information in evaluating

and operating business internally and as such deemed it important to provide all this information to investors. The non-GAAP financial

measures disclosed by the company should not be considered in isolation or as a substitute for, or superior to, financial measures calculated

in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements

should be carefully evaluated. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of these

Non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures and not rely on any single financial measure

to evaluate the company’s business. For more information on the non-GAAP financial measures, please see the “Reconciliation

of GAAP to Non-GAAP Financial Measures” later in this release. This accompanying table has more details on the GAAP financial measures

that are most directly comparable to non-GAAP financial measures and the related reconciliations between these financial measures.

About Rail Vision

Ltd.

Rail Vision is a development

stage technology company that is seeking to revolutionize railway safety and the data-related market. The company has developed cutting

edge, artificial intelligence based, industry-leading technology specifically designed for railways. The company has developed its railway

detection and systems to save lives, increase efficiency, and dramatically reduce expenses for the railway operators. Rail Vision believes

that its technology will significantly increase railway safety around the world, while creating significant benefits and adding value

to everyone who relies on the train ecosystem: from passengers using trains for transportation to companies that use railways to deliver

goods and services. In addition, the company believes that its technology has the potential to advance the revolutionary concept of autonomous

trains into a practical reality. For more information, please visit https://www.railvision.io/

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act and other securities laws. Words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates”

and similar expressions or variations of such words are intended to identify forward-looking statements. For example, the Company is using

forward-looking statements when it discusses its commitment to excellence and innovation, as it continues to implement solutions that

meet and exceed customer expectations. Forward-looking statements are not historical facts, and are based upon management’s current

expectations, beliefs and projections, many of which, by their nature, are inherently uncertain. Such expectations, beliefs and projections

are expressed in good faith. However, there can be no assurance that management’s expectations, beliefs and projections will be

achieved, and actual results may differ materially from what is expressed in or indicated by the forward-looking statements. Forward-looking

statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed

in the forward-looking statements. For a more detailed description of the risks and uncertainties affecting the Company, reference is

made to the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), including,

but not limited to, the risks detailed in the Company’s annual report on Form 20-F filed with the SEC on March 28, 2024. Forward-looking

statements speak only as of the date the statements are made. The Company assumes no obligation to update forward-looking statements to

reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward-looking

information except to the extent required by applicable securities laws. If the Company does update one or more forward-looking statements,

no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward-looking

statements. References and links to websites have been provided as a convenience, and the information contained on such websites is not

incorporated by reference into this press release. Rail Vision is not responsible for the contents of third-party websites.

Contacts

Shahar Hania

Chief Executive Officer

Rail Vision Ltd.

15 Ha’Tidhar St

Ra’anana, 4366517 Israel

Telephone: +972- 9-957-7706

Investor Relations:

Michal Efraty

investors@railvision.io

Rail Vision Ltd.

INTERIM CONDENSED BALANCE SHEETS

(U.S. dollars in thousands, except share

data and per share data)

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 9,691 | | |

$ | 3,066 | |

| Restricted cash | |

| 215 | | |

| 223 | |

| Accounts receivable | |

| 135 | | |

| -- | |

| Inventories | |

| 968 | | |

| 977 | |

| Other current assets | |

| 354 | | |

| 336 | |

| Total current assets | |

| 11,363 | | |

| 4,602 | |

| | |

| | | |

| | |

| Non-current Assets: | |

| | | |

| | |

| Operating lease - right of use asset | |

| 738 | | |

| 889 | |

| Fixed assets, net | |

| 351 | | |

| 430 | |

| | |

| 1,089 | | |

| 1,319 | |

| | |

| | | |

| | |

| Total assets | |

| 12,452 | | |

| 5,921 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade accounts payables | |

| 88 | | |

| 185 | |

| Current operating lease liability | |

| 282 | | |

| 285 | |

| Other accounts payable | |

| 1,823 | | |

| 2,140 | |

| Total current liabilities | |

| 2,193 | | |

| 2,610 | |

| | |

| | | |

| | |

| Non-current operating lease liability | |

| 363 | | |

| 524 | |

| | |

| | | |

| | |

| Total liabilities | |

| 2,556 | | |

| 3,134 | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Ordinary shares | |

| -- | | |

| 68 | |

| Additional paid in capital | |

| 100,182 | | |

| 68,681 | |

| Accumulated deficit | |

| (90,286 | ) | |

| (65,962 | ) |

| Total shareholders’ equity | |

| 9,896 | | |

| 2,787 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

| 12,452 | | |

| 5,921 | |

Rail Vision Ltd.

UNAUDITED INTERIM CONDENSED STATEMENTS OF

COMPREHENSIVE LOSS

(U.S. dollars in thousands, except share

data and per share data)

| | |

Six months ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 761 | | |

$ | -- | |

| Cost of revenues | |

| (372 | ) | |

| -- | |

| Gross profit | |

| 389 | | |

| -- | |

| | |

| | | |

| | |

| Research and development expenses | |

| (2,458 | ) | |

| (3,682 | ) |

| General and administrative expenses | |

| (2,116 | ) | |

| (2,303 | ) |

| | |

| | | |

| | |

| Operating loss | |

| (4,185 | ) | |

| (5,985 | ) |

| | |

| | | |

| | |

| Financial (expenses) income: | |

| | | |

| | |

| Revaluation of derivative warrant liabilities | |

| (18,835 | ) | |

| -- | |

| Other financing income (expenses), net | |

| (1,304 | ) | |

| 150 | |

| Net loss for the period | |

| (24,324 | ) | |

| (5,835 | ) |

| | |

| | | |

| | |

| Basic and diluted loss per share | |

| (1.99 | ) | |

| (2.69 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding used to compute basic and diluted loss per ordinary share | |

| 12,193,918 | | |

| 2,167,170 | |

Rail Vision Ltd.

UNAUDITED INTERIM CONDENSED STATEMENTS OF

CHANGES IN TEMPORARY EQUITY AND SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share

data and per share data)

| |

|

Ordinary Shares |

|

|

Additional |

|

|

|

|

|

Total |

|

| |

|

Number of

shares |

|

|

USD |

|

|

paid in

capital |

|

|

Accumulated

Deficit |

|

|

shareholders’

equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of January 1, 2024 |

|

|

2,998,278 |

|

|

|

68 |

|

|

|

68,681 |

|

|

|

(65,962 |

) |

|

|

2,787 |

|

| Cancelation of the par value of ordinary shares |

|

|

-- |

|

|

|

(68 |

) |

|

|

68 |

|

|

|

-- |

|

|

|

-- |

|

| Issuance of units of ordinary shares and pre-funded warrants, net of issuance costs (*) |

|

|

3,554,200 |

(**) |

|

|

-- |

|

|

|

1,404 |

|

|

|

-- |

|

|

|

1,404 |

|

| Exercise of warrants to ordinary shares, net of issuance costs (***) |

|

|

12,258,487 |

|

|

|

-- |

|

|

|

23,791 |

|

|

|

-- |

|

|

|

23,791 |

|

| Classification of warrant liabilities to equity warrants |

|

|

-- |

|

|

|

-- |

|

|

|

6,143 |

|

|

|

-- |

|

|

|

6,143 |

|

| Share-based payment |

|

|

-- |

|

|

|

-- |

|

|

|

95 |

|

|

|

-- |

|

|

|

95 |

|

| Net loss for the period |

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

|

|

(24,324 |

) |

|

|

(24,324 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of June 30, 2024 |

|

|

18,810,965 |

|

|

|

-- |

|

|

|

100,182 |

|

|

|

(90,286 |

) |

|

|

9,896 |

|

| (*) | Issuance costs in the amount of approximately $39. |

| (**) | Including 1,902,742 Pre-funded Warrants which were exercised

to 1,902,742 ordinary shares during February and March 2024. |

| (***) | Issuance costs in the amount of approximately $187. |

Rail Vision Ltd.

UNAUDITED INTERIM CONDENSED STATEMENTS OF

CHANGES IN TEMPORARY EQUITY AND

SHAREHOLDERS’ EQUITY (Cont.)

(U.S. dollars in thousands, except share

data and per share data)

| | |

Ordinary Shares | | |

Additional | | |

| | |

Total | |

| | |

Number of

shares | | |

USD | | |

paid in

capital | | |

Accumulated

Deficit | | |

shareholders’

equity | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of January 1, 2023 | |

| 1,987,005 | | |

| 46 | | |

| 63,033 | | |

| (54,814 | ) | |

| 8,265 | |

| Issuance of shares as a result of exercise of warrants | |

| 24,431 | | |

| 1 | | |

| (1 | ) | |

| -- | | |

| -- | |

| Issuance of units of ordinary shares and warrants, net of issuance costs (*) | |

| 986,842 | | |

| 21 | | |

| 5,374 | | |

| -- | | |

| 5,395 | |

| Share-based payment | |

| -- | | |

| -- | | |

| 165 | | |

| -- | | |

| 165 | |

| Net loss for the period | |

| -- | | |

| -- | | |

| -- | | |

| (5,835 | ) | |

| (5,835 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of June 30, 2023 | |

| 2,998,278 | | |

| 68 | | |

| 68,571 | | |

| (60,649 | ) | |

| 7,990 | |

| (*) | Issuance expenses in the amount of approximately $603. |

Rail Vision Ltd.

INTERIM CONDENSED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(U.S. dollars in thousands)

| | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities | |

| | |

| |

| Net loss for the period | |

$ | (24,324 | ) | |

$ | (5,835 | ) |

| | |

| | | |

| | |

| Adjustments to reconcile loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 85 | | |

| 80 | |

| Share-based payment | |

| 95 | | |

| 165 | |

| Change in operating lease liability | |

| (13 | ) | |

| (39 | ) |

| Effect of exchange rate changes on cash and cash equivalents | |

| 56 | | |

| -- | |

| Revaluation of derivative warrant liabilities | |

| 18,835 | | |

| -- | |

| Amortization of a discount related to a convertible loan credit facility | |

| 1,229 | | |

| -- | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| Increase in accounts receivables | |

| (135 | ) | |

| -- | |

| Increase in other current assets | |

| (18 | ) | |

| (80 | ) |

| Decrease (increase) in Inventories | |

| 9 | | |

| (491 | ) |

| Increase (decrease) in trade accounts payable | |

| (97 | ) | |

| 167 | |

| Increase (decrease) in other accounts payable | |

| (317 | ) | |

| 624 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (4,595 | ) | |

| (5,409 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of fixed assets | |

| (6 | ) | |

| (137 | ) |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| (6 | ) | |

| (137 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from a convertible loan credit facility and issuance of warrants | |

| 1,500 | | |

| -- | |

| Payments on convertible loan credit facility | |

| (1,000 | ) | |

| -- | |

| Proceeds from exercise of warrants, net of issuance expenses | |

| 7,813 | | |

| -- | |

| Proceeds from issuance of shares and warrants, net of issuance expenses | |

| 2,961 | | |

| 5,460 | |

| | |

| | | |

| | |

| Net cash provided by financing activities | |

| 11,274 | | |

| 5,460 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (56 | ) | |

| -- | |

| Increase (Decrease) in cash, cash equivalents and restricted cash | |

| 6,617 | | |

| (86 | ) |

| Cash, cash equivalents and restricted cash at the beginning of the period | |

| 3,289 | | |

| 8,492 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at the end of the period | |

$ | 9,906 | | |

$ | 8,406 | |

| Non Cash Activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Conversion of a convertible loan credit facility to ordinary shares | |

| 500 | | |

| -- | |

| Issuance expenses recorded in other accounts payables | |

| -- | | |

| 65 | |

Rail Vision Ltd.

RECONCILIATION OF GAAP TO NON-GAAP Financial

Measures

(U.S. dollars in thousands, except share

data and per share data)

| | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| GAAP operating loss | |

| (4,185 | ) | |

| (5,985 | ) |

| Stock-based compensation in research and development expenses | |

| 18 | | |

| 28 | |

| Stock-based compensation in general and administrative expenses | |

| 77 | | |

| 136 | |

| Non-GAAP operating loss | |

| (4,090 | ) | |

| (5,821 | ) |

| | |

| | | |

| | |

| GAAP Revaluation of derivative warrant liability expenses | |

| (18,835 | ) | |

| -- | |

| Revaluation of derivative warrant liabilities | |

| 18,835 | | |

| -- | |

| Non-GAAP Revaluation of derivative warrant liabilities expenses | |

| -- | | |

| -- | |

| | |

| | | |

| | |

| GAAP net loss | |

| (24,324 | ) | |

| (5,835 | ) |

| Stock-based compensation expenses | |

| 95 | | |

| 164 | |

| Revaluation of derivative warrant liability expenses | |

| 18,835 | | |

| -- | |

| Non-GAAP net loss | |

| (5,394 | ) | |

| (5,671 | ) |

| | |

| | | |

| | |

| GAAP Basic and diluted loss per share | |

| (1.99 | ) | |

| (2.69 | ) |

| Non-GAAP Basic and diluted loss per share | |

| (0.44 | ) | |

| (2.62 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding used to compute basic and diluted loss per ordinary share | |

| 12,193,918 | | |

| 2,167,170 | |

11

Exhibit 99.2

Rail Vision Ltd.

INTERIM CONDENSED FINANCIAL STATEMENTS

As of June 30, 2024

U.S. DOLLARS IN THOUSANDS

(Except share and per share data)

(UNAUDITED)

Rail Vision Ltd.

INTERIM CONDENSED FINANCIAL STATEMENTS

As of June 30, 2024

U.S. DOLLARS IN THOUSANDS

(Except share and per share data)

(UNAUDITED)

INDEX

Rail Vision Ltd.

INTERIM CONDENSED BALANCE SHEETS

(U.S. dollars in thousands, except share

data and per share data)

| | |

June 30,

2024 | | |

December 31,

2023 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 9,691 | | |

$ | 3,066 | |

| Restricted cash | |

| 215 | | |

| 223 | |

| Accounts receivable | |

| 135 | | |

| – | |

| Inventories | |

| 968 | | |

| 977 | |

| Other current assets | |

| 354 | | |

| 336 | |

| Total current assets | |

| 11,363 | | |

| 4,602 | |

| | |

| | | |

| | |

| Non-current Assets: | |

| | | |

| | |

| Operating lease - right of use asset | |

| 738 | | |

| 889 | |

| Fixed assets, net | |

| 351 | | |

| 430 | |

| | |

| 1,089 | | |

| 1,319 | |

| | |

| | | |

| | |

| Total assets | |

| 12,452 | | |

| 5,921 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade accounts payables | |

| 88 | | |

| 185 | |

| Current operating lease liability | |

| 282 | | |

| 285 | |

| Other accounts payable | |

| 1,823 | | |

| 2,140 | |

| Total current liabilities | |

| 2,193 | | |

| 2,610 | |

| | |

| | | |

| | |

| Non-current operating lease liability | |

| 363 | | |

| 524 | |

| | |

| | | |

| | |

| Total liabilities | |

| 2,556 | | |

| 3,134 | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Ordinary shares | |

| -- | | |

| 68 | |

| Additional paid in capital | |

| 100,182 | | |

| 68,681 | |

| Accumulated deficit | |

| (90,286 | ) | |

| (65,962 | ) |

| Total shareholders’ equity | |

| 9,896 | | |

| 2,787 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

| 12,452 | | |

| 5,921 | |

The accompanying notes are an integral part of the financial statements.

Rail Vision Ltd.

UNAUDITED INTERIM CONDENSED STATEMENTS OF

COMPREHENSIVE LOSS

(U.S. dollars in thousands, except share

data and per ordinary share data)

| | |

Six months ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 761 | | |

$ | – | |

| Cost of revenues | |

| (372 | ) | |

| – | |

| Gross profit | |

| 389 | | |

| – | |

| | |

| | | |

| | |

| Research and development expenses | |

| (2,458 | ) | |

| (3,682 | ) |

| | |

| | | |

| | |

| General and administrative expenses | |

| (2,116 | ) | |

| (2,303 | ) |

| | |

| | | |

| | |

| Operating loss | |

| (4,185 | ) | |

| (5,985 | ) |

| | |

| | | |

| | |

| Financial (expenses) income: | |

| | | |

| | |

| Revaluation of derivative warrant liabilities | |

| (18,835 | ) | |

| – | |

| Other financing income (expenses), net | |

| (1,304 | ) | |

| 150 | |

| | |

| | | |

| | |

| Net loss for the period | |

| (24,324 | ) | |

| (5,835 | ) |

| | |

| | | |

| | |

Basic and diluted loss per share | |

| (1.99 | ) | |

| (2.69 | ) |

| | |

| | | |

| | |

Weighted average number of shares outstanding used to compute basic and diluted loss per ordinary share | |

| 12,193,918 | | |

| 2,167,170 | |

The accompanying notes are an integral part of the financial statements.

Rail Vision Ltd.

UNAUDITED INTERIM CONDENSED STATEMENTS OF

CHANGES IN SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share

data and per share data)

| | |

Ordinary Shares | | |

Additional | | |

| | |

Total | |

| | |

Number of

shares | | |

USD | | |

paid in

capital | | |

Accumulated

Deficit | | |

shareholders’

equity | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance as of January 1, 2024 | |

| 2,998,278 | | |

| 68 | | |

| 68,681 | | |

| (65,962 | ) | |

| 2,787 | |

| Cancelation of the par value of ordinary shares (See Note 3E) | |

| – | | |

| (68 | ) | |

| 68 | | |

| – | | |

| – | |

| Issuance of units of ordinary shares and pre-funded warrants, net of issuance costs (*) | |

| 3,554,200 | (**) | |

| – | | |

| 1,404 | | |

| – | | |

| 1,404 | |

| Exercise of warrants to ordinary shares, net of issuance costs (***) | |

| 12,258,487 | | |

| – | | |

| 23,791 | | |

| – | | |

| 23,791 | |

| Classification of warrant liabilities to equity warrants (See Note 3A) | |

| – | | |

| – | | |

| 6,143 | | |

| – | | |

| 6,143 | |

| Share-based payment | |

| – | | |

| – | | |

| 95 | | |

| – | | |

| 95 | |

| Net loss for the period | |

| – | | |

| – | | |

| – | | |

| (24,324 | ) | |

| (24,324 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of June 30, 2024 | |

| 18,810,965 | | |

| – | | |

| 100,182 | | |

| (90,286 | ) | |

| 9,896 | |

Rail Vision Ltd.

UNAUDITED INTERIM CONDENSED STATEMENTS OF

CHANGES IN SHAREHOLDERS’ EQUITY (Cont.)

(U.S. dollars in thousands, except share

data and per share data)

| | |

Ordinary

Shares | | |

Additional | | |

| | |

Total | |

| | |

Number

of

shares | | |

USD | | |

paid

in

capital | | |

Accumulated

Deficit | | |

shareholders’

equity | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as of January 1, 2023 | |

| 1,987,005 | | |

| 46 | | |

| 63,033 | | |

| (54,814 | ) | |

| 8,265 | |

| Issuance

of shares as a result of exercise of warrants | |

| 24,431 | | |

| 1 | | |

| (1 | ) | |

| – | | |

| – | |

| Issuance

of units of ordinary shares and warrants, net of issuance costs (*) | |

| 986,842 | | |

| 21 | | |

| 5,374 | | |

| – | | |

| 5,395 | |

| Share-based

payment | |

| – | | |

| – | | |

| 165 | | |

| – | | |

| 165 | |

| Net

loss for the period | |

| – | | |

| – | | |

| – | | |

| (5,835 | ) | |

| (5,835 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as of June 30, 2023 | |

| 2,998,278 | | |

| 68 | | |

| 68,571 | | |

| (60,649 | ) | |

| 7,990 | |

The accompanying notes are an integral part of the consolidated

financial statements.

Rail Vision Ltd.

INTERIM CONDENSED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(U.S. dollars in thousands)

| | |

Six months ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating activities | |

| | |

| |

| Net loss for the period | |

$ | (24,324 | ) | |

$ | (5,835 | ) |

| | |

| | | |

| | |

| Adjustments to reconcile loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 85 | | |

| 80 | |

| Share-based payment | |

| 95 | | |

| 165 | |

| Change in operating lease liability | |

| (13 | ) | |

| (39 | ) |

| Effect of exchange rate changes on cash and cash equivalents | |

| 56 | | |

| – | |

| Revaluation of derivative warrant liabilities | |

| 18,835 | | |

| – | |

| Amortization of a discount related to a convertible loan credit facility | |

| 1,229 | | |

| – | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| Increase in accounts receivables | |

| (135 | ) | |

| – | |

| Increase in other current assets | |

| (18 | ) | |

| (80 | ) |

| Decrease (increase) in Inventories | |

| 9 | | |

| (491 | ) |

| Increase (decrease) in trade accounts payable | |

| (97 | ) | |

| 167 | |

| Increase (decrease) in other accounts payable | |

| (317 | ) | |

| 624 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (4,595 | ) | |

| (5,409 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of fixed assets | |

| (6 | ) | |

| (137 | ) |

| | |

| | | |

| | |

| Net cash used in investing activities | |

| (6 | ) | |

| (137 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from a convertible loan credit facility and issuance of warrants | |

| 1,500 | | |

| – | |

| Payments on convertible loan credit facility | |

| (1,000 | ) | |

| – | |

| Proceeds from exercise of warrants, net of issuance expenses | |

| 7,813 | | |

| – | |

| Proceeds from issuance of shares and warrants, net of issuance expenses | |

| 2,961 | | |

| 5,460 | |

| | |

| | | |

| | |

| Net cash provided by financing activities | |

| 11,274 | | |

| 5,460 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (56 | ) | |

| – | |

| Increase (Decrease) in cash, cash equivalents and restricted cash | |

| 6,617 | | |

| (86 | ) |

| Cash, cash equivalents and restricted cash at the beginning of the period | |

| 3,289 | | |

| 8,492 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at the end of the period | |

$ | 9,906 | | |

$ | 8,406 | |

| | |

| | | |

| | |

| Non Cash Activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Conversion of a convertible loan credit facility to ordinary shares | |

| 500 | | |

| – | |

| Issuance expenses recorded in other accounts payables | |

| -- | | |

| 65 | |

The accompanying notes are an integral part

of the consolidated financial statements.

Rail Vision Ltd.

Notes to the Interim Condensed Consolidated

Financial Statements (Unaudited)

(U.S. dollars in thousands, except share

and per share data and exercise prices)

NOTE 1 – GENERAL

Rail Vision Ltd. (the “Company”)

was incorporated and registered in Israel on April 18, 2016. The Company is a development-stage technology company that is engaged in

the design, development and assembly of railway detection systems designed to solve the challenges in railway operational safety, efficiency

and predictive maintenance. The Company’s railway detection systems include different types of cameras, including optics, visible

light spectrum cameras (video) and thermal cameras that transmit data to a ruggedized on-board computer which is designed to be suitable

for the rough environment of a train’s locomotive.

These interim condensed financial statements

should be read in conjunction with the Company’s audited financial statements as of December 31, 2023 and for the year ended on

that date, and the accompanying notes included in the Company’s Annual Report on Form 20-F, filed with the Securities and Exchange

Commission on March 28, 2024.

The Company’s activities are

subject to significant risks and uncertainties. The Company has incurred significant losses since the date of its inception, and anticipates

that it will continue to incur significant losses until it will be able to successfully commercialize its products. Failure to obtain

this necessary capital when needed may force the Company to delay, limit or terminate its product development efforts or other operations. In

addition, the Company is subject to risks from, among other things, competition associated with the industry in general, other risks associated

with financing, liquidity requirements, rapidly changing customer requirements, the loss of key personnel and the effect of planned expansion

of operations on the future results of the Company.

To date, the Company has not generated

significant revenues from its activities and has incurred substantial operating losses. Management expects the Company to continue to

generate substantial operating losses and to continue to fund its operations primarily through the utilization of its current financial

resources, sales of its products, and through additional raises of capital.

As described in note 3A and note 3B,

during the reported period and subsequent to the balance sheet date, the Company raised approximately $12 million as part of issuance

of shares, proceeds from a convertible loan credit facility and exercises of warrants, and according to the current monthly burn rate,

the management anticipates that its cash and cash equivalents as of the issuance date of the financial statements and the future expected

cash flow from sales will be sufficient for 12 months of operations.

NOTE 2 – BASIS OF PRESENTATION AND

SIGNIFICANT ACCOUNTING POLICIES

| A. | Unaudited Interim Financial Statements |

The accompanying unaudited interim

condensed financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”)

for interim financial information. Accordingly, they do not include all the information and footnotes required by GAAP for complete financial

statements. In management’s opinion, the unaudited interim financial statements have been prepared on the same basis as the annual

financial statements and reflect all adjustments, which include only normal recurring adjustments necessary for the fair presentation

of the Company’s financial position as of June 30, 2024, and the Company’s results of operations and cash flows for the six

months ended June 30, 2024, and 2023. For further information, reference is made to the financial statements and footnotes thereto included

in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023.

The results of operations for the six

months ended June 30, 2024, are not necessarily indicative of the results that may be expected for the year ending December 31, 2024.

Rail Vision Ltd.

Notes to the Interim Condensed Consolidated

Financial Statements (Unaudited)

(U.S. dollars in thousands, except share and

per share data and exercise prices)

NOTE 2 – BASIS OF PRESENTATION AND

SIGNIFICANT ACCOUNTING POLICIES (Cont.)

| B. | Significant Accounting Policies |

The significant accounting policies

followed in the preparation of these unaudited interim condensed financial statements are identical to those applied in the preparation

of the latest annual financial statements, other than:

Warrants liabilities

The Company evaluated the warrants

in accordance with ASC 815 “Derivatives and Hedging - Contracts in Entity’s Own Equity” (“ASC 815”) and

concluded that a provision in the warrant agreement related to certain tender or exchange offers precludes the warrants from being accounted

for as components of equity. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance

and as of each subsequent period end date while the warrants are outstanding. As the warrants meet the definition of a derivative as contemplated

in ASC 815, the warrants are recorded as derivative liabilities on the balance sheet and measured at fair value at inception and at each

reporting date thereafter in accordance with ASC 820 “Fair Value Measurement” (“ASC 820”), with changes in fair

value recognized in the condensed statements of comprehensive loss in the period of change.

Fair Value of Financial Instruments

ASC 820 “Fair Value Measurements

and Disclosures” (“ASC 820”), defines fair value as the price that would be received from selling an asset or paid to

transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements

for assets and liabilities required to be recorded at fair value, the Company considers the principal or most advantageous market in which

it would transact. The Company also considers assumptions that market participants would use when pricing the asset or liability, such

as, inherent risk, transfer restrictions and risk of nonperformance. Hierarchical levels are directly related to the amount of subjectivity

with the inputs to the valuation of these assets or liabilities as follows:

Level 1 - Observable inputs such as

unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date;

Level 2 - Inputs (other than quoted

prices included in Level 1) are either directly or indirectly observable inputs for similar assets or liabilities. These include quoted

prices for identical or similar assets or liabilities in active markets and quoted prices for identical or similar assets of liabilities

in markets that are not active;

Level 3 - Unobservable inputs that

are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The carrying values of cash and cash

equivalents, restricted cash, accounts receivable, trade accounts payable, accrued expenses and employees and related expenses recorded

in other accounts payable, approximate their fair value due to the short-term maturity of these instruments.

The Company’s warrants liability

was classified within Level 3 of the fair value hierarchy because of the volatility input incorporated in the Company’s Black-Scholes

model at inception and on subsequent valuation dates involves unobservable inputs. The warrant liability was classified to equity on June

29, 2024. As of June 30, 2024, no liabilities were classified within level 3 of the fair value hierarchy.

The preparation of financial statements

in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the financial

statements and accompanying notes. Management believes that the estimates, judgments and assumptions used are reasonable based upon information

available at the time they are made. Actual results could differ from those estimates.

Rail Vision Ltd.

Notes to the Interim Condensed Consolidated

Financial Statements (Unaudited)

(U.S. dollars in thousands, except share and

per share data and exercise prices)

NOTE 3 – SIGNIFICANT EVENTS IN THE

REPORTING PERIOD

| A. | Execution of Credit Facility Agreement and Issuance of

Facility Warrant |

On January 9, 2024, the Company entered

into the Facility Agreement for a $6,000 credit facility (the “Credit Facility”) and an additional amount up to $3,000, subject

to certain conditions (the “Additional Loans”) with a global investment firm (the “Lender”).

The Credit Facility, which had an initial

term of 10 months, accrued interest at a rate of 8% per annum. The first payment of $1,500 was drawn down upon execution of the Facility

Agreement and the remaining amount was able to be drawn down in eight equal installments as of March 7, 2024. As detailed below, the Facility

Agreement terminated on March 1, 2024.

After the Credit Facility was exhausted,

the Company was able to draw down the Additional Loans in an aggregate amount up to $3,000. The Additional Loans included two initial

installments of up to $750, and two additional installments of up to $750, the latter of which were subject to certain conditions. The

Additional Loans accrued interest at a rate of 12% per annum.

In the event that the Company entered

into an alternate credit facility on more favorable terms, the Lender’s funding obligations under the Credit Facility were to decrease

with respect to the amount actually received by the Company under such alternate credit facility. The Lender’s financing obligations

were to terminate in the event the Company drew down $7,500 or more pursuant to an alternate credit facility or closed one or more equity

financing transaction in an aggregate amount of at least $5,000 (including the conversion of the Credit Facility as mentioned below).

As of March 1, 2024, in connection with the January 2024 PIPE (as defined in note 3B), the Company received aggregate gross proceeds of

more than $5,000 from the purchase of Units and exercise of warrants (see Note 3B below), and accordingly, the Lender’s financing

obligations terminated.

Until the Company closed one or more

equity financing transactions in an aggregate amount of at least $5,000, it had the right to convert an amount of up to $1,500 out of

the outstanding loan (including accrued interest) into ordinary shares of the Company, in connection with and in the framework of a financing

transaction of the Company on the date that followed the date upon which the Company notified the Lender of such financing transaction,

which conversion was to occur upon the same terms. In connection with the January 2024 PIPE (as defined in note 3B), the Company converted

$500 of the outstanding loan and issued to the Lender the Facility Conversion Pre-Funded Warrant and the Facility Conversion Common Warrant

(see Note 3B below).

In addition, the loan, together with

accrued interest, was required to be repaid at a rate of 30% of the gross proceeds of any equity financing transactions consummated by

the Company during the term of the Credit Facility, which met a minimum threshold aggregate amount (initially, $5,000 and increasing by

an additional $500 for each month during the term) until the loan is repaid in full. The repayment of the Credit Facility was required

to be made on the last day of each calendar month during which the sources for repayment specified above were actually received by the

Company. The loan was permitted be prepaid early without any penalty.

Rail Vision Ltd.

Notes to the Interim Condensed Consolidated

Financial Statements (Unaudited)

(U.S. dollars in thousands, except share and

per share data and exercise prices)

NOTE 3 – SIGNIFICANT EVENTS IN THE

REPORTING PERIOD (Cont.)

| A. | Execution of Credit Facility Agreement and Issuance of Facility Warrant (Cont.) |

As part of the Facility Agreement,

the Company issued a warrant (the “Facility Warrant”) to the Lender to purchase 2,419,354 ordinary shares of the Company representing

an aggregate exercise amount of $7,500, with a per share exercise price of $3.10, subject to certain adjustments and certain anti-dilution

protection. The Facility Warrant was exercisable upon issuance and has a term of 5 years from the date of issuance.

The Facility Warrants were classified

on the issuance date to warrant liabilities, as they were not considered indexed to the Company’s own equity.

The fair value of the Facility Warrants

at issuance date was $1,229 and the remaining amount of $271 was allocated to the convertible loan credit facility. On March 1, 2024,

the date of termination of the Credit Facility (as detailed above), the discount amount of $1,229 was fully amortized. As a result the

Company recorded an amount of $1,229 in “Other financing income (expenses), net”.

The January 2024 PIPE, as defined and

detailed in Note 3B below, triggered an anti-dilution protection and accordingly the exercise price of the Facility Warrant was adjusted

to $0.408 and the amount of ordinary shares issuable upon the exercise of the Facility Warrant was adjusted to 18,382,353 shares.

As of June 30, 2024, 6,720,000 Facility

Warrants have been exercised resulting in gross proceeds of approximately $2,742 to the Company.

The Facility Warrant agreement includes

some provisions that expired on June 29, 2024. The Company reassessed the Facility Warrants’ current terms and concluded that they were

no longer classified as a liability and that they are considered indexed to the Company’s own equity. As a result, the Company classified

its warrant liabilities to additional paid in capital in the amount of $6,143.

Subsequent to June 30, 2024 additional

1,300,000 Facility Warrants have been exercised resulting in additional gross proceeds of approximately $530 to the Company.

| B. | January 2024 private placement (“PIPE”) |

On January 18, 2024, the Company entered

into a binding term sheet directly with a global investment firm (the “Lead Investor”) for the purchase and sale in a private

placement (the “January 2024 PIPE”) of units (the “Units”) to the Lead Investor and other investors (collectively,

the “Investors”). Each Unit consists of (i) one ordinary share of the Company and (ii) one and a half warrants to purchase

ordinary shares of the Company of a minimum of $2,500 of Units and up to a maximum of $3,000 of Units. The January 2024 PIPE closed on

January 31, 2024 following the execution of definitive documentation between the Company and the Investors.

On January 30, 2024, the Company entered

into the definitive securities purchase agreement with the Investors for the issue of 3,046,457 Units consisting of (A) (i) 1,651,458

of the Company’s ordinary shares, and/or (ii) pre-funded warrants (the “PIPE Pre-Funded Warrants”) to purchase up to

1,394,999 ordinary shares and (B) common warrants (the “PIPE Common Warrants”) to purchase up to 4,569,688 ordinary shares.

The purchase price per Unit is $0.98475. The aggregate gross proceeds from the January 2024 PIPE were $3,000. $2,961 net of issuance costs.

The PIPE Pre-Funded Warrants are immediately

exercisable at an exercise price of $0.0001 per ordinary share, subject to certain adjustments and certain anti-dilution protection set

forth therein and will not expire until exercised in full. The PIPE Common Warrants are exercisable upon issuance at an exercise price

of $0.98475 per ordinary share, subject to certain adjustments and certain anti-dilution protection set forth therein and will have a

5.5-year term from the issuance date.

Rail Vision Ltd.

Notes to the Interim Condensed Consolidated

Financial Statements (Unaudited)

(U.S. dollars in thousands, except share and

per share data and exercise prices)

NOTE 3 – SIGNIFICANT EVENTS IN THE

REPORTING PERIOD (Cont.)

| B. | January 2024 private placement (“PIPE”) (Cont.) |

In

connection with the closing of the January 2024 PIPE, the Company exercised its conversion

right pursuant to the Credit Facility to convert $500 of the outstanding convertible loan credit facility that was extended to the Company

by the Lender of the Credit Facility. Following such conversion, the Company issued to the Lender 507,743 Units consisting of (i)

a pre-funded warrant (the “Facility Conversion Pre-Funded Warrant”) to purchase up to 507,743 ordinary shares and (ii) a common

warrant (the “Facility Conversion Common Warrant”) to purchase up to 761,615 ordinary shares. The Facility Conversion Pre-Funded

Warrant and the Facility Conversion Common Warrant are in substantially the same form and on substantially the same terms as the PIPE

Pre-Funded Warrant and PIPE Common Warrant, respectively.

The

PIPE Common Warrants and the Facility Conversion Common Warrant were classified on the issuance

date to warrant liabilities, as they were not considered indexed to the Company’s own equity.

As

of June 30, 2024, all of the January 2024 PIPE Pre-Funded Warrants, the Facility Conversion

Pre-Funded Warrants, the Facility Conversion Common Warrants and the January 2024

PIPE Warrants have been exercised resulting in gross proceeds of approximately $5,250 to the Company ($5,063 net of issuance costs).

| C. | A Leading US-Based Rail & Leasing Services Company Orders Rail Vision Switch Yard Systems Valued

at Up to $5 Million |

On January 17, 2024, a leading US-based

rail and leasing services company signed a supply contract with the Company for the purchase of the Company’s Switch Yard Systems.

The first phase of the contract is

valued at $1,000. Follow-on orders for additional Switch Yard Systems, valued at up to $4,000, are subject to customer approval. The contract

also includes specific purchase quotas that, if met, provide the customer with exclusivity in the North American industrial railyards

switching segment.

In April 2024, the Company received

an initial purchase order amounting to approximately $1,000 as part of this contract. The order is for the purchase of the Company’s

Shunting Yard systems, which are expected to be installed during the third quarter of this year.

In June 2024, the Company received

a follow-on order from this customer in the amount of approximately $200, which is in addition to the existing contract and refers to

additional services requested by the customer.

As of June 30, 2024, a payment received

from this customer in the amount of $375, was recorded as deferred revenues in other accounts payable.

| D. | In January 2024, investors from a private placement from May 2023 exercised 493,424 warrants to purchase

ordinary shares on a cashless basis. As a result of the cashless exercises, the Company issued 181,002 ordinary shares to such investors. |

| E. | On February 21, 2024, the Company convened an extraordinary general meeting of shareholders (the “Meeting”).

At the Meeting, the shareholders of the Company approved (i) the cancelation of the par value of the Company’s registered and issued

ordinary shares; (ii) an increase of the Company’s registered share capital from 12,500,000 ordinary shares to 100,000,000 ordinary

shares; and to amend the Company’s Amended and Restated Articles of Association accordingly. |

Rail Vision Ltd.

Notes to the Interim Condensed Consolidated

Financial Statements (Unaudited)

(U.S. dollars in thousands, except share and

per share data and exercise prices)

NOTE 3 – SIGNIFICANT EVENTS IN THE

REPORTING PERIOD (Cont.)

| F. | Purchase Order from Loram, a Top US-Based Railway Track Maintenance Supplier |

In April 2024, the Company received

an order for its Switch Yard System from Loram, a leading US- based provider of railway track maintenance equipment and services.

In June 2024, the Company completed

the successful delivery and installation of its Shunting Yard product to Loram. This installation fulfills the above mentioned purchase

order and marks the beginning of a pilot project aimed at enhancing Loram’s rail track maintenance operations with the Company’s

advanced technology. During the six months ended June 30, 2024, the Company recognized revenues from the sale of the system and the related

services in the total amount of approximately $145.

| G. | Israel Railways Commercial Agreement: |

In January 2023, the Company signed

an agreement with Israel Railways for the purchase by Israel Railways of ten Rail Vision Main Line Systems and related services for a

total amount of approximately $1,400.

In February 2024, the Company completed

the first installation of its Main Line Systems in Israel Railways. During the six months ended June 30, 2024, the Company recognized

revenues from this agreement in the total amount of approximately $101.

| H. | Purchase Order from a Leading Latin America Mining Company |

On October 17, 2023, the Company received

a purchase order in the amount of $492 for a single Main Line system and related services from a leading Latin American (“LATAM”)

mining company. On December 11, 2023, the Company completed the delivery of the Main Line system to the LATAM mining company but hadn’t

fully transferred the control on the system to the customer. In addition to the delivery of the system, the Company is providing supervision,

guidance, and training services as part of the $492 purchase order.

In June 2024, the Company received

a follow-on order from this customer for additional services, in the amount of approximately $24.

In June 2024, the Company completed

a successfully installation of its system at the LATAM mining company and led training sessions for the mining company’s team.

Accordingly, during the six months ended June 30, 2024, the Company recognized revenues from the above mentioned purchase orders, in the

total amount of approximately $516.

| I. | Purchase Order from a Class 1 US Railroad Company |

On March 11, 2024, the Company received

an order for its Switch Yard System from a Class 1 freight rail company in the US. The freight rail company will install and use the system

on its locomotive for evaluation and testing different scenarios related to safety.

On June 10, 2024, the Company completed

the successful installation of its Shunting Yard product for this customer and the customer will use the system on its locomotive for

evaluation in different scenarios related to safety and efficiency during a few months trial, expected to be completed in November 2024. As

the delivery of the system and the provision of services during the trial period were identified by the Company as a single performance

obligation, as of June 30, 2024, a payment received from this customer in the amount of $81, was recorded as deferred revenues in other

accounts payable. In addition, the Company recorded an amount of approximately $61 as deferred expenses

NOTE 4 – SUBSEQUENT EVENTS

| A. | Exercise of Facility Warrants - see Note 3A above. |

1.99

2.69

12193918

2167170

false

--12-31

Q2

2024-06-30

0001743905

0001743905

2024-01-01

2024-06-30

0001743905

2024-06-30

0001743905

2023-12-31

0001743905

2023-01-01

2023-06-30

0001743905

us-gaap:CommonStockMember

2023-12-31

0001743905

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001743905

us-gaap:RetainedEarningsMember

2023-12-31

0001743905

us-gaap:CommonStockMember

2024-01-01

2024-06-30

0001743905

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-06-30

0001743905

us-gaap:RetainedEarningsMember

2024-01-01

2024-06-30

0001743905

us-gaap:CommonStockMember

2024-06-30

0001743905

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001743905

us-gaap:RetainedEarningsMember

2024-06-30

0001743905

us-gaap:CommonStockMember

2022-12-31

0001743905

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001743905

us-gaap:RetainedEarningsMember

2022-12-31

0001743905

2022-12-31

0001743905

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001743905

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001743905

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001743905

us-gaap:CommonStockMember

2023-06-30

0001743905

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001743905

us-gaap:RetainedEarningsMember

2023-06-30

0001743905

2023-06-30

0001743905

2024-01-09

0001743905

rvsn:CreditFacilityAgreementMember

2024-01-01

2024-06-30

0001743905

rvsn:CreditFacilityAgreementMember

2024-03-07

2024-03-07

0001743905

rvsn:TwoInitialInstallmentsMember

2024-01-01

2024-06-30

0001743905

rvsn:TwoAdditionalInstallmentsMember

2024-01-01

2024-06-30

0001743905

2024-03-01

2024-03-01

0001743905

rvsn:EquityFinancingMember

2024-06-30

0001743905

rvsn:EquityFinancingMember

2024-01-01

2024-06-30

0001743905

rvsn:FacilityWarrantMember

2024-06-30

0001743905

rvsn:CreditFacilityAgreementMember

2024-01-01

2024-06-30

0001743905

rvsn:CreditFacilityAgreementMember

2024-06-30

0001743905

us-gaap:LineOfCreditMember

2024-06-30

0001743905

rvsn:FacilityWarrantMember

2024-01-01

2024-01-31

0001743905

rvsn:FacilityWarrantMember

2024-01-31

0001743905

2024-01-18

2024-01-18

0001743905

srt:MinimumMember

2024-01-18

2024-01-18

0001743905

srt:MaximumMember

2024-01-18

2024-01-18

0001743905

us-gaap:InvestorMember

2024-01-30

2024-01-30

0001743905

us-gaap:CommonStockMember

2024-01-30

2024-01-30

0001743905

rvsn:PIPEPreFundedWarrantsMember

2024-01-30

0001743905

rvsn:PIPECommonWarrantsMember

2024-01-30

0001743905

2024-01-30

2024-01-30

0001743905

rvsn:PIPEPreFundedWarrantsMember

2024-06-30

0001743905

rvsn:PIPECommonWarrantsMember

2024-06-30

0001743905

rvsn:AntidilutionMember

2024-01-01

2024-06-30

0001743905

rvsn:CreditFacilityAgreementMember

2024-06-30

0001743905

us-gaap:WarrantMember

2024-06-30

0001743905

rvsn:PIPEPreFundedWarrantsMember

2024-01-01

2024-06-30

0001743905

2024-01-31

0001743905

us-gaap:CommonStockMember

2024-01-31

0001743905

srt:MinimumMember

2024-02-21

0001743905

srt:MaximumMember

2024-02-21

0001743905

2023-01-01

2023-01-31

0001743905

2023-10-17

2023-10-17

0001743905

2023-12-11

2023-12-11

iso4217:USD

iso4217:USD

xbrli:shares

xbrli:shares

xbrli:pure

Exhibit 99.3

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

The

following discussion contains “forward-looking statements,” including statements regarding expectations, beliefs, intentions

or strategies for the future. These statements may identify important factors which could cause our actual results to differ materially

from those indicated by the forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on

such forward-looking statements. Factors that could cause our actual results to differ materially from those expressed or implied in such

forward-looking statements include, but are not limited to:

| |

● |

our lack of operating history; |

| |

● |

our current and future capital requirements and our belief that our existing cash will be sufficient to fund our operations for more than one year from the date that the financial statements are issued; |

| |

● |

our ability to manufacture, market and sell our products and to generate revenues; |

| |

● |

our ability to maintain our relationships with key partners and grow relationships with new partners; |

| |

● |

our ability to maintain or protect the validity of our U.S. and other patents and other intellectual property; |

| |

● |

our ability to launch and penetrate markets in new locations and new market segments; |

| |

● |

our ability to retain key executive members and hire additional personnel; |

| |

● |

our ability to maintain and expand intellectual property rights; |

| |

● |

interpretations of current laws and the passages of future laws; |

| |

● |

our ability to achieve greater regulatory compliance needed in existing and new markets; |

| |

● |

the overall demand for passenger and freight transport; |

| |

● |

our ability to achieve key performance milestones in our planned operational testing; |

| |

● |

our ability to establish adequate sales, marketing and distribution channels; |

| |

● |

acceptance of our business model by investors; |

| |

● |

our ability to maintain the listing of our ordinary shares on the Nasdaq Capital Market; |

| |

● |

security, political and economic instability in the Middle East that could harm our business, including due to the current war between Israel and Hamas; and |

| |

● |

other risks and uncertainties, including those listed in the section titled “Risk Factors” in our Annual Report on Form 20-F filed with the SEC on March 28, 2024, or the Annual Report. |

The

preceding list is not intended to be an exhaustive list of any forward-looking statements and are based on our beliefs, assumptions and

expectations of future performance, taking into account the information available to us. These statements are only predictions based upon

our current expectations and projections about future events. There are important factors that could cause our actual results to differ

materially from the results expressed or implied by the forward-looking statements.

The

forward-looking statements contained herein are based upon information available to our management as of the date hereof and, while we

believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements

should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information.

The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. Except as required

by law, we undertake no obligation to update publicly any forward-looking statements after the date hereof to conform these statements

to actual results or to changes in our expectations.

Operating Results.

The

following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial

statements and the related notes included in our Annual Report, as well as our unaudited condensed financial statements and the related

notes thereto for the six months ended June 30, 2024, included elsewhere in this Report on Form 6-K. The discussion below contains forward-looking

statements that are based upon our current expectations and are subject to uncertainty and changes in circumstances. Actual results may

differ materially from these expectations due to inaccurate assumptions and known or unknown risks and uncertainties.

The

following financial data in this narrative are expressed in thousands of U.S. dollars, except for share and per share data or as otherwise

noted.

Overview

We

are a development stage technology company that is seeking to revolutionize railway safety and the data-related market. We have developed

cutting edge, artificial intelligence based, industry-leading technology specifically designed for railways. We have developed our railway

detection and systems to save lives, increase efficiency, and dramatically reduce expenses for the railway operators. We believe that

our technology will significantly increase railway safety around the world, while creating significant benefits and adding value to everyone

who relies on the train ecosystem: from passengers using trains for transportation to companies that use railways to deliver goods and

services. In addition, we believe that our technology has the potential to advance the revolutionary concept of autonomous trains into

a practical reality.

Operating Expenses

Our

current operating expenses consist of two components — research and development expenses and general and administrative

expenses. To date, we have not generated significant revenues.

Research

and Development Expenses

Our

research and development expenses consist primarily of salaries and related personnel expenses (including share-based payments) and other

related research and development expenses.

The

following table discloses the breakdown of research and development expenses:

| | |

Six months ended

June 30, | |

| (in thousands of USD) | |

2024 | | |

2023 | |

| | |

| | |

| |

| Depreciation | |

$ | 76 | | |

$ | 71 | |

| Share-based payment | |

| 18 | | |

| 28 | |

| Payroll and related expenses | |

| 2,036 | | |

| 2,867 | |

| Equipment | |

| 89 | | |

| 442 | |

| Rent and office maintenance | |

| 202 | | |

| 208 | |

| Other | |

| 37 | | |

| 66 | |

| | |

| | | |

| | |

| Total | |

| 2,458 | | |

| 3,682 | |

General

and Administrative Expenses

General

and administrative expenses consist primarily of salaries and related expenses, professional service fees for accounting, legal and bookkeeping,

facilities, travel expenses and other general and administrative expenses.

The