Sinclair Announces Supplement to Confidential Offering Memorandum, Offer to Exchange and Consent Solicitation Statement Relating to the Exchange Offer and Consent Solicitation of 4.375% Second-Out First Lien Secured Notes of Sinclair Television Group

January 30 2025 - 7:00AM

Business Wire

Sinclair, Inc. (Nasdaq: SBGI), the “Company” or “Sinclair”)

today announced that Sinclair Television Group, Inc. (“STG” or the

“Issuer”) has supplemented and amended the Confidential Offering

Memorandum, Offer to Exchange and Consent Solicitation Statement,

dated as of January 27, 2025 (the “Offering Memorandum”) with

respect to the previously announced (i) private exchange offer (the

“Exchange Offer”) to Eligible Holders (as defined below) of 4.375%

Second-Out First Lien Secured Notes due 2032 (the “Exchange

Second-Out Notes”) for any and all of the Issuer’s outstanding

4.125% Senior Secured Notes due 2030 (the “Existing Notes”) and

(ii) the solicitation of consents (the “Consent Solicitation”) from

Eligible Holders of the Existing Notes, pursuant to a supplement

dated the date hereof (“Supplement No. 1”). Supplement No. 1 amends

certain terms of the asset sale covenant and the definition of

“Permitted Liens” that apply to the Exchange Second-Out Notes as

further set forth in Supplement No. 1.

Except as otherwise described under “Amendments to Description

of Exchange Second-Out Notes” in Supplement No. 1, the terms and

conditions of the Exchange Offer and the Consent Solicitation set

forth in the Offering Memorandum remain unchanged. Capitalized

terms not defined herein shall have the respective meanings

ascribed to them in the Offering Memorandum.

Important Information

The Exchange Offer and Consent Solicitation, including the

Issuer’s acceptance of validly tendered Existing Notes and payment

of the applicable consideration, is conditioned on the satisfaction

or waiver of certain conditions precedent, including, but not

limited to, the Transactions Condition, as further described in the

Offering Memorandum. The Issuer may terminate, withdraw, amend or

extend the Exchange Offer and/or Consent Solicitation in its sole

discretion, subject to certain exceptions.

The Exchange Offer is being made, and the Exchange Second-Out

Notes are being offered and issued, only to holders of Existing

Notes who are reasonably believed to be (i) “qualified

institutional buyers” as defined in Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”) or (ii) not U.S.

persons (as defined in Regulation S under the Securities Act) or

purchasing for the account or benefit of U.S. persons, other than a

distributor, and are purchasing the Exchange Second-Out Notes in an

offshore transaction in accordance with Regulation S. The holders

of Existing Notes who are eligible to participate in the Exchange

Offer pursuant to the foregoing conditions are referred to as

“Eligible Holders.” Only Eligible Holders are authorized to receive

or review the Offering Memorandum or to participate in the Exchange

Offer and Consent Solicitation.

J.P. Morgan Securities LLC is acting as sole Dealer Manager for

the Exchange Offer and Consent Solicitation.

The Offering Memorandum will be distributed only to holders of

Existing Notes that complete and return a letter of eligibility

confirming that they are Eligible Holders. Copies of the

eligibility letter are available to holders through the information

and exchange agent for the Exchange Offer and Consent Solicitation,

Ipreo LLC, at (888) 593-9546 (U.S. toll-free) or (212) 849-3880

(Banks and Brokers) or ipreo-exchangeoffer@ihsmarkit.com.

The Exchange Offer and Consent Solicitation is made only by, and

pursuant to the terms of, the Offering Memorandum, and the

information in this news release is qualified by reference

thereto.

This press release shall not constitute an offer to sell or the

solicitation of an offer to exchange or purchase the Exchange

Second-Out Notes, nor shall there be any offer or exchange of the

Exchange Second-Out Notes in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful. In addition,

this press release is neither an offer to exchange or purchase nor

a solicitation of an offer to sell any Existing Notes in the

Exchange Offer or a solicitation of consents to the Proposed

Amendments, and this press release does not constitute a notice of

redemption with respect to any securities.

The Exchange Second-Out Notes have not been and will not be

registered under the Securities Act or any state securities laws

and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

requirements. Accordingly, the Exchange Second-Out Notes are being

offered for exchange only to persons reasonably believed to be (i)

“qualified institutional buyers” (as defined in Rule 144A under the

Securities Act) or (ii) not U.S. persons (as defined in Regulation

S under the Securities Act) or purchasing for the account or

benefit of U.S. persons, other than a distributor, and are

purchasing the Exchange Second-Out Notes in an offshore transaction

in accordance with Regulation S.

Forward-Looking

Statements:

The matters discussed in this news release, particularly those

in the section labeled “Outlook,” include forward-looking

statements regarding, among other things, the other Transactions.

When used in this news release, the words “outlook,” “intends to,”

“believes,” “anticipates,” “expects,” “achieves,” “estimates,” and

similar expressions are intended to identify forward-looking

statements. Such statements are subject to a number of risks and

uncertainties. Actual results in the future could differ materially

and adversely from those described in the forward-looking

statements as a result of various important factors, including and

in addition to the assumptions set forth therein, but not limited

to, the occurrence of any event, change or other circumstance that

could give rise to the termination of the other Transactions or the

Exchange Offer and/or Consent Solicitation, the ability to

negotiate and reach agreement on definitive documentation relating

to the other Transactions or the Exchange Offer and/or Consent

Solicitation, the ability to satisfy closing conditions to the

completion of the other Transactions or the Exchange Offer and/or

Consent Solicitation; the Company’s ability to achieve the

anticipated benefits from the other Transactions and the Exchange

Offer and/or Consent Solicitation; other risks related to the

completion of the other Transactions, the Exchange Offer or the

Consent Solicitation and actions related thereto, the Company’s

ability the rate of decline in the number of subscribers to

services provided by traditional and virtual multi-channel video

programming distributors; the Company’s ability to generate cash to

service its substantial indebtedness; the successful execution of

outsourcing agreements; the successful execution of retransmission

consent agreements; the successful execution of network and

Distributor affiliation agreements; the Company’s ability to

identify and consummate acquisitions and investments, to manage

increased financial leverage resulting from acquisitions and

investments, and to achieve anticipated returns on those

investments once consummated; the Company’s ability to compete for

viewers and advertisers; pricing and demand fluctuations in local

and national advertising; the appeal of the Company’s programming

and volatility in programming costs; material legal, financial and

reputational risks and operational disruptions resulting from a

breach of the Company’s information systems; the impact of FCC and

other regulatory proceedings against the Company; compliance with

laws and uncertainties associated with potential changes in the

regulatory environment affecting the Company’s business and growth

strategy; the impact of pending and future litigation claims

against the Company; the Company’s limited experience in operating

or investing in non-broadcast related businesses; and any risk

factors set forth in the Company’s recent reports on Form 10-Q

and/or Form 10-K, as filed with the Securities and Exchange

Commission. There can be no assurances that the assumptions and

other factors referred to in this release will occur. The Company

undertakes no obligation to publicly release the result of any

revisions to these forward-looking statements except as required by

law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130707511/en/

Investor Contacts: Chris King, VP, Investor Relations Billie-Jo

McIntire, VP, Corporate Finance (410) 568-1500

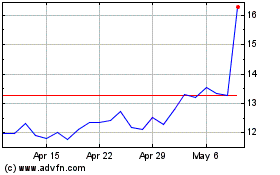

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Dec 2024 to Jan 2025

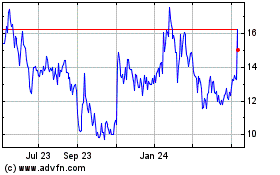

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Jan 2024 to Jan 2025