0000918965false00009189652024-06-302024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

ScanSource, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| SC | | 00-26926 | | 57-0965380 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

6 Logue Court, Greenville, SC 29615

(Address of principal executive offices, including zip code)

864-288-2432

(Registrant’s telephone number, including area code)

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, no par value | | SCSC | | NASDAQ Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On November 7, 2024, ScanSource, Inc. (the "Company") issued a press release announcing its financial results for its first quarter ended September 30, 2024. A copy of the press release and accompanying Earnings Infographic are attached as Exhibits 99.1 and 99.2 hereto and incorporated herein by reference and also made available through the Company’s website at www.scansource.com. An updated investor presentation will be made available on the Company's website within approximately two weeks.

The information in Item 2.02 of this Report, including the Exhibits 99.1 and 99.2 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any other filing under the Securities Act of 1933 or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 – Press release issued by ScanSource, Inc. on November 7, 2024. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Company’s annual and quarterly reports filed with the Securities and Exchange Commission.

99.2 – Earnings Infographic for the financial results conference call held on November 7, 2024. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Company’s annual and quarterly reports filed with the Securities and Exchange Commission.

| | | | | |

Exhibit

Number | Description |

| |

| 99.1 | |

| 99.2 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | ScanSource, Inc. |

| | | | |

| Date: | November 7, 2024 | | | | | | /s/ STEVE JONES |

| | | | | | | Steve Jones |

| | | | | | | Senior Executive Vice President and Chief Financial Officer |

FOR IMMEDIATE RELEASE

| | | | | | | | |

| Contact: | | |

| Steve Jones | | Mary M. Gentry |

| Senior EVP, Chief Financial Officer | | SVP, Treasurer and Investor Relations |

| ScanSource, Inc. | | ScanSource, Inc. |

| (864) 286-4302 | | (864) 286-4892 |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

Achieves Strong Q1 Free Cash Flow and EPS Growth

GREENVILLE, SC -- November 7, 2024 -- ScanSource, Inc. (NASDAQ: SCSC), a leading hybrid distributor connecting devices to the cloud, today announced financial results for the first quarter ended September 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| First Quarter Summary | | |

| Q1 FY25 | | Q1 FY24 | | Change | | | | | | |

| (in thousands, except percentages and per share data) |

Select reported measures: | | | | | | | | | | | |

| Net sales | $ | 775,580 | | | $ | 876,305 | | | -11.5% | | | | | | |

| Gross profit | $ | 101,619 | | | $ | 106,508 | | | -4.6% | | | | | | |

| Gross profit margin % | 13.10 | % | | 12.15 | % | | 95bp | | | | | | |

| Operating income | $ | 17,630 | | | $ | 24,084 | | | -26.8% | | | | | | |

| GAAP net income | $ | 16,974 | | | $ | 15,432 | | | 10.0% | | | | | | |

| GAAP diluted EPS | $ | 0.69 | | | $ | 0.61 | | | 13.1% | | | | | | |

| | | | | | | | | | | |

Select Non-GAAP measures*: | | | | | | | | | | | |

| Adjusted EBITDA | $ | 35,666 | | | $ | 34,919 | | | 2.1% | | | | | | |

| Adjusted EBITDA margin % | 4.60 | % | | 3.98 | % | | 62bp | | | | | | |

| Non-GAAP net income | $ | 20,823 | | | $ | 18,728 | | | 11.2% | | | | | | |

| Non-GAAP diluted EPS | $ | 0.84 | | | $ | 0.74 | | | 13.5% | | | | | | |

| | | | | | | | | | | |

| Note: Margin % reflects measure as a percentage of sales. | | | | | | | | | | | |

| n/m - not meaningful | | | | | | | | | | | |

* Represents non-GAAP financial measures. For more information and a reconciliation to the most directly comparable GAAP financial measure, see "Non-GAAP Financial Information" below as well as the accompanying Supplementary Information. |

| | | | | | | | | | | |

| | | | | | | | | | | |

“In the first quarter, our team delivered strong free cash flow and EPS growth in a soft demand environment,” said Mike Baur, Chairman and CEO, ScanSource, Inc. “Our results demonstrate our hybrid distribution success with our focus on specialty technologies and Intelisys & advisory recurring revenue.”

New Reporting Segments

Effective July 1, 2024, ScanSource realigned its operating segments to represent the different sales models it uses in executing its hybrid distribution growth strategy. The two realigned operating segments are Specialty Technology Solutions and Intelisys & Advisory. The Specialty Technology Solutions segment combines the Company’s former segments, with the exception of the Company’s Intelisys business. The Intelisys & Advisory segment includes the Company’s Intelisys and technology advisors businesses, including Channel Exchange (formerly known as intY USA), RPM and Resourcive. Both segments include recurring revenue.

ScanSource has reclassified certain prior period amounts in the accompanying Supplementary Information under “Segment Information” to conform with the current quarter presentation. These reclassifications had no effect on the condensed consolidated financial results.

Quarterly Results

Net sales for the first quarter of fiscal year 2025 totaled $775.6 million, down 11.5% year-over-year, or down 10.7% for non-GAAP net sales (organic growth). Net sales for products and services decreased 12.5% year-over-year, while recurring revenue increased 18.8% year-over-year. Specialty Technology Solutions net sales for the first quarter decreased 11.9% year-over-year to $752.3 million primarily due to continued soft demand in a more cautious technology spending environment. Intelisys & Advisory net sales for the first quarter increased 4.1% year-over-year to $23.3 million primarily from an increase in Intelisys sales.

Gross profit for the first quarter of fiscal year 2025 decreased 4.6% year-over-year to $101.6 million with a gross profit margin of 13.10% versus 12.15% in the prior-year quarter. The gross profit margin reflects a higher contribution of recurring revenue in our overall revenue mix, which is recorded on a net basis and therefore contributes to a higher gross profit margin. For the first quarter of fiscal year 2025, the percentage of gross profit from recurring revenue increased to 31.8%.

For the first quarter of fiscal year 2025, operating income was $17.6 million compared to $24.1 million in the prior-year quarter. First quarter fiscal year 2025 non-GAAP operating income decreased to $27.5 million from $28.5 million in the prior-year quarter.

On a GAAP basis, net income for the first quarter of fiscal year 2025 totaled $17.0 million, or $0.69 per diluted share, compared to net income of $15.4 million, or $0.61 per diluted share, for the prior-year quarter. First quarter fiscal year 2025 non-GAAP net income totaled $20.8 million, or $0.84 per diluted share, up from $18.7 million, or $0.74 per diluted share, for the prior-year quarter.

On a non-GAAP basis, adjusted EBITDA for the first quarter of fiscal year 2025 increased 2.1% to $35.7 million, or 4.60% of net sales, compared to $34.9 million, or 3.98% of net sales, for the prior-year quarter.

Balance Sheet and Cash Flow

As of September 30, 2024, ScanSource had cash and cash equivalents of $145.0 million and total debt of $143.6 million.

ScanSource generated $44.8 million of operating cash flow and $42.5 million of free cash flow (non-GAAP) for the first quarter of fiscal 2025. ScanSource also had share repurchases of $28.1 million for the first quarter of fiscal 2025.

Acquisition of Resourcive

On August 8, 2024, ScanSource completed the acquisition of Resourcive, a leading technology advisor, included in the Intelisys & Advisory segment. Founded in 2001 in Pelham, NY, Resourcive delivers strategic IT sourcing solutions to the mid-market and enterprise, advising clients on value creation strategies that are enabled by technology. Starting with the acquisition of Resourcive, ScanSource is creating the advisory channel model of the future. This business is separate from ScanSource’s Intelisys business, the industry’s leading technology services distributor.

Acquisition of Advantix

On August 15, 2024, ScanSource completed the acquisition of Advantix, a VAR-focused, managed connectivity experience provider specializing in wireless enablement solutions, included in the Specialty Technology Solutions segment. Founded in 2001 in Frisco, Texas, Advantix enables mobility VARs to sell hardware combined with the recurring revenue stream from data connectivity. The Advantix acquisition is the launching point for ScanSource’s new Integrated Solutions Group (ISG). The ISG is focused on developing solutions and services that provide channel partners the opportunity to wrap additional value around their hardware offerings.

Annual Financial Outlook for Fiscal Year 2025

ScanSource reaffirms previously provided guidance set forth below for the full fiscal year ended June 30, 2025.

| | | | | | | | | | | | | | | | | |

| | FY25 Annual Outlook | | | | | | | |

| | | | | | | | | |

| Net sales | | $3.1 billion to $3.5 billion | | | | | | | |

| Adjusted EBITDA (non-GAAP) | | $140 million to $160 million | | | | | | | |

| Free cash flow (non-GAAP) | | At least $70 million | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Adjusted EBITDA is a non-GAAP measure, which excludes estimates for amortization of intangible assets, depreciation expense, and non-cash shared-based compensation expense. Free cash flow is a non-GAAP measure, which excludes the effect of estimated capital expenditures from estimated operating cash flow.

ScanSource believes that a quantitative reconciliation of such forward-looking information to the most directly comparable GAAP financial measure cannot be made without unreasonable efforts, because a reconciliation of these non-GAAP financial measures would require an estimate of future non-operating items such as acquisitions and divestitures, restructuring costs, impairment charges and other unusual or non-recurring items. Neither the timing nor likelihood of these events, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, a reconciliation of such forward-looking information to the most directly comparable GAAP financial measure is not provided.

Webcast Details and Earnings Infographic

At approximately 8:45 a.m. ET today, an Earnings Infographic, as a supplement to this press release and the earnings conference call, will be available on ScanSource's website, www.scansource.com (Investor Relations section). ScanSource will present additional information about its financial results and business in a conference call today, November 7, 2024, at 10:30 a.m. ET. A webcast of the call will be available for all interested parties and can be accessed at www.scansource.com (Investor Relations section). The webcast will be available for replay for 60 days.

Safe Harbor Statement

This press release contains “forward-looking” statements, including ScanSource's FY25 annual outlook, which involve risks and uncertainties, many of which are beyond ScanSource's control. No undue reliance should be placed on such statements, as any number of factors could cause actual results to differ materially from anticipated or forecasted results, including, but not limited to, the following factors, which are neither presented in order of importance nor weighted: macroeconomic conditions, including potential prolonged economic weakness, inflation, the failure to manage and implement ScanSource's growth strategy, credit risks involving ScanSource's larger customers and suppliers, changes in interest and exchange rates and regulatory regimes impacting ScanSource's international operations, risk to the business from a cyberattack, a failure of IT systems, failure to hire and retain quality employees, loss of ScanSource's major customers, relationships with key suppliers and customers or a termination or a modification of the terms under which it operates with these key suppliers and customers, changes in ScanSource's operating strategy, and other factors set forth in the "Risk Factors" contained in ScanSource's annual report on Form 10-K for the year ended June 30, 2024. Except as may be required by law, ScanSource expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this press release or otherwise.

Non-GAAP Financial Information

In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles ("GAAP"), ScanSource also discloses certain non-GAAP financial measures, which are summarized below. Non-GAAP financial measures are used to understand and evaluate performance, including comparisons from period to period. Non-GAAP results exclude items such as amortization of intangible assets related to acquisitions, acquisition and divestiture costs, gain on sale of business, and restructuring costs and include other non-GAAP adjustments.

Net sales on a constant currency basis excluding acquisitions and divestitures to calculate organic growth ("non-GAAP net sales"): ScanSource discloses the percentage change in net sales excluding the translation impact from changes in foreign currency exchange rates between reporting periods and excluding the net sales from acquisitions and divestitures prior to the first full year from the transaction date. This measure enhances the comparability between periods to help analyze underlying trends on an organic basis.

Adjusted earnings before interest expense, income taxes, depreciation, and amortization (“Adjusted EBITDA”): Adjusted EBITDA starts with net income and adds back interest expense, income tax expense, depreciation expense, amortization of intangible assets, changes in fair value of contingent considerations, and other non-GAAP adjustments, including acquisition and divestiture costs, gain/loss on sale of business, restructuring costs, cyberattack restoration costs, insurance recovery, tax recovery, and non-cash share-based compensation expense. Since Adjusted EBITDA excludes some non-cash costs of investing in ScanSource’s business and people, management believes that Adjusted EBITDA shows the profitability from the business operations more clearly. The Adjusted EBITDA margin is calculated as Adjusted EBITDA as a percentage of net sales.

Adjusted return on invested capital ("Adjusted ROIC"): Adjusted ROIC assists management in comparing ScanSource's performance over various reporting periods on a consistent basis because it removes from operating results the impact of items that do not reflect core operating performance. Management believes the calculation of Adjusted ROIC provides useful information to investors and is an additional relevant comparison of its performance. Adjusted ROIC is calculated as Adjusted EBITDA over invested capital. Invested capital is defined as average equity plus average daily funded interest-bearing debt for the period. Management believes the calculation of Adjusted ROIC provides useful information to investors and is an additional relevant comparison of ScanSource's performance during the year.

Free cash flow: ScanSource presents free cash flow as it is a measure used by management to measure our business. ScanSource believes this measure provides more information regarding liquidity and capital resources. Free cash flow is defined as cash flows from operating activities less capital expenditures.

Net debt: Net debt includes total balance sheet debt less cash and cash equivalents. ScanSource believes this measure is useful in assessing its borrowing capacity.

Additional Non-GAAP Metrics: To evaluate current period performance on a more consistent basis with prior periods, ScanSource discloses non-GAAP SG&A expenses, non-GAAP operating income, non-GAAP pre-tax income, non-GAAP net income, and non-GAAP diluted earnings per share (non-GAAP diluted EPS). These non-GAAP results exclude amortization of intangible assets related to acquisitions, acquisition and divestiture costs, gain on sale of business, restructuring costs, and other non-GAAP adjustments. These metrics include the translation impact of changes in foreign currency exchange rates. Non-GAAP metrics are useful in assessing and understanding ScanSource's performance especially when comparing results with previous periods or forecasting performance for future periods.

These non-GAAP financial measures have limitations as analytical tools, and the non-GAAP financial measures that ScanSource reports may not be comparable to similarly titled amounts reported by other companies. Analysis of results and outlook on a non-GAAP basis should be considered in addition to, and not in substitution for or as superior to, measurements of financial performance prepared in accordance with GAAP. A reconciliation of ScanSource's non-GAAP financial information to GAAP is set forth in the Supplementary Information (Unaudited) below.

About ScanSource, Inc.

ScanSource, Inc. (NASDAQ: SCSC) is a leading hybrid distributor connecting devices to the cloud and accelerating growth for channel partners across hardware, software as a service (SaaS), connectivity and cloud. ScanSource enables channel partners to deliver solutions for their end customers to address changing buying and consumption patterns. ScanSource uses multiple sales models to offer hybrid distribution solutions from leading suppliers of specialty technologies, connectivity and cloud. Founded in 1992 and headquartered in Greenville, South Carolina, ScanSource was named one of the 2024 Best Places to Work in South Carolina and on FORTUNE magazine’s 2024 List of World’s Most Admired Companies. ScanSource ranks #776 on the Fortune 1000. For more information, visit www.scansource.com.

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Condensed Consolidated Balance Sheets (Unaudited) |

| (in thousands, except share data) |

| September 30, 2024 | | June 30, 2024* |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 145,044 | | | $ | 185,460 | |

Accounts receivable, less allowance of $22,721 at September 30, 2024 and $20,684 at June 30, 2024 | 567,127 | | | 581,523 | |

| Inventories | 504,078 | | | 512,634 | |

| Prepaid expenses and other current assets | 136,110 | | | 125,082 | |

| Total current assets | 1,352,359 | | | 1,404,699 | |

| Property and equipment, net | 32,940 | | | 33,501 | |

| Goodwill | 232,856 | | | 206,301 | |

| Identifiable intangible assets, net | 77,800 | | | 37,634 | |

| Deferred income taxes | 17,490 | | | 19,902 | |

| Other non-current assets | 73,064 | | | 76,995 | |

| | | |

| Total assets | $ | 1,786,509 | | | $ | 1,779,032 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 578,657 | | | $ | 587,984 | |

| Accrued expenses and other current liabilities | 69,326 | | | 65,616 | |

| | | |

| Income taxes payable | 6,376 | | | 7,895 | |

| | | |

| Current portion of long-term debt | 9,736 | | | 7,857 | |

| | | |

| Total current liabilities | 666,006 | | | 669,352 | |

| | | |

| Long-term debt, net of current portion | 133,913 | | | 136,149 | |

| Borrowings under revolving credit facility | — | | | 50 | |

| Long-term portion of contingent consideration | 15,289 | | | — | |

| Other long-term liabilities | 50,408 | | | 49,226 | |

| Total liabilities | 865,616 | | | 854,777 | |

| Commitments and contingencies | | | |

| Shareholders’ equity: | | | |

Preferred stock, no par value; 3,000,000 shares authorized, none issued | — | | | — | |

Common stock, no par value; 45,000,000 shares authorized, 24,005,107 and 24,243,848 shares issued and outstanding at September 30, 2024 and June 30, 2024, respectively | 2,975 | | | 26,370 | |

| Retained earnings | 1,030,712 | | | 1,013,738 | |

| Accumulated other comprehensive loss | (112,794) | | | (115,853) | |

| Total shareholders’ equity | 920,893 | | | 924,255 | |

| Total liabilities and shareholders’ equity | $ | 1,786,509 | | | $ | 1,779,032 | |

| | | |

| *Derived from audited financial statements. | | | |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Condensed Consolidated Income Statements (Unaudited) |

| (in thousands, except per share data) |

| | | | | | | |

| | Quarter ended September 30, 2024 | | |

| | 2024 | | 2023 | | | | |

| Net sales | $ | 775,580 | | | $ | 876,305 | | | | | |

| Cost of goods sold | 673,961 | | | 769,797 | | | | | |

| Gross profit | 101,619 | | | 106,508 | | | | | |

| Selling, general and administrative expenses | 71,706 | | | 75,436 | | | | | |

| Depreciation expense | 2,857 | | | 2,795 | | | | | |

| Intangible amortization expense | 4,358 | | | 4,193 | | | | | |

| Restructuring and other charges | 5,068 | | | — | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income | 17,630 | | | 24,084 | | | | | |

| Interest expense | 2,109 | | | 5,585 | | | | | |

| Interest income | (2,659) | | | (1,325) | | | | | |

| | | | | | | |

| Other (income) expense, net | (4,782) | | | 677 | | | | | |

| Income before income taxes | 22,962 | | | 19,147 | | | | | |

| Provision for income taxes | 5,988 | | | 3,715 | | | | | |

| | | | | | | |

| | | | | | | |

| Net income | $ | 16,974 | | | $ | 15,432 | | | | | |

| | | | | | | |

| Per share data: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income per common share, basic | $ | 0.70 | | | $ | 0.62 | | | | | |

| Weighted-average shares outstanding, basic | 24,147 | | | 24,886 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income per common share, diluted | $ | 0.69 | | | $ | 0.61 | | | | | |

| Weighted-average shares outstanding, diluted | 24,646 | | | 25,178 | | | | | |

| | | | | | | |

| | | | | | | |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Condensed Consolidated Statements of Cash Flows (Unaudited) |

| (in thousands) |

| Quarter ended September 30, | | |

| 2024 | | 2023 | | | | |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 16,974 | | | $ | 15,432 | | | | | |

| | | | | | | |

| | | | | | | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | | |

| | | | | | | |

| Depreciation and amortization | 7,471 | | | 7,217 | | | | | |

| Amortization of debt issue costs | 96 | | | 96 | | | | | |

| Provision for doubtful accounts | 1,678 | | | 4,157 | | | | | |

| Share-based compensation | 2,471 | | | 2,769 | | | | | |

| | | | | | | |

| Deferred income taxes | 2,433 | | | 1,303 | | | | | |

| | | | | | | |

| | | | | | | |

| Finance lease interest | 25 | | | 15 | | | | | |

| Changes in operating assets and liabilities, net of acquisitions: | | | | | | | |

| Accounts receivable | 20,606 | | | 53,284 | | | | | |

| Inventories | 9,524 | | | 99,630 | | | | | |

| Prepaid expenses and other assets | (1,952) | | | (7,743) | | | | | |

| Other non-current assets | 3,285 | | | 11,227 | | | | | |

| Accounts payable | (17,002) | | | (70,292) | | | | | |

| Accrued expenses and other liabilities | 744 | | | (21,764) | | | | | |

| Income taxes payable | (1,523) | | | (1,798) | | | | | |

| Net cash provided by (used in) operating activities | 44,830 | | | 93,533 | | | | | |

| Cash flows from investing activities: | | | | | | | |

| Capital expenditures | (2,375) | | | (2,315) | | | | | |

| Cash paid for business acquisitions, net of cash acquired | (56,849) | | | — | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash provided by (used in) investing activities | (59,224) | | | (2,315) | | | | | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| Borrowings on revolving credit, net of expenses | 8,381 | | | 588,570 | | | | | |

| Repayments on revolving credit, net of expenses | (8,430) | | | (669,424) | | | | | |

| Repayments on long-term debt, net | (357) | | | (938) | | | | | |

| Borrowings (repayments) on finance lease obligation | (275) | | | (191) | | | | | |

| | | | | | | |

| | | | | | | |

| Exercise of stock options | 6,971 | | | 72 | | | | | |

| Taxes paid on settlement of equity awards | (4,794) | | | (1,582) | | | | | |

| Common stock repurchased | (28,126) | | | — | | | | | |

| | | | | | | |

| Net cash (used in) provided by financing activities | (26,630) | | | (83,493) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

|

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | 608 | | | (1,256) | | | | | |

| Increase in cash and cash equivalents | (40,416) | | | 6,469 | | | | | |

| Cash and cash equivalents at beginning of period | 185,460 | | | 36,178 | | | | | |

| Cash and cash equivalents at period end | $ | 145,044 | | | $ | 42,647 | | | | | |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Supplementary Information (Unaudited) |

| (in thousands, except percentages) |

| | | | | | | |

| Non-GAAP Financial Information: | | | |

| Quarter ended September 30, | | |

| 2024 | | 2023 | | | | |

| Reconciliation of Net Income to Adjusted EBITDA: | | | | | | | |

| Net income (GAAP) | $ | 16,974 | | $ | 15,432 | | | | |

| Plus: Interest expense | 2,109 | | 5,585 | | | | |

| Plus: Income taxes | 5,988 | | 3,715 | | | | |

| Plus: Depreciation and amortization | 7,471 | | 7,217 | | | | |

| EBITDA (non-GAAP) | 32,542 | | 31,949 | | | | |

| | | | | | | |

| Plus: Share-based compensation | 2,471 | | 2,769 | | | | |

| | | | | | | |

| Plus: Acquisition and divestiture costs | 377 | | — | | | | |

| Plus: Cyberattack restoration costs | 76 | | 201 | | | | |

| Plus: Restructuring costs | 5,068 | | — | | | | |

| Plus: Insurance recovery, net of payments | (4,868) | | — | | | | |

| | | | | | | |

| Adjusted EBITDA (numerator for Adjusted ROIC) (non-GAAP) | $ | 35,666 | | $ | 34,919 | | | | |

| | | | | | | |

| Invested Capital Calculations: | | | | | | | |

| Equity – beginning of the period | $ | 924,254 | | $ | 905,298 | | | | |

| Equity – end of the period | 920,893 | | 915,253 | | | | |

| | | | | | | |

| Plus: Share-based compensation, net | 1,856 | | 2,068 | | | | |

| Plus: Acquisition and divestiture costs | 377 | | — | | | | |

| Plus: Cyberattack restoration costs, net | 57 | | 150 | | | | |

| Plus: Restructuring costs, net of tax | 3,818 | | — | | | | |

| | | | | | | |

| Plus: Insurance recovery, net | (3,667) | | — | | | | |

| | | | | | | |

| | | | | | | |

| Average equity | 923,794 | | 911,385 | | | | |

Average funded debt (b) | 144,020 | | 352,897 | | | | |

| Invested capital (denominator for Adjusted ROIC) (non-GAAP) | $ | 1,067,814 | | $ | 1,264,282 | | | | |

| | | | | | | |

Adjusted return on invested capital ratio (Adjusted ROIC), annualized(a) | 13.3 | % | | 11.0 | % | | | | |

| | | | | | | |

(a) The annualized adjusted EBITDA amount is divided by days in the quarter times 365 days per year, or 366 days for leap year. There were 92 days in the current and prior-year quarter. |

|

(b) Average funded debt is calculated as the average daily amounts outstanding on short-term and long-term interest-bearing debt. |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Supplementary Information (Unaudited) |

| | | |

| Net Sales by Segment: | | | |

| Quarter ended September 30, | | |

| 2024 | | 2023 | | % Change |

| Specialty Technology Solutions: | (in thousands) | | |

| | | | | |

| | | | | |

| Net sales, reported | $ | 752,299 | | | $ | 853,950 | | | (11.9) | % |

Foreign exchange impact (a) | 8,645 | | | — | | | |

| Less: Divestitures | — | | | (2,282) | | | |

| Less: Acquisitions | (3,512) | | | — | | | |

| Non-GAAP net sales | $ | 757,432 | | | $ | 851,668 | | | (11.1) | % |

| | | | | |

| Intelisys & Advisory: | | | | | |

| | | | | |

| | | | | |

| Net sales, reported | $ | 23,281 | | | $ | 22,355 | | | 4.1 | % |

Foreign exchange impact (a) | (3) | | | — | | | |

| | | | | |

| Less: Acquisitions | (577) | | | — | | | |

| Non-GAAP net sales | $ | 22,701 | | | $ | 22,355 | | | 1.5 | % |

| | | | | |

| Consolidated: | | | | | |

| | | | | |

| | | | | |

| Net sales, reported | $ | 775,580 | | | $ | 876,305 | | | (11.5) | % |

Foreign exchange impact (a) | 8,642 | | | — | | | |

| Less: Divestitures | — | | | (2,282) | | | |

| Less: Acquisitions | (4,089) | | | — | | | |

| Non-GAAP net sales | $ | 780,133 | | | $ | 874,023 | | | (10.7) | % |

| | | | | |

(a) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter ended September 30, 2024 into U.S. dollars using the average foreign exchange rates for the quarter ended September 30, 2023. |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Supplementary Information (Unaudited) |

| Net Sales by Revenue Type: | | | | | | |

| | | | | | |

| | Quarter ended September 30, | | |

| | 2024 | | 2023 | | % Change |

| | (in thousands) | | |

| Revenue by product/service: | | | | | | |

| Products and services | | $ | 741,567 | | | $ | 847,674 | | | (12.5) | % |

Recurring revenue(a) | | 34,013 | | | 28,631 | | | 18.8 | % |

| | $ | 775,580 | | | $ | 876,305 | | | (11.5) | % |

(a) Recurring revenue represents primarily agency commissions, SaaS, subscriptions, and hardware rentals. |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Supplementary Information (Unaudited) |

| (in thousands) |

| Segment Information: | | | | | |

| | | | | | | | | |

| Quarter ended | | Fiscal year ended |

| September 30, 2023 | | December 31, 2023 | | March 31, 2024 | | June 30, 2024 | | June 30, 2024* |

| Net sales: | | | | | | | | | |

| Specialty Technology Solutions | $ | 853,950 | | | $ | 861,514 | | | $ | 729,834 | | | $ | 722,251 | | | $ | 3,167,549 | |

| Intelisys & Advisory | 22,355 | | | 23,278 | | | 22,765 | | | 23,862 | | | 92,260 | |

| $ | 876,305 | | | $ | 884,792 | | | $ | 752,599 | | | $ | 746,113 | | | $ | 3,259,809 | |

| | | | | | | | | |

| Gross profit: | | | | | | | | | |

| Specialty Technology Solutions | $ | 84,263 | | | $ | 77,591 | | | $ | 71,840 | | | $ | 73,563 | | | $ | 307,257 | |

| Intelisys & Advisory | 22,245 | | | 23,157 | | | 22,641 | | | 23,752 | | | 91,795 | |

| $ | 106,508 | | | $ | 100,748 | | | $ | 94,481 | | | $ | 97,315 | | | $ | 399,052 | |

| | | | | | | | | |

| Operating income (loss): | | | | | | | | | |

| Specialty Technology Solutions | $ | 17,636 | | | $ | 19,696 | | | $ | 14,581 | | | $ | 14,764 | | | $ | 66,677 | |

| Intelisys & Advisory | 6,649 | | | 8,273 | | | 7,488 | | | 8,186 | | | 30,596 | |

| Corporate | (201) | | | (1,143) | | | (4,527) | | | (1,078) | | | (6,949) | |

| $ | 24,084 | | | $ | 26,826 | | | $ | 17,542 | | | $ | 21,872 | | | 90,324 | |

| | | | | | | | | |

| Quarter ended | | Fiscal year ended |

| September 30, 2022 | | December 31, 2022 | | March 31, 2023 | | June 30, 2023 | | June 30, 2023* |

| Net sales: | | | | | | | | | |

| Specialty Technology Solutions | $ | 923,399 | | | $ | 989,668 | | | $ | 863,965 | | | $ | 924,635 | | | $ | 3,701,667 | |

| Intelisys & Advisory | 20,414 | | | 21,573 | | | 21,554 | | | 22,513 | | | 86,054 | |

| $ | 943,813 | | | $ | 1,011,241 | | | $ | 885,519 | | | $ | 947,148 | | | $ | 3,787,721 | |

| | | | | | | | | |

| Gross profit: | | | | | | | | | |

| Specialty Technology Solutions | $ | 93,174 | | | $ | 93,861 | | | $ | 90,302 | | | $ | 86,243 | | | $ | 363,580 | |

| Intelisys & Advisory | 20,311 | | | 21,473 | | | 21,460 | | | 22,415 | | | 85,659 | |

| $ | 113,485 | | | $ | 115,334 | | | $ | 111,762 | | | $ | 108,658 | | | $ | 449,239 | |

| | | | | | | | | |

| Operating income (loss): | | | | | | | | | |

| Specialty Technology Solutions | $ | 30,192 | | | $ | 32,618 | | | $ | 28,283 | | | $ | 21,736 | | | $ | 112,829 | |

| Intelisys & Advisory | 4,696 | | | 6,814 | | | 5,996 | | | 7,011 | | | 24,517 | |

| Corporate | — | | | — | | | — | | | (1,460) | | | (1,460) | |

| $ | 34,888 | | | $ | 39,432 | | | $ | 34,279 | | | $ | 27,287 | | | $ | 135,886 | |

*Derived from audited financial statements. | | | | | | |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries |

| Supplementary Information (Unaudited) |

| | | | | |

| Net Sales by Geography: | | | |

| Quarter ended September 30, | | |

| 2024 | | 2023 | | % Change |

| United States and Canada: | (in thousands) | | |

| Net sales, as reported | $ | 712,019 | | | $ | 791,000 | | | (10.0) | % |

| Less: Acquisitions | (4,089) | | | — | | | |

| Non-GAAP net sales | $ | 707,930 | | | $ | 791,000 | | | (10.5) | % |

| | | | | |

| Brazil: | | | | | |

| | | | | |

| | | | | |

Net sales, reported(a) | $ | 63,561 | | | $ | 85,305 | | | (25.5) | % |

Foreign exchange impact(b) | 8,642 | | | — | | | |

| Less: Divestitures | — | | | (2,282) | | | |

| Non-GAAP net sales | $ | 72,203 | | | $ | 83,023 | | | (13.0) | % |

| | | | | |

| Consolidated: | | | | | |

| | | | | |

| | | | | |

| Net sales, reported | $ | 775,580 | | | $ | 876,305 | | | (11.5) | % |

Foreign exchange impact(b) | 8,642 | | | — | | | |

| Less: Divestitures | — | | | (2,282) | | | |

| Less: Acquisitions | (4,089) | | | — | | | |

| Non-GAAP net sales | $ | 780,133 | | | $ | 874,023 | | | (10.7) | % |

| | | | | |

(a) Countries outside of the United States, Canada and Brazil represent $0.1 million, or 0.2% of sales, for the quarter ended September 30, 2024 and $2.4 million, or 2.8% of sales, for the quarter ended September 30, 2023. |

(b) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter ended September 30, 2024 into U.S. dollars using the average foreign exchange rates for the quarter ended September 30, 2023. |

| | | | | | | | | | | | | | | |

|

|

|

| Free Cash Flow: | | | | | |

| | | | | | | |

| Quarter ended September 30, | | |

| 2024 | | 2023 | | | | |

| GAAP operating cash flow | $ | 44,830 | | | $ | 93,533 | | | | | |

| Less: Capital expenditures | (2,375) | | | (2,315) | | | | | |

| Free cash flow (non-GAAP) | $ | 42,455 | | | $ | 91,218 | | | | | |

| | | | | | | |

SCANSOURCE REPORTS FIRST QUARTER RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ScanSource, Inc. and Subsidiaries | | | | |

| Supplementary Information (Unaudited) | | | | |

| (in thousands, except per share data) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Other Non-GAAP Financial Information: | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended September 30, 2024 | | | | |

| | GAAP Measure | | Intangible amortization expense | | | | Acquisition & divestiture costs (a) | | Restructuring costs | | Insurance recovery, net | | | | Cyberattack restoration costs | | | | Non-GAAP measure | | | | |

| (in thousands, except per share data) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| SG&A expenses | | $71,706 | | $— | | | | $(377) | | $— | | $— | | | | $(76) | | | | $71,253 | | | | |

| Operating income | | 17,630 | | 4,358 | | | | 377 | | 5,068 | | — | | | | 76 | | | | 27,509 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Pre-tax income | | 22,962 | | 4,358 | | | | 377 | | 5,068 | | (4,868) | | | | 76 | | | | 27,973 | | | | |

| Net income | | 16,974 | | 3,264 | | | | 377 | | 3,818 | | (3,667) | | | | 57 | | | | 20,823 | | | | |

| Diluted EPS | | $0.69 | | $0.13 | | | | $0.02 | | $0.15 | | $(0.15) | | | | $— | | | | $0.84 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended September 30, 2023 | | | | |

| | GAAP Measure | | Intangible amortization expense | | | | Acquisition & divestiture costs | | Restructuring costs | | Insurance recovery, net | | | | Cyberattack restoration costs | | | | Non-GAAP measure | | | | |

| (in thousands, except per share data) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| SG&A expense | | $75,436 | | $— | | | | $— | | $— | | $— | | | | $(201) | | | | $75,235 | | | | |

| Operating income | | 24,084 | | 4,193 | | | | — | | — | | — | | | | 201 | | | | 28,478 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Pre-tax income | | 19,147 | | 4,193 | | | | — | | — | | — | | | | 201 | | | | 23,541 | | | | |

| Net income | | 15,432 | | 3,146 | | | | — | | — | | — | | | | 150 | | | | 18,728 | | | | |

| Diluted EPS | | $0.61 | | $0.12 | | | | $— | | $— | | $— | | | | $0.01 | | | | $0.74 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(a) Acquisition and divestiture costs for the quarter ended September 30, 2024 are generally nondeductible for tax purposes.

Fiscal First Quarter 2025 Earnings In the first quarter, our team delivered strong free cash flow and EPS growth in a soft demand environment. Our results demonstrate our hybrid distribution success with our focus on specialty technologies and Intelisys & advisory recurring revenue.” Mike Baur Chair and CEO, ScanSource, Inc. Key Highlights Soft Demand with Higher Gross Profit Margins Completed Acquisitions of High Margin, Recurring Revenue Businesses Higher Margins Reflect Strength of Business Fundamentals and Recurring Revenue Net Sales -11% Y/Y $776M Reaffirmed FY25 Annual Outlook; Achieved Strong Q1 Cash Flow © ScanSource 2025 Consolidated Specialty Technology Solutions Segment Gross Profit -5% Y/Y $102M, 13.1% margin Intelisys & Advisory Segment STS, Net Sales -12% Y/Y $752M I&A, Net Sales +4% Y/Y $23M STS, Gross Profit -7% Y/Y $78M, 10.4% margin I&A, Gross Profit +4% Y/Y $23M, 99.5% margin

* Non GAAPmeasure For further financial data, non GAAP financial disclosures and cautionary language regarding forward looking statements, please refer to the following pages and ScanSource’s first quarter fiscal year 2025 news release issued on November 7, 2024, which accompanies this presentation and is available at www.scansource.com in the Investor Relations section [click here]. First Quarter Operating Metrics Mid-Term Goals Mid-term: 3-to-4-year time frame Fiscal Year 2025 Annual Outlook reaffirmed as of November 7, 2024 © ScanSource 2025 2 Net Sales $3.1 billion to $3.5 billion Adjusted EBITDA* $140 million to $160 million Free Cash Flow* At least $70 million Recurring Revenue as % of Gross Profits Adjusted ROIC* Adjusted EBITDA Margin* Net Sales Growth per year Building to 30%+ Mid Teens4.5%-5%5%-7.5% Focus on Working Capital Efficiency Improvements $0.69 per share GAAP Diluted EPS +13% Y/Y $35.7M, +2%Y/Y Adjusted EBITDA* 4.60% Adjusted EBITDA Margin* $45M QTR Operating Cash Flow $42M QTR Free Cash Flow* $0.84 per share Non-GAAP Diluted EPS* +14% Y/Y (0.0)x Net Debt* to TTM Adjusted EBITDA* 13.3% Adjusted ROIC* $28M in share repurchases

Forward-Looking Statements This Earnings Infographic and supporting materials contain “forward-looking” statements, including ScanSource's FY25 annual outlook and mid-term goals, which involve risks and uncertainties, many of which are beyond ScanSource’s control. No undue reliance should be placed on such statements, as any number of factors could cause actual results to differ materially from anticipated or forecasted results, including, but not limited to, the following factors, which are neither presented in order of importance nor weighted: macroeconomic conditions, including potential prolonged economic weakness, inflation, the failure to manage and implement ScanSource's growth strategy, credit risks involving ScanSource's larger customers and suppliers, changes in interest and exchange rates and regulatory regimes impacting ScanSource's international operations, risk to the business from a cyberattack, a failure of IT systems, failure to hire and retain quality employees, loss of ScanSource's major customers, relationships with key suppliers and customers or a termination or a modification of the terms under which it operates with these key suppliers and customers, changes in ScanSource's operating strategy, and other factors set forth in the "Risk Factors" contained in ScanSource's annual report on Form 10-K for the year ended June 30, 2024, and subsequent reports on Form 10-Q, filed with the Securities and Exchange Commission. Except as may be required by law, ScanSource expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this Earnings Infographic or otherwise. Non-GAAP Financial Information In addition to disclosing results that are determined in accordance with United States Generally Accepted Accounting Principles (“GAAP”), ScanSource also discloses certain non-GAAP measures, including non-GAAP SG&A expenses, non-GAAP operating income, non-GAAP operating income margin, non-GAAP pre-tax income, non-GAAP net income, non-GAAP diluted EPS, adjusted EBITDA, adjusted EBITDA margin, net debt, adjusted ROIC, free cash flow and net sales in constant currency excluding acquisitions and divestitures (organic growth). A reconciliation of the Company's non-GAAP financial information to GAAP financial information is provided in the following supporting materials and in the Company’s Form 8-K, filed with the SEC, with the quarterly earnings press release for the period indicated. Please see the “Non-GAAP Financial Information” section in the quarterly earnings press release for additional description of ScanSource’s non-GAAP measures. ScanSource discloses forward-looking information that is not presented in accordance with GAAP with respect to adjusted EBITDA, adjusted EBITDA margin, adjusted ROIC, and free cash flow. ScanSource believes that a quantitative reconciliation of such forward-looking information to the most directly comparable GAAP financial measure cannot be made without unreasonable efforts, because a reconciliation of these non-GAAP financial measures would require an estimate of future non-operating items such as acquisitions and divestitures, restructuring costs, impairment charges and other unusual or non-recurring items. Neither the timing nor likelihood of these events, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, a reconciliation of such forward- looking information to the most directly comparable GAAP financial measure is not provided. 3

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

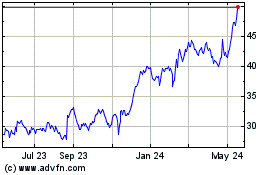

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Feb 2025 to Mar 2025

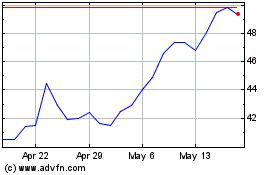

ScanSource (NASDAQ:SCSC)

Historical Stock Chart

From Mar 2024 to Mar 2025