UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-40786

Sigma

Lithium Corporation

(Translation of registrant's name into English)

2200 HSBC Building

885 West Georgia Street

Vancouver, British Columbia

V6C

3E8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation

S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document

that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is

incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country

exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject

of a Form 6-K submission or other Commission filing on EDGAR.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Sigma Lithium Corporation |

| |

(Registrant) |

| Date: July 29, 2024 |

|

| |

Ana Cristina Cabral Gardner |

| |

Chief Executive Officer |

Exhibit 99.1

SIGMA

LITHIUM SIGNS INAUGURAL DEFERRED US$ 22M LETTER OF CREDIT EXPORT FINANCING WITH BANCO DO BRASIL

HIGHLIGHTS

| · | Sigma

Lithium signed on July 24, 2024 a deferred US$ 22.4 million letter of credit (the “Transaction”)

with Banco do Brasil. |

| · | This

Transaction strengthens Sigma’s commercial power, enabling it to offer 90-day “export

vendor financing” to its clients at very low rates. |

| · | The

Transaction amount was calculated based on the 22,000t July 5th shipment

at the price of 8.75% of Lithium Hydroxide quoted at the LME. |

| · | The

Transaction represents the inaugural solution for the Company developed in tandem with Banco

do Brasil to deepen Sigma Lithium’s commercial partnerships during the seasonal lithium

purchase cycles. |

| · | As

a result of the Transaction, Sigma Lithium will gradually phase out existing trade finance

lines (drawn but mostly unused in the Company’s treasury) and move from a position

of receiving advance payments (at a higher cost) to providing vendor financing and widening

its client base. |

| · | The

Transaction allows Sigma Lithium to further improve its competitive position by strengthening

commercial flexibility with the goal of institutionalizing a premium for its lithium concentrate. |

| · | The

Company’s ability to access this category of export financing demonstrates it has achieved

maturity as producer within its first year of operations. |

São

Paulo, Brazil – (July 29, 2024) – Sigma Lithium Corporation (“Sigma Lithium” or the “Company”)

(NASDAQ: SGML, BVMF: S2GM34, TSXV: SGML), a leading global lithium producer dedicated to powering

the next generation of electric vehicles with carbon neutral, socially and environmentally sustainable lithium concentrate, is pleased

to announce it signed an inaugural deferred US$ 22.4 million letter of credit for export financing with Banco do Brasil.

As Sigma matures as

an industrial producer and demonstrates its ability to consistently deliver its Quintuple Zero Green Lithium, it gained access to access

low-cost trade finance mechanisms through Banco do Brasil, available to the country’s largest industrial exporters. These agreements

enhance Sigma Lithium’s commercial flexibility and market access.

As a result of the

lower interest export credit lines, the Company will phase out the existing trade lines in its treasury, thus decreasing the Company’s

recurring interest expenses and further improving its competitiveness.

Ana Cabral, Co-Chair

and CEO of Sigma Lithium notes, “We have reached a significant milestone in our journey as a producer, achieving the maturity

to access trade financing instruments available to Brazil’s largest exporters. We are honored to be working with Banco do Brasil,

the country’s largest bank, which has extended through its balance sheet in Asia highly competitive interest rates to Sigma Lithium.

Banco do Brasil has a history of more than a century in fostering the development of industrial exporters in the country. With this inaugural

Transaction with Sigma Lithium, one of the world’s largest producers of industrial lithium materials, Banco do Brasil strengthens

its leading position in developing the Brazilian green industrialization of future facing battery materials.”

| |  | | 1 |

“Maintaining

a consistent shipping schedule, demonstrating our product quality and low costs, as well as our ability to market to downstream battery

and auto makers, has opened these additional credit opportunities for Sigma. The Transaction enhances the Company’s flexibility

in how it markets its Quintuple Zero Green Lithium, ultimately helping to institutionalize a price premium that reflects its superior

chemical qualities.”

Picture

1: Sigma CEO and commercial executives with the Banco do Brasil executives at signing ceremony

ABOUT

SIGMA LITHIUM

Sigma Lithium (NASDAQ:

SGML, TSXV: SGML, BVMF: S2GM34) is a leading global lithium producer dedicated to powering the next generation of electric vehicle batteries

with carbon neutral, socially and environmentally sustainable chemical-grade lithium concentrate.

Sigma Lithium is one

of the world’s largest lithium producers with an annual production capacity of 270,000 tonnes of chemical grade lithium concentrate

(36,700 LCE annually). The Company operates at the forefront of environmental and social sustainability in the EV battery materials supply

chain at its Grota do Cirilo Operation in Brazil. The Company produces Quintuple Zero Green Lithium at its state-of-the-art Greentech

lithium plant that delivers zero carbon lithium, produced with zero dirty power, zero potable water, zero toxic chemicals and zero tailings’

dams.

| |  | | 2 |

Phase 1 of the project

entered commercial production in 2Q23 and has an annual capacity of 270,000 tonnes of concentrate (36,700 LCE annually).The Company has

issued a Final Investment Decision formally approving construction to nearly double capacity to 520,000 tonnes of concentrate through

the addition of a Phase 2 expansion of its Greentech Plant.

Please refer to the

Company’s National Instrument 43-101 technical report titled “Grota do Cirilo Lithium Project Araçuaí and Itinga

Regions, Minas Gerais, Brazil, Amended and Restated Technical Report” issued March 19, 2024, which was prepared for Sigma

Lithium by Homero Delboni Jr., MAusIMM, Promon Engenharia; Marc-Antoine Laporte, P.Geo, SGS Canada Inc; Jarrett Quinn, P.Eng., Primero

Group Americas; Porfirio Cabaleiro Rodriguez, (MEng), FAIG, GE21 Consultoria Mineral; and William van Breugel, P.Eng (the “Updated

Technical Report”). The Updated Technical Report is filed on SEDAR and is also available on the Company’s website.

For

more information about Sigma Lithium, visit https://www.sigmalithiumresources.com/

FOR

ADDITIONAL INFORMATION PLEASE CONTACT

Matthew DeYoe, EVP

Corporate Affairs & Strategic Development

+1 (201) 819-0303

matthew.deyoe@sigmalithium.com.br

Daniel Abdo,

Director, Investor Relations

+55 11 2985-0089

daniel.abdo@sigmalithium.com.br

Sigma

Lithium

|

|

Sigma

Lithium |

|

|

@sigmalithium |

|

|

@SigmaLithium |

| |  | | 3 |

FORWARD-LOOKING

STATEMENTS

This news release

includes certain "forward-looking information" under applicable Canadian and U.S. securities legislation, including but not

limited to statements relating to timing and costs related to the general business and operational outlook of the Company, the environmental

footprint of tailings and positive ecosystem impact relating thereto, donation and upcycling of tailings, timing and quantities relating

to tailings and Green Lithium, achievements and projections relating to the Zero Tailings strategy, achievement of ramp-up volumes, production

estimates and the operational status of the Groto do Cirilo Project, and other forward-looking information. All statements that address

future plans, activities, events, estimates, expectations or developments that the Company believes, expects or anticipates will or may

occur is forward-looking information, including statements regarding the potential development of mineral resources and mineral reserves

which may or may not occur. Forward-looking information contained herein is based on certain assumptions regarding, among other things:

general economic and political conditions; the stable and supportive legislative, regulatory and community environment in Brazil; demand

for lithium, including that such demand is supported by growth in the electric vehicle market; the Company’s market position and

future financial and operating performance; the Company’s estimates of mineral resources and mineral reserves, including whether

mineral resources will ever be developed into mineral reserves; and the Company’s ability to operate its mineral projects including

that the Company will not experience any materials or equipment shortages, any labour or service provider outages or delays or any technical

issues. Although management believes that the assumptions and expectations reflected in the forward-looking information are reasonable,

there can be no assurance that these assumptions and expectations will prove to be correct. Forward-looking information inherently involves

and is subject to risks and uncertainties, including but not limited to that the market prices for lithium may not remain at current

levels; and the market for electric vehicles and other large format batteries currently has limited market share and no assurances can

be given for the rate at which this market will develop, if at all, which could affect the success of the Company and its ability to

develop lithium operations. There can be no assurance that such statements will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking

information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of

new information, future events or otherwise, except as required by law. For more information on the risks, uncertainties and assumptions

that could cause our actual results to differ from current expectations, please refer to the current annual information form of the Company

and other public filings available under the Company’s profile at www.sedar.com.

Neither the

TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this news release.

| |  | | 4 |

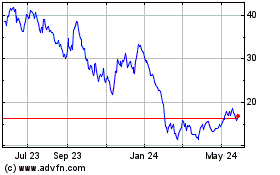

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Oct 2024 to Nov 2024

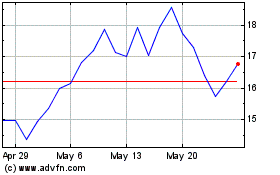

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Nov 2023 to Nov 2024