Steven Madden, Ltd. (Nasdaq: SHOO), a leading designer and marketer

of fashion-forward footwear, accessories and apparel, today

announced financial results for the third quarter ended

September 30, 2024.

Amounts referred to as “Adjusted” are

non-GAAP measures that exclude the items defined as “Non-GAAP

Adjustments” in the “Non-GAAP Reconciliation” section.

Third Quarter

2024 Results

- Revenue increased 13.0% to

$624.7 million, compared to $552.7 million in the same period

of 2023.

- Gross profit as a percentage of revenue was 41.5%, compared to

42.1% in the same period of 2023. Adjusted gross profit as a

percentage of revenue was 41.6% in the third quarter of 2024.

- Operating expenses as a percentage

of revenue were 28.6%, compared to 27.1% in the same period of

2023. Adjusted operating expenses as a percentage of revenue were

27.9%, compared to 27.0% in the same period of 2023.

- Income from operations totaled

$74.6 million, or 11.9% of revenue, compared to

$82.7 million, or 15.0% of revenue, in the same period of

2023. Adjusted income from operations totaled $85.4 million, or

13.7% of revenue, compared to $83.4 million, or 15.1% of revenue,

in the same period of 2023.

- Net income attributable to Steven

Madden, Ltd. was $55.3 million, or $0.77 per diluted share,

compared to $64.4 million, or $0.87 per diluted share, in the

same period of 2023. Adjusted net income attributable to Steven

Madden, Ltd. was $64.8 million, or $0.91 per diluted share,

compared to $65.1 million, or $0.88 per diluted share, in the same

period of 2023.

Edward Rosenfeld, Chairman and Chief Executive

Officer, commented, “We delivered strong results in the third

quarter, with revenue and Adjusted earnings exceeding expectations.

This performance was driven by outstanding growth in the

accessories and apparel categories – including another quarter of

exceptional performance in Steve Madden handbags and a strong

contribution from newly acquired Almost Famous – and robust top

line gains in international markets and direct-to-consumer

channels, demonstrating our team’s strong execution of our key

strategic initiatives. Based on these results, we are raising our

guidance for 2024 revenue and Adjusted earnings.”

Third Quarter

2024 Channel Results

Revenue for the wholesale business was

$495.7 million, a 14.4% increase compared to the third quarter

of 2023. Excluding the newly acquired Almost Famous, wholesale

revenue increased 4.8%. Wholesale footwear revenue decreased 2.2%.

Wholesale accessories/apparel revenue increased 54.2%, or 21.6%

excluding Almost Famous. Gross profit as a percentage of wholesale

revenue was 35.5%, compared to 35.9% in the third quarter of 2023,

driven by the impact of Almost Famous.

Direct-to-consumer revenue was

$125.5 million, a 7.8% increase compared to the third quarter

of 2023. Gross profit as a percentage of direct-to-consumer revenue

increased to 64.0%, compared to 63.7% in the third quarter of 2023,

driven by reduced promotional activity.

The Company ended the quarter with 282

brick-and-mortar retail stores and five e-commerce websites, as

well as 67 company-operated concessions in international

markets.

Balance Sheet and Cash Flow

Highlights

As of September 30, 2024, cash, cash

equivalents and short-term investments totaled $150.5 million.

Inventory totaled $268.7 million, compared to

$205.7 million at the end of the third quarter of 2023.

During the third quarter of 2024, the Company

spent $20.2 million on repurchases of its common stock, which

includes shares acquired through the net settlement of employees’

stock awards.

Quarterly Cash Dividend

The Company’s Board of Directors approved a

quarterly cash dividend of $0.21 per share. The dividend is payable

on December 27, 2024 to stockholders of record as of the close of

business on December 13, 2024.

Updated 2024 Outlook

For fiscal 2024, the Company now expects revenue

will increase 13% to 14% compared to 2023. The Company now expects

diluted EPS will be in the range of $2.36 to $2.41. The Company now

expects Adjusted diluted EPS will be in the range of $2.62 to

$2.67.

Conference Call Information

Interested stockholders are invited to listen to

the conference call scheduled for today, November 7, 2024, at 8:30

a.m. Eastern Time, which will include a discussion of the Company's

third quarter 2024 earnings results and 2024 outlook. The call will

be webcast live on the Company’s website at

https://investor.stevemadden.com. A webcast replay of the

conference call will be available on the Company's website or via

the following webcast link

https://edge.media-server.com/mmc/p/ktw3zrcobeginning today at

approximately 10:00 a.m. Eastern Time.

About Steve Madden

Steve Madden designs, sources and markets

fashion-forward footwear, accessories and apparel. In addition to

marketing products under its own brands including Steve Madden®,

Dolce Vita®, Betsey Johnson®, and Blondo®, Steve Madden licenses

footwear, handbags and other accessory categories for the Anne

Klein® brand. Steve Madden also designs and sources products under

private label brand names for various retailers. Steve Madden’s

wholesale distribution includes department stores, mass merchants,

off-price retailers, shoe chains, online retailers, national

chains, specialty retailers and independent stores. Steve Madden

also directly operates brick-and-mortar retail stores and

e-commerce websites. In addition, Steve Madden licenses certain of

its brands to third parties for the marketing and sale of certain

products in the apparel, accessory and home categories. For local

store information and the latest boots, booties, fashion sneakers,

dress shoes, sandals, and more, please visit www.stevemadden.com,

www.dolcevita.com and our other branded websites.

Safe Harbor Statement Under the U.S.

Private Securities Litigation Reform Act of 1995

This press release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. Examples of

forward-looking statements include, among others, statements

regarding revenue and earnings guidance, plans, strategies,

objectives, expectations and intentions. Forward-looking statements

can be identified by words such as: “may”, “will”, “expect”,

“believe”, “should”, “anticipate”, “project”, “predict”, “plan”,

“intend”, “estimate”, or “confident” and similar expressions or the

negative of these expressions. Forward-looking statements are

neither historical facts nor assurances of future performance.

Instead, they represent the Company’s current beliefs,

expectations, and assumptions regarding anticipated events and

trends affecting its business and industry based on information

available as of the time such statements are made. Investors are

cautioned that such forward-looking statements are inherently

subject to risks and uncertainties, many of which cannot be

predicted with accuracy and some of which may be outside of the

Company’s control. The Company’s actual results and financial

condition may differ materially from those indicated in these

forward-looking statements. As such, investors should not rely upon

them. Important risks and uncertainties include:

- geopolitical tensions in the

regions in which we operate and any related challenging

macroeconomic conditions globally that may materially adversely

affect our customers, vendors, and partners, and the duration and

extent to which these factors may impact our future business and

operations, results of operations and financial condition;

- the Company’s ability to navigate

shifting macro-economic environments, including but not limited to

inflation and the potential for recessionary conditions;

- the Company’s ability to accurately

anticipate fashion trends and promptly respond to consumer

demand;

- the Company’s ability to compete

effectively in a highly competitive market;

- the Company’s ability to adapt its

business model to rapid changes in the retail industry;

- supply chain disruptions to product

delivery systems and logistics, and the Company’s ability to

properly manage inventory;

- the Company’s reliance on

independent manufacturers to produce and deliver products in a

timely manner, especially when faced with adversities such as work

stoppages, transportation delays, public health emergencies, social

unrest, changes in local economic conditions, and political

upheavals as well as their ability to meet the Company’s quality

standards;

- the Company’s dependence on the

hiring and retention of key personnel;

- the Company’s ability to

successfully implement growth strategies and integrate acquired

businesses;

- changes in trade policies and

tariffs imposed by the United States government and the governments

of other nations in which the Company manufactures and sells

products;

- the Company’s ability to adequately

protect its trademarks and other intellectual property rights;

- the Company’s ability to maintain

adequate liquidity when negatively impacted by unforeseen events

such as an epidemic or a pandemic, which may cause disruption to

the Company’s business operations for an indeterminable period of

time;

- legal, regulatory, political and

economic risks that may affect the Company’s sales in international

markets;

- changes in U.S. and foreign tax

laws that could have an adverse effect on the Company’s financial

results;

- additional tax liabilities

resulting from audits by various taxing authorities;

- cybersecurity risks and costs of

defending against, mitigating, and responding to data security

threats and breaches impacting the Company;

- the Company’s ability to achieve

operating results that are consistent with prior financial

guidance; and

- other risks and uncertainties

indicated from time to time in the Company’s filings with the

Securities and Exchange Commission.

The Company does not undertake, and disclaims,

any obligation to publicly update any forward-looking statement,

including, without limitation, any guidance regarding revenue or

earnings, whether as a result of new information, future

developments, or otherwise.

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per share

amounts)(Unaudited)

| |

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

| |

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

621,170 |

|

|

$ |

549,846 |

|

$ |

1,693,446 |

|

$ |

1,454,420 |

| Licensing fee income |

|

|

3,505 |

|

|

|

2,886 |

|

|

7,163 |

|

|

7,448 |

| Total revenue |

|

|

624,675 |

|

|

|

552,732 |

|

|

1,700,609 |

|

|

1,461,868 |

| Cost of sales |

|

|

365,131 |

|

|

|

320,107 |

|

|

999,121 |

|

|

844,281 |

| Gross profit |

|

|

259,544 |

|

|

|

232,625 |

|

|

701,488 |

|

|

617,587 |

| Operating expenses |

|

|

178,915 |

|

|

|

149,887 |

|

|

507,343 |

|

|

444,298 |

| Change in valuation of

contingent payment liability |

|

|

(2,584 |

) |

|

|

— |

|

|

5,616 |

|

|

— |

| Impairment of intangibles |

|

|

8,635 |

|

|

|

— |

|

|

10,335 |

|

|

— |

| Income from operations |

|

|

74,578 |

|

|

|

82,738 |

|

|

178,194 |

|

|

173,289 |

| Interest and other income,

net |

|

|

1,400 |

|

|

|

1,922 |

|

|

4,309 |

|

|

5,898 |

| Income before provision for

income taxes |

|

|

75,978 |

|

|

|

84,660 |

|

|

182,503 |

|

|

179,187 |

| Provision for income

taxes |

|

|

19,390 |

|

|

|

19,552 |

|

|

44,404 |

|

|

42,219 |

| Net income |

|

|

56,588 |

|

|

|

65,108 |

|

|

138,099 |

|

|

136,968 |

| Less: net income attributable

to noncontrolling interest |

|

|

1,310 |

|

|

|

695 |

|

|

3,510 |

|

|

1,295 |

| Net income attributable to

Steven Madden, Ltd. |

|

$ |

55,278 |

|

|

$ |

64,413 |

|

$ |

134,589 |

|

$ |

135,673 |

| |

|

|

|

|

|

|

|

|

| Basic income per share |

|

$ |

0.78 |

|

|

$ |

0.88 |

|

$ |

1.88 |

|

$ |

1.84 |

| |

|

|

|

|

|

|

|

|

| Diluted income per share |

|

$ |

0.77 |

|

|

$ |

0.87 |

|

$ |

1.87 |

|

$ |

1.81 |

| |

|

|

|

|

|

|

|

|

| Basic weighted average common

shares outstanding |

|

|

70,806 |

|

|

|

72,943 |

|

|

71,516 |

|

|

73,679 |

| |

|

|

|

|

|

|

|

|

| Diluted weighted average

common shares outstanding |

|

|

71,569 |

|

|

|

74,071 |

|

|

72,135 |

|

|

74,917 |

| |

|

|

|

|

|

|

|

|

| Cash dividends declared per

common share |

|

$ |

0.21 |

|

|

$ |

0.21 |

|

$ |

0.63 |

|

$ |

0.63 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

| |

|

|

|

As of |

|

|

| |

|

September 30, 2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

|

|

(Unaudited) |

|

|

|

(Unaudited) |

| ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

139,414 |

|

$ |

204,640 |

|

$ |

191,804 |

| Short-term investments |

|

|

11,064 |

|

|

15,173 |

|

|

14,641 |

| Accounts receivable, net of

allowances |

|

|

56,297 |

|

|

40,246 |

|

|

58,538 |

| Factor accounts

receivable |

|

|

426,408 |

|

|

320,723 |

|

|

342,871 |

| Inventories |

|

|

268,669 |

|

|

228,990 |

|

|

205,693 |

| Prepaid expenses and other

current assets |

|

|

28,041 |

|

|

29,009 |

|

|

24,334 |

| Income tax receivable and

prepaid income taxes |

|

|

14,950 |

|

|

16,051 |

|

|

15,702 |

| Total current assets |

|

|

944,843 |

|

|

854,832 |

|

|

853,583 |

| Note receivable - related

party |

|

|

— |

|

|

— |

|

|

100 |

| Property and equipment,

net |

|

|

52,906 |

|

|

47,199 |

|

|

44,920 |

| Operating lease right-of-use

asset |

|

|

148,391 |

|

|

122,783 |

|

|

113,058 |

| Deposits and other |

|

|

20,166 |

|

|

16,250 |

|

|

10,567 |

| Deferred tax assets |

|

|

609 |

|

|

609 |

|

|

1,570 |

| Goodwill |

|

|

181,905 |

|

|

180,003 |

|

|

168,612 |

| Intangibles, net |

|

|

108,308 |

|

|

126,267 |

|

|

99,817 |

| Total Assets |

|

$ |

1,457,128 |

|

$ |

1,347,943 |

|

$ |

1,292,227 |

|

LIABILITIES |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

| Accounts payable |

|

$ |

225,586 |

|

$ |

161,140 |

|

$ |

140,623 |

| Accrued expenses |

|

|

150,067 |

|

|

154,751 |

|

|

129,754 |

| Operating leases - current

portion |

|

|

43,812 |

|

|

40,342 |

|

|

36,521 |

| Income taxes payable |

|

|

12,435 |

|

|

5,998 |

|

|

13,519 |

| Contingent payment liability -

current portion |

|

|

7,716 |

|

|

3,325 |

|

|

1,153 |

| Accrued incentive

compensation |

|

|

13,347 |

|

|

12,068 |

|

|

10,190 |

| Total current liabilities |

|

|

452,963 |

|

|

377,624 |

|

|

331,760 |

| Contingent payment liability -

long-term portion |

|

|

11,200 |

|

|

9,975 |

|

|

— |

| Operating leases - long-term

portion |

|

|

118,674 |

|

|

98,536 |

|

|

91,916 |

| Deferred tax liabilities |

|

|

8,777 |

|

|

8,606 |

|

|

3,923 |

| Other liabilities |

|

|

5,448 |

|

|

5,170 |

|

|

10,914 |

| Total Liabilities |

|

|

597,062 |

|

|

499,911 |

|

|

438,513 |

| |

|

|

|

|

|

|

| STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

| Total Steven Madden, Ltd.

stockholders’ equity |

|

|

833,923 |

|

|

829,598 |

|

|

837,038 |

| Noncontrolling interest |

|

|

26,143 |

|

|

18,434 |

|

|

16,676 |

| Total stockholders’

equity |

|

|

860,066 |

|

|

848,032 |

|

|

853,714 |

| Total Liabilities and

Stockholders’ Equity |

|

$ |

1,457,128 |

|

$ |

1,347,943 |

|

$ |

1,292,227 |

| |

|

|

|

|

|

|

|

|

|

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)(Unaudited)

|

|

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

| Cash flows from

operating activities: |

|

|

|

|

|

Net income |

|

$ |

138,099 |

|

|

$ |

136,968 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

Stock-based compensation |

|

|

19,531 |

|

|

|

18,169 |

|

|

Depreciation and amortization |

|

|

14,736 |

|

|

|

11,138 |

|

|

Loss on disposal of fixed assets |

|

|

112 |

|

|

|

204 |

|

|

Impairment of intangibles |

|

|

10,335 |

|

|

|

— |

|

|

Loss on divestiture of business |

|

|

3,199 |

|

|

|

— |

|

|

Impairment of lease right-of-use asset |

|

|

— |

|

|

|

95 |

|

|

Accrued interest on note receivable - related party |

|

|

— |

|

|

|

(6 |

) |

|

Notes receivable - related party |

|

|

— |

|

|

|

307 |

|

|

Change in valuation of contingent payment liability |

|

|

5,616 |

|

|

|

— |

|

|

Other operating activities |

|

|

(48 |

) |

|

|

417 |

|

|

Changes, net of acquisitions, in: |

|

|

|

|

|

Accounts receivable |

|

|

(15,794 |

) |

|

|

(20,601 |

) |

|

Factor accounts receivable |

|

|

(108,276 |

) |

|

|

(93,274 |

) |

|

Inventories |

|

|

(39,064 |

) |

|

|

23,541 |

|

|

Prepaid expenses, income tax receivables, prepaid taxes, and other

assets |

|

|

(864 |

) |

|

|

(264 |

) |

|

Accounts payable and accrued expenses |

|

|

66,853 |

|

|

|

4,991 |

|

|

Accrued incentive compensation |

|

|

1,382 |

|

|

|

(1,598 |

) |

|

Leases and other liabilities |

|

|

(1,572 |

) |

|

|

(2,331 |

) |

| |

|

|

|

|

|

Net cash provided by operating activities |

|

|

94,245 |

|

|

|

77,756 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

Capital expenditures |

|

|

(16,642 |

) |

|

|

(13,899 |

) |

|

Purchases of short-term investments |

|

|

(12,840 |

) |

|

|

(15,979 |

) |

|

Maturity/sale of short-term investments |

|

|

16,654 |

|

|

|

16,335 |

|

|

Acquisition of business |

|

|

(4,259 |

) |

|

|

— |

|

|

Other investing activities |

|

|

372 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

|

(16,715 |

) |

|

|

(13,543 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

Common stock repurchased and net settlements of stock awards |

|

|

(95,788 |

) |

|

|

(104,215 |

) |

|

Proceeds from exercise of stock options |

|

|

1,086 |

|

|

|

1,171 |

|

|

Investment of noncontrolling interest |

|

|

— |

|

|

|

4,582 |

|

|

Cash dividends paid on common stock |

|

|

(45,880 |

) |

|

|

(47,594 |

) |

|

Distribution of noncontrolling interest |

|

|

— |

|

|

|

(1,102 |

) |

|

Net cash used in financing activities |

|

|

(140,582 |

) |

|

|

(147,158 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

(2,174 |

) |

|

|

36 |

|

|

Net decrease in cash and cash equivalents |

|

|

(65,226 |

) |

|

|

(82,909 |

) |

| Cash and cash equivalents –

beginning of period |

|

|

204,640 |

|

|

|

274,713 |

|

| |

|

|

|

|

| Cash and cash equivalents –

end of period |

|

$ |

139,414 |

|

|

$ |

191,804 |

|

| |

|

|

|

|

|

|

|

|

STEVEN MADDEN, LTD. AND

SUBSIDIARIES

NON-GAAP RECONCILIATION

(In thousands, except per share amounts)

(Unaudited)

The Company uses non-GAAP financial information

to evaluate its operating performance and in order to represent the

manner in which the Company conducts and views its

business. Additionally, the Company believes the

information assists investors in comparing the Company’s

performance across reporting periods on a consistent basis by

excluding items that are not indicative of its core

business. The non-GAAP financial information is

provided in addition to, and not as an alternative to, the

Company’s reported results prepared in accordance with

GAAP.

|

Table 1 - Reconciliation of GAAP gross profit to Adjusted gross

profit |

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit |

|

$ |

259,544 |

|

$ |

232,625 |

|

$ |

701,488 |

|

$ |

617,587 |

| Non-GAAP

Adjustments |

|

|

59 |

|

|

— |

|

|

393 |

|

|

— |

|

Adjusted gross profit |

|

$ |

259,603 |

|

$ |

232,625 |

|

$ |

701,881 |

|

$ |

617,587 |

|

Table 2 - Reconciliation of GAAP operating expenses to Adjusted

operating expenses |

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

GAAP operating expenses |

|

$ |

178,915 |

|

|

$ |

149,887 |

|

|

$ |

507,343 |

|

|

$ |

444,298 |

|

| Non-GAAP

Adjustments |

|

|

(4,680 |

) |

|

|

(622 |

) |

|

|

(6,301 |

) |

|

|

(2,298 |

) |

|

Adjusted operating expenses |

|

$ |

174,235 |

|

|

$ |

149,265 |

|

|

$ |

501,042 |

|

|

$ |

442,000 |

|

|

Table 3 - Reconciliation of GAAP income from operations to Adjusted

income from operations |

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

GAAP income from operations |

|

$ |

74,578 |

|

$ |

82,738 |

|

$ |

178,194 |

|

$ |

173,289 |

| Non-GAAP

Adjustments |

|

|

10,790 |

|

|

622 |

|

|

22,645 |

|

|

2,298 |

|

Adjusted income from operations |

|

$ |

85,368 |

|

$ |

83,360 |

|

$ |

200,839 |

|

$ |

175,587 |

|

Table 4 - Reconciliation of GAAP provision for income taxes to

Adjusted provision for income taxes |

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

GAAP provision for income taxes |

|

$ |

19,390 |

|

$ |

19,552 |

|

|

$ |

44,404 |

|

$ |

42,219 |

| Non-GAAP

Adjustments |

|

|

1,238 |

|

|

(85 |

) |

|

|

4,032 |

|

|

309 |

|

Adjusted provision for income taxes |

|

$ |

20,628 |

|

$ |

19,467 |

|

|

$ |

48,436 |

|

$ |

42,528 |

|

Table 5 - Reconciliation of GAAP net income attributable to

noncontrolling interest to Adjusted net income attributable to

noncontrolling interest |

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

GAAP net income attributable to noncontrolling interest |

|

$ |

1,310 |

|

$ |

695 |

|

$ |

3,510 |

|

$ |

1,295 |

| Non-GAAP

Adjustments |

|

|

25 |

|

|

— |

|

|

155 |

|

|

— |

|

Adjusted net income attributable to noncontrolling interest |

|

$ |

1,335 |

|

$ |

695 |

|

$ |

3,665 |

|

$ |

1,295 |

|

Table 6 - Reconciliation of GAAP net income attributable to Steven

Madden, Ltd. to Adjusted net income attributable to Steven Madden,

Ltd. |

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2024 |

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

GAAP net income attributable to Steven Madden, Ltd. |

|

$ |

55,278 |

|

$ |

64,413 |

|

$ |

134,589 |

|

$ |

135,673 |

| Non-GAAP

Adjustments |

|

|

9,527 |

|

|

707 |

|

|

18,459 |

|

|

1,989 |

| Adjusted

net income attributable to Steven Madden, Ltd. |

|

$ |

64,805 |

|

$ |

65,120 |

|

$ |

153,048 |

|

$ |

137,662 |

|

|

|

|

|

|

|

|

|

|

| GAAP

diluted net income per share |

|

$ |

0.77 |

|

$ |

0.87 |

|

$ |

1.87 |

|

$ |

1.81 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted net income per share |

|

$ |

0.91 |

|

$ |

0.88 |

|

$ |

2.12 |

|

$ |

1.84 |

|

Table 7 - Reconciliation of GAAP diluted net income per share to

Adjusted diluted net income per share in 2024 outlook |

|

|

|

Updated 2024 Outlook |

|

|

|

Low End |

|

High End |

|

|

|

|

|

|

|

GAAP diluted net income per share |

|

$ |

2.36 |

|

$ |

2.41 |

| Non-GAAP

Adjustments |

|

|

0.26 |

|

|

0.26 |

|

Adjusted diluted net income per share |

|

$ |

2.62 |

|

$ |

2.67 |

Non-GAAP Adjustments include the items

below.

For the third quarter of 2024:

- $3.2 million pre-tax ($3.7 million

after-tax) expense in connection with a divestiture of a business,

included in operating expenses.

- $1.5 million pre-tax ($1.1 million

after-tax) expense in connection with an acquisition and formation

of joint ventures, included in operating expenses.

- $8.6 million pre-tax ($6.6 million

after-tax) expense in connection with a trademark impairment.

- $2.6 million pre-tax ($2.0 million

after-tax) benefit in connection with the change in valuation of a

contingent consideration in connection with the acquisition of

Almost Famous.

For the third quarter of 2023:

- $2.7 million pre-tax ($2.3 million

after-tax) expense in connection with the write-off of an

investment in a subsidiary in Asia, included in operating

expenses.

- $2.2 million pre-tax ($1.6 million

after-tax) benefit in connection with the dissolution of an entity

in Asia, included in operating expenses.

Contact

Steven Madden, Ltd.VP of Corporate Development & Investor

RelationsDanielle

McCoy718-308-2611InvestorRelations@stevemadden.com

This press release was published by a CLEAR® Verified

individual.

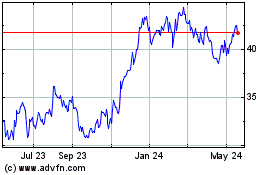

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

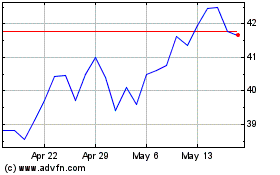

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jan 2024 to Jan 2025