Sol-Gel Technologies, Ltd. (NASDAQ: SLGL), a

dermatology company, pioneering treatments for patients with severe

skin conditions, conducting a Phase-3 clinical trial of SGT-610

(patidegib gel, 2%) for Gorlin syndrome, and with two approved

large-category dermatology products, TWYNEO® and EPSOLAY®, today

announced financial results for the second quarter ended June 30,

2024, and provided a corporate update.

Q2

2024 and Recent Corporate

Developments

-

On August 15, 2024, Sol-Gel signed a new agreement with Padagis,

which replaces the parties’ prior collaborative agreement for the

development and commercialization of a drug product generic to

Zoryve® Cream (roflumilast cream 0.3%). Under this new

agreement, Sol-Gel is to unconditionally

receive quarterly payments which will be paid over 24 months

and low single digit royalties from gross profits from sales of

roflumilast cream for a period of five years, in lieu of its 50%

share in future gross profits from such sales. In

addition, Sol-Gel will cease paying any outstanding and

future costs related to this prior collaborative agreement. The

amount to be received by Padagis together with the elimination of

future expected expenses related to this asset is expected to

enhance our cash position by approximately $6 million.

-

Recognizing that TWYNEO and EPSOLAY have a significant commercial

potential also outside the U.S., during July 2024, Sol-Gel has

successfully signed six initial license agreements with key

partners covering most European countries and South Africa. Sol-Gel

expects to sign additional agreements covering the majority of

Latin American countries, Australia, New Zealand, South Korea,

Spain, Italy and Portugal. These already signed agreements together

with agreements we anticipate to sign in the future, are expected

to provide upfront and regulatory milestone payments of up to $3.7

million, which we expect to utilize on adapting TWYNEO and EPSOLAY

to the regulatory requirements of these new territories. Based on

the forecasts received from Sol-Gel’s current and potential

partners, Sol-Gel expects that TWYNEO and EPSOLAY will launch in

the majority of these new territories in 2027 and 2026

respectively, and following launch these transactions are

anticipated to provide Sol-Gel with an annual royalty revenue

stream starting with approximately $1 million to $2 million in 2026

and growing gradually to approximately up to $10 million for the

year 2030 and further.

-

The Phase 3 study in Sol-Gel’s key asset SGT-610 in approximately

140 subjects (with 100 subjects required to complete the Study), at

about 42 experienced clinical centers is ongoing. To date, Sol-Gel

has signed agreements with 39 centers in multiple countries,

including the U.S., Germany, Italy, France, and

the UK, and approximately 29 of these enters have been activated.

Top line results are anticipated in Q2 2026. SGT-610 is a topically

applied patidegib, a hedgehog signaling pathway blocker 2% gel If

approved, SGT-610 is expected to be the first approved product for

the prevention of new BCC lesions in Gorlin syndrome patients and

is targeting a market exceeding $300 million annually.

-

Sol-Gel’s proof-of-concept study for SGT-210 (topical erlotinib) in

patients with Darier disease is ongoing. Darier disease is a

significant unmet medical need, with a market potential estimated

between $200 million to $300 million. If we successfully complete

this proof-of-concept study and the required pre-clinical studies,

we anticipate filing for a Phase 2 IND in Q2 2025. SGT-210 is

currently being used in a compassionate use treatment of a

pediatric patient suffering from a rare disease, and given the

preliminary highly encouraging response,we are cautiously

optimistic about the potential for success in other viable

keratoderma indications, recognizing that further research and

clinical studies are necessary to validate any broader applications

of our therapy.

-

Subject to shareholder approval, Mr. Arkin, the Company’s Executive

Chairman and controlling shareholder, who has several decades of

experience in leading positions in the pharmaceutical industry and

in the dermatological space in particular, will assume the role of

interim CEO as of January 1, 2025. During his tenure as interim

CEO, Mr. Arkin plans to transition away from the majority of his

other business activities in order to dedicate himself to his new

full-time position as interim CEO of the Company. Mr. Arkin will

not be entitled to any compensation for assuming this position. On

July 15, 2024, Sol-Gel announced management realignment whereby

pending shareholder approval our CEO Dr. Alon Seri-Levy will step

down as CEO and Board Member, effective December 31, 2024,and will

then continue to serve the Company as a consultant to our new CEO

and management team for at least one year.

-

Effective July 12, 2024, Mr. Eyal Ben-Or, the Company's previous

Director of Finance, assumed the role of Chief Financial Officer

(CFO). Prior to his employment in Sol-Gel Mr. Ben-Or worked at

Mobileye and KPMG Israel. Mr. Ben-Or, is a certified public

accountant, holds an MBA and a BA in accounting from the College of

Management in Israel. Mr. Ben-Or replacesthe Company’s previous

CFO, Mr. Gilad Mamlok, who will facilitate the transition through

December 31, 2024.

Mr. Mori

Arkin,

Executive Chairman

of Sol-Gel, stated: "We

are encouraged by Sol-Gel’s financial results for the second

quarter of 2024 and our ability to extend our cash runway into the

first quarter of 2026. We will continue to explore opportunities

for non-dilutive funding to potentially further extend our runway

through topline results. In our pipeline, we continue to conduct

the pivotal Phase 3 clinical trial of SGT-610 for preventing new

basal cell carcinomas in Gorlin Syndrome patients, targeting a

market exceeding $300 million, with top line results anticipated in

the second quarter of 2026 along with our proof-of-concept study

for SGT-210 (topical erlotinib) in Darier disease patients

targeting a market of between $200 million to $300 million. These

two rare disease projects reflect the huge growth potential of a

company of our size. The Sol-Gel management team and I are

committed to spare no effort to realize this potential".

Financial Results for the

Second Quarter

2024

Total revenue in the second quarter

was $5.4 million, which primarily consisted of licensing

revenue from Beimei, Galderma and Searchlight, compared to $0.6

million revenues for the same period in 2023.

Research and development expenses were $2.4

million compared to $5.3 million for the same period in 2023. The

decrease of $2.9 million was primarily attributed to a decrease of

$0.7 million in manufacturing expenses related to TWYNEO, a

decrease of $0.7 million in clinical development expenses related

to a generic product candidate, a decrease of $0.5 million in

payroll expenses due to the adoption of cost saving measures

initiated during the third quarter of 2023, a decrease of $0.5

million related to R&D expenses, a decrease of $0.3 million in

clinical trial expenses related to SGT-610 and a decrease of $0.2

million in clinical expenses related to SGT-210.

General and administrative expenses

were $1.4 million compared to $1.8 million for the

same period in 2023. The decrease of $0.4 million was

mainly attributed to a decrease in professional expenses.

Sol-Gel reported a net income of $1.9

million for the second quarter of 2024 and earnings

of $0.07 per basic and diluted share, compared to a net

loss of $6.0 million and a loss of $0.22 per

basic and diluted share for the same period in 2023.

As of June 30,

2024, Sol-Gel had $15.6 million in cash, cash

equivalents, and deposits and $14.9 million in marketable

securities for a total balance of $30.5 million. The Company

expects its cash resources to fund cash requirements into the first

quarter of 2026.

About TWYNEO and

EPSOLAY

TWYNEO is a topical cream containing a

fixed-dose combination of tretinoin, 0.1%, and benzoyl peroxide,

3%, cream for the treatment of acne vulgaris in adults and

pediatric patients 9 years of age and older. TWYNEO is the first

acne treatment that contains a fixed-dose combination of benzoyl

peroxide and tretinoin. Tretinoin and benzoyl peroxide are widely

prescribed separately for acne vulgaris; however, benzoyl peroxide

causes degradation of the tretinoin molecule, thereby potentially

reducing its effectiveness if used at the same time or combined in

the same formulation. TWYNEO uses silica (silicon dioxide) core

shell structures to separately micro-encapsulate tretinoin crystals

and benzoyl peroxide crystals enabling inclusion of the two active

ingredients in the cream.

EPSOLAY is a topical cream containing benzoyl

peroxide (BPO), 5%, for the treatment of bumps and blemishes

(inflammatory lesions) of rosacea in adults. EPSOLAY utilizes

a proprietary, patented technology to encapsulate BPO within

silica-based microcapsules to create a barrier between the

medication and the skin. The silica-based shell is designed to

slowly release BPO over time to provide a tolerable and effective

treatment.

About

Gorlin Syndrome and SGT-610

SGT-610, a hedgehog signaling pathway blocker,

has the potential to be the first ever treatment for prevention of

BCCs in Gorlin syndrome patients, if approved. Gorlin syndrome, an

autosomal dominant genetic disorder affecting approximately 1 in

27,000-31,000 people in the U.S., is mostly caused by

inheritance of one defective copy of the tumor suppressor patched

homolog 1 (PTCH1) gene. Normally, the PTCH1 gene blocks the

smoothened, frizzle class receptor (SMO) gene, turning off the

hedgehog signaling pathway when it is not needed. Mutations in the

PTCH1 gene may cause a loss of PTCH1 function, release of SMO, and

may allow BCC tumor cells to divide uncontrollably. Patidegib, the

active substance in SGT-610, is designed to block the SMO signal,

thus, allowing cells to function normally and reducing the

production of new tumors.

About

Darier Disease and

SGT-210

SGT-210 is a topical erlotinib drug candidate

that is formulated for the treatment of Darier Disease and other

hyperkeratosis-related indications. Erlotinib is a tyrosine kinase

receptor inhibitor that acts on the epidermal growth factor

receptor, a protein present on cell surfaces that plays a key role

in promoting cell growth and division. Darier Disease is a rare,

genetic keratinization disorder which is classically characterized

scaly crusted papules in a seborrheic

distribution and in skin folds.

About Sol-Gel Technologies

Sol-Gel Technologies, Ltd. is a dermatology

company focused on identifying, developing and commercializing or

partnering drug products to treat skin

diseases. Sol-Gel developed TWYNEO which is approved by

the FDA for the treatment of acne vulgaris in adults and pediatric

patients nine years of age and older; and EPSOLAY, which is

approved by the FDA for the treatment of inflammatory lesions of

rosacea in adults.

The Company’s pipeline also includes Phase 3

clinical trial of Orphan and breakthrough drug candidate SGT-610,

which is a new topical hedgehog inhibitor being developed to

prevent the new basal cell carcinoma lesions in patients with

Gorlin syndrome that is expected to have an improved safety profile

compared to oral hedgehog inhibitors as well as topical drug

candidate SGT-210 under investigation for the treatment

of rare hyper keratinization disorders.

For additional information, please visit our new

website: www.sol-gel.com

Forward Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements contained in this press release

that do not relate to matters of historical fact should be

considered forward-looking statements, including, but not limited

to the amounts to be received under our current and future

licensing agreements and our agreement with Padagis with respect to

the generic drug product to Zoryve® Cream (roflumilast cream,

0.3%), the out-licensing Twyneo and Epsolay in additional

territories, our expected cash runway, the expected royalties

amounts to be received from Galderma, the potential of Sol-Gel’s

assets including Twyneo, Epsolay, SGT-610, and SGT-210, the

timeline for advancing SGT-610 and SGT-210, and the size of

SGT-610’s market. In some cases, you can identify forward-looking

statements by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential,” or the negative of these terms or other

similar expressions. Forward-looking statements are based on

information we have when those statements are made or our

management’s current expectations and are subject to risks and

uncertainties that could cause actual performance or results to

differ materially from those expressed in or suggested by the

forward-looking statements. Important factors that could cause such

differences include, but are not limited to, our ability to enter

into further collaborations, lower than anticipated annual revenue

income from new collaborations, a delay in the timing of our

clinical trials, the success of our clinical trials, and an

increase in our anticipated costs and expenses, as well as the

following factors: (i) the adequacy of our financial and other

resources, particularly in light of our history of recurring losses

and the uncertainty regarding the adequacy of our liquidity to

pursue our complete business objectives; (ii) our ability to

complete the development of our product candidates; (iii) our

ability to find suitable co-development partners; (iv) our ability

to obtain and maintain regulatory approvals for our product

candidates in our target markets, the potential delay in receiving

such regulatory approvals and the possibility of adverse regulatory

or legal actions relating to our product candidates even if

regulatory approval is obtained; (v) our collaborators’ ability to

commercialize our pharmaceutical product candidates; (vi) our

ability to obtain and maintain adequate protection of our

intellectual property; (vii) our collaborators’ ability to

manufacture our product candidates in commercial quantities, at an

adequate quality or at an acceptable cost; (viii) our

collaborators’ ability to establish adequate sales, marketing and

distribution channels; (ix) acceptance of our product candidates by

healthcare professionals and patients; (x) the possibility that we

may face third-party claims of intellectual property infringement;

(xi) the timing and results of clinical trials that we may conduct

or that our competitors and others may conduct relating to our or

their products; (xii) intense competition in our industry, with

competitors having substantially greater financial, technological,

research and development, regulatory and clinical, manufacturing,

marketing and sales, distribution and personnel resources than we

do; (xiii) potential product liability claims; (xiv) potential

adverse federal, state and local government regulation in the

United States, China, Europe or Israel; and (xv)

loss or retirement of key executives and research scientists; (xvi)

general market, political and economic conditions in the countries

in which the Company operates; and, (xvii) the current war between

Israel and Hamas and any deterioration of the war in Israel into a

broader regional conflict involving Israel with other

parties. These factors and other important factors discussed in the

Company's Annual Report on Form 20-F filed with the Securities

and Exchange Commission (“SEC”) on March 13, 2024, and our

other reports filed with the SEC, could cause actual

results to differ materially from those indicated by the

forward-looking statements made in this press release. Except as

required by law, we undertake no obligation to update any

forward-looking statements in this press release.

Sol-Gel Contact:Eyal Ben-OrChief Financial

Officerinfo@sol-gel.com+972-8-9313429

Source: Sol-Gel Technologies Ltd.

|

SOL-GEL TECHNOLOGIES LTD. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(U.S. dollars in thousands, except share and per share data) |

|

(Unaudited) |

|

|

|

|

December 31, |

|

June 30, |

|

|

2023 |

|

2024 |

|

|

|

|

|

|

Assets |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

7,513 |

|

$ |

11,549 |

|

Bank deposits |

|

10,012 |

|

|

4,012 |

|

Marketable securities |

|

20,471 |

|

|

14,912 |

|

Accounts receivables |

|

377 |

|

|

6,059 |

|

Prepaid expenses and other current assets |

|

2,794 |

|

|

1,750 |

|

TOTAL CURRENT ASSETS |

|

41,167 |

|

|

38,282 |

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

|

|

Restricted long-term deposits and cash equivalents |

|

1,284 |

|

|

1,273 |

|

Property and equipment, net |

|

434 |

|

|

305 |

|

Operating lease right-of-use assets |

|

1,721 |

|

|

1,507 |

|

Other long-term assets |

|

55 |

|

|

34 |

|

Funds in respect of employee rights upon retirement |

|

626 |

|

|

604 |

|

TOTAL NON-CURRENT ASSETS |

|

4,120 |

|

|

3,723 |

|

TOTAL ASSETS |

$ |

45,287 |

|

$ |

42,005 |

|

Liabilities and shareholders' equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

$ |

154 |

|

$ |

679 |

|

Other accounts payable |

|

3,921 |

|

|

4,147 |

|

Current maturities of operating leases |

|

447 |

|

|

376 |

|

TOTAL CURRENT LIABILITIES |

|

4,522 |

|

|

5,202 |

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES |

|

|

|

|

|

|

Operating leases liabilities |

|

1,206 |

|

|

1,018 |

|

Liability for employee rights upon retirement |

|

915 |

|

|

883 |

|

TOTAL LONG-TERM LIABILITIES |

|

2,121 |

|

|

1,901 |

|

TOTAL LIABILITIES |

|

6,643 |

|

|

7,103 |

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

Ordinary Shares, NIS 0.1 par value – authorized: 50,000,000 as of

December 31, 2023 and June 30, 2024; issued and outstanding:

27,857,620 as of December 31, 2023 and June 30, 2024. |

|

774 |

|

|

774 |

|

Additional paid-in capital |

|

258,173 |

|

|

258,799 |

|

Accumulated deficit |

|

(220,303) |

|

|

(224,671) |

|

TOTAL SHAREHOLDERS' EQUITY |

|

38,644 |

|

|

34,902 |

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

45,287 |

|

$ |

42,005 |

|

|

|

|

|

SOL-GEL TECHNOLOGIES LTD. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(U.S. dollars in thousands, except share and per share data) |

|

(Unaudited) |

| |

| |

| |

Six months ended |

Three months ended |

| |

June 30 |

|

June 30 |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

REVENUE |

$ |

894 |

|

$ |

5,899 |

|

$ |

594 |

|

$ |

5,433 |

|

RESEARCH AND DEVELOPMENT EXPENSES |

|

14,698 |

|

|

7,783 |

|

|

5,312 |

|

|

2,438 |

|

GENERAL AND ADMINISTRATIVE EXPENSES |

|

3,786 |

|

|

3,203 |

|

|

1,809 |

|

|

1,371 |

|

OPERATING INCOME (LOSS) |

$ |

(17,590) |

|

$ |

(5,087) |

|

$ |

(6,527) |

|

$ |

1,624 |

|

FINANCIAL INCOME, net |

|

899 |

|

|

719 |

|

|

557 |

|

|

352 |

|

NET INCOME (LOSS) FOR THE PERIOD |

$ |

(16,691) |

|

$ |

(4,368) |

|

$ |

(5,970) |

|

$ |

1,976 |

|

BASIC AND DILUTED EARNINGS (LOSS) PER |

|

|

|

|

|

|

|

|

|

|

|

|

ORDINARY SHARE |

$ |

(0.63) |

|

$ |

(0.16) |

|

$ |

(0.22) |

|

$ |

0.07 |

|

WEIGHTED AVERAGE NUMBER OF SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

OUTSTANDING USED IN COMPUTATION OF |

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED LOSS PER SHARE |

|

26,306,484 |

|

|

27,857,620 |

|

|

27,660,326 |

|

|

27,857,620 |

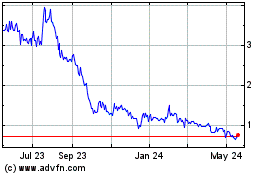

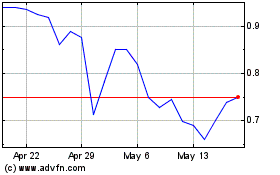

Sol Gel Technologies (NASDAQ:SLGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sol Gel Technologies (NASDAQ:SLGL)

Historical Stock Chart

From Dec 2023 to Dec 2024