0001023459false00010234592024-06-112024-06-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

June 11, 2024

(Date of the earliest event reported)

Simulations Plus, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| California | 001-32046 | 95-4595609 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

42505 10th Street West, Lancaster, California 93534-7059

(Address of principal executive offices) (Zip Code)

661-723-7723

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14z-12 under Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

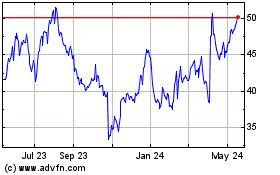

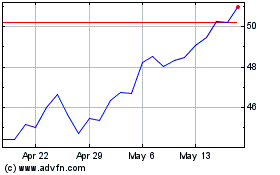

| Common Stock, par value $0.001 per share | SLP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On June 11, 2024, Simulations Plus, Inc. (the “Company”) entered into a Stock Purchase Agreement, by and among the Company, Pro-ficiency Holdings, Inc. (“Pro-ficiency”), each of the stockholders of Pro-ficiency (collectively, the “Sellers”) and WRYP Stockholders Services, LLC, solely in its capacity as the Sellers’ Representative (the “Purchase Agreement”). Pursuant to the Purchase Agreement, at closing on June 11, 2024 (the “Closing”), the Company purchased 100% of the issued and outstanding capital stock of Pro-ficiency (the “Acquisition”) from the Sellers for an aggregate purchase price of $100,000,000 in cash, subject to post-closing adjustments for net working capital, closing cash, indebtedness, and transaction expenses (collectively, the “Purchase Price”). An aggregate of $1,000,000 of the Purchase Price was placed in escrow to fund payment obligations of the Sellers with respect to post-Closing Purchase Price adjustments and post-Closing indemnification obligations of the Sellers, and another portion of the Purchase Price was deposited into an account to reimburse the Seller Representative for any fees and expenses incurred by the Seller Representative in performing its duties under the Purchase Agreement as the representative of the Sellers. As a result of the Acquisition, at Closing, Pro-ficiency became a wholly-owned subsidiary of the Company.

The Purchase Agreement contains standard representations, warranties and covenants and other terms customary in similar transactions. Subject to the provisions of the Purchase Agreement, the Sellers have agreed to indemnify the Company and its affiliates for losses resulting from breaches of representations, warranties and covenants of the Sellers and Pro-ficiency in the Purchase Agreement and for certain other specified matters. The Sellers’ indemnification obligations are subject to various limitations, including, among other things, a deductible, caps, and time limitations.

In connection with the Acquisition, the Company has obtained a customary buyer’s representation and warranty insurance policy (the “R&W Insurance Policy”) providing for up to $10,000,000 in coverage in the case of breaches of representations and warranties of the Sellers and Pro-ficiency contained in the Purchase Agreement, subject to certain exclusions and an initial $500,000 retention. The Company, on the one hand, and the Sellers, on the other hand, each bore one-half of the cost of obtaining the R&W Insurance Policy.

In consideration for their receipt of the Purchase Price, at Closing, certain of the Sellers entered into restrictive covenant agreements providing for certain customary restrictive covenants, including customary non-competition, non-solicitation, no hire, and non-disparagement covenants for a period of three years following Closing and customary confidentiality covenants.

The foregoing description of the Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the full text of Purchase Agreement, a copy of which is attached to this Current Report on Form 8-K (this “Report”) as Exhibit 10.1 and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Transaction Bonuses

On June 10, 2024, in connection with Acquisition, the Board approved the grant of cash bonuses to Will Frederick, Chief Financial Officer and Chief Operating Officer of the Company, in the amount of $137,500, and Brett Howell, the President, Quantitative Systems Pharmacology Solutions of the Company, in the amount of $13,750 (the “Transaction Bonuses”), the payment of which was contingent upon consummation of the Acquisition. The Transaction Bonuses were approved by the Board to, among other reasons, recognize the significant contributions by Messrs. Frederick and Howell in connection with the Acquisition.

Raymer Employment Agreement

In connection with, and as a condition to closing of, the Acquisition, on June 11, 2024, Michael Raymer, the chief executive officer of Pro-ficiency pre-Acquisition, was appointed as Business Unit President of the Company and the Company entered into an Amended and Restated Employment Agreement (the “Raymer Agreement”) with Mr. Raymer. Pursuant to the Raymer Agreement, effective as of Closing, Mr. Raymer will serve as Business Unit President of the Company.

Mr. Raymer, age 65, is a successful healthcare executive with over three decades of executive experience in the development of healthcare enterprise software, medical devices, diagnostics, and consumer health products. Mr. Raymer has serve as chief executive officer of Pro-ficiency since February 2021. Prior to joining Pro-ficiency, from January 2018 to March 2021, he served as chief strategy officer and as a board member of Angel MD, an on-line marketplace connecting early stage healthcare companies with MDs/PhDs, investors and industry to create better investment outcomes. Mr. Raymer

has also previously served as president of Perspectum Diagnostics Ltd, managing director and a founder of Health Advisory Partners, senior vice president of M*Modal, global market strategist and general manager of Microsoft, and senior vice president and general manager of GE Healthcare. Mr. Raymer attended University of Kansas and University of Missouri – KK.

The Raymer Agreement has an initial term commencing June 11, 2024 and ending December 31, 2024, after which it will automatically renew for successive one year terms (each such renewal term ending on December 31 of the applicable year), unless earlier terminated pursuant to its terms. Pursuant to the Raymer Agreement, Mr. Raymer will receive an annual base salary of $325,000 and shall be eligible to receive (i) a grant of stock options, with a target of 15,000 stock options, under the Company’s 2021 Equity Incentive Plan, as amended, as determined by the board of directors of the Company (the “Board”), in its discretion, and (ii) for each fiscal year during the Term, a performance bonus in an amount not to exceed 25% of his base salary, payable at the end of each calendar year, the amount of which shall be determined by the compensation committee of the Board based on the financial performance and achievements of the Company for the previous fiscal year, provided that Mr. Raymer must be employed by the Company on the last day of the applicable calendar year to be eligible for the bonus related to the last fiscal year.

In the event that Mr. Raymer is terminated for Cause (as defined in the Raymer Agreement), by mutual agreement or as a result of his death or complete disability, or if Mr. Raymer terminates his employment for any reason, Mr. Raymer shall be paid his salary and benefits through the effective date of termination.

In the event that Mr. Raymer is terminated without Cause (as defined in the Raymer Agreement), Mr. Raymer shall be paid his salary and benefits through the effective date of termination. In addition, so long as he signs a release of claims, he shall receive (i) a one-time payment of an amount equal to the greater of twelve months of his base salary and his base salary for the remaining term of the Raymer Agreement, and (ii) and COBRA continuation benefits for the twelve months after termination paid for by the Company.

Except as set forth in the Purchase Agreement, there is no other arrangement or understanding between Mr. Raymer and any other person pursuant to which Mr. Raymer was appointed as Business Unit President of the Company. There are no family relationships between Mr. Raymer and any of the Company’s directors, executive officers or persons nominated or chosen by the Company to become a director or executive officer. Mr. Raymer is not a participant in any related-person transaction or proposed related-person transaction required to be disclosed by Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with this appointment.

The foregoing description of the Raymer Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Raymer Agreement, a copy of which is attached to this Report as Exhibit 10.2 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On June 12, 2024, the Company issued a press release announcing the Acquisition. The press release is furnished as Exhibit 99.1 to this Report.

Additionally, on June 12, 2024, the Company posted a corporate presentation providing information regarding the Acquisition to the Company’s website in the “Investors” section. A copy of that corporate presentation is furnished as Exhibit 99.2 hereto and incorporated herein by reference.

In accordance with General Instructions B.2 of Form 8-K, the information set forth in Item 7.01 of this Report, including Exhibits 99.1 And 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Report.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Report, including the disclosures set forth herein and in Exhibits 99.1 and 99.2 attached hereto, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Report or reports hereafter furnished, including in other publicly available documents filed with the Securities and Exchange Commission (the “Commission”), to the Company’s stockholders and other publicly

available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to, the risks set forth herein and in such other documents filed with the Commission, each of which could adversely affect our business and the accuracy of the forward-looking statements contained herein. Our actual results, performance or achievements may differ materially from those expressed or implied by such forward-looking statements.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| 2.1* | |

| 10.1 | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| SIMULATIONS PLUS, INC. |

| |

| Dated: June 12, 2024 | By: /s/ Will Frederick |

| Will Frederick |

| Chief Financial Officer and Chief Operating Officer |

Exhibit 2.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS NOT MATERIAL AND IS THE TYPE OF INFORMATION THAT THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS AS PRIVATE AND CONFIDENTIAL. REDACTED INFORMATION IS INDICATED BY [***].

STOCK PURCHASE AGREEMENT

by and among

SIMULATIONS PLUS, INC.,

as “Purchaser”

THE UNDERSIGNED STOCKHOLDERS OF PRO-FICIENCY HOLDINGS, INC.,

as “Sellers”,

PRO-FICIENCY HOLDINGS, INC.,

as “Company”

and

WRYP STOCKHOLDERS SERVICES, LLC

as “Sellers’ Representative”

Dated as of June 11, 2024

TABLE OF CONTENTS

Page

EXHIBITS AND SCHEDULES

Exhibit A Company Interests

Exhibit B Illustration of Net Working Capital Calculation

Exhibit C Form of Escrow Agreement

Exhibit D Form of Disbursing Agent Agreement

Exhibit E Form of Restrictive Covenant Agreement

Exhibit F Form of Transaction Bonus Agreement

Exhibit G Form of Employment Agreement

Exhibit H Form of IP Assignment Agreement

Exhibit I Form of Loan Termination and Release Agreement

Schedule 1.1-1 Company Approvals

Schedule 1.1-2 Company Governmental Approvals

Schedule 1.1-3 Indebtedness

Schedule 1.1-4 Key Employees

Schedule 1.1-5 Permitted Liens

Schedule 1.1-6 Promissory Notes

Schedule 1.1-7 Transaction Bonuses

Schedule 2.4(a) Repaid Indebtedness

Schedule 3.2(a) Restrictive Covenant Agreement Parties

Schedule 3.2(d) IP Assignment Agreements

Schedule 3.2(g) Terminated Contracts

Schedule 3.2(i) Required Resignees

Schedule 3.2(j) Required Consents

Schedule 7.13 Additional Covenants

Schedule 8.2(g) Certain Indemnity Matters

Schedule 8.4(a) Dollar One Matters

Disclosure Schedule

STOCK PURCHASE AGREEMENT

This Stock Purchase Agreement (this “Agreement”), effective as of June 11, 2024 (the “Effective Date”), is made by and among Simulations Plus, Inc., a California corporation (“Purchaser”), Pro-ficiency Holdings, Inc., a Delaware corporation (the “Company”), the undersigned stockholders of the Company (each, a “Seller,” and collectively, the “Sellers”), and WRYP Stockholders Services, LLC, a North Carolina limited liability company, solely in its capacity as the Sellers’ Representative (the “Sellers’ Representative”). Purchaser, the Sellers and the Sellers’ Representative are each individually referred to herein as a “Party,” and collectively, as the “Parties.”

RECITALS

WHEREAS, as of the execution and delivery of this Agreement and the Closing, the Sellers, collectively, are the record holders and beneficial owners of all of the issued and outstanding capital stock of the Company, including without limitation the Company Common Stock and Company Preferred Stock, as set forth on Exhibit A attached hereto (collectively, the “Company Capital Stock”);

WHEREAS, each Seller that held Company Options prior to the Closing (such Sellers indicated on Exhibit A) exercised all such Company Options prior to the Closing, and in some cases, the amount of the exercise price was loaned to such Seller by the Company, as evidenced by a Promissory Note;

WHEREAS, at the Closing, the Sellers desire to sell and transfer to Purchaser, and Purchaser desires to purchase from the Sellers, all right, title and interest in and to one hundred percent (100%) of the issued and outstanding shares of Company Capital Stock, as set forth on Exhibit A attached hereto under the heading “Purchased Securities” (the “Purchased Securities”), free and clear of all Liens (other than Liens imposed by applicable securities Laws), all subject to and in accordance with the terms and conditions of this Agreement; and

WHEREAS, concurrently with the execution and delivery of this Agreement, and effective as of the Closing, the Purchaser will enter into employment agreements with each of the Key Employees (the “Employment Agreements”).

NOW, THEREFORE, on the basis of the foregoing recitals and in consideration of the respective covenants, agreements, representations and warranties contained herein, the Parties hereto agree as follows:

ARTICLE 1

DEFINITIONS

1.1Definitions. For purposes of this Agreement, the following terms have the meanings set forth below:

“Acceptance Notice” has the meaning set forth in Section 2.5(b).

“Accounts Receivable” has the meaning set forth in Section 4.4(d).

“Action” means any suit, litigation, arbitration, mediation, claim, complaint, dispute, action, cause of action, assessment, charge, demand, grievance, audit, investigation, inquiry, inspection, examination, notice letter or other proceeding.

“Actual Adjustment Amount” has the meaning set forth in Section 2.5(a).

“Actual Excess Cash” has the meaning set forth in Section 2.5(a).

“Actual Indebtedness” has the meaning set forth in Section 2.5(a).

“Actual Net Working Capital” has the meaning set forth in Section 2.5(a).

“Actual Transaction Expenses” has the meaning set forth in Section 2.5(a).

“Additional Tail Policies” has the meaning set forth in Section 7.4(d).

“Adjustment Amount” means the amount equal to (a) the Excess Cash, (b) plus the amount (if any) by which Net Working Capital as of the Effective Time exceeds Target Net Working Capital, (c) minus the amount (if any) by which Net Working Capital as of the Effective Time is less than Target Net Working Capital, (d) minus the amount of Indebtedness of the Company as of immediately prior to the Effective Time and (e) minus the amount of unpaid Transaction Expenses. For the avoidance of doubt, the “Adjustment Amount” may be a positive or negative number (if a positive number, such amount shall increase the Purchase Price, and if a negative number, such amount shall decrease the Purchase Price).

“Adjustment Escrow Amount” means an amount in cash equal to $500,000.

“Adjustment Escrow Funds” means the Adjustment Escrow Amount, including any dividends, interest, distributions and other income received in respect thereof, less any losses on investments thereof, and less amounts disbursed therefrom from time to time in accordance with this Agreement.

“Adjustment Escrow Sub-Account” means the sub-account established pursuant to the Escrow Agreement into which the Adjustment Escrow Amount is deposited at the Closing with the Escrow Agent.

“Adjustment Shortfall” has the meaning set forth in Section 2.6(b).

“Adjustment Surplus” has the meaning set forth in Section 2.6(a)

“Advisers” has the meaning set forth in Section 9.17(c).

“Affiliate” of any particular Person means, any other Person, directly or indirectly, whether through one or more intermediaries or otherwise, controlling, controlled by or under common control with, such particular Person. “Affiliate” includes any general partner, managing member, director, manager, officer (or functional equivalent of the foregoing), if any, of such particular Person. For the purposes of this definition, “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ownership of voting Equity Securities, by Contract or Organizational Documents or otherwise.

“Agreed Adjustments” has the meaning set forth in Section 2.5(c).

“Agreement” has the meaning set forth in the Preamble.

“Agreement Period” has the meaning set forth in Section 2.5(c).

“Anti-Corruption Law” means any applicable Law relating to bribery, corruption or any similar illegal act or omission, including the U.S. Foreign Corrupt Practices Act, the Canadian Corruption of Foreign Public Officials Act, the U.K. Bribery Act and any Laws enacted pursuant to, or arising under, the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions or the Prevention of Corruption Act, 1988.

“Anti-Terrorism Laws” means any applicable Law related to terrorism financing or money laundering, including, but not limited to, the International Emergency Economic Powers Act, the Trading With the Enemy Act, the International Security Development and Cooperation Act, the Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001, the Patriot Act, and any rules or regulations promulgated pursuant to or under the authority of any of the foregoing.

“Assumption Notice” has the meaning set forth in Section 8.5(a)(ii)

“Audited Financial Statements” has the meaning set forth in Section 4.4(a).

“Balance Sheet Date” has the meaning set forth in Section 4.4(a).

“Base Purchase Price” means an amount equal to $100,000,000.

“Basket” has the meaning set forth in Section 8.4(a).

“Behavioral Data” means any behavioral, browsing, usage, purchase, interest-based, demographic or other information that is directly attributable to, or later associated with, Personal Data, where such information could reasonably be used to identify a natural Person.

“Benefit Plan” means any “employee benefit plan” (as such term is defined in Section 3(3) of ERISA) and any other equity purchase, stock option, restricted equity interest, equity-like interest, severance, retention, employment, change-of-control, compensation, bonus, incentive, performance award, deferred compensation, profit-sharing, employee loan, fringe benefit, holiday, pension, retirement and other benefit plan, agreement, program, policy, commitment or other arrangement (including any related funding mechanism now in effect), whether formal or informal, oral or written, material employee benefit plan, program or arrangement that the Company or its Subsidiaries currently maintains or contributes to for the benefit of any current or former officer, director, employee or former employee (or their beneficiaries) of the Company or any of its Subsidiaries or to which the Company or its Subsidiaries has or may have any Liability.

“Benefits Liability” means, without duplication (i) any stay or retention bonus, incentive bonus, termination, change of control bonus, transaction bonus, severance award and other compensatory payments or obligations that are in each case, incurred or become payable as a result of or in connection with the execution of this Agreement or the consummation of the transactions contemplated by this Agreement (whether alone or in combination with any other event) that are payable by the Company or its Subsidiaries and that are not included in the calculation of Transaction Expenses; (ii) any obligations of the Company or its Subsidiaries for severance accrued, payable or otherwise owed to any former employee, director, officer or independent contractor whose employment or engagement was terminated prior to the Closing Date; (iii) any obligations of the Company or its Subsidiaries for [***]; (iv) any obligations of the Company and its Subsidiaries for unfunded deferred compensation; (v) any obligations of the Company or its Subsidiaries under any employee pension benefit plans, including any underfunding and any unsatisfied obligation for “withdrawal liability” as such term is defined under ERISA to a “multiemployer plan” (as defined in Section 3(37) of ERISA), determined based on the most

recent withdrawal liability estimates provided by the multiemployer plan; (vi) obligations of the Company or its Subsidiaries for the employer portion of any employment, unemployment, social security, payroll or similar related Tax or other employer-related obligations, including the employer’s portion of social security Taxes deferred in accordance with the CARES Act or any amount paid or to be paid to offset or gross-up any Person for any excise Tax or income Tax, in each case, arising with respect to the payment of any foregoing amount.

“Bonus Statement” has the meaning set forth in Section 7.11(c)(i).

“Business” means the business of the Company and its Subsidiaries as currently conducted or currently proposed to be conducted, including the business of simulation modeling software, consulting, medical communication, and events management services for pharmaceutical companies and clinical trials.

“Business Day” means any day other than Saturday, Sunday or any other day on which commercial banks located in the State of Delaware or Lancaster, California are authorized or required by Law to be closed.

“Business Permits” has the meaning set forth in Section 4.8(b).

“Cap” has the meaning set forth in Section 8.4(a).

“CARES Act Funds” has the meaning set forth in Section 4.20.

“CARES Act Programs” has the meaning set forth in Section 4.20.

“Cash” means, as of a designated date or time, the cash and cash equivalents of the Company (including marketable securities and short-term investments, but excluding Restricted Cash) as of such date and time, determined in accordance with GAAP (it being understood that such Cash shall be increased by the amount of any uncleared checks, wire transfers (including payment by Purchaser to the Company in respect of the Promissory Notes on behalf of certain Sellers) and drafts deposited into a bank account of the Company and reduced by the aggregate amount of all overdrafts, checks, wire transfers or drafts that are issued, outstanding or in transit at such time).

“Claim Dispute Notice” has the meaning set forth in Section 8.5(b).

“Closing” has the meaning set forth in Section 3.1.

“Closing Date” has the meaning set forth in Section 3.1.

“Closing Statement” has the meaning set forth in Section 2.5(a).

“Code” means the Internal Revenue Code of 1986, as amended.

“Company” has the meaning set forth in the Preamble.

“Company Approvals” means, collectively with any Company Governmental Approvals, any consent, license, permit, approval, waiver or authorization or order of, filing with or any notification to, any Person, required as a result of the execution, delivery or performance of this Agreement or the

Transaction Documents or the consummation of the Transactions, including those set forth or required to be set forth on Schedule 1.1-1 attached hereto.

“Company Capital Stock” has the meaning set forth in the Recitals.

“Company Common Stock” means the common stock of the Company, par value $0.0001 per share.

“Company Confidential Information” means any and all confidential and proprietary information, data, books and records or other materials of the Company or its Subsidiaries, in whatever form, that concerns, arises from, relates to or is associated or used in connection with, in whole or in part, the Company, its Subsidiaries or the Business, including any past, present and future business affairs of the Company and its Subsidiaries. “Company Confidential Information” includes the Company’s and its Subsidiaries’ information that is (a) any Contracts, information, documents and materials relating to this Agreement, the Transaction Documents and the Transactions (including the terms, conditions and other provisions hereof and thereof); (b) (i) methods of operation, (ii) price lists and pricing policies, (iii) financial information, budgets and projections, (iv) personnel data, (v) past, present or future business plans, (vi) compilations of data, other works of authorship, improvements, discoveries, (vii) products, new product or new technology information, product prototypes, product copies, operational and data processing capabilities, systems, source code, object code, software and hardware and the documentation thereof, (viii) advertising or marketing plans and materials, (ix) information regarding any director, manager, officer, employee, consultant, contractor, professor, student, assistant, researcher, trustee, executor, administrator or other service providers, or (x) information regarding any actual or prospective clients, customers, vendors, suppliers, landlords, licensors, lenders, advisors, attorneys, joint venturers, financing sources, insurers, or any other Person having a business relationship with the Company or its Subsidiaries that concerns, arises from, relates to or is associated or used in connection with, in whole or in part, the Company, its Subsidiaries or the Business; (c) Trade Secrets; (d) information that has been entrusted to the Company or its Subsidiaries by a third party under or subject to any confidentiality agreement or other contractual, legal or fiduciary obligation of confidentiality; and (e) any other confidential or proprietary information, whether such information was developed in whole or in part by the Company or its Subsidiaries or others on behalf of the Company or its Subsidiaries, or was obtained by the Company or an Affiliate of the Company from a third party, and irrespective of whether such information has been identified by the Company or Affiliate of the Company as secret or confidential. Notwithstanding the foregoing, “Company Confidential Information” shall not include any information or data to the extent that such information or data (1) becomes generally available to the public by publication or otherwise after the Closing through no fault of the Sellers, (2) has been voluntarily disclosed to the public by Purchaser or the Company after the Closing (except where such public disclosure has been made, directly or indirectly, by any Seller or any Affiliate or Representative thereof, without Purchaser’s written authorization) or (3) is independently developed and disclosed by a third party without breaching or violating this Agreement, any Transaction Document or the legal rights or obligations of any Person (including under any confidentiality agreement or other contractual, legal or fiduciary duty or obligation of confidentiality).

“Company Datasets” has the meaning set forth in Section 4.11(o).

“Company Governmental Approvals” means any consent, license, permit, approval, waiver, authorization or order of, filing with or notification to, any Governmental Authority required as a result of the execution, delivery or performance of this Agreement or the Transaction Documents or the

consummation of the Transactions, including those set forth or required to be set forth on Schedule 1.1-2 attached hereto.

“Company Intellectual Property” means, collectively, all Owned IP and all Licensed IP.

“Company IT Assets” has the meaning in set forth in Section 4.11(p).

“Company Options” means all options to purchase or otherwise acquire Company Common Stock (whether or not vested) granted by the Company.

“Company Preferred Stock” means the preferred stock of the Company, par value $0.0001 per share, consisting of 10,000,000 shares of Series A Preferred Stock and 9,511,277 shares of Series A-1 Preferred Stock.

“Company Privacy Policy” means each external privacy policy of the Company or its Subsidiaries published or in effect during the past three (3) years.

“Company Private Data Processing Contract” means any Contract of the Company or its Subsidiaries that relates to the Company’s or its Subsidiaries’ collection, use, disclosure, transfer, transmission, storage, hosting, disposal, retention, interception or other processing of Private Data.

“Company Products” means each product (including Software and databases) or service, licensed or sold by or on behalf of the Company or any of its Subsidiaries.

“Company Site” means pro-ficiency.com.

“Company Software” means any Software (including Software that is Owned IP or Licensed IP), that is embedded in, or used in the delivery, hosting or distribution of, any Company Products, including any such Software that is used to collect, transfer, transmit, store, host or otherwise process Private Data.

“Compass” has the meaning set forth in the Compass Agreement.

“Compass Agreement” means that certain Asset Purchase Agreement entered into by and among the Company and various other parties on June 7, 2023, as amended on December 29, 2023.

“Compass Earnout” means the amount of the Period Two Milestone Payment (as defined in the Compass Agreement).

[***].

“Confidential Information” means the Company Confidential Information and the Purchaser Confidential Information.

“Contract” means any contract, agreement, lease, sublease, license, sublicense, letter of intent (to the extent of any binding provisions therein), purchase order, statement of work, invoice, franchise, memorandum of understanding (to the extent of any binding provisions therein), promise, right, offer letter (to the extent of any binding provisions therein), letter agreement, insurance policy, Benefit Plan, note, bond, indenture, guarantee or other legally binding instrument, commitment, or obligation of any kind or nature, whether written or oral, together with any amendments, restatements, supplements or other modifications thereto.

“Copyleft License” means any license of Open Source Software that requires, as a condition of use, modification and/or distribution of such Open Source Software, that such Open Source Software, or any Software integrated with, derived from, used, or distributed with such Open Source Software or into which such Open Source Software is incorporated: (i) be made available or distributed in source code form; (ii) be licensed for the purpose of preparing derivative works; or (iii) be redistributable at no license fee. Copyleft Licenses include the GNU General Public License and the GNU Lesser General Public License.

“COVID-19” means SARS-CoV-2 or COVID-19 and any evolutions thereof or the associated epidemics, pandemics or disease outbreaks thereof.

“D&O Indemnified Persons” has the meaning set forth in Section 7.4(a).

“D&O Tail Policy” has the meaning set forth in Section 7.4(b).

“Data Room” has the meaning set forth in Section 1.2(k).

“Direct Claim” has the meaning set forth in Section 8.5(b).

“Direct Claim Notice” has the meaning set forth in Section 8.5(b).

“Disbursing Agent” means PNC Bank.

“Disbursing Agent Agreement” has the meaning set forth in Section 2.3(a).

“Disclosure Schedule” means the disclosure schedule delivered to Purchaser in connection with this Agreement, which sets forth the exceptions to the representations and warranties contained in ARTICLE 4.

“Distribution Schedule” has the meaning set forth in Section 2.2(b)

“Dollar One Loss” has the meaning set forth in Section 8.4(a).

“Effective Date” has the meaning set forth in the Preamble.

“Effective Time” means 11:59 p.m. (Eastern Time) on the Closing Date.

[***]

“Employment Agreement” has the meaning set forth in Section 3.2(c).

“Engagement” has the meaning set forth in Section 9.17(a).

“Enforceability Exception” has the meaning set forth in Section 4.2(a).

“Environmental Laws” means all Laws regulating occupational safety and health hazards, pollution or protection of the environment, including all those relating to the presence, use, production, generation, handling, transportation, treatment, storage, disposal, distribution, labeling, testing, processing, discharge, release, threatened release, control or cleanup of any materials, substances or wastes classified as hazardous under any such Law.

“Equity Security” means, with respect to any Person, (a) any share, unit, capital stock, partnership or membership interest, unit of participation, voting securities, debt securities or other similar ownership interest (however designated) in such Person, (b) any equity, debt or other security or interest, directly or indirectly, convertible into or exercisable or exchangeable for any share, unit, capital stock, partnership or membership interest, unit of participation, voting securities, debt securities or other similar ownership interest (however designated) in such Person, (c) any option, warrant, purchase right, conversion right, exchange right, profits interest, preemptive right or other Contract that would, directly or indirectly, entitle any other Person to subscribe for or acquire any such interest in such Person or otherwise entitle any other Person to share in the equity, profits, earnings, losses or gains of such Person (including equity appreciation, phantom equity, profit participation or other similar rights) and (d) any equity appreciation right, phantom equity, equity right or other right the value of which is linked to the value of any securities or interests referred to in clauses (a) through (c) above or other similar rights.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate” shall mean any Person under common control with the Company or that, together the Company, could be deemed a “single employer” within the meaning of Section 4001(b)(1) of ERISA or within the meaning of Section 414(b), (c), (m) or (o) of the Code, and the regulations issued thereunder.

“Escrow Agent” means PNC Bank.

“Escrow Agreement” shall have the meaning set forth in Section 2.3(a).

“Escrow Amount” means the Adjustment Escrow Amount, plus the Indemnification Escrow Amount.

“Escrow Funds” means the Adjustment Escrow Funds, plus the Indemnification Escrow Funds.

“Estimated Adjustment Amount” has the meaning set forth in Section 2.2(a)(iii).

“Estimated Balance Sheet” has the meaning set forth in Section 2.2(a)(i).

“Estimated Closing Payment” means an amount equal to (a) the Base Purchase Price, (b) plus or minus, the Estimated Adjustment Amount, (c) minus the Escrow Amount, and (d) minus the Sellers’ Representative Fund Amount. For the avoidance of doubt, the “Estimated Adjustment Amount” may be a positive or negative number (if a positive number, such amount shall increase the Estimated Closing Payment, and if a negative number, such amount shall decrease the Estimated Closing Payment).

“Estimated Closing Statement” has the meaning set forth in Section 2.2(a).

“Estimated Excess Cash” has the meaning set forth in Section 2.2(a)(ii).

“Estimated Indebtedness” has the meaning set forth in Section 2.2(a)(ii).

“Estimated Net Working Capital” has the meaning set forth in Section 2.2(a)(ii).

“Estimated Purchase Price” means the calculation of Purchase Price using the estimates of Estimated Excess Cash, Estimated Indebtedness, Estimated Net Working Capital and Estimated

Transaction Expenses set forth in the Estimated Closing Statement delivered to Purchaser pursuant to Section 2.2(a) hereof.

“Estimated Transaction Expenses” has the meaning set forth in Section 2.2(a)(ii).

“Ex-Im Law” means any applicable Law relating to import, export, reexport, transfer or similar controls, including the Export Administration Regulations or the customs and import Laws administered by U.S. Customs and Border Protection.

“Excess Cash” means Cash in excess of the Minimum Cash Amount.

“Family Member” means, with respect to any individual, (i) the spouses, domestic partners, siblings, parents and children (whether natural or adopted) of such individual, (ii) parents of the spouses and domestic partners of such individual, (iii) such individual’s executor or personal representative, in his, her or its capacity as such, and (iv) any trust, partnership, limited liability company, corporation or similar entity whose owners and beneficiaries consist of any of the foregoing individuals or any retirement plan of such individual.

“Final Adjustment Amount” has the meaning set forth in Section 2.5(d).

“Final Closing Statement” has the meaning set forth in Section 2.5(d).

“Final Excess Cash” means the Excess Cash as finally determined pursuant to Section 2.5.

“Final Indebtedness” means the Indebtedness as finally determined pursuant to Section 2.5.

“Final Invoices” has the meaning set forth in Section 2.4(b).

“Final Net Working Capital” means the Net Working Capital as finally determined pursuant to Section 2.5.

“Final Transaction Expenses” means the Transaction Expenses as finally determined pursuant to Section 2.5.

“Financial Statements” has the meaning set forth in Section 4.4(a).

“Fraud” means actual and intentional common law fraud as defined by and construed under the Laws of the State of Delaware in the making of any representations and warranties in this Agreement. Under no circumstances will “Fraud” include any equitable fraud, negligent misrepresentation, promissory fraud, unfair dealings, or any other fraud or torts based on recklessness or negligence.

“Fugitive Agreement” means that certain Asset Purchase Agreement entered into by and among Pro-ficiency, LLC, a wholly-owned Subsidiary of the Company, and various other parties on July 1, 2022.

“Fundamental Representations” means (a) with respect to the Company, the representations and warranties contained in Sections 4.1(a) through (d) (Organization; Power and Authority), Section 4.2(a) (Binding Effect and Non-Contravention), Section 4.3 (Capitalization; Subsidiaries), Section 4.23 (Compass Agreement), Section 4.24 (Fugitive Agreement), and Section 4.25 (Brokerage) of this Agreement, (b) with respect to Sellers, the representations and warranties set forth in Section 5.1 (Organization, Power and Authority), Section 5.2 (Binding Effect and Non-Contravention), Section 5.3

(Title to Shares), Section 5.4 (Promissory Notes), Section 5.5 (Brokerage), and (c) with respect to Purchaser, the representations and warranties set forth in Section 6.1 (Organization, Power and Authority), and Section 6.2 (Binding Effect and Non-Contravention), of this Agreement.

“Funds Flow” has the meaning set forth in Section 2.2(b)(vii).

“GAAP” means United States generally accepted accounting principles as in effect from time to time, as consistently applied.

“GDPR” has the meaning set forth in Section 4.11(x).

“General Survival Date” has the meaning set forth in Section 8.1(a).

“Governmental Authority” means, whether domestic or foreign, any (a) nation, principality, state, commonwealth, province, territory, county, municipality, district or other jurisdiction of any governmental nature, (b) federal, state, local, municipal, foreign, provincial or other government, (c) governmental or quasi-governmental authority or entity of any nature or (d) authority, agency, body, board, branch, court, commission, department, entity, instrumentality, official, organization, tribunal or other Person exercising, or entitled to exercise, any power or authority of any governmental, executive, legislative, judicial, administrative, regulatory, police, military, municipal or taxing nature, including any self-regulatory organization or arbitration tribunal.

[***]

“Harmful Code” has the meaning set forth in Section 4.11(l).

“Income Tax” means U.S. federal income Tax and any other income Tax imposed on or measured by net income.

“Indebtedness” means, with respect to any Person and without duplication, any Liability of such Person or for which such Person has any Liability arising under or in respect of: (a) indebtedness for borrowed money; (b) any line of credit, note, bond, indenture, debenture or similar instrument; (c) the deferred purchase price of assets, property, goods or services (excluding (i) trade payables incurred in the Ordinary Course of Business and (ii) [***]; (d) any capital (but not operating) lease obligation, but excluding any obligations under any Real Property Leases; (e) any Liability of any other Person that is guaranteed, directly or indirectly, as guarantor, surety or otherwise, by such Person or secured by, contingent or otherwise, any Lien on any asset or property (whether real, personal, tangible or intangible) of such Person; (f) any commitment, whether drawn or undrawn, by which such Person assures a creditor against any Liability (including letters of credit and contingent reimbursement obligations with respect to any performance bond, customs bond, surety bond, bankers’ acceptance, fidelity bond or similar credit transaction or facility); (g) any interest rate, foreign currency exchange, currency swap or similar rate protection or hedging transaction (valued at the termination value thereof); (h) any seller note, deferred purchase price, earnout ([***]), contingent or similar payment Liability (such amount to be the maximum amount to the extent such amounts remain outstanding as of Closing; (i) the factoring of accounts receivable or off-balance sheet financing; (j) any Liability for Pre-Closing Taxes, regardless of when due or payable, including any deferred Taxes under the CARES Act or any similar provision of applicable Law or any memorandum or executive order of any president; (k) the purchase, redemption, retirement, defeasance or other acquisition of Equity Securities of such Person; (l) unpaid management, board or similar fees, costs or expenses due to any direct or indirect investor, board member or advisor of such Person or any of their Affiliates; (m) any amount payable in respect of the resolution or settlement of any

Action identified on Schedule 1.1-3 attached hereto; (n) any Benefits Liability; (o) [***]; (p) any transaction with an Affiliate [***]; (q) any accounts payable of such Person which have remained payable for a period of at least ninety (90); (r) any accrued interest, prepayment premium or penalty, break fee or other fee, cost or expense arising from or attributable to any of the foregoing, including with respect to the unwinding, prepayment or termination thereof; (s) with respect to the Company or its Subsidiaries, any “single trigger” or similar bonus, severance, change-in-control payments option exercise or cancellations or similar payment obligations of the Company or its Subsidiaries that become due or payable solely as a result of the consummation of the Transactions, (t) the Sales and Use Tax Amount, and (t) except as otherwise expressly excluded in subsections (a) – (t) of this definition of “Indebtedness”, any other Liability that is required to be reflected as debt on a balance sheet of such Person prepared in accordance with GAAP. Notwithstanding the foregoing, “Indebtedness” shall not include any Liability or Transaction Expense, in each case, to the extent actually included in the calculation of Final Net Working Capital or Final Transaction Expenses, respectively.

“Indemnification Escrow Amount” means an amount in cash equal to $500,000.

“Indemnification Escrow Funds” means the Indemnification Escrow Amount, including any dividends, interest, distributions and other income received in respect thereof, and less amounts disbursed therefrom from time to time in accordance with this Agreement.

“Indemnification Escrow Sub-Account” means the sub-account established pursuant to the Escrow Agreement into which the Indemnification Escrow Amount is deposited at the Closing with the Escrow Agent.

“Indemnified Party” means a Party that is seeking indemnification under ARTICLE 8.

“Indemnifying Party” means a Party from which indemnification is being sought under ARTICLE 8.

“Independent Auditor” has the meaning set forth in Section 2.5(c).

“Infringe” (and the related term “Infringement”) means infringe, breach, violate, misappropriate, dilute, contravene or constitute the unauthorized use of.

“Insurance Policies” has the meaning set forth in Section 4.17.

“Intellectual Property” mean algorithms, APIs, data, databases, data collections, diagrams, formulae, inventions (whether or not patentable), know-how, logos, designs, marks (including brand names, product names, logos, and slogans), methods, network configurations and architectures, processes, proprietary information, protocols, schematics, specifications, Software, Software code (in any form, including source code and executable or object code), subroutines, techniques, user interfaces, URLs, web sites, works of authorship (including written, audio and visual materials), business or technical information (including technical data, customer and supplier lists, pricing and cost information, and business and marketing plans and proposals), all other forms of technology (whether or not embodied in any tangible form and including all tangible embodiments of the foregoing), and other such items for which Intellectual Property Rights may be secured, including any documents or other tangible media containing any of the foregoing.

“Intellectual Property Rights” shall mean all rights of the following types, which may exist or be created under the Laws of any jurisdiction in the world: (i) rights associated with works of authorship,

including exclusive exploitation rights, copyrights and moral rights; (ii) Trademark, service mark, business name, brand name, domain name and trade name rights and similar rights; (iii) Trade Secret rights; (iv) patents, patent applications, utility models, design rights, and all related patent rights; (v) other proprietary rights in Intellectual Property; (vi) rights in or relating to applications, registrations, renewals, extensions, combinations, revisions, divisions, continuations, continuations-in-part and reissues of, and applications for, any of the rights referred to in clauses (i) through (v) above; and (vii) all causes of action and rights to sue or seek other remedies arising from or relating to the foregoing, including for any past or ongoing infringement, misuse or misappropriation.

“Interested Party” has the meaning set forth in Section 4.19.

“Interim Financial Statements” has the meaning set forth in Section 4.4(a).

“Invoice Amount” has the meaning set forth in Section 2.4(c).

“IP Assignment Agreement” has the meaning set forth in Section 3.2(d).

“IRS” means the United States Internal Revenue Service.

“Key Employees” means those individuals listed on Schedule 1.1-4 attached hereto.

“Key IP Representations” means (a) the last sentence of Section 4.11(b), (b) the first sentence of Section 4.11(c), (c) the first and second sentences of Section 4.11(d), (d) Section 4.11(e), (e) the first sentence of Section 4.11(f), (f) the first sentence of Section 4.11(i), (g) Section 4.11(j), (h) the first sentence of Section 4.11(m), (i) Section 4.11(s), and (j) the first sentence of Section 4.11(t).

“Knowledge” when referring to the “Sellers’ Knowledge,” “Knowledge of Sellers,” “to Sellers’ Knowledge,” or similar phrases means the actual knowledge of each Knowledge Party as well as the knowledge such Knowledge Party would reasonably be expected to have acquired after making due inquiry of all officers and their direct reports of such Seller that would reasonably be expected to have actual knowledge of such fact or other matter.

“Knowledge Party” means each of [***].

“Latest Balance Sheet” has the meaning set forth in Section 4.4(a).

“Law” means any applicable law, statute, legislation, constitution, common law, ordinance, code, judgment, order, writ, decree, determination, injunction, treaty, rule, regulation, requirement or ruling of any kind of any Governmental Authority or other Person having the effect of law.

“Liability” means any liability, obligation, damage or other loss of any kind or nature, whether asserted or unasserted, absolute or contingent, known or unknown, accrued or unaccrued, liquidated or unliquidated, due or to become due, whether or not foreseeable and regardless of when asserted.

“Licensed IP” means Intellectual Property Rights owned by Persons (other than the Company and its Subsidiaries) and used or held for use by the Company or its Subsidiaries or pursuant to which the Company or any of its Subsidiaries exercises any commercialization or similar right, in each case, pursuant to a valid and enforceable, written agreement.

“Lien” means any lien, pledge, mortgage, deed of trust, lease, license, security interest, charge, claim, easement, encumbrance, hypothecation, encroachment, restriction, option, proxy, right of first offer or refusal, defect in survey or title or other lien or encumbrance of any kind.

“Loan Termination and Release Agreement” has the meaning set forth in Section 3.2(e).

“Loss” means, collectively, any (a) liability, loss, cost, damage, debt, deficiency, disbursement, injury, interest, penalty, fine, Lien, Tax, fee, cost, expense, or other Liability of any kind, whether or not arising out of a third party claim, (b) fee, cost, expense, or other Liability of investigating, defending, asserting, prosecuting, settling or collecting any foregoing Loss (including court, arbitration and similar costs and the fees and expenses of any attorneys, advisors, witnesses or other professionals) and (c) the cost of any Tax, interest or penalty with respect to any foregoing Loss; provided, that, for purposes of Section 8.2 and Section 8.3, “Loss” shall be subject to the limitations of Section 8.6(e).

“Material Adverse Effect” means any change, effect, event, occurrence, state of facts or development (each, an “Event”) that, individually or in the aggregate, is, or would reasonably be expected to be, materially adverse to (a) the business, assets, properties, condition (financial or otherwise), results of operation of the Company, its Subsidiaries or the Business taken as a whole, or (b) the ability of Sellers to perform their obligations under this Agreement or any Transaction Document or consummate the Transaction; provided, however, none of the following shall be deemed in itself, or in any combination, to constitute, and none of the following shall be taken into account in determining whether there has been or will be, a Material Adverse Effect: any adverse Event arising from, relating to or resulting from (i) the announcement or pendency of the transactions contemplated by this Agreement, (ii) conditions affecting the industry in which the Company or its Subsidiaries participate, the United States economy as a whole or the capital markets in general or any market in which the Company or its Subsidiaries operate, (iii) changes (or proposed changes) in, or the interpretation of, GAAP, (iv) changes (or proposed changes) in, or the interpretation of, Law, rules, regulations, orders, or other binding directives issued by any Governmental Authority, (v) performance or compliance with the terms of, or the taking of any action required by, this Agreement, (vi) national or international political or social conditions, including the commencement, continuation or escalation of a war, armed hostilities or other international or national calamity or act of terrorism directly or indirectly involving the United States of America, (vii) earthquakes, hurricanes, tsunamis, tornadoes, floods, mudslides, wildfires or other natural disasters, weather conditions, acts of God, epidemics, disease outbreaks, pandemics (including any effect resulting from, arising in connection with or otherwise related to COVID-19 and/or any COVID-19 measures) and other force majeure events in the United States or any other country or region in the world, (viii) any failure of the Company or its Subsidiaries to meet any projections, forecasts or estimates of revenue, earnings, cash flow or cash position (it being understood that the facts or occurrences giving rise to such failure that are not otherwise excluded from the definition of “Material Adverse Effect” may be taken into account when determining whether there has been a Material Adverse Effect), or (ix) the availability or cost of equity, debt or other financing to Purchaser; provided, that, in the case of clause (ii), (iii), (iv) or (v), such Event does not affect the Company and its Subsidiaries in a disproportionate and adverse manner as compared to other Persons owning, operating or conducting, in whole or in part, the Business.

“Material Contracts” has the meaning set forth in Section 4.15(a).

“Minimum Cash Amount” means $400,000.

“Multi-Section Losses” has the meaning set forth in Section 8.7(b).

“Net Working Capital” means (a) the consolidated amount of current assets of the Company (excluding Cash, other than the Minimum Cash Amount to the extent actually included in the calculation of the Final Adjustment Amount), minus (b) the consolidated amount of current Liabilities of the Company and the short- and long-term portions of deferred revenue of the Company (excluding any Indebtedness or Transaction Expenses to the extent actually included in the calculation of the Final Adjustment Amount), in each case of (a) and (b): (i) determined as of the Effective Time, (ii) consisting of only those general ledger accounts set forth on the example calculation of Net Working Capital set forth on Exhibit B, and (iii) calculated in accordance with GAAP (except as otherwise set forth in this definition) using the same accounting principles, methods, policies, practices and procedures with consistent classifications, judgments and estimation methodology as used in the example calculation of Net Working Capital set forth on Exhibit B. In the event of a conflict between GAAP and Exhibit B, Exhibit B will control. For purposes of the amount to be included in Net Working Capital, the Parties agree that the current Liability amount included in Estimated Net Working Capital in respect of the True North Bonus Plan is not subject to adjustment and is the same amount that will be included as a current Liability in Final Net Working Capital in respect of the True North Bonus Plan.

“Objection” has the meaning set forth in Section 2.5(c).

“Objection Notice” has the meaning set forth in Section 2.5(b).

“Open Source Software” means any item of Company Software that is subject to any version of the GNU General Public License, the Affero General Public License, the GNU Lesser General Public License, the Eclipse Public License, the Common Public License, the Mozilla Public License, or any other license identified as an open source license by the Open Source Initiative (www.opensource.org). “Order” means any judgment, ruling, sentence, writ, decree, award, compliance agreement, demand, injunction, determination or order (whether judicial, executive, legislative, administrative or arbitral), including any determination of any Governmental Authority or arbitrator.

“Ordinary Course of Business” means an action or omission taken (or not taken) by the Company or any or its Subsidiaries in the usual and ordinary course of such Person’s day-to-day business, consistent (in nature, scope, manner, amount, magnitude and otherwise) with such Person’s past practices through the date of this Agreement, which does not require separate or special authorization or approval by the board of directors or managers, managing member or equityholders of such Person.

“Organizational Documents” means, (a) with respect to any Person that is a corporation, its articles or certificate of incorporation or memorandum and articles of association, as the case may be, and its bylaws; (b) with respect to any Person that is a limited partnership, its certificate of limited partnership and its limited partnership or operating agreement; (c) with respect to any Person that is a limited liability company, its certificate of formation and its limited liability company or operating agreement; (d) with respect to any Person that is a trust or other entity, its declaration or agreement of trust or its constituent document; and (e) with respect to any other Person, its comparable organizational documents, in each case, as has been amended or restated.

“Owned IP” means all Intellectual Property owned or purported to be owned, in whole or part, by the Company or its Subsidiaries, including jointly with other Persons.

“Pandemic Response Law” means the Consolidated Appropriations Act, 2021, or applicable rules and regulations promulgated thereunder, as amended from time to time, the American Rescue Plan Act of 2021, Pub L. 117-2 (117th Cong.) (Mar. 11, 2021), the Coronavirus Aid, Relief, and Economic Security

Act, Pub. L. 116–136 (116th Cong.) (Mar. 27, 2020), the Families First Coronavirus Response Act, Pub. L. No. 116-127 (116th Cong.) (Mar. 18, 2020), and any other similar, future, or additional federal, state, local, or non-U.S. Law, or administrative guidance that addresses or is intended to benefit taxpayers in response to the COVID-19 pandemic and associated economic downturn.

“Parties” has the meaning set forth in the Preamble.

“Payoff Amount” has the meaning set forth in Section 2.4(c).

“Payoff Letters” has the meaning set forth in Section 2.4(b).

“Permit” means any permit, franchise, grant, authorization, declaration, order, license, registration, requirement, easement, variance, exemption, consent, certificate, approval, filing or similar right of any kind issued by a Governmental Authority.

“Permitted Liens” means (a) liens for Taxes that are not yet due and payable or the amount or validity of which is being contested in good faith by appropriate proceedings and for which adequate reserves have been established in the Latest Balance Sheet in compliance with GAAP and set forth on Schedule 1.1-5 attached hereto; (b) liens arising under original purchase price conditional sales Contracts and equipment leases with third parties set forth on Schedule 1.1-4; (c) recorded easements, covenants, conditions and similar restrictions of public land record or any zoning restrictions or regulations enacted by any Governmental Authority (provided, that, no such Lien described in this clause (c) impairs the current use, occupancy, value or marketability of title of the real property subject thereto); (d) pledges or deposits to secure obligations under Law related to workers or unemployment compensation or similar legislation to the extent included in Restricted Cash and set forth on the face of the latest Financial Statements; (e) mechanic’s, materialman’s, warehouseman’s, supplier’s, vendor’s or similar liens arising or incurred in the Ordinary Course of Business securing amounts that are not yet due and payable or the amount or validity of which is being contested in good faith by appropriate proceedings and for which adequate reserves have been established in the Latest Balance Sheet in compliance with GAAP and set forth on Schedule 1.1-4 and which are set forth on the face of the latest Financial Statements; and (f) any liens disclosed in Schedule 1.1-4 under the heading Permitted Liens.

“Person” means an individual, a partnership, a corporation, an association, a limited liability company, a joint stock company, a trust, a joint venture, an unincorporated organization, an estate, a labor union or a Governmental Authority.

“Personnel” has the meaning set forth in Section 4.11(b).

“Personal Data” means any piece of information considered “personally identifiable information,” “personal data,” or “personal information” under any Privacy Laws.

“Plans” means the Pro-ficiency Holdings, Inc. 2021 Stock Plan, as amended.

“Pre-Closing Tax Period” means any taxable period of the Company that ends on or before the Closing Date and the portion of any Straddle Period that ends on (and includes) the Closing Date.

“Pre-Closing Taxes” means (i) all Taxes of the Company, or for which the Company has any Liability, for any Pre-Closing Tax Period (as determined under Section 7.6(c) with respect to any Straddle Period), (ii) all Taxes of any member of an affiliated, consolidated, combined or unitary group of which the Company is or was a member on or prior to the Closing Date, including pursuant to Section 1.1502-6

of the Treasury Regulations (or any analogous or similar state, local, or non-U.S. Law), (iii) all Taxes of any Person imposed on the Company or for which the Company has any Liability as a transferee or successor, by contract, pursuant to any Law or otherwise, as a result of an event or transaction occurring, or Contract entered into, prior to the Closing, (iv) the Sellers’ portion of any Transfer Taxes under Section 7.6(h), (v) all employment, payroll, social security, unemployment or withholding Taxes imposed on the Company or for which the Company has any Liability with respect to compensatory payments made as a result of or in connection with the Transactions, and (vi) any amount that would have been described in clauses (i)-(v) of this definition but for a Pandemic Response Law. Notwithstanding the foregoing, Pre-Closing Taxes does not include any Sales and Use Taxes.

“Privacy Laws” means all Laws concerning the collection, processing, use, sharing, disclosure, transfer, deletion, storage or handling of Personal Data, that are applicable to the Sellers in their operation of the Business, including: (i) Laws relating to the collection, storage, processing, use, transfer, sharing, disclosure, or deletion of Personal Data, (ii) Laws relating to electronic and mobile communications, text messages, marketing or advertising materials, including anti-SPAM, unsolicited advertising or communications Laws, (iii) Laws relating to use of any credentials, (iv) the Canada Personal Information Protection and Electronic Documents Act (PIPEDA), (v) the United Kingdom Data Protection Act, (vi) the Health Insurance Portability and Accountability Act (HIPAA), (vii) the Australian Privacy Principals, (viii) the European Union General Data Protection Regulation (GDPR), (ix) the EU Privacy and Electronic Communications Directive 2002/58/EC (ePrivacy) (as amended) and all implementing regulations, (x) the Children’s Online Privacy Protection Act (COPPA), (xi) the California Consumer Privacy Act of 2018 (CCPA), (xii) the Fair Credit Reporting Act (FCRA), (xiii) the Fair and Accurate Credit Transactions Act (FACTA), (xiv) the Gramm-Leach-Bliley Act (GLBA), (xv) the Telephone Consumer Protection Act (TCPA), and (xvi) any other any applicable worldwide data protection or privacy Laws, in each case, if and to the extent applicable to the Sellers in their operation of the Business.

“Private Data” shall mean Behavioral Data and Personal Data.

“Pro Rata Share” means, with respect to a Seller, the proportional share of the Purchase Price payable to such Seller as of any given date based upon its, his, or her holdings of Company Capital Stock and determined in accordance with the Company’s Organizational Documents and as specified in the Distribution Schedule.

“Processing” means, with respect to data, any operation or set of operations including the use, collection, processing, storage, recording, organization, adaption, alteration, transfer, retrieval, consultation, disclosure, dissemination or otherwise making available, alignment or combination of such data, restriction, erasure or destruction.

“Promissory Notes” means those promissory notes set forth on Schedule 1.1-6 delivered to any of the Sellers in order to exercise Company Options.

“Purchase Price” means an amount equal to the following: (i) the Base Purchase Price; (ii) plus or minus, the Final Adjustment Amount. For purposes of clarity, the “Final Adjustment Amount” may be a positive or negative number and if a positive number, such amount shall increase the Purchase Price, and if a negative number, such amount shall reduce the Purchase Price.

“Purchased Securities” has the meaning set forth in the Recitals.

“Purchaser” has the meaning set forth in the Preamble.

“Purchaser Confidential Information” means, other than the Company Confidential Information, any confidential and proprietary information concerning the businesses and affairs of Purchaser and its subsidiaries that is not already generally available to the public.

“Purchaser Indemnified Parties” has the meaning set forth in Section 8.2.

“R&W Covered Claim” has the meaning set forth in Section 8.5(a)(vi).

“R&W Insurance Policy” means the buyer-side representation and warranty insurance policy, underwritten by BlueChip Underwriting Services and issued by insurance carriers referenced therein (the “R&W Insurer”), having policy number [***] (as it may be amended, modified or otherwise supplemented from time to time).

“R&W Insurance Policy Cost” means the premium for, and any fees, costs, expenses, Taxes or other amounts incurred by or on behalf of Purchaser or any Affiliate of Purchaser in connection with underwriting, negotiating, obtaining or binding the R&W Insurance Policy.

“R&W Retention” means the retention amount under the R&W Insurance Policy.

“Real Property” has the meaning set forth in Section 4.12(a).

“Real Property Leases” has the meaning set forth in Section 4.12(b).

“Registered IP” means all Owned IP that is registered, issued or subject to a pending application for registration or issuance, in each case, with a Governmental Authority or private registrar.

“Released Claims” has the meaning set forth in Section 9.4(a).

“Released Parties” has the meaning set forth in Section 9.4(a).

“Releasing Parties” has the meaning set forth in Section 9.4(a).

“Repaid Indebtedness” has the meaning set forth in Section 2.4(a).

“Representatives” means, with respect to any specified Person, any Affiliates, general partners, principals, officers, directors, managers, employees, auditors, accountants, advisors, counsel, and agents of such Person.

“Required Consents” has the meaning set forth in Section 3.2(j).

“Required Resignees” has the meaning set forth in Section 3.2(k).

“Required Terminations” has the meaning set forth in Section 3.2(i).

“Resolved Loss” has the meaning set forth in Section 8.6(d)(i).

“Restricted Cash” means the aggregate amount of cash or cash equivalents owned by the Company that is not freely accessible, transferable or usable by the Company for any lawful purpose because of a restriction on use or distribution under applicable Law or Contract, including cash held on behalf of or for the benefit of another Person, provided that “Restricted Cash” shall not include the RTP

security deposit or any deposit account collateral requirements that may be required by Bridge Bank in connection with the continuation of the Company credit cards issued by Bridge Bank.

“Restrictive Covenant Agreement” has the meaning set forth in Section 3.2(a).

[***].

“Sales and Use Taxes” means any state and local use, gross receipts, or similar Taxes or Sales Taxes of the Company, including any interest, penalties, fees, costs or other Liabilities payable in respect to such state and local use, gross receipts, or similar Taxes or Sales Taxes.

“Sales Taxes” has the meaning set forth in Section 4.9(m).

“Sanctioned Country” means any country or region that is the subject or target of a comprehensive embargo under applicable Sanctions Laws.

“Sanctioned Person” means any Person that is the subject or target of sanctions or restrictions under applicable Sanctions Laws or Ex-Im Laws, including: (i) any Person listed on any applicable U.S. or non-U.S. sanctions- or export-related restricted party list, including OFAC’s Specially Designated Nationals and Blocked Persons List; (ii) any Person that is, in the aggregate, fifty percent (50%) or greater owned, directly or indirectly, or otherwise controlled by one or more Persons described in clause (i); or (iii) located within or operating from a Sanctioned Country.

“Sanctions Law” means any Law relating to economic or trade sanctions, including any Law administered or enforced by the United States (including by OFAC or the U.S. Department of State) and the United Nations Security Council.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Seller Indemnified Parties” has the meaning set forth in Section 8.3.

“Sellers” has the meaning set forth in the Preamble.

“Sellers’ Representative” has the meaning set forth in the Preamble.

“Sellers’ Representative Fund Amount” means the amount of $250,000.

“Software” means computer software and databases, together with, as applicable, object code, source code, firmware, files, development tools, and embedded versions thereof, and documentation related thereto.

“Straddle Period” means any taxable period for Taxes beginning on or before and ending after the Closing Date.

“Standards Organization” has the meaning set forth in Section 4.11(c)(viii).

“Subsidiary” means, with respect to any Person, a corporation, partnership, trust, limited liability company, association, business enterprise or other entity in which such Person owns, holds or controls, directly or indirectly, through one or more Subsidiaries of such Person, (a) Equity Securities or other

ownership interests representing more than fifty percent (50%) of: (i) the issued and outstanding economic interests in such Person (including by way of allocation of gain or losses); or (ii) the voting power of all issued and outstanding Equity Securities or other ownership interests of such Person or (b) a majority of the voting power (whether by Law, Contract, Organizational Documents or otherwise) entitled to vote in, manage or control the election of the general partner, managing member, directors, managers, trustee or other governing body (or functional equivalent of any of the foregoing).

“Survival Period” has the meaning set forth in Section 8.1(a).

“Systems” means the computer, information technology, telecommunications and data processing assets, systems, equipment, facilities and services used (or held for use) by, on behalf of or for the Company or its Subsidiaries, whether owned, leased, outsourced, or licensed, including all software, hardware, servers, sites, circuits, networks, data communications lines, routers hubs, switches, interfaces, websites, communications facilities, platforms, technology, and related systems and services, whether outsourced, cloud-based or otherwise.

“Target Net Working Capital” means negative $500,000.

“Tax” means any federal, state, local or foreign income, gross income, gross receipts, net receipts, capital stock, franchise, profits, payroll, employment, withholding, social security, unemployment, disability, premium, real property, ad valorem/personal property, unclaimed property, environmental or windfall profit tax, escheat, stamp, excise, license, occupation, sales, use, transfer, registration, value added, alternative or add-on minimum tax, estimated or other tax, customs duty, governmental fee, or other like assessment or charge of any kind whatsoever, imposed by any Taxing Authority, including any interest, penalty or addition thereto, whether disputed or not, and including any obligations to indemnify or otherwise assume or succeed to the Tax liability of any other Person.

“Tax Contest” means any Action, audit, investigation, claim, litigation, dispute or controversy arising from, related to or in respect of Taxes.

“Tax Return” means any return, report, information return, election, statement, declaration, estimate, notice, notification, form, election, certificate, claim for refund or other document relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof, or other document or information filed with or submitted to, or required to be filed with or submitted to, any Taxing Authority in connection with the determination, assessment, collection, or payment of any Tax or in connection with the administration, implementation, or enforcement of or compliance with any Law relating to Tax.

“Taxing Authority” means any Governmental Authority responsible for the administration or imposition of any tax.

“Third Party Claim” means any Action made or brought by any Person who or that is not a party to this Agreement.

“Third Party Claim Notice” has the meaning set forth in Section 8.5(a)(i).

“Top Customer” has the meaning set forth in Section 4.18(b).

“Top Supplier” has the meaning set forth in Section 4.18(a).

“Trade Secret” means any information held confidential or deemed a trade secret under applicable Law.

“Trademarks” mean trademarks, service marks, trade dress, trade names, corporate names, d/b/a names, fictitious names, slogans, brand names, logos, and other source identifiers and identifying symbols, together with all goodwill associated therewith.

“Transaction Bonus Agreement” has the meaning set forth in Section 3.2(b).

“Transaction Bonuses” means those transaction bonuses payable to the Persons and in the amounts set forth on Schedule 1.1-7 [***].

“Transaction Documents” means this Agreement, the Escrow Agreement, the Disbursing Agent Agreement, the Restrictive Covenant Agreements, Transaction Bonus Agreements, Employment Agreements, and IP Assignment Agreements and any other certificate or instrument expressly contemplated by this Agreement or any of the foregoing.