false000008894100000889412025-03-132025-03-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 13, 2025

SEMTECH CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware |

(State or other jurisdiction of

incorporation) |

| | | | | | | | | | | |

| 001-06395 | | 95-2119684 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | |

| 200 Flynn Road | | |

| Camarillo, | California | | 93012-8790 |

| (Address of principal executive offices) | | (Zip Code) |

805-498-2111

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Exchange Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | SMTC | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 13, 2025, the Registrant issued a press release announcing its financial results for the fourth quarter and fiscal year 2025, which ended January 26, 2025. A copy of the press release is attached hereto as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

On March 13, 2025, the Registrant issued a press release containing forward-looking statements, including with respect to its future performance and financial results. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit 104 The Cover Page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101)

The information contained in Item 2.02, Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K hereto is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in Item 2.02, Item 7.01 and Exhibit 99.1 hereto shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference to Item 2.02, Item 7.01 and Exhibit 99.1, as applicable in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | SEMTECH CORPORATION |

| | | | |

| Date: | March 13, 2025 | | /s/ Mark Lin |

| | | Name: | Mark Lin |

| | | Title: | Chief Financial Officer |

FOR IMMEDIATE RELEASE

Contact:

Sara Kesten

Semtech Corporation

(805) 480-2004

webir@semtech.com

Semtech Announces Fourth Quarter and Fiscal Year 2025 Results

Fourth Quarter of Fiscal Year 2025

•Net sales of $251.0 million, up 6% sequentially

•GAAP gross margin of 52.0%, up 90 basis points sequentially and Non-GAAP adjusted gross margin of 53.2%, up 80 basis points sequentially

•GAAP operating margin of 8.5%, up 100 basis points sequentially and Non-GAAP adjusted operating margin of 19.9%, up 160 basis points sequentially

•GAAP diluted earnings per share of $0.43 and Non-GAAP adjusted diluted earnings per share of $0.40

•Operating cash flow of $33.5 million and free cash flow of $30.9 million

Fiscal Year 2025

•Net sales of $909.3 million, up 5% from fiscal year 2024

•GAAP gross margin of 50.2%, up 1,610 basis points from fiscal year 2024 and Non-GAAP adjusted gross margin of 51.5%, up 200 basis points from fiscal year 2024

•GAAP operating margin of 5.5% and Non-GAAP adjusted operating margin of 16.4%

•GAAP diluted loss per share of $2.26 and Non-GAAP adjusted diluted earnings per share of $0.88

CAMARILLO, Calif., March 13, 2025—Semtech Corporation (Nasdaq: SMTC), a high-performance semiconductor, IoT systems and cloud connectivity service provider, today reported unaudited financial results for its fourth quarter and fiscal year 2025, which ended January 26, 2025.

"Fiscal year 2025 represented a year of positive inflection on many fronts, with sequential improvement for each quarter reported in net sales, gross margin, operating margin and earnings per share," said Hong Hou, Semtech's president and chief executive officer. "In the new fiscal year, we are intently focusing on three core priorities to position Semtech for future success: portfolio optimization and simplification, strategic investment in research and development and driving margin expansion, all which we believe will deliver greater value to our shareholders."

| | | | | |

2 | Semtech Announces Fourth Quarter and Fiscal Year 2025 Results |

"Operating cash flow also reflected a positive inflection in our business and is expected to further benefit from lower cash interest requirements stemming from our debt reduction," said Mark Lin, Semtech's executive vice president and chief financial officer. "We executed to our previously stated capital allocation priority of reducing debt, with net debt as of the end of fiscal year 2025 decreasing 68% year-over-year, which we believe provides a stable financial foundation for long-term growth."

Fourth Quarter and Fiscal Year 2025 Results | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | | | | |

| (in millions, except per share data) | Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| GAAP Financial Results | | | | | | | | | |

| Net sales | $ | 251.0 | | | $ | 236.8 | | | $ | 192.9 | | | $ | 909.3 | | | $ | 868.8 | |

| Gross margin | 52.0 | % | | 51.1 | % | | (0.2) | % | | 50.2 | % | | 34.1 | % |

| Operating expenses, net | $ | 109.3 | | | $ | 103.2 | | | $ | 619.6 | | | $ | 406.6 | | | $ | 1,240.6 | |

| Operating income (loss) | $ | 21.2 | | | $ | 17.8 | | | $ | (620.0) | | | $ | 49.9 | | | $ | (944.3) | |

| Operating margin | 8.5 | % | | 7.5 | % | | (321.3) | % | | 5.5 | % | | (108.7) | % |

| Interest expense, net | $ | 16.7 | | | $ | 20.3 | | | $ | 22.1 | | | $ | 87.8 | | | $ | 92.8 | |

| Goodwill impairment | $ | 7.5 | | | $ | — | | | $ | 473.8 | | | $ | 7.5 | | | $ | 755.6 | |

| Intangible impairments | $ | — | | | $ | — | | | $ | 131.4 | | | $ | — | | | $ | 131.4 | |

| Net income (loss) attributable to common stockholders | $ | 39.1 | | | $ | (7.6) | | | $ | (642.4) | | | $ | (161.9) | | | $ | (1,092.0) | |

| Diluted earnings (loss) per share | $ | 0.43 | | | $ | (0.10) | | | $ | (9.98) | | | $ | (2.26) | | | $ | (17.03) | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | | | | |

| (in millions, except per share data) | Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Net sales | $ | 251.0 | | | $ | 236.8 | | | $ | 192.9 | | | $ | 909.3 | | | $ | 868.8 | |

| Non-GAAP Financial Results | | | | | | | | | |

| Adjusted gross margin* | 53.2 | % | | 52.4 | % | | 48.9 | % | | 51.5 | % | | 49.5 | % |

| Adjusted operating expenses, net* | $ | 83.7 | | | $ | 80.6 | | | $ | 76.5 | | | $ | 319.6 | | | $ | 337.5 | |

| Adjusted operating income* | $ | 49.8 | | | $ | 43.4 | | | $ | 17.8 | | | $ | 149.0 | | | $ | 92.7 | |

| Adjusted operating margin* | 19.9 | % | | 18.3 | % | | 9.2 | % | | 16.4 | % | | 10.7 | % |

| Adjusted interest expense, net* | $ | 11.2 | | | $ | 18.4 | | | $ | 19.9 | | | $ | 70.6 | | | $ | 81.8 | |

| Adjusted net income (loss) attributable to common stockholders* | $ | 34.5 | | | $ | 20.3 | | | $ | (3.7) | | | $ | 67.0 | | | $ | 9.1 | |

| Adjusted diluted earnings (loss) per share* | $ | 0.40 | | | $ | 0.26 | | | $ | (0.06) | | | $ | 0.88 | | | $ | 0.14 | |

| Adjusted EBITDA* | $ | 57.8 | | | $ | 51.1 | | | $ | 24.0 | | | $ | 182.5 | | | $ | 122.0 | |

| Adjusted EBITDA margin* | 23.0 | % | | 21.6 | % | | 12.5 | % | | 20.1 | % | | 14.0 | % |

*See "Non-GAAP Financial Measures" below for additional information about our non-GAAP financial results.

| | | | | |

3 | Semtech Announces Fourth Quarter and Fiscal Year 2025 Results |

First Quarter of Fiscal Year 2026 Outlook | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | |

| | | | | |

| Net sales | $ | 250.0 | | | +/- | | $5.0 |

| Non-GAAP Financial Measures | | | | | |

| Adjusted gross margin* | 53.0% | | +/- | | 50 bps |

| Adjusted operating expenses, net* | $ | 87.0 | | | +/- | | $1.0 |

| Adjusted operating income* | $ | 45.5 | | | +/- | | $3.0 |

| Adjusted operating margin* | 18.2% | | +/- | | 80 bps |

| Adjusted interest expense, net* | $ | 6.3 | | | | | |

| Normalized tax rate* | 15% | | | | |

| Adjusted diluted earnings per share* | $0.37 | | +/- | | $0.03 |

| Adjusted EBITDA* | $ | 53.3 | | | +/- | | $3.0 |

| Adjusted EBITDA margin* | 21.3% | | +/- | | 80 bps |

| | | | | |

| Non-GAAP diluted share count* | 90.1 | | | | |

|

*See "Non-GAAP Financial Measures" below for additional information about our non-GAAP financial results.

The Company is unable to include a reconciliation of forward-looking non-GAAP results to the corresponding GAAP measures as they are not available without unreasonable efforts due to the high variability and low visibility with respect to the impact of transaction, integration and restructuring expenses, share-based awards, amortization of acquisition-related intangible assets and other items that are excluded from these non-GAAP measures. The Company expects the variability of the above charges to have a potentially significant impact on its GAAP financial results.

Webcast and Conference Call

Semtech will be hosting a conference call today to discuss its fourth quarter and fiscal year 2025 results at 1:30 p.m. Pacific time. The dial-in number for the call is (877) 407-0312. Please use conference ID 13746451. An audio webcast and supplemental earnings materials for the quarter will be available on the Investor Relations section of Semtech's website at investors.semtech.com under "News & Events." A replay of the call will be available through April 10, 2025 at the same website or by calling (877) 660-6853 and entering conference ID 13746451.

Non-GAAP Financial Measures

To supplement the Company's consolidated financial statements prepared in accordance with GAAP, this release includes a presentation of select non-GAAP financial measures. The Company's non-GAAP measures of adjusted gross margin, adjusted product development and engineering expense, adjusted SG&A expense, adjusted operating expenses, net, adjusted operating income (loss), adjusted operating

| | | | | |

4 | Semtech Announces Fourth Quarter and Fiscal Year 2025 Results |

margin, adjusted interest expense, net, adjusted net income (loss) attributable to common stockholders, adjusted diluted earnings (loss) per share, adjusted normalized tax rate, adjusted EBITDA and adjusted EBITDA margin exclude the following items, if any and as applicable, as set forth in the reconciliations in the tables below under "Supplemental Information: Reconciliation of GAAP to Non-GAAP Results."

•Share-based compensation

•Intangible amortization

•Transaction and integration related costs or recoveries (including costs associated with the acquisition and integration of Sierra Wireless, Inc.)

•Restructuring and other reserves, including cumulative other reserves associated with historical activity including environmental, pension, deferred compensation and right-of-use asset impairments

•Litigation costs or dispute settlement charges or recoveries

•Equity method income or loss

•Investment gains, losses, reserves and impairments, including interest income from debt investments

•Write-off and amortization of deferred financing costs

•Interest rate swap termination

•Loss on extinguishment of debt

•Debt commitment fee

•Goodwill and intangible impairment

•Amortization of inventory step-up

In this release, the Company also presents adjusted EBITDA, adjusted EBITDA margin and free cash flow. Adjusted EBITDA is defined as net income (loss) attributable to common stockholders plus interest expense, interest income, (benefit) provision for income taxes, depreciation and amortization, and share-based compensation, and adjusted to exclude certain expenses, gains and losses that the Company believes are not indicative of its core results over time. Adjusted EBITDA margin is defined as adjusted EBITDA as a percentage of net sales. The Company considers free cash flow, which may be positive or negative, a non-GAAP financial measure defined as cash flows provided by (used in) operating activities less net capital expenditures. Management believes that the presentation of these non-GAAP measures provides useful information to investors regarding the Company's financial condition and results of operations. These non-GAAP financial measures are adjusted to exclude the items identified above because such items are either operating expenses that would not otherwise have been incurred by the Company in the normal course of the Company's business operations, or are not reflective of the Company's core results over time. These excluded items may include recurring as well as non-recurring

| | | | | |

5 | Semtech Announces Fourth Quarter and Fiscal Year 2025 Results |

items, and no inference should be made that all of these adjustments, charges, costs or expenses are unusual, infrequent or non-recurring. For example: certain restructuring and integration-related expenses (which consist of employee termination costs, facility closure or lease termination costs, and contract termination costs) may be considered recurring given the Company's ongoing efforts to be more cost effective and efficient; certain acquisition and disposition-related adjustments or expenses may be deemed recurring given the Company's regular evaluation of potential transactions and investments; and certain litigation expenses or dispute settlement charges or gains (which may include estimated losses for which the Company may have established a reserve, as well as any actual settlements, judgments, or other resolutions against, or in favor of, the Company related to litigation, arbitration, disputes or similar matters, and insurance recoveries received by the Company related to such matters) may be viewed as recurring given that the Company may from time to time be involved in, and may resolve, litigation, arbitration, disputes, and similar matters.

Notwithstanding that certain adjustments, charges, costs or expenses may be considered recurring, in order to provide meaningful comparisons, the Company believes that it is appropriate to exclude such items because they are not reflective of the Company's core results and tend to vary based on timing, frequency and magnitude.

These non-GAAP financial measures are provided to enhance the user's overall understanding of the Company's comparable financial performance between periods. In addition, the Company's management generally excludes the items noted above when managing and evaluating the performance of the business. Certain non-GAAP financial measures are also used in the Company's compensation programs. The financial statements provided with this release include reconciliations of these non-GAAP financial measures to their most comparable GAAP measures for the fourth quarter of fiscal year 2024, the third and fourth quarters of fiscal year 2025, and the full-year fiscal 2025 and fiscal 2024 periods.

The Company adopted a full-year, normalized tax rate for the computation of the non-GAAP income tax provision in order to provide better comparability across the interim reporting periods by reducing the quarterly variability in non-GAAP tax rates that can occur throughout the year. In estimating the full-year non-GAAP normalized tax rate, the Company utilized a full-year financial projection that considers multiple factors such as changes to the Company's current operating structure, existing positions in various tax jurisdictions, the effect of key tax law changes, and other significant tax matters to the extent they are applicable to the full fiscal year financial projection. In addition to the adjustments described above, this normalized tax rate excludes the impact of share-based awards and the amortization of acquisition-related intangible assets. For fiscal year 2025, the Company's projected non-GAAP normalized tax rate was 15% and was applied to each quarter of fiscal year 2025. For fiscal year 2026, the Company's projected non-

| | | | | |

6 | Semtech Announces Fourth Quarter and Fiscal Year 2025 Results |

GAAP normalized tax rate is 15% and will be applied to each quarter of fiscal year 2026. The Company's non-GAAP normalized tax rate on non-GAAP net income may be adjusted during the year to account for events or trends that the Company believes materially impact the original annual non-GAAP normalized tax rate including, but not limited to, significant changes resulting from tax legislation, acquisitions, entity structures or operational changes and other significant events. These additional non-GAAP financial measures should not be considered substitutes for any measures derived in accordance with GAAP and may be inconsistent with similar measures presented by other companies.

Effective as of the third quarter of fiscal year 2024, the Company’s non-GAAP measures were adjusted to exclude amortization of deferred financing costs, which had the impact of decreasing non-GAAP adjusted interest expense, net and increasing non-GAAP adjusted net income or loss attributable to common stockholders and non-GAAP adjusted earnings or loss per diluted share. This adjustment was applied retrospectively and all prior period amounts have been revised to conform to the current presentation.

To provide additional insight into the Company's first quarter outlook, this release also includes a presentation of forward-looking non-GAAP financial measures. See "First Quarter of Fiscal Year 2026 Outlook" above for further information.

Forward-Looking and Cautionary Statements

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, as amended, based on the Company's current expectations, estimates and projections about its operations, industry, financial condition, performance, results of operations, and liquidity. Forward-looking statements are statements other than historical information or statements of current condition and relate to matters such as future financial performance including the first quarter of fiscal year 2026 outlook; future operational performance; the anticipated impact of specific items on future earnings; the Company's expectations regarding near term growth trends; and the Company's plans, objectives and expectations. Statements containing words such as "may," "believes," "anticipates," "expects," "intends," "plans," "projects," "objectives," "estimates," "develops," "should," "could," "will," "designed to," "projections," or "outlook," or other similar expressions constitute forward-looking statements.

Forward-looking statements involve known and unknown risks and uncertainties that could cause actual results and events to differ materially from those projected. Potential factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the volatility of our financial results or impact of the cyclical nature of our industry, including during industry downturns or due to periodic economic uncertainty; the historical rapid decrease of the average selling

| | | | | |

7 | Semtech Announces Fourth Quarter and Fiscal Year 2025 Results |

prices of certain products; disruptions in U.S. or foreign government operations, funding or incentives; changes in export restrictions and laws affecting the Company's trade and investments, including tariffs or retaliatory tariffs; interruption or loss of supplies or services from the limited number of suppliers and subcontractors we rely upon; our suppliers' manufacturing capacity constraints or other supply chain disruptions; failure to successfully develop and sell new products, meet new industry standards or requirements or anticipate changes in projected or end market users; failure to adequately protect our intellectual property rights; failure to make the substantial investments in research and development that are required to remain competitive in our business or to properly anticipate competitive changes in the marketplace; the likelihood of our products being found defective or risk of liability claims asserted against us; business interruptions, such as natural disasters, acts of violence and the outbreak of contagious diseases; adverse changes to general economic conditions in China; the loss of any one of our small number of customers or failure to collect a receivable from them; competition from new or established IoT, cloud services and wireless service companies or from those with greater resources; the difficulties associated with integrating ours and Sierra Wireless, Inc.'s businesses and operations successfully as well as difficulties executing other acquisitions or divestitures; discovery of additional material weaknesses in our internal control over financial reporting in the future or otherwise failing to achieve and maintain effective disclosure controls, procedures and internal control over financial reporting; changes in our effective tax rates, the adoption of new U.S. or foreign tax legislation or exposure to additional tax liabilities, or material differences between our forecasted annual effective tax rates and actual tax rates; the Company's ability to comply with, or pursue business strategies due to, our level of indebtedness or the covenants under the agreements governing our indebtedness; and adverse developments affecting the financial services industry. Additionally, forward-looking statements should be considered in conjunction with the cautionary statements contained in the risk factors disclosed in the Company's filings with the Securities and Exchange Commission (the "SEC"), including the Company's Annual Report on Form 10-K for the fiscal year ended January 26, 2025, which the Company expects to file with the SEC on or before March 27, 2025, as such risk factors may be amended, supplemented or superseded from time to time by subsequent reports the Company files with the SEC. In light of the significant risks and uncertainties inherent in the forward-looking information included herein that may cause actual performance and results to differ materially from those predicted, any such forward-looking information should not be regarded as representations or guarantees by the Company of future performance or results, or that its objectives or plans will be achieved or that any of its operating expectations or financial forecasts will be realized. Reported results should not be considered an indication of future performance. Investors are cautioned not to place undue reliance on any forward-looking information contained herein, which reflect management's analysis only as of the date hereof. Except as required by law, the Company assumes no obligation to publicly release the results of any

| | | | | |

8 | Semtech Announces Fourth Quarter and Fiscal Year 2025 Results |

update or revision to any forward-looking statements that may be made to reflect new information, events or circumstances after the date hereof or to reflect the occurrence of unanticipated or future events, or otherwise.

Amounts reported in this press release are preliminary and subject to the finalization of the filing of our Annual Report on Form 10-K for the year ended January 26, 2025. In the reported results, Q4'25 refers to the quarter ended January 26, 2025, Q3'25 refers to the quarter ended October 27, 2024, Q4'24 refers to the quarter ended January 28, 2024, FY'25 refers to the fiscal year ended January 26, 2025, and FY'24 refers to the fiscal year ended January 28, 2024. Reported amounts may not foot precisely due to rounding.

About Semtech

Semtech Corporation (Nasdaq: SMTC) is a high-performance semiconductor, IoT systems and cloud connectivity service provider dedicated to delivering high-quality technology solutions that enable a smarter, more connected and sustainable planet. Our global teams are committed to empowering solution architects and application developers to develop breakthrough products for the infrastructure, industrial and consumer markets.

Semtech and the Semtech logo are registered trademarks or service marks of Semtech Corporation or its subsidiaries.

SMTC-F

SEMTECH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Net sales | $ | 251.0 | | | $ | 236.8 | | | $ | 192.9 | | | $ | 909.3 | | | $ | 868.8 | |

| Cost of sales | 118.2 | | | 113.6 | | | 99.3 | | | 443.7 | | | 447.0 | |

| Amortization of acquired technology | 2.3 | | | 2.3 | | | 2.3 | | | 9.1 | | | 33.7 | |

| Acquired technology impairments | — | | | — | | | 91.8 | | | — | | | 91.8 | |

| Total cost of sales | 120.5 | | | 115.9 | | | 193.3 | | | 452.8 | | | 572.5 | |

| Gross profit | 130.5 | | | 121.0 | | | (0.4) | | | 456.5 | | | 296.3 | |

| Operating expenses, net: | | | | | | | | | |

| Product development and engineering | 46.7 | | | 42.6 | | | 41.5 | | | 170.9 | | | 186.5 | |

| Selling, general and administrative | 54.5 | | | 59.8 | | | 55.2 | | | 222.4 | | | 220.2 | |

| Intangible amortization | 0.1 | | | 0.1 | | | 0.3 | | | 0.9 | | | 14.9 | |

| Restructuring | 0.4 | | | 0.7 | | | 9.2 | | | 4.9 | | | 23.8 | |

| | | | | | | | | |

| | | | | | | | | |

| Intangible impairments | — | | | — | | | 39.6 | | | — | | | 39.6 | |

| Goodwill impairment | 7.5 | | | — | | | 473.8 | | | 7.5 | | | 755.6 | |

| Total operating expenses, net | 109.3 | | | 103.2 | | | 619.6 | | | 406.6 | | | 1,240.6 | |

| Operating income (loss) | 21.2 | | | 17.8 | | | (620.0) | | | 49.9 | | | (944.3) | |

| Interest expense | (17.5) | | | (20.8) | | | (22.8) | | | (90.1) | | | (95.8) | |

| Interest income | 0.8 | | | 0.5 | | | 0.7 | | | 2.3 | | | 3.1 | |

| Loss on extinguishment of debt | — | | | — | | | — | | | (144.7) | | | — | |

| Non-operating income (expense), net | 2.0 | | | (1.1) | | | (2.0) | | | 0.3 | | | (0.5) | |

| Investment impairments and credit loss reserves, net | — | | | — | | | (1.7) | | | (1.1) | | | (3.9) | |

| Income (loss) before taxes and equity method (loss) income | 6.5 | | | (3.6) | | | (645.8) | | | (183.4) | | | (1,041.6) | |

| (Benefit) provision for income taxes | (33.2) | | | 4.0 | | | (3.3) | | | (22.0) | | | 50.5 | |

| Net income (loss) before equity method (loss) income | 39.7 | | | (7.6) | | | (642.4) | | | (161.3) | | | (1,092.1) | |

| Equity method (loss) income | (0.6) | | | — | | | 0.1 | | | (0.5) | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) attributable to common stockholders | $ | 39.1 | | | $ | (7.6) | | | $ | (642.4) | | | $ | (161.9) | | | $ | (1,092.0) | |

| | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | |

| Basic | $ | 0.48 | | | $ | (0.10) | | | $ | (9.98) | | | $ | (2.26) | | | $ | (17.03) | |

| Diluted | $ | 0.43 | | | $ | (0.10) | | | $ | (9.98) | | | $ | (2.26) | | | $ | (17.03) | |

| | | | | | | | | |

| Weighted average number of shares used in computing earnings (loss) per share: | | | | | | | | | |

| Basic | 81,313 | | | 75,319 | | | 64,363 | | | 71,606 | | | 64,127 | |

| Diluted | 90,298 | | | 75,319 | | | 64,363 | | | 71,606 | | | 64,127 | |

SEMTECH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| January 26, 2025 | | January 28, 2024 |

| | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 151.7 | | | $ | 128.6 | |

| Accounts receivable, net | 162.5 | | | 134.3 | |

| Inventories | 163.6 | | | 145.0 | |

| Prepaid taxes | 13.5 | | | 12.0 | |

| Other current assets | 94.1 | | | 114.3 | |

| Total current assets | 585.5 | | | 534.2 | |

| Non-current assets: | | | |

| Property, plant and equipment, net | 126.2 | | | 153.6 | |

| Deferred tax assets | 41.1 | | | 18.0 | |

| Goodwill | 533.1 | | | 541.2 | |

| Other intangible assets, net | 33.1 | | | 35.6 | |

| Other assets | 100.3 | | | 91.1 | |

| Total assets | $ | 1,419.3 | | | $ | 1,373.7 | |

| | | |

| LIABILITIES AND EQUITY (DEFICIT) | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 59.2 | | | $ | 45.1 | |

| Accrued liabilities | 178.2 | | | 172.1 | |

| Current portion of long-term debt | 45.6 | | | — | |

| Total current liabilities | 283.0 | | | 217.2 | |

| Non-current liabilities: | | | |

| Deferred tax liabilities | 0.8 | | | 0.8 | |

| Long-term debt | 505.9 | | | 1,371.0 | |

| Other long-term liabilities | 87.1 | | | 92.0 | |

| Stockholders' equity (deficit) | 542.4 | | | (307.4) | |

| Noncontrolling interest | — | | | 0.2 | |

| Total liabilities & equity (deficit) | $ | 1,419.3 | | | $ | 1,373.7 | |

SEMTECH CORPORATION

SUPPLEMENTAL CASH FLOW INFORMATION

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| | | | | | | | | |

| | | | | | | | | |

| Net cash provided by (used in) operating activities | $ | 33.5 | | | $ | 29.6 | | | $ | 13.9 | | | $ | 58.0 | | | $ | (93.9) | |

| Net capital expenditures | (2.6) | | | (0.5) | | | (1.7) | | | (7.9) | | | (29.2) | |

| Free cash flow | $ | 30.9 | | | $ | 29.1 | | | $ | 12.2 | | | $ | 50.1 | | | $ | (123.1) | |

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION: RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Gross margin (GAAP) | 52.0 | % | | 51.1 | % | | (0.2) | % | | 50.2 | % | | 34.1 | % |

| Share-based compensation | 0.3 | % | | 0.3 | % | | 0.3 | % | | 0.3 | % | | 0.2 | % |

| Amortization of acquired technology | 0.9 | % | | 1.0 | % | | 1.2 | % | | 1.0 | % | | 3.9 | % |

| Transaction and integration related costs, net | — | % | | — | % | | — | % | | — | % | | 0.3 | % |

| | | | | | | | | |

| Restructuring and other reserves, net | — | % | | — | % | | — | % | | — | % | | 0.1 | % |

| Acquired technology impairments | — | % | | — | % | | 47.6 | % | | — | % | | 10.5 | % |

| Amortization of inventory step-up | — | % | | — | % | | — | % | | — | % | | 0.4 | % |

| Adjusted gross margin (Non-GAAP) | 53.2 | % | | 52.4 | % | | 48.9 | % | | 51.5 | % | | 49.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Product development and engineering (GAAP) | $ | 46.7 | | | $ | 42.6 | | | $ | 41.5 | | | $ | 170.9 | | | $ | 186.5 | |

| Share-based compensation | (3.5) | | | (3.8) | | | (2.9) | | | (14.0) | | | (12.8) | |

| Transaction and integration related costs, net | — | | | — | | | (0.4) | | | — | | | (2.0) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted product development and engineering (Non-GAAP) | $ | 43.1 | | | $ | 38.7 | | | $ | 38.2 | | | $ | 156.9 | | | $ | 171.6 | |

| | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Selling, general and administrative (GAAP) | $ | 54.5 | | | $ | 59.8 | | | $ | 55.2 | | | $ | 222.4 | | | $ | 220.2 | |

| Share-based compensation | (13.0) | | | (13.8) | | | (8.4) | | | (51.1) | | | (25.3) | |

| Transaction and integration related costs, net | (0.9) | | | (3.2) | | | (8.5) | | | (7.4) | | | (28.8) | |

| | | | | | | | | |

| | | | | | | | | |

| Litigation costs, net | (0.1) | | | (0.9) | | | — | | | (1.2) | | | (0.2) | |

| Adjusted selling, general and administrative (Non-GAAP) | $ | 40.5 | | | $ | 41.9 | | | $ | 38.3 | | | $ | 162.6 | | | $ | 165.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Operating expenses, net (GAAP) | $ | 109.3 | | | $ | 103.2 | | | $ | 619.6 | | | $ | 406.6 | | | $ | 1,240.6 | |

| Share-based compensation | (16.5) | | | (17.6) | | | (11.2) | | | (65.1) | | | (38.2) | |

| Intangible amortization | (0.1) | | | (0.1) | | | (0.3) | | | (0.9) | | | (14.9) | |

| Transaction and integration related costs, net | (0.9) | | | (3.2) | | | (8.9) | | | (7.4) | | | (30.8) | |

| | | | | | | | | |

| Restructuring and other reserves, net | (0.4) | | | (0.7) | | | (9.2) | | | (4.9) | | | (23.8) | |

| Litigation costs, net | (0.1) | | | (0.9) | | | — | | | (1.2) | | | (0.2) | |

| | | | | | | | | |

| Intangible impairments | — | | | — | | | (39.6) | | | — | | | (39.6) | |

| Goodwill impairment | (7.5) | | | — | | | (473.8) | | | (7.5) | | | (755.6) | |

| Adjusted operating expenses, net (Non-GAAP) | $ | 83.7 | | | $ | 80.6 | | | $ | 76.5 | | | $ | 319.6 | | | $ | 337.5 | |

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION: RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED)

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Operating income (loss) (GAAP) | $ | 21.2 | | | $ | 17.8 | | | $ | (620.0) | | | $ | 49.9 | | | $ | (944.3) | |

| Share-based compensation | 17.3 | | | 18.4 | | | 11.8 | | | 68.0 | | | 40.2 | |

| Intangible amortization | 2.4 | | | 2.4 | | | 2.6 | | | 10.0 | | | 48.6 | |

| Transaction and integration related costs, net | 0.9 | | | 3.2 | | | 8.9 | | | 7.4 | | | 33.0 | |

| | | | | | | | | |

| Restructuring and other reserves, net | 0.4 | | | 0.7 | | | 9.2 | | | 4.9 | | | 24.6 | |

| Litigation costs, net | 0.1 | | | 0.9 | | | — | | | 1.2 | | | 0.2 | |

| | | | | | | | | |

| | | | | | | | | |

| Intangible impairments | — | | | — | | | 131.4 | | | — | | | 131.4 | |

| Goodwill impairment | 7.5 | | | — | | | 473.8 | | | 7.5 | | | 755.6 | |

| Amortization of inventory step-up | — | | | — | | | — | | | — | | | 3.3 | |

| Adjusted operating income (Non-GAAP) | $ | 49.8 | | | $ | 43.4 | | | $ | 17.8 | | | $ | 149.0 | | | $ | 92.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Operating margin (GAAP) | 8.5 | % | | 7.5 | % | | (321.3) | % | | 5.5 | % | | (108.7) | % |

| Share-based compensation | 6.9 | % | | 7.8 | % | | 6.1 | % | | 7.5 | % | | 4.6 | % |

| Intangible amortization | 0.9 | % | | 1.0 | % | | 1.3 | % | | 1.1 | % | | 5.6 | % |

| Transaction and integration related costs, net | 0.3 | % | | 1.4 | % | | 4.6 | % | | 0.8 | % | | 3.9 | % |

| | | | | | | | | |

| Restructuring and other reserves, net | 0.2 | % | | 0.3 | % | | 4.8 | % | | 0.6 | % | | 2.8 | % |

| Litigation costs, net | 0.1 | % | | 0.3 | % | | — | % | | 0.1 | % | | — | % |

| | | | | | | | | |

| | | | | | | | | |

| Intangible impairments | — | % | | — | % | | 68.1 | % | | — | % | | 15.1 | % |

| Goodwill impairment | 3.0 | % | | — | % | | 245.6 | % | | 0.8 | % | | 87.0 | % |

| Amortization of inventory step-up | — | % | | — | % | | — | % | | — | % | | 0.4 | % |

| Adjusted operating margin (Non-GAAP) | 19.9 | % | | 18.3 | % | | 9.2 | % | | 16.4 | % | | 10.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Interest expense, net (GAAP) | $ | 16.7 | | | $ | 20.3 | | | $ | 22.1 | | | $ | 87.8 | | | $ | 92.8 | |

| Amortization of deferred financing costs | (1.5) | | | (2.1) | | | (2.4) | | | (8.3) | | | (7.3) | |

| Write-off of deferred financing costs | (7.7) | | | — | | | — | | | (13.2) | | | (4.4) | |

| Interest rate swap termination | 3.6 | | | — | | | — | | | 3.6 | | | — | |

| | | | | | | | | |

| Investment income | 0.2 | | | 0.2 | | | 0.2 | | | 0.8 | | | 0.8 | |

| Adjusted interest expense, net (Non-GAAP) | $ | 11.2 | | | $ | 18.4 | | | $ | 19.9 | | | $ | 70.6 | | | $ | 81.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| Loss on extinguishment of debt (GAAP) | $ | — | | | $ | — | | | $ | — | | | $ | 144.7 | | | $ | — | |

| Loss on extinguishment of debt | — | | | — | | | — | | | (144.7) | | | — | |

| Adjusted loss on extinguishment of debt (Non-GAAP) | — | | | — | | | — | | | — | | | — | |

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION: RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED)

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| GAAP net income (loss) attributable to common stockholders | $ | 39.1 | | | $ | (7.6) | | | $ | (642.4) | | | $ | (161.9) | | | $ | (1,092.0) | |

| Adjustments to GAAP net income (loss) attributable to common stockholders: | | | | | | | | | |

| Share-based compensation | 17.3 | | | 18.4 | | | 11.8 | | | 68.0 | | | 40.2 | |

| Intangible amortization | 2.4 | | | 2.4 | | | 2.6 | | | 10.0 | | | 48.6 | |

| Transaction and integration related costs, net | 0.9 | | | 3.2 | | | 8.9 | | | 7.9 | | | 33.0 | |

| | | | | | | | | |

| Restructuring and other reserves, net | 0.4 | | | 0.7 | | | 9.2 | | | 4.9 | | | 24.6 | |

| Litigation costs, net | 0.1 | | | 0.9 | | | — | | | 1.2 | | | 0.2 | |

| | | | | | | | | |

| | | | | | | | | |

Investment (gains) losses, reserves and

impairments, net | (0.2) | | | (0.2) | | | 1.5 | | | — | | | 3.1 | |

| Amortization of deferred financing costs | 1.5 | | | 2.1 | | | 2.4 | | | 8.3 | | | 7.3 | |

| Write-off of deferred financing costs | 7.7 | | | — | | | — | | | 13.2 | | | 4.4 | |

| Interest rate swap termination | (3.6) | | | — | | | — | | | (3.6) | | | — | |

| Loss on extinguishment of debt | — | | | — | | | — | | | 144.7 | | | — | |

| | | | | | | | | |

| Intangible impairments | — | | | — | | | 131.4 | | | — | | | 131.4 | |

| Goodwill impairment | 7.5 | | | — | | | 473.8 | | | 7.5 | | | 755.6 | |

| Amortization of inventory step-up | — | | | — | | | — | | | — | | | 3.3 | |

| Total Non-GAAP adjustments before taxes | 34.0 | | | 27.5 | | | 641.6 | | | 262.2 | | | 1,051.9 | |

| Associated tax effect | (39.3) | | | 0.4 | | | (2.8) | | | (33.9) | | | 49.3 | |

| Equity method loss (income) | 0.6 | | | — | | | (0.1) | | | 0.5 | | | — | |

| Total of supplemental information, net of taxes | (4.7) | | | 27.9 | | | 638.7 | | | 228.9 | | | 1,101.1 | |

Non-GAAP net income (loss) attributable to common

stockholders | $ | 34.5 | | | $ | 20.3 | | | $ | (3.7) | | | $ | 67.0 | | | $ | 9.1 | |

| | | | | | | | | |

| GAAP diluted earnings (loss) per share | $ | 0.43 | | | $ | (0.10) | | | $ | (9.98) | | | $ | (2.26) | | | $ | (17.03) | |

| Adjustments per above | (0.03) | | | 0.36 | | | 9.92 | | | 3.14 | | | 17.17 | |

| Non-GAAP adjusted diluted earnings (loss) per share | $ | 0.40 | | | $ | 0.26 | | | $ | (0.06) | | | $ | 0.88 | | | $ | 0.14 | |

| Weighted-average number of shares used in computing diluted earnings (loss) per share: | | | | | | | | | |

| GAAP | 90,298 | | 75,319 | | 64,363 | | 71,606 | | 64,127 |

| Non-GAAP | 87,053 | | 78,581 | | 64,363 | | 76,244 | | 64,284 |

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION: RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED)

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| GAAP net income (loss) attributable to common stockholders | $ | 39.1 | | | $ | (7.6) | | | $ | (642.4) | | | $ | (161.9) | | | $ | (1,092.0) | |

| Interest expense | 17.5 | | | 20.8 | | | 22.8 | | | 90.1 | | | 95.8 | |

| Interest income | (0.8) | | | (0.5) | | | (0.7) | | | (2.3) | | | (3.1) | |

| Loss on extinguishment of debt | — | | | — | | | — | | | 144.7 | | | — | |

| Non-operating (income) expense, net | (2.0) | | | 1.1 | | | 2.0 | | | (0.3) | | | 0.5 | |

| Investment impairments and credit loss reserves, net | — | | | — | | | 1.7 | | | 1.1 | | | 3.9 | |

| (Benefit) provision for income taxes | (33.2) | | | 4.0 | | | (3.3) | | | (22.0) | | | 50.5 | |

| Equity method loss (income) | 0.6 | | | — | | | (0.1) | | | 0.5 | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| Share-based compensation | 17.3 | | | 18.4 | | | 11.8 | | | 68.0 | | | 40.2 | |

| Depreciation and amortization | 10.4 | | | 10.1 | | | 8.9 | | | 43.5 | | | 78.0 | |

| Transaction and integration related costs, net | 0.9 | | | 3.2 | | | 8.9 | | | 7.4 | | | 33.0 | |

| | | | | | | | | |

| Restructuring and other reserves, net | 0.4 | | | 0.7 | | | 9.2 | | | 4.9 | | | 24.6 | |

| Litigation costs, net | 0.1 | | | 0.9 | | | — | | | 1.2 | | | 0.2 | |

| | | | | | | | | |

| | | | | | | | | |

| Intangible impairments | — | | | — | | | 131.4 | | | — | | | 131.4 | |

| Goodwill impairment | 7.5 | | | — | | | 473.8 | | | 7.5 | | | 755.6 | |

| Amortization of inventory step-up | — | | | — | | | — | | | — | | | 3.3 | |

| Adjusted EBITDA | $ | 57.8 | | | $ | 51.1 | | | $ | 24.0 | | | $ | 182.5 | | | $ | 122.0 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | |

| Q4'25 | | Q3'25 | | Q4'24 | | FY'25 | | FY'24 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Operating margin (GAAP) | 8.5 | % | | 7.5 | % | | (321.3) | % | | 5.5 | % | | (108.7) | % |

| Share-based compensation | 6.9 | % | | 7.8 | % | | 6.1 | % | | 7.5 | % | | 4.6 | % |

| Depreciation and amortization | 4.0 | % | | 4.3 | % | | 4.6 | % | | 4.8 | % | | 8.9 | % |

| Transaction and integration related costs, net | 0.3 | % | | 1.4 | % | | 4.6 | % | | 0.8 | % | | 3.9 | % |

| | | | | | | | | |

| Restructuring and other reserves, net | 0.2 | % | | 0.3 | % | | 4.8 | % | | 0.6 | % | | 2.8 | % |

| Litigation costs, net | 0.1 | % | | 0.3 | % | | — | % | | 0.1 | % | | — | % |

| | | | | | | | | |

| | | | | | | | | |

| Intangible impairments | — | % | | — | % | | 68.1 | % | | — | % | | 15.1 | % |

| Goodwill impairment | 3.0 | % | | — | % | | 245.6 | % | | 0.8 | % | | 87.0 | % |

| Amortization of inventory step-up | — | % | | — | % | | — | % | | — | % | | 0.4 | % |

| Adjusted EBITDA margin | 23.0 | % | | 21.6 | % | | 12.5 | % | | 20.1 | % | | 14.0 | % |

CONTACT:

Sara Kesten

Semtech Corporation

(805) 480-2004

webir@semtech.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

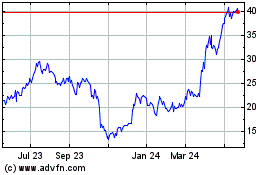

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Feb 2025 to Mar 2025

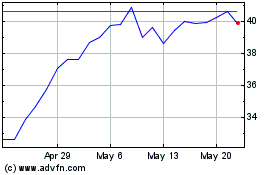

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Mar 2024 to Mar 2025