false

--03-31

0001367083

0001367083

2024-08-23

2024-08-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported) August 23,

2024

SONOMA

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-33216 |

|

68-0423298 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

5445

Conestoga Court, Suite

150

Boulder, CO 80301

(Address of principal executive offices)

(Zip Code)

(800) 759-9305

(Registrant’s telephone number, including

area code)

Not applicable.

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common

Stock |

SNOA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.03. |

Amendments to Articles of Incorporation or Bylaws, Change in Fiscal Year. |

On August 27, 2024, we filed a certificate of

amendment with the Secretary of State of the State of Delaware in order to increase the authorized shares of our common stock from 24,000,000

to 50,000,000 and to effect a 1-for-20 reverse stock split of our issued and outstanding common stock, effective August 29, 2024, 5:00pm

EDT. Sonoma common stock will begin trading on The Nasdaq Capital Market on a 1-for-20 adjusted basis when the market opens on August

30, 2024.

The increase in authorized shares and the reverse

stock split were approved by our stockholders on August 23, 2024. On August 23, 2024, the Board of Directors selected the 1-for-20 reverse

stock split ratio and authorized the implementation of the reverse stock split.

The certificate of amendment is attached to this

Current Report on Form 8-K as Exhibit 3.1 and its terms are incorporated herein by reference.

|

Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

Our adjourned annual meeting of stockholders was

held on August 23, 2024. Proxies were solicited pursuant to our definitive proxy statement filed on July 1, 2024 with the Securities and

Exchange Commission under Section 14(a) of the Securities Exchange Act of 1934.

The number of shares of the Company’s common

stock entitled to vote at the annual meeting was 19,004,393. The number of shares of common stock present or represented by valid proxy

at the annual meeting was 6,751,938. Each share of common stock was entitled to one vote with respect to matters submitted to the Company’s

stockholders at the annual meeting. At the annual meeting, our stockholders voted on the matters set forth below.

Proposal 1 – Election

of Class I Directors

Mr. Philippe Weigerstorfer

and Ms. Amy Trombly were each duly elected as our Class I directors. The results of the election were as follows:

| NOMINEE |

FOR |

WITHHELD |

| Philippe Weigerstorfer |

2,953,999 |

360,733 |

| Amy Trombly |

2,875,783 |

438,949 |

Proposal 2 –

Advisory Vote to Approve Executive Compensation

Our stockholders voted

upon and approved, by non-binding advisory vote, the compensation of our named executive officers for the year ended March 31, 2024, as

described in our proxy statement dated July 1, 2024. The votes on this proposal were as follows:

| FOR |

AGAINST |

ABSTAIN |

| 2,594,957 |

649,736 |

70,039 |

Proposal 3 – Reincorporation to Nevada

Our stockholders voted

upon and did not approve a proposal to authorize the reincorporation of the Company from the State of Delaware to the State of Nevada.

The votes on this proposal were as follows:

| FOR |

AGAINST |

ABSTAIN |

| 2,790,999 |

490,070 |

33,663 |

The affirmative vote

of a majority of the outstanding shares of our common stock entitled to vote is needed to approve the reincorporation of the Company from

the State of Delaware to the State of Nevada. This proposal did not receive the requisite number of votes, and we will not solicit additional

proxies on this proposal.

Proposal 4 – Authorized Share Increase

Our stockholders voted

upon and approved an amendment to our Restated Certificate of Incorporation, as amended, increasing the number of authorized shares of

common stock, $0.0001 par value per share, from 24,000,000 to 50,000,000. The votes on this proposal were as follows:

| FOR |

AGAINST |

ABSTAIN |

| 5,372,201 |

1,289,317 |

90,420 |

Proposal 5 – 2024 Equity Incentive

Plan

Our stockholders voted

upon and approved the Sonoma Pharmaceuticals, Inc. 2024 Equity Incentive Plan. The votes on this proposal were as follows:

| FOR |

AGAINST |

ABSTAIN |

| 2,656,548 |

578,335 |

79,849 |

Proposal 6 – Reverse Stock Split

Our stockholders voted

upon and approved an amendment to our Restated Certificate of Incorporation, as amended, and authorize the Board of Directors, if in their

judgment it is necessary, to effect a reverse stock split of our outstanding common stock at a whole number ratio in the range of 1-for-10

to 1-for-20. The votes on this proposal were as follows:

| FOR |

AGAINST |

ABSTAIN |

| 4,438,084 |

2,199,393 |

114,461 |

Proposal 7 – Ratification

of the Appointment of Independent Registered Public Accounting Firm

Our stockholders voted

upon and approved the ratification of the appointment of Frazier & Deeter, LLC as our independent registered public accounting firm

for the fiscal year ending March 31, 2025. The votes on this proposal were as follows:

| FOR |

AGAINST |

ABSTAIN |

| 6,592,064 |

112,823 |

47,051 |

Proposal 8 – Adjournment to Solicit

Additional Proxies

Our stockholders voted

upon and approved a proposal to authorize the adjournment of the meeting to permit further solicitation of proxies, if necessary or appropriate,

if sufficient votes are not represented at the meeting to approve any of the foregoing proposals. The votes on this proposal were as follows:

| FOR |

AGAINST |

ABSTAIN |

| 5,714,073 |

920,432 |

117,433 |

|

Item 7.01. |

Regulation FD Disclosure. |

On August 28, 2024, Sonoma Pharmaceuticals, Inc.

issued a press release with respect to a pending reverse split of its common stock. A copy of the press release is furnished herewith

as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 7.01 of

this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished pursuant to Item 7.01 and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, or under the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference

in such filing to this Item 7.01 of this Current Report.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SONOMA PHARMACEUTICALS, INC. |

| |

|

| |

|

| Date: August 28, 2024 |

By: |

/s/ Amy Trombly |

| |

Name:

Title: |

Amy Trombly

Chief Executive Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO THE

RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED

OF

SONOMA PHARMACEUTICALS, INC.

Sonoma Pharmaceuticals, Inc., a corporation organized

and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”) does hereby certify

that:

FIRST: That at a meeting of the Board of Directors

of the Corporation resolutions were duly adopted setting forth a proposed amendment of the Corporation’s Restated Certificate of

Incorporation, as amended, declaring said amendment to be advisable and calling a meeting of the stockholders of the Corporation for consideration

thereof. The resolution setting forth the proposed amendment is as follows:

RESOLVED, that Subsection A of Article FOURTH

of the Restated Certificate of Incorporation, as amended, of this Corporation be hereby amended by deleting and substituting by the following

Subsection A of Article FOURTH:

“A. Authorized Stock. The

Corporation is authorized to issue two classes of stock to be designated respectively Preferred Stock (“Preferred Stock”)

and Common Stock (“Common Stock”). Effective at 5:00 p.m. Eastern Time on August 29, 2024, the total number of shares

of all classes of capital stock the Corporation shall have authority to issue is fifty million seven hundred fourteen thousand two hundred

eighty-six (50,714,286). The total number of shares of Preferred Stock the Corporation shall have the authority to issue is seven hundred

fourteen thousand two hundred eighty-six (714,286). The total number of shares of Common Stock the Corporation shall have the authority

to issue is fifty million (50,000,000). The Preferred Stock and the Common Stock each shall have a par value of one one-hundredth of one

cent ($0.0001) per share. The number of authorized shares of Common Stock or Preferred Stock may be increased or decreased (but not below

the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the then outstanding shares of

Common Stock, without a vote of the holders of Preferred Stock, or of any series thereof, unless a vote of any such holders of Preferred

Stock is required pursuant to the provisions established by the Board of Directors of the Corporation (the “Board of Directors”)

in the resolution or resolutions providing for the issue of such Preferred Stock, and if such holders of such Preferred Stock are so entitled

to vote thereon, then, except as may otherwise be set forth in this Restated Certificate of Incorporation, the only stockholder approval

required shall be the affirmative vote of a majority of the combined voting power of the Common Stock and the Preferred Stock so entitled

to vote.

Effective at 5:00 p.m. Eastern Time

on August 29, 2024, the date of filing with the Secretary of State of the State of Delaware (such time, on such date, the “Effective

Time”) of this Certificate of Amendment pursuant to the DGCL, the Corporation shall effect a one for-twenty reverse split whereby

each twenty (20) shares of the Corporation’s Common Stock, $0.0001 par value per share, issued and outstanding immediately prior

to the Effective Time (the “Old Common Stock”) shall automatically, without further action on the part of the Corporation

or any holder of Old Common Stock, be reclassified, combined, converted and changed into one (1) fully paid and nonassessable share of

common stock, $0.0001 par value per share (the “New Common Stock”), subject to the treatment of fractional share interests

as described below. The conversion of the Old Common Stock into New Common Stock will be deemed to occur at the Effective Time. From and

after the Effective Time, certificates representing the Old Common Stock shall represent the number of shares of New Common Stock into

which such Old Common Stock shall have been converted pursuant to this Certificate of Amendment. In connection with the reverse split,

no fractional shares shall be issued. In lieu of fractional shares, the Corporation will pay in cash the value of each fractional share.

SECOND: That thereafter, pursuant to resolution

of the Corporation’s Board of Directors, a special meeting of the stockholders of the Corporation was duly called and held upon

notice in accordance with Section 222 of the General Corporation Law of the State of Delaware at which meeting the necessary number of

shares as required by statute were voted in favor of the amendment.

THIRD: That said amendment was duly adopted in

accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

In WITNESS WHEREOF, Sonoma

Pharmaceuticals, Inc. has caused this Certificate to be signed by its duly authorized officer this 27th day of August, 2024.

| |

SONOMA PHARMACEUTICALS, INC.

By: /s/ Amy Trombly

Amy Trombly

Chief Executive Officer |

Exhibit 99.1

Sonoma Pharmaceuticals Announces

1-for-20 Reverse Split of Outstanding Common Stock

August 28, 2024 / BOULDER, CO / Sonoma

Pharmaceuticals, Inc. (Nasdaq:SNOA), a global healthcare leader developing and producing patented Microcyn® technology

based stabilized hypochlorous acid (HOCl) products for a wide range of applications, including wound care, eye, oral and nasal care, dermatological

conditions, podiatry, and animal health care, today announced the timing for a 1-for-20 reverse split of its outstanding common stock

which will be effected on August 29, 2024 at 5:00 pm EDT. Sonoma common stock will begin trading on The Nasdaq Capital Market on a 1-for-20

adjusted basis when the market opens on August 30, 2024. The reverse stock split was previously approved by the Company’s stockholders

at the Company’s Annual Meeting held on August 14 and August 23, 2024. The Company’s Board of Directors approved the implementation

of a reverse stock split and determined the reverse stock split ratio on August 23, 2024.

Amy Trombly, Sonoma’s Chief Executive Officer

said, “This reverse stock split is necessary to maintain our listing on the Nasdaq Capital Market. We believe that maintaining our

listing on Nasdaq strengthens the confidence of our business partners and suppliers, the interest of investors, and the availability of

business development opportunities.”

At the effective time of the reverse stock split,

every twenty shares of Sonoma’s issued and outstanding common stock will be automatically converted into one newly issued and outstanding

share of common stock, without any change in the par value per share. No fractional shares will be issued. Instead of receiving

a fractional share, investors will receive cash in lieu at the closing price of the common stock on August 29, 2024.

Sonoma’s common stock outstanding will change

from approximately 20 million to approximately one million. Proportional adjustments will be made to Sonoma’s stock options and

equity-compensation plans. The reverse stock split will have no effect on the Company’s authorized shares of common stock,

which will be increased from 24,000,000 to 50,000,000 effective August 29, 2024 at 5:00 pm EDT, as also approved by the Company’s

stockholders and Board of Directors.

The Company’s common stock will continue

to trade on The Nasdaq Capital Market under the symbol “SNOA.” A new CUSIP number will be issued to Sonoma’s common

stock after the reverse stock split becomes effective.

The reverse stock split is intended to increase

the per share trading price of the Company’s common stock to satisfy the $1.00 minimum bid price requirement for continued listing

on The Nasdaq Capital Market. In order to maintain the Company’s listing on Nasdaq, the Company’s common stock must have a

closing bid price of $1.00 or more for a minimum of 10 consecutive trading days prior to September 16, 2024. There can be no assurance

that the reverse stock split will have the desired effect of raising the closing bid price of the Company’s common stock to meet

such requirement.

Once the reverse stock split becomes effective,

stockholders holding shares through a brokerage account or in book-entry form will have their shares automatically adjusted to reflect

the 1:20 reverse stock split. Existing stockholders holding common stock certificates will receive a Letter of Transmittal from

the Company’s transfer agent, Computershare, Inc. with specific instructions regarding the exchange of shares.

About Sonoma Pharmaceuticals, Inc.

Sonoma Pharmaceuticals is a global healthcare

leader for developing and producing stabilized hypochlorous acid (HOCl) products for a wide range of applications, including wound, eye,

oral and nasal care, dermatological conditions, podiatry, animal health care and non-toxic disinfectants. Sonoma’s products are

clinically proven to reduce itch, pain, scarring, and irritation safely and without damaging healthy tissue. In-vitro and clinical studies

of HOCl show it to safely manage skin abrasions, lacerations, minor irritations, cuts, and intact skin. Sonoma’s products are sold

either directly or via partners in 55 countries worldwide and the company actively seeks new distribution partners. The company's principal

office is in Boulder, Colorado, with manufacturing operations in Guadalajara, Mexico. European marketing and sales are headquartered in

Roermond, Netherlands. More information can be found at www.sonomapharma.com. For partnership opportunities, please contact busdev@sonomapharma.com.

Forward-Looking Statements

Except for historical information herein, matters

set forth in this press release are forward-looking within the meaning of the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995, including statements about the commercial and technology progress and future financial performance of Sonoma

Pharmaceuticals, Inc. and its subsidiaries (the "company"). These forward-looking statements are identified by the use of words

such as "continue," "develop," "anticipate," "expect" and "expand," among others. Forward-looking

statements in this press release are subject to certain risks and uncertainties inherent in the company's business that could cause actual

results to vary, including such risks that regulatory clinical and guideline developments may change, scientific data may not be sufficient

to meet regulatory standards or receipt of required regulatory clearances or approvals, clinical results may not be replicated in actual

patient settings, protection offered by the company's patents and patent applications may be challenged, invalidated or circumvented by

its competitors, the available market for the company's products will not be as large as expected, the company's products will not be

able to penetrate one or more targeted markets, revenues will not be sufficient to meet the company's cash needs, fund further development,

as well as uncertainties relative to the COVID-19 pandemic and economic development, varying product formulations and a multitude of diverse

regulatory and marketing requirements in different countries and municipalities, and other risks detailed from time to time in the company's

filings with the Securities and Exchange Commission. The company disclaims any obligation to update these forward-looking statements,

except as required by law.

Sonoma Pharmaceuticals™ and Microcyn®

are trademarks or registered trademarks of Sonoma Pharmaceuticals, Inc. All other trademarks and service marks are the property of their

respective owners.

Media and Investor Contact:

Sonoma Pharmaceuticals, Inc.

ir@sonomapharma.com

Website: www.sonomapharma.com

Follow us on LinkedIn: https://www.linkedin.com/company/sonoma-pharmaceuticals

Follow us on Instagram: https://www.instagram.com/sonomapharma_us/

Follow us on Facebook: https://www.facebook.com/sonomapharma/

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

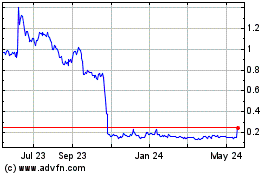

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Dec 2024 to Jan 2025

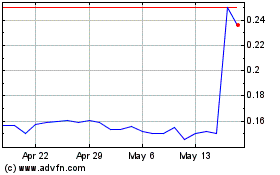

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Jan 2024 to Jan 2025