As filed with the Securities and Exchange Commission

on January 22, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT

OF 1933

SONNET BIOTHERAPEUTICS

HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

20-2932652 |

| (State or other jurisdiction |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| of incorporation or organization) |

|

Classification Code Number) |

|

Identification No.) |

100 Overlook Center, Suite 102

Princeton, New Jersey 08540

Telephone: 609-375-2227

(Address, including zip code, and telephone number,

including area code, of principal executive offices)

Pankaj Mohan, Ph.D.

CEO and Chairman

Sonnet BioTherapeutics Holdings, Inc.

100 Overlook Center, Suite 102

Princeton, New Jersey 08540

Telephone: (609) 375-2227

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Please send copies of all communications to:

Steven M. Skolnick, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, NY 10020

Telephone: (212) 262-6700

Approximate date of commencement of proposed sale

to the public:

From time to time after this Registration Statement

becomes effective.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant

to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant

to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective

registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer |

☐ |

Accelerated Filer |

☐ |

| Non-accelerated Filer |

☒ |

Smaller Reporting Company |

☒ |

| |

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY

22, 2025

PRELIMINARY PROSPECTUS

127,500 Shares of Common Stock

545,500 Shares of Common Stock issuable upon exercise

of 545,500 Outstanding Pre-Funded Warrants

1,758,325 Shares of Common Stock issuable upon exercise

of 1,758,325 Outstanding Common Warrants

This prospectus relates to the resale from time to

time, by the selling stockholders identified in this prospectus or their permitted transferees (the “Selling Stockholders”),

of up to (i) 127,500 shares (the “Shares”) of our common stock, par value $0.0001 per share (“Common Stock”),

(ii) 545,500 shares of Common Stock that may be issued upon the exercise of outstanding pre-funded warrants (the “Pre-Funded Warrants”),

and (iii) 1,758,325 shares of Common Stock that may be issued upon the exercise of outstanding common warrants (the “Common Warrants”

and together with the Pre-Funded Warrants, the “Warrants”). The Shares and the Warrants were issued to the Selling

Stockholders in two concurrent private placements, each of which closed on December 10, 2024. For additional information, see “Shares

Offered Hereby”.

The Selling Stockholders may, from time to time, sell,

transfer or otherwise dispose of any or all of their shares of Common Stock or interests in their shares of Common Stock on any stock

exchange, market or trading facility on which the shares of Common Stock are traded or in private transactions. These dispositions may

be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices

determined at the time of sale, or at negotiated prices. See “Plan of Distribution” in this prospectus for more information.

We will not receive any proceeds from the resale or other disposition of the shares of Common Stock by the Selling Stockholders. However,

we will receive the proceeds of any cash exercise of the Warrants. See “Use of Proceeds” beginning on page 7

and “Plan of Distribution” beginning on page 13 of this prospectus for more information.

You should read this prospectus, together with additional

information described under the headings “Information Incorporated by Reference” and “Where You Can Find More

Information,” carefully before you invest in any of our securities.

We effected a 1-for-8 reverse stock split on September

30, 2024, pursuant to which every eight shares of our issued and outstanding Common Stock were converted into one share of Common Stock.

The reverse stock split had no impact on the par value of our Common Stock or the authorized number of shares of our Common Stock. Unless

otherwise indicated, all share and per share information in this prospectus has been adjusted to reflect the September 30, 2024 reverse

stock split.

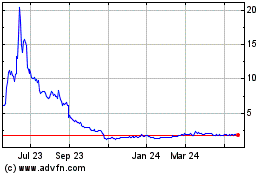

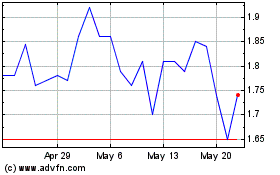

Our Common Stock is listed on The Nasdaq Capital

Market (“Nasdaq”) under the symbol “SONN.” On January 17, 2025, the last reported sale price of our Common

Stock as reported on Nasdaq was $1.54.

An investment in our securities involves a high

degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described

in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended September

30, 2024, filed with the Securities and Exchange Commission, or the SEC, on December 17, 2024, and our other filings we make with the

Securities and Exchange Commission from time to time, which are incorporated by reference herein in their entirety, together with other

information in this prospectus and the information incorporated by reference herein.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary

is a criminal offense.

The date of this prospectus is , 2025.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Neither we nor the Selling Stockholders has authorized

anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable

prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. When you make

a decision about whether to invest in our securities, you should not rely upon any information other than the information in this prospectus

or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus

nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after

the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to

buy our securities in any circumstances under which the offer or solicitation is unlawful.

We may also provide a prospectus supplement or post-effective

amendment to the registration statement to add information to, or update or change information contained in, this prospectus. Any statement

contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement

contained in such prospectus supplement or post-effective amendment modifies or supersedes such statement. Any statement so modified will

be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute

a part of this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to

the registration statement, together with the additional information to which we refer you in the sections of this prospectus titled “Information

Incorporated by Reference” and “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions

contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the

summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed

or will be filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents

as described below under “Where You Can Find More Information.”

This prospectus contains and incorporates by reference

certain market data and industry statistics and forecasts that are based on studies sponsored by us, independent industry publications

and other publicly available information. Although we believe these sources are reliable, estimates as they relate to projections involve

numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed

under “Risk Factors” in this prospectus and under similar headings in the documents incorporated by reference herein

and therein. Accordingly, investors should not place undue reliance on this information.

This prospectus contains references to trademarks,

trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred

to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the

applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do

not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement

or sponsorship of us by, any other companies.

Unless the context otherwise requires, references

in this prospectus to the “Company,” “we,” “us” and “our” and any related terms refer

to Sonnet BioTherapeutics Holdings, Inc. and its consolidated subsidiaries.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements

that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform

Act of 1995. All statements contained in this prospectus other than statements of historical fact, including statements regarding our

strategy, future operations, future financial position, liquidity, future revenue, projected expenses, results of operations, expectations

concerning the timing and our ability to commence and subsequently report data from planned non-clinical studies and clinical trials,

prospects, plans and objectives of management are forward-looking statements. The words “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “plan,” “expect,”

“predict,” “potential,” “opportunity,” “goals,” or “should,” and similar expressions

are intended to identify forward-looking statements. Such statements are based on management’s current expectations and involve

risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements

as a result of many factors.

We based these forward-looking statements largely

on our current expectations and projections about future events and trends that we believe may affect our financial condition, results

of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking

statements are subject to a number of risks, uncertainties, and assumptions, including those described in “Risk Factors”

in this prospectus, and under a similar heading in any other annual, periodic or current report incorporated by reference into this prospectus

or that we may file with the SEC in the future. These factors include, but are not limited to:

| ● | our lack of operating history and history of operating losses; |

| ● | our need for significant additional capital and our ability to satisfy our capital needs; |

| ● | our ability to complete required clinical trials of our products and obtain approval from the U.S. Food

and Drug Administration or other regulatory agents in different jurisdictions; |

| ● | our ability to maintain the listing of our common stock on The Nasdaq Capital Market; |

| ● | our ability to maintain or protect the validity of our patents and other intellectual property; |

| ● | our ability to retain key executive members; |

| ● | our ability to internally develop new inventions and intellectual property; |

| ● | interpretations of current laws and the passages of future laws; |

| ● | acceptance of our business model by investors; |

| ● | the emergence and effect of competing or complementary products, including the ability of our future products

to compete effectively; |

| ● | the accuracy of our estimates regarding expenses and capital requirements; |

| ● | our ability to adequately support growth; and |

| ● | other factors discussed under the section “Risk Factors” in this prospectus and in

our most recent Annual Report on Form 10-K. |

Moreover, we operate in a very competitive and rapidly

changing environment. New risks emerge quickly and from time to time. It is not possible for our management to predict all risks, nor

can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties

and assumptions, the future events and trends discussed in this prospectus, may not occur and actual results could differ materially and

adversely from those anticipated or implied in the forward-looking statements. We undertake no obligation to revise or publicly release

the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers

are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety

by this cautionary statement.

You should also read carefully the factors described

in the “Risk Factors” section of this prospectus, and under a similar heading in any other annual, periodic or current

report incorporated by reference into this prospectus, to better understand the risks and uncertainties inherent in our business and underlying

any forward-looking statements. You are advised to consult any further disclosures we make on related subjects in our future public filings.

PROSPECTUS SUMMARY

This summary highlights information about our company,

this offering and information contained in greater detail in other parts of this prospectus or incorporated by reference into this prospectus

from our filings with the SEC listed in the section entitled “Information Incorporated by Reference.” Because it is only a

summary, it does not contain all of the information that you should consider before purchasing our securities in this offering and it

is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated

by reference into this prospectus. You should read the entire prospectus, the registration statement of which this prospectus is a part,

and the information incorporated by reference into this prospectus in their entirety, including the “Risk Factors” and our

financial statements and the related notes incorporated by reference into this prospectus, before purchasing our securities in this offering.

Except as otherwise indicated herein or as the

context otherwise requires, references in this prospectus to “the Company,” “we,” “us” and “our”

refer to Sonnet BioTherapeutics Holdings, Inc. and our consolidated subsidiaries.

On September 30, 2024, we effected a reverse stock

split for our issued and outstanding Common Stock at a ratio of 1-for-8. On August 31, 2023, we effected a reverse stock split of our

issued and outstanding Common Stock at a ratio of 1-for-22. On September 16, 2022, we effected a reverse stock split of our issued and

outstanding Common Stock at a ratio of 1-for-14. All of our historical share and per share information related to issued and outstanding

Common Stock and outstanding options and warrants exercisable for Common Stock included in this prospectus have been adjusted, on a retroactive

basis, to reflect the reverse stock splits. See “Corporate Information.”

Corporate Overview

Sonnet BioTherapeutics Holdings, Inc. (“we,”

“us,” “our” or the “Company”), is a clinical stage, oncology-focused biotechnology company with a

proprietary platform for innovating biologic medicines of single- or bi-specific action. Known as FHAB™ (Fully Human Albumin Binding),

the technology utilizes a fully human single chain antibody fragment that binds to and “hitch-hikes” on human serum albumin

for transport to target tissues. We designed the construct to improve drug accumulation in specific tissues, as well as to extend the

duration of activity in the body. FHAB development candidates are produced in a mammalian cell culture, which enables glycosylation, thereby

reducing the risk of immunogenicity. We believe our FHAB technology, for which we received a U.S. patent in June 2021, is a distinguishing

feature of our biopharmaceutical platform that is well suited for future drug development across a range of human disease areas, including

in oncology, autoimmune, pathogenic, inflammatory, and hematological conditions.

Corporate Information

We were organized on October 21, 1999, under the name

Tulvine Systems, Inc., under the laws of the State of Delaware. On April 25, 2005, Tulvine Systems, Inc. formed a wholly owned subsidiary,

Chanticleer Holdings, Inc., and on May 2, 2005, Tulvine Systems, Inc. merged with, and changed its name to, Chanticleer Holdings, Inc.

On April 1, 2020, we completed our business combination with Sonnet BioTherapeutics, Inc. (“Sonnet”), in accordance with the

terms of the Agreement and Plan of Merger, dated as of October 10, 2019, as amended, by and among us, Sonnet and Biosub Inc., a wholly-owned

subsidiary of the Company (“Merger Sub”) (the “Merger Agreement”), pursuant to which Merger Sub merged with and

into Sonnet, with Sonnet surviving as a wholly owned subsidiary of us (the “Merger”). Under the terms of the Merger Agreement,

we issued shares of Common Stock to Sonnet’s stockholders at an exchange rate of 0.106572 shares for each share of Sonnet Common

Stock outstanding immediately prior to the Merger. In connection with the Merger, we changed our name from “Chanticleer Holdings,

Inc.” to “Sonnet BioTherapeutics Holdings, Inc.,” and the business conducted by us became the business conducted by

Sonnet.

On September 30, 2024, we effected a reverse stock

split of our issued and outstanding Common Stock at a ratio of 1-for-8 (the “2024 Reverse Stock Split”). On August 31, 2023,

we effected a reverse stock split of our issued and outstanding Common Stock at a ratio of 1-for-22 (the “2023 Reverse Stock Split”).

On September 16, 2022, we effected a reverse stock split of our issued and outstanding Common Stock at a ratio of 1-for-14 (the “2022

Reverse Stock Split” and, together with the 2024 Reverse Stock Split and the 2023 Reverse Stock Split, the “Reverse Stock

Splits”). Shares of Common Stock underlying outstanding stock options and other equity instruments convertible into Common Stock

were proportionately reduced and the respective exercise prices, if applicable, were proportionately increased in accordance with the

terms of the agreements governing such securities in connection with the Reverse Stock Splits. No fractional shares were issued in connection

with the Reverse Stock Splits. Stockholders who would otherwise be entitled to a fractional share of Common Stock instead receive a proportional

cash payment. All of our historical share and per share information related to issued and outstanding Common Stock and outstanding options

and warrants exercisable for Common Stock included or incorporated by reference in this prospectus have been adjusted, on a retroactive

basis, to reflect the Reverse Stock Splits.

Our principal executive offices are located at 100

Overlook Center, Suite 102, Princeton, New Jersey 08540, and our telephone number is (609) 375-2227. Our website is www.sonnetbio.com.

Our website and the information contained on, or that can be accessed through, our website shall not be deemed to be incorporated by reference

in, and are not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase

our Common Stock.

THE OFFERING

This prospectus relates to the resale or other disposition

from time to time by the Selling Stockholders identified in this prospectus of up to 127,500 shares of Common Stock and 2,303,825 shares

of Common Stock issuable upon exercise of the Warrants. None of the shares of Common Stock registered hereby are being offered for sale

by us.

| Shares of Common Stock offered by the Selling Stockholders |

|

Up to 127,500 shares of Common Stock and 2,303,825 shares of Common Stock issuable upon exercise of the Warrants. |

| |

|

|

| Common Stock outstanding prior to this offering |

|

3,007,431 shares. |

| |

|

|

| Common Stock outstanding immediately after this offering |

|

5,311,256 shares, assuming the exercise in full of the Warrants. |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus. However, we will receive the proceeds of any cash exercise of the Warrants. We intend to use the net proceeds from any cash exercise of the Warrants for research and development, including clinical trials, working capital and general corporate purposes. Please see the section entitled see “Use of Proceeds” on page 7 of this prospectus for a more detailed discussion. |

| |

|

|

| Common Stock ticker symbol |

|

“SONN.” |

| |

|

|

| Risk Factors |

|

An investment in our securities involves a high degree of risk. Please see the section entitled “Risk Factors” beginning on page 5 of this prospectus. In addition before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended September 30, 2024 filed with the SEC on December 17, 2024, and other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein. |

The number of shares of our Common Stock that will

be outstanding immediately after this offering is based on 3,007,431 shares of our Common Stock outstanding as of January 17,

2025, assuming the exercise of the Warrants in full, and excludes:

| ● |

9,175

shares of Common Stock reserved for issuance in connection with vested restricted stock units as of January 17, 2025; |

| |

|

| ● |

7,977

shares of Common Stock reserved for issuance in connection with vested restricted stock awards as of January 17, 2025; |

| |

|

| ● |

120,302 shares of Common Stock reserved for future issuance under the 2020 Omnibus Equity

Incentive Plan as of January 17, 2025; and |

| ● |

5,789,600 shares of Common Stock issuable upon the exercise of warrants outstanding as of January

17, 2025, with a weighted average exercise price of $14.47 per share. |

Unless otherwise indicated, this prospectus reflects

and assumes no issuances or exercises of any other outstanding shares, options or warrants after January 17, 2025.

RISK FACTORS

An investment in our securities involves a high degree

of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described in the

section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended September 30,

2024, filed with the SEC on December 17, 2024 and our other filings we make with the Securities and Exchange Commission from time to time,

which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated

by reference herein. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could

suffer materially. In such event, the trading price of our shares of Common Stock could decline, and you might lose all or part of your

investment.

SHARES OFFERED HEREBY

On December 9, 2024, we entered into a securities

purchase agreement (the “Registered Direct Purchase Agreement”) for a registered direct offering, pursuant to which we sold

an aggregate of (i) 768,000 shares of Common Stock (the “Registered Direct Shares”), and (ii) pre-funded warrants (the “Registered

Direct Pre-Funded Warrants”) to purchase up to an aggregate of 317,325 shares of Common Stock (the “Registered Direct Offering”).

Pursuant to the registered direct purchase agreement, in a concurrent private placement, we also sold common warrants (the “Registered

Direct Common Warrants”) to purchase up to 1,085,325 shares of Common Stock (the “First Private Placement”). Each Registered

Direct Share (or Registered Direct Pre-Funded Warrant in lieu thereof) was sold in the Registered Direct Offering together with one Registered

Direct Common Warrant at a combined offering price of $2.23, priced at-the-market under the rules of the Nasdaq Stock Market. The Registered

Direct Pre-Funded Warrants had an exercise price of $0.0001 per share, were immediately exercisable and were exercised in full on December

10, 2024. The Registered Direct Common Warrants have an exercise price of $2.10 per share, are immediately exercisable and will expire

five years from the date of issuance.

In addition, on December 9, 2024, we also entered

into a securities purchase agreement (the “Private Placement Purchase Agreement” and together with the Registered Direct Purchase

Agreement, the “Purchase Agreements”) for a concurrent private placement with an existing securityholder (the “Second

Private Placement, and together with the Registered Direct Offering and the First Private Placement, the “Offering”), pursuant

to which we sold an aggregate of (i) 127,500 shares of Common Stock (the “Private Placement Shares”), (ii) pre-funded warrants

to purchase up to an aggregate of 545,500 shares of Common Stock (the “Private Placement Pre-Funded Warrants”), and (iii)

common warrants (the “Private Placement Common Warrants” and, together with the Private Placement Pre-Funded Warrants and

the Registered Direct Common Warrants, the “Warrants”) to purchase up to an aggregate of 673,000 shares of Common Stock. Each

Private Placement Share (or Private Placement Pre-Funded Warrant in lieu thereof) was sold in the Second Private Placement together with

one Private Placement Common Warrant at a combined offering price of $2.23, priced at-the-market under the rules of the Nasdaq Stock Market.

The Private Placement Pre-Funded Warrants have an exercise price of $0.0001 per share, are immediately exercisable and may be exercised

at any time after the date of issuance until all of the Private Placement Pre-Funded Warrants are exercised in full. The Private Placement

Common Warrants have an exercise price of $2.10 per share, are immediately exercisable and will expire five years from the date of issuance.

The Offering closed on December 10, 2024 (the “Closing

Date”) for aggregate gross proceeds to us of approximately $3.9 million, before deducting the placement agent fees and estimated

offering expenses paid by us.

Pursuant to the Purchase Agreements, we agreed to

file a registration statement on Form S-1 providing for the resale of the Private Placement Shares and the shares underlying the Warrants

within 45 days after the date of the Purchase Agreements, and to use commercially reasonable efforts to cause such registration statement

to become effective within 181 days following the Closing Date and to keep such registration statement effective at all times until no

Selling Stockholder owns any Warrants or shares of Common Stock issuable upon exercise thereof. We have filed the registration statement

of which this prospectus forms a part pursuant to the Purchase Agreements. This prospectus covers the resale or other disposition by the

Selling Stockholders of the shares of up to 127,500 shares of Common Stock and up to 2,303,825 shares of Common Stock issuable upon exercise

of the Warrants.

We engaged Chardan Capital Markets LLC (the “Placement

Agent”) to act as our exclusive placement agent in connection with the transactions summarized above and paid the Placement Agent

a cash fee equal to 7.0% of the gross proceeds raised in the Offering, as well as a non-accountable expense allowance equal to 1.0% of

the total gross proceeds from the Offering. We also agreed to reimburse the Placement Agent for its expenses in connection with the Offering

in an amount up to $75,000.

USE OF PROCEEDS

We will not receive any proceeds from the sale of

Common Stock offered by the Selling Stockholders under this prospectus. However, we will receive the proceeds of any cash exercise of

the Warrants. If all of the Warrants were exercised for cash, we would receive aggregate proceeds of approximately $3,692,537.

We intend to use the net proceeds from any cash exercise of the Warrants for research and development, including clinical trials, working

capital, the repayment of all or a portion of our liabilities, and general corporate purposes.

This expected use of the net proceeds from this resale

represents our intentions based upon our current plans and business conditions, and our management will retain broad discretion as to

the ultimate allocation of the proceeds. We may temporarily invest funds that we do not immediately need for these purposes in investment

securities.

SELLING STOCKHOLDERS

This prospectus covers the resale or other disposition

by the Selling Stockholders identified in the table below of up to an aggregate of 127,500 shares of Common Stock and up to 2,303,825

shares of Common Stock issuable upon exercise of the Warrants.

The Selling Stockholders acquired their securities

in the transaction described above under the heading “Shares Offered Hereby.”

The Pre-Funded Warrants and the Common Warrants held

by the Selling Stockholders contain limitations which prevent the holder from exercising such Pre-Funded Warrants and Common Warrants

if such exercise would cause such Selling Stockholder, together with certain related parties, to beneficially own a number of shares of

Common Stock which would exceed 4.99% or 9.99%, as the case may be, of our then outstanding shares of Common Stock following such exercise,

excluding for purposes of such determination, shares of Common Stock issuable upon exercise of the Pre-Funded Warrants and Common Warrants

which have not been exercised.

The table below sets forth, as of January 17,

2025, the following information regarding the Selling Stockholders:

| ● |

the names of the Selling Stockholders; |

| ● |

the number of shares of Common Stock owned by the Selling Stockholders prior to this offering, without regard to any beneficial ownership limitations contained in the Warrants; |

| ● |

the number of shares of Common Stock to be offered by the Selling Stockholders in this offering; |

| ● |

the number of shares of Common Stock to be owned by the Selling Stockholders assuming the sale of all of the shares of Common Stock covered by this prospectus; and |

| ● |

the percentage of our issued and outstanding shares of Common Stock to be owned by the Selling Stockholders

assuming the sale of all of the shares of Common Stock covered by this prospectus based on the number of shares of Common Stock issued

and outstanding as of January 17, 2025. |

Except as described above, the number of shares of

Common Stock beneficially owned by each Selling Stockholder has been determined in accordance with Rule 13d-3 under the Exchange Act

and includes, for such purpose, shares of Common Stock that such Selling Stockholder has the right to acquire within 60 days of January

17, 2025.

All information with respect to the common stock ownership

of the Selling Stockholders has been furnished by or on behalf of the Selling Stockholders. We believe, based on information supplied

by the Selling Stockholders, that except as may otherwise be indicated in the footnotes to the table below, each Selling Stockholder has

sole voting and dispositive power with respect to the shares of Common Stock reported as beneficially owned by it. Because the Selling

Stockholders identified in the table may sell some or all of the shares of Common Stock beneficially owned by them and covered by this

prospectus, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares

of Common Stock, no estimate can be given as to the number of shares of Common Stock available for resale hereby that will be held by

the Selling Stockholders upon termination of this offering. In addition, the Selling Stockholders may have sold, transferred or otherwise

disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of Common Stock they beneficially

own in transactions exempt from the registration requirements of the Securities Act after the date on which they provided the information

set forth in the table below. We have, therefore, assumed for the purposes of the following table, that each Selling Stockholder will

sell all of the shares of Common Stock owned beneficially by it that are covered by this prospectus, but will not sell any other shares

of Common Stock that they presently own. The Selling Stockholders have not held any position or office, or have otherwise had a material

relationship, with us or any of our subsidiaries within the past three years other than as a result of the ownership of our shares of

Common Stock or other securities.

| | |

Shares Beneficially Owned Prior to | | |

Maximum Number of

Shares Being Offered

Pursuant to this | | |

Shares Beneficially Owned

After this Offering | |

| Name of Selling Stockholders | |

Offering(1) | | |

Prospectus | | |

Number | | |

Percent(2) | |

| Anson Investments Master Fund LP(3) | |

| 1,495,653 | | |

| 361,775 | | |

| 1,133,878 | | |

| 4.99 | % |

| Hudson Bay Master Fund Ltd.(4) | |

| 363,154 | | |

| 361,775 | | |

| 1,379 | | |

| * | % |

| MMCAP International Inc. SPC(5) | |

| 1,472,887 | | |

| 361,775 | | |

| 1,111,112 | | |

| 4.99 | % |

| The 1993 Shukla Family Trust, U/D/T December 27, 1993(6) | |

| 2,242,186 | | |

| 1,346,000 | | |

| 896,186 | | |

| 4.99 | % |

*Less than 1.0%.

| 1. |

Includes the shares of Common Stock underlying the Warrants, although the Warrants are subject to 4.99% (or, at the election of the holder, 9.99%) beneficial ownership limitations, as applicable. |

| |

|

| 2. |

Percentage is based on 3,007,431 shares of Common Stock outstanding as of January 17, 2025,

assuming the resale of all of the shares of Common Stock covered by this prospectus. |

| 3. |

Contains (i) Common Warrants to purchase up to 361,775 shares of Common Stock, and (ii) warrants

to purchase up to 1,33,878 shares of Common Stock issuable pursuant to the Company’s offering from November 2024 subject

to a beneficial ownership blocker of 4.99%. Anson Advisors Inc. and Anson Funds Management LP, in their capacity as co-investment

advisors of Anson Investments Master Fund LP, have the power to vote and direct the disposition of all securities held by Anson Investments

Master Fund LP. Tony Moore is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management

LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Each of Mr. Moore, Mr. Kassam and Mr. Nathoo disclaim beneficial

ownership of these securities, except to the extent of their pecuniary interest therein |

| |

|

| 4. |

Contains (i) Common Warrants to purchase up to 361,775 shares of Common Stock, and (ii) warrants to purchase up to 1,379 shares of Common Stock issuable pursuant to the Company’s offering from August 2021 subject to a beneficial ownership blocker of 4.99%. Hudson Bay Capital Management LP, in its capacity as the investment manager of Hudson Bay Master Fund Ltd., has the power to vote and to direct the disposition of all securities held by Hudson Bay Master Fund Ltd. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Mr. Gerber disclaim beneficial ownership over these securities, except to the extent of any pecuniary interest therein. |

| |

|

| 5. |

Contains (i) Common Warrants to purchase up to 361,775 shares of Common Stock, and (ii) warrants to purchase up to 1,111,112 shares of Common Stock issuable pursuant to the Company’s offering from November 2024 subject to a beneficial ownership blocker of 4.99%. MM Asset Management Inc., in its capacity as the investment advisor of MMCAP International Inc. SPC, has the power to vote and to direct the disposition of all securities held by MMCAP International Inc. SPC. Matthew MacIsaac is the secretary of MM Asset Management Inc. Each of MM Asset Management Inc. and Mr. MacIsaac disclaim beneficial ownership over these securities, except to the extent of any pecuniary interest therein. |

| |

|

| 6. |

Contains (i) 184,444 shares of Common Stock, (ii) Common Warrants to purchase up to 673,000

shares of Common Stock, (iii) Pre-Funded Warrants to purchase up to 545,500 shares of Common Stock, (iv) warrants to purchase

up to 375,000 shares of Common Stock issued in the Company’s offering from June 2024 subject to a beneficial ownership blocker

of 4.99%, (v) 155,125 shares of Common Stock issuable pursuant to the Inducement Letter underlying Existing Warrants subject to a

beneficial ownership blocker of 4.99%, (vi) warrants to purchase up to 5,260 shares of Common Stock issued in the Company’s

offering from February 2023 subject to a beneficial ownership blocker of 4.99%, (vii) pre-funded warrants to purchase up to 99,687

shares of Common Stock issued in the Company’s offering from October 2023 subject to a beneficial ownership blocker of 4.99%,

(viii) warrants to purchase up to 203,125 shares of Common Stock issued in the Company’s offering from October 2023 subject

to a beneficial ownership blocker of 4.99% and (ix) Series 3 super voting preferred warrants to purchase up to 1,045 shares of Common

Stock issued in August 2022 subject to a beneficial ownership blocker of 4.99%. |

DESCRIPTION OF CAPITAL STOCK

The following is a summary of information concerning

our capital stock and does not purport to be complete. The summary is subject to, and qualified in its entirety by reference to, our certificate

of incorporation, as amended (the “Certificate of Incorporation”), our amended and restated bylaws (the “Bylaws”)

and the Delaware General Corporation Law (the “DGCL”). You are urged to read our Certificate of Incorporation, Bylaws and

the applicable provisions of the DGCL for additional information.

General

Our authorized capital stock consists of:

| ● | 125,000,000 shares of Common Stock, par value $0.0001 per share; and |

| ● | 5,000,000 shares of preferred stock, par value $0.0001 per share, of which, as of the date of this prospectus,

none of which shares have been designated. |

As of close of business on January 17, 2025, 3,007,431 shares of Common Stock were issued and outstanding and no shares of preferred stock were issued and outstanding.

The additional shares of our authorized stock available

for issuance may be issued at times and under circumstances so as to have a dilutive effect on earnings per share and on the equity ownership

of the holders of our Common Stock. The ability of our board of directors to issue additional shares of stock could enhance the board’s

ability to negotiate on behalf of the stockholders in a takeover situation but could also be used by the board to make a change-in-control

more difficult, thereby denying stockholders the potential to sell their shares at a premium and entrenching current management. The following

description is a summary of the material provisions of our capital stock. You should refer to our Certificate of Incorporation, as amended

(the “Certificate of Incorporation”) and Amended and Restated Bylaws (the “Bylaws”), both of which are on file

with the SEC as exhibits to previous SEC filings, for additional information. The summary below is qualified by provisions of applicable

law.

Common Stock

Holders of our Common Stock are each entitled to cast

one vote for each share held of record on all matters presented to stockholders. Cumulative voting is not allowed; the holders of a majority

of our outstanding shares of Common Stock may elect all directors. Holders of our Common Stock are entitled to receive such dividends

as may be declared by our board out of funds legally available and, in the event of liquidation, to share pro rata in any distribution

of our assets after payment of liabilities. Our directors are not obligated to declare a dividend. It is not anticipated that we will

pau dividends in the foreseeable future. Holders of our do not have preemptive rights to subscribe to any additional shares we may issue

in the future. There are no conversion, redemption, sinking fund or similar provisions regarding the Common Stock. All outstanding shares

of Common Stock are fully paid and nonassessable.

The rights, preferences and privileges of holders

of Common Stock are subject to the rights of the holders of any outstanding shares of preferred stock.

Preferred Stock

We are authorized to issue up to 5,000,000 shares

of preferred stock, all of which are undesignated. Our board of directors has the authority to issue preferred stock in one or more classes

or series and to fix the designations, powers, preferences and rights, and the qualifications, limitations or restrictions thereof, including

dividend rights, conversion right, voting rights, terms of redemption, liquidation preferences and the number of shares constituting any

class or series, without further vote or action by the stockholders. Although we have no present plans to issue any other shares of preferred

stock, the issuance of shares of preferred stock, or the issuance of rights to purchase such shares, could decrease the amount of earnings

and assets available for distribution to the holders of Common Stock, could adversely affect the rights and powers, including voting rights,

of the Common Stock, and could have the effect of delaying, deterring or preventing a change of control of us or an unsolicited acquisition

proposal. The preferred stock may provide for an adjustment of the conversion price in the event of an issuance or deemed issuance at

a price less than the applicable conversion price, subject to certain exceptions.

If we offer a specific series of preferred stock under

this prospectus, we will describe the terms of the preferred stock in the prospectus supplement for such offering and will file a copy

of the certificate establishing the terms of the preferred stock with the SEC. To the extent required, this description will include:

| ● | the title and stated value; |

| ● | the number of shares offered, the liquidation preference per share and the purchase price; |

| ● | the dividend rate(s), period(s) and/or payment date(s), or method(s) of calculation for such dividends; |

| ● | whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends

will accumulate; |

| ● | the procedures for any auction and remarketing, if any; |

| ● | the provisions for a sinking fund, if any; |

| ● | the provisions for redemption, if applicable; |

| ● | any listing of the preferred stock on any securities exchange or market; |

| ● | whether the preferred stock will be convertible into our Common Stock, and, if applicable, the conversion

price (or how it will be calculated) and conversion period; |

| ● | whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange

price (or how it will be calculated) and exchange period; |

| ● | voting rights, if any, of the preferred stock; |

| ● | a discussion of any material and/or special U.S. federal income tax considerations applicable to the preferred

stock; |

| ● | the relative ranking and preferences of the preferred stock as to dividend rights and rights upon liquidation,

dissolution or winding up of our affairs; and |

| ● | any material limitations on issuance of any class or series of preferred stock ranking senior to or on

a parity with the series of preferred stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs. |

Anti-takeover Effects of Delaware Law and our Certificate

of Incorporation and Bylaws

Our Certificate of Incorporation and Bylaws contain

provisions that could have the effect of discouraging potential acquisition proposals or tender offers or delaying or preventing a change

of control. These provisions are as follows:

| ● | they provide that special meetings of stockholders may be called by the President, the board of directors

or at the request by stockholders of record owning at least thirty-three and one-third percent (33 1/3%) of the issued and outstanding

voting shares of our Common Stock; |

| ● | they do not include a provision for cumulative voting in the election of directors. Under cumulative voting,

a minority stockholder holding a sufficient number of shares may be able to ensure the election of one or more directors. The absence

of cumulative voting may have the effect of limiting the ability of minority stockholders to effect changes in our board of directors;

and |

| ● | they allow us to issue, without

stockholder approval, up to 5,000,000 shares of preferred stock that could adversely

affect the rights and powers of the holders of our Common Stock. |

We are subject to the provisions of Section 203 of

the Delaware General Corporation Law, an anti-takeover law. Subject to certain exceptions, the statute prohibits a publicly held Delaware

corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years

after the date of the transaction in which the person became an interested stockholder unless:

| ● | prior to such date, the board of directors of the corporation approved either the business combination

or the transaction which resulted in the stockholder becoming an interested stockholder; |

| ● | upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least eighty-five percent (85%) of the voting stock of the corporation outstanding at the time the

transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned (1) by persons who are

directors and also officers and (2) by employee stock plans in which employee participants do not have the right to determine confidentially

whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| ● | on or after such date, the business combination is approved by the board of directors and authorized at

an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least sixty-six and two-thirds

percent (66 2/3%) of the outstanding voting stock that is not owned by the interested stockholder. |

Generally, for purposes of Section 203, a “business

combination” includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder.

An “interested stockholder” is a person who, together with affiliates and associates, owns or, within three (3) years prior

to the determination of interested stockholder status, owned fifteen percent (15%) or more of a corporation’s outstanding voting

securities.

Potential Effects of Authorized but Unissued Stock

We have shares of Common Stock and preferred stock

available for future issuance without stockholder approval. We may utilize these additional shares for a variety of corporate purposes,

including future public offerings to raise additional capital, to facilitate corporate acquisitions or payment as a dividend on the capital

stock.

The existence of unissued and unreserved Common Stock

and preferred stock may enable our board of directors to issue shares to persons friendly to current management or to issue preferred

stock with terms that could render more difficult or discourage a third-party attempt to obtain control of us by means of a merger, tender

offer, proxy contest or otherwise, thereby protecting the continuity of our management. In addition, the board of directors has the discretion

to determine designations, rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights,

redemption privileges and liquidation preferences of each series of preferred stock, all to the fullest extent permissible under the DGCL

and subject to any limitations set forth in our Certificate of Incorporation. The purpose of authorizing the board of directors to issue

preferred stock and to determine the rights and preferences applicable to such preferred stock is to eliminate delays associated with

a stockholder vote on specific issuances. The issuance of preferred stock, while providing desirable flexibility in connection with possible

financings, acquisitions and other corporate purposes, could have the effect of making it more difficult for a third-party to acquire,

or could discourage a third-party from acquiring, a majority of our outstanding voting stock.

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock

is Securities Transfer Corporation. The transfer agent address is Securities Transfer Corporation, 2901 N Dallas Parkway, Suite 380, Plano,

TX 75093, (469) 633-0101. The transfer agent and registrar for any series or class of preferred stock will be set forth in each applicable

prospectus supplement.

PLAN OF DISTRIBUTION

Each Selling Stockholder of the securities and any

of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on

The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions.

These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling

securities:

| ● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| ● |

privately negotiated transactions; |

| ● |

settlement of short sales; |

| ● |

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security; |

| ● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| ● |

a combination of any such methods of sale; or |

| ● |

any other method permitted pursuant to applicable law. |

The Selling Stockholders may also sell securities

under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders

(or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except

as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission

in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities or interests

therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in

turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell

securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that

in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other

financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial

institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant

to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or

agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale

of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder

has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute

the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify

the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We

agreed to keep this registration statement effective until each Selling Stockholder no longer own

any of the securities registered hereunder. The resale securities will be sold only through registered or licensed brokers or

dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may

not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification

requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

Common Stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

Our

Common Stock is quoted on The Nasdaq Capital Market under the symbol “SONN.”

LEGAL

MATTERS

The

validity of the shares of Common Stock offered hereby will be passed upon for us by Lowenstein Sandler LLP, New York, New York.

EXPERTS

The

consolidated financial statements of Sonnet BioTherapeutics Holdings, Inc. as of September 30, 2024 and 2023 and for the years then ended

have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated

by reference herein, and upon the authority of said firm as experts in accounting and auditing. The audit report covering the September

30, 2024 consolidated financial statements contains an explanatory paragraph that states that Sonnet BioTherapeutics Holdings, Inc. has

incurred recurring losses and negative cash flows from operations since inception and will require substantial additional financing to

continue to fund its research and development activities that raise substantial doubt about its ability to continue as a going concern.

The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to “incorporate by reference” information into this document, which means that we can disclose important information

to you by referring you to another document filed separately with the SEC. The information incorporated by reference is an important

part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information.

We

incorporate by reference the following documents or information that we have filed with the SEC:

| ● |

our

Annual Report on Form 10-K (the “Form 10-K”) for the fiscal year ended September 30, 2024 filed with the SEC on December

17, 2024; |

| ● |

our Current Reports on

Form 8-K filed with the SEC on October

9, 2024, October

17, 2024, November

6, 2024, November

8, 2024, December

4, 2024, December

9, 2024, December

10, 2024, December

17, 2024, and January 21, 2025 (other than any portions thereof deemed furnished and not filed); and |

| |

|

| ● |

the description of Common

Stock of the Company contained in our Registration Statement on Form 8-A, filed on June 7, 2012 under Section 12(b) of the Exchange

Act including any amendments or reports filed for the purpose of updating such description, including Exhibit 4.8 to the Form 10-K. |

All

reports and other documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date that

this registration statement becomes effective and after the date of this prospectus but before the termination of the offering of the

securities hereunder will also be considered to be incorporated by reference into this prospectus from the date of the filing of these

reports and documents, and will supersede the information herein; provided, however, that all reports, exhibits and other information

that we “furnish” to the SEC will not be considered incorporated by reference into this prospectus. We undertake to provide

without charge to each person (including any beneficial owner) who receives a copy of this prospectus, upon written or oral request,

a copy of all of the preceding documents that are incorporated by reference (other than exhibits, unless the exhibits are specifically

incorporated by reference into these documents).

You

may request a copy of these filings at no cost, by writing or telephoning us at the following address:

Sonnet

BioTherapeutics Holdings, Inc.

Attn:

Pankaj Mohan, Ph.D., CEO and Chairman

100

Overlook Center, Suite 102

Princeton,

New Jersey 08540

(609)

375-2227

You

may also access these filings on our website at www.sonnetbio.com. You should rely only on the information incorporated by reference

or provided in this prospectus. We have not authorized anyone else to provide different or additional information on our behalf. An offer

of these securities is not being made in any jurisdiction where the offer or sale is not permitted. You should not assume that the information

in this prospectus is accurate as of any date other than the date of those respective documents.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus is part of a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth

in the registration statement and the exhibits to the registration statement. For further information with respect to us, we refer you

to the registration statement and the exhibits and schedules filed as a part of the registration statement. You should rely only on the

information contained in this prospectus or incorporated by reference into this prospectus. We have not authorized anyone else to provide

you with different information. You should assume that the information contained in this prospectus, or any document incorporated by

reference in this prospectus, is accurate only as of the date of those respective documents, regardless of the time of delivery of this

prospectus or any sale of our securities.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public from commercial document retrieval services and over the Internet at the SEC’s website at http://www.sec.gov.

We

maintain a website at www.sonnetbio.com. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the

SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to,

the SEC. The information contained in, or that can be accessed through, our website is not incorporated by reference into, and is not

part of, this prospectus.

127,500

Shares of Common Stock

545,500

Shares of Common Stock issuable upon exercise of 545,500 Outstanding Pre-Funded Warrants

1,758,325

Shares of Common Stock issuable upon exercise of 1,758,325 Outstanding Common Warrants

PRELIMINARY

PROSPECTUS

,

2025

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

13. Other Expenses of Issuance and Distribution

The

following table sets forth the costs and expenses, other than underwriting discounts and commissions, payable by us in connection with

the sale and distribution of the securities being registered. All of the amounts shown are estimates, except for the SEC registration

fee and the FINRA filing fee:

| | |

Amount to

be paid | |

| SEC registration fee | |

$ | 565.80 | |

| Legal fees and expenses | |

| 50,000 | |

| Accounting fees and expenses | |

| 15,000 | |

| Miscellaneous | |

| 4,434.20 | |

| Total expenses | |

$ | 70,000.00 | |

Item

14. Indemnification of Directors and Officers

Section

145 of the Delaware General Corporation Law (the “DGCL”) provides, in general, that a corporation incorporated under the

laws of the State of Delaware, as we are, may indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding (other than a derivative action by or in the right of the corporation) by reason of the

fact that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the

corporation as a director, officer, employee or agent of another enterprise, against expenses (including attorneys’ fees), judgments,

fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding

if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the

corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s conduct was

unlawful. In the case of a derivative action, a Delaware corporation may indemnify any such person against expenses (including attorneys’

fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit if such person

acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation,

except that no indemnification will be made in respect of any claim, issue or matter as to which such person will have been adjudged

to be liable to the corporation unless and only to the extent that the Court of Chancery of the State of Delaware or any other court

in which such action was brought determines such person is fairly and reasonably entitled to indemnity for such expenses.

Article

X of our Certificate of Incorporation states that to the fullest extent permitted by the DGCL, a director of the corporation shall not

be liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director.

Under

Article VI of our Bylaws, any director, officer, employee or agent of the Company who was or is made or is threatened to be made a party

or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”)

by reason of the fact that such director, officer, employee or agent or a person for whom such director, officer, employee or agent is

the legal representative, is or was a director or officer of the Company or, while serving as a director, officer, employee or agent

of the Company, is or was serving at the request of the Company as a director, officer, employee or agent of another corporation or of

a partnership, joint venture, trust, enterprise or non-profit entity, including service with respect to employee benefit plans (an “Indemnification

Covered Person”), against all liability and loss suffered and expenses (including attorneys’ fees, judgments, fines ERISA

excise taxes or penalties and amounts paid in settlement) reasonably incurred by such person in connection with any such Proceeding.

We

maintain a general liability insurance policy that covers certain liabilities of directors and officers of our corporation arising out

of claims based on acts or omissions in their capacities as directors or officers.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons

pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable.

Item

15. Recent Sales of Unregistered Securities.

In

the three years preceding the filing of this registration statement, the Company made sales of the following unregistered securities:

August

2022 Offering

In

August 2022, we entered into a securities purchase agreement (the “Preferred SPA”) with several accredited investors for

the issuance and sale of (i) an aggregate of 22,275 shares of our Series 3 convertible preferred stock, stated value $100 per share (the

“Series 3 Stock”), (ii) 225 shares of our Series 4 convertible preferred stock, stated value $100 per share (the “Series

4 Stock”), and (iii) Series 3 warrants (the “Series 3 Warrants”) to purchase up to 1,566 shares of Common Stock

in a private placement for aggregate gross proceeds of $2.3 million, with $0.1 million of issuance costs for net proceeds of $2.1 million.

The shares of Series 3 Stock were convertible into an aggregate of 3,106 shares of Common Stock and the shares of Series 4 Stock were

convertible into an aggregate of 31 shares of Common Stock, in each case, at a conversion price of $717.024 per share. The Series 3 Warrants

have an exercise price of $717.024 per share, are exercisable commencing six months after issuance, and will expire five years from the

issuance date. In September 2022, all shares of Series 3 Stock and Series 4 Stock issued in connection with the Preferred SPA were converted

into shares of Common Stock.

The

shares of Series 3 Stock and Series 4 Stock and the shares of Common Stock issuable upon the conversion of the Series 3 Stock and the

Series 4 Stock and the exercise of the Series 3 Warrants were offered pursuant to an exemption from the registration requirement of the

Securities Act provided in Section 4(a)(2) of the Securities Act and/or Rule 506 promulgated under Regulation D of the Securities Act.

June

2023 Offering

In

connection with a registered direct offering of our shares of Common Stock and pre-funded warrants to purchase shares of Common Stock,

on June 28, 2023, we entered into a securities purchase agreement with certain institutional investors, pursuant to which, among other

things, we sold to such investors warrants (the “June 2023 Private Warrants”) to purchase up to 28,409 shares of Common Stock

in a private placement. No separate consideration was paid for the issuance of the June 2023 Private Warrants. In addition, we issued

to Chardan or its designees, warrants (the “June 2023 PA Warrants” and together with the June 2023 Private Warrants, the

“June 2023 Warrants”) to purchase up to 852 shares of Common Stock. The June 2023 Warrants are currently exercisable, have

a term of exercise equal to five years from the date of the securities purchase agreement and have an exercise price equal to $118.7824

per share.

The

June 2023 Warrants and the shares of Common Stock issuable upon exercise of the June 2023 Warrants were offered pursuant to an exemption

from the registration requirement of the Securities Act provided in Section 4(a)(2) of the Securities Act and/or Rule 506 promulgated

under Regulation D of the Securities Act.

June

2024 Warrant Inducement Offering

On

June 19, 2024, we entered into inducement offer letter agreements with holders of certain existing warrants issued in October 2023 having

an original exercise price of $12.80 per share to purchase up to an aggregate of 354,994 shares of Common Stock at a reduced exercise

price of $9.60 per share (the “Warrant Inducement Offering”). The Warrant Inducement Offering closed on June 21, 2024, resulting

in gross proceeds to us of $3.4 million and net proceeds of $2.9 million. Also, in connection with the Warrant Inducement Offering, we

(i) issued to holders who participated in the transaction new Common Stock warrants to purchase an aggregate of 703,125 shares of Common

Stock, (ii) reduced the exercise price of existing warrants to purchase 353,562 shares of Common Stock for those holders who did not

exercise warrants in the transaction from $12.80 per share to $9.60 per share for the remaining term of the warrants, and (iii) reduced

the exercise price of certain existing warrants issued in June 2023 to purchase 28,409 shares of Common Stock from $118.7824 per share

to $12.40 per share and extended the expiration date of these warrants from December 30, 2026 to June 21, 2029. The new Common Stock

warrants are immediately exercisable at a price of $12.40 per share and expire five years from the date of issuance. Warrants to purchase

14,142 shares of Common Stock were issued as compensation to Ladenburg Thalmann & Co. Inc. for its services as the placement agent

related for the Warrant Inducement Offering. These Common Stock warrants are immediately exercisable at a price of $14.88 per share and

expire five years from the date of issuance.

We

issued the new Common Stock warrants to the holders in reliance on the exemption from registration provided for under Section 4(a)(2)

of the Securities Act. We relied on this exemption from registration for private placements based in part on the representations made

by the holders, including the representations with respect to each holder’s status as an “accredited investor,” as

such term is defined in Rule 501(a) of the Securities Act, and each holder’s investment intent.

December

2024 Offering

On

December 9, 2024, we entered into a securities purchase agreement for a registered direct offering, pursuant to which we sold an aggregate

of (i) 768,000 shares of Common Stock, and (ii) pre-funded warrants to purchase up to an aggregate of 317,325 shares of Common Stock.

Pursuant to the registered direct purchase agreement, in a concurrent private placement, we also sold warrants to purchase up to 1,085,325

shares of Common Stock (the “Registered Direct Common Warrants”). Each registered direct share (or registered direct pre-funded

warrant in lieu thereof) was sold in the registered direct offering together with one registered direct common warrant at a combined