Summit State Bank (Nasdaq: SSBI) today reported net income for the

year ended December 31, 2023 of $10,822,000, or $1.62 per diluted

share, a decrease of $6,146,000, or 36%, compared to net income of

$16,968,000, or $2.54 per diluted share for the year ended December

31, 2022. For the fourth quarter ended December 31, 2023, net

income was $1,901,000, or $0.28 per diluted share, compared to

$4,553,000 or $0.68 per diluted share, for the fourth quarter ended

December 31, 2022.

The Board of Directors declared a quarterly cash

dividend of $0.12 per share on January 29, 2024. The quarterly

dividend will be paid on February 15, 2024 to shareholders of

record on February 8, 2024.

“We closed out the year with solid operating

results despite the challenges across the entire banking industry,”

said Brian Reed, President and CEO. “The persistently high interest

rate environment continued to impact net interest income growth

with higher interest expense on deposits and borrowings, which

affected our operating performance for the fourth quarter and the

full year 2023. However, we continue to see steady loan demand in

our markets, and total deposit balances have increased compared to

a year ago. Further, our capital levels and excess liquidity

positions remain strong, and together with revenue generation we

have a solid foundation upon which to continue to grow in the year

ahead.”

Fourth Quarter 2023 Financial

Highlights (at or for the three months ended December 31,

2023)

- Net income was $1,901,000, or $0.28

per diluted share in the fourth quarter of 2023, compared to

$4,553,000, or $0.68 per diluted share, in the fourth quarter of

2022 and $1,821,000, or $0.27 per diluted share, for the quarter

ended September 30, 2023.

- Reversal of net credit losses was

$65,000, compared to a provision for net credit losses of $662,000

in the fourth quarter a year ago and a reversal of net credit

losses of $5,000 at September 30, 2023.

- Net interest margin was 2.85%,

compared to 4.29% in the fourth quarter a year ago and 2.80% in the

preceding quarter.

- Fourth quarter revenues (interest

income plus noninterest income) decreased 6.0% to $15,333,000,

compared to $16,320,000 in the fourth quarter a year ago and

decreased 6.7% compared to $16,427,000 in the preceding

quarter.

- Annualized return on average assets

was 0.67%, compared to 1.69% in the fourth quarter of 2022 and

0.63% in the preceding quarter.

- Annualized return on average equity

was 8.02%, compared to 20.84% in the fourth quarter a year ago and

7.70% in the preceding quarter.

- Net loans increased $24,919,000 to

$938,626,000 at December 31, 2023, compared to $913,707,000 one

year earlier and increased $6,400,000 compared to $932,226,000

three months earlier.

- Total deposits increased 5% to

$1,009,693,000 at December 31, 2023 compared to $962,655,000 at

December 31, 2022 and decreased 2% when compared to the prior

quarter end of $1,030,836,000.

- The Bank’s nonperforming loans to

gross loans increased to 4.63% at December 31, 2023 compared to

3.72% at September 30, 2023 and 0.40% at December 31, 2022.

Additionally, nonperforming assets to total assets increased to

3.94%, at December 31, 2023 compared to 3.09% at September 30, 2023

and 0.34% at December 31, 2022.

- Book value increased to $14.40 per

share, compared to $13.15 per share a year ago.

- Declared a quarterly cash dividend of $0.12 per share for the

three months ended December 31, 2023, September 30, 2023, and

December 31, 2022.

Operating Results

For the fourth quarter of 2023, the annualized

return on average assets was 0.67% and the annualized return on

average equity was 8.02%. This compared to an annualized return on

average assets of 1.69% and an annualized return on average equity

of 20.84%, respectively, for the fourth quarter of 2022.

“Following an unprecedented rise in funding

costs that has affected the entire banking industry over the past

year, our net interest margin started to stabilize during the

fourth quarter; expanding five basis points compared to the prior

quarter,” said Reed. “We are working hard to retain rate sensitive

customer deposits, and while deposit pricing pressure persists, we

continue to benefit from new loan growth as well as existing loans

repricing at higher rates.” Summit’s net interest margin was 2.85%

in the fourth quarter of 2023, compared to 2.80% in the preceding

quarter and 4.29% in the fourth quarter of 2022.

Interest and dividend income increased 6% to

$15,036,000 in the fourth quarter of 2023 compared to $14,188,000

in the fourth quarter of 2022. The increase in interest income is

attributable to a $312,000 increase in loan interest yield

primarily driven by increased loan volume and secondarily by

increased rates, $423,000 increase in interest on deposits with

banks and $113,000 increase in investment interest.

Non-interest income decreased in the fourth

quarter of 2023 to $297,000 compared to $2,132,000 in the fourth

quarter of 2022. The Bank recognized no gains on sales of SBA

guaranteed loan balances in the fourth quarter of 2023, compared to

$1,762,000 in gains on sales of SBA and USDA guaranteed loan

balances in the fourth quarter of 2022.

Operating expenses decreased in the fourth

quarter of 2023 to $5,483,000 compared to $6,395,000 in the fourth

quarter of 2022. The decrease was primarily due to a $741,000

decrease in stock appreciation rights expense, a $570,000 decrease

in annual bonus payout, offset by a one-time expense of $470,000

for a cyber fraud loss.

Balance Sheet Review

Net loans increased 3% to $938,626,000 at

December 31, 2023 compared to $913,707,000 at December 31, 2022 and

increased 1% compared to September 30, 2023.

Total deposits increased 5% to $1,009,693,000 at

December 31, 2023 compared to $962,655,000 at December 31, 2022 and

decreased 2% when compared to the prior quarter end. Most of the

deposit growth year-over-year was due to the Bank’s ongoing focus

on growing local deposits organically. At December 31, 2023,

noninterest bearing demand deposit accounts decreased 20% compared

to a year ago and represented 20% of total deposits; savings, NOW

and money market accounts increased 47% compared to a year ago and

represented 51% of total deposits, and CDs decreased 18% compared

to a year ago and comprised 29% of total deposits. The average cost

of deposits was 2.79% in the fourth quarter of 2023, compared to

1.06% in the fourth quarter of 2022, and 2.63% in the third quarter

of 2023.

Shareholders’ equity was $97,678,000 at December

31, 2023, compared to $93,439,000 three months earlier and

$88,547,000 a year earlier. The increase in shareholders’ equity

compared to a year ago was primarily due to an increase of

$7,571,000 in retained earnings and a decrease of $1,269,000 in

accumulated other comprehensive loss; this change was related to a

decrease in the unrealized loss on available for sale securities

reflecting the decrease in market interest rates during the year.

At December 31, 2023, book value was $14.40 per share, compared to

$13.77 three months earlier, and $13.15 at December 31, 2022.

Summit State Bank continues to maintain capital

levels in excess of the requirements to be categorized as

“well-capitalized” with tangible equity to tangible assets of 8.38%

at December 31, 2023, compared to 8.24% at September 30, 2023, and

8.10% at December 31, 2022.

Credit Quality

“Identifying and resolving problem credits and

maintaining an adequate reserve balance remains a top priority,”

said Reed. Nonperforming assets were $44,206,000, or 3.94% of total

assets, at December 31, 2023, and consisted of eighteen loans; one

loan totaling $6,449,000 is a real estate secured commercial loan,

two loans totaling $5,690,000 are real estate secured construction

and land loans and fifteen loans totaling $32,067,000 are

commercial and agriculture secured loans. All nonperforming assets

were individually assessed, many of which are sufficiently

collateralized, resulting in a corresponding reserve of $1,613,000.

There were $35,267,000 in nonperforming assets at September 30,

2023, and $3,756,000 in nonperforming assets at December 31,

2022.

Due to minimal projected change in expected

losses, the Bank recorded a $65,000 reversal of net credit loss

expense for unfunded commitments in the fourth quarter of 2023.

This compared to $662,000 provision for net credit loss expense in

the fourth quarter of 2022. The allowance for credit losses to

total loans was 1.60% on December 31, 2023 and December 31, 2022.

The real estate portfolio, which accounts for a majority of the

Bank’s loan portfolio, has an average loan-to-value of 50% and debt

service coverage ratio of 1.92% as of December 31, 2023.During

challenging economic times, we remain focused on our mission of

providing exceptional service to our customers and meeting all of

their financial needs,” said Reed.

About Summit State Bank

Founded in 1982 and headquartered in Sonoma

County, Summit State Bank (Nasdaq: SSBI), is an award-winning

community bank servicing the North Bay. The Bank serves small

businesses, nonprofits, and the community, with total assets of

$1,123 million and total equity of $98 million at December 31,

2023. The Bank has built its reputation over the past 40 years by

specializing in providing exceptional customer service and

customized financial solutions to aid in the success of its

customers.

Summit State Bank is dedicated to investing in

and celebrating the diverse backgrounds, cultures and talents of

its employees to create high performance and support the evolving

needs of its customers and community it serves. The Bank has been

consistently recognized for its achievements and has been awarded

Best Places to Work in the North Bay, Top Community Bank Loan

Producer, Raymond James Bankers Cup, Super Premier Performing Bank,

the Piper Sandler SM-ALL Star Award, the Independent Community

Bankers of America’s Best-Performing Community Banks, and the San

Francisco Business Times’ 2023 Bay Area Corporate Philanthropists.

For more information, visit www.summitstatebank.com.

Forward-looking Statements

The financial results in this release are

preliminary. Final financial results and other disclosures will be

reported in Summit State Bank’s annual report on Form 10-K for the

period ended December 31, 2023 and may differ materially from the

results and disclosures in this release due to, among other things,

the completion of final review procedures, the occurrence of

subsequent events or the discovery of additional information.

Except for historical information contained

herein, the statements contained in this news release, are

forward-looking statements within the meaning of the “safe harbor”

provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. This release may contain forward-looking statements that

are subject to risks and uncertainties. Such risks and

uncertainties may include but are not necessarily limited to

fluctuations in interest rates, inflation, government regulations

and general economic conditions, and competition within the

business areas in which the Bank will be conducting its operations,

including the real estate market in California and other factors

beyond the Bank’s control. Such risks and uncertainties could cause

results for subsequent interim periods or for the entire year to

differ materially from those indicated. You should not place undue

reliance on the forward-looking statements, which reflect

management’s view only as of the date hereof. The Bank undertakes

no obligation to publicly revise these forward-looking statements

to reflect subsequent events or circumstances.

| SUMMIT STATE

BANK |

| STATEMENTS

OF INCOME |

| (In thousands except

earnings per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended |

|

Year Ended |

| |

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

| |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and dividend income: |

|

|

|

|

|

|

|

| |

Interest and fees on loans |

$ |

13,409 |

|

|

$ |

13,097 |

|

|

$ |

52,560 |

|

|

$ |

46,124 |

|

| |

Interest on deposits with banks |

|

792 |

|

|

|

369 |

|

|

|

4,410 |

|

|

|

596 |

|

| |

Interest on investment securities |

|

712 |

|

|

|

624 |

|

|

|

2,855 |

|

|

|

1,935 |

|

| |

Dividends on FHLB stock |

|

123 |

|

|

|

98 |

|

|

|

416 |

|

|

|

301 |

|

| |

|

|

Total interest and dividend income |

|

15,036 |

|

|

|

14,188 |

|

|

|

60,241 |

|

|

|

48,956 |

|

|

Interest expense: |

|

|

|

|

|

|

|

| |

Deposits |

|

7,113 |

|

|

|

2,380 |

|

|

|

24,227 |

|

|

|

4,942 |

|

| |

Federal Home Loan Bank advances |

|

- |

|

|

|

463 |

|

|

|

177 |

|

|

|

1,212 |

|

| |

Junior subordinated debt |

|

94 |

|

|

|

94 |

|

|

|

375 |

|

|

|

375 |

|

| |

|

|

Total interest expense |

|

7,207 |

|

|

|

2,937 |

|

|

|

24,779 |

|

|

|

6,529 |

|

| |

|

|

Net interest income before provision for credit losses |

|

7,829 |

|

|

|

11,251 |

|

|

|

35,462 |

|

|

|

42,427 |

|

|

(Reversal of) provision for credit losses on loans |

|

(31 |

) |

|

|

807 |

|

|

|

342 |

|

|

|

2,683 |

|

|

Reversal of credit losses on unfunded loan commitments |

|

(65 |

) |

|

|

(145 |

) |

|

|

(68 |

) |

|

|

(142 |

) |

|

Provision for credit losses on investments |

|

31 |

|

|

|

- |

|

|

|

58 |

|

|

|

- |

|

| |

|

|

Net interest income after provision for (reversal of) credit |

|

|

|

|

|

|

|

| |

|

|

|

losses,

unfunded loan commitments and investments |

|

7,894 |

|

|

|

10,589 |

|

|

|

35,130 |

|

|

|

39,886 |

|

|

Non-interest income: |

|

|

|

|

|

|

|

| |

Service charges on deposit accounts |

|

219 |

|

|

|

219 |

|

|

|

872 |

|

|

|

859 |

|

| |

Rental income |

|

54 |

|

|

|

37 |

|

|

|

193 |

|

|

|

199 |

|

| |

Net gain on loan sales |

|

- |

|

|

|

1,762 |

|

|

|

2,481 |

|

|

|

5,839 |

|

| |

Net (loss) gain on securities |

|

- |

|

|

|

(3 |

) |

|

|

- |

|

|

|

4 |

|

| |

Other income |

|

24 |

|

|

|

117 |

|

|

|

1,655 |

|

|

|

594 |

|

| |

|

|

Total non-interest income |

|

297 |

|

|

|

2,132 |

|

|

|

5,201 |

|

|

|

7,495 |

|

|

Non-interest expense: |

|

|

|

|

|

|

|

| |

Salaries and employee benefits |

|

3,044 |

|

|

|

3,873 |

|

|

|

15,399 |

|

|

|

14,651 |

|

| |

Occupancy and equipment |

|

386 |

|

|

|

506 |

|

|

|

1,713 |

|

|

|

1,716 |

|

| |

Other expenses |

|

2,053 |

|

|

|

2,016 |

|

|

|

7,938 |

|

|

|

7,144 |

|

| |

|

|

Total non-interest expense |

|

5,483 |

|

|

|

6,395 |

|

|

|

25,050 |

|

|

|

23,511 |

|

| |

|

|

Income before provision for income taxes |

|

2,708 |

|

|

|

6,326 |

|

|

|

15,281 |

|

|

|

23,870 |

|

|

Provision for income taxes |

|

807 |

|

|

|

1,773 |

|

|

|

4,459 |

|

|

|

6,902 |

|

| |

|

|

Net income |

$ |

1,901 |

|

|

$ |

4,553 |

|

|

$ |

10,822 |

|

|

$ |

16,968 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.28 |

|

|

$ |

0.68 |

|

|

$ |

1.62 |

|

|

$ |

2.54 |

|

|

Diluted earnings per common share |

$ |

0.28 |

|

|

$ |

0.68 |

|

|

$ |

1.62 |

|

|

$ |

2.54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares of common stock outstanding |

|

6,698 |

|

|

|

6,688 |

|

|

|

6,695 |

|

|

|

6,687 |

|

|

Diluted weighted average shares of common stock outstanding |

|

6,698 |

|

|

|

6,688 |

|

|

|

6,698 |

|

|

|

6,687 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| SUMMIT STATE

BANK |

| BALANCE

SHEETS |

| (In thousands except

share data) |

| |

|

|

|

|

|

|

| |

|

|

|

December 31, 2023 |

|

December 31, 2022 |

| |

|

|

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

ASSETS |

|

|

|

| |

|

|

|

|

|

|

|

Cash and due from banks |

$ |

57,789 |

|

$ |

77,567 |

| |

|

|

Total cash

and cash equivalents |

|

57,789 |

|

|

77,567 |

| |

|

|

|

|

|

|

|

Investment securities: |

|

|

|

| |

Available-for-sale, less allowance for credit losses of $58 and

$0 |

|

|

|

| |

|

(at fair value; amortized cost of $97,034 in 2023 and $98,017

in 2022) |

|

84,546 |

|

|

83,785 |

| |

|

|

|

|

|

|

|

Loans, less allowance for credit losses of $15,221 and $14,839 |

|

938,626 |

|

|

913,707 |

|

Bank premises and equipment, net |

|

5,316 |

|

|

5,461 |

|

Investment in Federal Home Loan Bank (FHLB) stock, at cost |

|

5,541 |

|

|

4,737 |

|

Goodwill |

|

|

4,119 |

|

|

4,119 |

|

Affordable housing tax credit investments |

|

8,405 |

|

|

8,881 |

|

Accrued interest receivable and other assets |

|

18,166 |

|

|

17,086 |

| |

|

|

|

|

|

|

| |

|

|

Total

assets |

$ |

1,122,508 |

|

$ |

1,115,343 |

| |

|

|

|

|

|

|

| LIABILITIES

AND |

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

| |

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

| |

Demand - non interest-bearing |

$ |

201,909 |

|

$ |

252,033 |

| |

Demand - interest-bearing |

|

244,748 |

|

|

143,767 |

| |

Savings |

|

54,352 |

|

|

67,117 |

| |

Money market |

|

212,278 |

|

|

137,362 |

| |

Time deposits that meet or exceed the FDIC insurance limit |

|

63,159 |

|

|

141,691 |

| |

Other time deposits |

|

233,247 |

|

|

220,685 |

| |

|

|

Total

deposits |

|

1,009,693 |

|

|

962,655 |

| |

|

|

|

|

|

|

|

Federal Home Loan Bank advances |

|

- |

|

|

41,000 |

|

Junior subordinated debt, net |

|

5,920 |

|

|

5,905 |

|

Affordable housing commitment |

|

4,094 |

|

|

4,677 |

|

Accrued interest payable and other liabilities |

|

5,123 |

|

|

12,560 |

| |

|

|

|

|

|

|

| |

|

|

Total

liabilities |

|

1,024,830 |

|

|

1,026,797 |

| |

|

|

|

|

|

|

| |

|

|

Total

shareholders' equity |

|

97,678 |

|

|

88,546 |

| |

|

|

|

|

|

|

| |

|

|

Total

liabilities and shareholders' equity |

$ |

1,122,508 |

|

$ |

1,115,343 |

| |

|

|

|

|

|

|

| Financial

Summary |

| (In

thousands except per share data) |

| |

|

|

|

|

|

|

|

|

| |

|

As of and

for the |

|

As of and

for the |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

Statement of Income Data: |

|

|

|

|

|

|

|

|

| Net interest

income |

|

$ |

7,829 |

|

|

$ |

11,251 |

|

|

$ |

35,462 |

|

|

$ |

42,427 |

|

| (Reversal

of) provision for credit losses on loans |

|

|

(31 |

) |

|

|

807 |

|

|

|

342 |

|

|

|

2,683 |

|

|

Reversal of provision for credit losses on unfunded loan

commitments |

|

(65 |

) |

|

|

(145 |

) |

|

|

(68 |

) |

|

|

(142 |

) |

| Provision

for credit losses on investments |

|

|

31 |

|

|

|

- |

|

|

|

58 |

|

|

|

- |

|

| Non-interest

income |

|

|

297 |

|

|

|

2,132 |

|

|

|

5,201 |

|

|

|

7,495 |

|

| Non-interest

expense |

|

|

5,483 |

|

|

|

6,395 |

|

|

|

25,050 |

|

|

|

23,511 |

|

| Provision

for income taxes |

|

|

807 |

|

|

|

1,773 |

|

|

|

4,459 |

|

|

|

6,902 |

|

| Net

income |

|

$ |

1,901 |

|

|

$ |

4,553 |

|

|

$ |

10,822 |

|

|

$ |

16,968 |

|

| |

|

|

|

|

|

|

|

|

|

Selected per Common Share Data: |

|

|

|

|

|

|

|

|

| Basic

earnings per common share |

|

$ |

0.28 |

|

|

$ |

0.68 |

|

|

$ |

1.62 |

|

|

$ |

2.54 |

|

| Diluted

earnings per common share |

|

$ |

0.28 |

|

|

$ |

0.68 |

|

|

$ |

1.62 |

|

|

$ |

2.54 |

|

| Dividend per

share |

|

$ |

0.12 |

|

|

$ |

0.12 |

|

|

$ |

0.48 |

|

|

$ |

0.48 |

|

| Book value

per common share (1) |

|

$ |

14.40 |

|

|

$ |

13.15 |

|

|

$ |

14.40 |

|

|

$ |

13.15 |

|

| |

|

|

|

|

|

|

|

|

|

Selected Balance Sheet Data: |

|

|

|

|

|

|

|

|

| Assets |

|

$ |

1,122,508 |

|

|

$ |

1,115,343 |

|

|

$ |

1,122,508 |

|

|

$ |

1,115,343 |

|

| Loans,

net |

|

|

938,626 |

|

|

|

913,707 |

|

|

|

938,626 |

|

|

|

913,707 |

|

|

Deposits |

|

|

1,009,693 |

|

|

|

962,655 |

|

|

|

1,009,693 |

|

|

|

962,655 |

|

| Average

assets |

|

|

1,123,057 |

|

|

|

1,070,000 |

|

|

|

1,142,790 |

|

|

|

1,005,186 |

|

| Average

earning assets |

|

|

1,089,808 |

|

|

|

1,040,154 |

|

|

|

1,110,801 |

|

|

|

978,169 |

|

| Average

shareholders' equity |

|

|

94,096 |

|

|

|

86,675 |

|

|

|

93,621 |

|

|

|

86,038 |

|

|

Nonperforming loans |

|

|

44,206 |

|

|

|

3,756 |

|

|

|

44,206 |

|

|

|

3,756 |

|

| Total

nonperforming assets |

|

|

44,206 |

|

|

|

3,756 |

|

|

|

44,206 |

|

|

|

3,756 |

|

| |

|

|

|

|

|

|

|

|

|

Selected Ratios: |

|

|

|

|

|

|

|

|

| Return on

average assets (2) |

|

|

0.67 |

% |

|

|

1.69 |

% |

|

|

0.95 |

% |

|

|

1.69 |

% |

| Return on

average common shareholders' equity (2) |

|

|

8.02 |

% |

|

|

20.84 |

% |

|

|

11.56 |

% |

|

|

19.72 |

% |

| Efficiency

ratio (3) |

|

|

67.47 |

% |

|

|

47.77 |

% |

|

|

61.60 |

% |

|

|

47.10 |

% |

| Net interest

margin (2) |

|

|

2.85 |

% |

|

|

4.29 |

% |

|

|

3.19 |

% |

|

|

4.34 |

% |

| Common

equity tier 1 capital ratio |

|

|

10.15 |

% |

|

|

9.41 |

% |

|

|

10.15 |

% |

|

|

9.41 |

% |

| Tier 1

capital ratio |

|

|

10.15 |

% |

|

|

9.41 |

% |

|

|

10.15 |

% |

|

|

9.41 |

% |

| Total

capital ratio |

|

|

12.00 |

% |

|

|

11.27 |

% |

|

|

12.00 |

% |

|

|

11.27 |

% |

| Tier 1

leverage ratio |

|

|

8.85 |

% |

|

|

8.53 |

% |

|

|

8.85 |

% |

|

|

8.53 |

% |

| Common

dividend payout ratio (4) |

|

|

42.63 |

% |

|

|

17.72 |

% |

|

|

30.05 |

% |

|

|

19.01 |

% |

| Average

shareholders' equity to average assets |

|

|

8.38 |

% |

|

|

8.10 |

% |

|

|

8.19 |

% |

|

|

8.56 |

% |

|

Nonperforming loans to total loans |

|

|

4.63 |

% |

|

|

0.40 |

% |

|

|

4.63 |

% |

|

|

0.40 |

% |

|

Nonperforming assets to total assets |

|

|

3.94 |

% |

|

|

0.34 |

% |

|

|

3.94 |

% |

|

|

0.34 |

% |

| Allowance

for credit losses to total loans |

|

|

1.60 |

% |

|

|

1.60 |

% |

|

|

1.60 |

% |

|

|

1.60 |

% |

| Allowance

for credit losses to nonperforming loans |

|

|

34.43 |

% |

|

|

395.09 |

% |

|

|

34.43 |

% |

|

|

395.09 |

% |

| |

|

|

|

|

|

(1) Total shareholders' equity divided by total common shares

outstanding. |

|

|

|

|

|

(2) Annualized. |

|

|

|

|

|

(3) Non-interest expenses to net interest and non-interest income,

net of securities gains. |

|

|

|

|

|

|

|

(4) Common dividends divided by net income available for common

shareholders. |

|

|

|

|

Contact: Brian Reed, President and CEO, Summit State

Bank (707) 568-4908

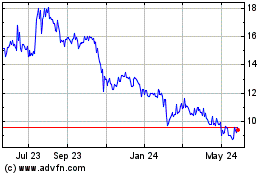

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From Jan 2025 to Feb 2025

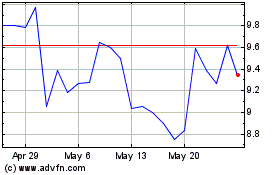

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From Feb 2024 to Feb 2025