0001236275FALSE00012362752024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2024

______________________________

QXO, INC.

(Exact name of registrant as specified in its charter)

______________________________

| | | | | | | | | | | |

| Delaware | 001-38063 | 16-1633636 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| |

Five American Lane

Greenwich, Connecticut | 06831 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 888-998-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.00001 per share | | QXO | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2024, QXO, Inc. (the “Company”) issued a press release announcing its results of operations for the fiscal quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 14, 2024

| | | | | | | | | | | |

| QXO, INC. | |

| | | |

| | | |

| By: | /s/ Ihsan Essaid | |

| | Ihsan Essaid | |

| | Chief Financial Officer | |

QXO Reports Second Quarter 2024 Results

GREENWICH, Conn. — August 14, 2024 — QXO, Inc. (Nasdaq: QXO) today announced its second quarter results for the three and six months ended June 30, 2024.

Financial Highlights for the Three Months Ended June 30, 2024, Compared with the Three Months Ended June 30, 2023:

•Total revenue was $14.54 million, compared with $13.26 million.

•Software product revenue was $3.78 million, compared with $3.30 million.

•Service and other revenue was $10.76 million, compared with $9.96 million.

•Net loss was ($591,000) or ($9.93) loss per basic and diluted share, compared with net income of $344,000 or $0.52 earnings per basic and diluted share.

•Adjusted EBITDA, a non-GAAP measure, was ($1.21) million, compared with $705,000.

•As of June 30, 2024, the company had approximately $971 million in cash on hand. In July 2024, the company completed two previously announced private placements, increasing its cash position to approximately $5.0 billion.

Financial Highlights for the Six Months Ended June 30, 2024, Compared with the Six Months Ended June 30, 2023:

•Total revenue was $28.98 million, compared with $26.39 million.

•Software product revenue was $7.26 million, compared with $6.62 million.

•Service and other revenue was $21.72 million, compared with $19.77 million.

•Net loss was ($452,000) or ($9.72) loss per basic and diluted share, compared with net income of $621,000 or $0.95 earnings per basic and diluted share.

•Adjusted EBITDA, a non-GAAP measure, was ($708,000), compared with $1.37 million.

The year-over-year declines in three- and six-month 2024 Adjusted EBITDA were due to higher employee-related costs in the second quarter, reflecting the introduction of a new senior management team to execute the company’s expansive growth plan.

Brad Jacobs, chairman and chief executive officer of QXO, said, “I’m pleased that we’ve achieved three significant milestones in less than 10 weeks since launching QXO. We have an accomplished senior management team and board of directors in place, and approximately $5 billion of cash to execute our strategy, following two private placements. These are all cornerstones of our plan to become a tech-forward leader in building products distribution through accretive acquisitions and organic growth.”

For more details on QXO’s three- and six-month results, refer to the company’s Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”), accessible at www.sec.gov.

About QXO

QXO provides technology solutions, primarily to clients in the manufacturing, distribution and service sectors. The company provides consulting and professional services, including specialized programming, training and technical support, and develops proprietary software. As a value-added reseller of business application software, QXO offers solutions for accounting, financial reporting, enterprise resource planning, warehouse management systems, customer relationship management,business intelligence and other applications. QXO plans to become a tech-forward leader in the $800 billion building products distribution industry. The company is targeting tens of

billions of dollars of annual revenue in the next decade through accretive acquisitions and organic growth. Visit QXO.com for more information.

Non-GAAP Financial Measures

As required by the rules of the SEC, we provide reconciliations of the non-GAAP financial measures contained in this press release to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this press release.

QXO’s non-GAAP financial measures in this press release include Adjusted EBITDA.

We believe that the above adjusted financial measure facilitates analysis of our ongoing business operations because it excludes items that may not be reflective of, or are unrelated to, QXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying business. Other companies may calculate this non-GAAP financial measure differently, and therefore our measure may not be comparable to similarly titled measures of other companies. This non-GAAP financial measure should only be used as a supplemental measure of our operating performance.

Adjusted EBITDA includes adjustments for share-based compensation, transaction, and severance costs as set forth in the attached reconciliation. Transaction adjustments are generally incremental costs that result from an actual or planned acquisition or divestiture and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Management uses this non-GAAP financial measure in making financial, operating and planning decisions and evaluating QXO’s ongoing performance.

We believe that Adjusted EBITDA improves comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses.

Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net income (loss), and our other GAAP results.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements that are not historical facts, including statements about beliefs, expectations, targets and goals are forward-looking statements. These statements are based on plans, estimates, expectations and/or goals at the time the statements are made, and readers should not place undue reliance on them. In some cases, readers can identify forward-looking statements by the use of forward-looking terms such as “may,” “will,” “should,” “expect,” “opportunity,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “target,” “goal,” or “continue,” or the negative of these terms or other comparable terms. Forward-looking statements involve inherent risks and uncertainties and readers are cautioned that a number of important factors could cause actual results to differ materially from those contained in any such forward-looking statements. Factors that could cause actual results to differ materially from those described herein include, among others:

•risks associated with potential significant volatility and fluctuations in the market price of the company’s common stock;

•risks associated with raising additional equity or debt capital from public or private markets to pursue the company’s business plan, including potentially one or more additional private placements of common stock, and the effects that raising such capital may have on the company and its business, including the risk of substantial dilution or that the company’s common stock may experience a substantial decline in trading price;

•the possibility that additional future financings may not be available to the company on acceptable terms or at all;

•the possibility that an active, liquid trading market for the company’s common stock may not develop or, if developed, may not be sustained;

•the possibility that the company’s outstanding warrants and preferred stock may or may not be converted or exercised, and the economic impact on the company and the holders of common stock of the company that may result from either such exercise or conversion, including dilution, or the continuance of the preferred stock remaining outstanding, and the impact its terms, including its dividend, may have on the company and the common stock of the company;

•uncertainties regarding the company’s focus, strategic plans and other management actions;

•the risk that the company is or becomes highly dependent on the continued leadership of Brad Jacobs as chairman and chief executive officer and the possibility that the loss of Mr. Jacobs in these roles could have a material adverse effect on the company’s business, financial condition and results of operations;

•the possibility that the concentration of ownership by Mr. Jacobs may have the effect of delaying or preventing a change in control of the company and might affect the market price of shares of the common stock of the company;

•the risk that Mr. Jacobs’ past performance may not be representative of future results;

•the risk that the company is unable to attract and retain world-class talent;

•the risk that the failure to consummate any acquisition expeditiously, or at all, could have a material adverse effect on the company’s business prospects, financial condition, results of operations or the price of the company’s common stock;

•risks that the company may not be able to enter into agreements with acquisition targets on attractive terms, or at all, that agreed acquisitions may not be consummated, or, if consummated, that the anticipated benefits thereof may not be realized and that the company encounter difficulties in integrating and operating such acquired companies, or that matters related to an acquired business (including operating results or liabilities or contingencies) may have a negative effect on the company or its securities or ability to implement its business strategy, including that any such transaction may be dilutive or have other negative consequences to the company and its value or the trading prices of its securities;

•risks associated with cybersecurity and technology, including attempts by third parties to defeat the security measures of the company and its business partners, and the loss of confidential information and other business disruptions;

•the possibility that new investors in any future financing transactions could gain rights, preferences and privileges senior to those of the company’s existing stockholders;

•the possibility that building products distribution industry demand may soften or shift substantially due to cyclicality or seasonality or dependence on general economic conditions, including inflation or deflation, interest rates, governmental subsidies or incentives, consumer confidence, labor and supply shortages, weather and commodity prices;

•the possibility that regional or global barriers to trade or a global trade war could increase the cost of products in the building products distribution industry, which could adversely impact the competitiveness of such products and the financial results of businesses in the industry;

•risks associated with periodic litigation, regulatory proceedings and enforcement actions, which may adversely affect the company’s business and financial performance;

•uncertainties regarding general economic, business, competitive, legal, regulatory, tax and geopolitical conditions; and

•other factors, including those set forth in the company’s filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and subsequent Quarterly Reports on Form 10-Q.

You should not rely on forward-looking statements as predictions of future events, and you should understand that these statements are not guarantees of performance or results, and our actual results could differ materially from those expressed in the forward-looking statements due to a variety of factors. We have based the forward-looking statements contained in this document primarily on our current assumptions, expectations and projections about future events and trends that we believe may affect our business, financial condition, and results of operations. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this document. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

Forward-looking statements herein speak only as of the date each statement is made. The company undertakes no obligation to update any of these statements in light of new information or future events, except to the extent required by applicable law.

Media Contact:

Joe Checkler

joe.checkler@qxo.com

203-609-9650

Investor Contact:

Mark Manduca

mark.manduca@qxo.com

203-321-3889

| | | | | | | | |

| QXO, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (in thousands, except share and per share data) |

| | |

| June 30, 2024 | December 31, 2023 |

| ASSETS | (unaudited) | |

| Current assets: | | |

Cash and cash equivalents | $ | 971,284 | | $ | 6,143 | |

Accounts receivable, net | 3,015 | | 2,969 | |

Prepaid expenses and other current assets | 5,539 | | 2,684 | |

Total current assets | 979,838 | | 11,796 | |

| Property and equipment, net | 511 | | 503 | |

| Operating lease right-of-use assets | 380 | | 522 | |

| Intangible assets, net | 4,486 | | 4,919 | |

| Goodwill | 1,140 | | 1,140 | |

| Deferred tax assets | 1,614 | | 1,444 | |

| Other non-current assets | 216 | | 171 | |

Total assets | $ | 988,185 | | $ | 20,495 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | |

| Current liabilities: | | |

Accounts payable | $ | 6,194 | | $ | 4,563 | |

Accrued expenses | 5,397 | | 2,681 | |

Deferred revenue | 3,113 | | 3,161 | |

Long-term debt - current portion | 784 | | 702 | |

Finance lease obligations - current portion | 141 | | 154 | |

Operating lease liabilities - current portion | 217 | | 263 | |

Total current liabilities | 15,846 | | 11,524 | |

| Long-term debt net of current portion | 693 | | 994 | |

| Finance lease obligations net of current portion | 247 | | 247 | |

| Operating lease liabilities net of current portion | 164 | | 259 | |

Total liabilities | 16,950 | | 13,024 | |

| Commitments and contingencies | | |

| Stockholders’ equity: | | |

| Preferred stock, $0,001 par value; authorized 10,000,000 shares, 1,000,000 and 0 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 498,684 | | - | |

| Common stock, $0.00001 par value; authorized 2,000,000,000 shares, 664,284 and 664,448 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | - | | - | |

Additional paid-in capital | 474,951 | | 9,419 | |

Accumulated deficit | (2,400) | | (1,948) | |

| Total stockholders’ equity | 971,235 | | 7,471 | |

| Total liabilities and stockholders’ equity | $ | 988,185 | | $ | 20,495 | |

| | | | | | | | | | | | | | |

| QXO, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in thousands, except per share data) |

(Unaudited) |

| | | | |

| Three Months Ended | Six Months Ended |

| June 30, 2024 | June 30, 2023 | June 30, 2024 | June 30, 2023 |

| Revenue: | | | | |

Software product, net | $ | 3,776 | | $ | 3,298 | | $ | 7,256 | | $ | 6,620 | |

Service and other, net | 10,764 | | 9,959 | | 21,719 | | 19,765 | |

Total revenue, net | 14,540 | | 13,257 | | 28,975 | | 26,385 | |

| Cost of revenue | | | | |

Product | 2,369 | | 2,027 | | 4,568 | | 3,960 | |

Service and other | 6,376 | | 6,045 | | 12,955 | | 11,883 | |

Total cost of revenue | 8,745 | | 8,072 | | 17,523 | | 15,843 | |

| Operating expenses: | | | | |

| Selling, general and administrative expenses | 9,835 | | 4,525 | | 15,024 | | 9,305 | |

| Depreciation and amortization expenses | 261 | | 204 | | 501 | | 411 | |

Total operating expenses | 10,096 | | 4,729 | | 15,525 | | 9,716 | |

| (Loss) income from operations | (4,301) | | 456 | | (4,073) | | 826 | |

| Other income (expense), net: | | | | |

| Interest income (expense), net | 3,470 | | (17) | | 3,450 | | (35) | |

Total other income (expense) | 3,470 | | (17) | | 3,450 | | (35) | |

| (Loss) income before taxes | (831) | | 439 | | (623) | | 791 | |

| (Benefit) provision for income taxes | (240) | | 95 | | (171) | | 170 | |

| Net (loss) income | $ | (591) | | $ | 344 | | $ | (452) | | $ | 621 | |

| (Loss) earnings per common share - basic and fully diluted | $ | (9.93) | | $ | 0.52 | | $ | (9.72) | | $ | 0.95 | |

| Weighted average shares outstanding: | | | | |

| Basic | 664 | 657 | 664 | 657 |

| Diluted | 664 | 657 | 664 | 657 |

| | | | | | | | |

| QXO, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (in thousands) |

| (Unaudited) |

| | |

| Six Months Ended June 30, |

| 2024 | 2023 |

| Cash flows from operating activities: | | |

Net (loss) income | $ | (452) | | $ | 621 | |

| Adjustments to reconcile net (loss) income to net cash used in operating activities: | | |

Deferred income taxes | (171) | | 220 | |

Depreciation | 142 | | 178 | |

Amortization of intangibles | 432 | | 324 | |

Non-cash lease expense | 140 | | 188 | |

Provision for expected losses | 25 | | (68) | |

Share-based compensation | - | | 41 | |

| Changes in assets and liabilities: | | |

Accounts receivable | (71) | | 73 | |

Prepaid expenses and other current assets | (2,855) | | (611) | |

Other assets | (144) | | - | |

Accounts payable | 1,631 | | (452) | |

Accrued expenses | 829 | | (257) | |

Deferred revenue | (48) | | (393) | |

Operating lease liabilities | (141) | | (188) | |

| Net cash used in operating activities | (683) | | (324) | |

| Cash flows from investing activities: | | |

Purchase of property and equipment | (62) | | (24) | |

| Net cash used in investing activities | (62) | | (24) | |

| Cash flows from financing activities: | | |

Payment of long-term debt | (219) | | (422) | |

Proceeds from issuance of preferred stock and warrants, net of offering costs | 983,650 | | - | |

Payment of common-stock dividend | (17,400) | | - | |

Cash payment for fractional shares | (45) | | - | |

Payment of finance lease obligations | (100) | | (109) | |

| Net cash provided by (used in) financing activities | 965,886 | | (531) | |

| Net increase (decrease) in cash | 965,141 | | (879) | |

| Cash, beginning of period | 6,143 | | 8,009 | |

| Cash, end of period | $ | 971,284 | | $ | 7,130 | |

| Cash paid during period for: | | |

Interest | $ | 23 | | $ | 58 | |

Income taxes | $ | - | | $ | 23 | |

| | | | | | | | | | | | | | |

| QXO, INC. AND SUBSIDIARIES |

| RECONCILIATION OF NET (LOSS) INCOME TO ADJUSTED EBITDA |

| (in thousands) |

| (Unaudited) |

| Three Months Ended | Six Months Ended |

| June 30, 2024 | June 30, 2023 | June 30, 2024 | June 30, 2023 |

| | | | |

| Net (loss) income | $ | (591) | | $ | 344 | | $ | (452) | | $ | 621 | |

| Add (deduct): | | | | |

Depreciation and amortization | 303 | | 249 | | 574 | | 502 | |

Share-based compensation | - | | - | | - | | 41 | |

Interest (income) expense | (3,470) | | 17 | | (3,450) | | 35 | |

(Benefit) provision for income taxes | (240) | | 95 | | (171) | | 170 | |

Transaction costs | 23 | | - | | 23 | | - | |

Severance costs | 2,768 | | - | | 2,768 | | - | |

| Adjusted EBITDA | $ | (1,207) | | $ | 705 | | $ | (708) | | $ | 1,369 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

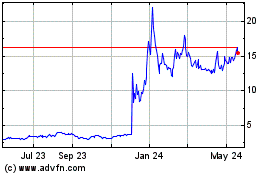

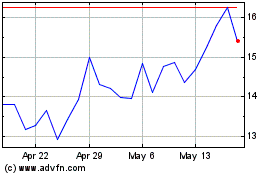

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Jan 2025 to Feb 2025

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Feb 2024 to Feb 2025