Net Sales Up 10% to $88.6 Million Driven by

Growth in All Regions

Americas Up 14%, EMEA Up 12% and APAC Up 9%

Market Building Initiatives Drive EVO ICL™

Uptake and Reinforce Opportunity

The end of the paragraph after bullets in the "Outlook" section

of release should read: APAC sales growth of 5% (prior outlook

was 7%), including approximately 2% growth in China (prior outlook

was 10%) and all other APAC countries approximately 10-20% growth

(prior outlook was flat). (Instead of: APAC sales growth of 4%

(prior outlook was 7%), including approximately 2% growth in China

(prior outlook was 10%).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241030604379/en/

The updated release reads:

STAAR SURGICAL REPORTS THIRD QUARTER 2024

RESULTS

Net Sales Up 10% to $88.6 Million Driven by

Growth in All Regions

Americas Up 14%, EMEA Up 12% and APAC Up 9%

Market Building Initiatives Drive EVO ICL™

Uptake and Reinforce Opportunity

STAAR Surgical Company (NASDAQ: STAA), a leading developer,

manufacturer and marketer of the EVO family of Implantable

Collamer® Lenses (EVO ICL™) for myopia, astigmatism and presbyopia,

today reported financial results for the third quarter ended

September 27, 2024.

Third Quarter 2024

Overview

- Net sales of $88.6 million, up 10% from prior year quarter

- ICL sales of $89.1 million, up 10% from prior year quarter

- Gross margin of 77.3% as compared to 79.2% year ago

- Net income of $10.0 million or $0.20 per share, up from $4.8

million or $0.10 per share year ago

- Adjusted EBITDA of $16.2 million or $0.33 per share as compared

to $16.5 million or $0.33 per share year ago

- $236.0 million of cash, cash equivalents and investments

available for sale as of September 27, 2024

“In the third quarter, we achieved double-digit sales growth

against a macroeconomic environment that softened in the second

half of the quarter, particularly in China,” said Tom Frinzi,

President and CEO of STAAR Surgical. “STAAR is well positioned to

navigate through the current market dynamics, which we believe are

transitory. Looking ahead, we are encouraged by the recent shift in

fiscal policy and announced stimulus in China and will continue to

closely monitor the potential impact on our near to midterm growth

outlook.”

Mr. Frinzi concluded, “Our focus on customer engagement and

market expansion continues to yield solid results, helping drive

industry-leading growth and market share gains. As our surgeon

customers perform more EVO procedures, they are increasingly using

our technology for moderate myopia, which underscores EVO ICL as

the treatment choice for -6D and above and expands our total

addressable market.”

Third Quarter 2024 Financial

Results

Net sales were $88.6 million for the third quarter of 2024, up

10% from $80.3 million reported in the prior year quarter. This

sales increase was driven by ICL sales growth of $8.0 million, up

10%, and unit growth of 6% from the prior year period. Other

Product sales declined $0.2 million from the prior year period.

Changes in currency, primarily the Japanese Yen, negatively

impacted reported total net sales by $0.3 million for the third

quarter of 2024.

Gross profit margin for the third quarter of 2024 was 77.3% of

net sales as compared to the prior year quarter of 79.2% of net

sales. Gross margin in the third quarter was lower primarily due to

reduced unit production that resulted in less absorption of fixed

overhead.

Operating expenses for the third quarter of 2024 were $62.8

million, up from the prior year quarter of $57.3 million. General

and administrative expenses were $21.7 million, up from $19.3

million in the prior year quarter, driven primarily by increased

facility costs and compensation-related expenses. Selling and

marketing expenses were $26.6 million – consistent with the prior

year quarter. Research and development expenses were $14.5 million,

up from the prior year quarter of $11.5 million, primarily due to

purchases of in-process research and development, as well as

compensation-related expenses, which were partially offset by lower

clinical trial costs.

Operating income for the third quarter of 2024 was $5.7 million

or 6.4% of net sales as compared to operating income of $6.3

million or 7.8% of net sales for the third quarter of 2023.

Net income for the third quarter of 2024 was $10.0 million or

$0.20 income per share, up from $4.8 million or $0.10 income per

share for the prior year quarter. The increase in net income was

primarily attributable to a gain on foreign currency

transactions.

As of September 27, 2024, cash, cash equivalents and investments

available for sale totaled $236.0 million, up from $232.4 million

on December 29, 2023.

Outlook

The Company maintained its prior outlook for fiscal year 2024

net sales and Adjusted EBITDA.

- Net sales of $340 million to $345 million.

- Adjusted EBITDA of approximately $42 million and Adjusted

EBITDA per diluted share of approximately $0.80.

The outlook above contemplates EVO ICL sales growth of 17% in

the Americas (prior outlook was 15%) including 20% in the U.S.

(prior outlook was 25%); EMEA sales growth of 10% (prior outlook

was 6%); and APAC sales growth of 5% (prior outlook was 7%),

including approximately 2% growth in China (prior outlook was 10%)

and all other APAC countries approximately 10-20% growth (prior

outlook was flat).

Earnings Webcast

The Company will host an earnings webcast today, Wednesday,

October 30 at 4:30 p.m. Eastern / 1:30 p.m. Pacific to discuss its

financial results and operational progress. To access the webcast

please use the following link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=fmU0YbKB.

The live webcast, earnings webcast presentation and an archived

version of the webcast can be accessed from the investor relations

section of the STAAR website at www.staar.com.

Use of Non-GAAP Financial

Measures

To supplement the Company’s financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables include

certain non-GAAP financial measures, including Adjusted EBITDA.

Management uses these non-GAAP financial measures in its evaluation

of Company operating performance and believes investors will find

them useful in evaluating the Company’s operating performance,

including cash flow generation, and in analyzing period-to-period

financial performance of core business operations and underlying

business trends. Non-GAAP financial measures are in addition to,

not a substitute for, or superior to, measures of financial

performance prepared in accordance with GAAP.

EBITDA is a non-GAAP financial measure, which is calculated by

adding interest income and expense, net; provision for income

taxes; and depreciation and amortization to net income. In

calculating Adjusted EBITDA and Adjusted EBITDA per diluted share,

the Company further adjusts for stock-based compensation expense.

As stock-based compensation is a non-cash expense that can vary

significantly based on the timing, size and nature of awards

granted, the Company believes that the exclusion of stock-based

compensation expense can assist investors in comparisons of Company

operating results with other peer companies because (i) the amount

of such expense in any specific period may not directly correlate

to the underlying performance of our business operations and (ii)

such expense can vary significantly between periods as a result of

the timing of grants of new stock-based awards, including

inducement grants in connection with hiring. Additionally, the

Company believes that excluding stock-based compensation from

Adjusted EBITDA and Adjusted EBITDA per diluted share assists

management and investors in making meaningful comparisons between

the Company’s operating performance and the operating performance

of other companies that may use different forms of employee

compensation or different valuation methodologies for their

stock-based compensation. Investors should note that stock-based

compensation is a key incentive offered to employees whose efforts

contributed to the operating results in the periods presented and

are expected to contribute to operating results in future periods.

Investors should also note that such expenses will recur in the

future.

The Company also presents certain financial information on a

constant currency basis, which is intended to exclude the effects

of foreign currency fluctuations. The Company conducts a

significant part of its activities outside the U.S. It receives

sales revenue and pays expenses principally in U.S. dollars, Swiss

francs, Japanese yen and euros. The exchange rates between dollars

and non-U.S. currencies can fluctuate greatly and can have a

significant effect on the Company’s results when reported in U.S.

dollars. In order to compare the Company's performance from period

to period without the effect of currency, the Company will apply

the same average exchange rate applicable in the prior period, or

the “constant currency” rate to sales or expenses in the current

period as well.

In the tables provided below, the Company has included a

reconciliation of Adjusted EBITDA and Adjusted EBITDA per diluted

share to net income and net income per diluted share, the most

directly comparable GAAP financial measure, as well as supplemental

financial information with net sales expressed in constant

currency. The Company has also provided a reconciliation of

forward-looking Adjusted EBITDA and Adjusted EBITDA per diluted

share to net income and net income per diluted share. This

represents forward-looking information, and actual results may

vary. Please see the risks and assumptions referred to in the Safe

Harbor section of this press release.

About STAAR Surgical

STAAR, which has been dedicated solely to ophthalmic surgery for

over 40 years, designs, develops, manufactures and markets

implantable lenses for the eye. These lenses are intended to

provide visual freedom for patients, lessening or eliminating the

reliance on glasses or contact lenses. All of these lenses are

foldable, which permits the surgeon to insert them through a small

incision. STAAR’s lens used in refractive surgery is called an

Implantable Collamer® Lens or “ICL,” which includes the EVO ICL™

product line. More than 3,000,000 ICLs have been sold to date and

STAAR markets these lenses in over 75 countries. To learn more

about the ICL go to: EVOICL.com. Headquartered in Lake Forest, CA,

the company operates manufacturing and packaging facilities in

Aliso Viejo, CA, Monrovia, CA and Nidau, Switzerland. For more

information, please visit the Company’s website at

www.staar.com.

Safe Harbor

All statements that are not statements of historical fact are

forward-looking statements, including statements about any of the

following: any financial projections, anticipated financial

results, estimates and outlook (including as to net sales, Adjusted

EBITDA, and Adjusted EBITDA per diluted share), plans, strategies,

and objectives of management for 2024 and beyond or prospects for

achieving such plans, expectations for sales, revenue, margin,

expenses or earnings, and any statements of assumptions underlying

any of the foregoing, including those relating to financial

performance in the upcoming quarter, fiscal year 2024 and beyond.

Important factors that could cause actual results to differ

materially from those indicated by such forward-looking statements

include risks and uncertainties related to global economic

conditions, as well as the factors set forth in the Company’s

Annual Report on Form 10-K for the year ended December 29, 2023

under the caption “Risk Factors,” which is on file with the

Securities and Exchange Commission and available in the “Investor

Information” section of the company’s website under the heading

“SEC Filings.” We disclaim any intention or obligation to update or

revise any financial projections or forward-looking statement due

to new information or events. These statements are based on

expectations and assumptions as of the date of this press release

and are subject to numerous risks and uncertainties, which could

cause actual results to differ materially from those described in

the forward-looking statements. The risks and uncertainties include

the following: global economic conditions; the impact of COVID-19;

the discretion of regulatory agencies to approve or reject

existing, new or improved products, or to require additional

actions before or after approval, or to take enforcement action;

international conflicts, trade disputes and substantial dependence

on demand from Asia; and the willingness of surgeons and patients

to adopt a new or improved product and procedure.

We intend to use our website as a means of disclosing material

non-public information and for complying with our disclosure

obligations under Regulation FD. Such disclosures will be included

on our website in the ‘Investor Relations’ sections. Accordingly,

investors should monitor such portions of our website, in addition

to following our press releases, SEC filings and public conference

calls and webcasts.

Consolidated Balance Sheets (in 000's)

Unaudited ASSETS September 27,

2024 December 29, 2023 Current assets: Cash and cash

equivalents

$

164,003

$

183,038

Investments available for sale

71,955

37,688

Accounts receivable trade, net

104,510

94,704

Inventories, net

40,361

35,130

Prepayments, deposits, and other current assets

16,277

14,709

Total current assets

397,106

365,269

Investments available for sale

-

11,703

Property, plant, and equipment, net

81,580

66,835

Finance lease right-of-use assets, net

73

183

Operating lease right-of-use assets, net

37,897

34,387

Goodwill

1,786

1,786

Deferred income taxes

5,324

5,190

Other assets

13,824

3,339

Total assets

$

537,590

$

488,692

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable

$

14,694

$

13,557

Obligations under finance leases

84

165

Obligations under operating leases

4,531

4,202

Allowance for sales returns

8,124

6,174

Other current liabilities

38,908

40,938

Total current liabilities

66,341

65,036

Obligations under finance leases

-

42

Obligations under operating leases

35,385

31,425

Deferred income taxes

1,056

1,077

Asset retirement obligations

127

103

Pension liability

6,559

5,055

Total liabilities

109,468

102,738

Stockholders' equity: Common stock

493

488

Additional paid-in capital

466,579

436,947

Accumulated other comprehensive loss

(5,602

)

(4,113

)

Accumulated deficit

(33,348

)

(47,368

)

Total stockholders' equity

428,122

385,954

Total liabilities and stockholders' equity

$

537,590

$

488,692

Consolidated Statements of Income (in 000's except for

per share data) Unaudited Three Months

Ended Year to Date

% of

Sales

September 27,

2024

% of

Sales

September 29,

2023

Fav (Unfav)

Amount

%

% of

Sales

September 27,

2024

% of

Sales

September 29,

2023

Fav (Unfav)

Amount

%

Net sales

100.0%

$

88,590

100.0%

$

80,308

$

8,282

10.3%

100.0%

$

264,951

100.0%

$

246,142

$

18,809

7.6%

Cost of sales

22.7%

20,103

20.8%

16,670

(3,433

)

(20.6)%

21.5%

57,017

22.0%

54,216

(2,801

)

(5.2)%

Gross profit

77.3%

68,487

79.2%

63,638

4,849

7.6%

78.5%

207,934

78.0%

191,926

16,008

8.3%

Selling, general and administrative expenses: General and

administrative

24.4%

21,685

24.0%

19,266

(2,419

)

(12.6)%

25.9%

68,554

22.6%

55,461

(13,093

)

(23.6)%

Selling and marketing

30.1%

26,623

33.1%

26,607

(16

)

(0.1)%

31.0%

82,150

34.6%

85,238

3,088

3.6%

Research and development

16.4%

14,497

14.3%

11,470

(3,027

)

(26.4)%

15.8%

41,931

13.6%

33,535

(8,396

)

(25.0)%

Total selling, general, and administrative expenses

70.9%

62,805

71.4%

57,343

(5,462

)

(9.5)%

72.7%

192,635

70.8%

174,234

(18,401

)

(10.6)%

Operating income

6.4%

5,682

7.8%

6,295

(613

)

(9.7)%

5.8%

15,299

7.2%

17,692

(2,393

)

(13.5)%

Other income (expense): Interest income, net

1.6%

1,407

2.1%

1,690

(283

)

(16.7)%

1.6%

4,358

2.1%

5,287

(929

)

(17.6)%

Gain (loss) on foreign currency transactions

6.7%

5,931

-1.7%

(1,384

)

7,315

528.5%

0.2%

585

-1.3%

(3,240

)

3,825

118.1%

Royalty income

0.0%

-

0.1%

74

(74

)

(100.0)%

0.2%

508

0.0%

74

434

586.5%

Other income, net

0.2%

139

0.1%

71

68

95.8%

0.2%

532

0.1%

144

388

269.4%

Total other income, net

8.5%

7,477

0.6%

451

7,026

1557.9%

2.2%

5,983

0.9%

2,265

3,718

164.2%

Income before provision for income taxes

14.9%

13,159

8.4%

6,746

6,413

95.1%

8.0%

21,282

8.1%

19,957

1,325

6.6%

Provision for income taxes

3.6%

3,179

2.4%

1,929

(1,250

)

(64.8)%

2.7%

7,262

2.6%

6,366

(896

)

(14.1)%

Net income

11.3%

9,980

6.0%

4,817

5,163

107.2%

5.3%

14,020

5.5%

13,591

429

3.2%

Net income per share - basic

0.20

0.10

0.29

0.28

Net income per share - diluted

0.20

0.10

0.28

0.27

Weighted average shares outstanding - basic

49,199

48,613

49,078

48,426

Weighted average shares outstanding - diluted

49,731

49,370

49,614

49,494

Consolidated Statements of Cash Flows (in 000's)

Unaudited Three Months Ended Year to

Date

September 27,

2024

September 29,

2023

September 27,

2024

September 29,

2023

Cash flows from operating activities: Net income

$

9,980

$

4,817

$

14,020

$

13,591

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: Depreciation of property and equipment

1,757

1,345

4,516

3,743

Amortization of long-lived intangibles

-

(2

)

-

169

Accretion/Amortization of investments available for sale

(124

)

(348

)

(410

)

(2,172

)

Deferred income taxes

(13

)

(10

)

47

65

Change in net pension liability

(16

)

(139

)

(162

)

(766

)

Stock-based compensation expense

7,160

8,846

22,541

23,334

Change in asset retirement obligation

4

3

24

(104

)

Loss on disposal of property and equipment

1,642

17

1,668

41

Provision for sales returns and bad debts

868

921

1,947

1,925

Inventory provision

849

460

1,873

4,090

Changes in working capital: Accounts receivable

(10,139

)

(18,092

)

(9,703

)

(50,436

)

Inventories

(1,091

)

(5,593

)

(5,962

)

(9,975

)

Prepayments, deposits and other assets

(5,152

)

(919

)

(12,237

)

(3,584

)

Accounts payable

(5,649

)

(1,819

)

(2,031

)

(3,266

)

Other current liabilities

3,740

4,538

(1,048

)

5,970

Net cash provided by (used in) operating activities

3,816

(5,975

)

15,083

(17,375

)

Cash flows from investing activities: Acquisition of

property and equipment

(6,231

)

(9,185

)

(17,669

)

(15,100

)

Purchase of investments available for sale

(40,945

)

(9,712

)

(61,194

)

(52,314

)

Proceeds from sale or maturity of investments available for sale

11,935

50,737

39,141

119,359

Net provided by (used in) investing activities

(35,241

)

31,840

(39,722

)

51,945

Cash flows from financing activities: Repayment of finance

lease obligations

(42

)

(39

)

(124

)

(121

)

Repurchase of employee common stock for taxes withheld

-

(112

)

(1,396

)

(2,096

)

Proceeds from vested restricted stock and exercise of stock options

1,657

7,258

7,354

9,265

Net cash provided by financing activities

1,615

7,107

5,834

7,048

Effect of exchange rate changes on cash and cash equivalents

1,037

(235

)

(230

)

(666

)

Increase (decrease) in cash and cash equivalents

(28,773

)

32,737

(19,035

)

40,952

Cash and cash equivalents, at beginning of the period

192,776

94,695

183,038

86,480

Cash and cash equivalents, at end of the period

$

164,003

$

127,432

$

164,003

$

127,432

Reconciliation of Non-GAAP Financial Measure Net Income

to Adjusted EBITDA (in 000's except for per share data)

Unaudited

2021

Q1-22

Q2-22

Q3-22

Q4-22

2022

Q1-23

Q2-23

Q3-23

Q4-23

2023

Q1-24

Q2-24

Q3-24

2024

Outlook(2)

Net income (loss) - (as reported)

$

27,511

$

9,602

$

13,038

$

10,262

$

6,763

$

39,665

$

2,710

$

6,064

$

4,817

$

7,756

$

21,347

$

(3,339

)

$

7,379

$

9,980

$

3,800

Provision (benefit) for income taxes

3,793

1,925

2,431

2,315

(784

)

5,887

2,009

2,428

1,929

5,983

12,349

1,128

2,955

3,179

7,600

Other (income) expense, net

2,035

586

1,551

1,128

(5,015

)

(1,750

)

(1,919

)

105

(451

)

(3,334

)

(5,599

)

(70

)

1,564

(7,477

)

(7,500

)

Depreciation

3,608

994

1,030

1,077

1,380

4,481

1,113

1,285

1,345

1,368

5,111

1,237

1,522

1,757

6,000

(Gain) loss on disposal of property plant and equipment(3)

2

-

-

-

65

65

-

24

17

32

73

-

26

1,642

1,700

Amortization of intangible assets

34

8

7

7

6

28

7

10

(2

)

(2

)

13

-

-

-

-

Stock-based compensation

14,605

3,894

5,754

5,727

4,996

20,371

6,065

8,423

8,846

182

23,516

6,339

9,042

7,160

30,200

Adjusted EBITDA

$

51,588

$

17,009

$

23,811

$

20,516

$

7,411

$

68,747

$

9,985

$

18,339

$

16,501

$

11,985

$

56,810

$

5,295

$

22,488

$

16,241

$

41,800

Adjusted EBITDA as a % of Revenue

22.4

%

26.9

%

29.4

%

27.0

%

11.6

%

24.2

%

13.6

%

19.9

%

20.6

%

15.7

%

17.6

%

6.8

%

22.7

%

18.3

%

12.2

%

Net income (loss) per share, diluted - (as reported)

$

0.56

$

0.19

$

0.26

$

0.21

$

0.14

$

0.80

$

0.05

$

0.12

$

0.10

$

0.16

$

0.43

$

(0.07

)

$

0.15

$

0.20

$

0.07

Provision (benefit) for income taxes

0.08

0.04

0.05

0.05

(0.02

)

0.12

0.04

0.05

0.04

0.12

0.25

0.02

0.06

0.06

0.15

Other (income) expense, net

0.04

0.01

0.03

0.02

(0.10

)

(0.04

)

(0.04

)

-

(0.01

)

(0.07

)

(0.11

)

-

0.03

(0.15

)

(0.14

)

Depreciation

0.07

0.02

0.02

0.02

0.03

0.09

0.02

0.03

0.03

0.03

0.10

0.03

0.03

0.04

0.12

(Gain) loss on disposal of property plant and equipment

-

-

-

-

-

-

-

-

-

-

-

-

-

0.03

0.03

Amortization of intangible assets

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Stock-based compensation

0.30

0.08

0.12

0.12

0.10

0.41

0.12

0.17

0.18

-

0.48

0.13

0.18

0.14

0.58

Adjusted EBITDA per share, diluted(1)

$

1.04

$

0.35

$

0.48

$

0.41

$

0.15

$

1.39

$

0.20

$

0.37

$

0.33

$

0.24

$

1.15

$

0.11

$

0.45

$

0.33

$

0.80

Weighted average shares outstanding - Diluted

49,456

49,288

49,223

49,549

49,389

49,380

49,500

49,516

49,370

49,242

49,427

48,907

49,811

49,731

52,000

(1) Adjusted EBITDA per diluted share may not add due to

rounding (2) 2024 Adjusted EBITDA Outlook line items are all

approximations and assumes breakeven Net Income (3) The Q3-2024 non

cash write-off of $1.6M was related to the former EVO Experience

Center

ICL Sales by Geography (in 000's)

Unaudited Fiscal Year Three Months Ended

ICL Sales by Region(5)

2021

2022

2023

June 30,

2023

September 29,

2023

December 29,

2023

March 29,

2024

June 28,

2024

September 27,

2024

Americas(1)

$

14,054

$

20,114

$

22,233

$

5,954

$

5,449

$

5,264

$

6,260

$

6,794

$

6,187

EMEA(2)

37,343

36,715

39,318

9,782

9,253

10,103

11,299

10,727

10,333

APAC(3)

161,508

212,883

257,876

77,376

66,367

59,254

59,592

81,844

72,581

Global ICL Sales

$

212,905

$

269,712

$

319,427

$

93,112

$

81,069

$

74,621

$

77,151

$

99,365

$

89,101

Global ICL Sales Growth

51

%

27

%

18

%

19

%

13

%

22

%

9

%

7

%

10

%

Americas ICL Sales Growth

59

%

43

%

11

%

12

%

5

%

(8

)%

12

%

14

%

14

%

EMEA ICL Sales Growth

45

%

(2

)%

7

%

(11

)%

14

%

18

%

11

%

10

%

12

%

APAC ICL Sales Growth

51

%

32

%

21

%

26

%

13

%

26

%

9

%

6

%

9

%

Global ICL Unit Growth

48

%

33

%

19

%

21

%

14

%

19

%

2

%

3

%

6

%

Fiscal Year Three Months Ended ICL Sales by

Country(4)(5)

2021

2022

2023

June 30,

2023

September 29,

2023

December 29,

2023

March 29,

2024

June 28,

2024

September 27,

2024

China

$

107,130

$

147,967

$

185,404

$

61,288

$

48,262

$

40,813

$

38,460

$

63,345

$

51,719

Growth

50

%

38

%

25

%

33

%

14

%

30

%

10

%

3

%

7

%

Japan

$

28,688

$

32,623

$

36,352

$

8,563

$

9,091

$

9,495

$

10,227

$

9,735

$

10,490

Growth

56

%

14

%

11

%

13

%

12

%

16

%

11

%

14

%

15

%

South Korea

$

15,173

$

17,940

$

19,853

$

3,316

$

4,886

$

4,996

$

6,725

$

3,973

$

5,434

Growth

36

%

18

%

11

%

(15

)%

1

%

39

%

1

%

20

%

11

%

United States

$

9,478

$

15,070

$

17,168

$

4,446

$

4,162

$

4,164

$

5,039

$

5,541

$

4,823

Growth

58

%

59

%

14

%

10

%

6

%

(8

)%

15

%

25

%

16

%

Notes: (1) Americas includes the United States,

Canada and Latin American countries (2) EMEA includes Spain,

Germany, United Kingdom, European, Middle East and Africa

Distributors (3) APAC includes China, Japan, South Korea, India and

the rest of Asia Pacific distributors (4) ICL Sales by country

includes countries representing more than 5% of total ICL sales in

the most recently completed fiscal year (5) ICL sales do not

include IOL, injector or other sales

Reconciliation of Non-GAAP

Financial Measure Constant Currency Sales (in

000's) Unaudited Three Months Ended

As Reported Constant Currency Sales

September 27,

2024

Effect of

Currency

Constant

Currency

September 29,

2023

$ Change

% Change

$ Change

% Change

ICL

$

89,101

$

300

$

89,401

$

81,069

$

8,032

9.9

%

$

8,332

10.3

%

Cataract IOL

-

-

-

(221

)

221

(100.0

)%

221

(100.0

)%

Other

(511

)

(2

)

(513

)

(540

)

29

(5.4

)%

27

(5.0

)%

Total Sales

$

88,590

$

298

$

88,888

$

80,308

$

8,282

10.3

%

$

8,580

10.7

%

Year to Date As Reported Constant

Currency Sales

September 27,

2024

Effect of

Currency

Constant

Currency

September 29,

2023

$ Change

% Change

$ Change

% Change

ICL

$

265,617

$

2,515

$

268,132

$

244,806

$

20,811

8.5

%

$

23,326

9.5

%

Cataract IOL

-

-

-

1,295

(1,295

)

(100.0

)%

(1,295

)

(100.0

)%

Other

(666

)

111

(555

)

41

(707

)

(1724.4

)%

(596

)

(1453.7

)%

Total Sales

$

264,951

$

2,626

$

267,577

$

246,142

$

18,809

7.6

%

$

21,435

8.7

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030604379/en/

Investors & Media Brian Moore Vice President,

Investor Relations and Corporate Development 626-303-7902, Ext.

3023 bmoore@staar.com

Investors – Asia Niko Liu, CFA Director, Investor

Relations and Corporate Development – Asia +852-6092-5076

nliu@staar.com

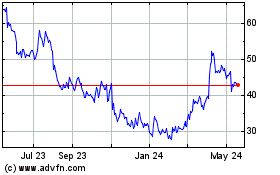

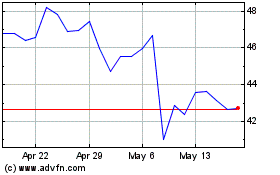

STAAR Surgical (NASDAQ:STAA)

Historical Stock Chart

From Nov 2024 to Dec 2024

STAAR Surgical (NASDAQ:STAA)

Historical Stock Chart

From Dec 2023 to Dec 2024