UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

☒ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

STRATTEC SECURITY CORPORATION

(Name of Registrant as Specified in Its Charter)

Registrant

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check all boxes that apply):

|

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

3333 West Good Hope Road, Milwaukee, Wisconsin 53209

September [20], 2024

Dear Fellow Shareholders,

It is a pleasure to write my first Chairman’s Letter to Shareholders since I was appointed Chairman of the Board in January of this year. One of my goals is to improve STRATTEC’s governance and I believe with the steps the Board has taken through the year that we have made great strides. For instance, we are asking you to approve at our 2024 Annual Meeting of Shareholders an amendment to our Articles of Incorporation to declassify our Board. If this proposal is approved, each director will be elected to serve a term of one year, rather than serving for three years. Such a move, I believe, makes directors more accountable to our shareholders. In addition, last month, the Board adopted “proxy access” provisions in our amended By-Laws, making it easier for shareholders to put any potential competitive slate of directors on the same proxy slate as incumbent directors. The Board believes such actions, including others described below, are “pro-shareholder.”

Board refreshment is very important for all companies. As shown in the proxy statement, we are nominating a new director, Matteo Anversa. Matteo was until very recently the Chief Financial Officer of Gentherm, a leading automotive supplier and prior to that he had progressively challenging financial roles with Fiat-Chrysler, Ferrari and General Electric. Effective September 1, 2024, Matteo was appointed Chief Financial Officer of Logitech. We look forward to Matteo joining us, along with the fresh insights he will provide.

We also thank two departing directors, David Zimmer and Harry Stratton, for their years of dedicated service. David had served on the Board since 2006 while Harry served with us since 1994 when we became an independent public company. With their retirements, the average tenure of directors’ service on the Board has decreased from over 19 years at this time last year to under three years following this year’s meeting, assuming that all nominees are elected as proposed.

Ownership alignment and director accountability. Under the capable leadership of Nominating and Governance Committee Chair Tina Chang, we have implemented minimum stock ownership guidelines for both directors and officers. We believe that insiders should be on the “same side” as you, the owners of the Company. This Committee also initiated and completed a robust performance evaluation process with peer reviews of the Board itself, committees, and individual Board members. And, to bring clarity to the proper function of the board as a governing body, the Board has both updated its Committee Charters and introduced one for the Chairman.

Compensation alignment. As Chair of the Compensation Committee, Thomas Florsheim, Jr. has worked diligently to better align our compensation structure to business performance. We retained, for the first time, a full-time independent compensation consultant, Pay Governance, to modernize and align the Corporation’s compensation programs. This Committee has implemented a new short-term incentive program and a new long-term incentive program, each of which contain what we believe are appropriate and distinct performance metrics. We are asking you to approve additional shares for this new long-term incentive program that we expect will help to drive shareholder value.

We also revamped the compensation program for non-employee directors. Beginning this fiscal year, directors will no longer receive committee fees or participate in any incentive bonus program. We also changed the timing of director restricted stock grants — rather than being granted at the end of the year in arrears, they will be granted (subject to a one-year cliff vesting) at the beginning of each year of service. Because of this transition, there will be a one-time “double grant” of restricted stock awards disclosed in next year’s proxy statement (purely as a result of the timing).

Continuing education of directors is also vitally important. In May, our auditors, Deloitte, supported the entire Board’s ongoing education on cybersecurity and IT governance requirements, issues which are highly importance to us, our customers, and suppliers.

Appointment of new Chief Executive Officer. I believe it is important to note that the independent directors who served as members of the CEO search committee (Tina Chang, Tom Florsheim, Bruce Lisman, and me) declined any committee fees related to the search process. The terrific news is that the search produced what we believe is a truly outstanding and energetic CEO in Jennifer Slater. You can find her letter to shareholders in the Corporation’s Annual Report.

Shareholder engagement. Since becoming Chairman, I have reached out to several of our large shareholders and have benefited from their views on a number of governance and other matters. As always, we welcome feedback from our shareholders. Shareholders may send communication by mail or courier delivery addressed as follows: Board of Directors (or Committee Chair, Board Member, or Non-Management Directors, as the case may require), c/o Secretary, STRATTEC Security Corporation, 3333 West Good Hope Road, Milwaukee, Wisconsin 53209, as described under our Investor Relations portion of the Company’s website, https://investors.strattec.com/information-request.

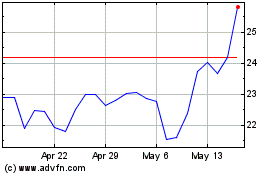

The creation of long-term shareholder value is our overarching goal. While one year is a very short measure, we believe the market is recognizing the change occurring at STRATTEC. Our stock outperformed the S&P 500 during the past fiscal year with STRATTEC’s stock increasing nearly 32% (from about $19.00 to $25.00) from July 3, 2023 to June 28, 2024, compared with just over 22% for the S&P 500. I would also note that, subsequent to the release of fourth quarter earnings in early August 2024, the stock rose from about $25 to nearly $35 as I write this letter. It’s important to note as stated in the release, our fourth quarter benefited from one-time price increases that had been accumulated from prior years. As a Board and management team, we are cognizant of fluctuations in our stock price. Importantly, our focus is on what we can control and on building a sustainable business with long-term performance that drives shareholder value.

Sincerely,

|

|

F. Jack Liebau, Jr. |

Chairman of the Board |

************

STRATTEC SECURITY CORPORATION

3333 WEST GOOD HOPE ROAD

MILWAUKEE, WISCONSIN 53209

Notice of Annual Meeting of Shareholders

to be held on October 23, 2024

The Annual Meeting of Shareholders (the “Annual Meeting”) of STRATTEC SECURITY CORPORATION, a Wisconsin corporation (the “Corporation” or “STRATTEC”), will be held at the Holiday Inn Milwaukee Riverfront Hotel, 4700 North Port Washington Road, Milwaukee, Wisconsin 53212, on Wednesday, October 23, 2024, at 8:00 a.m. local time, for the purposes of considering and taking action on the following:

1. to approve a proposal to amend our Amended and Restated Articles of Incorporation, as amended ("Articles") to declassify our Board of Directors so that all directors will be elected annually;

2. to elect six directors to serve until the 2025 Annual Meeting of Shareholders if Proposal 1 is approved or, if Proposal 1 is not approved, to elect two directors to serve until the 2027 Annual Meeting of Shareholders and one director to serve until the 2026 Annual Meeting of Shareholders;

3. to approve a non-binding advisory proposal on executive compensation;

4. to approve a proposal to adopt the STRATTEC SECURITY CORPORATION Stock Incentive Plan; and

5. to take action with respect to any other matters that may be properly brought before the Annual Meeting and that might be considered by the shareholders of a Wisconsin corporation at their annual meeting.

|

By order of the Board of Directors |

|

DENNIS BOWE, |

Secretary |

Milwaukee, Wisconsin

September [20], 2024

|

Shareholders of record at the close of business on August 21, 2024 are entitled to vote at the Annual Meeting. Your vote is important to ensure that a majority of our stock is represented. Whether or not you plan to attend the Annual Meeting in person, please complete, sign and date the enclosed proxy card and return it promptly in the enclosed envelope. Your vote is being solicited by the Board of the Directors of the Corporation. If you later find that you may be present at the Annual Meeting or for any other reason desire to revoke your proxy, you may do so at any time before it is voted. Shareholders holding shares in brokerage accounts (“street name” holders) who wish to vote at the Annual Meeting will need to obtain a proxy form and voting instructions from the institution that holds their shares. |

TABLE OF CONTENTS

STRATTEC SECURITY CORPORATION

3333 WEST GOOD HOPE ROAD

MILWAUKEE, WISCONSIN 53209

Proxy Statement for the 2024 Annual Meeting of Shareholders

to be Held on October 23, 2024

Important Notice Regarding the Availability of Proxy Materials for the

2024 Annual Meeting of Shareholders to be held on October 23, 2024:

This Proxy Statement and the Accompanying Annual Report

are Available at www.strattec.com

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of STRATTEC SECURITY CORPORATION of proxies, in the accompanying form, to be used at the Annsual Meeting to be held at the Holiday Inn Milwaukee Riverfront Hotel, 4700 North Port Washington Road, Milwaukee, Wisconsin 53212, on Wednesday, October 23, 2024, at 8:00 a.m., local time, and any adjournments thereof. Only shareholders of record at the close of business on August 21, 2024 will be entitled to notice of and to vote at the Annual Meeting. There will be no presentation regarding our operations at the Annual Meeting. The only matters to be discussed at the Annual Meeting are the matters set forth in this Proxy Statement for the 2024 Annual Meeting of Shareholders and such other matters as are properly presented at the Annual Meeting.

Our principal executive offices are located at 3333 West Good Hope Road, Milwaukee, Wisconsin 53209. It is expected that our Annual Report to Shareholders, this Proxy Statement and the accompanying form of proxy will be mailed, furnished or otherwise made available to shareholders on or about September [20], 2024.

GENERAL INFORMATION

Proxies and Voting Procedures

The shares represented by each valid proxy received in time will be voted at the Annual Meeting and, if a choice is specified in the form of proxy, it will be voted in accordance with that specification. If you submit a proxy without providing voting instructions, the shares represented by that proxy will be voted “For”:

•approval of the proposal to amend our Articles to declassify our Board of Directors so that all directors will be elected annually election to the Board of Directors;

•election to the Board of Directors of the six nominees named in the accompanying proxy statement as directors to serve until the 2025 Annual Meeting of Shareholders or, if Proposal 1 is not approved, election of two director nominees to serve until the 2027 Annual Meeting of Shareholders and one director nominee to serve until the 2026 Annual Meeting of Shareholders;

•approval of the non-binding advisory proposal on executive compensation; and

•approval of the proposal to adopt the Incentive Plan.

If any other matters are properly presented at the Annual Meeting, including, among other things, consideration of a motion to adjourn the meeting to another time or place, the individuals named as proxies and acting thereunder will have the authority to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. If the Annual Meeting is adjourned or postponed, a proxy will remain valid and may be voted at the adjourned or postponed meeting. As of the date of printing of this Proxy Statement, we do not know of any other matters that are to be presented at the Annual Meeting other than (1) the proposal to amend our Articles to declassify our Board of Directors so that all directors will be elected annually, (2) election of the six nominees named in the accompanying proxy statement as directors to serve until the 2025 Annual Meeting of

Shareholders or, if Proposal 1 is not approved, election of two director nominees to serve until the 2027 Annual Meeting of Shareholders and one director nominee to serve until the 2025 Annual Meeting of Shareholders, (3) the non-binding advisory proposal on executive compensation, and (4) the proposal to adopt the Incentive Plan.

Shareholders may revoke proxies at any time to the extent they have not been exercised by giving us written notice or by delivering a later executed proxy. Attendance at the Annual Meeting will not automatically revoke a proxy, but a record shareholder attending the Annual Meeting may request a ballot and vote in person, thereby revoking a prior granted proxy. The cost of solicitation of proxies will be borne by STRATTEC. Shareholders holding shares in brokerage accounts (“street name” holders) who wish to vote at the Annual Meeting will need to obtain a proxy form and voting instructions from the institution that holds their shares. Solicitation will be made primarily by use of the mail; provided, however, some solicitation may be made by our management employees, without payment of any additional compensation, by telephone, by facsimile, by email or in person.

Shareholders Entitled to Vote

Only shareholders of record at the close of business on August 21, 2024 will be entitled to notice of and to vote at the Annual Meeting. On the record date, we had issued and outstanding 4,102,852 shares of our common stock, $0.01 par value per share (the “Common Stock”) entitled to one vote per share.

Quorum; Required Vote

A majority of the votes entitled to be cast at the Annual Meeting, represented either in person or by proxy, shall constitute a quorum with respect to the meeting. Under Wisconsin law and our Articles and Bylaws (as amended), the vote required for approval of the matters specified in the Notice of the Annual Meeting is as follows:

•Approval of the proposal to amend our Articles requires the majority of the votes entitled to be cast on the proposal to be cast in favor of the amendment proposal.

•The Corporation has previously adopted a majority voting standard in uncontested elections of directors. Accordingly, for an uncontested election a majority of the votes properly cast in favor of the election of each nominee director is required for the election of that director. A majority of the votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” with respect to that director’s election. In the event of a contested election of directors, a plurality of votes cast is required for the election of directors. This means that in contested elections the director nominees with the most votes received will be elected to fill the open directorship positions.

•Approval of the non-binding advisory proposal on executive compensation requires the number of properly cast votes in favor of this proposal to exceed the number of properly cast votes against this proposal.

•Approval of the Incentive Plan requires the number of properly cast votes in favor of this proposal to exceed the number of properly cast votes against this proposal.

•Approval of any other matter that may properly be presented at the Annual Meeting will require the number of properly cast votes in favor of such matter to exceed the number of properly cast votes against such matter.

Abstentions and broker nonvotes (i.e., shares held by brokers in “street name,” voting on certain matters due to discretionary authority or instructions from the beneficial owners but not voting on other matters due to lack of authority to vote on such matters without instructions from the beneficial owner) will count toward the quorum requirement but will not count as votes cast in the determination of whether the directors are elected or whether such other matters noted above are approved. The Inspector of Election appointed by our Board of Directors will count the votes and ballots.

PROPOSAL 1: AMENDMENT OF ARTICLES

Introduction

On August 20, 2024, our Board of Directors approved an amendment to Article V of Articles to eliminate the classification of our Board of Directors so that each director would stand for election annually. If our shareholders approve this declassification amendment proposal, we will file the amendment with the Secretary of State of the State of Wisconsin as soon as is practicable, and it will become effective upon filing.

Article V of our Articles currently requires the Board of Directors to be divided into three classes, as nearly equal in number as possible, as determined by the Board of Directors. Each class of directors currently serves staggered, three-year terms, with the term of office of one class expiring each year. Article V also provides that directors may be removed from office by the shareholders, but only for cause and only by the affirmative vote of a majority of the votes then entitled to be cast in an election of directors. Article V also contains several provisions which refer to the time at which the Corporation had only one shareholder that are no longer applicable.

If Proposal 1 is approved, Article V of our Articles will be amended and replaced in its entirety with the following:

"ARTICLE V

Board of Directors

(a) The authorized number of directors of the corporation which shall constitute the entire Board of Directors shall be such as from time to time shall be determined by a majority of the then authorized number of directors. At each annual meeting of shareholders, directors shall be elected to hold office for a term expiring at the annual meeting of shareholders held in the year following the year of their election. No decrease in the number of directors constituting the Board of Directors shall shorten the term of an incumbent director.

(b) Any director may be removed from office by the shareholders, but only for cause and only by the affirmative vote of a majority of the votes then entitled to be cast in an election of directors.

(c) Any vacancy occurring on the Board of Directors, including, but not limited to, a vacancy created by an increase in the number of directors or the removal of a director, shall be filled only by the affirmative vote of a majority of the directors then in office, even if such majority is less than a quorum of the Board of Directors, or by a sole remaining director. If no director remains in office, any vacancy may be filled by the shareholders. Any director elected to fill a vacancy shall serve until the next election of directors.

(d) Each director shall be elected by a majority of the votes cast by the shares entitled to vote in the election of directors at a meeting at which a quorum is present except in a contested election of directors, in which case such directors will be elected by a plurality of the votes cast by the shares entitled to vote at a meeting."

The following is a "marked" version of the proposed changes to the current Article V:

"ARTICLE V

Board of Directors

(a) Until such time as the Corporation has more than one shareholder, the Corporation’s Board of Directors shall consist of one director.

(a)(b) Upon the date the Corporation has more than one shareholder and thereafter, t The authorized number of directors of the corporation which shall constitute the entire Board of Directors shall be such as from time to time shall be determined by a majority of the then authorized number of directors, but in no case shall the authorized number of directors be less than 5 or more than 7.

The directors shall be divided with respect to the time for which they severally hold office into three classes, as nearly equal in number as possible, as determined by the Board of Directors, with the members of each class to hold office until their successors have been elected and qualified, or until their earlier resignation or removal.

At each annual meeting of shareholders, the successors of the members of the class of directors whose term expires at that meeting shall be elected to hold office for a term expiring at the annual meeting of shareholders held in the third year following the year of their election.

No decrease in the number of directors constituting the Board of Directors shall shorten the term of an incumbent director.

(b)(c) Any director may be removed from office by the shareholders, but only for cause and only by the affirmative vote of a majority of the votes then entitled to be cast in an election of directors.

(c)(d) Any vacancy occurring on the Board of Directors, including, but not limited to, a vacancy created by an increase in the number of directors or the removal of a director, shall be filled only by the affirmative vote of a majority of the directors then in office, even if such majority is less than a quorum of the Board of Directors, or by a sole remaining director.

If no director remains in office, any vacancy may be filled by the shareholders.

Any director elected to fill a vacancy shall serve until the next election of directorsthe class for which such director shall have been chosen.

(d)(e) Each director shall be elected by a majority of the votes cast by the shares entitled to vote in the election of directors at a meeting at which a quorum is present except in a contested election of directors, in which case such directors will be elected by a plurality of the votes cast by the shares entitled to vote at a meeting."

Reasons for Proposed Amendment

The Corporation has maintained a classified Board of Directors since the adoption of its Amended and Restated Articles of Incorporation effective February 23, 1995. The merits of a classified board of directors have been extensively discussed as a corporate governance practice. Some institutional advisors and investors believe that classified boards have the effect of insulating directors from a corporation’s shareholders and in prior years many public companies determined that, regardless of the merits of a classified board in deterring coercive takeover attempts, under good corporate governance trends, it is advisable that all directors of a corporation be elected annually.

While we believe our current governance structure has served our stockholders well, our Board of Directors has considered the advantages and disadvantages of our classified board structure and determined that amending our Articles to declassify our Board is consistent with our desire to implement best governance practices, and is in the best interests of our Corporation, shareholders and other constituencies.

Effect of Voting Outcomes

If Proposal 1 is approved and the proposed amendments to our Articles become effective at the 2024 Annual Meeting, the annual election of all directors will begin with the 2024 Annual Meeting. Consequently, the director nominees listed in Proposal 2 would be subject to election for one-year terms expiring at the 2025 Annual Meeting of Shareholders. The following directors who otherwise would be subject to re-election in 2025 and 2026 have agreed to resign and to stand for re-election at the 2024 Annual Meeting if Proposal 1 is approved by shareholders: Tina Chang, F. Jack Liebau, Jr., and Bruce M. Lisman. David R. Zimmer, who otherwise would be subject to re-election in 2026, is retiring from the Board of Directors and is not standing for re-election at the 2024 Annual Meeting. If Proposal 1 is not approved by shareholders, then our Board of Directors will remain classified and, pursuant to Proposal 2, only the following director nominees will be considered for election at the 2024 Annual Meeting, in the respective classes: Thomas W. Florsheim, Jr. and Jennifer Slater, with terms expiring in 2027, and Matteo Anversa, with a term expiring in 2025. In that case, all other directors would continue in office for the remainder of their three-year terms, subject to their earlier resignation, removal or death.

If a quorum is present, approval of this proposal requires the affirmative vote of the shareholders present in person or by proxy at the meeting and having a majority of the votes entitled to vote thereon. If you execute and return a proxy, but do not specify how to vote the shares represented by your proxy, the persons named as proxies will vote “FOR” the amendment to our certificate of incorporation. In determining whether this item has received the requisite number of affirmative votes, abstentions and broker non-votes will count for quorum purposes and will have the same effect as votes against the proposal.

Our Board recommends a vote “FOR” approval of Proposal 1.

PROPOSAL 2: ELECTION OF DIRECTORS

Our Board currently consists of seven members. Prior to the adoption of the amendment to our Articles described in Proposal 1, our Articles provide that our Board be divided into three classes having staggered terms of three years each. If the shareholders approve the proposal to amend our Articles to declassify our Board of Directors, the Board has established that the number of directors to be elected at the 2024 Annual Meeting be fixed at six and that the persons named in the enclosed proxy will vote to elect all six of the following nominees as directors for terms ending at the 2025 Annual Meeting of Shareholders, unless you withhold authority to vote for any or all of the nominees by marking the proxy to that effect or so voting in person: Tina Chang, Thomas W. Florsheim, Jr., F. Jack Liebau, Jr., Bruce M. Lisman, Jennifer L. Slater, and Matteo Anversa. The directors who would be subject to re-election in 2025 and 2026, except for David R. Zimmer, have agreed to resign and to stand for re-election in 2024 if Proposal 1 is approved. Mr. Zimmer, whose term otherwise would expire in 2026, is retiring from the Board of Directors at the Annual Meeting and the Board has nominated Matteo Anversa for election to the director position being vacated by Mr. Zimmer.

If the shareholders do not approve Proposal 1 and the related amendment to our Articles, the term of office of the 2024 class of directors will expire at the 2024 Annual Meeting and the terms of office for the 2025 and 2026 classes of directors, other than Mr. Zimmer, will expire at the 2025 and 2026 Annual Meetings, respectively. In that event, the persons named in the enclosed proxy will vote to elect the following director nominees, in the respective classes, unless authority is withheld to vote for any or all of the nominees: (1) for terms expiring in 2027, Thomas W. Florsheim, Jr. and Jennifer L. Slater; and (2) for a term expiring in 2025, Matteo Anversa. The following directors would continue to serve for terms expiring in the years noted: (1) Bruce M. Lisman and F. Jack Liebau, Jr., 2026, and (2) Tina Chang, 2025.

Harold M. Stratton II, one of our incumbent directors whose term is expiring at the 2024 Annual Meeting, is retiring from the Board of Directors and is not standing for re-election at the Annual Meeting. Mr. Stratton has served as a director since 1994 and is currently a member of our Audit and Compensation Committees. Mr. Stratton’s service on these committees will end in connection with the Annual Meeting. Mr. Stratton also formerly served as Chairman of our Board of Directors and as the first President of the Corporation.

David M. Zimmer, one of our incumbent directors whose term would otherwise expire at the 2026 Annual Meeting, is also retiring from the Board of Directors and, even if Proposal 1 is approved, is not standing for re-election at the Annual Meeting. Mr. Zimmer has served as a director since 2006 and currently is the Chairman of our Audit and a member of the Compensation Committee. Mr. Zimmer’s service on these committees will end in connection with the Annual Meeting.

We want to express our deep gratitude for the years of dedicated service that Mr. Stratton and Mr. Zimmer have provided to STRATTEC.

Director Qualifications and Selection Criteria

Our Board of Directors, at the recommendation of our Nominating and Corporate Governance Committee, has adopted Director Selection Criteria which are available under the Investor Relations tab of our website at https://investors.strattec.com/corporate-governance/highlights. These criteria are periodically reviewed by our Nominating and Corporate Governance Committee. The criteria require independence and an absence of material conflicts of interest of all independent and non-management directors. The criteria also describe the personal attributes and the broad mix of skills and experience of directors sought by STRATTEC in order to enhance the diversity of perspectives, professional experience, education and other relevant attributes, and the overall strength of the composition of the Board.

The table below the section “Board of Directors Recommendation” provides specific information as of the date of this Proxy Statement about each nominee for election to our Board of Directors at the Annual Meeting. The information presented includes information each director nominee has provided us about his or her age, principal occupation, business experience for the past five years, and the names of other publicly-held companies of which he or she currently serves as a director or has served as a director during the past five years. Our Nominating and Corporate Governance Committee regularly evaluates the mix of experience, qualifications, attributes and skills of our directors using a matrix of areas that this Committee considers important for our business, which experience,

qualifications, attributes and skills that we consider most important for membership on the Board include a background in the items set forth in our Director Selection Criteria. In addition to the information presented below regarding the nominee’s or incumbent’s specific experience, qualifications, attributes and skills that led our Nominating and Corporate Governance Committee to the conclusion that such person should serve as a director of STRATTEC, our Nominating and Corporate Governance Committee also considered the qualifications and criteria described below under “Director Skills Matrix” and “Corporate Governance Matters – Director Nominations” with the objective of creating a complementary mix of directors.

Director Skills Matrix

We believe our director nominees and incumbent directors are talented individuals with diverse skillsets and backgrounds, as reflected in their biographies set forth below. Many of the directors have extensive and direct automotive industry experience and/or experience in various industries that impact key functional areas of our business, such as in electronics, financial and technology matters. The directors also have varying educational backgrounds, levels of schooling and public board experience, including a mix of college, post-graduate and multiple public board and committee experience that brings strengths and diversity to the STRATTEC Board. In addition to having a diverse Board, many of our officers have diverse backgrounds. One officer is Hispanic and another is of Middle Eastern descent.

The Director Skills Matrix shown below summarizes the key skills and expertise that we consider important for our directors considering our business strategy. Specifically, the following matrix highlights the key skills, experiences, qualifications and attributes that our Nominating and Corporate Governance Committee considers in evaluating the strength and diversity of the Board and which the directors bring to the Board to maintain effective oversight. A mark indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not mean the incumbent or nominee director does not possess that qualification or skill. Although the matrix below also summarizes certain background information with respect to each incumbent or nominee director, please review our director biographies set forth below which describe each such person’s specific background and relevant experience in more detail.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tina

Chang |

|

Thomas

Florsheim |

|

F. Jack

Liebau, Jr. |

|

Bruce

Lisman |

|

Jennifer

Slater |

|

Matteo

Anversa |

|

CORPORATE SKILLS

EXPERIENCE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

President /CEO/Executive Mgmt |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

CFO / Audit / Controller |

|

|

|

|

|

|

|

|

|

|

|

X |

|

Automotive Industry |

|

|

|

|

|

|

|

|

|

X |

|

X |

|

Strategic Planning |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

Mergers & Acquisitions |

|

|

|

X |

|

X |

|

X |

|

X |

|

X |

|

International Business |

|

X |

|

X |

|

|

|

X |

|

X |

|

X |

|

Corporate Governance |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

Public Company Boards |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

Private Company Boards |

|

X |

|

|

|

X |

|

X |

|

X |

|

X |

|

FUNCTIONAL SKILLS

EXPERIENCE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineering |

|

|

|

|

|

|

|

|

|

X |

|

|

|

Financial |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

Information Technology |

|

X |

|

X |

|

|

|

|

|

X |

|

X |

|

Sales / Marketing |

|

|

|

X |

|

|

|

X |

|

X |

|

|

|

Electronics |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations |

|

X |

|

X |

|

|

|

|

|

X |

|

|

|

Risk Management |

|

X |

|

X |

|

X |

|

X |

|

X |

|

X |

|

Public Relations |

|

X |

|

|

|

|

|

|

|

|

|

|

|

Human Resources |

|

X |

|

|

|

|

|

|

|

|

|

|

|

Compensation |

|

X |

|

X |

|

X |

|

X |

|

X |

|

|

|

Legal |

|

X |

|

|

|

|

|

|

|

|

|

|

|

E-commerce |

|

X |

|

X |

|

|

|

|

|

X |

|

|

|

Distribution |

|

|

|

X |

|

X |

|

X |

|

X |

|

X |

|

PERSONAL HISTORY |

|

|

|

|

|

|

|

|

|

|

|

|

|

STRATTEC Board tenure |

|

2 |

|

12 |

|

1 |

|

1 |

|

— |

|

— |

|

Age |

|

52 |

|

66 |

|

60 |

|

77 |

|

50 |

|

52 |

|

Career status |

|

Full Time |

|

Full Time |

|

Full Time |

|

Retired |

|

Full Time |

|

Full Time |

|

We believe that the diversity of experience, qualifications, attributes and skills of our directors is important to our success. We expect that our Nominating and Corporate Governance Committee will on an annual basis review and reevaluate the above matrix to confirm that it aligns with our corporate strategies and oversight needs.

Board of Directors Recommendation

The Board of Directors recommends that shareholders vote FOR the election of the following nominees as directors of STRATTEC to serve for a one year term expiring at the 2025 Annual Meeting of Shareholders, provided that Proposal 1 is approved by shareholders: Tina Chang, Thomas W. Florsheim, Jr., F. Jack Liebau, Jr., Bruce M. Lisman, Jennifer L. Slater, and Matteo Anversa.

|

|

|

|

|

|

|

|

|

Name, Principal Occupation for Past Five Years and Directorships |

|

Age |

|

|

Director

Since |

|

Nominees for election at the Annual Meeting: |

|

|

|

|

|

|

|

|

|

|

|

TINA CHANG |

|

|

52 |

|

|

|

2022 |

|

|

|

|

Since 1996, Ms. Chang has served as Chairman of the Board and Chief Executive Officer of SysLogic, Inc. (an information systems consulting and services firm). Ms. Chang is also an owner (either directly or indirectly through SysLogic, Inc.) of SysSpark, LLC, a product innovation company, Cyberspect, LLC, a cybersecurity software and SaaS company, and WillBridge Ltd., a social benefit corporation. Ms. Chang has served on the boards of Central States Manufacturing, Inc., since 2019, and Delta Dental of Wisconsin, since January 2022. She has also served as a Director of Weyco Group, Inc. (a company engaged in the business of the design and distribution of quality and innovative footwear) since 2007. Ms. Chang is a member of the Executive, Audit, Corporate Governance and Compensation Committees for Weyco Group, Inc. (NASDAQ: WEYS). Previously, Ms. Chang served as a Director and Advisor of The Private Bank — Wisconsin from 2004 to 2013. Ms. Chang is also a private real estate investor and owns and manages mixed-use residential and commercial real estate in the Milwaukee, Wisconsin area. Ms. Chang brings to the Board a strong background in business, technology and process development in the information technology and cybersecurity areas. With technology and cybersecurity issues being an ever increasing component of STRATTEC’s business, Ms. Chang’s experience is valuable to the Board as part of its risk oversight duties. She is also strongly involved in the local business community and with charitable organizations, and brings to the Board these varied experiences. This business and career experience led to the conclusion that she should continue to serve as a director of STRATTEC. |

|

|

|

|

|

|

|

|

|

|

|

THOMAS W. FLORSHEIM, JR. |

|

|

66 |

|

|

|

2012 |

|

Chairman of the Board and Chief Executive Officer of the Weyco Group, Inc. (NASDAQ: WEYS), a company engaged in the business of the design and distribution of quality and innovative footwear, since 2002. Prior to that, Mr. Florsheim was President and Chief Executive Officer of the Weyco Group, Inc. from 1999 to 2002, President and Chief Operating Officer from 1996 to 1999, and Vice President from 1988 to 1996. Chairman and a director of Weyco Group, Inc. Mr. Florsheim is a chairman and chief executive officer of a public company. His skill sets include significant experience in mergers and acquisitions, financial oversight, compensation matters and organizational development. His career in the consumer goods industry has exposed him to manufacturing, marketing and engineering solutions on a global basis. This business and career experience led to the conclusion that he should continue to serve as a director of STRATTEC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name, Principal Occupation for Past Five Years and Directorships |

|

Age |

|

|

Director

Since |

|

BRUCE M. LISMAN |

|

|

77 |

|

|

|

2023 |

|

Mr. Lisman is a private investor. He serves on the boards of two other public companies — Myers Industries (NYSE: MYE) since 2015 and Associated Capital Group (NYSE: AC) since 2015, and two private companies — National Life Group, a mutual life insurance company since 2004 and Bank of Burlington since 2022. Prior board service includes an electric utility, an electricity transmission company, a regional banking company, an aftermarket automotive supply company, and an engineering and construction company (as Executive Chair). Other past board service includes the University of Vermont (Chair), and American Forests (Chair), the nation’s oldest conservation organization.He was Chairman of JP Morgan’s Global Equity Division (2008-2009), and Head or Co-Head of Bear Stearns Global Equity Division from 1987 to 2008. Earlier, he was the Director of Research (1984-1987) at Bear Stearns, and before that was a research analyst covering a broad range of industries. In his capacity as a board member, Mr. Lisman has served as Board Chairman, a member of all relevant committees and has chaired Compensation, Governance, and Audit Committees. The Board believes that Mr. Lisman’s qualifications to serve on our Board include his extensive board service including leadership positions, as well as his service as a successful senior executive and his investment experience. |

|

|

|

|

|

|

|

|

|

|

|

F. JACK LIEBAU, JR. |

|

|

60 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

Mr. Liebau is managing director of Beach Investment Counsel, Inc., an investment management company. Mr. Liebau is the former President and CEO of Roundwood Asset Management, a subsidiary managing public equities for Alleghany Corporation’s insurance companies, the former President and Founder, Liebau Asset Management Company, which managed money for individuals, foundations, and corporations, and the former Partner and Portfolio Manager for Davis Funds and Primecap Management Company, investment management firms. Mr. Liebau’s current and former directorships include: Board Chair and director of Myers Industries, Inc. (NYSE: MYE); director of Motorcar Parts of America, Inc. (Nasdaq:MPAA), a remanufacturer, manufacturer, and distributor of automotive aftermarket parts; director of BNY Mellon ETF Trust; non-Executive Board Chair and Member of Special Investigations Limited Company, a private, Virginia-based professional services company and government contractor in the information technology, cybersecurity, investigations, and intelligence sectors; director of MuxIP, unlisted software company serving media companies; director and CFO of the Edwin Gregson Foundation; former director of The Pep Boys, a nationwide auto parts retailer; former director of Herley Industries, Inc., a defense technology company; former director of Media General, Inc., then owner of newspapers and television stations; former Vice President of Andover Alumni Council; and former director of Kidspace Children’s Museum. The Board believes that Mr. Liebau’s qualifications to serve on our Board include his: (1) vast financial, strategic, executive and investment experience working with companies in a wide range of industries, including his qualification as an “audit committee financial expert”; (2) experience in corporate governance and corporate and non-profit board service; and (3) experience working effectively with management teams, analyzing strategic options, and communicating with various constituencies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name, Principal Occupation for Past Five Years and Directorships |

|

Age |

|

|

Director

Since |

|

|

|

|

JENNIFER L. SLATER |

|

|

50 |

|

|

|

2024 |

|

Ms. Slater has served as STRATTEC's President and Chief Executive Officer since July 1, 2024. Ms. Slater had most recently served as Executive Vice President and General Manager, Performance Sensing, of Sensata Technologies, Inc. (NYSE: ST), a global industrial technology company, since April 2024, after serving as Senior Vice President, Automotive & Aftermarket, beginning April 2023. Ms. Slater also served as the Vice President and General Manager of Sensata’s Heavy Duty and Off-Road business from September 2022 through March 2023. From 2019 to September 2022, Ms. Slater served as Group Vice President and General Manager, Global OE and Products, at Clarios, LLC, a manufacturer and distributor of advanced energy storage solutions for the automotive market. Ms. Slater has served as a director of Valvoline Inc. (NYSE: VVV), an American retail automotive services company since July 2022, currently serving on its Compensation and Governance and Nominating Committees. Ms. Slater is a member of the Society of Automotive Engineers and was named a 2017 STEP Ahead winner by the Manufacturing Institute, recognizing Women in Manufacturing. Ms. Slater is our CEO, has significant experiences as an executive officer of other public companies, and serves as a director on another public company. Her extensive experience and knowledge of the automotive industry, including automotive OEMs, and her recent focus on energy storage solutions to meet evolving vehicle electrification needs, product management and strategy, engineering, finance, and sales provide her with the qualifications and skills to serve as a director of STRATTEC. |

|

|

|

|

|

|

|

|

|

|

|

MATTEO ANVERSA |

|

|

52 |

|

|

|

-- |

|

|

|

|

|

|

|

|

|

|

Mr. Anversa serves as the Chief Financial Officer of Logitech International (SIX: LOGN) (Nasdaq: LOGI), a Swiss public company that designs software-enabled hardware solutions. He previously served as Executive Vice President of Finance, Chief Financial Officer, and Treasurer of Gentherm, Inc. (NASDAQ: THRM), a market leader in thermal and pneumatic comfort in the automotive industry, from January 2019 through August 2024, and as Executive Vice President and Chief Financial Officer of Myers Industries, Inc. (NYSE: MYE), a manufacturer of polymer-based material handling products and a distributor of tire repair and retread products, from December 2016 through December 2018. Mr. Anversa previously held executive management positions at Fiat Chrysler Automobiles N.V. since 2013, including Vice President, Group FP&A Fiat Chrysler and Chief Financial Officer for Ferrari SpA. Mr. Anversa began his career with General Electric Corporation where he held various leadership roles during his 16-year tenure. Mr. Anversa served as a director of Gabelli Value for Italy (VALU), an Italian company listed on AIM Italia, from 2018 to 2020. |

|

|

|

|

|

|

|

|

|

|

|

Mr. Anversa's extensive experience as a public company executive officer, including experience in the automotive industry, his public company financial expertise, and his experience as a director of a foreign exchange listed company, provide him with the qualifications and skills to serve as a director of STRATTEC. |

|

|

|

|

|

|

|

|

|

|

|

If the shareholders do not approve Proposal 1, the term of office of the 2024 class of directors will expire at the 2024 Annual Meeting and the terms of office for the 2025 and 2026 classes of directors, other than Mr. Zimmer, will expire at the 2025 and 2026 Annual Meetings, respectively. In that event, the persons named in the enclosed proxy will vote to elect the following director nominees, in the respective classes, unless authority is withheld to vote for any or all of the nominees: (1) for terms expiring in 2027, Thomas W. Florsheim, Jr. and Jennifer L. Slater, and (2) for a term expiring in 2025, Matteo Anversa. The following directors would continue to serve for terms expiring as noted: (1) Bruce M. Lisman and F. Jack Liebau, Jr., 2026, and (2) Tina Chang, 2025.

DIRECTORS’ MEETINGS AND COMMITTEES

Meetings and Director Attendance

Our Board of Directors held eight meetings in fiscal 2024, and all of our directors who served as directors during fiscal 2024 attended 100% of the Board meetings and more than 75% of the meetings of the committees of the Board on which they served at the time of such meetings. Executive sessions, or meetings of non-employee directors without management present, are held at each Board meeting.

The committees of our Board of Directors consist of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The chart below identifies the members and chair of each of these committees as of the date of this Proxy Statement, along with the number of meetings held by each Committee during fiscal 2024:

|

|

|

|

|

|

|

|

|

Audit |

|

Compensation |

|

Nominating

and Corporate

Governance |

Number of Meetings |

|

4 |

|

5 |

|

6 |

Name of Director: |

|

|

|

|

|

|

Tina Chang |

|

X |

|

|

|

X* |

Thomas Florsheim |

|

|

|

X* |

|

X |

Jack Liebau |

|

X |

|

X |

|

X |

Bruce Lisman |

|

X |

|

X |

|

X |

X = Committee member; * = Committee chair

Mr. Liebau, as Board Chair, is a member of each Board committee. Messrs. Stratton and Zimmer were directors during fiscal 2024 and served as members of the aforementioned committees during the entirety of fiscal 2024, but are retiring from the Board of Directors at the Annual Meeting and are not standing for re-election at the Annual Meeting. Ms. Slater, as our Chief Executive Officer, is not a member of any Board committee but regularly attends Board and committee meetings.

Audit Committee

The Audit Committee is responsible for assisting our Board of Directors with oversight of: (1) the integrity of our financial statements; (2) our compliance with legal and regulatory requirements; (3) our independent auditor’s qualifications and independence; (4) the performance of our internal accounting function and the independent auditors; and (5) the review of the scope and adequacy of our internal accounting controls. In addition, the chairman of the Audit Committee participates in quarterly meetings with members of our management and our outside auditors to review our quarterly earnings releases and quarterly financial statements prior to their issuance or filing with the U.S. Securities and Exchange Commission (the “Commission”). Our Audit Committee has the direct authority and responsibility to appoint, replace, compensate, oversee and retain the independent auditors, and is an “audit committee” for purposes of Section 3(a)(58)(A) of the Securities Exchange Act of 1934.

Compensation Committee

The Compensation Committee, in addition to such other duties as may be specified by our Board of Directors: (1) oversees and reviews the compensation and benefits of our executive officers (including determining the compensation of our Chief Executive Officer); (2) makes appropriate recommendations to our Board of Directors with respect to our incentive compensation plans and equity-based plans; (3) administers our incentive compensation plans and equity-based plans in accordance with the responsibilities assigned to the Committee under any and all such plans, including our Team Incentive Plan for STRATTEC SECURITY CORPORATION (the “TIPS Bonus Plan”) for participation by Executive Officers and Senior Managers and our Amended and Restated Stock Incentive Plan (the “Amended and Restated Stock Incentive Plan”); and (4) reviews and makes recommendations to our Board of Directors with respect to the compensation of our non-employee directors, including under our TIPS Bonus Plan for Non-Employee Members of the Board of Directors. The Compensation Committee’s charter requires that the

Corporation provide the Compensation Committee with adequate funding to engage any compensation consultants or other advisers the Committee deems appropriate to engage. Although Compensation Committee did not engage any independent consultant to assist it in reviewing the Corporation's compensation practices and levels established with respect to fiscal year 2024, during fiscal year 2024 the Committee engaged PayGovernance as an independent consultant to advise the Committee, the Board, and the Corporation regarding compensation practices and levels for fiscal 2025.

In early fiscal year 2025, the Compensation Committee recommended, and the Board of Directors approved, the adoption of stock ownership guidelines for our executive officers to encourage stock ownership and alignment with our shareholders' interests. The new guidelines are as follows:

• CEO: 5x annual base salary

• CFO and other EOs: 2x annual base salary

Shares directly and beneficially owned will be counted towards these holding guidelines, as well as time-based restricted share grants prior to vesting. Executives are now required to hold all net vested shares from equity awards until they meet their guideline. Once an executive officer satisfies their guideline, they will be considered to remain in compliance as long as they continue to own the shares that satisfied their guideline (regardless of fluctuations in share price). Our Stock Ownership Guidelines are available on the “Corporate Governance” page accessed from the “Investor Relations” page of the Corporation's website at https://investors.strattec.com.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, in addition to such other duties as may be specified by our Board of Directors, is responsible for assisting our Board of Directors by: (1) identifying individuals qualified to become members of our Board of Directors and its committees; (2) recommending guidelines and criteria to the Board of Directors to determine the qualifications of potential directors; (3) making recommendations to the Board of Directors concerning the size and composition of the Board and its committees, including developing and annually reviewing our Director Skills Matrix; (4) recommending to our Board of Directors nominees for election to the Board at the annual meeting of shareholders; (5) developing and recommending to our Board of Directors a set of corporate governance principles applicable to our business; and (6) assisting our Board of Directors in assessing director performance and the effectiveness of the Board of Directors as a whole.

The Nominating and Corporate Governance Committee identifies, interviews, and recommends candidates it determines are qualified and suitable to serve as a director. Recommendations for Board candidates may be made to the Committee by the Corporation’s Chief Executive Officer, other current Board members, and shareholders of the Corporation. Once appropriate candidates are identified, the Nominating and Corporate Governance Committee evaluates their qualifications to determine which candidate best meets the Corporation’s Director Selection Criteria (which is described in greater detail under the section titled “Director Nominations” below), without regard to the source of the recommendation. Additionally, the Committee evaluates potential director candidates in light of its annual review of the Director Skills Matrix summarized above. In accordance with this Director Selection Criteria and the Director Skills Matrix, the Committee seeks a variety of perspectives, professional experience, education, skills, and other individual qualities and attributes. A copy of the Corporation’s Director Selection Criteria is are available under the Investor Relations tab of our website at https://investors.strattec.com/corporate-governance/highlights. The Nominating and Corporate Governance Committee then interviews the candidate before making a recommendation to the Board.

Charters of Committees

Our Board of Directors has adopted, and may amend from time to time, a written charter for each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. We make available on our website at www.strattec.com, free of charge, copies of each of these charters. We are not including the information contained on or available through our website as a part of, or incorporating such information by reference into, this Proxy Statement.

CORPORATE GOVERNANCE MATTERS

Director Independence

Our Board of Directors has reviewed the independence of our continuing directors and the nominees for election to the Board at the Annual Meeting under the applicable listing standards of the NASDAQ Stock Market. Based on this review, our Board of Directors determined that each of the following directors is independent under the NASDAQ Stock Market listing standards:

|

|

Matteo Anversa (1) |

Tina Chang |

Thomas W. Florsheim, Jr. |

F. Jack Liebau, Jr. |

Bruce M. Lisman |

Harold M. Stratton II (2) |

David R. Zimmer (2) |

|

(1) Mr. Anversa is being first nominated to be elected as a director at the 2024 Annual Meeting.

(2) Messrs. Stratton and Zimmer are retiring from the Board of Directors at the 2024 Annual Meeting.

Based on such listing standards, Jennifer L. Slater is the only director and director nominee who is not independent due to her role as STRATTEC's President and Chief Executive Officer.

Board Diversity and Disclosure

The Company has historically been proactive in seeking to ensure that its Board possesses, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives, while at the same time seeking to ensure that the Board is comprised of directors who have broad and diverse backgrounds, perspectives and experiences. The following table reflects STRATTEC’s Board diversity matrix as of July 1, 2024 disclosed in accordance with Nasdaq Rule 5606, as self-disclosed by our current incumbent directors to STRATTEC. To review our Board Diversity Matrix as of July 1, 2023 please see the Proxy Statement for our 2023 Annual Meeting of Shareholders filed with the Commission on September 7, 2023.

|

|

|

|

|

|

|

|

|

|

Board Diversity Matrix (as of July 1, 2024) |

Total Number of Directors |

|

7 |

|

|

Female |

|

Male |

|

Non-Binary |

|

Did Not

Disclose

Gender |

|

Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

Directors |

|

2 |

|

5 |

|

|

|

|

|

Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

African American or Black |

|

|

|

|

|

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

|

|

|

|

|

Asian |

|

1 |

|

|

|

|

|

|

|

Hispanic or Latinx |

|

|

|

|

|

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

|

White |

|

|

|

6 |

|

|

|

|

|

Two or More Races or Ethnicities |

|

|

|

|

|

|

|

|

|

LGBTQ+ |

|

0 |

Did Not Disclose Demographic Background |

|

0 |

The above matrix includes Messrs. Stratton and Zimmer, who are retiring at the Annual Meeting and will not be standing for re-election to our Board of Directors, but who served on the Board of Directors through our fiscal 2024

and are expected to continue to serve through the first part of our fiscal 2025 through the date of the Annual Meeting. The above table does not include director nominee Matteo Anversa, who is not an incumbent director.

Board Leadership Structure

We currently have different persons serving as our Chief Executive Officer and as Chairman of our Board of Directors. F. Jack Liebau, Jr. has served the Chair of our Board since January 1, 2024, and Jennifer L. Slater is our current President and Chief Executive Officer. Although our Board of Directors does not have a formal policy with respect to its leadership structure, since September 1, 2012 we have had different persons serve as our Chief Executive Officer and Chairman of the Board of Directors. The Board of Directors believes that the current structure of appointing an independent non-executive Chair best serves STRATTEC as a good governance practice because it allows Ms. Slater to focus on managing the Corporation's day-to-day business and implementing our strategies while allowing an independent director to lead the Board of Directors in its primary role of review and oversight of executive management. The Board of Directors also believes that its leadership structure has created an environment of open, efficient communication between the Board of Directors and management, enabling the Board of Directors to maintain an active, informed role in fulfilling its duties.

Although we believe that separating the Chairman and Chief Executive Officer roles is appropriate for the foreseeable future, we will continue to review this issue periodically to determine whether, based on the relevant facts and circumstances at such time, combining these offices would serve our best interests and the best interests of our shareholders and other constituencies.

The Board’s Role in Risk Oversight

General Oversight

Our Board of Directors is responsible for exercising the corporate powers of STRATTEC and overseeing the management of our business and affairs, including management’s establishment and implementation of key strategic priorities and initiatives. The Board reviews and discusses with management periodically, and no less than annually, company strategy and conducts formal strategic reviews at each Board meeting. We believe any long-term, sustainable value creation and preservation are possible only through the prudent assumption and management of both risks and potential rewards, and our Board takes a leading role in overseeing our overall risk tolerances as a part of our strategic planning process and in overseeing our management of strategic risks.

The role of our Board of Directors in STRATTEC’s risk oversight process includes receiving reports from members of our senior management team on areas of material risk to STRATTEC, including operational, financial, legal and regulatory, technology, strategic and reputational risks. Except as noted below, our Board has delegated to the Audit Committee primary responsibility for overseeing management’s risk assessments and implementing appropriate risk management policies and guidelines, including those related to financial reporting and regulatory compliance. Our Board has delegated to the Compensation Committee primary oversight responsibility to ensure that compensation programs and practices do not encourage unnecessary or excessive risk-taking and that any risks are subject to appropriate controls. Our Board has delegated to the Nominating and Corporate Governance Committee primary oversight responsibility to ensure that STRATTEC’s governance standards establish effective systems for monitoring and accountability. Our Board has assumed, to date, direct responsibility for our cyber and intellectual property security programs. Moreover, our Board has overseen management’s implementation of a number of robust policies and compliance programs to address various areas of legal and regulatory risks, including the following: a corporate code of ethics, an insider trading policy, a supplier code of conduct and supplier quality manual, a conflict minerals compliance program, a quality policy, an environmental policy and a whistleblower hotline policy.

Cybersecurity and Environmental, Social and Governance matters

Our Board as a whole also routinely discusses with management STRATTEC programs, policies and procedures that have been implemented, formalized, and documented to address internal compliance with respect to various regulatory matters, including with respect to intellectual property and cybersecurity management and with respect to environmental, social and governance matters (“ESG Matters”). With respect to intellectual property and cybersecurity management, our Board oversees high-risk cybersecurity areas for STRATTEC and requires management to provide annual reports to the Board regarding implementation of comprehensive programs to address these risks, as well as providing the Board with updates on progress and initiatives undertaken by management in this area. Additionally, the Board requests that management update it periodically on employee training and incident reporting in this area.

STRATTEC is committed to the principles of sound environmental stewardship and the responsible and sustainable use of energy and natural resources. All of our facilities are required to operate in compliance with applicable laws and regulations and in a manner to avoid harm to the environment, prevent pollution, and reduce waste. We believe we have a strong record of environmental compliance in our facilities and our products generally have a low environmental impact. With respect to ESG Matters, STRATTEC's management provides our Board of Directors at least annually with an update and report regarding our major initiatives in this area, including progress and improvements made with respect to energy improvement initiatives related to implementation of more energy efficient capital equipment to reduce carbon emissions, annual certifications on STRATTEC's environmental management systems and other matters related to energy consumption, hazardous waste generation and CO2 neutralization.

Compensation Matters

As noted above, our Board has delegated to the Compensation Committee primary oversight responsibility to help ensure that the compensation programs and practices of STRATTEC do not encourage unreasonable or excessive risk-taking and that any risks are subject to appropriate controls. As part of this process, STRATTEC (with oversight of the Compensation Committee) designs its overall compensation programs and practices, including incentive compensation for both executives and non-executive employees, in a manner intended to support our strategic priorities and initiatives to enhance long-term sustainable value without encouraging unnecessary or unreasonable risk-taking. At the same time, STRATTEC recognizes that its goals cannot be fully achieved while avoiding all risk. The Compensation Committee, with assistance from executive management, periodically reviews STRATTEC's compensation programs and practices in the context of its risk profile, together with its other risk mitigation and risk management programs, to ensure that these programs and practices work together for the long-term benefit of STRATTEC and its shareholders. Based on its review of STRATTEC's compensation programs, the Compensation Committee believes that STRATTEC's incentive compensation policies for both executive and non-executive employees have not materially and adversely affected STRATTEC by encouraging unreasonable or excessive risk-taking in the recent past, are not likely to have such a material adverse effect in the future and provide for multiple and reasonably effective safeguards to protect against unnecessary or unreasonable risk-taking.

Director Nominations

We have a Nominating and Corporate Governance Committee of our Board of Directors. Based on the review described under “Corporate Governance Matters—Director Independence,” our Board has determined that each member of the Nominating and Corporate Governance Committee is independent under the applicable listing standards of the NASDAQ Stock Market.

The Nominating and Corporate Governance Committee will consider director nominees recommended by shareholders in accordance with our Bylaws, as amended by the Board of Directors on August 20, 2024. Pursuant to Section 2.01(c) of our Bylaws, a shareholder may nominate a candidate for election as a director of the Corporation only if written notice of such intention is received by the Secretary, either by personal delivery or by United States mail, postage prepaid, and received at the Corporation's principal executive offices (i) in the case of an annual meeting, not less than 90 nor more than 120 days prior to the one year anniversary date of the immediately preceding annual meeting of Shareholders; provided, however, that in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the Shareholder in order to be timely must be so

received not later than the close of business on the tenth day following the day on which notice of the date of the annual meeting was mailed or public disclosure of the date of the annual meeting was made, whichever first occurs; and (ii) in the case of a special meeting of shareholders called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs. The proponent's notice must include the undertakings and information required by Section 2.01(c).

The Nominating and Corporate Governance Committee believes that a nominee recommended for a position on our Board of Directors must have an appropriate mix of director characteristics, experience, diverse perspectives and skills. In light of the foregoing, our Board has adopted Director Selection Criteria, a copy of which are available under the Investor Relations tab of our website at https://investors.strattec.com/corporate-governance/highlights. These criteria are periodically reviewed by the Nominating and Corporate Governance Committee and generally require absence of material conflicts of interest of all independent and non-management directors. The criteria also describe the personal attributes and the broad mix of skills and experience of directors sought by the Corporation in order to enhance the diversity of perspectives, professional experience, education and other relevant attributes and the overall strength of the composition of the Board taking into account the uniqueness attributable to STRATTEC’s industry. These Director Selection Criteria work in concert with our Director Skills Matrix and amended Bylaws, as described above, in helping our Nominating and Corporate Governance Committee identify and select director candidates to our Board. In this regard, some of the criteria that may be taken into account by the Nominating and Corporate Governance Committee include:

•personal integrity and high ethical character;

•professional excellence;

•accountability and responsiveness;

•absence of conflicts of interest;

•fresh intellectual perspectives and ideas; and

•relevant expertise and experience (including related to financial and accounting matters) and the ability to offer advice and guidance to management based on that expertise and experience that coincides with STRATTEC’s strategic initiatives.

Shareholder Proxy Access

In accordance with our Bylaws, as amended by the Board of Directors on August 20, 2024, a shareholder may also request that the Corporation include in its proxy statement in which it solicits proxies with respect to the election of directors at an annual meeting of shareholders, any person nominated for election (a “Shareholder Nominee”) to the Board by a shareholder or by a group of not more than 20 Shareholders that (i) satisfies the requirements of 2.01(d) of our Bylaws (such individual shareholder or shareholder group, including each member thereof, to the extent the context requires, an “Eligible Shareholder”), and (ii) expressly requests in the notice required by such Section 2.01(d) to have the Shareholder Nominee included in the Corporation’s proxy materials pursuant to such Section 2.01(d). The information that the Corporation will include in its proxy statement is the information provided by the Eligible Shareholder to the secretary of the Corporation concerning the Shareholder Nominee and the Eligible Shareholder that is required to be disclosed in the Corporation’s proxy statement by the regulations promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and if the Eligible Shareholder so elects, a written statement, not to exceed 500 words, in support of the Shareholder Nominee’s candidacy (the “Statement”). The Corporation may omit from its proxy materials any information or Statement (or portion thereof) that it, in good faith, believes would violate any applicable law or regulation. The Corporation will not be required pursuant to Section 2.01(d) to include any information regarding a Shareholder Nominee in its proxy materials for any meeting of Shareholders for which any person is engaging in a solicitation within the meaning of Rule 14a-1(l) under the Exchange Act in support of the election of any individual as a director at such meeting other than Shareholder Nominees or nominees of the Board. The maximum number of Shareholder Nominees nominated by all Eligible Shareholders that the Corporation shall be required to include in its proxy materials with respect to an Annual Meeting generally shall not exceed the greater of

(i) two, or (ii) 20% of the total number of members of the Corporation’s Board rounded to the closest whole number below 20%.

The Corporation will be required to include information regarding a Shareholder Nominee in its proxy materials with respect to an Annual Meeting only if the notice of the nomination relating to the Shareholder Nominee is delivered to, or mailed to and received by, the Secretary of the Corporation no earlier than 120 days and no later than 90 days before the anniversary of the previous year’s annual meeting of shareholders, provided, however, that if the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the shareholder must be received not later than the close of business on the tenth day following the day on which notice of the date of the annual meeting was mailed or public disclosure of the date of the annual meeting was made, whichever first occurs, or if the Corporation is holding a special meeting of shareholders, then the shareholder must deliver the notice a reasonable time before the Corporation issues its proxy materials, as specified by the Corporation in a Current Report on Form 8-K filed pursuant to Item 5.08.

Communications between Shareholders and the Board of Directors

Our shareholders may communicate with our Board of Directors or any of our individual directors by directing such communication to our Secretary at the address of our corporate headquarters, 3333 West Good Hope Road, Milwaukee, Wisconsin 53209. Each such communication should indicate that the sender is a shareholder of STRATTEC and that the sender is directing the communication to one or more of our individual directors or to our Board as a whole.