Current Report Filing (8-k)

November 22 2022 - 3:04PM

Edgar (US Regulatory)

0001089907

false

0001089907

2022-11-16

2022-11-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of Earliest Event Reported): November 16,

2022

SWK HOLDINGS

CORPORATION

(Exact Name

of the Registrant as Specified in Its Charter)

Delaware

(State or

Other Jurisdiction of Incorporation)

| 001-39184 |

77-0435679 |

| (Commission

File Number) |

(IRS

Employer Identification No.) |

| |

|

| 14755

Preston Road, Suite 105, Dallas, TX |

75254 |

| (Address

of Principal Executive Offices) |

(Zip

Code) |

(972) 687-7250

(Registrant’s

Telephone Number, Including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| o |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o |

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on

which registered |

Common

Stock, par value

$0.001 per share |

SWKH |

The Nasdaq

Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company o

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On November 16, 2022, SWK Holdings Corporation (“SWK”

or the “Company”) and its wholly-owned subsidiary SWK Funding LLC (“SWK Funding”, and collectively, the “Borrowers”)

entered into the fifth amendment (the “Fifth Amendment”) to the Loan and Security Agreement, dated as of June 29, 2018 (as

amended, the “Loan Agreement”) with Cadence Bank, successor by merger to Cadence Bank, N.A., successor by merger to State

Bank and Trust Company, as a lender and administrative agent. All capitalized terms not otherwise defined herein are defined in the Loan

Agreement filed as Exhibit 10.1 to this current report on Form 8-K.

Pursuant to the Fifth Amendment, the Loan Agreement

was amended to increase the Term Loan Commitment to $35.0 million and to extend the Loan Agreement Termination Date to September 30, 2025.

The Fifth Amendment includes an accordion feature that allows for a $15.0 million commitment increase, subject to conditions outlined

in the Loan Agreement.

The Loan Agreement accrues interest at the Adjusted

Term SOFR Index, with a floor of 1.00 percent, plus a 2.65 percent margin and principal is repayable in full at maturity. Interest is

generally required to be paid monthly in arrears. In connection with the Fifth Amendment, the Company paid approximately $0.2 million

in amendment and other fees, which will be capitalized as deferred financing costs and will be amortized on a straight-line basis over the term of the Loan Agreement.

The Loan Agreement has an advance rate against the

Company’s finance receivables portfolio, including 85 percent against senior first lien loans, 70 percent against second lien loans

and 50 percent against royalty receivables, subject to certain eligibility requirements as defined in the Loan Agreement. The Loan Agreement

contains certain affirmative, negative and financial covenants including covenants related to maintaining a minimum fixed charge coverage

ratio and tangible net worth. The obligations under the Loan Agreement may be accelerated upon the occurrence of an event of default under

the Loan Agreement.

The Loan Agreement requires the payment of an unused

line fee of 0.35 percent and also provides for quarterly minimum fee income of $60,000 less the aggregate interest and unused line fees

paid during the immediately preceding quarter. Unused line fees and minimum fee income are recorded as interest expense.

The description above of the Fifth Amendment and

the amended Loan Agreement is qualified in its entirety by reference to the full text of the Loan Agreement, as amended and

restated. A conformed copy of the Fifth Amendment and Loan Agreement is filed as Exhibit 10.1 to this current report on Form 8-K and

incorporated by reference herein.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant. |

The disclosures in Item 1.01 above are incorporated by reference into this

Item 2.03.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SWK HOLDINGS CORPORATION |

| |

|

| By: |

/s/ Joe D. Staggs |

| |

Joe D. Staggs |

| |

President and Interim Chief Executive Officer |

Date: November 22, 2022

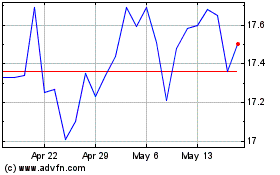

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Dec 2024 to Jan 2025

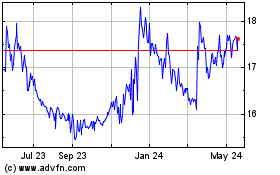

SWK (NASDAQ:SWKH)

Historical Stock Chart

From Jan 2024 to Jan 2025