Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 29 2024 - 5:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES

EXCHANGE ACT OF 1934

For the month of

August 2024

Commission

File Number: 001-38878

So-Young International

Inc.

2/F, East Tower,

Poly Plaza

No. 66 Xiangbin

Road

Chaoyang District,

Beijing, 100012

People's Republic

of China

(Address of principal

executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

So-Young International Inc. |

| |

|

|

|

|

| |

|

By |

|

/s/ Hui Zhao |

| |

|

Name |

: |

Hui Zhao |

| |

|

Title |

: |

Chief Financial Officer |

| |

|

|

|

|

| Date: August 29, 2024 |

|

|

|

|

Exhibit 99.1

So-Young Announces Receipt of Minimum Bid Price

Notice from Nasdaq

BEIJING, Aug. 29, 2024-- So-Young International Inc. (Nasdaq:

SY) ("So-Young" or the "Company"), the largest and most vibrant social community in China for consumers, professionals

and service providers in the medical aesthetics industry, today announced it has received a notification letter dated August 28,

2024 (the “Notice”) from the staff of the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”),

indicating that for the last 30 consecutive business days, the closing bid price of the Company’s American depositary shares (the

“ADSs”) was below the minimum bid price of US$1.00 per share requirement set forth in Nasdaq Listing Rule 5450(a)(1).

The Notice has no current effect on the listing or trading of the Company’s ADSs on Nasdaq.

Pursuant to the Nasdaq Listing Rule 5810(c)(3)(A), the Company

is provided with a compliance period of 180 calendar days, or until February 24, 2025, to regain compliance under the Nasdaq Listing

Rules. If at any time during the 180-day compliance period, the closing bid price of the Company’s ADSs is US$1.00 per share or

higher for at least ten consecutive business days, Nasdaq will provide the Company written confirmation of compliance and the matter will

be closed. In the event the Company does not regain compliance by February 24, 2025, subject to the determination by the staff of

Nasdaq, the Company may be eligible for an additional 180-day compliance period if it meets the continued listing requirement for market

value of publicly held shares and all other initial listing standards, with the exception of the minimum bid price requirement. In this

case, the Company will need to provide written notice of its intention to cure the deficiency during the second compliance period, including

by effecting a reverse stock split, if necessary.

The Nasdaq notification letter does not affect the Company’s

business operations, and the Company will take all reasonable measures to regain compliance within the prescribed grace period.

About So-Young International Inc.

So-Young International Inc. (Nasdaq: SY) is the largest and most vibrant

social community in China for consumers, professionals and service providers in the medical aesthetics industry. The Company presents

users with reliable information through offering high quality and trustworthy content together with a multitude of social functions on

its platform, as well as by curating medical aesthetic service providers that are carefully selected and vetted. Leveraging So-Young's

strong brand image, extensive audience reach, trust from its users, highly engaging social community and data insights, the Company is

well-positioned to expand both along the medical aesthetic industry value chain and into the massive, fast-growing consumption healthcare

service market.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements

are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as "will," "expects," "anticipates," "future,"

"intends," "plans," "believes," "estimates," "confident" and similar statements. So-Young

may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission, in its

annual report to shareholders, in press releases and other written materials and in verbal statements made by its officers, directors

or employees to third parties. Statements that are not historical facts, including but not limited to statements about So-Young's beliefs

and expectations, are forward-looking statements. Forward looking statements involve inherent risks and uncertainties. A number of factors

could cause actual results to differ materially from those contained in any forward-looking statement. Further information regarding these

and other risks is included in the Company's filings with the Securities and Exchange Commission. All information provided in this press

release is as of the date of the press release, and So-Young undertakes no duty to update such information, except as required under applicable

law.

For investor and media inquiries, please contact:

So-Young

Investor Relations

Ms. Mona Qiao

Phone: +86-10-8790-2012

E-mail: ir@soyoung.com

Christensen

In China

Ms. Dee Wang

Phone: +86-10-5900-1548

E-mail: dee.wang@christensencomms.com

In US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

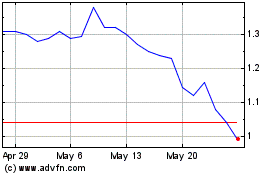

So Young (NASDAQ:SY)

Historical Stock Chart

From Sep 2024 to Oct 2024

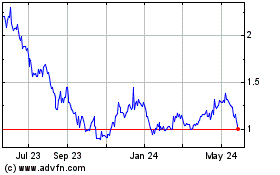

So Young (NASDAQ:SY)

Historical Stock Chart

From Oct 2023 to Oct 2024