As filed with the Securities and Exchange Commission on January 30, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SYNAPTICS INCORPORATED

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | |

| Delaware | | 77-0118518 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

1109 McKay Drive

San Jose, California 95131

(Address of Principal Executive Offices) (Zip Code)

SYNAPTICS INCORPORATED 2025 INDUCEMENT EQUITY PLAN

(Full title of the plan)

Ken Rizvi

Senior Vice President and Chief Financial Officer

1109 McKay Drive

San Jose, California 95131

(Name and address of agent for service)

(408) 904-1100

(Telephone number, including area code, of agent for service)

Copies to:

| | | | | | | | |

| | |

Lisa Bodensteiner Senior Vice President, Chief Legal Officer and Secretary Synaptics Incorporated 1109 McKay Drive San Jose, California 95131 Tel: (408) 904-1100 Fax: (408) 904-1110 | | Mark M. Bekheit Richard Kim Latham & Watkins LLP 140 Scott Drive Menlo Park, California 94025 Tel: (650) 328-4600 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Synaptics Incorporated (the “Registrant”) is filing with the Securities and Exchange Commission (the “SEC”) this registration statement on Form S-8 (this “Registration Statement”) for the purpose of registering 1,700,000 shares of its common stock, par value $0.001 per share (the “Common Stock”) for issuance under the Synaptics Incorporated 2025 Inducement Equity Plan (the “Inducement Plan”) adopted by the compensation committee of the Registrant's board of directors on January 27, 2025. The Inducement Plan provides for, among other things, the grant of nonqualified stock options, restricted stock units, dividend equivalents, and stock appreciation rights to eligible individuals.

PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

The documents containing the information specified in Part I of Form S-8 will be sent or given to participants as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”). These documents and the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| | | | | |

ITEM 3. | INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE |

The following documents filed by the Registrant with the SEC are incorporated by reference into this Registration Statement:

(d) The Registrant’s Current Reports on Form 8-K filed with the SEC on October 31, 2024, November 13, 2024, November 19, 2024, November 21, 2024, November 26, 2024, and January 28, 2025.

(e) The description of the Registrant’s Common Stock contained in Exhibit 4.4 of the Registrant’s Annual Report on Form 10-K for the fiscal year ended June 29, 2019, filed with the SEC on August 23, 2019, including any amendment or report filed for the purpose of updating such description.

(e) All other reports and documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items) on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part of this Registration Statement from the date of the filing of such reports and documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

ITEM 4. DESCRIPTION OF SECURITIES

Not applicable.

ITEM 5. INTERESTS OF NAMED EXPERTS AND COUNSEL

Not applicable.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS

The Registrant’s certificate of incorporation and bylaws provide, in general, that the Registrant will indemnify and advance expenses, to the fullest extent permitted by the Delaware General Corporation Law (the “DGCL”), to each person who is or was a director or officer of the Registrant, or who serves or served any other enterprise or organization at the request of the Registrant (an “Indemnitee”). In addition, the Registrant has adopted provisions in its bylaws and entered into indemnification agreements that require it to indemnify its directors, officers, and certain other representatives of the Registrant against expenses and certain other liabilities arising out of their conduct on behalf of the Registrant to the maximum extent and under all circumstances permitted by law. Indemnification may not apply in certain circumstances to actions arising under the federal securities laws.

Under Delaware law, to the extent that an Indemnitee is successful on the merits or otherwise in defense of an action, suit, or proceeding brought against him or her by reason of the fact that he or she is or was a director, officer, or agent of the Registrant, or serves or served any other enterprise or organization at the request of the Registrant, the Registrant shall indemnify him or her if he or she is a present or former director or officer of the Registrant, or otherwise may indemnify him or her, against expenses (including attorneys’ fees) actually and reasonably incurred in connection with such action, suit, or proceeding.

If unsuccessful in defense of a third-party civil suit or a criminal suit, or if such a suit is settled, an Indemnitee may be indemnified under Delaware law against both (i) expenses, including attorneys’ fees, and (ii) judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with such action, suit, or proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Registrant, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

If unsuccessful in defense of a suit brought by or in the right of the Registrant, or if such a suit is settled, an Indemnitee may be indemnified under Delaware law only against expenses (including attorneys’ fees) actually and reasonably incurred in connection with the defense or settlement of the suit if he or she acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interests of the Registrant except that if the Indemnitee is adjudged to be liable to the Registrant, he or she cannot be indemnified unless a court determines that he or she is fairly and reasonably entitled to indemnity for such expenses.

Also under Delaware law, expenses incurred by an officer or director in defending a civil or criminal action, suit, or proceeding may be paid by the Registrant in advance of the final disposition of the suit, action, or proceeding upon receipt of an undertaking by or on behalf of the officer or director to repay such amount if it is ultimately determined that he or she is not entitled to be indemnified by the Registrant. The Registrant may also advance expenses (including attorneys’ fees) incurred by other employees and agents of the Registrant upon such terms and conditions, if any, that the board of directors of the Registrant deems appropriate.

The foregoing is only a general summary of certain aspects of Delaware law and the Registrant’s certificate of incorporation and bylaws dealing with indemnification of directors and officers, and does not purport to be complete. It is qualified in its entirety by reference to the detailed provisions of Section 145 of the DGCL and the Registrant’s certificate of incorporation and bylaws.

The Registrant has entered into indemnification agreements with its directors and executive officers to give its directors and executive officers additional contractual assurances regarding the scope of the indemnification set forth in the Registrant’s certificate of incorporation and bylaws and to provide additional procedural protections. The Registrant intends to enter into a similar agreement with its future directors and executive officers.

ITEM 7. EXEMPTION FROM REGISTRATION CLAIMED

Not applicable.

ITEM 8. EXHIBITS

| | | | | | | | |

| | |

Exhibit

No. | | Description |

| |

| 4.1 | (1) | |

| | |

| 4.2 | (2) | |

| | |

| 4.3 | (3) | |

| | |

| 5.1 | | |

| |

| 23.1 | | Consent of Latham & Watkins LLP (included in Exhibit 5.1 above) |

| |

| 23.2 | | |

| |

| 24.1 | | Power of Attorney (included on the signature page of this Form S-8) |

| | |

| 99.1 | | |

| | |

| 107.1 | | |

| | | | | |

(1) | Filed as Exhibit 3.1 to Registrant’s Current Report on Form 8-K (File No. 000-49602), filed with the SEC on October 26, 2023, and incorporated herein by reference. |

| | | | | |

(2) | Filed as Exhibit 3.2 to Registrant’s Current Report on Form 8-K (File No. 000-49602), filed with the SEC on August 2, 2010, and incorporated herein by reference |

| | | | | |

(3) | Filed as Exhibit 4 to Registrant’s Annual Report on Form 10-K (File No. 000-49602), filed with the SEC on September 12, 2002, and incorporated herein by reference. |

ITEM 9. UNDERTAKINGS

(a) The Registrant hereby undertakes:

| | | | | | | | |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| | | | | | | | |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| | | | | | | | |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” table in the effective registration statement; and |

| | | | | | | | |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the registration statement is on Form S-8, and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, that are incorporated by reference in the registration statement.

| | | | | | | | |

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| | | | | | | | |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

(b) The Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934, as amended), that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of San Jose, State of California, on January 30, 2025.

| | | | | | | | |

| | |

| SYNAPTICS INCORPORATED |

| |

| By: | | /s/ Michael E. Hurlston |

| | Michael E. Hurlston |

| | President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Michael E. Hurlston and Ken Rizvi, and each or any one of them, as his or her true and lawful attorney-in-fact and agent, each with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his or her substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | Title | | Date |

| | |

| /s/ Michael E. Hurlston | | President, Chief Executive Officer and | | January 30, 2025 |

| Michael E. Hurlston | | Director (Principal Executive Officer) | | |

| | |

| /s/ Ken Rizvi | | Senior Vice President and Chief Financial Officer (Principal Financial Officer) | | January 30, 2025 |

| Ken Rizvi | | Officer) | | |

| | |

| /s/ Esther Song | | Vice President and Corporate Controller (Principal Accounting Officer) | | January 30, 2025 |

| Esther Song | | | | |

| | |

| /s/ Nelson C. Chan | | Chairman of the Board and Director | | January 30, 2025 |

| Nelson C. Chan | | | | |

| | |

| /s/ Jeffrey D. Buchanan | | Director | | January 30, 2025 |

| Jeffrey D. Buchanan | | | | |

| | |

| /s/ Keith B. Geeslin | | Director | | January 30, 2025 |

| Keith B. Geeslin | | | | |

| | |

| /s/ Susan J. Hardman | | Director | | January 30, 2025 |

| Susan J. Hardman | | | | |

| /s/ Patricia Kummrow | | Director | | January 30, 2025 |

| Patricia Kummrow | | | | |

| | |

| /s/ Vivie Lee | | Director | | January 30, 2025 |

| Vivie Lee | | | | |

| | | | |

| /s/ James L. Whims | | Director | | January 30, 2025 |

| James L. Whims | | | | | |

0000817720Synaptics IncorporatedS-8S-8EX-FILING FEESxbrli:sharesiso4217:USDxbrli:pure000081772012025-01-302025-01-3000008177202025-01-302025-01-30

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Synaptics Incorporated

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | |

Security

Type | | Security

Class

Title | | Fee

Calculation

Rule | | Amount

Registered(1) | | Proposed

Maximum

Offering

Price Per

Unit(2) | | Maximum

Aggregate

Offering

Price | | Fee

Rate | | Amount of

Registration

Fee |

| | | | | | | | |

| Equity | | Common stock, par value $0.001 per share | | Rules 457(c) and 457(h) | | 1,700,000 | | $80.30 | | $136,510,000.00 | | $0.0001531 | | $20,899.68 |

| | | | | |

| Total Offering Amounts | | | | $136,510,000.00 | | | | $20,899.68 |

| | | | | |

Total Fee Offsets(3) | | | | | | | | $0 |

| | | | | |

| Net Fee Due | | | | | | | | $20,899.68 |

| | | | | |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall also cover any additional shares of the Registrant’s common stock that become issuable under the Synaptics Incorporated 2025 Inducement Equity Plan (the “Inducement Plan”) by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration that increases the number of the Registrant’s outstanding shares of common stock. |

| | | | | |

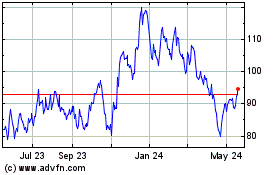

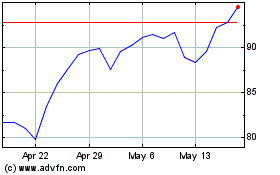

| (2) | Pursuant to 457(c) and 457(h) under the Securities Act, the proposed maximum offering price per share is estimated solely for the purpose of calculating the registration fee and is based upon the average of the high and low prices of the Registrant’s common stock as reported on the Nasdaq Global Select Market on January 28, 2025, which date is within five business days prior to filing this Registration Statement. |

| | | | | |

| (3) | The Registrant does not have any fee offsets. |

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

SYNAPTICS INCORPORATED

(Pursuant to Sections 242 and 245 of the General Corporation Law of the State of Delaware)

Synaptics Incorporated, a corporation organized and existing under and by virtue of the provisions of the General Corporation Law of the State of Delaware (the “DGCL”),

DOES HEREBY CERTIFY:

1. That the name of this corporation is Synaptics Incorporated, and that this corporation was originally incorporated pursuant to the DGCL on January 7, 2002.

2. That the Board of Directors duly adopted resolutions proposing to amend and restate the Certificate of Incorporation of this corporation, declaring said amendment and restatement to be advisable and in the best interests of this corporation and its stockholders, and authorizing the appropriate officers of this corporation to solicit the approval of the stockholders therefor, which resolution setting forth the proposed amendment and restatement is as follows:

RESOLVED, that the Certificate of Incorporation of this corporation be amended and restated in its entirety to read as follows:

FIRST: The name of the corporation is Synaptics Incorporated (the “Corporation”).

SECOND: The registered office of the Corporation in the State of Delaware is 1209 Orange Street, City of Wilmington, County of New Castle, Delaware 19801. The name of the Corporation’s registered agent is The Corporation Trust Company.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended (the “DGCL”).

FOURTH: The Corporation shall be authorized to issue two classes of shares of capital stock, to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares of Common Stock and Preferred Stock that the Corporation shall have authority to issue is one hundred thirty million (130,000,000) of which one hundred twenty million (120,000,000) shares shall be Common Stock and ten million (10,000,000) shall be Preferred Stock. The par value of the shares of Common Stock is one-tenth of one cent ($.001) per share. The par value of the shares of Preferred Stock is one-tenth of one cent ($.001) per share.

The shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors is hereby authorized, by filing a certificate pursuant to the applicable law of the State of Delaware, to establish from time to time the number of shares to be included in each series, and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limitations, or restrictions thereof, including, but not limited to, the fixing or alteration of the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), the redemption price or prices, and the liquidation preferences of any wholly unissued series of shares of Preferred Stock, or any of them; and to increase or decrease the number of shares of any series subsequent to the issue of the shares of that series, but not below the number of shares of that series then outstanding. In case the number of shares of any series shall be so decreased, the shares constituting such decrease shall resume the status they had prior to the adoption of the resolution originally fixing the number of shares of that series.

FIFTH: The size of the Board of Directors may be increased or decreased in the manner provided in the Bylaws of the Corporation.

All corporate powers of the Corporation shall be exercised by or under the direction of the Board of Directors except as otherwise provided herein or by law.

Until the election of directors at the 2025 annual meeting of stockholders of the Corporation, the Board of Directors (other than those directors elected by the holders of any series of Preferred Stock provided for or fixed pursuant to the provisions of Article FOURTH hereof) shall be divided into three classes: Class I, Class II, and Class III. Each director elected prior to the 2024 annual meeting of stockholders shall be elected for a term expiring on the date of the third annual meeting of stockholders following the annual meeting at which the director was elected. Each director elected at the 2024 annual meeting of stockholders shall be elected for a one-year term expiring at the 2025 annual meeting of stockholders. Each director elected at the 2025 annual meeting of stockholders shall be elected for a one-year term expiring at the 2026 annual meeting of stockholders. At the 2026 annual meeting of stockholders and each annual meeting of stockholders thereafter, all directors shall be elected for a one-year term expiring at the next annual meeting of stockholders. Any director’s death, resignation, disqualification, or removal shall result in the elimination of any classification of the seat previously held by such director, and any director chosen to fill such vacancy or a newly-created directorship shall hold office for a term expiring at the next annual meeting of stockholders.

Notwithstanding any of the forgoing provisions of this Article FIFTH, each director shall serve until such director’s term has expired and such director’s successor is elected and qualified or until such director’s earlier death, resignation, disqualification, or removal.

Subject to the rights of the holders of any series of Preferred Stock then outstanding, directors may be removed from office at any time, with or without cause, by the affirmative vote of the holders of at least sixty six and two-thirds percent (66-2/3%) of the combined voting power of the then outstanding shares of all classes and series of stock of the Corporation entitled to vote generally in the election of directors (the “Voting Stock”), voting together as a single class (it being understood that for the purposes of this Article FIFTH, each share of Voting Stock shall have the number of votes granted to it in accordance with Article FOURTH of this Certificate of Incorporation). No decrease in the authorized number of directors constituting the Board shall shorten the term of any incumbent director.

Notwithstanding anything contained in this Certificate of Incorporation to the contrary, and in addition to any other vote required by law, the affirmative vote of not less than sixty-six and two-thirds percent (66-2/3%) of the combined voting power of the Voting Stock, voting together as a single class, shall be required to alter, amend, repeal, or adopt any provision inconsistent with this Article FIFTH.

SIXTH: Unless and except to the extent that the Bylaws of the Corporation shall so require, the election of directors of the Corporation need not be by written ballot.

SEVENTH: A director of the Corporation shall not be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL. Any repeal or modification of this Article shall not adversely affect any right or protection of a director of the Corporation existing hereunder with respect to any act or omission occurring prior to such repeal or modification.

EIGHTH: Subject to the power of the stockholders of the Corporation to adopt, amend, or repeal any Bylaw made by the Board of Directors, the Board of Directors is expressly authorized and empowered to adopt, amend or repeal the Bylaws of the Corporation. The Bylaws of the Corporation shall not be made, repealed, altered, amended, or rescinded by the stockholders of the Corporation except at an annual or special meeting of stockholders by the vote, in addition to any other vote required by law, of the holders of record of not less than sixty- six and two-thirds percent (66-2/3%) of the Voting Stock, considered for purposes of this Article EIGHTH as one class.

NINTH: Special meetings of the stockholders of the Corporation for any purpose or purposes may be called at any time by the Board of Directors or by a committee of the Board of Directors that has been duly designated by the Board of Directors and whose powers and authority, as provided in a resolution of the Board of Directors or in the bylaws of the Corporation, include the power to call such meetings. Special meetings of the stockholders of the Corporation may not be called by any other person or persons.

TENTH: No action that is required or permitted to be taken by the stockholders of the Corporation at any annual or special meeting of stockholders may be effected by written consent of stockholders in lieu of a meeting of stockholders.

ELEVENTH: The Board of Directors, when evaluating any (a) tender offer or invitation for tenders, or proposal to make a tender offer or request or invitation for tenders, by another party, for any equity security of the Corporation or (b) proposal or offer by another party to (i) merge or consolidate the Corporation or any subsidiary of the Corporation with another corporation, (ii) purchase or otherwise acquire all or a substantial portion of the properties or assets of the Corporation or any subsidiary thereof, or sell or otherwise dispose of to the Corporation or any subsidiary thereof all or a substantial portion of the properties or assets of such other party or (iii) liquidate, dissolve, reclassify the securities of, declare an extraordinary dividend of, recapitalize or reorganize the Corporation, shall take into account all factors that the Board of Directors deems relevant, including, without limitation, to the extent so deemed relevant, the potential impact on employees, customers, suppliers, partners, joint venturers and other constituents of the Corporation and the communities in which the Corporation operates.

TWELFTH: The provisions set forth in this Article TWELFTH and in Article FIFTH (dealing with removal of directors), EIGHTH (dealing with the alteration of Bylaws by the stockholders), NINTH (dealing with special meetings of the stockholders), and TENTH (dealing with written consent of stockholders) herein may not be repealed or amended in any respect, and no article imposing cumulative voting in the election of directors may be added, unless such action is approved by the affirmative vote of not less than sixty-six and two-thirds percent (66-2/3%) of the Voting Stock, considered for purposes of this Article TWELFTH as one class. The voting requirements contained in Article FIFTH, Article EIGHTH and this Article TWELFTH shall be in addition to the voting requirements imposed by law, other provisions of this Certificate of Incorporation, or any certificate of designation providing for the creation and issuance of Preferred Stock preferences in favor of certain classes or series of classes of shares of the Corporation.

THIRTEENTH: The Corporation reserves the right at any time, and from time to time, to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, and other provisions authorized by the laws of the State of Delaware at the time in force may be added or inserted, in the manner now or hereafter prescribed by law; and all rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to this Certificate of Incorporation in its present form or as hereafter amended are granted subject to the rights reserved in this Article.

* * *

3. That the foregoing amendment and restatement was approved by the holders of the requisite number of shares of this corporation in accordance with the DGCL.

4. That this Certificate of Incorporation, which restates and integrates and further amends the provisions of this corporation’s Certificate of Incorporation, has been duly adopted in accordance with Sections 242 and 245 of the DGCL.

[Signature Page Follows]

IN WITNESS WHEREOF, this Amended and Restated Certificate of Incorporation has been executed by a duly authorized officer of this corporation on this October day of 24th, 2023.

By: /s/ Michael Hurlston

Michael Hurlston

Chief Executive Officer

THIRD AMENDED AND RESTATED

BYLAWS

OF

SYNAPTICS INCORPORATED

Amended and Restated as of July 27, 2010

Table of Contents

Section 1.1. Principal Office 1 Section 1.2. Other Offices 1 ARTICLE II MEETINGS OF STOCKHOLDERS 1 Section 2.1. Place of Meetings 1 Section 2.2. Annual Meetings 1 Section 2.3. Notice of Stockholder Business; Nominations 1 Section 2.4. Special Meetings 6 Section 2.5. Notice of Meetings 6 Section 2.6. Fixing Date for Determination of Stockholders of Record 6 Section 2.7. Voting List; Right to Examine 6 Section 2.8. Adjournments 7 Section 2.10. Organization 7 Section 2.11. Voting; Proxies 7 Section 2.12. Inspectors of Election 8 Section 2.13. Consent of Stockholders in Lieu of Meeting 8 Section 2.14. Conduct of Meetings 8 ARTICLE III BOARD OF DIRECTORS 9 Section 3.1. Number; Qualifications 9 Section 3.2. Resignation; Removal; Vacancies 9 Section 3.3. Regular and Special Meetings 9 Section 3.4. Quorum; Vote Required for Action 10 Section 3.5. Organization 10 Section 3.6. Committees 10 Section 3.7. Action of Directors in Lieu of Meeting 10 Section 3.8. Attendance Via Telecommunications 11 ARTICLE IV NOTICE - WAIVERS - MEETINGS 11 Section 4.1. Manner of Notice 11 Section 4.2. Waiver of Notice of Meetings of Stockholders, Directors, and Committees 11 Section 5.1. Executive Officers; Election; Qualifications; Term of Office; Resignation; Removal; Vacancies 11 Section 5.2. Powers and Duties of Executive Officers 12 ARTICLE VI CERTIFICATES OF STOCK 12 Section 6.1. Certificates 12 Section 6.2. Lost, Stolen, or Destroyed Stock Certificates; Issuance of New Certificates 12 ARTICLE VII RIGHT TO INDEMNIFICATION 12 Section 7.1. Right to Indemnification 12 Section 7.2. Prepayment of Expenses 13 Section 7.4. Nonexclusivity of Rights 13 Section 7.5. Other Indemnification 13 Section 7.6. Nature of Indemnification Rights; Amendment or Repeal 13 Section 7.7. Insurance for Indemnification 13 Section 7.8. Other Indemnification and Prepayment of Expenses 14 ARTICLE VIII MISCELLANEOUS 14 Section 8.1. Fiscal Year 14 Section 8.3. Form of Records 14 Section 8.4. Severability 14

THIRD AMENDED AND RESTATED

BYLAWS

OF

SYNAPTICS INCORPORATED

(a Delaware corporation)

Adopted July 27, 2010

Article I

Offices

Section 1.1.Principal Office. The registered agent and office of Synaptics Incorporated (the “Corporation”) in the state of Delaware shall be The Corporation Trust Company, 1209 Orange Street, City of Wilmington, Delaware 19801, County of New Castle, or such other registered agent or office (which need not be a place of business of the Corporation) as the Board of Directors of the Corporation (the “Board of Directors”) may designate from time to time in the manner provided by applicable law.

Section 1.2.Other Offices. The Corporation may have offices also at such other places within and without the state of Delaware as the Board of Directors may from time to time designate or as the business of the Corporation may require.

Article II

Meetings of Stockholders

Section 2.1.Place of Meetings. Meetings of stockholders shall be held at the place, if any, either within or without the state of Delaware, as may be designated by resolution of the Board of Directors from time to time.

Section 2.2.Annual Meetings. If required by law, annual meetings of stockholders shall be held at such date and time as determined by resolution of the Board of Directors and as set forth in the notice of meeting required by Section 2.5, at which time they shall elect a Board of Directors and transact any other business as may properly be brought before the meeting.

Section 2.3.Notice of Stockholder Business; Nominations.

(A)Annual Meetings of Stockholders. Nominations of one or more individuals to the Board of Directors (each, a “Nomination,” and more than one, “Nominations”) and the proposal of business other than Nominations (“Business”) to be considered by the stockholders of the Corporation may be made at an annual meeting of stockholders only (1) pursuant to the Corporation’s notice of meeting (or any supplement thereto), provided, however, that reference in the Corporation’s notice of meeting to the election of directors or to the election of members of the Board of Directors shall not include or be deemed to include Nominations, (2) by or at the direction of the Board of Directors, or (3) by any stockholder of the Corporation who was a stockholder of record of the Corporation at the time the notice provided for in this Section 2.3 is delivered to the Secretary of the Corporation, who is entitled to vote at the meeting, and who complies with the notice procedures set forth in this Section 2.3.

(B)Special Meetings of Stockholders. Only such Business shall be conducted at a special meeting of stockholders of the Corporation as shall have been brought before the meeting pursuant to the Corporation’s notice of meeting; provided, however, that reference in the Corporation’s notice of meeting to the election of directors or to the election of members of the Board of Directors shall not include or be deemed to include Nominations. Nominations may be made at a special meeting of stockholders at which directors are to be elected pursuant to the Corporation’s notice of meeting as aforesaid (1) by or at the direction of the Board of Directors or (2) provided that the Board of Directors has determined that directors shall be elected at such meeting, by any stockholder of the Corporation who is a stockholder of record at the time the notice provided for in this Section 2.3 is delivered to the Secretary of the Corporation, who is entitled to vote at the meeting and upon such election, and who complies with the notice procedures set forth in this Section 2.3. In the event the Corporation calls a special meeting of stockholders for the purpose of electing one or more directors to the Board of Directors, any such stockholder entitled to vote in such election of directors may make Nominations of one or more individuals (as the case may be) for election to such position(s) as specified in the Corporation’s notice of meeting, if the

stockholder’s notice required by Section 2.3(C)(1) shall be delivered to the Secretary of the Corporation at the principal executive offices of the Corporation in accordance with Section 2.3(C)(1)(e).

(C)Stockholder Nominations and Business. For Nominations and Business to be properly brought before an annual meeting by a stockholder pursuant to Section 2.3(A)(3), the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation in compliance with this Section 2.3, and any such proposed Business must constitute a proper matter for stockholder action. For Nominations to be properly brought before a special meeting by a stockholder pursuant to Section 2.3(B)(2), the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation in compliance with this Section 2.3.

(1)Stockholder Nominations.

(a)Only individual(s) subject to a Nomination made in compliance with the procedures set forth in this Section 2.3 shall be eligible for election at an annual or special meeting of stockholders of the Corporation, and any individual(s) subject to a Nomination not made in compliance with this Section 2.3 shall not be considered nor acted upon at such meeting of stockholders.

(b)For Nominations to be properly brought before an annual or special meeting of stockholders of the Corporation by a stockholder pursuant to Section 2.3(A)(3) or Section 2.3(B)(2), respectively, the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation at the principal executive offices of the Corporation pursuant to this Section 2.3. To be timely, the stockholder’s notice must be delivered to the Secretary of the Corporation as provided in Section 2.3(C)(1)(c) or Section 2.3(C)(1)(d), in the case of an annual meeting of stockholders of the Corporation, and Section 2.3(C)(1)(e), in the case of a special meeting of stockholders of the Corporation, respectively.

(c)In the case of an annual meeting of stockholders of the Corporation, to be timely, any Nomination made pursuant to Section 2.3(A)(3) shall be delivered to the Secretary of the Corporation at the principal executive offices of the Corporation not later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made by the Corporation). In no event shall the public announcement of an adjournment or postponement of an annual meeting of stockholders of the Corporation commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above.

(d)Notwithstanding Section 2.3(C)(1)(c), in the event that the number of directors to be elected to the Board of Directors at an annual meeting of stockholders of the Corporation is increased and there is no public announcement by the Corporation naming the nominees for the additional directorships at least one hundred (100) days prior to the first anniversary of the preceding year’s annual meeting, the stockholder’s notice required by this Section 2.3 shall also be considered timely, but only with respect to nominees for the additional directorships, if it shall be delivered to the Secretary of the Corporation at the principal executive offices of the Corporation not later than the close of business on the tenth (10th) day following the day on which such public announcement is first made by the Corporation.

(e)In the case of a special meeting of stockholders of the Corporation, to be timely, any Nomination made pursuant to Section 2.3(B)(2) shall be delivered to the Secretary of the Corporation at the principal executive offices of the Corporation not earlier than the close of business on the one hundred twentieth (120th) day prior to such special meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such special meeting or the tenth (10th) day following the day on which public announcement is first made of the date of such special meeting and of the nominees proposed by the Board of Directors to be elected at such special meeting. In no event shall the public announcement of an adjournment or postponement of a special meeting of stockholders of the Corporation commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above.

(f)A stockholder’s notice of Nomination(s) pursuant to Section 2.3(A)(3) or Section 2.3(B)(2) shall set forth: (i) as to any Nomination to be made by such stockholder, (A) all information relating to the individual subject to such Nomination that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to and in accordance with Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), without regard to the application of the Exchange Act to either the Nomination or the Corporation, and (B) such individual’s written

consent to being named in a proxy statement as a nominee and to serving as a director if elected, and (C) the actions proposed to be taken by such individual if elected; and (ii) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the Nomination is made (A) the name and address of such stockholder, as they appear on the Corporation’s books, and of such beneficial owner, (B) the class, series, and number of shares of capital stock of the Corporation which are owned beneficially and of record by such stockholder and such beneficial owner, (C) a representation that the stockholder is a holder of record of stock of the Corporation entitled to vote at such meeting and such stockholder (or a qualified representative of the stockholder) intends to appear in person or by proxy at the meeting to propose such Nomination, (D) a description of any agreement, arrangement, or understanding between such stockholder and such beneficial owner, and the individual subject to such Nomination, and (E) a representation whether the stockholder or the beneficial owner, if any, intends or is part of a group which intends (1) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Corporation’s outstanding capital stock required to elect the individual subject to the Nomination and/or (2) otherwise to solicit proxies from stockholders of the Corporation in support of such Nomination. The Corporation may require any individual subject to such Nomination to furnish such other information as it may reasonably require to determine the eligibility of such individual to serve as a director of the Corporation.

(2)Stockholder Business.

(a)Only such Business shall be conducted at an annual or special meeting of stockholders of the Corporation as shall have been brought before such meeting in compliance with the procedures set forth in this Section 2.3, and any Business not brought in accordance with this Section 2.3 shall not be considered nor acted upon at such meeting of stockholders; provided, however, that if the Business is otherwise subject to Rule 14a-8 (or any successor thereto) promulgated under the Exchange Act (“Rule 14a-8”), the notice requirements of this Section 2.3(C)(2) shall be deemed satisfied by a stockholder if the stockholder has notified the Corporation of his, her, or its intention to present such Business at an annual meeting of stockholders of the Corporation in accordance with Rule 14a-8, and such Business has been included in a proxy statement that has been prepared by the Corporation to solicit proxies for such annual meeting.

(b)In the case of an annual meeting of stockholders of the Corporation, to be timely, any such written notice of a proposal of Business pursuant to Section 2.3(A)(3) shall be delivered to the Secretary of the Corporation at the principal executive offices of the Corporation not later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting (provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made by the Corporation). In no event shall the public announcement of an adjournment or postponement of an annual meeting of stockholders of the Corporation commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above.

(c)A stockholder’s notice of a proposal of Business pursuant to Section 2.3(A)(3) shall set forth: (i) as to the Business proposed by such stockholder, a brief description of the Business desired to be brought before the meeting, the text of the proposal or Business (including the text of any resolutions proposed for consideration and in the event that such Business includes a proposal to amend the Bylaws of the Corporation, the language of the proposed amendment), the reasons for conducting such Business at the meeting and any material interest in such Business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made; and (ii) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made (A) the name and address of such stockholder, as they appear on the Corporation’s books, and of such beneficial owner, (B) the class, series, and number of shares of capital stock of the Corporation which are owned beneficially and of record by such stockholder and such beneficial owner, (C) a representation that the stockholder is a holder of record of stock of the Corporation entitled to vote at such meeting and such stockholder (or a qualified representative of such stockholder) intends to appear in person or by proxy at the meeting to propose such Business, and (D) a representation whether the stockholder or the beneficial owner, if any, intends or is part of a group which intends (1) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Corporation’s outstanding capital stock required to approve or adopt the proposed Business and/or (2) otherwise to solicit proxies from stockholders of the Corporation in support of such Business.

(D)General.

(1)Except as otherwise provided by law, the chairman of the meeting of stockholders of the Corporation shall have the power and duty (a) to determine whether a Nomination or Business proposed to be brought before such meeting was made or proposed in accordance with the procedures set forth in

this Section 2.3, and (b) if any proposed Nomination or Business was not made or proposed in compliance with this Section 2.3, to declare that such Nomination or Business shall be disregarded or that such proposed Nomination or Business shall not be considered or transacted. Notwithstanding the foregoing provisions of this Section 2.3, if the stockholder (or a qualified representative of such stockholder) does not appear at the annual or special meeting of stockholders of the Corporation to present a Nomination or Business, such Nomination or Business shall be disregarded and such Nomination or Business shall not be considered or transacted, notwithstanding that proxies in respect of such vote may have been received by the Corporation.

(2)For purposes of this Section 2.3, “public announcement” shall include disclosure in a press release reported by the Dow Jones News Service, Associated Press or comparable national news service, or in a document publicly filed by the Corporation with the Securities and Exchange Commission.

(3)Nothing in this Section 2.3 shall be deemed to affect (a) the rights or obligations, if any, of stockholders of the Corporation to request inclusion of proposals in the Corporation’s proxy statement pursuant to Rule 14a-8 (to the extent that the Corporation or such proposals are subject to Rule 14a-8), or (b) the rights, if any, of the holders of any series of preferred stock of the Corporation to elect directors pursuant to any applicable provisions of the Certificate of Incorporation of the Corporation (the “Certificate of Incorporation”).

Section 2.4.Special Meetings. A special meeting of stockholders of the Corporation for any purpose or purposes may be called at any time only by (i) resolution of the Board of Directors or (ii) by a committee of the Board of Directors that has been duly designated by the Board of Directors and whose powers and authority, as provided in a resolution of the Board of Directors or in these Bylaws, include the power to call such meetings, and may not be called by any other person or persons, such special meeting to be held at such date and time as shall be designated in the notice or waiver of notice thereof. Only business within the purposes described in the Corporation’s notice of meeting required by Section 2.5 may be conducted at the special meeting.

Section 2.5.Notice of Meetings. Whenever stockholders are required or permitted to take any action at a meeting, a written notice of the meeting shall be given that shall state the place, date, and hour of the meeting and, in the case of a special meeting, the purpose or purposes for which the meeting is called. Unless otherwise provided by law, the Certificate of Incorporation, or these Bylaws, the written notice of any meeting shall be given no less than ten (10) nor more than sixty (60) days before the date of the meeting to each stockholder entitled to vote at such meeting. If mailed, such notice shall be deemed to be given when deposited in the United States mail, postage prepaid, directed to the stockholder at his, her, or its address as it appears on the records of the Corporation.

Section 2.6.Fixing Date for Determination of Stockholders of Record. In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, or entitled to receive payment of any dividend or other distribution or allotment of any rights, or entitled to exercise any rights in respect of any change, conversion, or exchange of stock or for the purpose of any other lawful action, the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Directors and which record date: (a) in the case of determination of stockholders entitled to vote at any meeting of stockholders or adjournment thereof, shall, unless otherwise required by law, not be more than sixty (60) nor less than ten (10) days before the date of such meeting, and (b) in the case of any other action, shall not be more than sixty (60) days prior to such other action. If no record date is fixed: (i) the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given, or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held, and (ii) the record date for determining stockholders for any other purpose shall be at the close of business on the day on which the Board of Directors adopts the resolution relating thereto. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided, however, that the Board of Directors may fix a new record date for the adjourned meeting.

Section 2.7.Voting List; Right to Examine. The officer who has charge of the stock ledger of the Corporation shall prepare and make, at least ten (10) days before every meeting of stockholders, a complete list of the stockholders entitled to vote at the meeting, arranged in alphabetical order, and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination of any stockholder for any purpose germane to the meeting for a period of at least ten (10) days prior to the meeting: (i) on a reasonably accessible electronic network, provided that the information required to gain access to such list is provided with the notice of the meeting, or (ii) during ordinary business hours, at the principal place of business of the Corporation. The list of stockholders must also be open to examination at the meeting as required by applicable law. Except as otherwise required by law, the stock ledger shall be the only evidence as to who are the stockholders entitled to examine the stock ledger, the list of stockholders or the books of the Corporation, or to vote in person or by proxy at any meeting of stockholders.

Section 2.8.Adjournments. Any meeting of stockholders, annual or special, may adjourn from time to time to reconvene at the same or some other place, and notice need not be given of any such adjourned meeting if the time and place, if any, thereof, and the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such adjourned meeting are announced at the meeting at which the adjournment is taken. At the adjourned meeting, the Corporation may transact any business which might have been transacted at the original meeting. If the adjournment is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

Section 2.9.Quorum. Except as otherwise provided by law, the Certificate of Incorporation, or these Bylaws, at each meeting of stockholders the presence in person or by proxy of the holders of a majority in voting power of all outstanding shares of stock entitled to vote at the meeting shall be necessary and sufficient to constitute a quorum. In the absence of a quorum, the stockholders so present may, by a majority in voting power thereof, adjourn the meeting from time to time in the manner provided in Section 2.8 until a quorum shall attend. Shares of its own stock belonging to the Corporation or to another corporation, if a majority of the shares entitled to vote in the election of directors of such other corporation is held, directly or indirectly, by the Corporation, shall neither be entitled to vote nor be counted for quorum purposes; provided, however, that the foregoing shall not limit the right of the Corporation to vote stock, including but not limited to its own stock, held by it in a fiduciary capacity.

Section 2.10.Organization. Meetings of stockholders shall be presided over by the Chief Executive Officer, if any, or in his or her absence by the Chairman of the Board of Directors, if any, or in his or her absence by the President, or in his or her absence by a Vice President, or in the absence of the foregoing persons by a chairman designated by the Board of Directors, or in the absence of such designation, by a chairman chosen at the meeting. The Secretary of the Corporation shall act as secretary of the meeting, but in his or her absence the chairman of the meeting may appoint any person to act as secretary of the meeting.

Section 2.11.Voting; Proxies. Except as otherwise provided by the Certificate of Incorporation, each stockholder entitled to vote at any meeting of stockholders shall be entitled to one vote for each share of stock held by such stockholder that has voting power upon the matter in question. Each stockholder entitled to vote at a meeting of stockholders may authorize another person or persons to act for such stockholder by proxy, but no such proxy shall be voted or acted upon after three (3) years from its date, unless the proxy provides for a longer period. A proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A stockholder may revoke any proxy that is not irrevocable by attending the meeting and voting in person or by filing an instrument in writing revoking the proxy or another duly executed proxy bearing a later date with the Secretary of the Corporation. Voting at meetings of stockholders need not be by written ballot. At all meetings of stockholders for the election of directors a majority of the votes cast shall be sufficient to elect. All other elections and questions presented to the stockholders at a meeting at which a quorum is present shall, unless otherwise provided by the Certificate of Incorporation, these Bylaws, the rules or regulations of any stock exchange applicable to the Corporation, or applicable law or pursuant to any regulation applicable to the Corporation or its securities, be decided by the affirmative vote of the holders of a majority of the votes cast. For purposes of these Bylaws, “votes cast” shall mean all votes cast in favor of and against a particular proposal or matter, but shall not include abstentions or broker non-votes.

Section 2.12.Inspectors of Election. The Corporation may, and shall if required by law, in advance of any meeting of stockholders, appoint one or more inspectors of election, who may be employees of the Corporation, to act at the meeting or any adjournment thereof and to make a written report thereof. The Corporation may designate one or more persons as alternate inspectors to replace any inspector who fails to act. In the event that no inspector so appointed or designated is able to act at a meeting of stockholders, the chairman of the meeting shall appoint one or more inspectors to act at the meeting. Each inspector, before entering upon the discharge of his or her duties, shall take and sign an oath to execute faithfully the duties of inspector with strict impartiality and according to the best of his or her ability. The inspector or inspectors so appointed or designated shall (i) ascertain the number of shares of capital stock of the Corporation outstanding and the voting power of each such share, (ii) determine the shares of capital stock of the Corporation represented at the meeting and the validity of proxies and ballots, (iii) count all votes and ballots, (iv) determine and retain for a reasonable period a record of the disposition of any challenges made to any determination by the inspectors, and (v) certify their determination of the number of shares of capital stock of the Corporation represented at the meeting and such inspectors’ count of all votes and ballots. Such certification and report shall specify such other information as may be required by applicable law. In determining the validity and counting of proxies and ballots cast at any meeting of stockholders of the Corporation, the inspectors may consider such information as is permitted by applicable law. No person who is a candidate for an office at an election may serve as an inspector at such election.

Section 2.13.Consent of Stockholders in Lieu of Meeting. Except as otherwise provided in the Certificate of Incorporation, the holders of common stock of the Corporation may not act without a meeting.

Section 2.14.Conduct of Meetings. The date and time of the opening and the closing of the polls for each matter upon which the stockholders will vote at a meeting shall be announced at the meeting by the chairman of the meeting. The Board of Directors may adopt by resolution such rules and regulations for the conduct of the meeting of stockholders as it shall deem appropriate. Except to the extent inconsistent with such rules and regulations as adopted by the Board of Directors, the chairman of the meeting of stockholders shall have the right and authority to convene and to adjourn the meeting, to prescribe such rules, regulations, and procedures and to do all such acts as, in the judgment of such chairman of the meeting, are appropriate for the proper conduct of the meeting. Such rules, regulations, or procedures, whether adopted by the Board of Directors or prescribed by the chairman of the meeting, may include, without limitation, the following: (i) the establishment of an agenda or order of business for the meeting, (ii) rules and procedures for maintaining order at the meeting and the safety of those present, (iii) limitations on attendance at or participation in the meeting to stockholders of record of the Corporation, their duly authorized and constituted proxies, or such other persons as the chairman of the meeting shall determine, (iv) restrictions on entry to the meeting after the time fixed for the commencement thereof, and (v) limitations on the time allotted to questions or comments by participants. The chairman of the meeting of stockholders, in addition to making any other determinations that may be appropriate to the conduct of the meeting or are otherwise contemplated by Section 2.3(D) hereof, shall, if the facts warrant, determine and declare to the meeting that a matter or business was not properly brought before the meeting and, if such chairman of the meeting should so determine, such chairman of the meeting shall so declare to the meeting, and any such matter or business not properly brought before the meeting shall not be transacted or considered. Unless and to the extent determined by the Board of Directors or the chairman of the meeting, meetings of stockholders shall not be required to be held in accordance with the rules of parliamentary procedure.

Article III

Board of Directors

Section 3.1.Number; Qualifications. Subject to the provisions of the Certificate of Incorporation, the number of directors of the Corporation shall consist of not fewer than three (3) nor more than fifteen (15) members, the exact number to be determined from time to time by resolution adopted by the affirmative vote of a majority of the entire Board of Directors; provided, however, no director’s term shall be shortened by reason of a resolution reducing the number of directors. Directors must be natural persons who are 18 years of age or older but need not be residents of the state of Delaware, stockholders of the Corporation, or citizens of the United States.

Section 3.2.Resignation; Removal; Vacancies. Any director may resign at any time upon notice given in writing or by electronic transmission to the Corporation. A resignation is effective when the resignation is delivered unless the resignation specifies a later effective date or an effective date determined upon the happening of an event or events. Unless as otherwise provided by the Certificate of Incorporation, at a special meeting of stockholders called expressly for that purpose, any director or the entire Board of Directors may be removed from office at any time, only by the affirmative vote of 66-2/3 percent or more of the total voting power of the then outstanding capital stock of the Corporation entitled to vote generally in the election of directors, voting as a single class. Unless otherwise provided by law or the Certificate of Incorporation, any newly created directorship or any vacancy occurring in the Board of Directors for any cause may be filled solely and exclusively by a majority of the remaining members of the Board of Directors, although such majority is less than a quorum, or by the sole remaining director, and each director so elected shall hold office until the expiration of the term of office of the director whom he has replaced or until his or her successor is elected and qualified.

Section 3.3.Regular and Special Meetings.

(A) Regular meetings of the Board of Directors may be held at such places within or without the state of Delaware and at such times as the Board of Directors may from time to time determine, and if so determined, notices thereof need not be given.

(B) Special meetings of the Board of Directors may be held at any time or place within or without the state of Delaware whenever called by the Chief Executive Officer, President, any Vice President, the Secretary, or by at least two members of the Board of Directors. Notice of a special meeting of the Board of Directors shall be given by the person or persons calling the meeting at least twenty-four (24) hours before the special meeting.

Section 3.4.Quorum; Vote Required for Action. At all meetings of the Board of Directors a majority of the whole Board of Directors shall constitute a quorum for the transaction of business. Except in cases

in which the Certificate of Incorporation or these Bylaws otherwise provide, the vote of a majority of the votes cast by directors present at a meeting at which a quorum is present shall be the act of the Board of Directors.

Section 3.5.Organization. Meetings of the Board of Directors shall be presided over by the Chairman of the Board of Directors, if any, or in his or her absence by the Vice Chairman of the Board of Directors, if any, or in his or her absence by the Chief Executive Officer, or in the absence of the foregoing persons by a chairman chosen at the meeting. The Secretary shall act as secretary of the meeting, but in his or her absence the chairman of the meeting may appoint any person to act as secretary of the meeting.

Section 3.6.Committees.

(A) The Board of Directors may designate one or more committees, each committee to consist of one or more of the directors of the Corporation. The Board of Directors may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of the committee. In the absence or disqualification of a member of the committee, the member or members thereof present at any meeting and not disqualified from voting, whether or not he, she, or they constitute a quorum, may unanimously appoint another member of the Board of Directors to act at the meeting in place of any such absent or disqualified member. Any such committee, to the extent permitted by law and to the extent provided in the resolution of the Board of Directors or these Bylaws, shall have and may exercise all the powers and authority of the Board of Directors in the management of the business and affairs of the Corporation, and may authorize the seal of the Corporation to be affixed to all papers which may require it.

(B) Unless the Board of Directors otherwise provides, each committee designated by the Board of Directors may make, alter, and repeal rules for the conduct of its business. In the absence of such rules, each committee shall conduct its business in the same manner as the Board of Directors conducts its business pursuant to this Article III of these Bylaws.

Section 3.7.Action of Directors in Lieu of Meeting. Unless otherwise restricted by the Certificate of Incorporation or these Bylaws, any action required or permitted to be taken at any meeting of the Board of Directors, or of any committee thereof, may be taken without a meeting, without prior notice, and without a vote, if all members of the Board of Directors or such committee, as the case may be, consent thereto in writing or by electronic transmission, and the writing or writings or electronic transmission or transmissions are filed with the minutes of proceedings of the Board of Directors or such committee. Such filing shall be in paper form if such minutes are maintained in paper form and shall be in electronic form if such minutes are maintained in electronic form.

Section 3.8.Attendance Via Telecommunications. Members of the Board of Directors, or any committee designated by the Board of Directors, may participate in a meeting thereof by means of conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and participation in a meeting pursuant to this Section 3.8 shall constitute presence in person at such meeting.

Article IV

Notice - Waivers - Meetings

Section 4.1.Manner of Notice. Except as otherwise provided herein or permitted by applicable law, notices to directors and stockholders shall be in writing and delivered personally or mailed to the directors or stockholders at their addresses appearing on the books of the Corporation. Notice to directors may be given by telecopier, telephone, or other means of electronic transmission.

Section 4.2.Waiver of Notice of Meetings of Stockholders, Directors, and Committees. Any written waiver of notice, signed by the person entitled to notice, whether before or after the time stated therein, shall be deemed equivalent to notice. Attendance of a person at a meeting shall constitute a waiver of notice of such meeting, except when the person attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. Neither the business to be transacted at, nor the purpose of any regular or special meeting of the stockholders, directors, or members of a committee of directors need be specified in any written waiver of notice.

Article V

Officers

Section 5.1.Executive Officers; Election; Qualifications; Term of Office; Resignation; Removal; Vacancies. The Board of Directors shall elect a President and Secretary or Treasurer, and it may, if it so determines, choose a Chairman of the Board of Directors and a Vice Chairman of the Board of Directors from among its members. The Board of Directors may also elect a Chief Executive Officer, one or more Vice Presidents, one or more Assistant Secretaries, one or more Assistant Treasurers, and such other officers as the Board of Directors deems necessary. Each such officer shall hold office until the first meeting of the Board of Directors after the annual meeting of stockholders next succeeding his or her election, and until his or her successor is elected and qualified or until his or her earlier death, resignation, or removal. Any officer may resign at any time upon written notice to the Corporation. The Board of Directors may remove any officer, with or without cause, at any time, but such removal shall be without prejudice to the contractual rights of such officer, if any, with the Corporation. Any number of offices may be held by the same person. Any vacancy occurring in any office of the Corporation by death, resignation, removal, or otherwise may be filled for the unexpired portion of the term by the Board of Directors at any regular or special meeting.

Section 5.2.Powers and Duties of Executive Officers. The officers of the Corporation shall have such powers and duties in the management of the Corporation as may be prescribed by the Board of Directors and, to the extent not so provided, as generally pertain to their respective officers, subject to the control of the Board of Directors. The Board of Directors may require any officer, agent, or employee to give security for the faithful performance of his or her duties.

Article VI

Certificates of Stock

Section 6.1.Certificates. Every holder of stock represented by certificates shall be entitled to have a certificate signed by or in the name of the Corporation by the Chairperson or Vice Chairperson of the Board of Directors, if any, or the President or a Vice President, and by the Treasurer or an Assistant Treasurer, or the Secretary or an Assistant Secretary, of the Corporation certifying the number of shares owned by such holder in the Corporation. Any of or all the signatures on the certificate may be a facsimile. In case any officer, transfer agent, or registrar who has signed or whose facsimile signature has been placed upon a certificate shall have ceased to be such officer, transfer agent, or registrar before such certificate is issued, it may be issued by the Corporation with the same effect as if such person were such officer, transfer agent, or registrar at the date of issue. The Corporation shall not have the power to issue a certificate in bearer form.

Section 6.2.Lost, Stolen, or Destroyed Stock Certificates; Issuance of New Certificates. The Corporation may issue a new certificate of stock in the place of any certificate theretofore issued by it, alleged to have been lost, stolen, or destroyed, and the Corporation may require the owner of the lost, stolen, or destroyed certificate, or such owner’s legal representative, to give the Corporation a bond sufficient to indemnify it against any claim that may be made against it on account of the alleged loss, theft, or destruction of any such certificate or the issuance of such new certificate.

Article VII

Right to Indemnification

Section 7.1.Right to Indemnification. The Corporation shall indemnify and hold harmless, to the fullest extent permitted by applicable law as it presently exists or may hereafter be amended, any person who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”), by reason of the fact that he or she or a person for whom he or she is the legal representative, is or was a director or officer of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust, enterprise, or nonprofit entity, including service with respect to employee benefit plans (an “indemnitee”), against all liability and loss suffered and expenses (including attorneys' fees) reasonably incurred by such indemnitee. The Corporation shall not be obligated to indemnify an indemnitee (a) with respect to a proceeding (or part thereof) initiated or brought voluntarily by such indemnitee and not by way of defense, (b) for any amounts paid in settlement of an action indemnified against by the Corporation without the proper written consent of the Corporation, or (c) in connection with any event in which the indemnitee did not act in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the Corporation.

Section 7.2.Prepayment of Expenses. The Corporation shall to the fullest extent permitted by applicable law pay the expenses (including attorneys’ fees) incurred by an indemnitee in defending any proceeding in advance of its final disposition; provided, however, that the payment of expenses incurred by a current director or