0001850079falseTelesis Bio Inc.00018500792024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 07, 2024 |

TELESIS BIO INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40497 |

45-1216839 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

10431 Wateridge Circle Suite 150 |

|

San Diego, California |

|

92121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 228-4115 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

TBIO |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2024, Telesis Bio Inc. issued a press release (the “Earnings Release”) announcing results for the quarter ended June 30, 2024. A copy of the Earnings Release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information under Item 2.02 in this current report on Form 8-K and the related information in the Earnings Release attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TELESIS BIO INC. |

|

|

|

|

Date: |

August 7, 2024 |

By: |

/s/ Eric Esser |

|

|

|

Eric Esser

President and Chief Executive Officer |

Telesis Bio Reports Second Quarter and First Half 2024 Financial Results

August 7, 2024

SAN DIEGO, August 7, 2024 (GLOBE NEWSWIRE) – Telesis Bio Inc. (NASDAQ: TBIO), a leading provider of RNA and DNA solutions enabling researchers to accelerate therapeutic discovery through advanced, flexible, and rapid automated synthesis technology in their own lab, today announced financial results for the second quarter and first half of 2024.

Highlights

•Gibson SOLA – the Company continues to advance its Gibson SOLA reagent platform that enables on-premises automated overnight synthesis of high-fidelity long DNA and mRNA on a variety of liquid handling platforms. The Company’s presentation “Enhancing Therapeutic Protein Production with Gibson SOLA Enzymatic DNA Assembly: Pioneering on-Demand DNA and mRNA Synthesis for Biotechnological Innovation”, delivered in May at the 2024 PEGS conference in Boston was well received, and the Company continues to see growing interest in the market for adopting this platform.

•Eton Subsidiary – the Company made a strategic decision to divest its Eton subsidiary. As a result, Eton is reflected as a discontinued operation in the consolidated financial statements of the Company for all periods presented.

•Second Quarter, 2024 Restructuring – along with the action related to our Eton subsidiary noted above, in the second quarter of the year the Company undertook a variety of additional restructuring activities tied to further reducing its cost base across all areas of the business. The goal of this process was to align our cost structure to current market conditions and our focus on commercial adoption of Gibson SOLA. While these actions resulted in significant second quarter, 2024 non-recurring expenditures (described in the Summary of Financial Results that follows), the favorable impact on future quarters will be substantial relative to Company spending levels of recent years.

•CEO Transition – as previously reported on April 18, 2024, Eric Esser , President, and COO of Telesis Bio assumed the role of CEO and joined the Company’s Board of Directors. Prior to his appointment as CEO, Eric had successfully run Telesis Bio’s operations for approximately two years.

•Pfizer Collaboration - in other recent highlights, the Company continues to pursue activities under its strategic research collaboration and license agreement with Pfizer. This program is based upon Telesis’ proprietary SOLA platform which utilizes enzymatic DNA synthesis technology for potential application by Pfizer in mRNA-based vaccines and other biopharma products.

Summary of Second Quarter 2024 Financial Results

Revenue - Revenue for the three months ended June 30, 2024 was $1.6 million compared to $7.0 million for the three months ended June 30, 2023 ($2.7 million and $8.7 million, respectively including revenue from Eton). The decrease was attributable to a reduction in product revenue of $1.8 million driven by our transition to Gibson SOLA as our primary commercial focus, and a decrease in collaboration revenue of $3.5 million, driven primarily by the timing of milestone completion under our strategic collaborations with Pfizer and reduction in deferred revenue recognition from up-front payments under that collaboration.

Gross Margin – The Company’s gross margin percentage was -52% for the three months ended June 30, 2024, compared to 71% for the same period in 2023. The unfavorable change in gross margin percentage was primarily driven by recognition of $1.8 million in one-time charges related to restructuring, and a decrease in high-margin collaboration revenue due to milestone timing. Absent the $1.8 million restructuring charge in the second quarter of 2024, gross margin would have been 64% for the quarter.

Operating Expense – Second quarter of 2024 operating expense of $10.7 million was $1.7 million or 14% improved from the prior year result of $12.4 million even with significant restructuring charges recorded during the current year period. Exclusive of employee severance and impairment charges tied to restructuring activity, the current year expense level of $10.7 million would have been $8.8 million representing a $3.7 million or 30% reduction from the prior year level of $12.4 million.

With respect to all restructuring charges noted above and posted in the second quarter of 2024, the favorable impact on future quarters will be substantial.

Net loss was $13.2 million for the second quarter of 2024, compared to a loss of $8.4 million in the same period in the prior year. Net loss per share was $7.62 for the second quarter of 2024, compared to $5.10 for the corresponding prior year period.

As of June 30, 2024, cash, cash equivalents, restricted cash, and investments were $10.3 million, and notes payable was $5.3 million.

The Company will not be issuing additional forward-looking guidance at this time.

About Telesis Bio

Telesis Bio is empowering scientists with the ability to create novel, synthetic biology-enabled solutions for many of humanity’s greatest challenges. As inventors of the industry-standard Gibson Assembly® method and the first commercial automated benchtop DNA and mRNA synthesis system, Telesis Bio is enabling rapid, accurate and reproducible writing of DNA and mRNA for numerous downstream markets. Company products and technologies deliver virtually

error-free synthesis of DNA and RNA at scale within days and hours instead of weeks or months. Scientists around the world are using the technology in their own laboratories to accelerate the design-build-test paradigm for novel, high-value products for precision medicine, biologics drug discovery, vaccine and therapeutic development, genome editing, and cell and gene therapy. Telesis Bio is a public company based in San Diego. For more information, visit www.telesisbio.com. Telesis Bio, the Telesis Bio logo, Gibson Assembly, and BioXp are trademarks of Telesis Bio Inc.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts contained herein are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include statements and guidance regarding Telesis Bio’s future financial performance as well as statements regarding the future release and success of new and existing products and services. Such statements are based on current assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially from current expectations. These risks and uncertainties, many of which are beyond our control, include risks described in the section entitled Risk Factors and elsewhere in our most recently filed Quarterly Report on Form 10-Q and Annual Report on Form 10-K. These forward-looking statements speak only as of the date hereof and should not be unduly relied upon. Telesis Bio disclaims any obligation to update these forward-looking statements.

Contact:

William J. Kullback

Chief Financial Officer

bill.kullback@telesisbio.com

Telesis Bio Inc.

Selected Statements of Operations Financial Data

(in thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

$ |

841 |

|

|

$ |

2,670 |

|

|

$ |

2,105 |

|

|

$ |

5,671 |

|

|

Service revenue |

|

— |

|

|

|

65 |

|

|

|

— |

|

|

|

101 |

|

|

Collaboration revenue |

|

— |

|

|

|

3,462 |

|

|

|

— |

|

|

|

4,424 |

|

|

Royalties and other revenue |

|

709 |

|

|

|

807 |

|

|

|

1,634 |

|

|

|

1,486 |

|

|

Total revenue |

|

1,550 |

|

|

|

7,004 |

|

|

|

3,739 |

|

|

|

11,682 |

|

|

Cost of revenue |

|

2,349 |

|

|

|

2,039 |

|

|

|

3,431 |

|

|

|

3,934 |

|

|

Gross Profit |

|

(799 |

) |

|

|

4,965 |

|

|

|

308 |

|

|

|

7,748 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

2,470 |

|

|

|

3,921 |

|

|

|

4,829 |

|

|

|

8,414 |

|

|

Sales and marketing |

|

1,698 |

|

|

|

3,192 |

|

|

|

3,260 |

|

|

|

6,867 |

|

|

General and administrative |

|

5,507 |

|

|

|

5,294 |

|

|

|

10,481 |

|

|

|

10,396 |

|

|

Impairment of property and equipment |

|

1,017 |

|

|

|

— |

|

|

|

1,017 |

|

|

|

— |

|

|

Total operating expenses |

|

10,692 |

|

|

|

12,407 |

|

|

|

19,587 |

|

|

|

25,677 |

|

|

Loss from operations |

|

(11,491 |

) |

|

|

(7,442 |

) |

|

|

(19,279 |

) |

|

|

(17,929 |

) |

|

Interest income |

|

160 |

|

|

|

374 |

|

|

|

388 |

|

|

|

764 |

|

|

Interest expense |

|

(214 |

) |

|

|

(707 |

) |

|

|

(431 |

) |

|

|

(1,346 |

) |

|

Change in fair value of derivative liabilities |

|

— |

|

|

|

19 |

|

|

|

— |

|

|

|

159 |

|

|

Other expense, net |

|

(15 |

) |

|

|

(3 |

) |

|

|

(146 |

) |

|

|

(39 |

) |

|

Provision for income taxes |

|

(1 |

) |

|

|

(4 |

) |

|

|

(3 |

) |

|

|

(7 |

) |

|

Loss from continuing operations |

|

(11,561 |

) |

|

|

(7,763 |

) |

|

|

(19,471 |

) |

|

|

(18,398 |

) |

|

Loss from discontinuing operations |

|

(1,024 |

) |

|

|

(524 |

) |

|

|

(1,751 |

) |

|

|

(1,008 |

) |

|

Net Loss |

$ |

(12,585 |

) |

|

$ |

(8,287 |

) |

|

$ |

(21,222 |

) |

|

$ |

(19,406 |

) |

|

Less: redeemable convertible preferred stock dividends |

|

(596 |

) |

|

|

(153 |

) |

|

|

(1,181 |

) |

|

|

(153 |

) |

|

Net loss attributable to common stockholders |

$ |

(13,181 |

) |

|

$ |

(8,440 |

) |

|

$ |

(22,403 |

) |

|

$ |

(19,559 |

) |

|

Net loss per share from continuing operations attributable to common stockholders—basic and diluted |

$ |

(7.03 |

) |

|

$ |

(4.79 |

) |

|

$ |

(12.14 |

) |

|

$ |

(11.24 |

) |

|

Net loss per share from discontinuing operations attributable to common stockholders—basic and diluted |

$ |

(0.59 |

) |

|

$ |

(0.32 |

) |

|

$ |

(1.03 |

) |

|

$ |

(0.61 |

) |

|

Net loss per share attributable to common stockholders—basic and diluted |

$ |

(7.62 |

) |

|

$ |

(5.10 |

) |

|

$ |

(13.17 |

) |

|

$ |

(11.85 |

) |

|

Weighted average common stock outstanding—basic and diluted |

|

1,730,210 |

|

|

|

1,654,127 |

|

|

|

1,700,596 |

|

|

|

1,651,053 |

|

|

Telesis Bio Inc.

Selected Balance Sheet Financial Data

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

2024 |

|

|

2023 |

|

Balance Sheet Data: |

|

|

|

|

|

Cash, restricted cash, cash equivalents and short-term investments |

$ |

10,314 |

|

|

$ |

19,333 |

|

Working capital |

|

7,143 |

|

|

|

22,167 |

|

Total assets |

|

52,727 |

|

|

|

70,411 |

|

Total liabilities |

|

42,781 |

|

|

|

40,873 |

|

Redeemable convertible preferred stock |

|

30,481 |

|

|

|

29,300 |

|

Accumulated deficit |

|

(182,687 |

) |

|

|

(161,465 |

) |

Total stockholders’ (deficit) equity |

|

(20,535 |

) |

|

|

238 |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity Registrant Name |

Telesis Bio Inc.

|

| Entity Central Index Key |

0001850079

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40497

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

45-1216839

|

| Entity Address, Address Line One |

10431 Wateridge Circle

|

| Entity Address, Address Line Two |

Suite 150

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

(858)

|

| Local Phone Number |

228-4115

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

TBIO

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

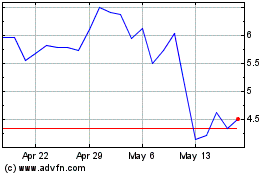

Telesis Bio (NASDAQ:TBIO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Telesis Bio (NASDAQ:TBIO)

Historical Stock Chart

From Feb 2024 to Feb 2025