Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 08 2025 - 4:03PM

Edgar (US Regulatory)

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

|

| FORM 6-K |

|

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

|

|

For the month of January 2025

Commission File Number: 001-36363

|

| TCTM KIDS IT EDUCATION INC. |

|

19/F, Building A, Vanke Times Center

No.186 Beiyuan Road, Chaoyang District

Beijing, 100102, People's Republic of China

Tel: +86 10 6213-5687

|

|

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TCTM Kids IT Education Inc.

| |

By: |

/s/ Xiaolan Tang |

| |

Name: |

Xiaolan Tang |

| |

Title: |

Chief Executive Officer |

| |

|

| Date: January 8, 2025 |

|

EXHIBIT INDEX

Exhibit 99.1

TCTM Announces Receipt of Nasdaq Notification

Regarding Minimum Bid Price

BEIJING,

January 8, 2025 /PRNewswire/ — TCTM Kids IT Education Inc. (NASDAQ: TCTM) (“TCTM” or the “Company”),

a leading provider of IT-focused supplementary STEM education services in China, today announced that it received a written notification

from the Staff of the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) dated January 3,

2025 (the “Notification”), indicating that because the closing bid price of the Company’s American depositary shares

(“ADSs”) for the last 30 consecutive business days was below the minimum bid price of US$1.00 per share, the Company

no longer meets the minimum bid price requirement for the Nasdaq Capital Market, set forth in Nasdaq Listing Rule 5550(a)(2). The

Notification has no immediate effect on the listing or the trading of the Company’s ADSs on the Nasdaq Capital Market.

Pursuant

to the Nasdaq Listing Rules 5810(c)(3)(A), the applicable grace period to regain compliance is 180 calendar days, or until July 2,

2025. The Company can cure this deficiency if the closing bid price of its ADS is $1.00 per share or higher for at least ten

consecutive business days during the grace period. In the event the Company does not regain compliance by July 2, 2025, subject to

the determination by the staff of Nasdaq, the Company may be eligible for an additional 180-day compliance period if it meets the continued

listing requirement for market value of publicly held shares and all other initial listing standards, with the exception of the minimum

bid price requirement. In this case, the Company will need to provide written notice of its intention to cure the deficiency during the

second compliance period, including by effecting a reverse stock split, if necessary.

The

Notification does not affect the Company’s business operations, and the Company will take all reasonable measures to regain

compliance within the prescribed grace period.

About TCTM Kids IT Education Inc.

TCTM is a leading provider of IT-focused supplementary

STEM education services in China. Through its innovative education platform combining live distance instruction, classroom-based tutoring

and online learning modules, TCTM offers IT-focused supplementary STEM education programs, including computer coding and robotics programming

courses, etc., targeting students between three and eighteen years of age. Aiming to encourage “code to learn,” TCTM

embraces the latest trends in STEM education and technology to develop children's logical thinking and learning abilities while allowing

them to discover their interests and potential.

Safe Harbor Statement

This current report contains forward-looking statements

made under the “safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S.

Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates,” “confident” and similar statements. TCTM may also make written or oral forward-looking statements

in its reports filed with or furnished to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Any statements

that are not historical facts, including any business outlook and statements about TCTM’s beliefs and expectations, are forward-looking

statements. Many factors, risks and uncertainties could cause actual results to differ materially from those in the forward-looking statements.

For further information, please contact:

Investor Relations Contact

TCTM Kids IT Education Inc.

Email: ir@tctm.cn

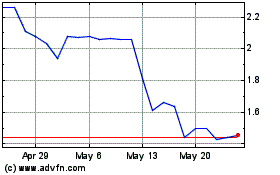

TCTM Kids IT Education (NASDAQ:TCTM)

Historical Stock Chart

From Dec 2024 to Jan 2025

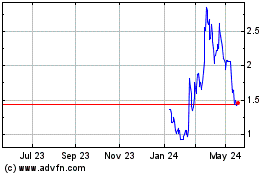

TCTM Kids IT Education (NASDAQ:TCTM)

Historical Stock Chart

From Jan 2024 to Jan 2025