SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 16)*

MILLICOM INTERNATIONAL CELLULAR S.A.

(Name of Issuer)

Common Shares

(Title of Class of Securities)

L6388F110

(CUSIP Number)

Denis Klimentchenko

Skadden, Arps, Slate, Meagher & Flom

(UK) LLP

22 Bishopsgate

London, EC2N 4BQ

Tel: +44(0)20 7519 7289

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

September 6, 2024

(Date of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box: x

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a

prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No.: L6388F110

| 1 |

NAMES OF REPORTING PERSONS

Atlas Luxco S.à r.l. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO, BK |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Luxembourg |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

69,236,111(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

69,236,111(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

69,236,111(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

40.42% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| |

|

|

|

(1) Reflects (i) 67,005,179 Swedish

Depositary Receipts (“SDRs”) beneficially owned by Atlas Luxco S.à r.l. (“Atlas”), which

may be exchanged for Issuer common shares, par value $1.50 per share (“Common Shares”), on a one-for-one basis; and

(ii) 2,230,932 Common Shares beneficially owned by Atlas. Atlas Investissement, as the controlling shareholder of Atlas, may be deemed

to have shared beneficial ownership over the Common Shares beneficially owned by Atlas. NJJ Holding, as the controlling shareholder of

Atlas Investissement, may be deemed to have shared beneficial ownership over the Common Shares beneficially owned by Atlas and Atlas Investissement.

Xavier Niel, as the sole owner of NJJ Holding, may be deemed to have shared beneficial ownership over the Common Shares beneficially owned

by Atlas, Atlas Investissement and NJJ Holding.

CUSIP No.: L6388F110

| 1 |

NAMES OF REPORTING PERSONS

Atlas Investissement |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

France |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

69,236,111(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

69,236,111(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

69,236,111(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

40.42% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| |

|

|

|

(1) Reflects (i) 67,005,179 SDRs beneficially

owned by Atlas, which may be exchanged for Common Shares on a one-for-one basis; and (ii) 2,230,932 Common Shares beneficially owned

by Atlas. Atlas Investissement, as the controlling shareholder of Atlas, may be deemed to have shared beneficial ownership over the Common

Shares beneficially owned by Atlas. NJJ Holding, as the controlling shareholder of Atlas Investissement, may be deemed to have shared

beneficial ownership over the Common Shares beneficially owned by Atlas and Atlas Investissement. Xavier Niel, as the sole owner of NJJ

Holding, may be deemed to have shared beneficial ownership over the Common Shares beneficially owned by Atlas, Atlas Investissement and

NJJ Holding.

CUSIP No.: L6388F110

| 1 |

NAMES OF REPORTING PERSONS

NJJ Holding |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

France |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

69,236,111(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

69,236,111(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

69,236,111(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

40.42% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| |

|

|

|

(1) Reflects (i) 67,005,179 SDRs beneficially

owned by Atlas, which may be exchanged for Common Shares on a one-for-one basis; and (ii) 2,230,932 Common Shares beneficially owned

by Atlas. Atlas Investissement, as the controlling shareholder of Atlas, may be deemed to have shared beneficial ownership over the Common

Shares beneficially owned by Atlas. NJJ Holding, as the controlling shareholder of Atlas Investissement, may be deemed to have shared

beneficial ownership over the Common Shares beneficially owned by Atlas and Atlas Investissement. Xavier Niel, as the sole owner of NJJ

Holding, may be deemed to have shared beneficial ownership over the Common Shares beneficially owned by Atlas, Atlas Investissement and

NJJ Holding.

CUSIP No.: L6388F110

| 1 |

NAMES OF REPORTING PERSONS

Xavier Niel |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

France |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

69,236,111(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

69,236,111(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

69,236,111(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS)

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

40.42% |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

| |

|

|

|

(1) Reflects (i) 67,005,179 SDRs beneficially

owned by Atlas, which may be exchanged for Common Shares on a one-for-one basis; and (ii) 2,230,932 Common Shares beneficially owned

by Atlas. Atlas Investissement, as the controlling shareholder of Atlas, may be deemed to have shared beneficial ownership over the Common

Shares beneficially owned by Atlas. NJJ Holding, as the controlling shareholder of Atlas Investissement, may be deemed to have shared

beneficial ownership over the Common Shares beneficially owned by Atlas and Atlas Investissement. Xavier Niel, as the sole owner of NJJ

Holding, may be deemed to have shared beneficial ownership over the Common Shares beneficially owned by Atlas, Atlas Investissement and

NJJ Holding.

Explanatory Note

This

Amendment No. 16 (“Amendment No. 16”) to Schedule 13D relates to the Common Shares, par value $1.50 per share

(the “Common Shares”), of Millicom International Cellular S.A., a Luxembourg company (the “Issuer”),

and amends and supplements the initial statement on Schedule 13D filed on February 24, 2023, as amended by Amendment No. 1 to

the Schedule 13D filed on March 28, 2023, Amendment No. 2 to the Schedule 13D filed on April 26, 2023, Amendment No. 3

to the Schedule 13D filed on May 12, 2023, Amendment No. 4 to the Schedule 13D filed on May 25, 2023, Amendment No. 5

to the Schedule 13D filed on June 2, 2023, Amendment No. 6 to the Schedule 13D filed on July 24, 2023, Amendment No. 7

to the Schedule 13D filed on August 24, 2023, Amendment No. 8 to the Schedule 13D filed on October 2, 2023, Amendment No. 9

to the Schedule 13D filed on November 8, 2023, Amendment No. 10 to the Schedule 13D filed on January 17, 2024, Amendment

No. 11 to the Schedule 13D filed on May 23, 2024, Amendment No. 12 to the Schedule 13D filed on July 3, 2024, Amendment

No 13. to the Schedule 13D filed on July 22, 2024, Amendment No. 14 to the Schedule 13D filed on August 2, 2024 and Amendment

No. 15 to the Schedule 13D filed on August 26, 2024 (as so amended, the “Schedule 13D”). Capitalized terms

used but not defined in this Amendment No. 16 shall have the same meanings ascribed to them in the Schedule 13D.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and supplemented by adding

the following:

On

September 6, 2024, Atlas entered into a blind mandate purchase plan, in the form of an SDR Purchase Mandate (the “Purchase

Mandate”), pursuant to which Atlas may purchase up to a maximum of 7,000,000 SDRs, subject to certain other pre-agreed pricing

limits and volume limits. The maximum purchase price for each SDR will be the SEK equivalent, from time to time, of USD 25.75. The amount

and timing of any purchase, if any, may vary and will be determined based on market conditions, share price and other factors. The program

will not require Atlas to purchase any specific number of SDRs or execute any purchases at all, and may be modified, suspended or terminated

at any time at short notice in accordance with the terms of the Purchase Mandate.

The

foregoing description of the Purchase Mandate is qualified in its entirety by reference to the Purchase Mandate, which is filed as Exhibit 16

to the Schedule 13D and incorporated herein by reference.

Item 6. Contracts, Arrangements, Understandings or Relationships

With Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby amended and

supplemented as follows:

The information set forth

in Item 4 of this Amendment No. 16 is incorporated herein by reference.

Item 7. Material to be filed as Exhibits.

Item 7 of the Schedule 13D is hereby amended by adding the following

exhibit:

SIGNATURES

After reasonable inquiry and

to the best of each of the undersigned’s knowledge and belief, each of the undersigned, severally and not jointly, certifies that

the information set forth in this statement is true, complete and correct.

Dated: September 9, 2024

| ATLAS LUXCO S.À R.L. |

|

| |

|

| By: |

/s/ Anthony Maarek |

|

| Name: |

Anthony Maarek |

|

| Title: |

Manager |

|

| |

|

| By: |

/s/ Tigran Khachatryan |

|

| Name: |

Tigran Khachatryan |

|

| Title: |

Manager |

|

| |

|

| ATLAS INVESTISSEMENT |

|

| |

|

| By: |

/s/ Xavier Niel |

|

| Name: |

Xavier Niel |

|

| Title: |

Président of NJJ Holding itself Président of Atlas Investissement |

|

| |

|

| NJJ HOLDING |

|

| |

|

| By: |

/s/ Xavier Niel |

|

| Name: |

Xavier Niel |

|

| Title: |

Président |

|

| |

|

| XAVIER NIEL |

|

| |

|

| By: |

/s/ Xavier Niel |

|

Exhibit 16

[LETTERHEAD]

SDR PURCHASE MANDATE

Dated 6th September, 2024

BY AND BETWEEN:

ATLAS LUXCO S.À

R.L., a Luxembourg limited liability company, having its registered office at 53, boulevard Royal, L-2449 Luxembourg, Grand

Duchy of Luxembourg, registered with the Trade and Companies Register of Luxembourg under number B274990, uniquely identified by

its Legal Entity Identifier 254900O4SDG3SCXOL887, duly represented for the purposes hereof,

(the “Client”)

On the one hand,

AND:

[*****][*****],

(the “Intermediary”)

On the other hand,

(the Client and the Intermediary, each a “Party”

and together the “Parties”)

WHEREAS:

by virtue of this agreement (the “Agreement”),

the Client wishes to appoint the Intermediary to acquire SDRs (as defined below) on behalf of the Client representing (i) a total

number of SDRs not higher than the Target Number of SDRs (as defined below) and (ii) an Aggregate Purchase Amount (as defined below)

in respect of the last day of the Purchase Period (as defined below) not higher than the Target Amount (as defined below).

NOW IT IS HEREBY AGREED AS FOLLOWS:

“Aggregate Purchase Amount”

has the meaning ascribed to this term in the Mandate Letter.

“Assignment” has the meaning

ascribed to this term in Clause 2.1 (Appointment).

“Commencement

Date” means the Monday the 9th of September 2024 (included).

“Completion Date” means the

date deemed to be the “Completion Date” pursuant to Clause 2.2 (Completion of the Assignment).

“Completion Event” means that

either (i) the Aggregate Purchase Amount is equal to (or as close as possible to but without exceeding) the Target Amount or (ii) the

number of SDRs purchased under this Agreement is equal to the Target Number of SDRs.

“Daily Purchase Amount” has

the meaning given to such term in the Mandate Letter.

“Deposit

Agreement” means the general terms and conditions of SDR Issuer for Swedish depositary receipts regarding Shares dated

January 2012, as amended in February 2022 and as from time to time amended or supplemented in accordance with their terms.

“Early Termination Date” has

the meaning ascribed to this term in Clause 7.2 or 7.3 (Early termination in case of insolvency or Early termination at the request

of the Client), as the case may be.

“End Date” has the meaning

given to such term in the Mandate Letter.

“Event” has the meaning ascribed

to this term in Clause 7.2 (Early termination in case of insolvency).

“Exchange Act” has the meaning

ascribed to this term in Clause 2.1 (Appointment).

“Issuer”

means Millicom International Cellular S.A.

“Mandate Letter” means a letter

whose title is “Project Meria – SDR Mandate Letter” entered into by the Parties to the Agreement dated on or

about the date hereof setting out certain commercial terms with respect to the Agreement.

“MAR” means Regulation (EU)

No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and

repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC

and 2004/72/EC.

“Market Disruption Event” means

any suspension of, or material limitation imposed on, trading by the Swedish Exchange or otherwise under applicable laws or regulations

and whether by reason of movements in price exceeding limits permitted by the Swedish Exchange or otherwise under applicable laws or regulations

(i) relating to the SDRs on the Swedish Exchange, or (ii) in futures or options contracts relating to the SDRs (or respectively

to the Shares on the US Exchange).

“Maximum Price per SDR” has

the meaning ascribed to this term in the Mandate Letter.

“Purchase Period” means the

period from, and including, the Commencement Date to, and including, the Completion Date.

“Relevant Ratio” means the

number of Shares representing one SDR pursuant to the terms of the Deposit Agreement on a given date, being as of the date of this Agreement

one such SDR representing one Share.

“SDRs” means Swedish depositary

receipts relating to the Issuer (ISIN: SE0001174970) issued by the SDR Issuer in respect of the Shares, the Relevant Ratio of such Shares

representing one SDR and each traded on the Swedish Exchange.

“SDR Issuer” means

Skandinaviska Enskilda Banken AB (publ).

“Share”

means the ordinary shares constituting the capital of the Issuer.

“Swedish

Exchange” means Nasdaq Stockholm AB.

“Target Amount” has the meaning

ascribed to this term in the Mandate Letter.

“Target Number of SDRs” has

the meaning ascribed to this term in the Mandate Letter.

“Trading Day” means a day on

which the Swedish Exchange is open for trading and which is not a day during which a Market Disruption Event has occurred.

“US Exchange

” means the Nasdaq Global Select Market.

The Client appoints the Intermediary, who accepts

the appointment, to purchase a number of SDRs on the Client’s behalf and for the Client’s account during the Purchase Period

such that the amount payable by the Client is not higher than the Target Amount, provided that the total number of SDRs purchased

by the Intermediary pursuant to the Assignment during the Purchase Period shall not exceed the Target Number of SDRs.

The Intermediary hereby represents and covenants

to Client that it has implemented policies and procedures, taking into consideration the nature of its business, reasonably designed to

ensure that individuals making investment decisions related to the Assignment do not have access to material nonpublic information regarding

the Issuer, SDRs or the Shares that may be in possession of other individuals employed by Intermediary in violation of applicable securities

laws.

The Intermediary may use the services of a third

party to carry out the Assignment, subject to remaining responsible for the acts or omissions of such third party to the Client. In such

case, the third party shall be subject to the same obligations as the Intermediary would have been under this Agreement.

The mission described in this Clause 2 (Assignment)

is referred to in the Agreement as the “Assignment”.

| 2.2 | Completion of the Assignment |

If a Completion Event has occurred on any day,

that day shall be deemed to be the Completion Date of the Assignment. If a Completion Event has not occurred before the End Date, then

the End Date shall be deemed to be the Completion Date of the Assignment.

The Client shall not appoint any financial intermediary

other than the Intermediary to purchase SDRs or Shares on its behalf during the Purchase Period.

| 2.4 | Conditions to be met in relation to the Assignment |

The SDRs shall be bought by the Intermediary on

the Swedish Exchange and/or any relevant trading venues and/or directly from brokers or directly from sellers of SDRs, in each case outside

the United States, and in accordance, on a best effort basis but in any event without prejudice to the Maximum Price per SDR, with the

terms of the Mandate Letter. The Intermediary’s interventions in relation to the Assignment shall take place in accordance with

all applicable laws and regulations.

In particular, the

Intermediary shall not, when executing trades in relation to the Assignment, purchase any SDRs at a price per SDR which is higher than

the Maximum Price per SDR.

| 2.5 | Independence of the Intermediary |

The Intermediary shall perform the Assignment

independently of, and without influence by or consultation with, the Client with regard to the timing of the purchases and shall be solely

responsible for carrying out the purchase of the SDRs in relation to the Assignment.

The Client shall not exercise or attempt to exercise

authority over any purchases of SDRs executed by the Intermediary pursuant to the Assignment, and the Client shall not provide to the

Intermediary’s trading team dealing with the Assignment any information or instructions with respect to the Assignment which would

influence the interventions of the Intermediary in respect thereof. Additionally, the Assignment does not permit the Client to exercise

any subsequent influence over how, when, or whether to effect any purchases of SDRs under the Assignment. The Client represents and covenants

to the Intermediary that it shall not alter or deviate from the terms of the Assignment to purchase SDRs or enter into or alter a corresponding

or hedging transaction or position with respect to SDRs.

At the end of each Trading Day, the Intermediary

will send to the Client by email such information relating to the purchases of SDRs during that Trading Day in relation to the Assignment

in the form agreed between the Client and the Intermediary.

The information referred to above shall be deemed

to have been sent to the Client if sent by email to the persons designated under Clause 3.2 (Persons to contact within the Client).

| 2.7 | Settlement and Delivery |

In accordance with the rules of the Swedish

Exchange, the transactions in SDRs shall be cleared and settled delivery versus payment, net of VAT, two Trading Days after their execution

by the Intermediary at the price at which the SDRs have been purchased by the Intermediary.

The SDRs purchased pursuant to the Assignment

during the Purchase Period shall be delivered to the Client on the account set forth in the Mandate Letter.

The amounts necessary to purchase the SDRs pursuant

to the Assignment shall be withdrawn from the Client’s account set forth in the Mandate Letter.

The Intermediary shall charge brokerage fees,

as set forth in the Mandate Letter, to the Client on the SDRs purchased in respect of the Assignment.

The Client will support the cost of any applicable

taxes (such as Financial Transaction Tax and value added tax (VAT) if any) relating to the Assignment.

| 3.1 | Persons to contact within the Intermediary |

The persons to contact within the Intermediary are set out in the Mandate

Letter.

| 3.2 | Persons to contact within the Client |

The persons to contact within the Client are set out in the Mandate

Letter.

| 4. | Representations and warranties of the Client and the Intermediary |

4.1 The Client represents and warrants that

(a) it has full power to enter into and perform

its obligations under the Agreement and to purchase the SDRs;

(b) all authorizations, approvals, consents

and licenses required by it (corporate, legal or otherwise) for the purchase of the SDRs and the transaction contemplated hereby have

been obtained;

(c) it is

entering into the Agreement, and the Assignment contemplated herein, in good faith and not as part of a plan or scheme to evade the prohibitions

of any applicable laws or regulations, such as Rule 10b5-1 under the Exchange Act and shall act in good faith with respect to the

Agreement and Assignment;

(d) it has no outstanding (and will not subsequently

enter into any additional) contract, instruction, or plan that would qualify for the affirmative defense under paragraph (c)(1) of

Rule 10b5-1 under the Exchange Act during the term of the Assignment; and

(e) it is not an “officer” within

the meaning of Rule 16a-1(f).

(f) The Client confirms that, at the date

hereof, it does not possess and is not aware of any material non-public information (as defined in Rule 10b5-1 under the Exchange

Act) or inside information (as defined in article 7 of MAR), with respect to the Issuer, the Shares and/or the SDRs.

(g) it shall not disclose to the Intermediary

any information which may be considered as inside information as defined in article 7 of MAR. Should such insider information be disclosed

to the Intermediary, the Intermediary will take any and all necessary steps to ensure that such inside information will not be transferred

nor used on its own behalf or on behalf of third parties, either directly or indirectly.

(h) it shall be responsible for making all

declarations relating to crossing thresholds that would be required by the by-laws of the Issuer or by applicable laws and regulations.

(i) it authorizes the recording of the phone

conversations by the Intermediary during the execution of the Agreement and to produce such recordings as a proof before any courts or

regulatory authorities.

4.2 The Intermediary represents and warrants that

it has full power to enter into and perform its obligations under the Agreement, all authorizations, approvals, consents and licenses

required by it (corporate, legal or otherwise) for the purchase of the SDRs and the transaction contemplated hereby have been obtained,

and it will comply with MAR and other relevant securities laws and regulations in relation to the execution of the Agreement.

All information relating to the Agreement shall

be considered as confidential, and neither Party shall disclose this information without the prior written consent of the other Party,

except:

| (i) | if disclosure of such information is required by applicable laws or regulations (including the rules or

regulations of any relevant stock exchange), by court order or in connection with any judicial or regulatory inquiry or proceedings; or |

| (ii) | if the confidential information becomes publicly known other than as a result of a non-permitted disclosure

by either Party. |

The undertakings in this Clause 5 shall remain

in force for the duration of the Agreement and for a period of two years following the expiry or termination thereof.

The Client shall, on request, fully indemnify

and hold harmless the Intermediary, any entity of its group and their respective employees (an “Indemnified Person”)

for any direct losses and reasonable costs, fees, expenses and disbursements (including reasonable legal fees and expenses) (collectively,

the “Damages”) suffered or incurred by any Indemnified Person with respect to any action, procedure, claim, proceeding

or investigation of a judicial or other nature resulting or arising from the Assignment, initiated by a third party, involving or against

an Indemnified Person, except to the extent that such Damages are found in a judgement of a court of competent jurisdiction to have resulted

from the negligence, wilful default or misconduct, or fraud of the Indemnified Person. In no event shall the Client be liable for or reimburse

any indirect or consequential damages, such as loss of profit, loss of revenues, loss of reputation and/or loss of savings.

The Agreement shall take effect on the date hereof

and shall terminate, save in case of an early termination of the Agreement in accordance with Clause 7.2 (Early termination in

case of insolvency); Clause 7.3 (Early termination at the request of the Client) or Clause 8 (Sanctions), on the later

of:

| (ii) | the date on which the Client’s obligations under Clause 2.7 (Settlement and Delivery),

Clause 2.8 (Brokerage fee), and Clause 2.9 (Tax) have been fulfilled; and |

| (iii) | the date on which the Intermediary’s obligations under Clause 2.6 (Reporting), and Clause 2.7

(Settlement and Delivery) have been fulfilled. |

| 7.2 | Early termination in case of insolvency |

If a Party is declared

bankrupt or filing a request for protection from creditors, or if a Party fails to pay on the due date any amount payable by it

under the Agreement at the place at, and in the currency in, which it is expressed to be payable (the “Event”), the

other Party may issue a notice notifying the occurrence of the Event and the Agreement will automatically terminate on the 3rd Trading

Day following the receipt by either Party of such notice. If a Party receives written notice from a competent court, legislative body

or regulatory authority or becomes aware that the performance of this Agreement may no longer be permitted or is recommended

against, this Party may issue a notice notifying the occurrence of the Event and the Agreement will automatically terminate on the 1st Trading

Day following the receipt by either Party of such notice. The date designated for the early termination of the Agreement shall be an “Early

Termination Date”.

| 7.3 | Early termination at the request of the Client |

The Client shall be entitled to require the Intermediary

at any time to terminate the Assignment, provided that the Client does not have inside information (as defined under MAR) in respect of

the Issuer and no blackout period is applicable to it; at the time of the notice, (i) for any reason or (ii) if the further

implementation of the Assignment would otherwise cause a breach of any facility agreement material to the realisation of the Assignment

to which the Client is a party to from time to time or (iii) an infringement of applicable antitrust laws and regulations (including

under the Hart-Scott-Rodino Act Antitrust Improvements Acts of 1976), in each case by sending a notice to the Intermediary.

The Agreement will

automatically terminate on the 1st Trading Day following the receipt by the Intermediary of such notice, this date

being an “Early Termination Date”.

| 7.4 | Consequences of the termination of the Agreement |

Upon termination of the Agreement, the Parties

will be released from any obligations stipulated in this Agreement, except as regards Clause 4 (Representations and warranties

of the Client and the Intermediary), Clause 5 (Confidentiality), Clause 6 (Indemnity) and Clause 8 (Governing

Law and jurisdiction), which will survive the termination of the Agreement until the end of the applicable limitation periods.

This Agreement may

be amended, modified or waived by the Parties provided that (a) such amendment, modification or waiver (i) is in writing, and

(ii) is made in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b-5 under the Exchange Act;

and (b) at the time of such amendment, modification or waiver the Client shall be deemed to have represented and warranted to Intermediary

that it is not in possession of any material non-public information (as defined in Rule 10b5-1 under the Exchange Act) or

inside information (as defined in article 7 of MAR), with respect to the Issuer, the Shares and/or the SDRs (c) at the time

of such amendment, modification or waiver the Client is not subject to a blackout period;

For the purposes of this article, the terms "Sanctioned

Person" and "Sanctions" shall have the following meanings:

“Sanctioned Person” means any

person, whether or not having a legal personality that is:

(i) listed

on any list of designated persons in application of Sanctions;

(ii) located

in, or organised under the laws of, any country or territory that is subject to comprehensive Sanctions;

(iii) directly

or indirectly owned or controlled, as defined by the relevant Sanctions, by a person referred to in (i) or (ii) above;

(iv) which

otherwise is, or will become with the expiry of any period of time, subject to Sanctions.

“Sanctions” means any economic

or financial sanctions, trade embargoes or similar measures enacted, administered or enforced by any of the following (or by any agency

of any of the following):

| (b) | the United States of America; |

| (c) | the United Kingdom; or |

| (d) | the European Union or any present or future member state thereof; |

| (e) | to the extent permitted by laws and regulations, any other jurisdiction

relevant applicable to the performance of the Agreement. |

Each Party represents and warrants to the other

party at all times during the term of this Agreement that neither it nor any of its affiliates nor, to the best of its knowledge, any

controlled person, nor any agents is a Sanctioned Person.

The Client understands that the Intermediary must

not deal with any transaction for the benefit of a Sanctioned Person or in a manner that would constitute a violation of the Sanctions.

As such, and notwithstanding the fact that the operations have already been carried out, the Intermediary may immediately suspend any

payment, promise to pay or authorization to pay (or give any valuable consideration), if the Client is subject to Sanctions or does not

comply with the representations or warranties provided for in this article. Subject to applicable laws, regulations and authorizations

of the competent authorities, the Client may make such payment to a frozen account for the benefit of the Intermediary.

Either Party may terminate the agreement with

immediate effect and without compensation if the other party is in breach of the sanctions, representations or warranties provided for

in this clause.

| 9. | Governing law and jurisdiction |

The Agreement shall be governed by French law.

The competent courts of Paris will have exclusive

jurisdiction to settle any disputes arising out of or related to the validity, interpretation or enforcement of the Agreement.

[Remainder of the page intentionally left

blank]

| FOR THE INTERMEDIARY |

|

| |

|

| |

|

| /s/ [*****] |

|

| By: |

[*****] |

|

| Title: |

[*****] |

|

| |

[*****] |

|

| FOR THE CLIENT |

|

| |

|

| |

|

| /s/ Antony Maarek |

|

| By: |

Anthony Maarek |

|

| Title: |

Class A Manager |

|

| |

|

| |

|

| /s/ Tigran Khachatryan |

|

| By: |

Tigran Khachatryan |

|

| Title: |

Class B Manager |

|

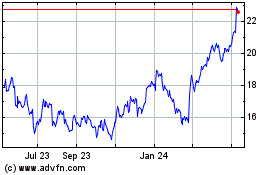

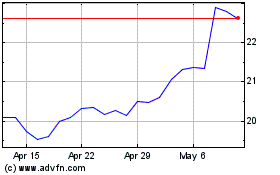

Millicom International C... (NASDAQ:TIGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Millicom International C... (NASDAQ:TIGO)

Historical Stock Chart

From Feb 2024 to Feb 2025