0000320121false00003201212025-03-102025-03-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 10, 2025

Date of Report (Date of earliest event reported)

TELOS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 001-08443 | 52-0880974 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

19886 Ashburn Road, | |

Ashburn, Virginia | 20147-2358 |

| (Address of principal executive offices) | (Zip Code) |

| | |

(703) 724-3800 |

| (Registrant’s telephone number, including area code) |

NOT APPLICABLE

(Former name, former address, and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common stock, $0.001 par value per share | TLS | The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On Monday, March 10, 2025, Telos Corporation (the “Company”) issued a press release announcing a conference call to discuss its financial results for the fourth quarter and year ended December 31, 2024, and posted those financial results on its website. A copy of the press release and financial results for the fourth quarter and year ended December 31, 2024 are attached as Exhibit 99.1 and Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

The Company will conduct a conference call to discuss its financial results on Monday, March 10, 2025, at 9:30 a.m., Eastern Time. A live broadcast of the conference call along with a supplemental presentation will be available to the public through links on the Investor Relations section of the Company’s website (https://investors.telos.com).

The information in this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 attached hereto, is furnished pursuant to Item 2.02 of this Current Report on Form 8-K. Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| | |

| | |

| 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K. |

S I G N A T U R E S

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| TELOS CORPORATION |

| | | |

| By: | | /s/ Mark Bendza |

| | | Mark Bendza |

| | | Chief Financial Officer |

Date: March 10, 2025

Telos Corporation Announces Fourth Quarter and Full Year 2024 Earnings

Ashburn, Va. – March 10, 2025 – Telos Corporation (NASDAQ: TLS), a leading provider of cyber, cloud and enterprise security solutions for the world’s most security-conscious organizations, has posted its 2024 fourth quarter and full year financial results on its investor relations website at https://investors.telos.com.

Telos will host a live webcast to discuss its fourth quarter and full year 2024 financial results today, March 10, 2025, at 9:30 a.m. EST. To access the webcast, visit https://edge.media-server.com/mmc/p/axkes5k6.

Related presentation materials will be made available on the Investors section of the Company’s website at https://investors.telos.com. In addition, an archived webcast will be available approximately two hours after the conclusion of the live event on the Investors section of the Company’s website.

About Telos Corporation

Telos Corporation (NASDAQ: TLS) empowers and protects the world’s most security-conscious organizations with solutions for continuous security assurance of individuals, systems, and information. Telos’ offerings include cybersecurity solutions for IT risk management and information security; cloud security solutions to protect cloud-based assets and enable continuous compliance with industry and government security standards; and enterprise security solutions for identity and access management, secure mobility, organizational messaging, and network management and defense. The company serves commercial enterprises, regulated industries and government customers around the world.

Media: media@telos.com

Investors: InvestorRelations@telos.com

Exhibit 99.2

Fourth Quarter 2024 Financial Results

MARCH 10, 2025

| | |

Telos Corporation Reports $26.4 Million of Revenue, 40.3% GAAP Gross Margin and 47.0% Cash Gross Margin1 in 4Q; Forecasts 7% to 15% Sequential Revenue Growth and Positive Cash Flow in 1Q 2025 |

Financial Summary

•Delivered $26.4 million of revenue, including $21.9 million or 83.1% from Security Solutions and $4.5 million or 16.9% from Secure Networks; Results were at the top end of the guidance range

•Revenue grew 10.9% sequentially from the third quarter of 2024, driven by 19.6% growth in Security Solutions due to:

◦The successful transition and ramp of a new program with DMDC (Defense Manpower Data Center), and

◦The continued growth in TSA PreCheck® enrollment locations; Expanded network of enrollment centers to 218 locations; Targeting 500 locations in fiscal year 2025

•Generated 40.3% GAAP gross margin; above the top end assumed in the guidance range

•Cash gross margin1 for the quarter was 47.0%, above the top end assumed in the guidance range and representing the highest quarterly cash gross margin1 since the Company’s IPO in 2020

•GAAP gross margin for the full year was 31.8%; Cash gross margin1 for the full year was 43.7%, representing a high for the Company since 2000

•GAAP net loss was $9.3 million; Adjusted EBITDA1 loss was $0.2 million and above the top end of the guidance range

•Cash flow from operations was a $10.5 million outflow and free cash flow1 was a $14.8 million outflow, reflecting a short-term buildup in working capital associated with high-growth programs and one-time capex investments in IT infrastructure expansion

Outlook

•First Quarter Guidance: Forecasts 7% to 15% sequential revenue growth, revenues of $28.2 million - $30.2 million, Adjusted EBITDA2 loss of $1.8 million to $0.8 million and positive cash flow

•Full Year: Forecasts significant improvements in revenue, adjusted EBITDA2, and cash flow

1 Cash Gross Margin, Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. Refer to “Non- GAAP Financial Measures” below.

2 Adjusted EBITDA is a non-GAAP financial measure. The Company has not provided a reconciliation to the most directly comparable GAAP measure to this forward-looking non-GAAP financial measure because certain items are out of the Company’s control or cannot be reasonably predicted. Accordingly, reconciliation of forward-looking Adjusted EBITDA is not available without unreasonable effort.

| | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2024 Financial Highlights |

| Three Months Ended |

| December 31, 2024 | | December 31, 2023 |

| (dollars in millions, except per share data) |

| Revenue | $ | 26.4 | | | $ | 41.1 | |

| Gross Profit | $ | 10.6 | | | $ | 14.1 | |

| Gross Margin | | 40.3% | | | | 34.3% | |

Adjusted Gross Profit 1 | $ | 10.8 | | | $ | 14.4 | |

Adjusted Gross Margin 1 | | 40.9% | | | | 35.0% | |

Cash Gross Profit 1 | $ | 12.4 | | | $ | 15.6 | |

Cash Gross Margin 1 | | 47.0% | | | | 38.0% | |

| GAAP Net Loss | $ | (9.3) | | | $ | (7.0) | |

Adjusted Net Loss 1 | $ | (2.8) | | | $ | (6.5) | |

EBITDA1 | $ | (7.4) | | | $ | (5.1) | |

Adjusted EBITDA 1 | $ | (0.2) | | | $ | (3.2) | |

Adjusted EBITDA Margin 1 | | (0.8%) | | | | (7.8%) | |

| GAAP EPS | $ | (0.13) | | | $ | (0.10) | |

Adjusted EPS 1 | $ | (0.04) | | | $ | (0.09) | |

| Weighted-average Shares of Common Stock Outstanding | $ | 72.4 | | | $ | 69.8 | |

| Cash Flow from Operations | $ | (10.5) | | | $ | 5.0 | |

Free Cash Flow 1 | $ | (14.8) | | | $ | 1.8 | |

1 Adjusted Gross Profit, Adjusted Gross Margin, Cash Gross Profit, Cash Gross Margin, Adjusted Net Loss, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EPS, and Free Cash Flow are non-GAAP financial measures. Refer to "Non-GAAP Financial Measures" below.Forward-Looking Statements

This summary contains forward-looking statements, including the forecasts in the headline and all of the information set forth in the “Outlook” section, which are made under the safe harbor provisions of the federal securities laws. These statements are based on the Company’s management’s current beliefs, expectations and assumptions about future events, conditions, and results and on information currently available to them. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. The Company believes that these risks and uncertainties include, but are not limited to, those described under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth from time to time in the Company’s filings and reports with the U.S. Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the year ended December 31, 2023, its forthcoming Annual Report on Form 10-K for the year ended December 31, 2024, and its Quarterly Reports on Form 10-Q, as well as future filings and reports by the Company, copies of which are available at https://investors.telos.com and on the SEC’s website at www.sec.gov.

Although the Company bases these forward-looking statements on assumptions that its management believes are reasonable when made, the Company cautions the reader that forward-looking statements are not guarantees of future performance and that the Company’s actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this summary. Given these risks, uncertainties, and other factors, many of which are beyond its control, the Company cautions the reader not to place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date of such statement and, except as required by law, the Company undertakes no obligation to update any forward-looking statement publicly, or to revise any forward-looking statement to reflect events or developments occurring after the date of the statement, even if new information becomes available in the future. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S. GAAP, we believe the non-GAAP financial measures of EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Adjusted Net Loss, Adjusted Earnings Per Share ("EPS"), Adjusted Gross Profit, Adjusted Gross Margin, Cash Gross Profit, Cash Gross Margin and Free Cash Flow are useful in evaluating our operating and cash flow performance. We believe that this non-GAAP financial information, when taken collectively with our GAAP results, may be helpful to readers of our financial statements because it provides consistency and comparability with past financial performance and assists in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. The non-GAAP financial information is presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly-titled non-GAAP measures used by other companies. A reconciliation is provided below for each of these non-GAAP financial measures to the most directly comparable financial measure stated in accordance with GAAP.

Telos believes that EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Loss and Adjusted EPS provide the Board of Directors, management and investors with a clear representation of the Company’s core operating performance and trends, provide greater visibility into the long-term financial performance of the Company, and eliminate the impact of items that do not relate to the ongoing operating performance of the business. Further, Adjusted EBITDA is used by the Board of Directors and management to prepare and approve the Company’s annual budget, and to evaluate the performance of certain management personnel when determining incentive compensation. Adjusted Gross Profit, Cash Gross Profit, Adjusted Gross Margin and Cash Gross Margin provide management and investors a clear representation of the core economics of gross profit and gross margin without the impact of non-cash expenses and sunk costs expended. Telos uses Free Cash Flow to understand the cash flows that directly correspond with our operations and the investments the Company must make in those operations, using a methodology that combines operating cash flows and capital expenditures. Further, Free Cash Flow may be useful to management and investors in evaluating the Company's operating and cash flow performance and liquidity, and to evaluate the performance of certain management personnel when determining incentive compensation. Telos believes these non-GAAP financial measures facilitate the comparison of the Company’s operating and cash performance on a consistent basis between periods by excluding certain items that may, or could, have a disproportionately positive or negative impact on the Company’s results of operations in any particular period. When viewed in combination with the Company’s results prepared in accordance with GAAP, these non-GAAP financial measures help provide a broader picture of factors and trends affecting the Company’s results of operations.

EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Adjusted Net Loss, Adjusted EPS, Adjusted Gross Profit, Adjusted Gross Margin, Cash Gross Profit, Cash Gross Margin, and Free Cash Flow are supplemental measures of operating and cash flow performance that are not made under GAAP and do not represent, and should not be considered as an alternative to gross profit, gross margin, net (loss) income, earnings per share or net cash flows (used in) provided by operating activities, as determined by GAAP.

The Company defines EBITDA as net (loss) income, adjusted for non-operating (income) expense, interest expense, provision for (benefit from) income taxes, and depreciation and amortization. The Company defines Adjusted EBITDA as EBITDA, adjusted for stock-based compensation expense, impairment loss on intangible assets, and restructuring expenses (adjustments). The Company defines EBITDA Margin, as EBITDA as a percentage of total revenue. The Company defines Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of total revenue. The Company defines Adjusted Net Loss as net (loss) income, adjusted for non-operating (income) expense, stock-based compensation expense, impairment loss on intangible assets, and restructuring expenses (adjustments). The Company defines Adjusted EPS as Adjusted Net Loss divided by the weighted-average number of common shares outstanding for the period. The Company defines Adjusted Gross Profit as gross profit, plus stock-based compensation expense, impairment loss on intangible assets, and restructuring expenses charged under cost of sales. The Company defines Adjusted Gross Margin as a Adjusted Gross Profit as a percentage of total revenue. The Company defines Cash Gross Profit as Adjusted Gross Profit, plus depreciation and amortization. The Company defines Cash Gross Margin as Cash Gross Profit as a percentage of total revenue. Free Cash Flow is defined as net cash (used in) provided by operating activities, less net purchases of property and equipment, and capitalized software development costs.

EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Adjusted Net Loss, Adjusted EPS, Adjusted Gross Profit, Adjusted Gross Margin, Cash Gross Profit, Cash Gross Margin, and Free Cash Flow each has limitations as an analytical tool, and you should not consider any of them in isolation, or as a substitute for analysis of results as reported under GAAP. Among other limitations, each of EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Adjusted Net Income (Loss), Adjusted EPS, Adjusted Gross Profit, Adjusted Gross Margin, Cash Gross Profit, Cash Gross Margin, and Free Cash Flow does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments, does not reflect the impact of certain cash and non-cash charges resulting from matters considered not to be indicative of ongoing operations, and does not reflect income tax expense or benefit. Other companies in the Company’s industry may calculate Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Loss, Adjusted EPS, Adjusted Gross Profit, Adjusted Gross Margin, Cash Gross Profit, Cash Gross Margin, and Free Cash Flow differently than Telos does, which limits its usefulness as a comparative measure. Because of these limitations, neither EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Adjusted Net Loss, Adjusted EPS, Adjusted Gross Profit, Adjusted Gross Margin, Cash Gross Profit, Cash Gross Margin nor Free Cash Flow should be considered as a replacement for gross profit, gross margin, net (loss) income, earnings per share, or net cash flows (used in) provided by operating activities, as determined by GAAP, or as a measure of profitability. Telos compensates for these limitations by relying primarily on the Company’s GAAP results and using non-GAAP measures only for supplemental purposes.

About Telos Corporation

Telos Corporation (NASDAQ: TLS) empowers and protects the world’s most security-conscious organizations with solutions for continuous security assurance of individuals, systems, and information. Telos’ offerings include cybersecurity solutions for IT risk management and information security; cloud security solutions to protect cloud-based assets and enable continuous compliance with industry and government security standards; and enterprise security solutions for identity and access management, secure mobility, organizational messaging, and network management and defense. The Company serves commercial enterprises, regulated industries and government customers around the world.

Media:

media@telos.com

Investors:

InvestorRelations@telos.com

TELOS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended December 31, | | For the Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands, except per share amounts) |

| Revenue – Security Solutions | $ | 21,921 | | | $ | 20,652 | | | $ | 76,760 | | | $ | 77,416 | |

| Revenue – Secure Networks | 4,451 | | | 20,407 | | | 31,512 | | | 67,962 | |

| Total revenue | 26,372 | | | 41,059 | | | 108,272 | | | 145,378 | |

| Cost of sales – Security Solutions (excluding impairment loss, depreciation and amortization) | 10,847 | | | 8,966 | | | 37,352 | | | 34,270 | |

| Cost of sales – Secure Networks (excluding impairment loss, depreciation and amortization) | 3,310 | | | 16,752 | | | 24,754 | | | 54,622 | |

| Impairment loss on intangible assets | — | | | — | | | 5,333 | | | — | |

| Depreciation and amortization | 1,597 | | | 1,253 | | | 6,404 | | | 3,544 | |

| Total cost of sales | 15,754 | | | 26,971 | | | 73,843 | | | 92,436 | |

| Gross profit | 10,618 | | | 14,088 | | | 34,429 | | | 52,942 | |

| Operating expenses: | | | | | | | |

| Research and development expenses | 1,404 | | | 3,476 | | | 8,442 | | | 11,760 | |

| Selling, general and administrative expenses | 19,141 | | | 18,659 | | | 75,487 | | | 81,010 | |

| Impairment loss on intangible assets | — | | | 138 | | | 6,373 | | | 487 | |

| Total operating expenses | 20,545 | | | 22,273 | | | 90,302 | | | 93,257 | |

| Operating loss | (9,927) | | | (8,185) | | | (55,873) | | | (40,315) | |

| Other income | 724 | | | 1,348 | | | 4,023 | | | 6,715 | |

| Interest expense | (152) | | | (175) | | | (644) | | | (786) | |

| Loss before income taxes | (9,355) | | | (7,012) | | | (52,494) | | | (34,386) | |

| Provision for income taxes | 25 | | | 32 | | | (26) | | | (36) | |

| Net loss | $ | (9,330) | | | $ | (6,980) | | | $ | (52,520) | | | $ | (34,422) | |

| | | | | | | |

| Net loss per share: | | | | | | | |

| Basic | $ | (0.13) | | | $ | (0.10) | | | $ | (0.73) | | | $ | (0.50) | |

| Diluted | $ | (0.13) | | | $ | (0.10) | | | $ | (0.73) | | | $ | (0.50) | |

| | | | | | | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 72,435 | | | 69,832 | | | 71,850 | | | 69,256 | |

| Diluted | 72,435 | | | 69,832 | | | 71,850 | | | 69,256 | |

TELOS CORPORATION

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| As of December 31, |

| 2024 | | 2023 |

| | | |

| (in thousands, except per share and share data) |

| Assets: | | | |

| Cash and cash equivalents | $ | 54,578 | | | $ | 99,260 | |

| Accounts receivable, net | 19,172 | | | 30,424 | |

| Inventories, net | 1,783 | | | 1,420 | |

| Prepaid expenses | 15,092 | | | 7,520 | |

| Other current assets | 793 | | | 1,367 | |

| Total current assets | 91,418 | | | 139,991 | |

| Property and equipment, net | 4,283 | | | 3,457 | |

| Finance lease right-of-use assets, net | 5,391 | | | 6,612 | |

| Operating lease right-of-use assets | 622 | | | 216 | |

| Goodwill | 17,922 | | | 17,922 | |

| Intangible assets, net | 30,410 | | | 39,616 | |

| Other assets | 8,189 | | | 885 | |

| Total assets | $ | 158,235 | | | $ | 208,699 | |

| Liabilities and Stockholders' Equity: | | | |

| Liabilities: | | | |

| Accounts payable and other accrued liabilities | $ | 4,300 | | | $ | 13,750 | |

| Accrued compensation and benefits | 7,608 | | | 14,569 | |

| Contract liabilities | 6,838 | | | 6,728 | |

| Finance lease obligations – current portion | 1,877 | | | 1,730 | |

| Operating lease obligations – current portion | 210 | | | 97 | |

| Other current liabilities | 1,302 | | | 2,324 | |

| Total current liabilities | 22,135 | | | 39,198 | |

| Finance lease obligations – non-current portion | 7,641 | | | 9,518 | |

| Operating lease obligations – non-current portion | 418 | | | 123 | |

| Deferred income taxes | 813 | | | 813 | |

| Other liabilities | 91 | | | 44 | |

| Total liabilities | 31,098 | | | 49,696 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Common stock, $0.001 par value, 250,000,000 shares authorized, 72,514,652 shares and 70,239,890 shares issued and outstanding as of December 31, 2024 and 2023, respectively | 111 | | | 109 | |

| Additional paid-in capital | 454,502 | | | 433,781 | |

| Accumulated other comprehensive loss | (129) | | | (60) | |

| Accumulated deficit | (327,347) | | | (274,827) | |

| Total stockholders' equity | 127,137 | | | 159,003 | |

| Total liabilities and stockholders' equity | $ | 158,235 | | | $ | 208,699 | |

TELOS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended December 31, | | For the Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands) |

| Cash flows from operating activities: | | | | | | | |

| Net loss | $ | (9,330) | | | $ | (6,980) | | | $ | (52,520) | | | $ | (34,422) | |

| Adjustments to reconcile net loss to cash flows from operations: | | | | | | | |

| Stock-based compensation | 7,394 | | | 1,934 | | | 21,411 | | | 24,396 | |

| Depreciation and amortization | 2,499 | | | 2,955 | | | 11,867 | | | 8,942 | |

| Impairment loss on intangible assets | — | | | 138 | | | 11,706 | | | 487 | |

| Provision for (recovery from) doubtful accounts | 8 | | | 24 | | | (20) | | | 152 | |

| Deferred income tax provision | (37) | | | 18 | | | — | | | 55 | |

| Loss (gain) on disposal of fixed assets | 4 | | | 1 | | | (9) | | | 2 | |

| Amortization of debt issuance costs | 18 | | | 18 | | | 70 | | | 69 | |

| Provision for inventory obsolescence | 108 | | | — | | | 108 | | | — | |

| Accretion of discount on acquisition holdback | — | | | — | | | — | | | 2 | |

| Gain on early extinguishment of other financing obligations | — | | | — | | | — | | | (1,427) | |

| Changes in other operating assets and liabilities: | | | | | | | |

| Accounts receivable | (4,299) | | | (5,024) | | | 11,272 | | | 9,493 | |

| Inventories | (485) | | | (436) | | | (471) | | | 1,457 | |

| Intangible assets – software held for resale | — | | | — | | | — | | | — | |

| Prepaid expenses, other current assets and other assets | (1,406) | | | 1,048 | | | (11,455) | | | (3,058) | |

| Accounts payable and other accrued payables | (1,256) | | | 6,125 | | | (9,417) | | | (8,817) | |

| Accrued compensation and benefits | (2,129) | | | 4,106 | | | (7,395) | | | 6,602 | |

| Contract liabilities | 58 | | | 953 | | | 110 | | | 283 | |

| Other current liabilities and other liabilities | (1,665) | | | 74 | | | (1,195) | | | (2,629) | |

| Net cash (used in) provided by operating activities | (10,518) | | | 4,954 | | | (25,938) | | | 1,587 | |

| Cash flows from investing activities: | | | | | | | |

| Capitalized software development costs | (2,401) | | | (2,592) | | | (11,505) | | | (14,552) | |

| Purchase of investment | — | | | — | | | (3,000) | | | — | |

| Purchases of property and equipment, net | (1,871) | | | (576) | | | (2,252) | | | (926) | |

| Net cash used in investing activities | (4,272) | | | (3,168) | | | (16,757) | | | (15,478) | |

| Cash flows from financing activities: | | | | | | | |

| Payments under finance lease obligations | (447) | | | (412) | | | (1,730) | | | (1,592) | |

| Payment of tax withholding related to net share settlement of equity awards | — | | | (2,066) | | | (457) | | | (3,742) | |

| Proceeds from exercise of stock options | 54 | | | — | | | 203 | | | — | |

| Repurchase of common stock | — | | | — | | | — | | | (139) | |

| Payments for debt issuance costs | — | | | — | | | — | | | (114) | |

| Payments of DFT holdback amount | — | | | — | | | — | | | (564) | |

| Net cash used in financing activities | (393) | | | (2,478) | | | (1,984) | | | (6,151) | |

| Net change in cash, cash equivalents, and restricted cash | (15,183) | | | (692) | | | (44,679) | | | (20,042) | |

| Cash, cash equivalents and restricted cash, beginning of period | 69,900 | | | 100,088 | | | 99,396 | | | 119,438 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 54,717 | | | $ | 99,396 | | | $ | 54,717 | | | $ | 99,396 | |

NON-GAAP FINANCIAL MEASURES

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Loss to EBITDA and Adjusted EBITDA; Net Loss Margin to EBITDA Margin and Adjusted EBITDA Margin |

| For the Three Months Ended December 31, | | For the Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Amount | | Margin | | Amount | | Margin | | Amount | | Margin | | Amount | | Margin |

| | | | | | | | | | | | | | | |

| (dollars in thousands) |

| Net loss | $ | (9,330) | | | (35.4)% | | $ | (6,980) | | | (17.0)% | | $ | (52,520) | | | (48.5)% | | $ | (34,422) | | | (23.7)% |

| Other income | (724) | | | (2.8)% | | (1,348) | | | (3.2)% | | (4,023) | | | (3.7)% | | (6,715) | | | (4.6)% |

| Interest expense | 152 | | | 0.6% | | 175 | | | 0.4% | | 644 | | | 0.6% | | 786 | | | 0.5% |

| Provision for income taxes | (25) | | | (0.1)% | | (32) | | | (0.1)% | | 26 | | | —% | | 36 | | | —% |

Depreciation and amortization (2) | 2,499 | | | 9.5% | | 3,093 | | | 7.5% | | 11,867 | | | 11.0% | | 9,429 | | | 6.5% |

| EBITDA (Non-GAAP) | (7,428) | | | (28.2)% | | (5,092) | | | (12.4)% | | (44,006) | | | (40.7)% | | (30,886) | | | (21.2)% |

Stock-based compensation expense (1) | 7,394 | | | 28.0% | | 1,934 | | | 4.7% | | 21,411 | | | 19.8% | | 24,396 | | | 16.8% |

Impairment loss on intangible assets (2) | — | | | —% | | — | | | —% | | 11,706 | | | 10.8% | | — | | | |

Restructuring expenses (3) | (167) | | | (0.6)% | | (65) | | | (0.1)% | | 1,270 | | | 1.2% | | 1,132 | | | 0.8% |

| Adjusted EBITDA (Non-GAAP) | $ | (201) | | | (0.8)% | | $ | (3,223) | | | (7.8)% | | $ | (9,619) | | | (8.9)% | | $ | (5,358) | | | (3.7)% |

(1) The stock-based compensation expense to EBITDA is made up of stock-based compensation expense for the awarded RSUs, PSUs, and stock options, and other sources. Stock-based compensation expense for the awarded RSUs, PSUs and stock options was $6.9 million and $19.4 million for the three and twelve months ended December 31, 2024, respectively, and $4.1 million and $22.9 million for the three and twelve months ended December 31, 2023, respectively. Stock-based compensation (adjustments) expense from other sources was $0.5 million and $2.1 million for the three and twelve months ended December 31, 2024, respectively, and $(2.1) million and $1.5 million for the three and twelve months ended December 31, 2023, respectively. The other sources of stock-based compensation consist of accrued compensation, which the Company intends to settle in shares of the Company's common stock. However, it is the Company’s discretion whether this compensation will ultimately be paid in stock or cash. The Company has the right to dictate the form of these payments up until the date at which they are paid. Any change to the expected payment form would result in out of quarter adjustments to this add back to Adjusted EBITDA.

(2) Due to its immaterial amount, the impairment loss on intangible assets of $0.1 million and $0.5 million for the three and twelve months ended December 31, 2023 was reported as part of depreciation and amortization expenses in 2023.

(3) The restructuring expenses include severance and other related benefit costs (including outplacement services and continuing health insurance coverage), external consulting and advisory fees related to implementing the restructuring plan.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Loss and GAAP EPS to Non-GAAP Adjusted Net Loss and Adjusted EPS |

| For the Three Months Ended December 31, | | For the Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Adjusted Net Loss | | Adjusted Earnings Per Share | | Adjusted Net Loss | | Adjusted Earnings Per Share | | Adjusted Net Loss | | Adjusted Earnings Per Share | | Adjusted Net Loss | | Adjusted Earnings Per Share |

| | | | | | | | | | | | | | | |

| (in thousands, except per share data) |

| Net loss | $ | (9,330) | | | $ | (0.13) | | | $ | (6,980) | | | $ | (0.10) | | | $ | (52,520) | | | $ | (0.73) | | | $ | (34,422) | | | $ | (0.50) | |

| Adjustments: | | | | | | | | | | | | | | | |

| Other income | (724) | | | (0.01) | | | (1,348) | | | (0.02) | | | (4,023) | | | (0.06) | | | (6,715) | | | (0.10) | |

Stock-based compensation expense (1) | 7,394 | | | 0.10 | | | 1,934 | | | 0.03 | | | 21,411 | | | 0.30 | | | 24,396 | | | 0.35 | |

Impairment loss on intangible assets (2) | — | | | — | | | — | | | — | | | 11,706 | | | 0.16 | | | — | | | — | |

Restructuring expenses (3) | (167) | | | — | | | (65) | | | — | | | 1,270 | | | 0.02 | | | 1,132 | | | 0.02 | |

| Adjusted net loss (Non-GAAP) | $ | (2,827) | | | $ | (0.04) | | | $ | (6,459) | | | $ | (0.09) | | | $ | (22,156) | | | $ | (0.31) | | | $ | (15,609) | | | $ | (0.23) | |

| Weighted-average shares of common stock outstanding, basic | 72,435 | | | | | 69,832 | | | | | 71,850 | | | | | 69,256 | | | |

(1) The stock-based compensation expense to EBITDA is made up of stock-based compensation expense for the awarded RSUs, PSUs, and stock options, and other sources. Stock-based compensation expense for the awarded RSUs, PSUs and stock options was $6.9 million and $19.4 million for the three and twelve months ended December 31, 2024, respectively, and $4.1 million and $22.9 million for the three and twelve months ended December 31, 2023, respectively. Stock-based compensation (adjustments) expense from other sources was $0.5 million and $2.1 million for the three and twelve months ended December 31, 2024, respectively, and $(2.1) million and $1.5 million for the three and twelve months ended December 31, 2023, respectively. The other sources of stock-based compensation consist of accrued compensation, which the Company intends to settle in shares of the Company's common stock. However, it is the Company’s discretion whether this compensation will ultimately be paid in stock or cash. The Company has the right to dictate the form of these payments up until the date at which they are paid. Any change to the expected payment form would result in out of quarter adjustments to this add back to Adjusted Net Loss.

(2) Due to its immaterial amount, the impairment loss on intangible assets of $0.1 million and $0.5 million for the three and twelve months ended December 31, 2023 was reported as part of depreciation and amortization expenses in 2023.

(3) The restructuring expenses include severance and other related benefit costs (including outplacement services and continuing health insurance coverage), external consulting and advisory fees related to implementing the restructuring plan.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Gross Profit to Adjusted Gross Profit and Cash Gross Profit; Gross Margin to Adjusted Gross Margin and Cash Gross Margin |

| For the Three Months Ended December 31, | | For the Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Amount | | Margin | | Amount | | Margin | | Amount | | Margin | | Amount | | Margin |

| | | | | | | | | | | | | | | |

| (dollars in thousands) |

| Gross profit | 10,618 | | | 40.3% | | 14,088 | | | 34.3% | | 34,429 | | | 31.8% | | $ | 52,942 | | | 36.4% |

| Adjustments: | | | | | | | | | | | | | | | |

| Stock-based compensation expense — cost of sales | 228 | | | 0.8% | | 276 | | | 0.7% | | 828 | | | 0.8% | | 900 | | | 0.6% |

| Impairment loss on intangible assets – cost of sales | — | | | —% | | — | | | —% | | 5,333 | | | 4.9% | | — | | | —% |

| Restructuring expenses — cost of sales | (52) | | | (0.2)% | | — | | | —% | | 341 | | | 0.3% | | — | | | —% |

| Adjusted gross profit (Non-GAAP) | 10,794 | | | 40.9% | | 14,364 | | | 35.0% | | 40,931 | | | 37.8% | | 53,842 | | | 37.0% |

| Depreciation and amortization — cost of sales | 1,597 | | | 6.1% | | 1,253 | | | 3.0% | | 6,404 | | | 5.9% | | 3,544 | | | 2.5% |

| Cash gross profit (Non-GAAP) | 12,391 | | | 47.0% | | 15,617 | | | 38.0% | | 47,335 | | | 43.7% | | $ | 57,386 | | | 39.5% |

| | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Cash (Used in) Provided by Operating Activities to Free Cash Flow |

| For the Three Months Ended

December 31, | | For the Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands) |

| Net cash flows (used in) provided by operating activities | $ | (10,518) | | | $ | 4,954 | | | $ | (25,938) | | | $ | 1,587 | |

| Adjustments: | | | | | | | |

| Purchases of property and equipment, net | (1,871) | | | (576) | | | (2,252) | | | (926) | |

| Capitalized software development costs | (2,401) | | | (2,592) | | | (11,505) | | | (14,552) | |

| Free cash flow (Non-GAAP) | $ | (14,790) | | | $ | 1,786 | | | $ | (39,695) | | | $ | (13,891) | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

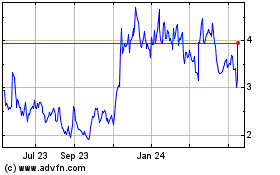

Telos (NASDAQ:TLS)

Historical Stock Chart

From Feb 2025 to Mar 2025

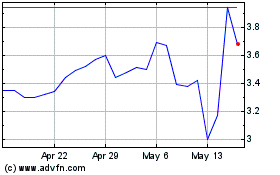

Telos (NASDAQ:TLS)

Historical Stock Chart

From Mar 2024 to Mar 2025