Bond investing saw a trend reversal to start this year. While

short-term bonds garnered investor attention last year, long-term

bonds have started to captivate investors’ interest this year.

The year started with overvaluation in the equity market, momentum

stock sell-off, geo-political tensions and slowdown in some

noteworthy nations like China and Japan (to some extent) which in

turn brightened the appeal for safe haven bond assets.

While the U.S. economy is progressing toward the final stage of

recovery as evident from the Fed’s steady wrap-up of the QE

program, rise in interest rate at some point of time and shortage

of cheap dollar to invest in risky assets are inevitable.

In this stage of recovery, the yield curve tends to flatten. With

the rising interest rate, corporate profits get squeezed and the

flair for bond investing, especially the long-dated ones, returns

to the market. Reduced corporate earnings will lead to poorer

dividend payout thus hurting investors’ fixed income share in case

of equity market investing.

In such a scenario, long-term bond ETFs known for their high yield

opportunities should satisfy the craving of yield-hungry investors.

Notably, long-term bonds have secured the longest period of gains

this year since September 2009 (read: Long-term Treasury ETFs Back

in Focus).

Why Are Long-Term Bonds Back in the Spotlight?

Across the spectrum of the yield curve, the short-dated bonds

remained out of favor since Fed Chair Janet Yellen hinted at hiking

short-term interest rates six months after the wrap-up of bond

buying program.

Though, of late, the Fed pared down its comments on raising

interest rates urgently, most investors and analysts have the

impression that short-term rates will be lifted probably mid

next year. At the current level, this seems the major driver of the

bull run of long-term bonds.

Also, the U.S. economy hardly expanded in Q1 and this lackluster

growth should stimulate the appeal for bond investing. Interest

rates are also rising slower than earlier feared. The inflationary

environment has also been muted, compelling investors not to demand

even higher yield to pay costs for inflation risk leading to a rise

in long-term bonds (read: Long-Term Treasury Bond ETF Investing

101).

In this backdrop, investors seeking to take advantage of the higher

bond prices might try their luck with a long-term bond ETF. While

there are a couple of choices in the space, we have highlighted the

three ETFs surging the most in the recent past that could be good

avenues to park money with higher yields at this time (see more in

the Zacks ETF Center).

25+ Year Zero Coupon U.S. Treasury Index Fund

(ZROZ)

This fund targets the Treasury STRIPS market. This product follows

the BofA Merrill Lynch Long US Treasury Principal STRIPS index,

which focuses on treasury principal STRIPS that has 25 years or

more remaining to final maturity.

This means that this benchmark focuses in on fixed income

securities that are sold at a discount to face value, and then

investors are paid the face value upon maturity. Investors should

note that these sorts of bonds which operate on the zero-coupon

format can underperform greatly in a rising rate scenario.

ZROZ holds only 21 securities in its basket. Additionally, ZROZ has

a bit higher effective maturity – at 27.34 years – while its 30 Day

SEC Yield comes in at a slightly more 3.48%.

Still, investors should note that ZROZ is not a very popular option

with about $74.1 million in assets, though it does cost just 15

basis points a year in fees. However, with its higher duration and

maturity, it can outperform when rates are sliding, as has been the

case so far in 2014, allowing ZROZ to log a 19.05% return till date

(read: 3 Bond ETFs Surging as Interest Rates Tumble).

Vanguard Extended Duration Treasury ETF

(EDV)

For another long-term play on the bond market, investors have EDV,

a fund that seeks to match the performance of the Barclays U.S.

Treasury STRIPS 20-30 Year Equal Par Bond Index. This particular

portfolio has an average maturity of 25.4 years, and a yield to

maturity of 3.7% for this 66-holding basket.

Investors should also note that this is a very cheap product, as it

charges just 12 basis points a year, so it will be an inexpensive

way to get into long duration bonds. EDV has added 1.95% last week

and 17.2% year to date (see Best ETF Strategies for 2014).

iShares 20+ Year Treasury Bond

(TLT)

This iShares product provides exposure to the long-term Treasury

bonds by tracking the Barclays Capital U.S. 20+ Year Treasury Bond

Index. It is one of the most popular and liquid ETFs in the bond

space having amassed over $3.8 billion in its asset base and more

than 7.3 million shares in average daily volume. The expense ratio

comes in at 0.15%.

Holding 23 securities in its basket, the fund focuses on the top

credit rating bonds (AA+ and higher). The average maturity comes in

27.16 years and the effective duration is 16.81 years. The product

gained more than 10.0% year-to-date and 1.12% past week. TLT

currently has a Zacks ETF Rank of 3 or Hold rating with a high risk

outlook.

Bottom Line

In a nutshell, long-term bond ETFs have suffered a lot of wobble

last year and are presently trading at a compelling valuation. With

the Fed steadily tapering the QE stimulus, investors will now start

wondering about the time frame of increases in short-term rates and

volatility will remain in the front end of the curve. Thus,

long-term bonds can satisfy investors’ need at least for the short

term, if not in the long run.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

VANGD-EX DUR TR (EDV): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

PIMCO-25Y ZERO (ZROZ): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

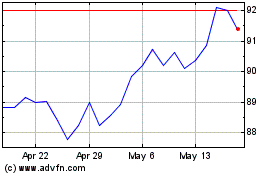

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Oct 2024 to Nov 2024

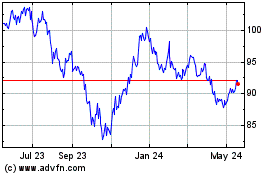

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Nov 2023 to Nov 2024