UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2024

Commission File Number: 001-36430

Tuniu Corporation

6, 8-12th Floor, Building 6-A, Juhuiyuan

No. 108 Xuanwudadao, Xuanwu District

Nanjing, Jiangsu Province 210023

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Tuniu Corporation |

| |

|

| |

By: |

/s/ Anqiang Chen |

| |

Name: |

Anqiang Chen |

| |

Title: |

Financial Controller |

Date:

December 5, 2024

Exhibit 99.1

Tuniu Announces Unaudited Third Quarter 2024

Financial Results

NANJING, China, December 5, 2024 - Tuniu

Corporation (NASDAQ: TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced

its unaudited financial results for the third quarter ended September 30, 2024.

"We are pleased to see that Tuniu continued

to maintain profitable growth in the third quarter of 2024, reaching our highest quarterly profit since our listing." said Mr. Donald

Dunde Yu, Tuniu’s founder, Chairman and Chief Executive Officer. "This quarter, our core packaged tours business continued

its steady growth. In the face of greater and more diversified peak season demand, we expanded our product and destination offerings to

provide more varied and personalized services for a wider range of customers. We also closely followed changes in consumer habits and

further developed our ‘travel + new media’ marketing model, integrating services with technology to continually enhance user

experience to attract more customers. Looking ahead, we remain committed to delivering outstanding customer experiences while striving

to promote high-quality development for the company."

Third Quarter 2024 Results

Net revenues

were RMB186.0 million (US$26.5 million1) in the third quarter of 2024, representing

a year-over-year increase of 4.4% from the corresponding period in 2023.

| · | Revenues from packaged tours were RMB

159.3 million (US$22.7 million) in the third quarter of 2024, representing a year-over-year increase of 6.2% from the corresponding period

in 2023. The increase was primarily due to the growth of organized tours. |

| · | Other revenues were RMB26.7 million (US$3.8

million) in the third quarter of 2024, representing a year-over-year decrease of 5.1% from the corresponding period in 2023. The decrease

was primarily due to the decrease in the fees for advertising services provided to tourism boards and bureaus. |

Cost of revenues

was RMB64.2 million (US$9.2 million) in the third quarter of 2024, representing a year-over-year increase of 1.2% from the

corresponding period in 2023. As a percentage of net revenues, cost of revenues was 34.5% in the third quarter of 2024, compared to 35.6%

in the corresponding period in 2023.

Gross profit

was RMB121.8 million (US$17.4 million) in the third quarter of 2024, representing a year-over-year increase of 6.1% from the

corresponding period in 2023.

1

The conversion of Renminbi ("RMB") into United States dollars ("US$") is based on the exchange rate

of US$1.00=RMB 7.0176 on September 30, 2024 as set forth in H.10 statistical release of the U.S. Federal Reserve Board and available

at https://www.federalreserve.gov/releases/h10/default.htm.

Operating expenses

were RMB92.6 million (US$13.2 million) in the third quarter of 2024, representing a year-over-year increase of 11.5% from the corresponding

period in 2023.

| · | Research and product development expenses

were RMB13.6 million (US$1.9 million) in the third quarter of 2024, representing a year-over-year decrease of 25.9%. The decrease

was primarily due to the decrease in research and product development personnel related expenses. Research and product development expenses

as a percentage of net revenues were 7.3% in the third quarter of 2024, decreasing from 10.3% as a percentage of net revenues in the corresponding

period in 2023. |

| · | Sales and marketing expenses were RMB60.6

million (US$8.6 million) in the third quarter of 2024, representing a year-over-year increase of 53.0%. The increase was primarily due

to the increase in promotion expenses. Sales and marketing expenses as a percentage of net revenues were 32.6% in the third quarter of

2024, increasing from 22.2% as a percentage of net revenues in the corresponding period in 2023. |

| · | General and administrative expenses were

RMB18.6 million (US$2.7 million) in the third quarter of 2024, representing a year-over-year decrease of 31.3%. The decrease was primarily

due to the reversal of allowance for doubtful accounts. General and administrative expenses as a percentage of net revenues were 10.0%

in the third quarter of 2024, decreasing from 15.2% as a percentage of net revenues in the corresponding period in 2023. |

Income from operations

was RMB29.2 million (US$4.2 million) in the third quarter of 2024, compared to an income from operations of RMB31.7 million in the third

quarter of 2023. Non-GAAP2 income from operations, which excluded share-based

compensation expenses and amortization of acquired intangible assets, was RMB31.3 million (US$4.5 million) in the third quarter of 2024.

Net income was

RMB43.9 million (US$6.3 million) in the third quarter of 2024, compared to a net income of RMB39.1 million in the third quarter of 2023.

Non-GAAP net income, which excluded share-based compensation expenses and amortization of acquired intangible assets, was RMB46.0

million (US$6.6 million) in the third quarter of 2024.

Net income attributable

to ordinary shareholders of Tuniu Corporation was RMB44.4 million (US$6.3 million) in the third quarter of 2024, compared to

a net income attributable to ordinary shareholders of Tuniu Corporation of RMB39.4 million in the third quarter of 2023. Non-GAAP net

income attributable to ordinary shareholders of Tuniu Corporation, which excluded share-based compensation expenses and amortization

of acquired intangible assets, was RMB46.6 million (US$6.6 million) in the third quarter of 2024.

As of September 30, 2024, the Company had

cash and cash equivalents, restricted cash and short-term investments of RMB1.3 billion (US$185.8 million).

2

The section below entitled "About Non-GAAP Financial Measures" provides information about the use of Non-GAAP

financial measures in this press release, and the table captioned “Reconciliations of GAAP and Non-GAAP Results" set forth

at the end of this press release reconciles Non-GAAP financial information with the Company's financial results under GAAP.

Business Outlook

For the fourth quarter of 2024, Tuniu expects

to generate RMB100.0 million to RMB105.0 million of net revenues, which represents a 0% to 5% increase year-over-year compared with net

revenues in the corresponding period in 2023. This forecast reflects Tuniu's current and preliminary view on the industry and its operations,

which is subject to change.

Share Repurchase Update

In March 2024, the Company's Board of Directors

authorized a share repurchase program under which the Company may repurchase up to US$10 million worth of its ordinary shares or American

depositary shares representing ordinary shares. As of November 30, 2024, the Company had repurchased an aggregate of approximately

6.2 million ADSs for approximately US$5.6 million from the open market under the share repurchase program.

Conference Call Information

Tuniu’s management will hold an earnings

conference call at 8:00 am U.S. Eastern Time, on December 5, 2024, (9:00 pm, Beijing/Hong Kong Time, on December 5, 2024) to

discuss the third quarter 2024 financial results.

To participate in the conference call, please

dial the following numbers:

| |

United States |

1-888-346-8982 |

| |

Hong Kong |

852-301-84992 |

| |

Mainland China |

4001-201203 |

| |

International |

1-412-902-4272 |

Conference ID: Tuniu 3Q 2024 Earnings

Conference Call

A telephone replay will be available one hour

after the end of the conference call through December 12, 2024. The dial-in details are as follows:

| |

United States |

1-877-344-7529 |

| |

International |

1-412-317-0088 |

Replay Access Code: 6264965

Additionally, a

live and archived webcast of the conference call will also be available on the Company’s investor relations website at http://ir.tuniu.com.

About Tuniu

Tuniu (Nasdaq: TOUR) is a leading online leisure

travel company in China that offers integrated travel service with a large selection of packaged tours, including organized and self-guided

tours, as well as travel-related services for leisure travelers through its website tuniu.com and mobile platform. Tuniu provides one-stop

leisure travel solutions and a compelling customer experience through its online platform and offline service network, including a dedicated

team of professional customer service representatives, 24/7 call centers, extensive networks of offline retail stores and self-operated

local tour operators. For more information, please visit http://ir.tuniu.com.

Safe Harbor Statement

This press release contains forward-looking statements

made under the "safe harbor" provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S.

Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "believes," "estimates,"

"confident" and similar statements. Tuniu may also make written or oral forward-looking statements in its reports filed with

or furnished to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical

facts, including statements about Tuniu's beliefs and expectations, are forward-looking statements that involve factors, risks and uncertainties

that could cause actual results to differ materially from those in the forward-looking statements. Such factors and risks include, but

are not limited to the following: Tuniu's goals and strategies; the growth of the online leisure travel market in China; the demand for

Tuniu’s products and services; its relationships with customers and travel suppliers; Tuniu’s ability to offer competitive

travel products and services; Tuniu’s future business development, results of operations and financial condition; competition in

the online travel industry in China; government policies and regulations relating to Tuniu’s structure, business and industry; the

impact of health epidemics on Tuniu’s business operations, the travel industry and the economy of China and elsewhere generally;

and the general economic and business condition in China and elsewhere. Further information regarding these and other risks, uncertainties

or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. All information provided in this press

release is current as of the date of the press release, and Tuniu does not undertake any obligation to update such information, except

as required under applicable law.

About Non-GAAP Financial Measures

To supplement the

Company's unaudited consolidated financial results presented in accordance with United States Generally Accepted Accounting Principles

(“GAAP”), the Company has provided non-GAAP information related to income from operations, net income, net income attributable

to ordinary shareholders of Tuniu Corporation, which excludes share-based compensation expenses, amortization of acquired intangible assets

and net gain on disposals of subsidiaries. The presentation of this non-GAAP financial measure is not intended to be considered

in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We believe that the

non-GAAP financial measures used in this press release are useful for understanding and assessing underlying business performance and

operating trends, and management and investors benefit from referring to these non-GAAP financial measures in assessing our financial

performance and when planning and forecasting future periods.

This non-GAAP financial measure is not defined

under U.S. GAAP and is not presented in accordance with U.S. GAAP. The non-GAAP financial measure has limitations as an analytical tool.

Further, this non-GAAP measure may differ from the non-GAAP information used by other companies, including peer companies, and therefore

its comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP financial measure to the nearest

U.S. GAAP performance measure, all of which should be considered when evaluating performance. Tuniu encourages investors and others to

review its financial information in its entirety and not rely on a single financial measure.

For more information on these non-GAAP financial

measures, please see the table captioned "Reconciliations of GAAP and non-GAAP Results" set forth at the end of this press release.

For investor and media inquiries, please contact:

China

Mary Chen

Investor Relations Director

Tuniu Corporation

Phone: +86-25-6960-9988

E-mail: ir@tuniu.com

(Financial Tables Follow)

Tuniu Corporation

Unaudited Condensed Consolidated Balance Sheets

(All amounts in thousands, except per share information)

| | |

December 31, 2023 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 378,989 | | |

| 401,925 | | |

| 57,274 | |

| Restricted cash | |

| 65,902 | | |

| 24,946 | | |

| 3,555 | |

| Short-term investments | |

| 777,890 | | |

| 877,088 | | |

| 124,984 | |

| Accounts receivable, net | |

| 41,633 | | |

| 61,616 | | |

| 8,780 | |

| Amounts due from related parties | |

| 9,515 | | |

| 221 | | |

| 31 | |

| Prepayments and other current assets | |

| 234,189 | | |

| 224,144 | | |

| 31,940 | |

| Total current assets | |

| 1,508,118 | | |

| 1,589,940 | | |

| 226,564 | |

| | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Long-term investments | |

| 209,819 | | |

| 210,991 | | |

| 30,066 | |

| Property and equipment, net | |

| 57,479 | | |

| 53,408 | | |

| 7,611 | |

| Intangible assets, net | |

| 26,091 | | |

| 23,154 | | |

| 3,299 | |

| Land use right, net | |

| 90,529 | | |

| 88,983 | | |

| 12,680 | |

| Operating lease right-of-use assets, net | |

| 12,484 | | |

| 9,892 | | |

| 1,410 | |

| Other non-current assets | |

| 55,960 | | |

| 30,548 | | |

| 4,353 | |

| Total non-current assets | |

| 452,362 | | |

| 416,976 | | |

| 59,419 | |

| Total assets | |

| 1,960,480 | | |

| 2,006,916 | | |

| 285,983 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Short-term borrowings | |

| 7,277 | | |

| 35 | | |

| 5 | |

| Accounts and notes payable | |

| 317,104 | | |

| 397,331 | | |

| 56,619 | |

| Amounts due to related parties | |

| 6,405 | | |

| 8,723 | | |

| 1,243 | |

| Salary and welfare payable | |

| 21,401 | | |

| 20,778 | | |

| 2,961 | |

| Taxes payable | |

| 4,305 | | |

| 2,265 | | |

| 323 | |

| Advances from customers | |

| 270,197 | | |

| 178,258 | | |

| 25,402 | |

| Operating lease liabilities, current | |

| 2,709 | | |

| 3,117 | | |

| 444 | |

| Accrued expenses and other current liabilities | |

| 329,481 | | |

| 323,590 | | |

| 46,110 | |

| Total current liabilities | |

| 958,879 | | |

| 934,097 | | |

| 133,107 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Operating lease liabilities, non-current | |

| 5,348 | | |

| 3,465 | | |

| 494 | |

| Deferred tax liabilities | |

| 6,027 | | |

| 5,338 | | |

| 761 | |

| Long-term borrowings | |

| 10,395 | | |

| - | | |

| - | |

| Total non-current liabilities | |

| 21,770 | | |

| 8,803 | | |

| 1,255 | |

| Total liabilities | |

| 980,649 | | |

| 942,900 | | |

| 134,362 | |

| | |

| | | |

| | | |

| | |

| Redeemable noncontrolling interests | |

| 27,200 | | |

| 27,200 | | |

| 3,876 | |

| | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 249 | | |

| 249 | | |

| 35 | |

| Less: Treasury stock | |

| (285,983 | ) | |

| (316,943 | ) | |

| (45,164 | ) |

| Additional paid-in capital | |

| 9,138,720 | | |

| 9,145,624 | | |

| 1,303,241 | |

| Accumulated other comprehensive income | |

| 305,416 | | |

| 304,892 | | |

| 43,447 | |

| Accumulated deficit | |

| (8,127,552 | ) | |

| (8,026,171 | ) | |

| (1,143,720 | ) |

| Total Tuniu Corporation shareholders’ equity | |

| 1,030,850 | | |

| 1,107,651 | | |

| 157,839 | |

| Noncontrolling interests | |

| (78,219 | ) | |

| (70,835 | ) | |

| (10,094 | ) |

| Total equity | |

| 952,631 | | |

| 1,036,816 | | |

| 147,745 | |

| Total liabilities, redeemable noncontrolling interests and equity | |

| 1,960,480 | | |

| 2,006,916 | | |

| 285,983 | |

Tuniu Corporation

Unaudited Condensed Consolidated Statements of Comprehensive Loss

(All

amounts in thousands, except per share information)

| | |

Quarter Ended | | |

Quarter Ended | | |

Quarter Ended | | |

Quarter Ended | |

| | |

September 30, 2023 | | |

June 30, 2024 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Packaged tours | |

| 150,052 | | |

| 89,782 | | |

| 159,289 | | |

| 22,699 | |

| Others | |

| 28,139 | | |

| 27,155 | | |

| 26,706 | | |

| 3,806 | |

| Net revenues | |

| 178,191 | | |

| 116,937 | | |

| 185,995 | | |

| 26,505 | |

| Cost of revenues | |

| (63,424 | ) | |

| (32,530 | ) | |

| (64,212 | ) | |

| (9,150 | ) |

| Gross profit | |

| 114,767 | | |

| 84,407 | | |

| 121,783 | | |

| 17,355 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research and product development | |

| (18,400 | ) | |

| (12,693 | ) | |

| (13,640 | ) | |

| (1,944 | ) |

| Sales and marketing | |

| (39,583 | ) | |

| (40,222 | ) | |

| (60,578 | ) | |

| (8,632 | ) |

| General and administrative | |

| (27,089 | ) | |

| (21,737 | ) | |

| (18,600 | ) | |

| (2,650 | ) |

| Other operating income | |

| 2,005 | | |

| 24,735 | | |

| 202 | | |

| 29 | |

| Total operating expenses | |

| (83,067 | ) | |

| (49,917 | ) | |

| (92,616 | ) | |

| (13,197 | ) |

| Income from operations | |

| 31,700 | | |

| 34,490 | | |

| 29,167 | | |

| 4,158 | |

| Other income/(expenses) | |

| | | |

| | | |

| | | |

| | |

| Interest and investment income, net | |

| 7,397 | | |

| 8,221 | | |

| 7,213 | | |

| 1,028 | |

| Interest expense | |

| (1,102 | ) | |

| (1,230 | ) | |

| (865 | ) | |

| (123 | ) |

| Foreign exchange gains/(losses), net | |

| 1,983 | | |

| (1,282 | ) | |

| 1,115 | | |

| 159 | |

| Other income, net | |

| 1,687 | | |

| 1,822 | | |

| 6,931 | | |

| 988 | |

| Income before income tax expense | |

| 41,665 | | |

| 42,021 | | |

| 43,561 | | |

| 6,210 | |

| Income tax loss | |

| (964 | ) | |

| (459 | ) | |

| (159 | ) | |

| (23 | ) |

| Equity in (loss)/income of affiliates | |

| (1,630 | ) | |

| 1,438 | | |

| 464 | | |

| 66 | |

| Net income | |

| 39,071 | | |

| 43,000 | | |

| 43,866 | | |

| 6,253 | |

| Net loss attributable to noncontrolling

interests | |

| (332 | ) | |

| (22 | ) | |

| (582 | ) | |

| (83 | ) |

| Net income attributable to ordinary shareholders of Tuniu Corporation | |

| 39,403 | | |

| 43,022 | | |

| 44,448 | | |

| 6,336 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 39,071 | | |

| 43,000 | | |

| 43,866 | | |

| 6,253 | |

| Other comprehensive (loss)/income: | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment, net of nil tax | |

| (1,413 | ) | |

| 4,301 | | |

| (6,859 | ) | |

| (977 | ) |

| Comprehensive income | |

| 37,658 | | |

| 47,301 | | |

| 37,007 | | |

| 5,276 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per ordinary share attributable to ordinary shareholders - basic and diluted | |

| 0.11 | | |

| 0.12 | | |

| 0.12 | | |

| 0.02 | |

| Net income per ADS - basic and diluted* | |

| 0.33 | | |

| 0.36 | | |

| 0.36 | | |

| 0.06 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of ordinary shares used in computing basic income per share | |

| 371,473,030 | | |

| 363,061,543 | | |

| 357,427,106 | | |

| 357,427,106 | |

| Weighted average number of ordinary shares used in computing diluted income per share | |

| 374,615,685 | | |

| 365,317,172 | | |

| 359,607,726 | | |

| 359,607,726 | |

| | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation expenses included are as follows: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 79 | | |

| 65 | | |

| 65 | | |

| 9 | |

| Research and product development | |

| 79 | | |

| 65 | | |

| 65 | | |

| 9 | |

| Sales and marketing | |

| 43 | | |

| 31 | | |

| 32 | | |

| 5 | |

| General and administrative | |

| 5,356 | | |

| 1,429 | | |

| 1,246 | | |

| 178 | |

| Total | |

| 5,557 | | |

| 1,590 | | |

| 1,408 | | |

| 201 | |

*Each ADS represents three of the Company's ordinary shares.

Reconciliations of GAAP and Non-GAAP Results

(All

amounts in thousands, except per share information)

| | |

Quarter

Ended September 30, 2024 | |

| | |

| |

Share-based | |

Amortization

of acquired | |

Net

gain on | |

Non-GAAP | |

| | |

GAAP

Result | |

Compensation | |

intangible

assets | |

disposals

of subsidiaries | |

Result | |

| Income from operations | |

| 29,167 | |

| 1,408 | |

| 764 | |

| - | |

| 31,339 | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net income | |

| 43,866 | |

| 1,408 | |

| 764 | |

| - | |

| 46,038 | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net income attributable to ordinary

shareholders | |

| 44,448 | |

| 1,408 | |

| 764 | |

| - | |

| 46,620 | |

| | |

Quarter

Ended June 30, 2024 | |

| | |

| |

Share-based | |

Amortization

of acquired | |

Net

gain on | |

Non-GAAP | |

| | |

GAAP

Result | |

Compensation | |

intangible

assets | |

disposals

of subsidiaries | |

Result | |

| Income from operations | |

| 34,490 | |

| 1,590 | |

| 828 | |

| (24,618 | ) |

| 12,290 | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net income | |

| 43,000 | |

| 1,590 | |

| 828 | |

| (24,618 | ) |

| 20,800 | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net income attributable to ordinary

shareholders | |

| 43,022 | |

| 1,590 | |

| 828 | |

| (24,618 | ) |

| 20,822 | |

| | |

Quarter

Ended September 30, 2023 | |

| | |

| |

Share-based | |

Amortization

of acquired | |

Net

gain on | |

Non-GAAP | |

| | |

GAAP

Result | |

Compensation | |

intangible

assets | |

disposals

of subsidiaries | |

Result | |

| Income from operations | |

| 31,700 | |

| 5,557 | |

| 828 | |

| - | |

| 38,085 | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net income | |

| 39,071 | |

| 5,557 | |

| 828 | |

| - | |

| 45,456 | |

| | |

| | |

| | |

| | |

| | |

| | |

| Net income attributable to ordinary

shareholders | |

| 39,403 | |

| 5,557 | |

| 828 | |

| - | |

| 45,788 | |

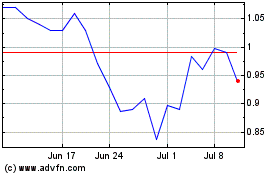

Tuniu (NASDAQ:TOUR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Tuniu (NASDAQ:TOUR)

Historical Stock Chart

From Jan 2024 to Jan 2025