ProShares, a premier provider of alternative exchange traded

funds (ETFs), announced today share splits on four of its ETFs and

reverse share splits on 20 of its ETFs. The splits and reverse

splits will not change the value of a shareholder's investment.

Splits

Three funds will split shares 2-for-1.

Ticker Fund Split Ratio TQQQ

ProShares UltraPro QQQ® 2:1 URTY ProShares

UltraPro Russell2000 2:1 UMDD ProShares UltraPro

MidCap400 2:1

One fund will split shares 3-for-1.

Ticker Fund Split Ratio UPRO

ProShares UltraPro S&P500® 3:1

All splits will apply to shareholders of record as of the close

of the markets on February 22, 2011, payable after the close of the

markets on February 24, 2011. The funds will trade at their

post-split prices on February 25, 2011. The ticker symbols and

CUSIP numbers for the funds will not change, and all will continue

to trade on NYSE Arca.

The splits will decrease the price per share of each fund with a

proportionate increase in the number of shares outstanding. For

example, for the 2-for-1 splits, each pre-split share held by a

shareholder will result in the receipt of 2 post-split shares,

which will be priced at one half of the net asset value (“NAV”) of

a pre-split share.

Illustration of a Split

The following table shows the effect of a hypothetical 2-for-1

split:

Period # of Shares Owned Hypothetical NAV

Value of Shares Pre-Split 100 $100.00

$10,000.00 Post-Split 200 $50.00 $10,000.00

Reverse Splits

Thirteen funds will reverse split shares 1-for-4.

Ticker Fund Split Ratio

Old CUSIP New CUSIP EPV ProShares

UltraShort MSCI Europe 1:4 74347X807 74348A301

MZZ ProShares UltraShort MidCap400 1:4

74347R859 74347X211 REW ProShares UltraShort

Technology 1:4 74347R578 74347X153 SDD

ProShares UltraShort SmallCap600 1:4 74347R792

74348A400 SDK ProShares UltraShort Russell MidCap Growth

1:4 74347R446 74347X187 SIJ ProShares

UltraShort Industrials 1:4 74347R594 74348A103

SJH ProShares UltraShort Russell2000 Value 1:4

74347R412 74348A509 SJL ProShares UltraShort Russell

MidCap Value 1:4 74347R438 74347X161 SKF

ProShares UltraShort Financials 1:4 74347R628

74347X146 SMK ProShares UltraShort MSCI Mexico

Investable Market 1:4 74344X872 74347X179 TWM

ProShares UltraShort Russell2000 1:4 74347R834

74348A202 UCO ProShares Ultra DJ-UBS Crude Oil*

1:4 74347W502 74347W650 ZSL ProShares

UltraShort Silver* 1:4 74347W726 74347W643

Seven funds will reverse split shares 1-for-5.

Ticker Fund Split Ratio

Old CUSIP New CUSIP CMD ProShares

UltraShort DJ-UBS Commodity* 1:5 74347W205

74347W676 JPX ProShares UltraShort MSCI Pacific ex-Japan

1:5 74347X609 74347X229 QID ProShares

UltraShort QQQ® 1:5 74347R875 74347X237 SCO

ProShares UltraShort DJ-UBS Crude Oil* 1:5

74347W809 74347W668 SKK ProShares UltraShort

Russell2000 Growth 1:5 74347R420 74347X195 SSG

ProShares UltraShort Semiconductors 1:5

74347R545 74347X245 TLL ProShares UltraShort

Telecommunications 1:5 74347R255 74347X252

All reverse splits will apply to shareholders of record as of

the close of the markets on February 24, 2011. The funds will trade

at their post-split prices on February 25, 2011. The ticker symbols

for the funds will not change, and all will continue to trade on

NYSE Arca. All funds undergoing a reverse split will be issued a

new CUSIP number.

The reverse splits will increase the price per share of each

fund with a proportionate decrease in the number of shares

outstanding. For example, for the 1-for-4 reverse splits, every

four pre-split shares held by a shareholder will result in the

receipt of one post-split share, which will be priced four times

higher than the net asset value (“NAV”) of a pre-split share.

Fractional Shares from Reverse Splits

For shareholders who hold quantities of shares that are not an

exact multiple of the reverse split ratio (for example, not a

multiple of 4 for a 1-to-4 split), the reverse split will result in

the creation of a fractional share. Post-reverse split fractional

shares will be redeemed for cash and be sent to your broker of

record. This redemption may cause some shareholders to realize

gains or losses, which could be a taxable event for those

shareholders.

Illustration of a Reverse Split

The following table shows the effect of a hypothetical 1-for-4

reverse split:

Period # of Shares Owned Hypothetical NAV

Value of Shares Pre-Split 100 $10.00 $1,000.00

Post-Split 25 $40.00 $1,000.00

About ProShares

ProShares is a premier provider of alternative ETFs, with 115

funds and nearly $25 billion in assets. ProShares offers the

largest family of geared (leveraged and inverse) ETFs.¹ ProShares

is part of ProFunds Group, which was founded in 1997 and includes

nearly $32 billion in mutual fund and ETF assets.²

Leveraged and inverse ProShares seek returns that are multiples

or inverse multiples (e.g., 2x, -2x) of the return of an index or

other benchmark (target) for a single day. Due to the

compounding of daily returns, leveraged and inverse ProShares’

returns over periods other than one day will likely differ in

amount and possibly direction from the target return for the same

period. Investors should monitor their holdings consistent with

their strategies, as frequently as daily. For more on correlation,

leverage and other risks, please read the ProShares prospectus.

* Commodity and Currency ProShares, which are issued by

ProShares Trust II. All other ProShares are issued by ProShares

Trust.

1 Source: Lipper, based on a worldwide analysis of all of the

known providers of funds in these categories. The analysis covered

ETFs, ETNs and mutual funds by the number of funds and assets as of

6/30/2010.

2 Number of funds and assets as of 2/11/2011.

There is no guarantee any ProShares ETF will achieve its

investment objective. Investing involves risk, including the

possible loss of principal. ProShares are non-diversified and

entail certain risks, including risk associated with the use of

derivatives (futures contracts, swap agreements and similar

instruments), imperfect benchmark correlation, leverage and market

price variance, all of which can increase volatility and decrease

performance. Short ProShares should lose money when their

benchmarks or indexes rise. See the prospectus for a more complete

description of risks.

Carefully consider the investment objectives, risks, charges

and expenses of ProShares before investing. This and other

information can be found in their summary and full prospectuses.

Read them carefully before investing. Obtain them at proshares.com

or from your financial professional or broker/dealer

representative.

Commodity and Currency ProShares ETFs are not regulated under

the Investment Company Act of 1940 and are not afforded its

protections. Investing in ETFs involves a substantial risk of

loss.

ProShares Trust II (issuer) has filed a registration

statement (including a prospectus) with the SEC for the offering to

which this communication relates. Before you invest, you should

read the prospectus in that registration statement and other

documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC website at sec.gov.

Alternatively, the issuer will arrange to send you the prospectus

if you request it by calling toll-free 866.776.5125, or visit

proshares.com.

“QQQ®” and “NASDAQ-100®” are trademarks of the NASDAQ OMX Group,

Inc. “Standard & Poor's®,” “S&P®,” “S&P 500®,”

“Standard & Poor’s 500™,” are trademarks of Standard &

Poor’s Financial Services LLC (“S&P”). “Dow Jones,” “DJ “Dow

Jones U.S. Sector Indexes,” “Dow Jones Select Sector Indexes,” “Dow

Jones-UBS Commodity IndexSM” and the names identifying each of the

individual “Dow Jones-UBS Sub-IndexesSM” are service marks of Dow

Jones Trademark Holdings, LLC, and UBS Securities, LLC, as the case

may be. The “ “Russell 2000® Index,” “Russell 2000® Growth Index,”

“Russell 2000® Value Index,” “Russell Midcap® Growth Index” and

“Russell Midcap® Value Index” are trademarks of Russell

Investments. “MSCI,” “MSCI Inc.,” “MSCI Index” are service marks of

MSCI. “The Dow Jones Indexes are licensed trademarks of CME Group

Index Services LLC (“CME”). Dow Jones service marks have been

licensed for use by CME. ProShares have not been passed on by these

entities or their subsidiaries or affiliates as to their legality

or suitability. ProShares are not sponsored, endorsed, sold or

promoted by these entities or their subsidiaries or affiliates, and

they make no representation regarding the advisability of investing

in these products. THESE ENTITIES AND THEIR SUBSIDIARIES AND

AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO

PROSHARES.

"ProFunds Group" includes ProFunds mutual funds and ProShares

ETFs. ProShares are distributed by SEI Investments Distribution

Co., which is not affiliated with the advisor or sponsor.

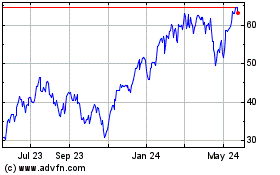

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

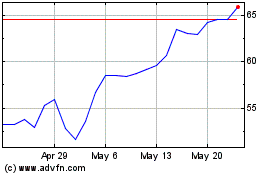

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Feb 2024 to Feb 2025