ProShares Names Industry Pioneer Benjamin Fulton to Lead Tactical Products Business

July 25 2018 - 10:30AM

Business Wire

ProShares, a premier provider of ETFs, today announced that Ben

Fulton has been named to the role of Managing Director. As a member

of senior management, Mr. Fulton will contribute to the firm’s

strategy and growing its business. He will report to ProShares CEO

Michael L. Sapir.

Mr. Fulton’s principal responsibilities will include overseeing

the company’s tactical products business. These products include

all ProShares’ and ProFunds’ geared (leveraged and inverse) and

volatility ETFs and mutual funds, which represent over $28 billion

in assets.

“I am delighted to have Ben join our senior leadership and for

him to help drive our business into the future,” said Mr. Sapir.

“Ben’s leadership capabilities and the depth and breadth of his

experience in the ETF industry are exceptionally rare.”

“I’ve always admired ProShares, and I am excited to join such a

longstanding and innovative leader in the financial industry,” Mr.

Fulton said. “I look forward to leading a focused and driven effort

to grow the company’s tactical products lineup, which can play an

important role for knowledgeable investors.”

Mr. Fulton brings with him more than 30 years of experience in

the global financial services industry. Most recently, Mr. Fulton

was Chief Executive Officer of Elkhorn Investments, a company he

founded in 2013. Previously, as Managing Director of the Global ETF

Business for Invesco, he had day-to-day responsibility over the

PowerShares ETF business. Prior to Invesco PowerShares, Mr. Fulton

held senior roles at Claymore Securities (Guggenheim), and Nuveen

Investments. Over the years, he and his product development teams

have won eight William F. Sharpe Most Innovative ETF Awards. Mr.

Fulton holds a bachelor’s degree in Business Administration and

Management from Taylor University in Indiana. He holds Series 3, 7,

24, 30, 63 and 66 FINRA registrations.

About ProShares | ProFunds:ProShares and its affiliates

have been at the forefront of the indexing revolution since 1997.

ProShares offers one of the largest lineups of ETFs, with more than

$30 billion in assets. The company is the leader in strategies such

as dividend growth, alternative and geared (leveraged and inverse).

ProShares continues to innovate with products that provide

strategic and tactical opportunities for investors to manage risk

and enhance returns. ProFunds, its mutual fund affiliate, manages

index funds across a wide spectrum of asset classes, including

broad-based equities, sectors, fixed income, commodities and

currencies.

July 25, 2018

ProShares is the leader in dividend growth, alternative and

geared (leveraged and inverse) strategies; Source: ProShares,

Strategic Insight and Lipper, based on number of funds and/or

assets, as of 12/31/17.

Investing involves risk, including the possible loss of

principal. Geared ProShares ETFs and ProFunds mutual funds

entail certain risks, which may include risk associated with the

use of derivatives (swap agreements, futures contracts and similar

instruments), imperfect benchmark correlation, leverage and market

price variance, all of which can increase volatility and decrease

performance. Short ProShares ETFs and ProFunds mutual funds should

lose money when their benchmarks or indexes rise. Geared ProShares

ETFs are non-diversified. Please see their summary and full

prospectuses for a more complete description of risks. There is

no guarantee any investment will achieve its investment objective.

Past performance is no guarantee of future results.

Carefully consider the investment objectives, risks, charges

and expenses of ProShares and ProFunds before investing. This and

other information can be found in summary and full prospectuses.

Read them carefully before investing. For a ProShares ETF

prospectus, visit ProShares.com or obtain one from

your financial advisor or broker-dealer representative. For a

ProFunds mutual fund prospectus, visit

ProFunds.com.

ProShares ETFs are distributed by SEI Investments Distribution

Co., which is not affiliated with the funds’ advisor or sponsor.

ProFunds Distributors, Inc. is distributor for ProFunds mutual

funds. SEI Investments Distribution Co. is not affiliated with

ProFunds or ProFunds Distributors. ©2018 PSA 2018-4813

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180725005562/en/

Media:Hewes Communications, Inc.Tucker Hewes,

212-207-9451tucker@hewescomm.comorInvestors:ProShares866-776-5125ProShares.com

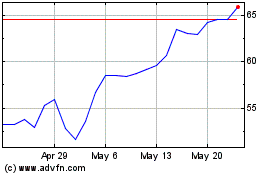

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

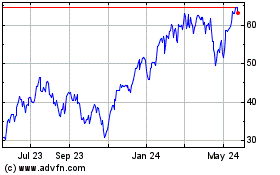

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Feb 2024 to Feb 2025