Completed Significant Actions to Increase

Earnings, Enhance Profitability Profile, Reduce Risk, and

Strengthen Capital Flexibility

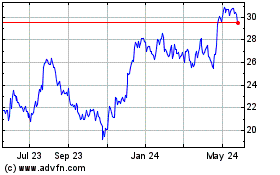

Trustmark Corporation (NASDAQGS:TRMK) announced second quarter

financial results which reflect the previously disclosed sale of

Fisher Brown Bottrell Insurance, Inc. (FBBI). As such, second

quarter financial results consist of both continuing operations and

discontinued operations. The discontinued operations include the

financial results of FBBI prior to the sale as well as the gain on

sale in the second quarter. The discontinued operations results are

presented as a single line item below income from continuing

operations in the accompanying tables for all periods presented.

Financial results from adjusted continuing operations exclude

significant non-routine transactions(1). Trustmark reported net

income of $73.8 million in the second quarter of 2024, representing

diluted earnings per share of $1.20 and net income from adjusted

continuing operations(1) of $40.5 million, or $0.66 per diluted

share.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240723250620/en/

Printer friendly version of earnings release with consolidated

financial statements and notes:

https://www.businesswire.com/news/home/54097962/en.

The Board of Directors declared a quarterly cash dividend of

$0.23 per share payable September 15, 2024, to shareholders of

record on September 1, 2024.

Significant Non-Routine Transactions in the Second

Quarter

- Completed sale of FBBI, producing a gain on sale of $228.3

million ($171.2 million, net of taxes)

- Restructured investment securities portfolio; sold available

for sale securities of $1.6 billion with an average yield of 1.36%,

which generated a loss of $182.8 million ($137.1 million, net of

taxes); purchased $1.4 billion of available for sale securities

with an average yield of 4.85%

- Sold a portfolio of 1-4 family mortgage loans that were three

payments delinquent and/or nonaccrual at time of selection totaling

$56.2 million (Mortgage Loan Sale) which generated a loss of $13.4

million ($10.1 million, net of taxes); sale drove a $54.1 million

reduction in nonperforming loans

- Exchanged Visa Class B-1 shares for Visa Class B-2 shares and

Visa Class C common stock; Visa Class C stock exchange resulted in

a gain of $8.1 million ($6.0 million, net of taxes)

Second Quarter Highlights

- Loans held for investment (HFI) increased $97.5 million, or

0.7%, from the prior quarter to $13.2 billion; excluding the

Mortgage Loan Sale, loans HFI increased $152.4 million, or 1.2%,

linked-quarter

- Deposits expanded $124.3 million, or 0.8%, linked-quarter to

$15.5 billion

- Net interest income (FTE) increased $8.1 million, or 6.0%,

linked-quarter to $144.3 million, resulting in a net interest

margin of 3.38%, up 17 basis points from the prior quarter

- Noninterest expense totaled $118.3 million, down $1.3 million,

or 1.1%, linked-quarter

- Tangible equity to tangible assets ratio increased 105 basis

points to 8.52% at June 30, 2024

- Tangible book value per share increased $3.20, or 14.5%, to

$25.23 at June 30, 2024

Duane A. Dewey, President and CEO, stated, “The second quarter

of 2024 was an extremely productive quarter for Trustmark. We

closed the previously announced sale of our insurance agency and

completed significant balance sheet restructuring to position the

company for improved operating performance into the second half of

the year and beyond. While completing these non-recurring events,

we also performed well in our core banking franchise with continued

loan growth, deposit growth, solid fee income and disciplined

expense management. The commitment and dedication of our associates

across the organization to successfully meet our clients’ financial

needs and execute the one-time projects are outstanding, and we

believe the company is very well positioned for future

opportunities.”

Balance Sheet Management

- Loans HFI totaled $13.2 billion, up 0.7% from the prior quarter

and 4.3% year-over-year

- Deposits totaled $15.5 billion, up 0.8% from the previous

quarter and 3.7% year-over-year

- Enhanced strong capital position with CET1 ratio of 10.92% and

total risk-based capital ratio of 13.29%

Loans HFI totaled $13.2 billion at June 30, 2024, reflecting an

increase of $97.5 million, or 0.7%, linked-quarter and $541.5

million, or 4.3%, year-over-year. The linked quarter growth

reflected increases in construction, development and other land

loans, loans secured by nonfarm, nonresidential properties, and

other loans and leases offset in part by declines in commercial and

industrial loans, other real estate secured loans, and 1-4 family

mortgage loans. Trustmark’s loan portfolio continues to be

well-diversified by loan type and geography.

Deposits totaled $15.5 billion at June 30, 2024, up $124.3

million, or 0.8%, from the prior quarter and $549.0 million, or

3.7%, year-over-year. Trustmark continues to maintain a strong

liquidity position as loans HFI represented 85.1% of total deposits

at June 30, 2024. Noninterest-bearing deposits represented 20.4% of

total deposits at June 30, 2024, compared to 19.8% at March 31,

2024. The cost of interest-bearing deposits increased 1 basis point

to 2.75% for the second quarter, while the cost of total deposits

was 2.18%, unchanged from the prior quarter. The total cost of

interest-bearing liabilities was 2.95% for the second quarter, up 3

basis points linked-quarter.

During the second quarter, Trustmark did not repurchase any of

its outstanding common shares. As previously announced, Trustmark’s

Board of Directors authorized a stock repurchase program effective

January 1, 2024, under which $50.0 million of Trustmark’s

outstanding shares may be acquired through December 31, 2024. As of

June 30, 2024, Trustmark had not repurchased any of its outstanding

common shares under this program. At June 30, 2024, Trustmark’s

tangible equity to tangible assets ratio was 8.52%, up 105 basis

points from the prior quarter, while the total risk-based capital

ratio was 13.29%, up 87 basis points from the prior quarter.

Tangible book value per share was $25.23 at June 30, 2024, an

increase of 14.5% from the prior quarter and 24.7% from the prior

year.

Credit Quality

- Nonaccrual loans declined 55.0% linked-quarter to $44.3

million, driven by the Mortgage Loan Sale

- Net charge-offs totaled $11.6 million for the second quarter;

excluding the Mortgage Loan Sale, net charge-offs totaled $3.0

million and represented 0.09% of average loans

- Allowance for credit losses (ACL) represented 1.18% of loans

HFI and 840.20% of nonaccrual loans HFI, excluding individually

analyzed loans, at June 30, 2024

Nonaccrual loans totaled $44.3 million at June 30, 2024, down

$54.1 million from the prior quarter and $30.7 million

year-over-year. Other real estate totaled $6.6 million, reflecting

a decrease of $1.0 million from the prior quarter and an increase

of $5.4 million from the prior year. Collectively, nonperforming

assets totaled $50.9 million at June 30, 2024, down $55.1 million,

or 52.0%, from the prior quarter and $25.3 million, or 33.2%, from

the prior year.

The total provision for credit losses for loans HFI was $23.3

million in the second quarter. Excluding the Mortgage Loan Sale,

the provision for credit losses for loans HFI was $14.7 million and

was primarily attributable to credit migration. The provision for

credit losses for off-balance sheet credit exposures was a negative

$3.6 million, primarily driven by decreases in unfunded

commitments. Collectively, the provision for credit losses,

excluding the Mortgage Loan Sale, totaled $11.1 million in the

second quarter compared to $7.5 million from the prior quarter and

$8.5 million in the second quarter of 2023.

Allocation of Trustmark’s $154.7 million ACL on loans HFI

represented 1.05% of commercial loans and 1.59% of consumer and

home mortgage loans, resulting in an ACL to total loans HFI of

1.18% at June 30, 2024. Management believes the level of the ACL is

commensurate with the credit losses currently expected in the loan

portfolio.

Revenue Generation

- Net interest income (FTE) totaled $144.3 million in the second

quarter, up 6.0% linked-quarter

- GAAP noninterest income was negative $141.3 million in the

second quarter while noninterest income from adjusted continuing

operations(1) totaled $38.2 million and represented 21.3% of total

revenue from adjusted continuing operations(1)

- GAAP revenue was negative $0.3 million in the second quarter

while revenue from adjusted continuing operations(1) totaled $179.3

million, up $7.1 million, or 4.1%, linked-quarter

Revenue from adjusted continuing operations(1) in the second

quarter totaled $179.3 million, an increase of $7.1 million, or

4.1%, from the prior quarter and $1.5 million, or 0.9%, from the

same quarter in the prior year. The linked-quarter increase

primarily reflects higher net interest income and solid growth in

bank card and other fees and wealth management revenue.

Net interest income (FTE) in the second quarter totaled $144.3

million, resulting in a net interest margin of 3.38%, up 17 basis

points from the prior quarter. The increase in the net interest

margin was primarily due to increased yields on the securities

portfolio and the loans HFI and held for sale portfolio as well as

the costs of interest-bearing deposits remaining relatively

flat.

Noninterest income from adjusted continuing operations(1) in the

second quarter totaled $38.2 million, a decrease of $1.1 million,

or 2.8%, from the prior quarter and an increase of $0.4 million, or

1.1%, year-over-year. Bank card and other fees totaled $9.2 million

in the second quarter, up $1.8 million, or 24.2%, linked-quarter

and $0.3 million, or 3.5%, year-over-year. The linked-quarter

increase reflects expanded customer derivative revenue, interchange

revenue, and miscellaneous other revenue. Service charges on

deposit accounts totaled $10.9 million in the second quarter,

relatively unchanged from the prior quarter and up $0.2 million, or

2.1%, year-over-year. Other, net totaled $7.5 million, up $4.4

million linked-quarter as the $8.1 million gain from Visa C

exchange was offset in part by the $4.8 million in

noncredit-related loss from the Mortgage Loan Sale. Other, net from

adjusted continuing operations(1) totaled $4.2 million, an increase

of $1.1 million, or 35.5%, from the prior quarter.

Mortgage loan production in the second quarter totaled $379.5

million, an increase of 38.5% from the prior quarter and a decrease

of 12.0% year-over-year. Mortgage banking revenue totaled $4.2

million in the second quarter, a decrease of $4.7 million

linked-quarter and $2.4 million year-over-year. The linked-quarter

decrease was principally attributable to increased net negative

hedge ineffectiveness, which was driven by a higher assumed

discount rate on servicing cash flows.

Wealth management revenue in the second quarter totaled $9.7

million, an increase of $0.7 million, or 8.3%, from the prior

quarter and $0.8 million, or 9.1%, year-over-year. The

linked-quarter growth reflected increased investment services and

trust management revenue while the year-over-year increase

reflected expanded brokerage revenue.

Noninterest Expense

- Noninterest expense declined $1.3 million, or 1.1%,

linked-quarter

- Salary and employee benefit expense declined $0.6 million, or

1.0%, linked-quarter

Noninterest expense in the second quarter totaled $118.3

million, a decrease of $1.3 million, or 1.1%, when compared to the

prior quarter. Salaries and employee benefits expense decreased

$0.6 million, or 1.0%, linked-quarter principally due to reduced

compensation expense and the seasonal decline in payroll taxes,

which were partially offset by increased commission expense. Other

expense declined $0.9 million, or 5.6%, linked-quarter.

(1) Please refer to Consolidated Financial Information, Note 1 –

Significant Non-Routine Transactions and Note 7 – Non-GAAP

Financial Measures.

Additional Information

As previously announced, Trustmark will conduct a conference

call with analysts on Wednesday, July 24, 2024, at 8:30 a.m.

Central Time to discuss the Corporation’s financial results.

Interested parties may listen to the conference call by dialing

(877) 317-3051 or by clicking on the link provided under the

Investor Relations section of our website at www.trustmark.com. A

replay of the conference call will also be available through

Wednesday, August 7, 2024, in archived format at the same web

address or by calling (877) 344-7529, passcode 4456612.

Trustmark is a financial services company providing banking and

financial solutions through offices in Alabama, Florida, Georgia,

Mississippi, Tennessee and Texas.

Forward-Looking Statements

Certain statements contained in this document constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. You can identify

forward-looking statements by words such as “may,” “hope,” “will,”

“should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “project,” “potential,” “seek,” “continue,”

“could,” “would,” “future” or the negative of those terms or other

words of similar meaning. You should read statements that contain

these words carefully because they discuss our future expectations

or state other “forward-looking” information. These forward-looking

statements include, but are not limited to, statements relating to

anticipated future operating and financial performance measures,

including net interest margin, credit quality, business

initiatives, growth opportunities and growth rates, among other

things, and encompass any estimate, prediction, expectation,

projection, opinion, anticipation, outlook or statement of belief

included therein as well as the management assumptions underlying

these forward-looking statements. You should be aware that the

occurrence of the events described under the caption “Risk Factors”

in Trustmark’s filings with the Securities and Exchange Commission

(SEC) could have an adverse effect on our business, results of

operations and financial condition. Should one or more of these

risks materialize, or should any such underlying assumptions prove

to be significantly different, actual results may vary

significantly from those anticipated, estimated, projected or

expected.

Risks that could cause actual results to differ materially from

current expectations of Management include, but are not limited to,

actions by the Board of Governors of the Federal Reserve System

(FRB) that impact the level of market interest rates, local, state,

national and international economic and market conditions,

conditions in the housing and real estate markets in the regions in

which Trustmark operates and the extent and duration of the current

volatility in the credit and financial markets, changes in the

level of nonperforming assets and charge-offs, an increase in

unemployment levels and slowdowns in economic growth, changes in

our ability to measure the fair value of assets in our portfolio,

material changes in the level and/or volatility of market interest

rates, the impacts related to or resulting from bank failures and

other economic and industry volatility, including potential

increased regulatory requirements, the demand for the products and

services we offer, potential unexpected adverse outcomes in pending

litigation matters, our ability to attract and retain

noninterest-bearing deposits and other low-cost funds, competition

in loan and deposit pricing, as well as the entry of new

competitors into our markets through de novo expansion and

acquisitions, economic conditions, changes in accounting standards

and practices, including changes in the interpretation of existing

standards, that affect our consolidated financial statements,

changes in consumer spending, borrowings and savings habits,

technological changes, changes in the financial performance or

condition of our borrowers, greater than expected costs or

difficulties related to the integration of acquisitions or new

products and lines of business, cyber-attacks and other breaches

which could affect our information system security, natural

disasters, environmental disasters, pandemics or other health

crises, acts of war or terrorism, and other risks described in our

filings with the SEC.

Although we believe that the expectations reflected in such

forward-looking statements are reasonable, we can give no assurance

that such expectations will prove to be correct. Except as required

by law, we undertake no obligation to update or revise any of this

information, whether as the result of new information, future

events or developments or otherwise.

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in

thousands) (unaudited) Linked Quarter Year

over Year QUARTERLY AVERAGE

BALANCES 6/30/2024 3/31/2024

6/30/2023 $ Change % Change $ Change

% Change Securities AFS-taxable

$

1,866,227

$

1,927,619

$

2,140,505

$

(61,392

)

-3.2

%

$

(274,278

)

-12.8

%

Securities AFS-nontaxable

—

—

4,796

—

n/m

(4,796

)

-100.0

%

Securities HTM-taxable

1,421,246

1,418,476

1,463,086

2,770

0.2

%

(41,840

)

-2.9

%

Securities HTM-nontaxable

112

340

1,718

(228

)

-67.1

%

(1,606

)

-93.5

%

Total securities

3,287,585

3,346,435

3,610,105

(58,850

)

-1.8

%

(322,520

)

-8.9

%

Loans (includes loans held for sale)

13,309,127

13,169,805

12,732,057

139,322

1.1

%

577,070

4.5

%

Fed funds sold and reverse repurchases

110

114

3,275

(4

)

-3.5

%

(3,165

)

-96.6

%

Other earning assets

592,625

571,215

903,027

21,410

3.7

%

(310,402

)

-34.4

%

Total earning assets

17,189,447

17,087,569

17,248,464

101,878

0.6

%

(59,017

)

-0.3

%

Allowance for credit losses (ACL), loans held

for investment (LHFI)

(143,245

)

(138,711

)

(121,960

)

(4,534

)

-3.3

%

(21,285

)

-17.5

%

Other assets

1,740,307

1,730,521

1,648,583

9,786

0.6

%

91,724

5.6

%

Total assets

$

18,786,509

$

18,679,379

$

18,775,087

$

107,130

0.6

%

$

11,422

0.1

%

Interest-bearing demand deposits

$

5,222,369

$

5,291,779

$

4,803,737

$

(69,410

)

-1.3

%

$

418,632

8.7

%

Savings deposits

3,653,966

3,686,027

4,002,134

(32,061

)

-0.9

%

(348,168

)

-8.7

%

Time deposits

3,346,046

3,321,601

2,335,752

24,445

0.7

%

1,010,294

43.3

%

Total interest-bearing deposits

12,222,381

12,299,407

11,141,623

(77,026

)

-0.6

%

1,080,758

9.7

%

Fed funds purchased and repurchases

434,760

428,127

389,834

6,633

1.5

%

44,926

11.5

%

Other borrowings

534,350

463,459

1,330,010

70,891

15.3

%

(795,660

)

-59.8

%

Subordinated notes

123,556

123,501

123,337

55

0.0

%

219

0.2

%

Junior subordinated debt securities

61,856

61,856

61,856

—

0.0

%

—

0.0

%

Total interest-bearing liabilities

13,376,903

13,376,350

13,046,660

553

0.0

%

330,243

2.5

%

Noninterest-bearing deposits

3,183,524

3,120,566

3,595,927

62,958

2.0

%

(412,403

)

-11.5

%

Other liabilities

498,593

505,942

552,209

(7,349

)

-1.5

%

(53,616

)

-9.7

%

Total liabilities

17,059,020

17,002,858

17,194,796

56,162

0.3

%

(135,776

)

-0.8

%

Shareholders' equity

1,727,489

1,676,521

1,580,291

50,968

3.0

%

147,198

9.3

%

Total liabilities and equity

$

18,786,509

$

18,679,379

$

18,775,087

$

107,130

0.6

%

$

11,422

0.1

%

n/m - percentage changes greater than +/- 100% are

considered not meaningful

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in

thousands) (unaudited) Linked Quarter Year

over Year PERIOD END

BALANCES 6/30/2024 3/31/2024

6/30/2023 $ Change % Change $ Change

% Change Cash and due from banks

$

822,141

$

606,061

$

831,852

$

216,080

35.7

%

$

(9,711

)

-1.2

%

Securities available for sale

1,621,659

1,702,299

1,871,883

(80,640

)

-4.7

%

(250,224

)

-13.4

%

Securities held to maturity

1,380,487

1,415,025

1,458,665

(34,538

)

-2.4

%

(78,178

)

-5.4

%

Loans held for sale (LHFS)

185,698

172,937

181,094

12,761

7.4

%

4,604

2.5

%

Loans held for investment (LHFI)

13,155,418

13,057,943

12,613,967

97,475

0.7

%

541,451

4.3

%

ACL LHFI

(154,685

)

(142,998

)

(129,298

)

(11,687

)

-8.2

%

(25,387

)

-19.6

%

Net LHFI

13,000,733

12,914,945

12,484,669

85,788

0.7

%

516,064

4.1

%

Premises and equipment, net

232,681

232,630

227,293

51

0.0

%

5,388

2.4

%

Mortgage servicing rights

136,658

138,044

134,350

(1,386

)

-1.0

%

2,308

1.7

%

Goodwill

334,605

334,605

334,605

—

0.0

%

—

0.0

%

Identifiable intangible assets

181

208

303

(27

)

-13.0

%

(122

)

-40.3

%

Other real estate

6,586

7,620

1,137

(1,034

)

-13.6

%

5,449

n/m

Operating lease right-of-use assets

36,925

34,324

35,561

2,601

7.6

%

1,364

3.8

%

Other assets

694,133

744,821

783,457

(50,688

)

-6.8

%

(89,324

)

-11.4

%

Assets of discontinued operations

—

73,093

77,757

(73,093

)

-100.0

%

(77,757

)

-100.0

%

Total assets

$

18,452,487

$

18,376,612

$

18,422,626

$

75,875

0.4

%

$

29,861

0.2

%

Deposits: Noninterest-bearing

$

3,153,506

$

3,039,652

$

3,461,073

$

113,854

3.7

%

$

(307,567

)

-8.9

%

Interest-bearing

12,309,382

12,298,905

11,452,827

10,477

0.1

%

856,555

7.5

%

Total deposits

15,462,888

15,338,557

14,913,900

124,331

0.8

%

548,988

3.7

%

Fed funds purchased and repurchases

314,121

393,215

311,179

(79,094

)

-20.1

%

2,942

0.9

%

Other borrowings

336,687

482,027

1,056,714

(145,340

)

-30.2

%

(720,027

)

-68.1

%

Subordinated notes

123,592

123,537

123,372

55

0.0

%

220

0.2

%

Junior subordinated debt securities

61,856

61,856

61,856

—

0.0

%

—

0.0

%

ACL on off-balance sheet credit exposures

30,265

33,865

34,841

(3,600

)

-10.6

%

(4,576

)

-13.1

%

Operating lease liabilities

40,517

37,792

38,172

2,725

7.2

%

2,345

6.1

%

Other liabilities

203,420

207,583

299,481

(4,163

)

-2.0

%

(96,061

)

-32.1

%

Liabilities of discontinued operations

—

15,581

11,918

(15,581

)

-100.0

%

(11,918

)

-100.0

%

Total liabilities

16,573,346

16,694,013

16,851,433

(120,667

)

-0.7

%

(278,087

)

-1.7

%

Common stock

12,753

12,747

12,724

6

0.0

%

29

0.2

%

Capital surplus

161,834

160,521

156,834

1,313

0.8

%

5,000

3.2

%

Retained earnings

1,796,111

1,736,485

1,667,339

59,626

3.4

%

128,772

7.7

%

Accumulated other comprehensive income (loss), net of tax

(91,557

)

(227,154

)

(265,704

)

135,597

59.7

%

174,147

65.5

%

Total shareholders' equity

1,879,141

1,682,599

1,571,193

196,542

11.7

%

307,948

19.6

%

Total liabilities and equity

$

18,452,487

$

18,376,612

$

18,422,626

$

75,875

0.4

%

$

29,861

0.2

%

n/m - percentage changes greater than +/- 100% are

considered not meaningful

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in thousands

except per share amounts) (unaudited) Quarter

Ended Linked Quarter Year over Year

INCOME STATEMENTS

6/30/2024 3/31/2024 6/30/2023 $ Change

% Change $ Change % Change Interest and fees

on LHFS & LHFI-FTE

$

216,399

$

209,456

$

192,941

$

6,943

3.3

%

$

23,458

12.2

%

Interest on securities-taxable

17,929

15,634

16,779

2,295

14.7

%

1,150

6.9

%

Interest on securities-tax exempt-FTE

1

4

69

(3

)

-75.0

%

(68

)

-98.6

%

Interest on fed funds sold and reverse repurchases

2

1

45

1

100.0

%

(43

)

-95.6

%

Other interest income

8,124

8,110

12,077

14

0.2

%

(3,953

)

-32.7

%

Total interest income-FTE

242,455

233,205

221,911

9,250

4.0

%

20,544

9.3

%

Interest on deposits

83,681

83,716

54,409

(35

)

0.0

%

29,272

53.8

%

Interest on fed funds purchased and repurchases

5,663

5,591

4,865

72

1.3

%

798

16.4

%

Other interest expense

8,778

7,703

19,350

1,075

14.0

%

(10,572

)

-54.6

%

Total interest expense

98,122

97,010

78,624

1,112

1.1

%

19,498

24.8

%

Net interest income-FTE

144,333

136,195

143,287

8,138

6.0

%

1,046

0.7

%

Provision for credit losses (PCL), LHFI

14,696

7,708

8,211

6,988

90.7

%

6,485

79.0

%

PCL, off-balance sheet credit exposures

(3,600

)

(192

)

245

(3,408

)

n/m

(3,845

)

n/m

PCL, LHFI sale of 1-4 family mortgage loans

8,633

—

—

8,633

n/m

8,633

n/m

Net interest income after provision-FTE

124,604

128,679

134,831

(4,075

)

3.2

%

(10,227

)

-7.6

%

Service charges on deposit accounts

10,924

10,958

10,695

(34

)

-0.3

%

229

2.1

%

Bank card and other fees

9,225

7,428

8,917

1,797

24.2

%

308

3.5

%

Mortgage banking, net

4,204

8,915

6,600

(4,711

)

-52.8

%

(2,396

)

-36.3

%

Wealth management

9,692

8,952

8,882

740

8.3

%

810

9.1

%

Other, net

7,461

3,102

2,735

4,359

n/m

4,726

n/m

Securities gains (losses), net

(182,792

)

—

—

(182,792

)

n/m

(182,792

)

n/m

Total noninterest income (loss)

(141,286

)

39,355

37,829

(180,641

)

n/m

(179,115

)

n/m

Salaries and employee benefits

64,838

65,487

66,799

(649

)

-1.0

%

(1,961

)

-2.9

%

Services and fees

24,743

24,431

27,821

312

1.3

%

(3,078

)

-11.1

%

Net occupancy-premises

7,265

7,270

6,897

(5

)

-0.1

%

368

5.3

%

Equipment expense

6,241

6,325

6,337

(84

)

-1.3

%

(96

)

-1.5

%

Other expense

15,239

16,151

13,767

(912

)

-5.6

%

1,472

10.7

%

Total noninterest expense

118,326

119,664

121,621

(1,338

)

-1.1

%

(3,295

)

-2.7

%

Income (loss) from continuing operations before income

taxes and tax eq adj

(135,008

)

48,370

51,039

(183,378

)

n/m

(186,047

)

n/m

Tax equivalent adjustment

3,304

3,365

3,383

(61

)

-1.8

%

(79

)

-2.3

%

Income (loss) from continuing operations before income

taxes

(138,312

)

45,005

47,656

(183,317

)

n/m

(185,968

)

n/m

Income taxes from continuing operations

(37,707

)

6,832

6,452

(44,539

)

n/m

(44,159

)

n/m

Income (loss) from continuing operations

(100,605

)

38,173

41,204

(138,778

)

n/m

(141,809

)

n/m

Income from discontinued operations (discont. ops) before

income taxes

232,640

4,512

5,127

228,128

n/m

227,513

n/m

Income taxes from discont. ops

58,203

1,150

1,294

57,053

n/m

56,909

n/m

Income from discont. ops

174,437

3,362

3,833

171,075

n/m

170,604

n/m

Net income

$

73,832

$

41,535

$

45,037

$

32,297

77.8

%

$

28,795

63.9

%

Per share data (1) Basic earnings (loss) per share

from continuing operations

$

(1.64

)

$

0.62

$

0.67

$

(2.26

)

n/m

$

(2.31

)

n/m

Basic earnings per share from discont. ops

$

2.85

$

0.05

$

0.06

$

2.80

n/m

$

2.79

n/m

Basic earnings per share - total

$

1.21

$

0.68

$

0.74

$

0.53

77.9

%

$

0.47

63.5

%

Diluted earnings (loss) per share from continuing

operations

$

(1.64

)

$

0.62

$

0.67

$

(2.26

)

n/m

$

(2.31

)

n/m

Diluted earnings per share from discont. ops

$

2.84

$

0.05

$

0.06

$

2.79

n/m

$

2.78

n/m

Diluted earnings per share - total

$

1.20

$

0.68

$

0.74

$

0.52

76.5

%

$

0.46

62.2

%

Dividends per share

$

0.23

$

0.23

$

0.23

—

0.0

%

—

0.0

%

Weighted average shares outstanding Basic

61,196,820

61,128,425

61,063,277

Diluted

61,415,957

61,348,364

61,230,031

Period end shares outstanding

61,205,969

61,178,366

61,069,036

(1) Due to rounding, earnings (loss) per share from

continuing operations and discontinued operations may not sum to

earnings per share from net income. n/m - percentage changes

greater than +/- 100% are considered not meaningful

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in

thousands) (unaudited) Quarter Ended

Linked Quarter Year over Year NONPERFORMING ASSETS 6/30/2024

3/31/2024 6/30/2023 $ Change % Change

$ Change % Change Nonaccrual LHFI Alabama (1)

$

26,222

$

23,261

$

11,058

$

2,961

12.7

%

$

15,164

n/m

Florida

614

585

334

29

5.0

%

280

83.8

%

Mississippi (2)

14,773

59,059

36,288

(44,286

)

-75.0

%

(21,515

)

-59.3

%

Tennessee (3)

2,084

1,800

5,088

284

15.8

%

(3,004

)

-59.0

%

Texas

599

13,646

22,259

(13,047

)

-95.6

%

(21,660

)

-97.3

%

Total nonaccrual LHFI

44,292

98,351

75,027

(54,059

)

-55.0

%

(30,735

)

-41.0

%

Other real estate Alabama (1)

485

1,050

—

(565

)

-53.8

%

485

n/m

Florida

—

71

—

(71

)

-100.0

%

—

n/m

Mississippi (2)

1,787

2,870

1,137

(1,083

)

-37.7

%

650

57.2

%

Tennessee (3)

86

86

—

—

0.0

%

86

n/m

Texas

4,228

3,543

—

685

19.3

%

4,228

n/m

Total other real estate

6,586

7,620

1,137

(1,034

)

-13.6

%

5,449

n/m

Total nonperforming assets

$

50,878

$

105,971

$

76,164

$

(55,093

)

-52.0

%

$

(25,286

)

-33.2

%

LOANS PAST DUE OVER 90

DAYS LHFI

$

5,413

$

5,243

$

3,911

$

170

3.2

%

$

1,502

38.4

%

LHFS-Guaranteed GNMA serviced loans (no obligation to

repurchase)

$

58,079

$

56,530

$

35,766

$

1,549

2.7

%

$

22,313

62.4

%

Quarter Ended Linked Quarter Year over

Year ACL LHFI

6/30/2024 3/31/2024 6/30/2023 $ Change

% Change $ Change % Change Beginning Balance

$

142,998

$

139,367

$

122,239

$

3,631

2.6

%

$

20,759

17.0

%

PCL, LHFI

14,696

7,708

8,211

6,988

90.7

%

6,485

79.0

%

PCL, LHFI sale of 1-4 family mortgage loans

8,633

—

—

8,633

n/m

8,633

n/m

Charge-offs, sale of 1-4 family mortgage loans

(8,633

)

—

—

(8,633

)

n/m

(8,633

)

n/m

Charge-offs

(5,120

)

(6,324

)

(2,773

)

1,204

19.0

%

(2,347

)

84.6

%

Recoveries

2,111

2,247

1,621

(136

)

-6.1

%

490

30.2

%

Net (charge-offs) recoveries

(11,642

)

(4,077

)

(1,152

)

(7,565

)

n/m

(10,490

)

n/m

Ending Balance

$

154,685

$

142,998

$

129,298

$

11,687

8.2

%

$

25,387

19.6

%

NET (CHARGE-OFFS)

RECOVERIES Alabama (1)

$

59

$

(341

)

$

(141

)

$

400

n/m

$

200

n/m

Florida

4

277

(35

)

(273

)

-98.6

%

39

n/m

Mississippi (2)

(9,112

)

(1,489

)

(762

)

(7,623

)

n/m

(8,350

)

n/m

Tennessee (3)

(122

)

(179

)

(166

)

57

31.8

%

44

26.5

%

Texas

(2,471

)

(2,345

)

(48

)

(126

)

-5.4

%

(2,423

)

n/m

Total net (charge-offs) recoveries

$

(11,642

)

$

(4,077

)

$

(1,152

)

$

(7,565

)

n/m

$

(10,490

)

n/m

(1) Alabama includes the Georgia Loan Production Office. (2)

Mississippi includes Central and Southern Mississippi Regions. (3)

Tennessee includes Memphis, Tennessee and Northern Mississippi

Regions. n/m - percentage changes greater than +/- 100% are

considered not meaningful

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in

thousands) (unaudited) Quarter Ended Six

Months Ended AVERAGE

BALANCES 6/30/2024 3/31/2024

12/31/2023 9/30/2023 6/30/2023

6/30/2024 6/30/2023 Securities AFS-taxable

$

1,866,227

$

1,927,619

$

1,986,825

$

2,049,006

$

2,140,505

$

1,896,923

$

2,163,684

Securities AFS-nontaxable

—

—

4,246

4,779

4,796

—

4,804

Securities HTM-taxable

1,421,246

1,418,476

1,430,169

1,445,895

1,463,086

1,419,861

1,471,140

Securities HTM-nontaxable

112

340

340

907

1,718

226

3,106

Total securities

3,287,585

3,346,435

3,421,580

3,500,587

3,610,105

3,317,010

3,642,734

Loans (includes loans held for sale)

13,309,127

13,169,805

13,010,028

12,926,942

12,732,057

13,239,466

12,631,810

Fed funds sold and reverse repurchases

110

114

121

230

3,275

112

2,829

Other earning assets

592,625

571,215

670,477

682,644

903,027

581,920

780,657

Total earning assets

17,189,447

17,087,569

17,102,206

17,110,403

17,248,464

17,138,508

17,058,030

ACL LHFI

(143,245

)

(138,711

)

(133,742

)

(127,915

)

(121,960

)

(140,978

)

(120,974

)

Other assets

1,740,307

1,730,521

1,749,069

1,721,310

1,648,583

1,735,414

1,700,643

Total assets

$

18,786,509

$

18,679,379

$

18,717,533

$

18,703,798

$

18,775,087

$

18,732,944

$

18,637,699

Interest-bearing demand deposits

$

5,222,369

$

5,291,779

$

5,053,935

$

4,875,714

$

4,803,737

$

5,257,074

$

4,777,591

Savings deposits

3,653,966

3,686,027

3,526,600

3,642,158

4,002,134

3,669,997

4,097,420

Time deposits

3,346,046

3,321,601

3,427,384

3,075,224

2,335,752

3,333,824

2,122,784

Total interest-bearing deposits

12,222,381

12,299,407

12,007,919

11,593,096

11,141,623

12,260,895

10,997,795

Fed funds purchased and repurchases

434,760

428,127

403,041

414,696

389,834

431,444

413,055

Other borrowings

534,350

463,459

590,765

912,151

1,330,010

498,905

1,221,032

Subordinated notes

123,556

123,501

123,446

123,391

123,337

123,529

123,309

Junior subordinated debt securities

61,856

61,856

61,856

61,856

61,856

61,856

61,856

Total interest-bearing liabilities

13,376,903

13,376,350

13,187,027

13,105,190

13,046,660

13,376,629

12,817,047

Noninterest-bearing deposits

3,183,524

3,120,566

3,296,351

3,429,815

3,595,927

3,152,045

3,703,987

Other liabilities

498,593

505,942

641,662

585,908

552,209

502,265

564,450

Total liabilities

17,059,020

17,002,858

17,125,040

17,120,913

17,194,796

17,030,939

17,085,484

Shareholders' equity

1,727,489

1,676,521

1,592,493

1,582,885

1,580,291

1,702,005

1,552,215

Total liabilities and equity

$

18,786,509

$

18,679,379

$

18,717,533

$

18,703,798

$

18,775,087

$

18,732,944

$

18,637,699

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in

thousands) (unaudited) PERIOD END BALANCES 6/30/2024

3/31/2024 12/31/2023 9/30/2023

6/30/2023 Cash and due from banks

$

822,141

$

606,061

$

975,343

$

750,292

$

831,852

Securities available for sale

1,621,659

1,702,299

1,762,878

1,766,174

1,871,883

Securities held to maturity

1,380,487

1,415,025

1,426,279

1,438,287

1,458,665

LHFS

185,698

172,937

184,812

169,244

181,094

LHFI

13,155,418

13,057,943

12,950,524

12,810,259

12,613,967

ACL LHFI

(154,685

)

(142,998

)

(139,367

)

(134,031

)

(129,298

)

Net LHFI

13,000,733

12,914,945

12,811,157

12,676,228

12,484,669

Premises and equipment, net

232,681

232,630

232,229

230,402

227,293

Mortgage servicing rights

136,658

138,044

131,870

142,379

134,350

Goodwill

334,605

334,605

334,605

334,605

334,605

Identifiable intangible assets

181

208

236

269

303

Other real estate

6,586

7,620

6,867

5,485

1,137

Operating lease right-of-use assets

36,925

34,324

35,711

37,115

35,561

Other assets

694,133

744,821

752,568

770,684

783,457

Assets of discontinued operations

—

73,093

67,634

69,675

77,757

Total assets

$

18,452,487

$

18,376,612

$

18,722,189

$

18,390,839

$

18,422,626

Deposits: Noninterest-bearing

$

3,153,506

$

3,039,652

$

3,197,620

$

3,320,124

$

3,461,073

Interest-bearing

12,309,382

12,298,905

12,372,143

11,781,799

11,452,827

Total deposits

15,462,888

15,338,557

15,569,763

15,101,923

14,913,900

Fed funds purchased and repurchases

314,121

393,215

405,745

321,799

311,179

Other borrowings

336,687

482,027

483,230

793,193

1,056,714

Subordinated notes

123,592

123,537

123,482

123,427

123,372

Junior subordinated debt securities

61,856

61,856

61,856

61,856

61,856

ACL on off-balance sheet credit exposures

30,265

33,865

34,057

34,945

34,841

Operating lease liabilities

40,517

37,792

39,097

40,150

38,172

Other liabilities

203,420

207,583

331,085

331,066

299,481

Liabilities of discontinued operations

—

15,581

12,027

12,129

11,918

Total liabilities

16,573,346

16,694,013

17,060,342

16,820,488

16,851,433

Common stock

12,753

12,747

12,725

12,724

12,724

Capital surplus

161,834

160,521

159,688

158,316

156,834

Retained earnings

1,796,111

1,736,485

1,709,157

1,687,199

1,667,339

Accumulated other comprehensive income (loss), net of tax

(91,557

)

(227,154

)

(219,723

)

(287,888

)

(265,704

)

Total shareholders' equity

1,879,141

1,682,599

1,661,847

1,570,351

1,571,193

Total liabilities and equity

$

18,452,487

$

18,376,612

$

18,722,189

$

18,390,839

$

18,422,626

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in thousands

except per share data) (unaudited) Quarter

Ended Six Months Ended INCOME

STATEMENTS 6/30/2024 3/31/2024

12/31/2023 9/30/2023 6/30/2023

6/30/2024 6/30/2023 Interest and fees on LHFS &

LHFI-FTE

$

216,399

$

209,456

$

210,288

$

206,523

$

192,941

$

425,855

$

371,908

Interest on securities-taxable

17,929

15,634

15,936

16,624

16,779

33,563

33,540

Interest on securities-tax exempt-FTE

1

4

44

58

69

5

161

Interest on fed funds sold and reverse repurchases

2

1

2

3

45

3

75

Other interest income

8,124

8,110

9,918

8,613

12,077

16,234

18,604

Total interest income-FTE

242,455

233,205

236,188

231,821

221,911

475,660

424,288

Interest on deposits

83,681

83,716

80,847

69,797

54,409

167,397

95,307

Interest on fed funds purchased and repurchases

5,663

5,591

5,347

5,375

4,865

11,254

9,697

Other interest expense

8,778

7,703

9,946

14,713

19,350

16,481

34,925

Total interest expense

98,122

97,010

96,140

89,885

78,624

195,132

139,929

Net interest income-FTE

144,333

136,195

140,048

141,936

143,287

280,528

284,359

PCL, LHFI

14,696

7,708

7,585

8,322

8,211

22,404

11,455

PCL, off-balance sheet credit exposures

(3,600

)

(192

)

(888

)

104

245

(3,792

)

(1,997

)

PCL, LHFI sale of 1-4 family mortgage loans

8,633

—

—

—

—

8,633

—

Net interest income after provision-FTE

124,604

128,679

133,351

133,510

134,831

253,283

274,901

Service charges on deposit accounts

10,924

10,958

11,311

11,074

10,695

21,882

21,031

Bank card and other fees

9,225

7,428

8,502

8,217

8,917

16,653

16,720

Mortgage banking, net

4,204

8,915

5,519

6,458

6,600

13,119

14,239

Wealth management

9,692

8,952

8,657

8,773

8,882

18,644

17,662

Other, net

7,461

3,102

2,577

2,399

2,735

10,563

5,255

Securities gains (losses), net

(182,792

)

—

39

—

—

(182,792

)

—

Total noninterest income (loss)

(141,286

)

39,355

36,605

36,921

37,829

(101,931

)

74,907

Salaries and employee benefits

64,838

65,487

69,326

67,374

66,799

130,325

131,571

Services and fees

24,743

24,431

27,478

27,472

27,821

49,174

52,855

Net occupancy-premises

7,265

7,270

7,144

7,151

6,897

14,535

14,212

Equipment expense

6,241

6,325

6,457

6,755

6,337

12,566

12,632

Litigation settlement expense

—

—

—

6,500

—

—

—

Other expense

15,239

16,151

15,790

15,039

13,767

31,390

27,940

Total noninterest expense

118,326

119,664

126,195

130,291

121,621

237,990

239,210

Income (loss) from continuing operations before income

taxes and tax eq adj

(135,008

)

48,370

43,761

40,140

51,039

(86,638

)

110,598

Tax equivalent adjustment

3,304

3,365

3,306

3,299

3,383

6,669

6,860

Income (loss) from continuing operations before income

taxes

(138,312

)

45,005

40,455

36,841

47,656

(93,307

)

103,738

Income taxes from continuing operations

(37,707

)

6,832

6,567

6,288

6,452

(30,875

)

14,889

Income (loss) from continuing operations

(100,605

)

38,173

33,888

30,553

41,204

(62,432

)

88,849

Income from discontinued operations (discont. ops) before

income taxes

232,640

4,512

2,965

4,649

5,127

237,152

8,688

Income taxes from discontinued operations

58,203

1,150

730

1,173

1,294

59,353

2,200

Income from discont. ops

174,437

3,362

2,235

3,476

3,833

177,799

6,488

Net income

$

73,832

$

41,535

$

36,123

$

34,029

$

45,037

$

115,367

$

95,337

Per share data (1) Basic earnings (loss) per share

from continuing operations

$

(1.64

)

$

0.62

$

0.55

$

0.50

$

0.67

$

(1.02

)

$

1.46

Basic earnings per share from discont. ops

$

2.85

$

0.05

$

0.04

$

0.06

$

0.06

$

2.91

$

0.11

Basic earnings per share - total

$

1.21

$

0.68

$

0.59

$

0.56

$

0.74

$

1.89

$

1.56

Diluted earnings (loss) per share from continuing

operations

$

(1.64

)

$

0.62

$

0.55

$

0.50

$

0.67

$

(1.02

)

$

1.45

Diluted earnings per share from discont. ops

$

2.84

$

0.05

$

0.04

$

0.06

$

0.06

$

2.90

$

0.11

Diluted earnings per share - total

$

1.20

$

0.68

$

0.59

$

0.56

$

0.74

$

1.88

$

1.56

Dividends per share

$

0.23

$

0.23

$

0.23

$

0.23

$

0.23

$

0.46

$

0.46

Weighted average shares outstanding Basic

61,196,820

61,128,425

61,070,481

61,069,750

61,063,277

61,162,623

61,037,312

Diluted

61,415,957

61,348,364

61,296,840

61,263,032

61,230,031

61,373,850

61,206,799

Period end shares outstanding

61,205,969

61,178,366

61,071,173

61,070,095

61,069,036

61,205,969

61,069,036

(1) Due to rounding, earnings (loss) per share from

continuing operations and discontinued operations may not sum to

earnings per share from net income.

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 ($ in

thousands) (unaudited) Quarter

Ended NONPERFORMING ASSETS

6/30/2024 3/31/2024 12/31/2023

9/30/2023 6/30/2023 Nonaccrual LHFI Alabama (1)

$

26,222

$

23,261

$

23,271

$

23,530

$

11,058

Florida

614

585

170

151

334

Mississippi (2)

14,773

59,059

54,615

45,050

36,288

Tennessee (3)

2,084

1,800

1,802

1,841

5,088

Texas

599

13,646

20,150

20,327

22,259

Total nonaccrual LHFI

44,292

98,351

100,008

90,899

75,027

Other real estate Alabama (1)

485

1,050

1,397

315

—

Florida

—

71

—

—

—

Mississippi (2)

1,787

2,870

1,242

942

1,137

Tennessee (3)

86

86

—

—

—

Texas

4,228

3,543

4,228

4,228

—

Total other real estate

6,586

7,620

6,867

5,485

1,137

Total nonperforming assets

$

50,878

$

105,971

$

106,875

$

96,384

$

76,164

LOANS PAST DUE OVER 90

DAYS LHFI

$

5,413

$

5,243

$

5,790

$

3,804

$

3,911

LHFS-Guaranteed GNMA serviced loans (no obligation to

repurchase)

$

58,079

$

56,530

$

51,243

$

42,532

$

35,766

Quarter Ended Six Months Ended

ACL LHFI 6/30/2024

3/31/2024 12/31/2023 9/30/2023

6/30/2023 6/30/2024 6/30/2023 Beginning

Balance

$

142,998

$

139,367

$

134,031

$

129,298

$

122,239

$

139,367

$

120,214

PCL, LHFI

14,696

7,708

7,585

8,322

8,211

22,404

11,455

PCL, LHFI sale of 1-4 family mortgage loans

8,633

—

—

—

—

8,633

—

Charge-offs, sale of 1-4 family mortgage loans

(8,633

)

—

—

—

—

(8,633

)

—

Charge-offs

(5,120

)

(6,324

)

(4,250

)

(7,496

)

(2,773

)

(11,444

)

(5,769

)

Recoveries

2,111

2,247

2,001

3,907

1,621

4,358

3,398

Net (charge-offs) recoveries

(11,642

)

(4,077

)

(2,249

)

(3,589

)

(1,152

)

(15,719

)

(2,371

)

Ending Balance

$

154,685

$

142,998

$

139,367

$

134,031

$

129,298

$

154,685

$

129,298

NET (CHARGE-OFFS)

RECOVERIES Alabama (1)

$

59

$

(341

)

$

(299

)

$

(165

)

$

(141

)

$

(282

)

$

(409

)

Florida

4

277

180

21

(35

)

281

(71

)

Mississippi (2)

(9,112

)

(1,489

)

(1,943

)

(1,867

)

(762

)

(10,601

)

(1,537

)

Tennessee (3)

(122

)

(179

)

(193

)

2,127

(166

)

(301

)

(290

)

Texas

(2,471

)

(2,345

)

6

(3,705

)

(48

)

(4,816

)

(64

)

Total net (charge-offs) recoveries

$

(11,642

)

$

(4,077

)

$

(2,249

)

$

(3,589

)

$

(1,152

)

$

(15,719

)

$

(2,371

)

(1) Alabama includes the Georgia Loan Production

Office. (2) Mississippi includes Central and Southern Mississippi

Regions. (3) Tennessee includes Memphis, Tennessee and Northern

Mississippi Regions.

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION June 30, 2024 (unaudited)

Quarter Ended Six Months Ended

FINANCIAL RATIOS AND OTHER DATA

6/30/2024 3/31/2024 12/31/2023

9/30/2023 6/30/2023 6/30/2024 6/30/2023

Return on average equity from continuing operations

-23.42

%

9.16

%

8.44

%

7.66

%

10.46

%

-7.38

%

11.54

%

Return on average equity from adjusted continuing operations (1)

9.06

%

9.16

%

8.68

%

8.87

%

10.46

%

9.11

%

11.54

%

Return on average equity - total

17.19

%

9.96

%

9.00

%

8.53

%

11.43

%

13.63

%

12.39

%

Return on average tangible equity from continuing operations

-29.05

%

11.45

%

10.70

%

9.72

%

13.28

%

-9.18

%

14.75

%

Return on average tangible equity from adjusted continuing

operations (1)

11.14

%

11.45

%

10.98

%

11.25

%

13.28

%

11.29

%

14.75

%

Return on average tangible equity - total

21.91

%

12.98

%

11.92

%

11.32

%

15.18

%

17.56

%

16.56

%

Return on average assets from continuing operations

-2.16

%

0.83

%

0.72

%

0.65

%

0.88

%

-0.67

%

0.97

%

Return on average assets from adjusted continuing operations (1)

0.87

%

0.83

%

0.74

%

0.75

%

0.88

%

0.85

%

0.97

%

Return on average assets - total

1.58

%

0.89

%

0.77

%

0.72

%

0.96

%

1.24

%

1.03

%

Interest margin - Yield - FTE

5.67

%

5.49

%

5.48

%

5.38

%

5.16

%

5.58

%

5.02

%

Interest margin - Cost

2.30

%

2.28

%

2.23

%

2.08

%

1.83

%

2.29

%

1.65

%

Net interest margin - FTE

3.38

%

3.21

%

3.25

%

3.29

%

3.33

%

3.29

%

3.36

%

Efficiency ratio (2)

63.81

%

66.90

%

69.76

%

68.27

%

66.12

%

65.32

%

65.52

%

Full-time equivalent employees

2,515

2,712

2,757

2,756

2,761

CREDIT QUALITY RATIOS

Net (recoveries) charge-offs (excl sale of 1-4 family mortgage

loans) / average loans

0.09

%

0.12

%

0.07

%

0.11

%

0.04

%

0.11

%

0.04

%

PCL, LHFI (excl PCL, LHFI sale of 1-4 family mortgage loans) /

average loans

0.44

%

0.24

%

0.23

%

0.26

%

0.26

%

0.34

%

0.18

%

Nonaccrual LHFI / (LHFI + LHFS)

0.33

%

0.74

%

0.76

%

0.70

%

0.59

%

Nonperforming assets / (LHFI + LHFS)

0.38

%

0.80

%

0.81

%

0.74

%

0.60

%

Nonperforming assets / (LHFI + LHFS + other real estate)

0.38

%

0.80

%

0.81

%

0.74

%

0.60

%

ACL LHFI / LHFI

1.18

%

1.10

%

1.08

%

1.05

%

1.03

%

ACL LHFI-commercial / commercial LHFI

1.05

%

0.93

%

0.85

%

0.86

%

0.84

%

ACL LHFI-consumer / consumer and home mortgage LHFI

1.59

%

1.63

%

1.81

%

1.66

%

1.60

%

ACL LHFI / nonaccrual LHFI

349.24

%

145.39

%

139.36

%

147.45

%

172.34

%

ACL LHFI / nonaccrual LHFI (excl individually analyzed loans)

840.20

%

235.29

%

249.31

%

273.60

%

301.44

%

CAPITAL RATIOS Total

equity / total assets

10.18

%

9.16

%

8.88

%

8.54

%

8.53

%

Tangible equity / tangible assets

8.52

%

7.47

%

7.22

%

6.84

%

6.83

%

Tangible equity / risk-weighted assets

10.18

%

8.83

%

8.76

%

8.16

%

8.26

%

Tier 1 leverage ratio

9.29

%

8.76

%

8.62

%

8.49

%

8.35

%

Common equity tier 1 capital ratio

10.92

%

10.12

%

10.04

%

9.89

%

9.87

%

Tier 1 risk-based capital ratio

11.31

%

10.51

%

10.44

%

10.29

%

10.27

%

Total risk-based capital ratio

13.29

%

12.42

%

12.29

%

12.11

%

12.08

%

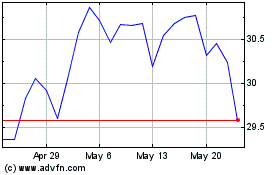

STOCK PERFORMANCE Market

value-Close

$

30.04

$

28.11

$

27.88

$

21.73

$

21.12

Book value

$

30.70

$

27.50

$

27.21

$

25.71

$

25.73

Tangible book value

$

25.23

$

22.03

$

21.73

$

20.23

$

20.24

(1) Adjusted continuing operations excludes significant

non-routine transactions. See Note 7 - Non-GAAP Financials Measures

in the Notes to the Consolidated Financials.

(2) See Note 7 – Non-GAAP Financial

Measures in the Notes to Consolidated Financials for Trustmark’s

efficiency ratio calculation.

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND

SUBSIDIARIES

NOTES TO CONSOLIDATED

FINANCIALS

June 30, 2024

($ in thousands)

(unaudited)

Note 1 - Significant Non-Routine Transactions

Trustmark completed the following significant non-routine

transactions during the second quarter of 2024:

- On May 31, 2024, Trustmark National Bank closed the sale of its

wholly owned subsidiary, Fisher Brown Bottrell Insurance, Inc.,

(FBBI) to Marsh & McLennan Agency LLC, consistent with the

terms as previously announced on April 23, 2024. Trustmark National

Bank is a wholly owned subsidiary of Trustmark Corporation.

Trustmark recognized a gain on the sale of $228.3 million ($171.2

million, net of taxes) in income from discontinued operations. The

operations of FBBI are also included in discontinued operations for

the current and prior periods.

- Trustmark restructured its investment securities portfolio by

selling $1.561 billion of available for sale securities with an

average yield of 1.36%, which generated a loss of $182.8 million

($137.1 million, net of taxes) and was recorded to noninterest

income in securities gains (losses), net. Trustmark purchased

$1.378 billion of available for sale securities with an average

yield of 4.85%.

- Trustmark sold a portfolio of 1-4 family mortgage loans that

were three payments delinquent and/or nonaccrual at the time of

selection totaling $56.2 million, which resulted in a loss of $13.4

million ($10.1 million, net of taxes). The portion of the loss

related to credit totaled $8.6 million and was recorded as

adjustments to charge-offs and the provision for credit losses. The

noncredit-related portion of the loss totaled $4.8 million and was

recorded to noninterest income in other, net.

- On April 8, 2024, Visa commenced an initial exchange offer

expiring on May 3, 2024, for any and all outstanding shares of Visa

Class B-1 common stock (Visa B-1 shares). Holders participating in

the exchange offer would receive a combination of Visa Class B-2

common stock (Visa B-2 shares) and Visa Class C common stock (Visa

C shares) in exchange for Visa B-1 shares that are validly tendered

and accepted for exchange by Visa. TNB tendered its 38.7 thousand

Visa B-1 shares, which was accepted by Visa. In exchange for each

Visa B-1 share that was validly tendered and accepted for exchange

by Visa, TNB received 50.0% of a newly issued Visa B-2 share and

newly issued Visa C shares equivalent in value to 50.0% of a Visa

B-1 share. The Visa C shares that were received by TNB were

recognized at fair value, which resulted in a gain of $8.1 million

($6.0 million, net of taxes) and recorded to noninterest income in

other, net during the second quarter of 2024. The Visa B-2 shares

were recorded at their nominal carrying value.

Note 2 - Securities Available for Sale and Held to

Maturity

The following table is a summary of the estimated fair value of

securities available for sale and the amortized cost of securities

held to maturity:

6/30/2024

3/31/2024

12/31/2023

9/30/2023

6/30/2023

SECURITIES

AVAILABLE FOR SALE

U.S. Treasury securities

$

172,955

$

372,424

$

372,368

$

363,476

$

362,966

U.S. Government agency obligations

—

5,594

5,792

6,780

6,999

Obligations of states and political

subdivisions

—

—

—

4,642

4,813

Mortgage-backed securities

Residential mortgage pass-through

securities

Guaranteed by GNMA

23,489

22,232

23,135

22,881

25,336

Issued by FNMA and FHLMC

1,060,869

1,129,521

1,176,798

1,171,521

1,250,435

Other residential mortgage-backed

securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

—

79,099

86,074

90,402

98,388

Commercial mortgage-backed securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

364,346

93,429

98,711

106,472

122,946

Total securities available for sale

$

1,621,659

$

1,702,299

$

1,762,878

$

1,766,174

$

1,871,883

SECURITIES HELD

TO MATURITY

U.S. Treasury securities

$

29,455

$

29,261

$

29,068

$

28,872

$

28,679

Obligations of states and political

subdivisions

—

340

340

341

1,180

Mortgage-backed securities

Residential mortgage pass-through

securities

Guaranteed by GNMA

17,998

18,387

13,005

13,090

13,235

Issued by FNMA and FHLMC

449,781

461,457

469,593

474,003

484,679

Other residential mortgage-backed

securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

138,951

146,447

154,466

162,031

171,002

Commercial mortgage-backed securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

744,302

759,133

759,807

759,950

759,890

Total securities held to maturity

$

1,380,487

$

1,415,025

$

1,426,279

$

1,438,287

$

1,458,665

At June 30, 2024, the net unamortized, unrealized loss included

in accumulated other comprehensive income (loss) in the

accompanying balance sheet for securities held to maturity

transferred from securities available for sale totaled $52.1

million.

Management continues to focus on asset quality as one of the

strategic goals of the securities portfolio, which is evidenced by

the investment of 100.0% of the portfolio in U.S. Treasury

securities, GSE-backed obligations and other Aaa rated securities

as determined by Moody’s. None of the securities owned by Trustmark

are collateralized by assets which are considered sub-prime.

Furthermore, outside of stock ownership in the Federal Home Loan

Bank of Dallas and Federal Reserve Bank, Trustmark does not hold

any other equity investment in a GSE.

TRUSTMARK CORPORATION AND

SUBSIDIARIES

NOTES TO CONSOLIDATED

FINANCIALS

June 30, 2024

($ in thousands)

(unaudited)

Note 3 – Loan Composition

LHFI consisted of the following during the periods

presented:

LHFI BY

TYPE

6/30/2024

3/31/2024

12/31/2023

9/30/2023

6/30/2023

Loans secured by real estate:

Construction, land development and other

land loans

$

1,638,972

$

1,539,461

$

1,510,679

$

1,609,326

$

1,722,657

Secured by 1-4 family residential

properties

2,878,295

2,891,481

2,904,715

2,893,606

2,854,182

Secured by nonfarm, nonresidential

properties

3,598,647

3,543,235

3,489,434

3,569,671

3,471,728

Other real estate secured

1,344,968

1,384,610

1,312,551

1,218,499

954,410

Commercial and industrial loans

1,880,607

1,922,711

1,922,910

1,828,924

1,883,480

Consumer loans

153,316

156,430

161,725

161,940

163,788

State and other political subdivision

loans

1,053,015

1,052,844

1,088,466

1,056,569

1,111,710

Other loans and leases

607,598

567,171

560,044

471,724

452,012

LHFI

13,155,418

13,057,943

12,950,524

12,810,259

12,613,967

ACL LHFI

(154,685

)

(142,998

)

(139,367

)

(134,031

)

(129,298

)

Net LHFI

$

13,000,733

$

12,914,945

$

12,811,157

$

12,676,228

$

12,484,669

The following table presents the LHFI composition based upon the

region where the loan was originated and reflects each region’s

diversified mix of loans:

June 30, 2024

LHFI -

COMPOSITION BY REGION

Total

Alabama (1)

Florida

Mississippi (Central and

Southern Regions)

Tennessee (Memphis, TN and

Northern MS Regions)

Texas

Loans secured by real estate:

Construction, land development and other

land loans

$

1,638,972

$

832,891

$

35,147

$

366,893

$

41,046

$

362,995

Secured by 1-4 family residential

properties

2,878,295

152,184

60,268

2,546,223

83,469

36,151

Secured by nonfarm, nonresidential

properties

3,598,647

1,052,737

226,977

1,512,307

133,835

672,791

Other real estate secured

1,344,968

560,797

1,703

370,854

6,384

405,230

Commercial and industrial loans

1,880,607

676,858

22,064

802,334

151,496

227,855

Consumer loans

153,316

21,806

7,084

93,505

16,814

14,107

State and other political subdivision

loans

1,053,015

72,787

51,084

796,947

23,672

108,525

Other loans and leases

607,598

285,089

8,505

202,159

43,062

68,783

Loans

$

13,155,418

$

3,655,149

$

412,832

$

6,691,222

$

499,778

$

1,896,437

CONSTRUCTION,

LAND DEVELOPMENT AND OTHER LAND LOANS BY REGION

Lots

$

72,597

$

27,887

$

7,284

$

19,673

$

6,506

$

11,247

Development

122,826

56,857

878

25,218

12,502

27,371

Unimproved land

104,436

19,762

12,051

27,149

7,859

37,615

1-4 family construction