0001785056false00017850562024-11-142024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 14, 2024 |

INTERACTIVE STRENGTH INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41610 |

82-1432916 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1005 Congress Avenue, Suite 925 |

|

Austin, Texas |

|

78701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 512 885-0035 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.0001 par value per share |

|

TRNR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 14, 2024, Interactive Strength Inc. (the "Company") issued a press release announcing its results of operations for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Interactive Strength Inc. |

|

|

|

|

Date: |

November 14, 2024 |

By: |

/s/ Michael J. Madigan |

|

|

|

Michael J. Madigan

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer)

|

INTERACTIVE STRENGTH INC.

Interactive Strength Inc. (Nasdaq: TRNR) Reports Third Quarter 2024 Results

Net Loss and Earnings per Diluted Share of $7.1 million and $1.53

Adjusted EBITDA was a $2.3 million loss, a $1.0 million improvement versus third quarter of 2023

The Company achieved third quarter revenue guidance of $2.0 million, a growth of 325% versus second quarter of 2024

The Company expects to generate $2.4 million in revenue in the fourth quarter of 2024

Stockholders’ Equity was $5.8 million at the end of the third quarter of 2024

Austin, Texas - November 14, 2024 - - Interactive Strength Inc. (Nasdaq: TRNR) (“TRNR” or the “Company”), maker of innovative specialty fitness equipment under the CLMBR and FORME brands, today announced its financial results for the third quarter of 2024.

The Company incurred a net loss of $7.1 million for the third quarter of 2024, or a loss of $1.53 per diluted share, as compared with a net loss of $10.4 million, or a loss of $29.35 per diluted share for the same period in 2023.

Adjusted EBITDA, a non-GAAP financial measure, was a $2.3 million loss for the quarter. Adjusted EBITDA for the third quarter reflects $3.2 million of non-cash stock-based compensation. For more information regarding the non-GAAP financial measures discussed in this press release, please see "Non-GAAP Financial Measures" and "Reconciliation of GAAP to Non-GAAP Financial Measures" below.

Trent Ward, Co-Founder and CEO of TRNR, said: “The third quarter was very positive for us as we achieved the revenue guidance of $2.0 million and reduced the adjusted EBITDA loss to $2.3 million. We expect to improve on both those figures in the fourth quarter, with revenue expected to be $2.4 million and adjusted EBITDA loss to be below $2.0 million.”

“Our balance sheet improved due to the capital raise in July,” Mr. Ward continued, “and we finished the quarter with $2.3 million of cash. Most importantly, we also had a stockholders’ equity of $5.8 million, which is well in excess of the Nasdaq requirement of $2.5 million, and we expect that that figure will be higher at the end of the fourth quarter. When combined with the reverse split earlier this week, we believe we are fully in compliance with Nasdaq listing standards and expect to receive notification of full compliance in due course.”

“We have distributed our first shareholder letter this quarter and we are excited to share more about our business vision. We are actively working on additional acquisitions and will communicate more at the appropriate time,” Mr. Ward concluded.

For more commentary, information and details on the quarter’s performance and operations, please see TRNR’s shareholder letter, which will be posted on the Company’s investor website, www.interactivestrength.com once the 10-Q has been filed after market close today.

TRNR Investor Contact

ir@interactivestrength.com

TRNR Media Contact

forme@jacktaylorpr.com

About Interactive Strength Inc.

Interactive Strength Inc. produces innovative specialty fitness equipment and digital fitness services under two main brands: 1) CLMBR and 2) FORME. Interactive Strength Inc. is listed on NASDAQ (symbol: TRNR).

CLMBR is a vertical climbing machine that offers an efficient and effective full-body strength and cardio workout. CLMBR's design is compact and easy to move – making it perfect for commercial or in-home use. With its low impact and ergonomic movement, CLMBR is safe for most ages and levels of ability and can be found at gyms and fitness studios, hotels, and physical therapy facilities, as well as available for consumers at home. www.clmbr.com.

FORME is a digital fitness platform that combines premium smart home gyms with live virtual personal training and coaching to deliver an immersive experience and better outcomes for both consumers and trainers. FORME delivers an immersive and dynamic at-home fitness experience through two connected hardware products: 1. The FORME Studio (fitness mirror) and 2. The FORME Studio Lift (fitness mirror and cable-based digital resistance). In addition to the company’s connected fitness hardware products, FORME offers expert personal training and health coaching in different formats and price points through Video On-Demand, Custom Training, and Live 1:1 virtual personal training. www.formelife.com.

Channels for Disclosure of Information

In compliance with disclosure obligations under Regulation FD, we announce material information to the public through a variety of means, including filings with the Securities and Exchange Commission (“SEC”), press releases, company blog posts, public conference calls, and webcasts, as well as via our investor relations website. Any updates to the list of disclosure channels through which we may announce information will be posted on the investor relations page on our website. The inclusion of our website address or the address of any third-party sites in this press release are intended as inactive textual references only.

Non-GAAP Financial Measures

In addition to our results determined in accordance with accounting principles generally accepted in the United States, or GAAP, we believe the following non-GAAP financial measures are useful in evaluating our operating performance.

The Company's non-GAAP financial measure in this press release consist of Adjusted EBITDA, which we define as net (loss) income, adjusted to exclude: other expense (income), net; income tax expense (benefit); depreciation and amortization expense; stock-based compensation expense; loss on debt extinguishment; vendor settlements; transaction related expenses; and IPO readiness costs and expenses.

The Company believes the above adjusted financial measures help facilitate analysis of operating performance and the operating leverage in our business. We believe that these non-GAAP financial measures are useful to investors for period-to-period comparisons of our business and in understanding and evaluating our operating results for the following reasons:

▪Adjusted EBITDA is widely used by investors and securities analysts to measure a company’s operating performance without regard to items such as stock-based compensation expense, depreciation and amortization expense, other expense (income), net, and provision for income taxes that can vary substantially from company to company depending upon their financing, capital structures, and the method by which assets were acquired;

▪Our management uses Adjusted EBITDA in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance; and

▪Adjusted EBITDA provides consistency and comparability with our past financial performance, facilitate period-to-period comparisons of our core operating results, and may also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results.

Our use of Adjusted EBITDA, or any other non-GAAP financial measures we may use in the future, is presented for supplemental informational purposes only and should not be considered as a substitute for, or in isolation from, our financial results presented in accordance with GAAP. Further, these non-GAAP financial measures have limitations as analytical tools. Some of these limitations are, or may in the future be, as follows:

•Although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•Adjusted EBITDA excludes stock-based compensation expense, which has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy;

•Adjusted EBITDA does not reflect: (1) changes in, or cash requirements for, our working capital needs; (2) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (3) tax payments that may represent a reduction in cash available to us;

•Adjusted EBITDA does not reflect impairment charges for fixed assets and capitalized content, and gains (losses) on disposals for fixed assets;

•Adjusted EBITDA does not reflect gains associated with debt extinguishments.

•Adjusted EBITDA does not reflect gains associated with vendor settlements.

•Adjusted EBITDA does not reflect IPO readiness costs and expenses that do not qualify as equity issuance costs.

•Adjusted EBITDA does not reflect transaction related expenses from CLMBR acquisition.

•Adjusted EBITDA does not reflect non cash fair value gains (losses) on convertible notes, warrants and unrealized currency gains (losses).

•Adjusted EBITDA does not reflect expenses related to the Asset Purchase Agreement and potential acquisition;

Further, the non-GAAP financial measures presented may not be comparable to similarly titled measures reported by other companies due to differences in the way that these measures are calculated. For example, the expenses and other items that we exclude in our calculation of Adjusted EBITDA may differ from the expenses and other items, if any, that other companies may exclude from Adjusted EBITDA when they report their operating results. Because companies in our industry may calculate such measures differently than we do, their usefulness as comparative measures is limited. Because of these limitations, Adjusted EBITDA should be considered along with other operating and financial performance measures presented in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms.However, the absence of these words does not mean that the statements are not forward-looking. Forward-looking statements include, but are not limited to, statements regarding: revenue projections for the third quarter based on expected deliveries; the Company's belief that it will be in compliance with the Equity Rule; the utility of non-GAAP financial measures; and the anticipated features and benefits of our product and service offerings. These forward-looking statements are subject to risks and uncertainties which may cause actual results to differ materially from those expressed or implied in such forward-looking statements. These risk and uncertainties include, but are not limited to, the following: our ability to achieve or maintain profitability; our future capital needs and ability to obtain additional financing to fund our operations; our ability to continue as a “going concern”; the growth rate, if any, of our business and revenue and our ability to manage any such growth; risks related to our subscription or any future revenue model; our limited operating history; our ability to compete successfully; fluctuations in our operating results and factors affecting the same; our reliance on sales of our Forme Studio equipment and CLMBR equipment; our ability to sustain competitive pricing levels; the growth rate, if any, of our target markets and our industry; the ability of our customers to obtain financing to purchase our products; our ability to forecast demand for our products and services, anticipate consumer preferences, and manage our inventory; our ability to attract and retain members, personal trainers, health coaches, and fitness instructors; our ability to expand our commercial and corporate wellness business; unforeseen costs and potential liability in connection with our products and services; our dependence on third-party systems and services; and risks related to potential acquisitions, intellectual property, litigation, dependence on key personnel, privacy, cybersecurity, and other regulatory, tax, and accounting matters, and international operations (including the impact of any geopolitical risks such as regional unrest or outbreak of hostilities or war), as well as the risks and uncertainties discussed in our most recently filed periodic reports on Form 10-Q and subsequent filings and as detailed from time to time in our SEC filings. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. All forward-looking statements set forth in this release are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this press release. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, or events and circumstances reflected in the forward-looking statements will be achieved or occur. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

KEY PERFORMANCE AND BUSINESS METRICS

(unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net Loss (in thousands) |

|

$ |

(7,141 |

) |

|

$ |

(10,408 |

) |

|

$ |

(29,172 |

) |

|

$ |

(39,971 |

) |

Adjusted EBITDA (in thousands) |

|

$ |

(2,348 |

) |

|

$ |

(3,373 |

) |

|

$ |

(8,691 |

) |

|

$ |

(13,532 |

) |

Adjusted EBTIDA - Please refer to the reconciliation table titled "Reconciliation of Non-GAAP Financial Measures"

With the acquisition of CLMBR, Inc., and the evolution of the FORME business, the Company is now primarily selling to commercial customers ("B2B") and therefore the previously reported Key Operational and Business Metrics associated with a direct to consumer business model ("DTC") are not indicative of the performance of the business. Therefore, the Company will no longer report the following Key Operational and Business Metrics: Households, Members, Annual Recurring Revenue, Average Annualized Recurring Revenue per Household, and Net Dollar Retention Rate.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONSOLIDATED RECONCILIATION OF ADJUSTED EBITDA TO NET LOSS

(unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Net Loss |

|

$ |

(7,141 |

) |

|

$ |

(10,408 |

) |

|

$ |

(29,172 |

) |

|

$ |

(39,971 |

) |

Adjusted to exclude the following: |

|

|

|

|

|

|

|

|

|

|

|

|

Total other expense (income), net |

|

|

(723 |

) |

|

|

333 |

|

|

|

5,718 |

|

|

|

(657 |

) |

Income tax benefit (expense) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Depreciation and amortization expense |

|

|

1,392 |

|

|

|

1,696 |

|

|

|

5,106 |

|

|

|

4,931 |

|

Stock-based compensation expense (1) |

|

|

3,157 |

|

|

|

4,836 |

|

|

|

9,448 |

|

|

|

23,773 |

|

Gain (loss) on extinguishment of debt (2) |

|

|

110 |

|

|

|

— |

|

|

|

(1,622 |

) |

|

|

— |

|

Vendor settlements (3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,595 |

) |

IPO readiness costs and expenses (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

817 |

|

Transaction related expenses (5) |

|

|

857 |

|

|

|

170 |

|

|

|

1,831 |

|

|

|

170 |

|

Adjusted EBITDA (6) |

|

$ |

(2,348 |

) |

|

$ |

(3,373 |

) |

|

$ |

(8,691 |

) |

|

$ |

(13,532 |

) |

(1) Stock-based compensation expense.

(2) Loss on debt extinguishment related to the conversion of promissory notes and senior secured notes to convertible notes.

(3) Gain on forgiveness of debt related to the third-party Content Provider.

(4) Adjusts for IPO- readiness costs and expenses that do not qualify as equity issuance costs.

(5) Transaction costs related to acquisition of CLMBR, Inc and Best Efforts Offering.

(6) Please refer to the "Non-GAAP Financial Measures" section.

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Fitness product revenue |

|

$ |

1,617 |

|

|

$ |

206 |

|

|

$ |

1,927 |

|

|

$ |

502 |

|

Membership revenue |

|

|

224 |

|

|

|

38 |

|

|

|

586 |

|

|

|

94 |

|

Training revenue |

|

|

173 |

|

|

|

62 |

|

|

|

484 |

|

|

|

183 |

|

Total revenue |

|

|

2,014 |

|

|

|

306 |

|

|

|

2,997 |

|

|

|

779 |

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of fitness product revenue |

|

|

(1,349 |

) |

|

|

(360 |

) |

|

|

(2,075 |

) |

|

|

(1,529 |

) |

Cost of membership |

|

|

(768 |

) |

|

|

(960 |

) |

|

|

(2,768 |

) |

|

|

(2,861 |

) |

Cost of training |

|

|

(185 |

) |

|

|

(109 |

) |

|

|

(522 |

) |

|

|

(300 |

) |

Total cost of revenue |

|

|

(2,302 |

) |

|

|

(1,429 |

) |

|

|

(5,365 |

) |

|

|

(4,690 |

) |

Gross loss |

|

|

(288 |

) |

|

|

(1,123 |

) |

|

|

(2,368 |

) |

|

|

(3,911 |

) |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,212 |

|

|

|

2,357 |

|

|

|

6,708 |

|

|

|

7,796 |

|

Sales and marketing |

|

|

194 |

|

|

|

282 |

|

|

|

562 |

|

|

|

1,473 |

|

General and administrative |

|

|

5,060 |

|

|

|

6,313 |

|

|

|

15,438 |

|

|

|

30,043 |

|

Total operating expenses |

|

|

7,466 |

|

|

|

8,952 |

|

|

|

22,708 |

|

|

|

39,312 |

|

Loss from operations |

|

|

(7,754 |

) |

|

|

(10,075 |

) |

|

|

(25,076 |

) |

|

|

(43,223 |

) |

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

256 |

|

|

|

(179 |

) |

|

|

(506 |

) |

|

|

25 |

|

Interest expense |

|

|

(1,831 |

) |

|

|

(154 |

) |

|

|

(6,750 |

) |

|

|

(1,382 |

) |

Gain upon debt forgiveness |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,595 |

|

Loss on issuance of warrants |

|

|

(4,780 |

) |

|

|

— |

|

|

|

(5,551 |

) |

|

|

— |

|

Gain (loss) upon extinguishment of debt and accounts payable |

|

|

110 |

|

|

|

— |

|

|

|

(1,622 |

) |

|

|

— |

|

Change in fair value of convertible notes |

|

|

— |

|

|

|

— |

|

|

|

(316 |

) |

|

|

(252 |

) |

Change in fair value of earnout |

|

|

— |

|

|

|

— |

|

|

|

1,300 |

|

|

|

— |

|

Change in fair value of derivatives |

|

|

956 |

|

|

|

— |

|

|

|

201 |

|

|

|

— |

|

Change in fair value of warrants |

|

|

5,902 |

|

|

|

— |

|

|

|

9,148 |

|

|

|

2,266 |

|

Total other income (expense), net |

|

|

613 |

|

|

|

(333 |

) |

|

|

(4,096 |

) |

|

|

3,252 |

|

Loss before provision for income taxes |

|

|

(7,141 |

) |

|

|

(10,408 |

) |

|

|

(29,172 |

) |

|

|

(39,971 |

) |

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss attributable to common stockholders |

|

$ |

(7,141 |

) |

|

$ |

(10,408 |

) |

|

$ |

(29,172 |

) |

|

$ |

(39,971 |

) |

Net loss per share - basic and diluted |

|

$ |

(1.53 |

) |

|

$ |

(29.35 |

) |

|

$ |

(15.22 |

) |

|

$ |

(136.06 |

) |

Weighted average common stock outstanding—basic and diluted |

|

|

4,653,452 |

|

|

|

354,656 |

|

|

|

1,916,375 |

|

|

|

293,773 |

|

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,269 |

|

|

$ |

— |

|

Accounts receivable, net of allowances |

|

|

519 |

|

|

|

1 |

|

Inventories, net |

|

|

4,773 |

|

|

|

2,607 |

|

Derivatives |

|

|

19 |

|

|

|

— |

|

Vendor deposits |

|

|

1,976 |

|

|

|

1,815 |

|

Prepaid expenses and other current assets |

|

|

684 |

|

|

|

933 |

|

Total current assets |

|

|

10,240 |

|

|

|

5,356 |

|

Property and equipment, net |

|

|

164 |

|

|

|

444 |

|

Right-of-use-assets |

|

|

492 |

|

|

|

283 |

|

Intangible assets, net |

|

|

7,184 |

|

|

|

2,254 |

|

Long-term inventories, net |

|

|

3,198 |

|

|

|

2,908 |

|

Vendor deposits long term |

|

|

310 |

|

|

|

309 |

|

Goodwill |

|

|

13,519 |

|

|

|

— |

|

Other assets |

|

|

2,646 |

|

|

|

5,248 |

|

Total Assets |

|

$ |

37,753 |

|

|

$ |

16,802 |

|

Liabilities, preferred stock and stockholders' equity (deficit) |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

12,880 |

|

|

$ |

10,562 |

|

Accrued expenses and other current liabilities |

|

|

3,174 |

|

|

|

906 |

|

Operating lease liability, current portion |

|

|

302 |

|

|

|

54 |

|

Deferred revenue |

|

|

104 |

|

|

|

77 |

|

Loan payable current portion |

|

|

5,298 |

|

|

|

5,806 |

|

Senior secured notes |

|

|

— |

|

|

|

3,096 |

|

Income tax payable |

|

|

7 |

|

|

|

7 |

|

Derivatives |

|

|

— |

|

|

|

122 |

|

Convertible note payable |

|

|

4,784 |

|

|

|

904 |

|

Total current liabilities |

|

|

26,549 |

|

|

|

21,534 |

|

Operating lease liability, net of current portion |

|

|

210 |

|

|

|

229 |

|

Other long term liabilities |

|

|

1,050 |

|

|

|

— |

|

Warrant liabilities |

|

|

156 |

|

|

|

591 |

|

Loan payable noncurrent |

|

|

3,996 |

|

|

|

— |

|

Total liabilities |

|

$ |

31,961 |

|

|

$ |

22,354 |

|

Commitments and contingencies (Note 14) |

|

|

|

|

|

|

Stockholders' equity (deficit) |

|

|

|

|

|

|

Series A preferred stock, par value $0.0001; 10,000,000 and 0 shares authorized as of September 30, 2024 and December 31, 2023, respectively; 5,368,865 and 0 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively. |

|

|

1 |

|

|

|

— |

|

Series B preferred stock, par value $0.0001; 1,500,000 and 0 shares authorized as of September 30, 2024 and December 31, 2023, respectively; 1,500,000 and 0 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively. |

|

|

— |

|

|

|

— |

|

Series C preferred stock, par value $0.0001; 5,000,000 and 0 shares authorized as of September 30, 2024 and December 31, 2023, respectively; 2,861,128 and 0 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively. |

|

|

— |

|

|

|

— |

|

Common stock, par value $0.0001; 900,000,000 shares authorized as of September 30, 2024 and December 31, 2023, respectively; 17,170,456 and 354,802 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively. |

|

|

8 |

|

|

|

7 |

|

Additional paid-in capital |

|

|

202,509 |

|

|

|

161,252 |

|

Accumulated other comprehensive (loss) income |

|

|

(105 |

) |

|

|

100 |

|

Accumulated deficit |

|

|

(196,621 |

) |

|

|

(166,911 |

) |

Total stockholders' equity (deficit) |

|

|

5,792 |

|

|

|

(5,552 |

) |

Total liabilities, preferred stock and stockholders' equity (deficit) |

|

$ |

37,753 |

|

|

$ |

16,802 |

|

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash Flows From Operating Activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(29,172 |

) |

|

$ |

(39,971 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Foreign currency |

|

|

218 |

|

|

|

64 |

|

Depreciation |

|

|

418 |

|

|

|

743 |

|

Amortization |

|

|

4,687 |

|

|

|

4,188 |

|

Non-cash lease expense |

|

|

203 |

|

|

|

66 |

|

Inventory valuation loss and inventory step up amortization |

|

|

141 |

|

|

|

261 |

|

Stock-based compensation |

|

|

9,448 |

|

|

|

23,773 |

|

Loss on extinguishment of debt and accounts payable |

|

|

1,622 |

|

|

|

— |

|

Gain upon debt forgiveness |

|

|

— |

|

|

|

(2,595 |

) |

Fair value of common stock issued with Best Efforts Offering |

|

|

299 |

|

|

|

— |

|

Interest expense |

|

|

2,147 |

|

|

|

77 |

|

Amortization of debt discount |

|

|

4,603 |

|

|

|

1,305 |

|

Common stock issued to lender in connection with entering Equity Line of Credit Agreement |

|

|

368 |

|

|

|

— |

|

Change in fair value of convertible notes |

|

|

316 |

|

|

|

252 |

|

Loss on issuance of warrants |

|

|

5,894 |

|

|

|

442 |

|

Loss on exchange of warrants for equity |

|

|

358 |

|

|

|

— |

|

Change in fair value of earnout |

|

|

(1,300 |

) |

|

|

— |

|

Change in fair value of derivatives |

|

|

(201 |

) |

|

|

— |

|

Change in fair value of warrants |

|

|

(9,148 |

) |

|

|

(2,266 |

) |

Changes in operating assets and liabilities |

|

|

|

|

|

|

Accounts receivable |

|

|

(1,134 |

) |

|

|

(7 |

) |

Inventories |

|

|

684 |

|

|

|

(442 |

) |

Prepaid expenses and other current assets |

|

|

342 |

|

|

|

464 |

|

Vendor deposits |

|

|

(101 |

) |

|

|

323 |

|

Warrant liabilities |

|

|

— |

|

|

|

— |

|

Other assets |

|

|

(13 |

) |

|

|

(10 |

) |

Accounts payable |

|

|

(3 |

) |

|

|

585 |

|

Accrued expenses and other current liabilities |

|

|

862 |

|

|

|

(780 |

) |

Deferred revenue |

|

|

(234 |

) |

|

|

37 |

|

Operating lease liabilities |

|

|

(213 |

) |

|

|

(70 |

) |

Net cash used in operating activities |

|

|

(8,909 |

) |

|

|

(13,561 |

) |

Cash Flows From Investing Activities: |

|

|

|

|

|

|

Acquisition of internal use software |

|

|

— |

|

|

|

(349 |

) |

Acquisition of business, cash paid, net of cash acquired |

|

|

(1,447 |

) |

|

|

— |

|

Acquisition of software and content |

|

|

40 |

|

|

|

(797 |

) |

Net cash used in investing activities |

|

|

(1,407 |

) |

|

|

(1,146 |

) |

Cash Flows From Financing Activities: |

|

|

|

|

|

|

Payments of loans |

|

|

(831 |

) |

|

|

— |

|

Proceeds from loans |

|

|

1,280 |

|

|

|

— |

|

Proceeds from related party loans |

|

|

650 |

|

|

|

465 |

|

Payments of related party loans |

|

|

(527 |

) |

|

|

(483 |

) |

Proceeds from issuance of common stock and pre-funded warrants upon offering, net of offering costs |

|

|

4,510 |

|

|

|

10,820 |

|

Payments of offering costs |

|

|

(90 |

) |

|

|

(1,453 |

) |

Proceeds from senior secured notes |

|

|

— |

|

|

|

3,030 |

|

Payments of senior secured notes |

|

|

— |

|

|

|

(2,000 |

) |

Redemption on convertible notes |

|

|

(212 |

) |

|

|

— |

|

Proceeds from issuance of convertible notes, net of issuance costs |

|

|

4,756 |

|

|

|

— |

|

Proceeds from the issuance of Class A common stock |

|

|

— |

|

|

|

4,247 |

|

Proceeds from issuance of common stock from At the Market Offering, net of issuance costs |

|

|

4,023 |

|

|

|

— |

|

Interest paid on loans and convertible notes |

|

|

(1,093 |

) |

|

|

— |

|

Proceeds from the exercise of common stock options and warrants |

|

|

92 |

|

|

|

30 |

|

Proceeds from the issuance of common stock from equity line of credit |

|

|

389 |

|

|

|

— |

|

Net cash provided by financing activities |

|

|

12,947 |

|

|

|

14,656 |

|

Effect of exchange rate on cash |

|

|

(362 |

) |

|

|

(145 |

) |

Net Change In Cash and Cash Equivalents |

|

|

2,269 |

|

|

|

(196 |

) |

Cash and restricted cash at beginning of the period |

|

|

- |

|

|

|

226 |

|

Cash and restricted cash at end of period |

|

$ |

2,269 |

|

|

$ |

30 |

|

Supplemental Disclosure Of Cash Flow Information: |

|

|

|

|

|

|

Interest expense due but not paid |

|

|

1,054 |

|

|

|

— |

|

Non-Cash Investing and Financing Information: |

|

|

|

|

|

|

Property & equipment in accounts payable |

|

|

18 |

|

|

|

18 |

|

Issuance of common stock and series B preferred stock for the acquisition of business |

|

|

3,969 |

|

|

|

— |

|

Offering costs in accounts payable and accrued expenses |

|

|

69 |

|

|

|

3,155 |

|

Issuance of preferred stock through conversion of debt |

|

|

15,170 |

|

|

|

— |

|

Exercise and exchange of stock warrants |

|

|

480 |

|

|

|

2,468 |

|

Conversion of convertible notes into common stock |

|

|

1,949 |

|

|

|

4,521 |

|

Right-of-use assets obtained in exchange for new operating lease liabilities |

|

|

— |

|

|

|

313 |

|

Decrease in right-of-use asset and operating lease liabilities due to lease termination |

|

|

— |

|

|

|

61 |

|

Issuance of common stock from convertible notes and conversion of debt |

|

|

920 |

|

|

|

— |

|

Issuance of common stock from rights offering |

|

|

— |

|

|

|

202 |

|

Net exercise of options |

|

|

— |

|

|

|

323 |

|

Non cash settlement of accounts receivable and debt |

|

|

750 |

|

|

|

— |

|

Stock-based compensation capitalized in intangible asset and other assets |

|

|

155 |

|

|

|

745 |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

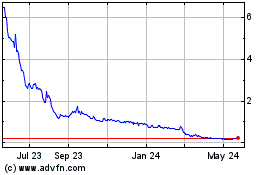

Interactive Strength (NASDAQ:TRNR)

Historical Stock Chart

From Jan 2025 to Feb 2025

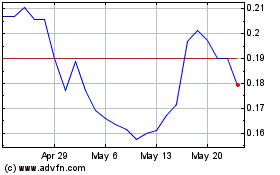

Interactive Strength (NASDAQ:TRNR)

Historical Stock Chart

From Feb 2024 to Feb 2025