false000178505600017850562024-12-132024-12-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 13, 2024 |

INTERACTIVE STRENGTH INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41610 |

82-1432916 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1005 Congress Avenue, Suite 925 |

|

Austin, Texas |

|

78701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 512 885-0035 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.0001 par value per share |

|

TRNR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on February 1, 2024, Interactive Strength Inc. (the “Company”) entered into a Note Purchase Agreement (the “Note Purchase Agreement”) with CLMBR Holdings LLC ("CLMBR" and collectively with the Company, the “Borrower”), and Treadway Holdings LLC (the “Purchaser”) pursuant to which the Company sold, and the Purchaser purchased, a Senior Secured Convertible Promissory Note (the “Original Note”) in the aggregate principal amount of $6,000,000, which is convertible into shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”).

As previously disclosed, on November 11, 2024, the Company, CLMBR and the Purchaser entered into an Amended and Restated Senior Secured Convertible Promissory Note (the “Amended and Restated Note”) that amended and restated the Original Note in its entirety. The Amended and Restated Note has a principal amount of $4,000,000.

From November 21st through December 13th, 2024, in addition to the principal amount converted that was previously disclosed on November 15th and November 21st, the Purchaser converted an additional $170,000 of the principal amount into a total of 35,491 shares of Common Stock (the “Note Conversion Shares”).

On December 13, 2024, the Company, CLMBR and the Purchaser entered into a Letter Agreement (the “Letter Agreement”) that amends the Note Purchase Agreement. Pursuant to the Letter Agreement, Section 3.2(a) of the Note Purchase Agreement was amended to allow the Borrower to extend the maturity date of the Amended and Restated Note (the “Maturity Date”) upon written notice to the Purchaser and payment of the Extension Fee (as defined below) to extend the Maturity Date for an additional thirty-day period (each an “Extension”). The Borrower shall be entitled to up to three Extensions.

Pursuant to the Letter Agreement, each “Extension Fee” shall be an amount in cash, calculated as of the Maturity Date prior to giving effect to such Extension, equal to five percent (5%) of the sum of (A) the outstanding principal balance of the Amended and Restated Note plus (B) the principal amount of converted Amended and Restated Note for which Purchaser is still holding the resulting conversion shares. For each Extension period, if the principal amount of the Amended and Restated Note converted by the Purchaser during such Extension period is less than the purchase price received by the Purchaser upon the sale of the resulting conversion shares (such difference, the “Conversion Profit”), then the Extension Fee for the following Extension shall be reduced by an amount equal to such Conversion Profit (but not less than zero).

As of December 13, 2024, the principal amount of the Amended and Restated Note was $3.0 million and the Purchaser was holding the conversion shares from the conversion of $170,000 in principal amount of the Amended and Restated Note.

In connection with the Letter Agreement, the Borrower exercised its option for the first Extension, paid the applicable Extension Fee of $160,000 and reimbursed the Purchaser’s accrued but unpaid legal fees of $17,000. As of December 13, 2024, the Maturity Date is January 14, 2025.

The foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

From November 21st through December 13th, 2024 in the aggregate, the holders of shares of the Company’s Series A Convertible Preferred Stock (“Series A”) converted 137,656 shares of Series A into 39,218 shares of Common Stock (the “Series A Conversion Shares").

The issuance of the Second November Conversion Shares in exchange for a reduction in the Principal Amount and the conversion of Series A shares was made by the Company pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended, contained in Section 3(a)(9) of such act on the basis that these offers constituted an exchange with existing holders of the Company’s securities, and no commission or other remuneration was paid to any party for soliciting such exchange.

As previously disclosed, the Company effected a reverse stock split of the Common Stock at a rate of 1-for-100 (the “Reverse Stock Split”), effective as of 9:00 a.m. Eastern Time on November 11, 2024.

As previously disclosed, the Reverse Stock Split decreased the number of shares of Common Stock issued and outstanding but such reduction was subject to adjustment for the rounding up of fractional shares.

On November 21st, due to the rounding up of fractional shares, a total of 217,396 shares of Common Stock were issued to certain shareholders who owed shares of Common Stock on November 11th, 2024.

Following the issuance of the Note Conversion Shares, the Series A Conversion Shares, the round-up shares, and unrelated issuances, as of December 17, 2024, the Company had 1,377,873 shares of Common Stock outstanding.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Interactive Strength Inc. |

|

|

|

|

Date: |

December 19, 2024 |

By: |

/s/ Michael J. Madigan |

|

|

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer) |

December 13, 2024

Re: Note Purchase Agreement

WHEREAS, this letter agreement (the “Letter Agreement”) is entered into in connection with that certain Note Purchase Agreement, dated as of February 1, 2024 (as amended, restated, supplemented or otherwise modified from time to time, the “Note Purchase Agreement”; capitalized terms used herein that are undefined shall have the meaning given thereto in the Note Purchase Agreement), by and among Interactive Strength Inc., a Delaware corporation (“TRNR”), CLMBR Holdings LLC, a Delaware limited liability company (“CLMBR” and collectively with TRNR, the “Borrower”), Treadway Holdings LLC (the “Purchaser”), and Woodway USA, Inc., a Wisconsin corporation (the “Guarantor”);

WHEREAS, capitalized term used herein shall have the meanings ascribed to them in the Note Purchase Agreement;

WHEREAS, the Note Purchase Agreement was previously amended by a letter agreement dated as of November 11, 2024 in connection with the issuance of an amended and restated senior secured convertible promissory note;

WHEREAS, the Borrower and the Purchaser desire to further amend the Note Purchase Agreement to allow for extensions to the Maturity Date on the terms and conditions set forth herein; and

WHEREAS, the Guarantor desires to reaffirm that the Guaranty Agreement will remain in full force and effect following such extensions.

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth herein and for other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, each of the Borrower, the Purchaser and the Guarantor agree as follows.

1.The effectiveness of the amendment set forth in Section 2 below is expressly conditioned upon the Borrower paying all of the Purchaser’s accrued but unpaid legal fees incurred in connection with this Letter Agreement and the other Note Documents in accordance with Section 13.12 of the Note Purchase Agreement.

2.Subject to Section 1 above, Section 3.2(a) of the Note Purchase Agreement is hereby amended and restated in its entirety as follows:

“(a) Maturity Date. The Borrower shall redeem the Notes on December 15, 2024 (the “Maturity Date”), by payment in Cash in full of the entire outstanding principal balance thereof (including all unpaid interest that has been added to the outstanding principal amount of such Note pursuant to Section 3.1(b)), together with any unpaid interest accrued thereon to such date; provided that, the Borrower shall have the option, upon written notice to the Purchaser and payment of the Extension Fee (as defined below), which notice and

payment must be made at least five (5) days prior to the Maturity Date, to extend the Maturity Date for an additional thirty (30) day period (each an “Extension”). The Borrower shall be entitled to up to three (3) Extensions provided it timely provides written notice thereof and pays the applicable Extension Fee, plus all accrued but unpaid interest on the Notes. Each “Extension Fee” shall be an amount in Cash, calculated as of the Maturity Date prior to giving effect to such Extension, equal to five percent (5%) of the sum of (A) the outstanding principal balance of the Notes plus (B) the principal amount of converted Notes for which Purchaser is still holding the resulting Conversion Shares. For each Extension period, if the principal amount of the Notes converted by the Purchaser during such Extension period is less than the purchase price received by the Purchaser upon the sale of the resulting Conversion Shares (such difference, the “Conversion Profit”), then the Extension Fee for the following Extension shall be reduced by an amount equal to such Conversion Profit (but not less than zero).”

3.The Borrower and Purchaser acknowledge and agree that, as of the date of this Letter Agreement: (i) the $200,000 that was being held as cash collateral by the Purchaser has been applied to reduce the principal of the Notes; and (ii) the Purchaser is holding Conversion Shares from the conversion of $170,000 in principal amount of Notes.

4.The Borrower and Purchaser acknowledge and agree that in connection with the execution and delivery of this Letter Agreement the Borrower has exercised its option for the first Extension, has paid the applicable Extension Fee of $160,000 and reimbursed all of the Purchaser’s accrued but unpaid legal fees in the amount of $17,000, and therefore the Maturity Date as of the date hereof is January 14, 2025.

5.Except as expressly provided herein, the Note Purchase Agreement and the other Note Documents shall remain unmodified and in full force and effect. Except as expressly set forth herein, this Letter Agreement shall not be deemed (a) to be a waiver of, or consent to, a modification or amendment of, any other term or condition of the Note Purchase Agreement or any other Note Document, (b) to prejudice any other right or rights which the Purchaser may now have or may have in the future under or in connection with the Note Purchase Agreement or any other Note Document or any of the instruments or agreements referred to therein, as the same may be amended, restated, supplemented or otherwise modified from time to time, (c) to be a commitment or any other undertaking or expression of any willingness to engage in any further discussion with the Note Parties or any other Person with respect to any waiver, amendment, modification or any other change to the Note Purchase Agreement or any other Note Document or any rights or remedies arising in favor of the Purchaser under or with respect to any such documents or (d) to be a waiver of, or consent to or a modification or amendment of, any other term or condition of any other agreement by and among the Note Parties, on the one hand, and the Purchaser, on the other hand.

6.Each of TRNR and CLMBR hereby (a) acknowledges and agrees that all of its Obligations under the Note Purchase Agreement and the other Note Documents are reaffirmed and remain in full force and effect on a continuous basis, (b) reaffirms each Lien granted by it to the Purchaser, (c) acknowledges and agrees that the grants of security interests by it pursuant to any Note Document shall remain, in full force and effect after giving effect to this Letter

Agreement, and (d) agrees that the Obligations include, among other things and without limitation, the prompt and complete payment and performance when due and payable (whether at the stated maturity, by acceleration or otherwise) of the Obligations. Nothing contained in this Letter Agreement shall be construed as substitution or novation of the Obligations outstanding under the Note Purchase Agreement or the other Note Documents, which shall remain in full force and effect. The terms and provisions of the Note Purchase Agreement are reaffirmed, ratified and confirmed and shall continue in full force and effect.

7.The Guarantor hereby acknowledges and agrees that all of its obligations under the Guaranty Agreement are reaffirmed and remain in full force and effect on a continuous basis, including following any Extension of the Maturity Date. Nothing contained in this Letter Agreement shall be construed as substitution or novation of the obligations outstanding under the Guaranty Agreement, which shall remain in full force and effect. The terms and provisions of the Guaranty Agreement are reaffirmed, ratified and confirmed and shall continue in full force and effect, including following any Extension of the Maturity Date.

8.This Letter Agreement constitutes a Note Document, and any breach of any covenant or obligation set forth herein shall constitute an Event of Default under the Note Purchase Agreement.

9.In consideration of the agreements of the Purchaser contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each of TRNR and CLMBR, on behalf of itself and its past, present and future Subsidiaries, successors, assigns, managers, members, officers, directors, agents, employees, professionals and other representatives (solely in their capacity as such and not in any other capacity) (the “Releasing Parties,” and each, a “Releasing Party”), hereby absolutely, unconditionally, and irrevocably releases, remises, and forever discharges the Purchaser and each of its respective past, present and future stockholders, members, partners, managers, principals, affiliates, subsidiaries, divisions, predecessors, directors, officers, attorneys, employees, professionals, agents, and other representatives, and their respective successors and assigns (the “Released Parties,” and each, a “Released Party”) of and from all demands, actions, causes of action, suits, covenants, contracts, controversies, agreements, promises, sums of money, accounts, bills, reckonings, damages, and any and all other claims, counterclaims, defenses, rights of set off, demands, and liabilities whatsoever (each, individually, a “Claim,” and collectively, “Claims”) of every kind and nature, known or unknown, at law or in equity, fixed or contingent, joint and/or several, secured or unsecured, due or not due, primary or secondary, liquidated or unliquidated, contractual or tortious, direct, indirect, or derivative, asserted or unasserted, foreseen or unforeseen, suspected or unsuspected, now existing, heretofore existing or which may heretofore accrue against any of the Released Parties, whether held in a personal or representative capacity, which any such Releasing Party may now or hereafter own, hold, have, or claim to have against any Released Party for, upon, or by reason of any circumstance, action, cause, omission, event or thing whatsoever which arises at any time on or prior to the date hereof, including, without limitation, for or on account of, or in relation to, or in any way in connection with this Letter Agreement, the Note Documents, or transactions contemplated hereunder or thereunder. Each Releasing Party understands, acknowledges, confirms, and agrees that the release set forth above may be pleaded as a full and complete defense and may

be used as a basis for an injunction against any action, suit, or other proceeding which may be instituted, prosecuted, or attempted in breach of the provisions of such release. Each of the parties acknowledges and agrees that the foregoing release is a material inducement to the Purchaser’s execution of this Letter Agreement and, but for the foregoing release, the Purchaser would not be willing to enter into this Letter Agreement. Each Releasing Party agrees that no fact, event, circumstance, evidence, or transaction which could now be asserted or which may hereafter be discovered shall affect, in any manner, the final, absolute, and unconditional nature of the release set forth above.

10.Each of TRNR and CLMBR, on behalf of itself and its successors, assigns and other legal representatives, hereby absolutely, unconditionally and irrevocably covenants and agrees with and in favor of each Released Party that it will not sue (at law, in equity, in any regulatory proceeding or otherwise) any Released Party on the basis of any Claim released, remised and discharged by the Loan Parties pursuant to the paragraph above. If TRNR, CLMBR or any of their respective successors, assigns or other legal representatives violate the foregoing covenant, each of TRNR and CLMBR , for itself and its successors, assigns and legal representatives, agrees to pay, in addition to such other damages as any Released Party may sustain as a result of such violation, all reasonable attorneys’ fees and costs incurred by any Released Party as a result of such violation.

11.In case any provision of this Letter Agreement shall be held to be invalid, illegal or unenforceable, such provision shall be severable from the rest of this Letter Agreement, and the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

12.Each of Sections 13.5 (Signatures; Counterparts), 13.7 (Governing Law) and 13.8 (Jurisdiction, Jury Trial Waiver, Etc.) of the Note Purchase Agreement are hereby incorporated herein by reference, mutatis mutandis.

[signature page follows]

Please indicate confirmation of the terms provided in this Letter Agreement by executing in the space provided below.

Very truly yours,

INTERACTIVE STRENGTH INC.

By: _/s/ Trent Ward ______________

Name: Trent Ward

Title: Chief Executive Officer

CLMBR HOLDINGS LLC

By: _/s/ Trent Ward ______________

Name: Trent Ward

Title: Chief Executive Officer

WOODWAY USA, INC.

By: _/s/ Douglas Bayerlein _________

Name: Douglas Bayerlein

Title: President

ACCEPTED AND AGREED:

TREADWAY HOLDINGS LLC

By:__/s/ Ron Freidman_________

Name: Ron Freidman

Title: Authorized Signatory

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

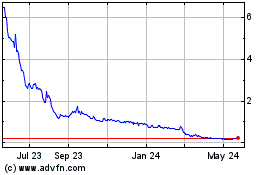

Interactive Strength (NASDAQ:TRNR)

Historical Stock Chart

From Jan 2025 to Feb 2025

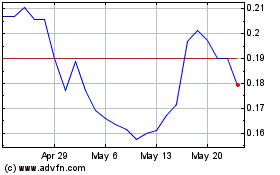

Interactive Strength (NASDAQ:TRNR)

Historical Stock Chart

From Feb 2024 to Feb 2025