false0001785056--12-3100017850562024-09-252024-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 25, 2024 |

INTERACTIVE STRENGTH INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41610 |

82-1432916 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1005 Congress Avenue, Suite 925 |

|

Austin, Texas |

|

78701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 512 885-0035 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.0001 par value per share |

|

TRNR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities.

On September 25, 2024, Interactive Strength Inc. (the "Company") and Vertical Investors, LLC (the “Lender”) entered into two new exchange agreements in substantially the same form as the agreement that was filed as an exhibit to the Company’s Current Report on Form 8-K filed on September 10th (the “September 25th Exchange Agreements”). Pursuant to the September 25th Exchange Agreements, the Company and Lender agreed to reduce the principal amount owed by the Company to the Lender pursuant to a February 2024 term loan by a total of $270,000 in exchange for the issuance of a total of 586,957 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”). These 586,957 shares are referred to herein as the “Exchange Shares.” The Exchange Shares were issued to the Lender at a price per Exchange Share of $0.46 (which is above the Common Stock’s Nasdaq Official Closing Price (the “NOCP”) of $0.4501 on September 3rd- the last complete trading day prior to the original exchange agreement being signed during trading hours on September 4th). The Exchange Shares did not contain a restrictive legend under the Securities Act of 1933.

As a result of the Company and the Lender entering into the September 25th Exchange Agreements and previous exchange agreements (some of which exchange agreements were not required to be reported pursuant to Item 3.02 of Form 8-K), the outstanding principal amount of the Loan is $4,357,863.06.

The issuance of the Exchange Shares in exchange for a reduction in the amount owed pursuant to a note was made by the Company pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended, contained in Section 3(a)(9) of such act on the basis that these offers constituted an exchange with existing holders of the Company’s securities, and no commission or other remuneration was paid to any party for soliciting such exchange.

Following the issuance of the Exchange Shares and unrelated issuances, as of September 27th, the Company had 17,172,926 shares of Common Stock outstanding.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On September 27, 2024, the Board of Directors of the Company approved the Certificate of Designations of Series C Convertible Preferred Stock of Interactive Strength Inc. (the “Series C Certificate”). The Series C Certificate was filed by the Company with the Secretary of State of the State of Delaware on September 27th.

The Series C Certificate designated 5,000,000 shares of the Company’s authorized preferred stock as Series C Convertible Preferred Stock (the “Series C Preferred Stock”). The Series C Preferred Stock does not have any voting rights other than those required by law or the Company’s Certificate of Incorporation, as amended.

Subject to certain restrictions specified in the Series C Certificate, and applicable legal and regulatory requirements, including without limitation, the listing requirements of the Nasdaq Stock Market, (i) each share of Series C Preferred Stock is convertible, at the option of the holder, at any time, provided that such conversion occurs prior to March 27, 2026, into such whole number of fully paid and non-assessable shares of Common Stock as is determined by dividing the Original Issue Price (as defined in the Series C Certificate) by the Conversion Price (as defined in the Series C Certificate) in effect at the time of conversion, and (ii) upon the earliest Mandatory Conversion Time (as defined in the Series C Certificate), all outstanding shares of Series C Preferred Stock shall automatically be converted into shares of Common Stock.

The Mandatory Conversion Time shall occur by March 27, 2026.

The Original Issue Price is $2.00 per share, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to such shares. The Conversion Price is $1.00 per share, subject to adjustment as provided in the Series C Certificate.

If required by the applicable Nasdaq listing requirements, without stockholder approval as required under such listing requirements, no holder of Series C Preferred Stock shall have the right to convert any shares of Series C Preferred Stock, if (A) (i) the total number of shares of Common Stock issuable upon such conversion, taken together with any shares of Common Stock previously issued upon conversion of shares of Series C Preferred Stock, would exceed 19.99% of the number of shares of Common Stock outstanding prior to September 27, 2024 and (ii) the Conversion Price is less than the Common Stock’s NOCP immediately preceding the Effective Date (equal to the $0.206 NOCP of September 26, 2024); or (B) such conversion would otherwise require shareholder approval under the Nasdaq listing requirements, including Nasdaq Listing Rule 5635.

Dividends accrue on each share of Series C Preferred Stock at the rate per annum of 15% of the Original Issue Price of such share, plus the amount of previously accrued dividends, compounded annually, subject to certain restrictions and provisions as set forth in the Series C Certificate.

The description of the Series C Certificate herein does not purport to be complete and is qualified in its entirety by reference to the full text of the Series C Certificate, which is attached as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

We do not intend to list the Series C Preferred Stock on any securities exchange or nationally recognized trading system and there is no established trading market for the Series C Preferred Stock.

This Current Report on Form 8-K, including this Item 5.03, shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Interactive Strength Inc. |

|

|

|

|

Date: |

October 1, 2024 |

By: |

/s/ Michael J. Madigan |

|

|

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer)

|

CERTIFICATE OF DESIGNATION OF SERIES C Convertible PREFERRED STOCK

OF

INTERACTIVE STRENGTH Inc.

Pursuant to Section 151

of the General Corporation Law of the State of Delaware (the “DGCL”)

I, the Chief Executive Officer of Interactive Strength Inc., a corporation organized and existing under the DGCL (the “Corporation”), in accordance with the provisions of Section 103 thereof, DO HEREBY CERTIFY:

That pursuant to the authority conferred upon the Board of the Directors of the Corporation (the “Board”) by the Amended and Restated Certificate of Incorporation of the Corporation, dated May 2, 2023, as amended (the “Certificate of Incorporation”), the Board on September 27, 2024, adopted the following resolution creating a series of Preferred Stock consisting of 5,000,000 shares designated as Series C Preferred Stock:

RESOLVED, that pursuant to the authority vested in the Board by the Certificate of Incorporation, the Board does hereby provide for the issuance of a series of Preferred Stock, par value $0.0001 per share, of the Corporation and, to the extent that the designations, powers, preferences and relative and other special rights and the qualifications, limitations and restrictions of such class of Preferred Stock are not stated and expressed in the Certificate of Incorporation, does hereby fix and herein state and express such designations, powers, preferences and relative and other special rights and the qualifications, limitations and restrictions thereof set forth below.

This Certificate of Designation shall be effective on September 27, 2024 (the “Effective Date”).

Article 1

DESIGNATION

The Corporation shall be authorized to issue 5,000,000 shares of Series C Convertible Preferred Stock, par value $0.0001 per share (the “Series C Preferred Stock”). The rights, preferences, powers, restrictions, and limitations of the Series C Preferred Stock shall be as set forth herein.

ARTICLE 2

DIVIDENDS

From and after the date of the issuance of any shares of Series C Preferred Stock, dividends at the rate per annum of 15% of the Original Issue Price (as defined below) of such share, plus the amount of previously accrued dividends, compounded annually, shall accrue on each share then

outstanding (the “Accruing Dividends”). Accruing Dividends shall accrue from day to day, whether or not declared, and shall be cumulative; provided, however, that except as set forth in the following sentence of this Article 2 or in Section 3.1, such Accruing Dividends shall be payable only when, as, and if declared by the Board, and, except as provided in Section 3.1, the Corporation shall be under no obligation to pay such Accruing Dividends. The Corporation shall not declare, pay or set aside any dividends on shares of any other class or series of capital stock of the Corporation (other than dividends on shares of Common Stock payable in shares of Common Stock) unless the holders of Series C Preferred Stock then outstanding shall first receive, or simultaneously receive, a dividend on each outstanding share of Series C Preferred Stock in an amount at least equal to the greater of (i) the amount of the aggregate Accruing Dividends then accrued on such share of Series C Preferred Stock and not previously paid and (ii) (A) in the case of a dividend on Common Stock or any class or series that is convertible into Common Stock other than the Series C Preferred Stock, that dividend per share of Series C Preferred Stock as would equal the product of (1) the dividend payable on each share of such class or series determined, if applicable, as if all shares of such class or series had been converted into Common Stock and (2) the number of shares of Common Stock issuable upon conversion of a share of Series C Preferred Stock, in each case calculated on the record date for determination of holders entitled to receive such dividend or (B) in the case of a dividend on any class or series that is not convertible into Common Stock, at a rate per share of Series C Preferred Stock determined by (1) dividing the amount of the dividend payable on each share of such class or series of capital stock by the original issuance price of such class or series of capital stock (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to such class or series) and (2) multiplying such fraction by an amount equal to the applicable Original Issue Price (as defined below); provided that if the Corporation declares, pays or sets aside, on the same date, a dividend on shares of more than one class or series of capital stock of the Corporation, the dividend payable to the holders of Series C Preferred Stock pursuant to this Article 2 shall be calculated based upon the dividend on the class or series of capital stock that would result in the highest dividend for the Series C Preferred Stock.

Article 3

LIQUIDATION PREFERENCE

Section 3.1 Preferential Payments to Holders of Series C Preferred Stock. In the event of (a) any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the holders of shares of Series C Preferred Stock then outstanding shall be entitled to be paid out of the assets of the Corporation available for distribution to its stockholders, and (b) a Deemed Liquidation Event (as defined below), the holders of shares of Series C Preferred Stock then outstanding shall be entitled to be paid out of the consideration payable to stockholders in such Deemed Liquidation Event, before any payment shall be made to the holders of the Corporation’s Series A Convertible Preferred Stock, Series B Convertible Preferred Stock or Common Stock by reason of their ownership thereof, an amount per share of Series C Preferred Stock equal to the greater of (i) the Original Issue Price (as defined below), plus any dividends accrued but unpaid thereon, whether or not declared, together with any other dividends declared but unpaid thereon, or (ii) such amount per share as would have been payable had all shares of Series C Preferred

Stock been converted into Common Stock pursuant to Section 5.1 immediately prior to such liquidation, dissolution, winding up or Deemed Liquidation Event (the amount payable pursuant to this sentence is hereinafter referred to as the “Liquidation Amount”). If upon any such liquidation, dissolution or winding up of the Corporation or Deemed Liquidation Event, the assets of the Corporation available for distribution to its stockholders shall be insufficient to pay the holders of shares of Series C Preferred Stock the full amount to which they shall be entitled under this Section 3.1, the holders of shares of Series C Preferred Stock shall share ratably in any distribution of the assets available for distribution in proportion to the respective amounts which would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full. The “Original Issue Price” shall mean $2.00 per share of Series C Preferred Stock, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to such shares.

Section 3.2 Deemed Liquidation Events. Each of the following events shall be considered a “Deemed Liquidation Event”:

(a) a merger, consolidation, statutory conversion, transfer, domestication, or continuance in which the Corporation is a constituent party or a subsidiary of the Corporation is a constituent party and the Corporation issues shares of its capital stock pursuant to such merger or consolidation, except any such merger or consolidation involving the Corporation or a subsidiary in which the shares of capital stock of the Corporation outstanding immediately prior to such merger or consolidation continue to represent, or are converted into or exchanged for shares of capital stock or other equity interests that represent, immediately following such merger or consolidation, of the capital stock or other equity interests of (1) the surviving or resulting corporation or entity; or (2) if the surviving or resulting corporation or entity is a wholly owned subsidiary of another corporation or entity immediately following such merger or consolidation, the parent corporation or entity of such surviving or resulting corporation or entity; or

(b) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of related transactions, by the Corporation or any subsidiary of the Corporation of all or substantially all the assets of the Corporation and its subsidiaries taken as a whole, or the sale, lease, transfer, exclusive license or other disposition (whether by merger, consolidation or otherwise) of one or more subsidiaries of the Corporation if substantially all of the assets of the Corporation and its subsidiaries taken as a whole are held by such subsidiary or subsidiaries, except where such sale, lease, transfer, exclusive license or other disposition is to a subsidiary of the Corporation.

Section 3.3 Amount Deemed Paid or Distributed. The amount deemed paid or distributed to the holders of capital stock of the Corporation upon any such merger, consolidation, sale, transfer, exclusive license, other disposition or redemption shall be the cash or the value of the property, rights or securities to be paid or distributed to such holders pursuant to such Deemed Liquidation Event.

Article 4

VOTING

The shares of Series C Preferred Stock shall not be entitled to any voting rights, other than any vote required by law or the Certificate of Incorporation.

Article 5

CONVERSION

Section 5.1 Optional Conversion. The holders of the Series C Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

(a) Conversion Ratio. Subject to the terms of Section 5.5, the applicable legal and regulatory requirements, including, without limitation, the Nasdaq Stock Market’s listing requirements, and as otherwise set forth in this Certificate of Designation, each share of Series C Preferred Stock shall be convertible, at the option of the holder thereof, at any time, and without the payment of additional consideration by the holder thereof, into such whole number of fully paid and non-assessable shares of Common Stock, as is determined by dividing the Original Issue Price by the Conversion Price (as defined below) in effect at the time of conversion. The “Conversion Price” applicable to the Series C Preferred Stock shall initially be equal to $1.00. Such initial Conversion Price, and the rate at which shares of Series C Preferred Stock may be converted into shares of Common Stock, shall be subject to adjustment as provided below.

(b) Termination of Conversion Rights. In the event of a liquidation, dissolution or winding up of the Corporation or a Deemed Liquidation Event, the Conversion Rights shall terminate at the close of business on the last full day preceding the date fixed for the payment of any such amounts distributable on such event to the holders of Series C Preferred Stock; provided that the foregoing termination of Conversion Rights shall not affect the amount(s) otherwise paid or payable in accordance with Section 3.1 to the holders of Series C Preferred Stock pursuant to such liquidation, dissolution or winding up of the Corporation or a Deemed Liquidation Event.

(c) Number of Shares Issuable Upon Conversion. Subject to the terms of Section 5.5, the applicable legal and regulatory requirements, including, without limitations, the Nasdaq Stock Market’s listing requirements, and as otherwise set forth in this Certificate of Designation, the number of shares of Common Stock issuable to a holder of Series C Preferred Stock upon conversion of such Series C Preferred Stock shall be the nearest whole share, after aggregating all fractional interests in shares of Common Stock that would otherwise be issuable upon conversion of all shares of Series C Preferred Stock being converted by such holder (with any fractional interests after such aggregation representing 0.5 or greater of a whole share being entitled to a whole share). For the avoidance of doubt, no fractional interests in shares of Common Stock shall be created or issuable as a result of the conversion of the Series C Preferred Stock pursuant to Section 5.1(a).

Section 5.2 Mechanics of Conversion.

(a) Notice of Conversion. In order for a holder of Series C Preferred Stock to voluntarily convert shares of Series C Preferred Stock into shares of Common Stock, such holder shall (a) provide written notice to the Corporation’s transfer agent at the office of the transfer agent for the Series C Preferred Stock (or at the principal office of the Corporation if the Corporation serves as its own transfer agent) that such holder elects to convert all or any number of such holder’s shares of Series C Preferred Stock and, if applicable, any event on which such conversion is contingent and (b), if such holder’s shares are certificated, surrender the certificate or certificates for such shares of Series C Preferred Stock (or, if such registered holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and agreement reasonably acceptable

to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate), at the office of the transfer agent for the Series C Preferred Stock (or at the principal office of the Corporation if the Corporation serves as its own transfer agent). Such notice shall state such holder’s name or the names of the nominees in which such holder wishes the shares of Common Stock to be issued. If required by the Corporation, any certificates surrendered for conversion shall be endorsed or accompanied by a written instrument or instruments of transfer, in form satisfactory to the Corporation, duly executed by the registered holder or his, her or its attorney duly authorized in writing. Unless a later time and date is otherwise specified by the Corporation, the close of business on the date of receipt by the transfer agent (or by the Corporation if the Corporation serves as its own transfer agent) of such notice and, if applicable, certificates (or lost certificate affidavit and agreement) shall be the time of conversion (the “Conversion Time”), and the shares of Common Stock issuable upon conversion of the specified shares shall be deemed to be outstanding of record as of such date. The Corporation shall, as soon as practicable after the Conversion Time (i) issue and deliver to such holder of Series C Preferred Stock, or to his, her or its nominees, a notice of issuance of uncertificated shares and may, upon written request, issue and deliver a certificate for the number of full shares of Common Stock issuable upon such conversion in accordance with the provisions hereof and, may, if applicable and upon written request, issue and deliver a certificate for the number (if any) of the shares of Series C Preferred Stock represented by any surrendered certificate that were not converted into Common Stock, and (ii) pay all declared but unpaid dividends on the shares of Series C Preferred Stock converted.

(b) Reservation of Shares. The Corporation shall at all times when the Series C Preferred Stock shall be outstanding, reserve and keep available out of its authorized but unissued capital stock, for the purpose of effecting the conversion of the Series C Preferred Stock, such number of its duly authorized shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding A Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Series C Preferred Stock, the Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to this Certificate of Incorporation. Before taking any action that would cause an adjustment reducing the Conversion Price for the Series C Preferred Stock below the then par value of the shares of Common Stock issuable upon conversion of the Series C Preferred Stock, the Corporation will take any corporate action which may, in the opinion of its counsel, be necessary in order that the Corporation may validly and legally issue fully paid and non‑assessable shares of Common Stock at such adjusted Conversion Price.

(c) Effect of Conversion. All shares of Series C Preferred Stock which shall have been surrendered for conversion as herein provided shall no longer be deemed to be outstanding and all rights with respect to such shares shall immediately cease and terminate at the Conversion Time, except only the right of the holders thereof to receive shares of Common Stock in exchange therefor and to receive payment of any dividends declared but unpaid thereon.

(d) No Further Adjustment. Upon any such conversion, no adjustment to the Conversion Price shall be made for any declared but unpaid dividends on the Series C Preferred Stock surrendered for conversion or on the Common Stock delivered upon conversion.

(e) Taxes. The Corporation shall pay any and all issue and other similar taxes that may be payable in respect of any issuance or delivery of shares of Common Stock upon conversion of shares of Series C Preferred Stock pursuant to this Section 5.2. The Corporation shall not, however, be required to pay any tax which may be payable in respect of any transfer involved in the issuance and delivery of shares of Common Stock in a name other than that in which the shares of Series C Preferred Stock so converted were registered, and no such issuance or delivery shall be made unless and until the person or entity requesting such issuance has paid to the Corporation the amount of any such tax or has established, to the satisfaction of the Corporation, that such tax has been paid.

Section 5.3 RESERVED.

Section 5.4 Mandatory Conversion.

(a) Trigger Events. Subject to the terms of Section 5.5, the applicable legal and regulatory requirements, including, without limitations, the Nasdaq Stock Market’s listing requirements, and as otherwise set forth in this Certificate of Designation, upon the earliest of:

(i) the date and time, or the occurrence of an event, specified by vote or written consent of a majority of the then outstanding shares of Series C Preferred Stock; and

(ii) the date that is eighteen (18) months following the Effective Date (the “Outside Conversion Date”) (the date and time specified, or the time of the event specified, in such vote or written consent in subclause (i) and (ii) above, or the Outside Conversion Date, as applicable, is referred to herein as the “Mandatory Conversion Time”), then all outstanding shares of Series C Preferred Stock shall automatically be converted into shares of Common Stock pursuant to Section 5.1(a) and such shares of Series C Preferred Stock may not be reissued by the Corporation. For the avoidance of doubt, if conversion pursuant to this Section 5.4(a) requires the consent of a majority of the then outstanding shares of Common Stock pursuant to Section 5.5(a), then such conversion shall occur immediately upon such consent.

(b) All holders of record of shares of Series C Preferred Stock shall be sent written notice of the Mandatory Conversion Time and the place designated for mandatory conversion of all such shares of Preferred Stock pursuant to this Section 5.4. Such notice need not be sent in advance of the occurrence of the Mandatory Conversion Time. Upon receipt of such notice, each holder of shares of Series C Preferred Stock in certificated form shall surrender his, her or its certificate or certificates for all such shares (or, if such holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate) to the Corporation at the place designated in such notice. If so required by the Corporation, any certificates surrendered for conversion shall be endorsed or accompanied by written instrument or instruments of transfer, in form satisfactory to the Corporation, duly executed by the registered holder or by his, her or its attorney duly authorized in writing. All rights with respect to the Preferred Stock converted pursuant to Section 5.4(a), including the rights, if any, to receive notices

and vote (other than as a holder of Common Stock), will terminate at the Mandatory Conversion Time (notwithstanding the failure of the holder or holders thereof to surrender any certificates at or prior to such time), except only the rights of the holders thereof, upon surrender of any certificate or certificates of such holders (or lost certificate affidavit and agreement) therefor, to receive the items provided for in the next sentence of this Section 5.4(b). As soon as practicable after the Mandatory Conversion Time and, if applicable, the surrender of any certificate or certificates (or lost certificate affidavit and agreement) for Preferred Stock, the Corporation shall (a) issue and deliver to such holder, or to his, her or its nominees, a notice of issuance of uncertificated shares and may, upon written request, issue and deliver a certificate for the number of full shares of Common Stock issuable upon such conversion in accordance with the provisions hereof and (b) pay any declared but unpaid dividends on the shares of Series C Preferred Stock converted, provided, however, that if such conversion is pursuant to Section 5.4(a)(ii), the Corporation shall declare and pay such dividends as would have accrued pursuant to Article 2 through the Outside Conversion Date. Such converted Series C Preferred Stock shall be retired and cancelled and may not be reissued as shares of such series, and the Corporation may thereafter take such appropriate action (without the need for stockholder action) as may be necessary to reduce the authorized number of shares of Preferred Stock accordingly.

Section 5.5 Conversion Restrictions.

(a) Stockholder Approval Restriction. If required by the applicable Nasdaq listing requirements, without stockholder approval as required under such listing requirements, no holder of Series C Preferred Stock shall have the right to convert any shares of Series C Preferred Stock, and no shares of Series C Preferred Stock shall otherwise be converted into shares of Common Stock without the consent of a majority of the total votes cast on a proposal with regard thereto voted on at duly called shareholder meeting with the necessary quorum of shareholders represented, if (A) (i) the total number of shares of Common Stock issuable upon such conversion, taken together with any shares of Common Stock previously issued upon conversion of shares of Series C Preferred Stock, would exceed 19.99% of the number of shares of Common Stock outstanding prior to the Effective Date and (ii) the Conversion Price is less than the lower of (x) the Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) immediately preceding the Effective Date or (y) the average Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the Effective Date, in each case subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Common Stock; or (B) such conversion would otherwise require shareholder approval under the Nasdaq listing requirements, including Nasdaq Listing Rule 5635.

(b) Beneficial Ownership Restriction. Notwithstanding anything to the contrary herein, no holder of Series C Preferred Stock shall have the right to convert any shares of Series C Preferred Stock to the extent that, after giving effect to the conversion, such holder (together with such holder’s affiliates, and any other persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own in excess of 4.99% of the total number of shares of Common Stock of the Corporation issued and outstanding immediately after giving effect to the conversion.

(i) For purposes of this clause, “beneficial ownership” shall be calculated in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

(ii) Each holder of Series C Preferred Stock shall be responsible for providing the Corporation with all information necessary to make a determination of beneficial ownership.

Article 6

CERTAIN ADJUSTMENTS

Section 6.1 Adjustment for Stock Splits and Combinations. If the Corporation shall at any time or from time to time after the Original Issuance Date effect a subdivision of the outstanding Common Stock, the Conversion Price of Series C Preferred Stock in effect immediately before that subdivision shall be proportionately decreased so that the number of shares of Common Stock issuable on conversion of each share of such series shall be increased in proportion to such increase in the aggregate number of shares of Common Stock outstanding. If the Corporation shall at any time or from time to time after the Original Issuance Date combine the outstanding shares of Common Stock, the Conversion Price of Series C Preferred Stock in effect immediately before the combination shall be proportionately increased so that the number of shares of Common Stock issuable on conversion of each share of such series shall be decreased in proportion to such decrease in the aggregate number of shares of Common Stock outstanding. Any adjustment under this Section 6.1 shall become effective at the close of business on the date the subdivision or combination becomes effective.

Section 6.2 Adjustment for Certain Dividends and Distributions. In the event the Corporation at any time or from time to time after the Original Issuance Date shall make or issue, or fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or other distribution payable on the Common Stock in additional shares of Common Stock, then and in each such event the Conversion Price of Series C Preferred Stock in effect immediately before such event shall be decreased as of the time of such issuance or, in the event such a record date shall have been fixed, as of the close of business on such record date, by multiplying the Conversion Price of (a) the numerator of which shall be the total number of shares of Common Stock issued and outstanding immediately prior to the time of such issuance or the close of business on such record date, and (b) the denominator of which shall be the total number of shares of Common Stock issued and outstanding immediately prior to the time of such issuance or the close of business on such record date plus the number of shares of Common Stock issuable in payment of such dividend or distribution.

Notwithstanding the foregoing, (a) if such record date shall have been fixed and such dividend is not fully paid or if such distribution is not fully made on the date fixed therefor, the Conversion Price of Series C Preferred Stock shall be recomputed accordingly as of the close of business on such record date and thereafter the Conversion Price of Series C Preferred Stock shall be adjusted pursuant to this Section 6.2 as of the time of actual payment of such dividends or distributions; (b) no such adjustment shall be made if the holders of Series C Preferred Stock simultaneously receive a dividend or other distribution of shares of Common Stock in a number equal to the number of shares of Common Stock as they would have received if all outstanding shares of Series C Preferred Stock had been converted into Common Stock on the date of such event; and (c) no such adjustment shall be made if such adjustment would result in the requirement to obtain the consent

of a majority of the then outstanding shares of Common Stock in connection with the conversion of the Series C Preferred Stock pursuant to Section 5.5(a).

Section 6.3 Adjustments for Other Dividends and Distributions. In the event the Corporation at any time or from time to time after the Original Issuance Date shall make or issue, or fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or other distribution payable in securities of the Corporation (other than a distribution of shares of Common Stock in respect of outstanding shares of Common Stock) or in other property and the provisions of Article 2 do not apply to such dividend or distribution, then and in each such event the holders of Series C Preferred Stock shall receive, simultaneously with the distribution to the holders of Common Stock, a dividend or other distribution of such securities or other property in an amount equal to the amount of such securities or other property as they would have received if all outstanding shares of Series C Preferred Stock had been converted into Common Stock on the date of such event.

Section 6.4 Adjustment for Merger or Reorganization, etc. Subject to the provisions of Section 3.3, if there shall occur any reorganization, recapitalization, reclassification, consolidation or merger involving the Corporation in which the Common Stock (but not the Series C Preferred Stock) is converted into or exchanged for securities, cash or other property (other than a transaction covered by Section 6.2 or Section 6.3), then, following any such reorganization, recapitalization, reclassification, consolidation or merger, each share of Series C Preferred Stock shall thereafter be convertible in lieu of the Common Stock into which it was convertible prior to such event into the kind and amount of securities, cash or other property which a holder of the number of shares of Common Stock of the Corporation issuable upon conversion of one share of Series C Preferred Stock immediately prior to such reorganization, recapitalization, reclassification, consolidation or merger would have been entitled to receive pursuant to such transaction; and, in such case, appropriate adjustment (as determined in good faith by the Board) shall be made in the application of the provisions in Section 5.2 and Article 6 with respect to the rights and interests thereafter of the holders of the Series C Preferred Stock, to the end that the provisions set forth in Section 5.2 and Article 6 (including provisions with respect to changes in and other adjustments of the Conversion Price of Series C Preferred Stock) shall thereafter be applicable, as nearly as reasonably may be, in relation to any securities or other property thereafter deliverable upon the conversion of the Seirs A Preferred Stock.

Section 6.5 Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Price of Series C Preferred Stock pursuant to Section 5.2 and Article 6, the Corporation at its expense shall, as promptly as reasonably practicable but in any event not later than ten (10) days thereafter, compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Series C Preferred Stock a certificate setting forth such adjustment or readjustment (including the kind and amount of securities, cash or other property into which Series C Preferred Stock is convertible) and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, as promptly as reasonably practicable after the written request at any time of any holder of Series C Preferred Stock (but in any event not later than ten (10) days thereafter), furnish or cause to be furnished to such holder a certificate setting forth (i) the Conversion Price then in effect for Series C Preferred Stock held by such holder, and (ii) the number of shares of Common Stock and the amount, if any, of other securities, cash or property which then would be received upon the conversion of Series C Preferred Stock.

Section 6.6 Notice of Record Date. In the event:

(a) the Corporation shall take a record of the holders of its Common Stock (or other capital stock or securities at the time issuable upon conversion of the Series C Preferred Stock) for the purpose of entitling or enabling them to receive any dividend or other distribution, or to receive any right to subscribe for or purchase any shares of capital stock of any class or series or any other securities, or to receive any other security;

(b) of any capital reorganization of the Corporation, any reclassification of the Common Stock of the Corporation, or any Deemed Liquidation Event; or

(c) of the voluntary or involuntary dissolution, liquidation or winding-up of the Corporation, then, and in each such case, the Corporation will send or cause to be sent to the holders of the Series C Preferred Stock a notice specifying, as the case may be, (i) the record date for such dividend, distribution or right, and the amount and character of such dividend, distribution or right, or (ii) the effective date on which such reorganization, reclassification, consolidation, merger, transfer, dissolution, liquidation or winding-up is proposed to take place, and the time, if any is to be fixed, as of which the holders of record of Common Stock (or such other capital stock or securities at the time issuable upon the conversion of the Series C Preferred Stock) shall be entitled to exchange their shares of Common Stock (or such other capital stock or securities) for securities or other property deliverable upon such reorganization, reclassification, consolidation, merger, transfer, dissolution, liquidation or winding-up, and the amount per share and character of such exchange applicable to the Series C Preferred Stock and the Common Stock. Such notice shall be sent at least ten (10) days prior to the record date or effective date for the event specified in such notice.

[Signature Page Follows]

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Designation to be duly executed as of this 27th day of September 2024.

Interactive Strength Inc.

By: /s/ Trent Ward

Name: Trent Ward

Title: Chief Executive Officer

[Signature Page to Series C Convertible Preferred Stock Certificate of Designation]

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

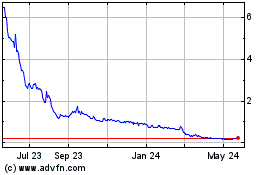

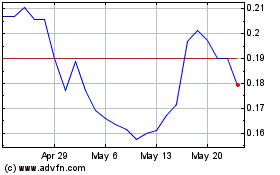

Interactive Strength (NASDAQ:TRNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Interactive Strength (NASDAQ:TRNR)

Historical Stock Chart

From Nov 2023 to Nov 2024