Twin Disc, Inc. (NASDAQ: TWIN) today reported

results for the second quarter ended December 27, 2024.

Fiscal Second Quarter 2025 Highlights

- Sales increased 23.2% year-over-year to $89.9 million, organic

sales* increased 10.1%

- Net income attributable to Twin Disc was $0.9 million

- EBITDA* increased 13.5% year-over-year to $6.3 million

- Operating cash flow of $4.3M

- Healthy six-month backlog of $124.0 million supported by strong

ongoing order activity

CEO Perspective

“This quarter's performance reflected another period of

double-digit top-line growth, partly driven by the acquisition of

Katsa Oy. The marine market remained stable, while Veth products

continued to expand to record levels in response to strong demand

and new orders within the North American market. Challenges in the

Asian oil and gas markets persist, though we are beginning to see

signs of stabilization. Meanwhile, the industrials segment has

already started to recover, with improving order rates through the

quarter,” commented John H. Batten, President and Chief Executive

Officer of Twin Disc.

“Following the successful integration of Katsa, we are focused

on executing on our strategic priorities and capitalizing on our

niche capabilities to enhance the business, while remaining

actively engaged in exploring additional opportunities that align

with our long-term growth strategy. With healthy end-market demand,

we aim to drive growth, reinforce our financial position, and

advance toward becoming the leading provider of hybrid and electric

solutions in our industry,” concluded Mr. Batten.

Second Quarter Results

Sales for the fiscal 2025 second quarter increased 23.2%

year-over-year to $89.9 million, driven by a $10.0 million

incremental benefit from Katsa Oy. On an organic basis, which

excludes the impacts of acquisitions and foreign currency exchange,

revenue increased 10.1%, due to strength in the Company’s Marine

and Propulsion Systems and Industrial product segments.

Sales by product group (certain amounts have been reclassified

from Marine and Propulsion to Other):

|

Product Group |

Q2 FY25 Sales |

Q2 FY24 Sales |

Change (%) |

|

(Thousands of $): |

|

Marine and Propulsion Systems |

$ |

56,692 |

$ |

45,753 |

23.9% |

|

Land-Based Transmissions |

|

19,010 |

|

15,863 |

19.8% |

|

Industrial |

|

9,458 |

|

6,532 |

44.8% |

|

Other |

|

4,761 |

|

4,846 |

(1.8)% |

|

Total |

$ |

89,891 |

$ |

72,994 |

23.2% |

Twin Disc delivered double-digit growth year-over-year in the

European and North American regions. The distribution of sales

across geographical regions shifted, with a greater proportion of

sales coming from the European region, with a lower proportion of

sales coming from the Asian Pacific region.

Gross profit increased 5.0% to $21.7 million compared to $20.7

million for the second quarter of fiscal 2024. Second quarter gross

margin decreased approximately 420 basis points to 24.1% from the

prior year period, reflecting the impact of a $1.6 million

inventory write-down due to product rationalization association

with the acquisition of Katsa, a $0.3 million purchase accounting

amortization expense related to the Katsa acquisition and

unfavorable product mix.

Marketing, engineering and administrative (ME&A) expense

increased by $1.7 million, or 9.9%, to $18.9 million, compared to

$17.2 million in the prior year quarter. The increased ME&A

expense was primarily driven by the addition of Katsa. However,

ME&A expenses were decreased by $0.6 million sequentially,

primarily due to a reduction in global bonus expense.

Net income attributable to Twin Disc for the quarter was $0.9

million, or $0.07 per diluted share, compared to net income

attributable to Twin Disc of $0.9 million, or $0.07 per diluted

share, for the second fiscal quarter of 2024. Net income was

impacted by an increase in Other Expense related to an increase in

the amortization of the net actuarial loss related to the Company’s

domestic defined benefit pension plan. Earnings before interest,

taxes, depreciation, and amortization (EBITDA) were $6.3 million in

the second quarter, up 13.5% compared to the second quarter of

fiscal 2024.

On a consolidated basis, the backlog of orders to be shipped

over the next six months is approximately $124.0 million, compared

to $144.3 million at the end of the first quarter. As a percentage

of six-month backlog, inventory increased from 99.7% at the end of

the first quarter, to 103.4% at the end of the second quarter.

Compared to the second fiscal quarter of 2024, cash decreased 24.3%

to $15.9 million, total debt increased 40.5% to $24.9 million, and

net debt* increased $12.3 million to $9.0 million. The increase was

primarily attributable to higher long-term debt related to the

Katsa acquisition.

CFO Perspective

Jeffrey S. Knutson, Vice President of Finance, Chief Financial

Officer, Treasurer and Secretary stated, "In the second quarter, we

experienced near-term pressure on margins partially due to mix and

several charges associated with inventory rationalization from the

Katsa acquisition as we eliminated redundant inventory, streamlined

operations and implemented synergies. As we move through the year,

we are focused on identifying and realizing additional operational

efficiencies to reduce margin pressure through prudent cost

management and executing on our commercial strategy. During the

quarter, we delivered solid operating cash flow marked by our

healthy inventory levels, reinforcing our ability to execute on

operational priorities. Looking ahead, we remain confident in the

strength of our financial position and our ability to support

continued growth while maintaining a healthy balance sheet."

Discussion of Results

Twin Disc will host a conference call to discuss these results

and to answer questions at 9:00 a.m. Eastern time on February 5,

2025. The live audio webcast will be available on Twin Disc’s

website at https://ir.twindisc.com. To participate in the

conference call, please dial (646) 968-2525 approximately ten

minutes before the call is scheduled to begin. A replay of the

webcast will be available at https://ir.twindisc.com shortly after

the call until February 4, 2026.

About Twin Disc

Twin Disc, Inc. designs, manufactures, and sells marine and

heavy-duty off-highway power transmission equipment. Products

offered include marine transmissions, azimuth drives, surface

drives, propellers, and boat management systems, as well as

power-shift transmissions, hydraulic torque converters, power

take-offs, industrial clutches, and control systems. The Company

sells its products to customers primarily in the pleasure craft,

commercial and military marine markets, as well as in the energy

and natural resources, government, and industrial markets. The

Company’s worldwide sales to both domestic and foreign customers

are transacted through a direct sales force and a distributor

network. For more information, please visit www.twindisc.com.

Forward-Looking Statements

This press release may contain statements that are forward

looking as defined by the Securities and Exchange Commission in its

rules, regulations, and releases. The words “anticipates,”

“believes,” “intends,” “estimates,” and “expects,” or similar

anticipatory expressions, usually identify forward-looking

statements. The Company intends that such forward-looking

statements qualify for the safe harbors from liability established

by the Private Securities Litigation Reform Act of 1995. All

forward-looking statements are based on current expectations and

are subject to certain risks and uncertainties that could cause

actual results or outcomes to differ materially from current

expectations. Such risks and uncertainties include the impact of

general economic conditions and the cyclical nature of many of the

Company’s product markets; foreign currency risks and other risks

associated with the Company’s international sales and operations;

the ability of the Company to successfully implement price

increases to offset increasing commodity costs; the ability of the

Company to generate sufficient cash to pay its indebtedness as it

becomes due; and the possibility of unforeseen tax consequences and

the impact of tax reform in the U.S. or other jurisdictions. These

and other risks are described under the caption “Risk Factors” in

Item 1A of the Company’s most recent Form 10-K filed with the

Securities and Exchange Commission, as supplemented in subsequent

periodic reports filed with the Securities and Exchange Commission.

Accordingly, the making of such statements should not be regarded

as a representation by the Company or any other person that the

results expressed therein will be achieved. The Company assumes no

obligation, and disclaims any obligation, to publicly update or

revise any forward-looking statements to reflect subsequent events,

new information, or otherwise.

*Non-GAAP Financial

Information

Financial information excluding the impact of asset impairments,

restructuring charges, foreign currency exchange rate changes and

the impact of acquisitions, if any, in this press release are not

measures that are defined in U.S. Generally Accepted Accounting

Principles (“GAAP”). These items are measures that management

believes are important to adjust for in order to have a meaningful

comparison to prior and future periods and to provide a basis for

future projections and for estimating our earnings growth

prospects. Non-GAAP measures are used by management as a

performance measure to judge profitability of our business absent

the impact of foreign currency exchange rate changes and

acquisitions. Management analyzes the company’s business

performance and trends excluding these amounts. These measures, as

well as EBITDA, provide a more consistent view of performance than

the closest GAAP equivalent for management and investors.

Management compensates for this by using these measures in

combination with the GAAP measures. The presentation of the

non-GAAP measures in this press release are made alongside the most

directly comparable GAAP measures.

Definitions

Organic net sales is defined respectively as net sales excluding

the recent acquisitions of Katsa Oy along with the divestiture of

BCS while adjusting for the effects of foreign currency

exchange.

Earnings before interest, taxes, depreciation, and amortization

(EBITDA) is calculated as net earnings or loss excluding interest

expense, the provision or benefit for income taxes, depreciation,

and amortization expenses.

Net debt is calculated as total debt less cash.

Investors: RiveronTwinDiscIR@Riveron.com

Source: Twin Disc, Incorporated

| |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND |

|

COMPREHENSIVE INCOME (LOSS) |

|

(In thousands, except per-share data; unaudited) |

| |

| |

|

For the Quarter Ended |

|

For the Two Quarters Ended |

|

|

|

December 27, 2024 |

|

December 29, 2023 |

|

December 27, 2024 |

|

December 29, 2023 |

| |

|

|

|

|

|

|

|

|

| Net sales |

$ |

89,921 |

$ |

72,994 |

$ |

162,818 |

$ |

136,547 |

| Cost of goods sold |

|

66,662 |

|

52,338 |

|

120,237 |

|

96,156 |

| Cost of goods sold –

Other |

|

1,579 |

|

- |

|

1,579 |

|

3,099 |

| Gross profit |

|

21,680 |

|

20,656 |

|

41,002 |

|

37,292 |

| |

|

|

|

|

|

|

|

|

| Marketing, engineering and

administrative expenses |

|

18,920 |

|

17,218 |

|

38,407 |

|

34,136 |

| Income from operations |

|

2,760 |

|

3,438 |

|

2,595 |

|

3,156 |

| |

|

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

| Interest expense |

|

495 |

|

392 |

|

1,131 |

|

786 |

| Other expense (income),

net |

|

(386) |

|

449 |

|

958 |

|

310 |

| |

|

109 |

|

841 |

|

2,089 |

|

1,096 |

| |

|

|

|

|

|

|

|

|

| Income before income taxes and

noncontrolling interest |

|

2,651 |

|

2,597 |

|

506 |

|

2,060 |

| Income tax expense |

|

1,552 |

|

1,662 |

|

2,179 |

|

2,208 |

| |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

1,099 |

|

935 |

|

(1,673) |

|

(148) |

| Less: Net income attributable

to noncontrolling interest, net of tax |

|

(180) |

|

(5) |

|

(173) |

|

(95) |

| Net income (loss) attributable

to Twin Disc, Incorporated |

$ |

919 |

$ |

930 |

$ |

(1,846) |

$ |

(243) |

| |

|

|

|

|

|

|

|

|

| Dividends per share |

$ |

0.04 |

$ |

0.04 |

$ |

0.08 |

$ |

0.04 |

| |

|

|

|

|

|

|

|

|

| Income (loss) per share

data: |

|

|

|

|

|

|

|

|

| Basic income (loss) per share

attributable to Twin Disc, Incorporated common shareholders |

$ |

0.07 |

$ |

0.07 |

$ |

(0.13) |

$ |

(0.02) |

| Diluted income (loss) per

share attributable to Twin Disc, Incorporated common

shareholders |

$ |

0.07 |

$ |

0.07 |

$ |

(0.13) |

$ |

(0.02) |

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding data: |

|

|

|

|

|

|

|

|

|

Basic shares outstanding |

|

13,868 |

|

13,718 |

|

13,818 |

|

13,629 |

|

Diluted shares outstanding |

|

14,058 |

|

13,923 |

|

13,818 |

|

13,629 |

| |

|

|

|

|

|

|

|

|

| Comprehensive income

(loss) |

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

1,099 |

|

935 |

$ |

(1,673) |

$ |

(148) |

| Benefit plan adjustments, net

of income taxes of $13, ($13), $2 and ($8), respectively |

|

(1,668) |

|

(108) |

|

(1,446) |

|

(279) |

| Foreign currency translation

adjustment |

|

(11,369) |

|

5,190 |

|

(4,078) |

|

2,154 |

| Unrealized gain (loss) on

hedges, net of income taxes of $0, $0, $0 and $0, respectively |

|

1,146 |

|

(485) |

|

293 |

|

(269) |

|

Comprehensive (loss) income |

|

(10,792) |

|

5,532 |

|

(6,904) |

|

1,458 |

| Less: Comprehensive income

attributable to noncontrolling interest |

|

122 |

|

40 |

|

258 |

|

190 |

| Comprehensive (loss) income

attributable to Twin Disc, Incorporated |

$ |

(10,914) |

$ |

5,492 |

$ |

(7,162) |

$ |

1,268 |

|

RECONCILIATION OF CONSOLIDATED NET LOSS TO

EBITDA |

|

(In thousands; unaudited) |

| |

| |

|

For the Quarter Ended |

|

For the Two Quarters Ended |

|

|

|

December 27, 2024 |

|

December 29, 2023 |

|

December 27, 2024 |

|

December 29, 2023 |

| |

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to Twin Disc, Incorporated |

$ |

919 |

$ |

930 |

$ |

(1,846) |

$ |

(243) |

| Interest expense |

|

495 |

|

392 |

|

1,131 |

|

786 |

| Income tax expense |

|

1,552 |

|

1,662 |

|

2,179 |

|

2,208 |

| Depreciation and

amortization |

|

3,296 |

|

2,535 |

|

6,534 |

|

5,023 |

| Earnings before interest,

taxes, depreciation, and amortization (EBITDA) |

$ |

6,262 |

$ |

5,519 |

$ |

7,998 |

$ |

7,774 |

|

RECONCILIATION OF TOTAL DEBT TO NET DEBT |

|

(In thousands; unaudited) |

| |

|

|

|

December 27, 2024 |

|

December 29, 2023 |

| |

|

|

|

|

| Current maturities of

long-term debt |

$ |

2,000 |

$ |

2,000 |

| Long-term debt |

|

22,873 |

|

15,698 |

| Total debt |

|

24,873 |

|

17,698 |

| Less cash |

|

15,906 |

|

21,021 |

| Net debt |

$ |

8,967 |

$ |

(3,323) |

|

RECONCILIATION OF REPORTED NET SALES TO ORGANIC NET

SALES |

|

(In thousands; unaudited) |

| |

| |

|

For the Quarter Ended |

|

|

|

December 27, 2024 |

|

December 29, 2023 |

| Net Sales |

$ |

89,921 |

$ |

72,994 |

| Less:

Acquisitions/Divestitures |

|

9,987 |

|

751 |

| Less: Foreign Currency

Impact |

|

355 |

|

- |

| Organic Net Sales |

$ |

79,579 |

$ |

72,243 |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands; except share amounts, unaudited) |

|

|

|

|

|

December 27, 2024 |

|

June 30, 2024 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash |

$ |

15,906 |

$ |

20,070 |

|

Trade accounts receivable, net |

|

53,670 |

|

52,207 |

|

Inventories, net |

|

128,278 |

|

130,484 |

|

Other current assets |

|

18,712 |

|

16,870 |

|

Total current assets |

|

216,566 |

|

219,631 |

|

|

|

|

|

| Property, plant and equipment,

net |

|

58,508 |

|

58,074 |

| Right-of-use assets operating

lease assets |

|

16,431 |

|

16,622 |

| Intangible assets, net |

|

10,856 |

|

12,686 |

| Deferred income taxes |

|

2,277 |

|

2,339 |

| Other noncurrent assets |

|

2,722 |

|

2,706 |

| Total assets |

$ |

307,360 |

$ |

312,058 |

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Current maturities of long-term debt |

$ |

2,000 |

$ |

2,000 |

|

Current maturities of right-of use operating lease obligations |

|

2,813 |

|

2,521 |

|

Accounts payable |

|

28,561 |

|

32,586 |

|

Accrued liabilities |

|

69,284 |

|

62,409 |

|

Total current liabilities |

|

102,658 |

|

99,516 |

|

. |

|

|

|

| Long-term debt |

|

22,873 |

|

23,811 |

| Right-of-use lease

obligations |

|

13,656 |

|

14,376 |

| Accrued retirement

benefits |

|

9,613 |

|

7,854 |

| Deferred income taxes |

|

4,712 |

|

5,340 |

| Other long-term

liabilities |

|

6,214 |

|

6,107 |

| Total liabilities |

|

159,726 |

|

157,004 |

| |

|

|

|

| Twin Disc, Incorporated

shareholders' equity: |

|

|

|

| Preferred shares authorized:

200,000; issued: none; no par value |

|

- |

|

- |

| Common shares authorized:

30,000,000; issued: 14,632,802; no par value |

|

40,111 |

|

41,798 |

| Retained earnings |

|

126,610 |

|

129,592 |

| Accumulated other

comprehensive loss |

|

(12,222) |

|

(6,905) |

|

|

|

154,499 |

|

164,485 |

| Less treasury stock, at cost

(486,940 and 637,778 shares, respectively) |

|

7,475 |

|

9,783 |

|

|

|

|

|

| Total Twin Disc, Incorporated

shareholders' equity |

|

147,024 |

|

154,702 |

|

|

|

|

|

| Noncontrolling interest |

|

610 |

|

352 |

| Total equity |

|

147,634 |

|

155,054 |

|

|

|

|

|

| Total liabilities and

equity |

$ |

307,360 |

$ |

312,058 |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In thousands; unaudited) |

|

|

|

|

|

For the Quarters Ended |

|

|

|

December 27, 2024 |

|

December 29, 2023 |

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

| Net loss |

$ |

(1,673) |

$ |

(148) |

| Adjustments to reconcile net

loss to net cash provided by operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

6,534 |

|

5,023 |

|

Gain on sale of assets |

|

(39) |

|

(42) |

|

Loss on write-down of industrial inventory |

|

1,579 |

|

- |

|

Loss on sale of boat management product line and related

inventory |

|

- |

|

3,099 |

|

Provision for deferred income taxes |

|

(363) |

|

280 |

|

Stock compensation expense and other non-cash changes, net |

|

1,625 |

|

1,413 |

|

Net change in operating assets and liabilities |

|

(3,348) |

|

6,422 |

| |

|

|

|

|

| Net cash provided by operating

activities |

|

4,315 |

|

16,047 |

| |

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

| Acquisition of property,

plant, and equipment |

|

(5,142) |

|

(5,419) |

| Proceeds from sale of fixed

assets |

|

39 |

|

- |

| Other, net |

|

(76) |

|

(252) |

| |

|

|

|

|

| Net cash used by investing

activities |

|

(5,179) |

|

(5,671) |

| |

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

| Borrowings under revolving

loan arrangements |

|

54,824 |

|

50,632 |

| Repayments of revolving loan

arrangements |

|

(54,824) |

|

(50,632) |

| Repayments of other long-term

debt |

|

(500) |

|

(1,010) |

| Dividends paid to

shareholders |

|

(1,136) |

|

(560) |

| Payments of finance lease

obligations |

|

(1,017) |

|

(471) |

| Payments of withholding taxes

on stock compensation |

|

(1,256) |

|

(1,772) |

| |

|

|

|

|

| Net cash used by financing

activities |

|

(3,909) |

|

(3,813) |

| |

|

|

|

|

| Effect of exchange rate

changes on cash |

|

609 |

|

1,195 |

| |

|

|

|

|

| Net change in cash |

|

(4,164) |

|

7,758 |

| |

|

|

|

|

| Cash: |

|

|

|

|

| Beginning of period |

|

20,070 |

|

13,263 |

| |

|

|

|

|

| End of period |

$ |

15,906 |

$ |

21,021 |

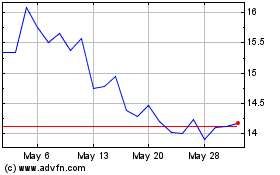

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Jan 2025 to Feb 2025

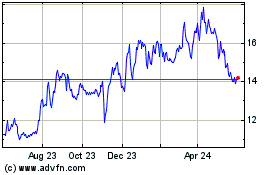

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Feb 2024 to Feb 2025