false

0001289460

0001289460

2024-12-27

2024-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported) December 27, 2024

TEXAS

ROADHOUSE, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

000-50972 |

|

20-1083890 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 6040

Dutchmans Lane, Louisville,

KY |

|

40205 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code (502) 426-9984

N/A

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each Class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

TXRH |

Nasdaq

Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 5.02. Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e) On

December 27, 2024, we entered into new employment agreements with Jerry Morgan, our Chief Executive Officer; Gina Tobin, our President;

Chris Monroe, our Chief Financial Officer; Chris Colson, our Chief Legal and Administrative Officer and Corporate Secretary; Hernan Mujica,

our Chief Technology Officer; and Travis Doster, our Chief Communications Officer. Each employment agreement is effective on January 8,

2025 and has an initial term expiring on January 7, 2028. Thereafter, each employment agreement will automatically renew for successive

one-year terms unless either party elects not to renew by providing written notice to the other party at least 60 days before

expiration. The new employment agreements supersede and replace the prior employment agreements with Messrs. Morgan, Monroe,

Colson, Mujica, and Doster and Ms. Tobin.

Base

Salary. Each officer’s employment agreement establishes an annual base salary as shown in the table below. During

the term of the employment agreement, base salary increases are at the discretion of the Compensation Committee.

| | |

2025 ($) | |

| Jerry Morgan | |

| 1,400,000 | |

| Gina Tobin | |

| 725,000 | |

| Chris Monroe | |

| 630,000 | |

| Chris Colson | |

| 630,000 | |

| Hernan Mujica | |

| 630,000 | |

| Travis Doster | |

| 630,000 | |

Incentive

Bonus. Each officer’s employment agreement provides an annual short-term cash incentive opportunity with a target

bonus as set forth in the table below, with increases in the target bonus amount at the discretion of the Compensation Committee. During

the term of the employment agreement, the performance criteria and terms of bonus awards are at the discretion of the Compensation Committee.

The targets are currently based upon earnings per share growth and pre-tax profits. Depending on the level of achievement of the goals,

the bonus may be reduced to a minimum of $0 or increased to a maximum of two times the base target amount under the current incentive

compensation policy of the Compensation Committee of the Board.

| | |

2025

Target Bonus

($) | |

2025

Minimum Bonus

($) | |

2025

Maximum Bonus

($) | |

| Jerry Morgan | |

| 1,400,000 | |

| 0 | |

| 2,800,000 | |

| Gina Tobin | |

| 725,000 | |

| 0 | |

| 1,450,000 | |

| Chris Monroe | |

| 525,000 | |

| 0 | |

| 1,050,000 | |

| Chris Colson | |

| 525,000 | |

| 0 | |

| 1,050,000 | |

| Hernan Mujica | |

| 525,000 | |

| 0 | |

| 1,050,000 | |

| Travis Doster | |

| 525,000 | |

| 0 | |

| 1,050,000 | |

Stock

Awards. Each employment agreement provides that the Compensation Committee of the Board may grant certain stock awards

to the executive officers during the term of the agreement. The amount, performance criteria and terms of equity awards are at the discretion

of the Compensation Committee of the Board. In connection with the same, on December 27, 2024, the Compensation Committee authorized

the grant of service-based restricted stock units equal to the dollar amount described in the table below for each executive officer with

respect to their respective 2025 fiscal year service. These service-based restricted stock units will be calculated by dividing the dollar

amount described in the table below by the per share closing sales price of the Company’s common stock on the Nasdaq Global Select

Market on the trading day immediately preceding the date of the grant, with such quotient rounded up or down to the nearest 100 shares.

Additionally, these service-based restricted stock units will be granted on January 8, 2025 and will vest on January 8, 2026,

provided the officer is still employed as of the vesting date.

| | |

Restricted Stock Units

($) | |

| Jerry Morgan | |

| 2,100,000 | |

| Gina Tobin | |

| 725,000 | |

| Chris Monroe | |

| 472,500 | |

| Chris Colson | |

| 472,500 | |

| Hernan Mujica | |

| 472,500 | |

| Travis Doster | |

| 472,500 | |

Additionally, on December 27,

2024, the Compensation Committee authorized a three-year grant of performance-based restricted stock units as described in the table below

for those executive officers listed below with respect to their respective 2025 fiscal year service, 2026 fiscal year service, and 2027

fiscal year service. These performance-based restricted stock units will be calculated by dividing the target dollar amount described

in the table below by the per share closing sales price of the Company’s common stock on the Nasdaq Global Select Market on the

trading day immediately preceding the date of the grant, with such quotient rounded up or down to the nearest 100 shares. Additionally,

these performance-based restricted stock units will be granted on January 8, 2025 and one-third of each officer’s performance-based

restricted stock units will vest each year on January 8 over a three-year period, commencing on January 8, 2026, subject to

the achievement of defined goals established by the Compensation Committee of the Board. The performance targets are currently based upon

earnings per share growth and pre-tax profits as more particularly described below. Depending on the level of achievement of the goals,

the number of performance-based restricted stock units vesting may be reduced to zero or increased to a maximum of two times the target

amount shown below.

| |

|

Target $ of

Performance-Based

Restricted Stock

Units |

|

Minimum $ of

Performance-Based

Restricted Stock

Units |

|

Maximum $ of

Performance-Based

Restricted Stock

Units |

|

| Jerry Morgan |

|

|

6,300,000 |

|

|

0 |

|

|

12,600,000 |

|

| Gina Tobin |

|

|

2,175,000 |

|

|

0 |

|

|

4,350,000 |

|

| Chris Monroe |

|

|

1,417,500 |

|

|

0 |

|

|

2,835,000 |

|

| Chris Colson |

|

|

1,417,500 |

|

|

0 |

|

|

2,835,000 |

|

| Hernan Mujica |

|

|

1,417,500 |

|

|

0 |

|

|

2,835,000 |

|

| Travis Doster |

|

|

1,417,500 |

|

|

0 |

|

|

2,835,000 |

|

For these performance-based

restricted stock units, the Compensation Committee established a two-pronged approach. Under this approach, 50% will be based on pre-tax

profits and the other 50% of the target equity award is awarded based on whether the Company achieves the following EPS growth target:

| (i) | with respect to the one-third portion of the applicable performance-based restricted stock units relating

to their 2025 fiscal year service, a one-year EPS growth target of 10% as compared to the 2024 fiscal year, |

| (ii) | with respect to the one-third portion of the applicable performance-based restricted stock units relating

to their 2026 fiscal year service, a two-year EPS growth target of 21% as compared to the 2024 fiscal year, and |

|

(iii) |

with respect to the one-third portion of the applicable performance-based restricted stock units relating to their 2027 fiscal year service, a three-year EPS growth target of 33% as compared to the 2024 fiscal year. |

Separation

and Change in Control Arrangements. The employment agreements provide that the agreement and an officer’s employment

will terminate during the term of the employment agreement if any of the following occurs: (i) termination by the Company for Cause

(as defined in the employment agreement); (ii) termination by the Company without Cause; (iii) resignation by the applicable

officer for Good Reason (as hereinafter defined); (iv) resignation by the applicable officer without Good Reason; (v) an officer’s

death or long-term disability; and/or (vi) an officer’s retirement. The employment agreements also provide for the payment

by the Company to the applicable officer of the Base Termination Payments (as hereinafter defined) and/or the Separation Pay (as hereinafter

defined) based on the applicable termination event. The following table describes the payment type by applicable termination event.

| Termination Event |

|

Payment Type |

| Termination for Cause |

|

Base Termination Payments |

| Termination without Cause |

|

Base Termination Payments and Separation Pay |

| Resignation for Good Reason |

|

Base Termination Payments and Separation Pay |

| Resignation without Good Reason |

|

Base Termination Payments |

| Officer Death / Long-Term Disability |

|

Base Termination Payments |

| Officer Retirement |

|

Base Termination Payments |

The

payment of the Separation Pay is generally contingent upon the officer’s execution of a full release of claims against the Company

and continued compliance with the non-competition, non-solicitation, confidentiality and other restrictive covenants. The employment

agreements provide for the reduction of Change in Control payments to the maximum amount that could be paid to the officers without giving

rise to the excise tax imposed by Section 4999 of the Internal Revenue Code. For the purposes of the employment agreements, (A) the

term “Good Reason” means termination for certain circumstances expressly described in the employment agreement

that occurs within 12 months following a Change of Control; (B) the term “Base Termination Payments” means

(i) the officer’s base salary through the date of termination, plus (ii) any incentive bonus earned but not yet paid for

any fiscal year ended before the date of termination, plus (iii) any accrued paid time off that might be due in accordance with the

Company’s policies, plus (iv) any expenses owed to the applicable officer under the employment agreement; and (C) the

term “Separation Pay” means the following:

(a) to

the extent the employment agreement is terminated by the Company without Cause, then (x) with respect to our Chief Executive Officer,

(i) two times the officer’s then current base salary, plus (ii) an incentive bonus for the year in which the date of termination

occurs, equal to the officer’s target bonus for that year, prorated based on the number of days in the fiscal year elapsed before

the date of termination, plus (iii) to the extent the officer is enrolled in the Company’s insurance plan as of the date of

termination, an amount equal to the approximate cost of the aggregate monthly premiums (less applicable withholdings) for a 18 month period

of ongoing medical, dental, and vision insurance via a timely election made under the Company’s health plan pursuant to the

Consolidated Omnibus Budget Reconciliation Act (COBRA); and (y) with respect to all other executives, (i) one times the officer’s

then current base salary, plus (ii) an incentive bonus for the year in which the date of termination occurs, equal to the officer’s

target bonus for that year, prorated based on the number of days in the fiscal year elapsed before the date of termination, plus (iii) to

the extent the officer is enrolled in the Company’s insurance plan as of the date of termination, an amount equal to the approximate

cost of the aggregate monthly premiums (less applicable withholdings) for a 12 month period of ongoing medical, dental, and vision insurance

via a timely election made under the Company’s health plan pursuant to the Consolidated Omnibus Budget Reconciliation Act (COBRA);

and

(b) to

the extent the employment agreement is terminated due to an officer’s resignation for Good Reason within 12 months following a Change

in Control, then (x) with respect to our Chief Executive Officer, (i) two times the officer’s then current base salary,

plus (ii) two times the officer’s then target incentive bonus, plus (iii) an incentive bonus for the year in which the

date of termination occurs, equal to the officer’s target bonus for that year, prorated based on the number of days in the fiscal

year elapsed before the date of termination, plus (iv) to the extent the officer is enrolled in the Company’s insurance plan

as of the date of termination, an amount equal to the approximate cost of the aggregate monthly premiums (less applicable withholdings)

for a 18 month period of ongoing medical, dental, and vision insurance via a timely election made under the Company’s health

plan pursuant to the Consolidated Omnibus Budget Reconciliation Act (COBRA); and (y) with respect to all other executives, (i) one

and half times the officer’s then current base salary, plus (ii) one and half times the officer’s then target incentive

bonus, plus (iii) an incentive bonus for the year in which the date of termination occurs, equal to the officer’s target bonus

for that year, prorated based on the number of days in the fiscal year elapsed before the date of termination, plus (iii) to the

extent the officer is enrolled in the Company’s insurance plan as of the date of termination, an amount equal to the approximate

cost of the aggregate monthly premiums (less applicable withholdings) for a 18 month period of ongoing medical, dental, and vision insurance

via a timely election made under the Company’s health plan pursuant to the Consolidated Omnibus Budget Reconciliation Act (COBRA).

Non-competition

and Other Restrictions. Each officer has agreed not to compete with us during the term of his or her employment and for a period

of two years following the termination of his or her employment agreement. The employment agreements also contain certain confidentiality,

non-solicitation, and non-disparagement provisions. The employment agreements contain a “clawback” provision that any compensation

paid or payable to the employment agreement or any other agreement or arrangement with the Company shall be subject to recovery or reduction

in future payments in lieu of recovery pursuant to any Company clawback policy in effect from time to time, whether adopted before or

after the date of the employment agreement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

TEXAS ROADHOUSE, INC. |

| |

|

| Date: December 31, 2024 |

By: |

/s/ Gerald L. Morgan |

| |

|

Gerald L. Morgan |

| |

|

Chief Executive Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

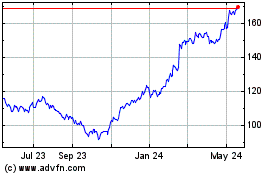

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Dec 2024 to Jan 2025

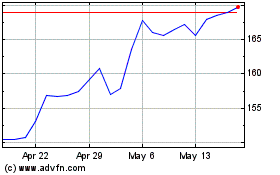

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Jan 2024 to Jan 2025