Unity Bancorp Reports Quarterly Earnings of $10.9 Million

October 11 2024 - 5:00AM

Unity Bancorp, Inc. (NASDAQ: UNTY), parent company of Unity Bank,

reported net income of $10.9 million, or $1.07 per diluted share,

for the quarter ended September 30, 2024, compared to net income of

$9.5 million, or $0.93 per diluted share for the quarter ended June

30, 2024. This represents a 15.3% increase in net income and a

15.1% increase in net income per diluted share. For the nine months

ended September 30, 2024, Unity Bancorp reported net income of

$29.9 million, or $2.94 per diluted share, compared to net income

of $29.9 million, or $2.88 per diluted share, for the nine months

ended September 30, 2023. This represents no change in net income

and a 2.1% increase in net income per diluted share, reflecting the

Company’s repurchase of outstanding shares.

James A. Hughes, President and CEO, commented on

the financial results: “We are excited to announce the highest

quarterly earnings results in the Unity Bancorp Inc.’s history. For

the quarter, we achieved $10.9 million of net income, equivalent to

$1.07 per diluted share. Our net interest margin expanded to 4.16%

and we delivered an impressive ROA of 1.76% and ROE of 15.55%.

In the third quarter, our organization

demonstrated its commitment to granting credit to small and

medium-sized businesses operating in our local communities. Gross

loans grew $46.9 million, or 2.2%, and commercial loans grew $50.6

million, or 3.8%, sequentially.

We have also benefited from continued deposit

momentum, with customer deposits growing $42.6 million, or 2.4%

sequentially. Deposits will continue to be the fuel that enables

our credit growth. We look forward to continuing to support our

communities by growing loans and deposits in tandem.

In September, the Federal Reserve cut short-term

interest rates 50 basis points, signaling a change to the operating

environment. At Unity, we are able to maintain strong profitability

metrics in all interest rate scenarios. We will continue to manage

our interest rate sensitivity, maintain a conservative capital

position and ensure ample liquidity levels. Our asset quality

ratios remain favorable and we closely monitor and manage our

nonperforming and past-due credit relationships.

Lastly, our strong financial results are a

reflection of our talented employee base. Their hard work and

dedication to our company significantly support the local economies

of the communities we serve.”

For the full version of the Company’s quarterly earnings

release, including financial tables, please visit News - Unity Bank

(q4ir.com).

Unity Bancorp, Inc. is a financial services

organization headquartered in Clinton, New Jersey, with

approximately $2.6 billion in assets and $2.0 billion in deposits.

Unity Bank, the Company’s wholly owned subsidiary, provides

financial services to retail, corporate and small business

customers through its robust branch network located in Bergen,

Hunterdon, Middlesex, Morris, Ocean, Somerset, Union and Warren

Counties in New Jersey and Northampton County in Pennsylvania. For

additional information about Unity, visit our website at

www.unitybank.com, or call 800-618-BANK.

This news release contains certain

forward-looking statements, either expressed or implied, which are

provided to assist the reader in understanding anticipated future

financial performance. These statements may be identified by use of

the words “believe”, “expect”, “intend”, “anticipate”, “estimate”,

“project” or similar expressions. These statements involve certain

risks, uncertainties, estimates and assumptions made by management,

which are subject to factors beyond the Company’s control and could

impede its ability to achieve these goals. These factors include

those items included in our Annual Report on Form 10-K under the

heading “Item IA-Risk Factors” as amended or supplemented by our

subsequent filings with the SEC, as well as general economic

conditions, trends in interest rates, the ability of our borrowers

to repay their loans, our ability to manage and reduce the level of

our nonperforming assets, results of regulatory exams, and the

impact of any health crisis or national disasters on the Bank, its

employees and customers, among other factors.

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction.

News Media & Financial Analyst

Contact:George Boyan, EVP and

CFO(908) 713-4565

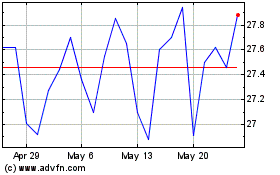

Unity Bancorp (NASDAQ:UNTY)

Historical Stock Chart

From Oct 2024 to Nov 2024

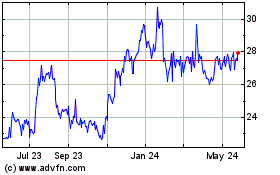

Unity Bancorp (NASDAQ:UNTY)

Historical Stock Chart

From Nov 2023 to Nov 2024