0001041657FALSE00010416572024-11-122024-11-120001041657us-gaap:CommonClassAMember2024-11-122024-11-120001041657uone:CommonClassDMember2024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant To Section 13 or 15(d)

Of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2024

URBAN ONE, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | 0-25969 | 52-1166660 |

(State or Other Jurisdiction

of Incorporation) | (Commission File No.) | (IRS Employer

Identification No.) |

1010 Wayne Avenue

14th Floor

Silver Spring, Maryland 20910

(301) 429-3200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Class | | Trading Symbol | | Name of Exchange on which Registered |

| Class A Common Stock, $.001 Par Value | | UONE | | NASDAQ Stock Market |

| Class D Common Stock, $.001 Par Value | | UONEK | | NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 under the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Urban One, Inc. (the “Company”) issued a press release setting forth the results for the quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1.

Item 8.01 Other Events.

During the course of its earnings call, the Company gave certain updates to its current outlook. First the Company noted that for the year-ending December 31, 2024, it now expects to achieve Adjusted EBITDA of $102-105 million versus its previous guidance of the lower end of the range of $110-120 million. Next, the Company noted that Q4 revenue was pacing approximately flat versus the comparable period in 2023 and the Company expected to post approximately $20.5 million in political advertising revenue for the full year. Finally, the Company also noted that it expects year-end cash on hand to be approximately $140.0 million.

ITEM 9.01. Financial Statements and Exhibits.

(c) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101) |

Forward Looking Statements

The Company cautions you certain of the statements in this Form 8-K or in its press release may represent “forward-looking statements” as defined in Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “expect,” “believe,” “anticipate,” “intend,” “plan,” “project,” “will” or “estimate,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. Except as required by law, the Company undertakes no obligation to update such statements to reflect events or circumstances arising after such date and cautions investors not to place undue reliance on any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: any recurrence of the COVID-19 pandemic or and other health epidemics or pandemics on the global economy; the cost and availability of capital or credit facility borrowings; the ability to obtain equity financing; general market conditions; the adequacy of cash flows or available debt resources to fund operations; and other risk factors described from time to time in the Company’s Forms 10-K, Forms 10-K/A, Forms 10-Q, Forms 10-Q/A and Form 8-K reports (including all amendments to those reports).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| URBAN ONE, INC. |

| |

| /s/ Peter D. Thompson |

| November 12, 2024 | Peter D. Thompson |

| Chief Financial Officer and Principal Accounting Officer |

Exhibit 99.1

NEWS RELEASE

| | | | | |

| November 12, 2024 | Contact: Peter D. Thompson, EVP and CFO |

| FOR IMMEDIATE RELEASE | (301) 429-4638 |

| Silver Spring, MD | |

URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

Silver Spring, MD: - Urban One, Inc. (NASDAQ: UONEK and UONE) today reported its results for the quarter ended September 30, 2024. For the three months ended September 30, 2024, net revenues were approximately $110.4 million, a decrease of 6.3% from the same period in 2023. The Company reported operating loss of approximately $26.2 million for the three months ended September 30, 2024, compared to operating loss of approximately $56.1 million for the three months ended September 30, 2023. Broadcast and digital operating income1 was approximately $35.4 million, a decrease of 19.2% from the same period in 2023. Net loss was approximately $31.8 million or $(0.68) per share (basic) compared to net loss of $54.4 million or $(1.14) per share (basic) for the same period in 2023. Adjusted EBITDA2 was approximately $25.4 million for the three months ended September 30, 2024, compared to approximately $34.7 million for the same period in 2023.

Alfred C. Liggins, III, Urban One’s CEO and President stated, “On a same station basis our radio division finished Q3 -7.7% excluding political, and -3.6% with political. We saw a strong uptick in political revenues beginning in September, with Q4 core radio revenue currently pacing down 3.0%, but up 23.9% overall. Reach Media increased margins and Adjusted EBITDA, despite an 8.2% reduction in revenue for the quarter, due to reduced selling, general and administrative expenses. Our Cable TV business continues to suffer from subscriber churn and audience delivery shortfall, impacting both advertising and affiliate revenues, which were both down double digit percentages in Q3. Digital advertising revenues were down 4.1% as the business experienced moderately weaker advertising demand than prior year. During Q2 we repurchased an additional $14.5 million of our 2028 notes at 75.0%, and we ended the quarter with approximately $115.5 million of cash, cash equivalents and restricted cash.”

PAGE 2-- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (unaudited) | | (unaudited) |

| STATEMENT OF OPERATIONS | (in thousands, except share data) | | (in thousands, except share data) |

| | | | | | | |

| NET REVENUE | $ | 110,393 | | $ | 117,825 | | $ | 332,547 | | $ | 357,346 |

| OPERATING EXPENSES | | | | | | | |

| Programming and technical, excluding stock-based compensation | 33,911 | | 33,903 | | 99,826 | | 100,304 |

| Selling, general and administrative, excluding stock-based compensation | 41,112 | | 40,142 | | 131,141 | | 126,634 |

| Corporate selling, general and administrative, excluding stock-based compensation | 12,354 | | 10,418 | | 38,033 | | 30,333 |

| Stock-based compensation | 1,152 | | 2,218 | | 3,615 | | 7,816 |

| Depreciation and amortization | 1,238 | | 1,808 | | 6,081 | | 6,291 |

| Impairment of goodwill, intangible assets, and long-lived assets | 46,823 | | 85,448 | | 127,581 | | 124,304 |

| Total operating expenses | 136,590 | | 173,937 | | 406,277 | | 395,682 |

| Operating loss | (26,197) | | (56,112) | | (73,730) | | (38,336) |

| INTEREST INCOME | 1,088 | | 2,256 | | 4,863 | | 4,488 |

| INTEREST EXPENSE | 11,649 | | 13,983 | | 37,051 | | 42,023 |

| | | | | | | |

| GAIN ON RETIREMENT OF DEBT | 3,472 | | | - | | 18,771 | | 2,356 |

| | | | | | | |

| Other income, net | 74 | | 75 | | 974 | | 96,535 |

| (Loss) income before (benefit from) provision for income taxes and non-controlling interest in income of subsidiaries | (33,212) | | | (67,764) | | | (86,173) | | | 23,020 | |

| (BENEFIT FROM)PROVISION FOR INCOME TAXES | (1,814) | | | (16,778) | | (17,824) | | | 5,259 |

| Net (loss) income from consolidated operations | (31,398) | | | (50,986) | | | (68,349) | | | 17,761 | |

| Loss from unconsolidated joint venture | - | | (2,728) | | (411) | | (2,728) |

| NET (LOSS) INCOME | (31,398) | | | (53,714) | | | (68,760) | | | 15,033 | |

| NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 400 | | 697 | | 976 | | 2,000 |

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | (31,798) | | $ | (54,411) | | $ | (69,736) | | $ | 13,033 |

| | | | | | | |

Weighted average shares outstanding - basic3 | 47,105,290 | | 47,722,263 | | 48,614,438 | | 47,592,010 |

Weighted average shares outstanding - diluted4 | 47,105,290 | | 47,722,263 | | 48,614,438 | | 50,358,881 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

PAGE 3 -- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| PER SHARE DATA - basic and diluted: | (unaudited) | | (unaudited) |

| (in thousands, except per share data) | | (in thousands, except per share data) |

| | | | | | | |

| Net (loss) income attributable to common stockholders (basic) | (0.68) | | (1.14) | | (1.43) | | 0.27 |

| | | | | | | |

| Net (loss) income attributable to common stockholders (diluted) | (0.68) | | (1.14) | | (1.43) | | 0.26 |

| | | | | | | |

| SELECTED OTHER DATA | | | | | | | |

Broadcast and digital operating income 1 | $ | 35,370 | | $ | 43,780 | | $ | 101,580 | | $ | 130,408 |

| | | | | | | |

| Broadcast and digital operating income reconciliation: | | | | | | | |

| | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (31,798) | | $ | (54,411) | | $ | (69,736) | | $ | 13,033 |

| Add back/(deduct) certain non-broadcast and digital operating income items included in net (loss) income: | | | | | | | |

| Interest income | (1,088) | | | (2,256) | | | (4,863) | | | (4,488) | |

| Interest expense | 11,649 | | 13,983 | | 37,051 | | 42,023 |

| (Benefit from) provision for income taxes | (1,814) | | (16,778) | | (17,824) | | 5,259 |

| Corporate selling, general and administrative expenses | 12,354 | | 10,418 | | 38,033 | | 30,333 |

| Stock-based compensation | 1,152 | | 2,218 | | 3,615 | | 7,816 |

| Gain on retirement of debt | (3,472) | | - | | | (18,771) | | | (2,356) | |

| Other income, net | (74) | | (75) | | | (974) | | | (96,535) | |

| Loss from unconsolidated joint venture | - | | 2,728 | | | 411 | | | 2,728 | |

| Depreciation and amortization | 1,238 | | 1,808 | | 6,081 | | 6,291 |

| Net income attributable to non-controlling interests | 400 | | 697 | | 976 | | 2,000 |

| Impairment of goodwill, intangible assets, and long-lived assets | 46,823 | | 85,448 | | 127,581 | | 124,304 |

| | | | | | | |

| Broadcast and digital operating income | $ | 35,370 | | $ | 43,780 | | $ | 101,580 | | $ | 130,408 |

| | | | | | | |

Adjusted EBITDA2 | $ | 25,414 | | $ | 34,650 | | $ | 76,593 | | $ | 103,874 |

| | | | | | | |

| Adjusted EBITDA reconciliation: | | | | | | | |

| | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (31,798) | | | $ | (54,411) | | | $ | (69,736) | | | $ | 13,033 | |

| Interest income | (1,088) | | | (2,256) | | | (4,863) | | | (4,488) | |

| Interest expense | 11,649 | | 13,983 | | 37,051 | | 42,023 |

| (Benefit from) provision for income taxes | (1,814) | | (16,778) | | (17,824) | | 5,259 |

| Depreciation and amortization | 1,238 | | 1,808 | | 6,081 | | 6,291 |

| EBITDA | $ | (21,813) | | $ | (57,654) | | $ | (49,291) | | $ | 62,118 |

| Stock-based compensation | 1,152 | | 2,218 | | 3,615 | | 7,816 |

| Gain on retirement of debt | (3,472) | | - | | | (18,771) | | | (2,356) | |

| Other income, net | (74) | | (75) | | | (974) | | | (96,535) | |

| Loss from unconsolidated joint venture | - | | 2,728 | | 411 | | 2,728 |

| Net income attributable to non-controlling interests | 400 | | 697 | | 976 | | 2,000 |

| Corporate development costs | 1,339 | | 1,594 | | 10,863 | | 4,317 |

| Employment Agreement Award and other compensation | - | | (845) | | | - | | (2,663) |

| Severance-related costs | 251 | | 31 | | 831 | | 318 |

Impairment of goodwill, intangible assets, and long-lived assets | 46,823 | | 85,448 | | 127,581 | | 124,304 |

Investment expense from MGM National Harbor | - | | - | | - | | (115) |

| Other nonrecurring expenses | 46 | | - | | (631) | | - |

| Loss from ceased non-core businesses initiatives | 762 | | 508 | | 1,983 | | 1,942 |

| Adjusted EBITDA | $ | 25,414 | | $ | 34,650 | | $ | 76,593 | | $ | 103,874 |

PAGE 4 -- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| | | |

| (in thousands) |

| (unaudited) | | |

| SELECTED BALANCE SHEET DATA: | |

| Cash and cash equivalents and restricted cash | $ | 115,489 | | | $ | 233,570 | |

| Intangible assets, net | 514,756 | | | 645,979 | |

| | | |

| Total assets | 962,603 | | | 1,211,173 | |

| Total debt (including current portion, net of issuance costs) | 593,918 | | | 716,246 | |

| Total liabilities | 747,203 | | | 920,588 | |

| Total stockholders' equity | 204,764 | | | 274,065 | |

| Redeemable non-controlling interests | 10,636 | | | 16,520 | |

| | | |

| | | | | | | | | | | |

| September 30, 2024 | | Applicable Interest Rate |

| (in thousands) | | |

| SELECTED LEVERAGE DATA: | | | |

| 7.375% senior secured notes due February 2028, net of issuance costs of approximately $6.1 million (fixed rate) | $ | 593,918 | | | 7.375 | % |

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements represent management's current expectations and are based upon information available to Urban One at the time of this release. These forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond Urban One's control, which may cause the actual results to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially are described in Urban One’s reports on Forms 10-K, 10-K/A, 10-Q, 10-Q/A, 8-K and other filings with the Securities and Exchange Commission (the “SEC”). Urban One does not undertake any duty to update any forward-looking statements.

PAGE 5 -- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

During the three months ended September 30, 2024, we recognized approximately $110.4 million in net revenues compared to approximately $117.8 million during the three months ended September 30, 2023. These amounts are net of agency commissions. We recognized approximately $39.7 million of revenue from our Radio Broadcasting segment during the three months ended September 30, 2024, compared to approximately $40.2 million during the three months ended September 30, 2023, a decrease of approximately $0.5 million. This decrease was primarily due to a decrease in national advertising offset by the Houston station acquisition, which was completed in August 2023. We recognized approximately $10.2 million of revenue from our Reach Media segment during the three months ended September 30, 2024, compared to approximately $11.2 million for the three months ended September 30, 2023, a decrease of approximately $1.0 million. The decrease was primarily driven by the decrease in overall demand and attrition of advertisers. We recognized approximately $20.4 million of revenue from our digital segment during each of the three months ended September 30, 2024 and 2023, respectively. We recognized approximately $40.7 million of revenue from our cable television segment during the three months ended September 30, 2024, compared to approximately $46.8 million for the three months ended September 30, 2023, a decrease of approximately $6.1 million. The decrease was primarily driven by a decrease in audience viewership affecting advertising sales and the consistent churn in subscribers.

The following charts indicates the sources of our net revenues for the three and nine months ended September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | | | |

| 2024 | | 2023 | | $ Change | | % Change |

| | | | | | | |

| (Unaudited) | | | | |

| (in thousands) | | | | |

| Net Revenues: | | | | | | | |

| Radio Advertising | $ | 44,991 | | | $ | 46,651 | | | $ | (1,660) | | | (3.6) | % |

| Political Advertising | 3,547 | | | 1,101 | | | 2,446 | | | 222.2% |

| Digital Advertising | 19,434 | | | 20,269 | | | (835) | | | (4.1)% |

| Cable Television Advertising | 21,868 | | | 25,218 | | | (3,350) | | (13.3)% |

| Cable Television Affiliate Fees | 18,808 | | | 21,569 | | | (2,761) | | | (12.8)% |

| Event Revenues & Other | 1,745 | | | 3,017 | | | (1,272) | | | (42.2)% |

| Net Revenues (as reported) | $ | 110,393 | | $ | 117,825 | | $ | (7,432) | | (6.3) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, | | | | |

| 2024 | | 2023 | | $ Change | | % Change |

| | | | | | | |

| (Unaudited) | | | | |

| (in thousands) | | | | |

| Net Revenues: | | | | | | | |

| Radio Advertising | $ | 131,753 | | $ | 134,549 | | $ | (2,796) | | | (2.1) | % |

| Political Advertising | 6,935 | | 1,933 | | 5,002 | | 258.8% |

| Digital Advertising | 48,910 | | 54,027 | | (5,117) | | | (9.5)% |

| Cable Television Advertising | 69,403 | | 81,286 | | (11,883) | | | (14.6)% |

| Cable Television Affiliate Fees | 58,910 | | 67,589 | | (8,679) | | | (12.8)% |

| Event Revenues & Other | 16,636 | | 17,962 | | (1,326) | | | (7.4)% |

| Net Revenues (as reported) | $ | 332,547 | | $ | 357,346 | | $ | (24,799) | | | (6.9) | % |

| | | | | | | |

| | | | | | | |

PAGE 6 -- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

Operating expenses, excluding depreciation and amortization, stock-based compensation, and impairment of goodwill, intangible assets and long-lived assets, were approximately $87.4 million for the three months ended September 30, 2024, up 3.5% from approximately $84.5 million for the comparable period in 2023. The overall increase in operating expense was primarily due to higher expenses in the Houston radio market as a result of the acquisition in August of 2023, higher third party professional fees and cloud-based software licenses.

Depreciation and amortization expense was approximately $1.2 million for the three months ended September 30, 2024, compared to approximately $1.8 million for the three months ended September 30, 2023, a decrease of approximately $0.6 million the due to the write off of aged property and equipment, net during the three months ended September 30, 2024.

Impairment of goodwill, intangible assets and long-lived assets was approximately $46.8 million during the three months ended September 30, 2024, compared to approximately $85.4 million for the three months ended September 30, 2023. The impairment loss of $46.8 million in the third quarter 2024 was associated with the impairment of broadcasting licenses within the radio broadcasting segment and TV One Trade name. The primary factors leading to the impairments were an increase in the discount rate, continued decline of projected gross market revenues for Radio Broadcasting, projected revenues for TV One and a decline in operating profit margin.

Interest income was approximately $1.1 million for the three months ended September 30, 2024, compared to approximately $2.3 million for the three months ended September 30, 2023. The decrease was driven by lower cash and cash equivalents balances during the three months ended September 30, 2024, than in the corresponding period in 2023.

Interest expense was approximately $11.6 million for the three months ended September 30, 2024, compared to approximately $14.0 million for the three months ended September 30, 2023, a decrease of approximately $2.3 million. During the three months ended September 30, 2024, the Company continued to repurchase its 2028 Notes, reducing the outstanding balance to $600.0 million compared to $725.0 million as of September 30, 2023.

For the three months ended September 30, 2024, we recorded a benefit from income taxes of approximately $1.8 million resulting in an effective tax rate of 5.5%. This rate includes discrete tax expense of $2.9 million primarily related to return to provision adjustments, changes in valuation allowance for certain of our state net operating losses, and stock-based compensation. For the three months ended September 30, 2023, we recorded a benefit from income taxes of approximately $16.8 million resulting in an effective tax rate of 23.8%. This rate includes $0.3 million of discrete tax benefits primarily related to deferred rate changes.

Other pertinent financial information includes capital expenditures of approximately $1.6 million and $2.5 million for the three months ended September 30, 2024 and 2023, respectively.

During the three months ended September 30, 2024, the Company repurchased 1,015,023 shares of Class A Common Stock in the amount of approximately $2.0 million at an average price of $2.01 per share and repurchased 586,989 shares of Class D Common Stock in the amount of approximately $0.8 million at an average price of $1.31 per share. During the three months ended September 30, 2023, the Company did not repurchase any shares of Class A Common Stock and repurchased 824 shares of Class D Common Stock in the amount of approximately $3,000 at an average price of $3.99 per share.

PAGE 7 -- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

Supplemental Financial Information:

For comparative purposes, the following more detailed, unaudited statements of operations for the three and nine months ended September 30, 2024 are included.

PAGE 8, 9, 10 & 11 -- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| (in thousands, unaudited) |

| Consolidated | | Radio Broadcasting | | Reach Media | | Digital | | Cable Television | | All Other - Corporate/ Eliminations |

| | | | | | | | | | | |

| STATEMENT OF OPERATIONS: | | | | | | | | | | | |

| | | | | | | | | | | |

| NET REVENUE | $ | 110,393 | | $ | 39,716 | | $ | 10,247 | | $ | 20,398 | | $ | 40,690 | | $ | (658) | |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Programming and technical | 33,911 | | 11,779 | | 3,700 | | 3,481 | | 15,177 | | (226) | |

| Selling, general and administrative | 41,112 | | 21,267 | | 1,451 | | 9,831 | | 8,815 | | (252) | |

| Corporate selling, general and administrative | 12,354 | | - | | 699 | | 3 | | 1,638 | | 10,014 |

| Stock-based compensation | 1,152 | | 125 | | 28 | | 56 | | 21 | | 922 |

| Depreciation and amortization | 1,238 | | 509 | | 39 | | 401 | | 47 | | 242 |

| Impairment of goodwill, intangible assets, and long-lived assets | 46,823 | | 37,734 | | - | | - | | 9,089 | | - |

| Total operating expenses | 136,590 | | 71,414 | | 5,917 | | 13,772 | | 34,787 | | 10,700 |

| Operating (loss) income | (26,197) | | (31,698) | | 4,330 | | 6,626 | | 5,903 | | (11,358) |

| INTEREST INCOME | 1,088 | | - | | - | | - | | - | | 1,088 |

| INTEREST EXPENSE | 11,649 | | 58 | | - | | - | | - | | 11,591 |

| | | | | | | | | | | |

| GAIN ON RETIREMENT OF DEBT | (3,472) | | | - | | - | | - | | - | | (3,472) | |

| OTHER INCOME (LOSS), net | 74 | | | (12) | | | - | | | - | | | - | | | 86 | |

| (Loss) income before income from consolidated operations before (benefit from) provision for income taxes | (33,212) | | (31,768) | | 4,330 | | 6,626 | | 5,903 | | (18,303) | |

| (BENEFIT FROM) PROVISION FOR INCOME TAXES | (1,814) | | | (2,344) | | | 941 | | | 380 | | | 1,218 | | | (2,009) | |

| NET (LOSS) INCOME | (31,398) | | | (29,424) | | 3,389 | | 6,246 | | 4,685 | | (16,294) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 400 | | | - | | | - | | | - | | | - | | | 400 | |

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | (31,798) | | | $ | (29,424) | | | $ | 3,389 | | | $ | 6,246 | | | $ | 4,685 | | | $ | (16,694) | |

| | | | | | | | | | | |

Adjusted EBITDA2 | $ | 25,414 | | $ | 8,030 | | $ | 3,655 | | $ | 6,363 | | $ | 15,060 | | $ | (7,695) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (in thousands, unaudited) |

| Consolidated | | Radio Broadcasting | | Reach Media | | Digital | | Cable Television | | All Other - Corporate/ Eliminations |

| | | | | | | | | | | |

| STATEMENT OF OPERATIONS: | | | | | | | | | | | |

| | | | | | | | | | | |

| NET REVENUE | $ | 117,825 | | $ | 40,152 | | $ | 11,157 | | $ | 20,356 | | $ | 46,787 | | $ | (627) | |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Programming and technical | 33,903 | | 11,715 | | 3,963 | | 3,384 | | 15,204 | | (363) | |

| Selling, general and administrative | 40,142 | | 19,829 | | 3,145 | | 9,623 | | 7,970 | | (425) | |

| Corporate selling, general and administrative | 10,418 | | - | | 673 | | 2 | | 1,374 | | 8,369 |

| Stock-based compensation | 2,218 | | 157 | | 184 | | 54 | | 15 | | 1,808 |

| Depreciation and amortization | 1,808 | | 925 | | 41 | | 376 | | 110 | | 356 |

| Impairment of goodwill, intangible assets, and long-lived assets | 85,448 | | 85,448 | | - | | - | | - | | - |

| Total operating expenses | 173,937 | | 118,074 | | 8,006 | | 13,439 | | 24,673 | | 9,745 |

| Operating (loss) income | (56,112) | | (77,922) | | 3,151 | | 6,917 | | 22,114 | | (10,372) |

| INTEREST INCOME | 2,256 | | - | | - | | - | | - | | 2,256 |

| INTEREST EXPENSE | 13,983 | | 56 | | - | | - | | - | | 13,927 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| OTHER INCOME, net | 75 | | 60 | | - | | - | | - | | 15 |

| (Loss) income before income from consolidated operations before (benefit from) provision for income taxes | (67,764) | | (77,918) | | 3,151 | | | 6,917 | | 22,114 | | (22,028) | |

| (BENEFIT FROM) PROVISION FOR INCOME TAXES | (16,778) | | | (17,617) | | | 310 | | | - | | | 2,487 | | | (1,958) | |

| Net (loss) income from consolidated operations | (50,986) | | (60,301) | | 2,841 | | 6,917 | | 19,627 | | (20,070) |

| LOSS FROM UNCONSOLIDATED JOINT VENTURE, net of tax | (2,728) | | | - | | | - | | | - | | | - | | | (2,728) | |

| NET (LOSS) INCOME | (53,714) | | (60,301) | | 2,841 | | 6,917 | | 19,627 | | (22,798) |

| NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | 697 | | | - | | | - | | | - | | | - | | | 697 | |

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | (54,411) | | | $ | (60,301) | | | $ | 2,841 | | | $ | 6,917 | | | $ | 19,627 | | | $ | (23,495) | |

| | | | | | | | | | | |

Adjusted EBITDA2 | $ | 34,650 | | $ | 8,583 | | $ | 3,420 | | $ | 7,356 | | $ | 22,239 | | $ | (6,948) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 |

| (in thousands, unaudited) |

| | | | | | | | | | | |

| Consolidated | | Radio Broadcasting | | Reach Media | | Digital | | Cable Television | | All Other - Corporate/ Eliminations |

| | | | | | | | | | | |

| STATEMENT OF OPERATIONS: | | | | | | | | | | | |

| | | | | | | | | | | |

| NET REVENUE | $ | 332,547 | | $ | 118,066 | | $ | 37,648 | | $ | 50,252 | | $ | 128,412 | | $ | (1,831) | |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Programming and technical | 99,826 | | 34,543 | | 10,824 | | 10,504 | | 44,690 | | (735) | |

| Selling, general and administrative | 131,141 | | 59,410 | | 14,855 | | 26,729 | | 31,511 | | (1,364) | |

| Corporate selling, general and administrative | 38,033 | | - | | 2,078 | | 10 | | 5,128 | | 30,817 |

| Stock-based compensation | 3,615 | | 362 | | 78 | | 138 | | 811 | | 2,226 |

| Depreciation and amortization | 6,081 | | 3,470 | | 121 | | 1,215 | | 348 | | 927 |

| Impairment of goodwill, intangible assets, and long-lived assets | 127,581 | | 118,492 | | - | | - | | 9,089 | | - |

| Total operating expenses | 406,277 | | 216,277 | | 27,956 | | 38,596 | | 91,577 | | 31,871 |

| Operating (loss) income | (73,730) | | | (98,211) | | | 9,692 | | | 11,656 | | | 36,835 | | | (33,702) | |

| INTEREST INCOME | 4,863 | | - | | - | | - | | - | | 4,863 |

| INTEREST EXPENSE | 37,051 | | 175 | | - | | - | | - | | 36,876 |

| | | | | | | | | | | |

| GAIN ON RETIREMENT OF DEBT | (18,771) | | - | | - | | - | | - | | (18,771) |

| OTHER INCOME (LOSS), net | 974 | | (11) | | - | | - | | - | | 985 |

| (Loss) income before income from consolidated operations before (benefit from) provision for income taxes | (86,173) | | (98,397) | | | 9,692 | | 11,656 | | 36,835 | | (45,959) |

| (BENEFIT FROM) PROVISION FOR INCOME TAXES | (17,824) | | (22,423) | | 2,114 | | (843) | | 8,082 | | (4,754) |

| Net (loss) income from consolidated operations | (68,349) | | | (75,974) | | 7,578 | | 12,499 | | 28,753 | | (41,205) | |

| LOSS FROM UNCONSOLIDATED JOINT VENTURE, net of tax | (411) | | - | | - | | - | | - | | (411) |

| NET (LOSS) INCOME | (68,760) | | (75,974) | | 7,578 | | 12,499 | | 28,753 | | (41,616) |

| NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | $ | 976 | | $ | - | | $ | - | | $ | - | | $ | - | | $ | 976 |

| NET (LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | (69,736) | | $ | (75,974) | | $ | 7,578 | | $ | 12,499 | | $ | 28,753 | | $ | (42,592) |

| | | | | | | | | | | |

Adjusted EBITDA2 | $ | 76,593 | | $ | 25,300 | | $ | 9,148 | | $ | 12,289 | | $ | 47,172 | | $ | (17,316) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| (in thousands, unaudited) |

| | | | | | | | | | | |

| Consolidated | | Radio Broadcasting | | Reach Media | | Digital | | Cable Television | | All Other - Corporate/ Eliminations |

| | | | | | | | | | | |

| STATEMENT OF OPERATIONS: | | | | | | | | | | | |

| | | | | | | | | | | |

| NET REVENUE | $ | 357,346 | | $ | 114,528 | | $ | 42,125 | | $ | 54,335 | | $ | 148,895 | | $ | (2,537) | |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Programming and technical | 100,304 | | 32,570 | | 11,969 | | 10,331 | | 46,562 | | (1,128) | |

| Selling, general and administrative | 126,634 | | 54,557 | | 16,721 | | 26,763 | | 30,390 | | (1,797) | |

| Corporate selling, general and administrative | 30,333 | | - | | 2,010 | | 3 | | 5,021 | | 23,299 |

| Stock-based compensation | 7,816 | | 446 | | 626 | | 134 | | 574 | | 6,036 |

| Depreciation and amortization | 6,291 | | 2,730 | | 120 | | 1,077 | | 1,327 | | 1,037 |

| Impairment of goodwill, intangible assets, and long-lived assets | 124,304 | | 124,304 | | - | | - | | - | | - |

| Total operating expenses | 395,682 | | 214,607 | | 31,446 | | 38,308 | | 83,874 | | 27,447 |

| Operating (loss) income | (38,336) | | (100,079) | | 10,679 | | 16,027 | | 65,021 | | (29,984) |

| INTEREST INCOME | 4,488 | | - | | - | | - | | - | | 4,488 |

| INTEREST EXPENSE | 42,023 | | 167 | | - | | - | | 2,559 | | 39,297 |

| | | | | | | | | | | |

| GAIN ON RETIREMENT OF DEBT | (2,356) | | - | | | - | | - | | - | | (2,356) |

| OTHER INCOME (LOSS), net | 96,535 | | (7) | | - | | - | | - | | 96,542 |

| Income (loss) before income from consolidated operations before provision for (benefit from) income taxes | 23,020 | | (100,253) | | 10,679 | | 16,027 | | 62,462 | | 34,105 | |

| PROVISION FOR (BENEFIT FROM) INCOME TAXES | 5,259 | | (24,535) | | 2,342 | | - | | 13,705 | | 13,747 |

| Net income (loss) from consolidated operations | 17,761 | | (75,718) | | 8,337 | | 16,027 | | 48,757 | | 20,358 |

| LOSS FROM UNCONSOLIDATED JOINT VENTURE, net of tax | (2,728) | | - | | - | | - | | - | | (2,728) |

| NET INCOME (LOSS) | 15,033 | | (75,718) | | 8,337 | | 16,027 | | 48,757 | | 17,630 |

| NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | $ | 2,000 | | $ | - | | $ | - | | $ | - | | $ | - | | $ | 2,000 |

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | 13,033 | | $ | (75,718) | | $ | 8,337 | | $ | 16,027 | | $ | 48,757 | | $ | 15,630 |

| | | | | | | | | | | |

Adjusted EBITDA2 | $ | 103,874 | | $ | 27,601 | | $ | 11,479 | | $ | 17,275 | | $ | 66,922 | | $ | (19,402) | |

PAGE 12 -- URBAN ONE, INC. REPORTS THIRD QUARTER 2024 RESULTS

Urban One, Inc. will hold a conference call to discuss its results for the third fiscal quarter of 2024. The conference call is scheduled for Tuesday, November 12, 2024 at 10:00 a.m. EST. To participate on this call, U.S. callers may dial toll-free 1-877-226-8189; international callers may dial direct (+1) 409-207-6980. The Access Code is 5487822.

A replay of the conference call will be available from 1:00 p.m. EST November 12, 2024 until 12:00 a.m. EST November 19, 2024. Callers may access the replay by calling 1-866-207-1041; international callers may dial direct (+1) 402-970-0847. The replay Access Code is 3607803.

Access to live audio and a replay of the conference call will also be available on Urban One's corporate website at www.urban1.com. The replay will be made available on the website for seven days after the call.

Urban One Inc. (urban1.com), together with its subsidiaries, is the largest diversified media company that primarily targets Black Americans and urban consumers in the United States. The Company owns TV One, LLC (tvone.tv), a television network serving more than 59 million households, offering a broad range of original programming, classic series and movies designed to entertain, inform, and inspire a diverse audience of adult Black viewers. As of November 12, 2024, we owned and/or operated 72 independently formatted, revenues producing broadcast stations (including 57 FM or AM stations, 13 HD stations, and the 2 low power television stations) branded under the trade name “Radio One” in 13 urban markets in the United States. Through its controlling interest in Reach Media, Inc. (blackamericaweb.com), the Company also operates syndicated programming including the Rickey Smiley Morning Show, and the DL Hughley Show. In addition to its radio and television broadcast assets, Urban One owns iOne Digital (ionedigital.com), our wholly owned digital platform serving the African American community through social content, news, information, and entertainment websites, including its Cassius, Bossip, HipHopWired and MadameNoire digital platforms and brands. Through our national multi-media operations, we provide advertisers with a unique and powerful delivery mechanism to the African American and urban audiences.

Notes:

1“Broadcast and digital operating income”: The radio broadcasting industry commonly refers to “station operating income” which consists of net income (loss) before depreciation and amortization, income taxes, interest expense, interest income, non-controlling interests in income of subsidiaries, other income, net, loss from unconsolidated joint venture, corporate selling, general and administrative expenses, stock-based compensation, impairment of goodwill, intangible assets, and long-lived assets and (gain) loss on retirement of debt. However, given the diverse nature of our business, station operating income is not truly reflective of our multi-media operation and, therefore, we use the term “broadcast and digital operating income.” Broadcast and digital operating income is not a measure of financial performance under GAAP. Nevertheless, broadcast and digital operating income is a significant measure used by our management to evaluate the operating performance of our core operating segments. Broadcast and digital operating income provides helpful information about our results of operations, apart from expenses associated with our fixed assets and goodwill, intangible assets, and long-lived assets, income taxes, investments, impairment charges, debt financings and retirements, corporate overhead and stock-based compensation. Our measure of broadcast and digital operating income is similar to industry use of station operating income; however, it reflects our more diverse business and therefore is not completely analogous to “station operating income” or other similarly titled measures as used by other companies. Broadcast and digital operating income does not represent operating income or loss, or cash flow from operating activities, as those terms are defined under GAAP, and should not be considered as an alternative to those measurements as an indicator of our performance.

2“Adjusted EBITDA": Adjusted EBITDA consists of net (loss) income plus (1) depreciation and amortization, income taxes, interest expense, net income attributable to non-controlling interests, impairment of goodwill, intangible assets, and long-lived assets, stock-based compensation, (gain) loss on retirement of debt, corporate costs, severance-related costs, investment income, loss from unconsolidated joint venture, loss from ceased non-core business initiatives less (2) other income, net and interest income. Net (loss) income before interest income, interest expense, income taxes, depreciation and amortization is commonly referred to in our business as “EBITDA.” Adjusted EBITDA and EBITDA are not measures of financial performance under GAAP. We believe Adjusted EBITDA is often a useful measure of a company’s operating performance and is a significant measure used by our management to evaluate the operating performance of our business. Accordingly, based on the previous description of Adjusted EBITDA, we believe that it provides useful information about the operating performance of our business, apart from the expenses associated with our fixed assets and goodwill, intangible assets, and long-lived assets or capital structure. Adjusted EBITDA is frequently used as one of the measures for comparing businesses in the broadcasting industry, although our measure of Adjusted EBITDA may not be comparable to similarly titled measures of other companies, including, but not limited to the fact that our definition includes the results of all four of our operating segments (Radio Broadcasting, Reach Media, digital and cable television). Business activities unrelated to these four segments are included in an “all other” category which the Company refers to as “All other - corporate/eliminations.” Adjusted EBITDA and EBITDA do not purport to represent operating income or cash flow from operating activities, as those terms are defined under GAAP, and should not be considered as alternatives to those measurements as an indicator of our performance. During the quarter, we made an immaterial change to the definition of adjusted EBITDA by adding back the loss from ceased non-core operations. All historical periods were recasted to reflect this immaterial change.

3For the three months ended September 30, 2024 and 2023, Urban One had 47,105,290 and 47,722,263 shares of common stock outstanding on a weighted average basis (basic), respectively. For the nine months ended September 30, 2024 and 2023, Urban One had 48,614,438 and 47,592,010 shares of common stock outstanding on a weighted average basis (basic), respectively.

4For the three months ended September 30, 2024 and 2023, Urban One had 47,105,290 and 47,722,263 shares of common stock outstanding on a weighted average basis (fully diluted for outstanding stock awards), respectively. For the nine months ended September 30, 2024 and 2023, Urban One had 48,614,438 and 50,358,881 shares of common stock outstanding on a weighted average basis (fully diluted for outstanding stock awards), respectively.

v3.24.3

Document and Entity Information

|

Nov. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity File Number |

0-25969

|

| Entity Registrant Name |

URBAN ONE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

52-1166660

|

| Entity Address, Address Line One |

1010 Wayne Avenue

|

| Entity Address, Address Line Two |

14th Floor

|

| Entity Address, City or Town |

Silver Spring

|

| Entity Address, State or Province |

MD

|

| City Area Code |

301

|

| Local Phone Number |

429-3200

|

| Entity Address, Postal Zip Code |

20910

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001041657

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $.001 Par Value

|

| Trading Symbol |

UONE

|

| Security Exchange Name |

NASDAQ

|

| Common Stock Class D [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class D Common Stock, $.001 Par Value

|

| Trading Symbol |

UONEK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=uone_CommonClassDMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

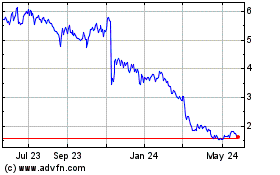

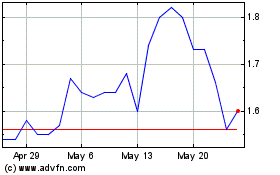

Urban One (NASDAQ:UONEK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Urban One (NASDAQ:UONEK)

Historical Stock Chart

From Feb 2024 to Feb 2025