United Maritime Corporation (“United” or the “Company”) (NASDAQ:

USEA), announced today its financial results for the fourth quarter

and twelve months ended December 31, 2023. The Company also

declared a quarterly cash dividend of $0.075 per common share for

the fourth quarter of 2023.

For the quarter ended December 31, 2023, the

Company generated Net Revenues of $11.6 million compared to $14.9

million in the fourth quarter of 2022. Adjusted EBITDA2 for the

quarter was $4.6 million, compared to $42.3 million for the same

period of 2022. Net Loss and Adjusted Net Loss for the quarter were

$0.7 million and $0.6 million, respectively, compared to Net Income

and Adjusted Net Income of $36.5 million and $39.8 million in the

fourth quarter of 2022. The Time Charter Equivalent (“TCE”) rate5

of the fleet for the fourth quarter of 2023 was $15,874 per day,

compared to $32,161 in the same period of 2022.

For the twelve-month period ended December 31,

2023, the Company generated Net Revenues of $36.1 million and

recorded an Adjusted EBITDA of $18.9 million. Net Income and

Adjusted Net Income for the twelve-month period were $0.2 million

and $2.8 million, respectively. The TCE rate of the fleet for 2023

was $15,380 per day.

Cash and cash-equivalents and restricted cash as

of December 31, 2023, stood at $14.5 million. Shareholders’ equity

at the end of the fourth quarter was $65.9 million, while long-term

debt, finance lease liabilities and other financial liabilities net

of deferred charges stood at $96.0 million as of December 31, 2023.

The book value of our fleet as of December 31, 2023, stood at

$152.5 million, including the two chartered-in Panamax vessels.

Stamatis Tsantanis, the Company’s

Chairman & Chief Executive Officer, stated:

“Our strategic priority for 2023 was to regrow

our fleet by reinvesting the proceeds from our first, successful

investment cycle, this time focusing on the dry bulk sector. The

total investment was $144 million, for the acquisition of seven

vessels, namely two Capesize, two Kamsarmax and three Panamax

bulkers. In this transitional year, the Company generated net

revenues of $36.1 million in 2023 and Adjusted EBITDA of $18.9

million, resulting in an Adjusted Net Income of $2.8 million. In

addition to achieving a positive net income, we tripled the book

value of our fleet. This was accomplished organically, without

resorting to any dilutive equity offering.

“With regards to our investment strategy, we are

pleased with the timing of our transition towards larger sizes of

dry bulk vessels, as we are currently witnessing the strongest

first quarter for the dry bulk market of the past decade. Looking

to further grow and renew our fleet, we recently agreed to enter

into an 18-month bareboat charter-in agreement for a 2016-built

Japanese Kamsarmax, that will be delivered to our fleet later this

year, with a purchase option for the Company at the end of the

charter.

“Most importantly, our shareholders’ reward

program continued uninterrupted in 2023, through buybacks of common

shares and payments of regular cash dividends. The total amount of

cash dividends declared in the last 15 months is $10.7 million, or

$1.38 per share, representing approximately 45% of United’s market

capitalization. This includes another quarterly dividend of $0.075

that our Board of Directors approved, representing approximately an

11% annualized dividend yield, which will be paid in April

2024.

“For the first quarter of 2024, we estimate our

daily net TCE rate will average approximately $14,157 per day.

Following our freight hedging strategy and in anticipation of the

seasonal slowdown of the first quarter, we fixed approximately half

of our ownership days at an average gross rate of about $14,300 per

day. Taking advantage of the recent strength in our market and the

resulting rally in freight futures, we are now covering some of our

second quarter ownership days at higher rates.

“Looking ahead, our outlook for the dry bulk

market remains constructive based on limited new Capesize

deliveries and continuing strong dry bulk commodity demand across

the board, while disruptions involving low Panama Canal water

levels and tensions in the Red Sea have reduced vessel

availability, especially in the Panamax segment. The healthy dry

bulk market seen so far in the first quarter seems to be

sustainable through the rest of the year, making us optimistic

about our financial performance in 2024 with a fleet that will

consist of three Capesize, three Kamsarmax and three Panamax

vessels.”

Current Company

Fleet:

|

Vessel Name |

Sector |

Capacity (DWT) |

Year Built |

Yard |

Employment Type |

Minimum T/C expiration |

Maximum T/C expiration(1) |

|

Goodship |

Dry Bulk / Capesize |

177,536 |

2005 |

Mitsui |

T/C Index Linked(2) |

Aug-24 |

Nov-24 |

|

Tradership |

Dry Bulk / Capesize |

176,925 |

2006 |

Namura |

T/C Index Linked(2) |

Aug-24 |

Jan-25 |

|

Gloriuship |

Dry Bulk / Capesize |

171,314 |

2004 |

Hyundai |

T/C Index Linked(2) |

Jan-24 |

Jun-24 |

|

Oasea |

Dry Bulk / Kamsarmax |

82,217 |

2010 |

Tsuneishi |

T/C Index Linked(2) |

Mar-24 |

Jul-24 |

|

Cretansea |

Dry Bulk / Kamsarmax |

81,508 |

2009 |

Universal |

T/C Index Linked(2) |

Apr-24 |

Jul-24 |

|

Chrisea(3) |

Dry Bulk / Panamax |

78,173 |

2013 |

Shin Kurushima |

T/C Index Linked(2) |

Jun-25 |

Sep-25 |

|

Synthesea(4) |

Dry Bulk / Panamax |

78,020 |

2015 |

Sasebo |

T/C Index Linked(2) |

Oct-24 |

Dec-24 |

|

Exelixsea |

Dry Bulk / Panamax |

76,361 |

2011 |

Oshima |

T/C Index Linked(2) |

Jul-24 |

Nov-24 |

|

Total/Average age |

|

922,054 |

14.6 years |

|

|

|

|

(1) The latest redelivery dates

do not include any additional optional periods.

(2) “T/C” refers to a time

charter agreement. Under these index-linked T/Cs, the Company has

the option to convert the index-linked rate to fixed for a period

of minimum two months, based on the prevailing FFA Rates for the

selected period, and has done so for certain vessels as part of its

freight hedging strategy, as described below under “First Quarter

2024 TCE Rate Guidance.”

(3) The vessel is technically

and commercially operated by the Company on the basis of an

18-month bareboat charter-in contract with the owners of the

vessel, including a purchase option at the end of the bareboat

charter in favour of the Company.

(4) The vessel is technically

and commercially operated by the Company on the basis of a 12-month

bareboat charter-in contract with the owners of the vessel,

including a purchase option at the end of the bareboat charter in

favour of the Company.

Vessel to be delivered

|

Vessel Name |

Sector |

Capacity (DWT) |

Year Built |

Yard |

|

tbr Nisea |

Dry Bulk / Kamsarmax |

82,235 |

2016 |

Oshima |

Fleet Data:

(Amounts in U.S. Dollars)

|

|

Q4 2023 |

Q4 2022 |

FY 2023 |

From January 20, 2022 (date of inception) to December 31, 2022 |

|

Ownership days (1) |

736 |

|

|

366 |

|

|

2,339 |

|

|

614 |

|

|

Operating days (2) |

700 |

|

|

366 |

|

|

2,143 |

|

|

610 |

|

|

Fleet utilization (3) |

|

95.1 |

% |

|

100 |

% |

|

91.6 |

% |

|

99.3 |

% |

|

TCE rate (4) |

$15,874 |

|

$32,161 |

|

$15,380 |

|

$28,752 |

|

|

Daily Vessel Operating Expenses (5) |

$6,788 |

|

$7,057 |

|

$6,861 |

|

$7,265 |

|

(1) Ownership days are the

total number of calendar days in a period during which the vessels

in a fleet have been owned or chartered. Ownership days are an

indicator of the size of the Company’s fleet over a period and

affect both the amount of revenues and the amount of expenses that

the Company recorded during a period.

(2) Operating days are the

number of available days in a period less the aggregate number of

days that the vessels are off-hire due to unforeseen circumstances.

Operating days include the days that our vessels are on ballast

voyages without having finalized agreements for their next

employment.

(3) Fleet utilization is the

percentage of time that the vessels are generating revenue and is

determined by dividing operating days by ownership days for the

relevant period.

(4) TCE rate is defined as the

Company’s net revenue less voyage expenses during a period divided

by the number of the Company’s operating days during the period.

Voyage expenses include port charges, bunker (fuel oil and diesel

oil) expenses, canal charges and other commissions. The Company

includes the TCE rate, a non-GAAP measure, as it believes it

provides additional meaningful information in conjunction with net

revenues from vessels, the most directly comparable U.S. GAAP

measure, and because it assists the Company’s management in making

decisions regarding the deployment and use of our vessels and

because the Company believes that it provides useful information to

investors regarding our financial performance. The Company’s

calculation of TCE rate may not be comparable to that reported by

other companies. The following table reconciles the Company’s net

revenues from vessels to the TCE rate.

(In thousands of U.S. Dollars, except operating days and

TCE rate)

|

|

Q4 2023 |

Q4 2022 |

FY 2023 |

From January 20, 2022 (date of inception) to December 31, 2022 |

|

Vessel revenue, net |

|

11,553 |

|

14,932 |

|

36,067 |

|

22,784 |

| Less: Voyage expenses |

|

441 |

|

3,161 |

|

3,107 |

|

5,245 |

| Time charter equivalent

revenues |

|

11,112 |

|

11,771 |

|

32,960 |

|

17,539 |

| Operating days |

|

700 |

|

366 |

|

2,143 |

|

610 |

| TCE rate |

$15,874 |

$32,161 |

$15,380 |

$28,752 |

(5) Vessel operating expenses

include crew costs, provisions, deck and engine stores, lubricants,

insurance, maintenance and repairs. Daily Vessel Operating Expenses

are calculated by dividing vessel operating expenses, excluding

pre-delivery costs of acquired vessels, by ownership days for the

relevant time periods. The Company’s calculation of daily vessel

operating expenses may not be comparable to that reported by other

companies. The following table reconciles the Company’s vessel

operating expenses to daily vessel operating expenses.

(In thousands of U.S. Dollars, except ownership days and

Daily Vessel Operating Expenses)

|

|

Q4 2023 |

Q4 2022 |

FY 2023 |

From January 20, 2022 (date of inception) to December 31, 2022 |

|

Vessel operating expenses |

|

5,209 |

|

3,000 |

|

20,338 |

|

5,179 |

| Less: Pre-delivery expenses |

|

213 |

|

417 |

|

4,291 |

|

718 |

| Vessel operating expenses before

pre-delivery expenses |

|

4,996 |

|

2,583 |

|

16,047 |

|

4,461 |

| Ownership days |

|

736 |

|

366 |

|

2,339 |

|

614 |

| Daily Vessel Operating

Expenses |

$6,788 |

$7,057 |

$6,861 |

$7,265 |

Net (loss) / income to EBITDA and Adjusted EBITDA

Reconciliation:

(In thousands of U.S. Dollars)

|

|

Q4 2023 |

Q4 2022 |

FY23 |

From January 20, 2022 (date of inception) to December 31,

2022 |

|

Net (loss) / income |

(726 |

) |

36,462 |

221 |

37,490 |

|

Interest and finance costs, net |

2,007 |

|

1,491 |

6,753 |

2,439 |

|

Depreciation and amortization |

3,153 |

|

957 |

9,363 |

1,903 |

|

EBITDA |

4,434 |

|

38,910 |

16,337 |

41,832 |

|

Stock based compensation |

18 |

|

2,789 |

2,522 |

2,789 |

|

Loss on extinguishment of debt |

105 |

|

593 |

85 |

593 |

|

Adjusted EBITDA |

4,557 |

|

42,292 |

18,944 |

45,214 |

Earnings Before Interest, Taxes, Depreciation

and Amortization (“EBITDA”) represents the sum of net income, net

interest and finance costs, depreciation and amortization and, if

any, income taxes during a period. EBITDA is not a recognized

measurement under U.S. GAAP. Adjusted EBITDA represents EBITDA

adjusted to exclude stock-based compensation, which the Company

believes is not indicative of the ongoing performance of its core

operations.

EBITDA and Adjusted EBITDA are presented as we

believe that these measures are useful to investors as a widely

used means of evaluating operating profitability. EBITDA and

Adjusted EBITDA as presented here may not be comparable to

similarly titled measures presented by other companies. These

non-GAAP measures should not be considered in isolation from, as a

substitute for, or superior to, financial measures prepared in

accordance with U.S. GAAP.

Net (Loss) / Income and Adjusted Net

(Loss) / Income Reconciliation and calculation of Adjusted (Loss) /

Earnings Per Share

(In thousands of U.S. Dollars)

|

|

Q4 2023 |

Q4 2022 |

FY 2023 |

From January 20, 2022 (date of inception) to December 31,

2022 |

|

Net (loss) / income |

(726 |

) |

36,462 |

221 |

37,490 |

|

Stock based compensation |

18 |

|

2,789 |

2,522 |

2,789 |

|

Loss on extinguishment of debt |

105 |

|

593 |

85 |

593 |

|

Adjusted net (loss) / income |

(603 |

) |

39,844 |

2,828 |

40,872 |

|

Adjusted net (loss) / income – common stockholders,

basic |

(603 |

) |

36,279 |

2,733 |

38,468 |

|

Adjusted net (loss) / income-common stockholders,

diluted |

(603 |

) |

37,328 |

2,733 |

39,317 |

|

Adjusted (loss) / earnings per common share, basic |

(0.07 |

) |

5.36 |

0.33 |

8.54 |

|

Adjusted (loss) / earnings per common share, diluted |

(0.07 |

) |

3.90 |

0.33 |

5.39 |

|

Weighted average number of common shares outstanding, basic |

8,711,308 |

|

6,769,246 |

8,359,487 |

4,503,397 |

|

Weighted average number of common shares outstanding, diluted |

8,771,308 |

|

9,565,410 |

8,359,487 |

7,299,561 |

To derive Adjusted Net (loss) / Income and

Adjusted (loss) / Earnings Per Share, both non-GAAP measures, from

Net (loss) / Income, we exclude certain non-cash items, as provided

in the table above. We believe that Adjusted Net (loss) / Income

and Adjusted (loss) / Earnings Per Share assist our management and

investors by increasing the comparability of our performance from

period to period since each such measure eliminates the effects of

such non-cash items as stock-based compensation, gain on

extinguishment of debt and other items which may vary from year to

year, for reasons unrelated to overall operating performance. In

addition, we believe that the presentation of the respective

measures provides investors with supplemental data relating to our

results of operations, and therefore, with a more complete

understanding of factors affecting our business than with GAAP

measures alone. Our method of computing Adjusted Net Income and

Adjusted Earnings Per Share may not necessarily be comparable to

other similarly titled captions of other companies due to

differences in methods of calculation.

Interest and Finance Costs to Cash

Interest and Finance Costs Reconciliation:

(In thousands of U.S. Dollars)

|

|

Q4 2023 |

Q4 2022 |

FY 2023 |

From January 20, 2022 (date of inception) to

December 31, 2022 |

|

Interest and finance costs |

(2,119 |

) |

(1,504 |

) |

(7,183 |

) |

(2,452 |

) |

|

Interest income |

112 |

|

13 |

|

430 |

|

13 |

|

|

Amortization of deferred finance charges and other discounts |

203 |

|

224 |

|

781 |

|

352 |

|

|

Cash interest and finance costs |

(1,804 |

) |

(1,267 |

) |

(5,972 |

) |

(2,087 |

) |

First Quarter 2024 TCE Rate Guidance:

As of the date hereof, approximately 78% of the

Company’s fleet expected operating days in the first quarter of

2024 have already been fixed at an estimated TCE rate of

approximately $13,797. Assuming that for the remaining operating

days of our index-linked T/Cs the averages of the Baltic Capesize

Index (“BCI”) and the Baltic Panamax Index (“BPI”) will be equal to

the respective average Forward Freight Agreement (“FFA”) rates of

$20,400 and $15,930 per day (based on the FFA curve of February 16,

2024), our estimated TCE rate for the first quarter of 2024 will be

approximately $14,1576. Our TCE rate guidance for the first quarter

of 2024 includes conversions of index-linked charter to fixed.

The following table provides the breakdown of

index-linked charters and fixed-rate charters in the first quarter

of 2024:

|

|

Operating Days |

TCE Rate |

|

|

TCE - fixed rate (index-linked conversion) |

368 |

$13,330 |

|

|

TCE – index-linked unhedged |

303 |

$15,162 |

|

|

Total / Average |

671 |

$14,157 |

|

Fourth Quarter and Recent Developments:

Dividend Distribution for Q3 2023 and

Declaration of Dividend for Q4 2023

On January 10, 2024, the Company paid the

previously announced quarterly cash dividend of $0.075 per share,

for the third quarter of 2023, to all shareholders of record as of

December 22, 2023.

The Company also declared a cash dividend of

$0.075 per share for the fourth quarter of 2023 payable on or about

April 10, 2024 to all shareholders of record as of March 22,

2024.

Buyback of Common Shares –

3rd Repurchase Plan

Since the beginning of the fourth quarter of

2023, we have repurchased 84,813 common shares in open market

transactions at an average price of approximately $2.41 per share

for an aggregate consideration of $0.2 million pursuant to the $3.0

million share repurchase program commenced in October 2022 with an

expiration date, as extended, of December 31, 2024. All the

abovementioned shares were cancelled and removed from our share

capital as of the date of this release. As of February 16, 2024,

the Company had 8,677,456 common shares issued and outstanding.

Financing Updates

Sale and Leaseback - Refinancing of M/Vs

Gloriuship, Goodship & Tradership

In November 2023, the Company entered into three

separate and identical $10.0 million sale and leaseback agreements

for the M/Vs Gloriuship, Goodship and Tradership. The lessors are

three Chinese companies, nominees of China Huarong Financial

Leasing Co., Ltd. The proceeds have been utilized to refinance the

outstanding indebtedness of the respective vessels under a loan

facility with EnTrust Global. On December 5, 2023, the vessels were

sold and chartered back on a bareboat basis for a period of 3

years. The Company has continuous options to repurchase the vessels

at predetermined prices, starting six months after the commencement

date. At the end of each bareboat period, United has the obligation

to repurchase each vessel for $5.0 million. Each financing bears

interest of 3-month Term SOFR plus 3.30% per annum and amortizes

through 36 consecutive monthly installments of approximately $0.14

million each.

Japanese Sale and Leaseback -

Refinancing of M/V Exelixsea

In February 2024, the Company has executed a

term sheet with an unaffiliated third party in Japan for a sale and

leaseback agreement, in order to refinance an existing facility of

$13.0 million secured by the M/V Exelixsea. The financing amount is

$13.8 million bearing an interest rate of 2.65% plus 3-month Term

SOFR. The charterhire principal will amortize over a six-year term,

through seventy-two consecutive monthly instalments of $0.2

million. The Company will have continuous options to repurchase the

vessel at predetermined prices, following the second anniversary of

the bareboat charter. At the end of the six-year bareboat period,

the ownership of the vessel will be transferred to United at no

additional cost.

Vessel Transactions and Commercial

Updates

Bareboat Charter Agreement for a

Kamsarmax dry bulk carrier

In February 2024, the Company agreed, subject to

final documentation, to enter into a bareboat charter agreement for

an 82,235 dwt Kamsarmax dry bulk carrier built in 2016 in Japan,

which will be renamed Nisea and is expected to be delivered to

United between June and October 2024. The vessel will be chartered

in under an 18-month bareboat charter agreement, with a down

payment of $7.5 million, a daily charter rate of $8,000 over the

period of the bareboat charter and a purchase option of $16.6

million at the end of the bareboat charter. In aggregate, the

acquisition cost for the vessel, following exercise of the purchase

option, will be approximately $28.5 million.

M/V Chrisea new time-charter

agreement

In February 2024, the Company entered into a new

T/C agreement at an improved index linked rate with the existing

charterer of the M/V Chrisea for a duration of about 12 to about 15

months. The charter will be in direct continuation from the current

T/C agreement and is expected to commence in June 2024. All other

terms of the T/C remain materially the same.

Conference

Call:

The Company’s management will host a conference

call to discuss the financial results today, Tuesday, February 20,

2024 at 10:00 a.m. Eastern Time.

Audio

Webcast:

There will be a live, and then archived, webcast

of the conference call on the Company’s website. To listen to the

archived audio file, visit our website, in the “Investors” section.

Participants to the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast,

following this link.

Conference Call

Details:

Participants have the option to register for the

call using the following link. You can use any number from the list

or add your phone number and let the system call you right

away.

| |

|

United Maritime CorporationUnaudited Condensed

Consolidated Balance Sheets(In thousands of U.S. Dollars) |

| |

|

|

|

December 31, 2023 |

|

|

December 31, 2022* |

|

| ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash |

|

14,501 |

|

|

69,932 |

|

|

Vessels and right-of-use assets, net and advances for vessels’

acquisitions |

|

152,525 |

|

|

50,200 |

|

|

Other assets |

|

7,779 |

|

|

5,523 |

|

| TOTAL

ASSETS |

|

174,805 |

|

|

125,655 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Long-term debt, finance lease liability and other financial

liabilities, net of deferred finance costs |

|

95,954 |

|

|

42,606 |

|

|

Other liabilities |

|

12,982 |

|

|

18,481 |

|

|

Stockholders’ equity |

|

65,869 |

|

|

64,568 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

174,805 |

|

|

125,655 |

|

* Derived from the audited consolidated financial statements as

of the period as of that date

| |

|

United Maritime CorporationUnaudited Condensed

Consolidated Statements of Operations (In thousands of U.S.

Dollars, except for share and per share data, unless otherwise

stated) |

| |

|

|

|

|

|

| |

|

Three months endedDecember 31, 2023 |

|

Three months endedDecember 31, 2022 |

|

For the year endedDecember 31, 2023 |

|

|

From January 20, 2022 (date of inception) to December 31, 2022 |

|

| Vessel Revenue,

net |

|

11,553 |

|

14,932 |

|

36,067 |

|

|

22,784 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses |

|

(441) |

|

(3,161) |

|

(3,107) |

|

|

(5,245) |

|

|

Vessel operating expenses |

|

(5,209) |

|

(3,000) |

|

(20,338) |

|

|

(5,179) |

|

|

Management fees |

|

(589) |

|

(295) |

|

(1,966) |

|

|

(526) |

|

|

General and administrative expenses |

|

(734) |

|

(5,082) |

|

(6,018) |

|

|

(5,524) |

|

|

Depreciation and amortization |

|

(3,153) |

|

(957) |

|

(9,363) |

|

|

(1,903) |

|

|

Gain on sale of vessels |

|

- |

|

36,095 |

|

11,804 |

|

|

36,095 |

|

| Operating

income |

|

1,427 |

|

38,532 |

|

7,079 |

|

|

40,502 |

|

| Other income /

(expenses): |

|

|

|

|

|

|

|

|

|

|

|

Interest and finance costs |

|

(2,119) |

|

(1,504) |

|

(7,183) |

|

|

(2,452) |

|

|

Interest and other income |

|

215 |

|

38 |

|

542 |

|

|

39 |

|

|

Loss on extinguishment of debt |

|

(105) |

|

(593) |

|

(85) |

|

|

(593) |

|

|

Other, net |

|

(144) |

|

(11) |

|

(132) |

|

|

(6) |

|

| Total other expenses,

net: |

|

(2,153) |

|

(2,070) |

|

(6,858) |

|

|

(3,012) |

|

| Net (loss) /

income |

|

(726) |

|

36,462 |

|

221 |

|

|

37,490 |

|

| Net (loss) / income

attributable to common stockholders |

|

(726) |

|

32,897 |

|

126 |

|

|

35,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) / income

per common share, basic |

|

(0.08) |

|

4.86 |

|

0.02 |

|

|

7.79 |

|

| Net (loss) / income

per common share, diluted |

|

(0.08) |

|

3.55 |

|

0.02 |

|

|

4.92 |

|

|

Weighted average number of common shares outstanding, basic |

|

8,711,308 |

|

6,769,246 |

|

8,359,487 |

|

|

4,503,397 |

|

|

Weighted average number of common shares outstanding, diluted |

|

8,711,308 |

|

9,565,410 |

|

8,359,487 |

|

|

7,299,561 |

|

|

|

|

United Maritime CorporationUnaudited Condensed

Consolidated Cash Flow Data (In thousands of U.S. Dollars) |

| |

|

| |

|

For the year endedDecember 31, 2023 |

|

From January 20,2022 (date of inception) to December 31, 2022 |

|

| Net cash (used in) /

provided by operating activities |

|

(6,228) |

|

7,875 |

|

| Net cash (used in) /

provided by investing activities |

|

(59,138) |

|

6,488 |

|

| Net cash provided by

financing activities |

|

9,935 |

|

55,569 |

|

About United Maritime Corporation

United Maritime Corporation is an international

shipping company specializing in worldwide seaborne transportation

services. The Company operates a fleet of eight dry bulk vessels

with an aggregate cargo carrying capacity of 922,054 dwt. Upon the

completion of the delivery of a third Kamsarmax vessel, the

Company’s operating fleet will consist of three Capesize, three

Kamsarmax and three Panamax vessels, with an aggregate cargo

carrying capacity of 1,004,289 dwt.

The Company is incorporated under the laws of

the Republic of the Marshall Islands and has executive offices in

Glyfada, Greece. The Company's common shares trade on the Nasdaq

Capital Market under the symbol “USEA.”

Please visit the Company’s website at:

www.unitedmaritime.gr.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events. Words such as "may",

"should", "expects", "intends", "plans", "believes", "anticipates",

"hopes", "estimates" and variations of such words and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. These statements involve known and unknown risks

and are based upon a number of assumptions and estimates, which are

inherently subject to significant uncertainties and contingencies,

many of which are beyond the control of the Company. Actual results

may differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause actual results

to differ materially include, but are not limited to, shipping

industry trends, including charter rates, vessel values and factors

affecting vessel supply and demand; the impact of changes in

regulatory requirements or actions taken by regulatory authorities

on the Company's operating or financial results; the Company's

financial condition and liquidity, including its ability to service

its indebtedness or to pay dividends; competitive factors in the

market in which the Company operates; increased operating costs

associated with vessel aging; vessel damage; future, pending or

recent acquisitions and dispositions, business strategy, areas of

possible expansion or contraction, and expected capital spending or

operating expenses; dependence on affiliates of the Company’s

former parent and third-party managers to operate the Company’s

business; availability of crew, number of off-hire days,

classification survey requirements and insurance costs; changes in

the Company’s relationships with contract counterparties; potential

liability from future litigation and incidents involving the

Company’s vessels; broader market impacts arising from war (or

threatened war) or international hostilities, such as between

Russia and Ukraine or Israel and Palestine; risks associated with

the length and severity of pandemics (including COVID-19),

including their effects on demand for crude oil, petroleum

products, dry bulk products, other types of products and the

transportation thereof; and other factors listed from time to time

in the Company's filings with the SEC, including its registration

statement on Form 20-F. The Company's filings can be obtained free

of charge on the SEC's website at www.sec.gov. Except to the extent

required by law, the Company expressly disclaims any obligations or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in the Company's expectations with respect thereto or any change in

events, conditions or circumstances on which any statement is

based.

For further information please contact:

United Investor RelationsTel: +30 213 0181 522E-mail:

ir@usea.gr

Capital Link, Inc.Paul Lampoutis230 Park Avenue Suite 1540New

York, NY 10169Tel: (212) 661-7566E-mail: usea@capitallink.com

_________________________________________

1 From January 20, 2022 (date of inception) to

December 31, 2022.

2 Adjusted (loss) / earnings per share, Adjusted

Net (loss) / Income, EBITDA and Adjusted EBITDA are non-GAAP

measures. Please see the reconciliation below of Adjusted (loss) /

earnings per share, Adjusted Net (loss) / Income, EBITDA and

Adjusted EBITDA to net (loss) / income, the most directly

comparable U.S. GAAP measure.

3 Based on the closing price on February 16,

2024.

4 Assuming exercise of the purchase options

for the bareboat-in vessels.

5 TCE Rate is a non-GAAP measure. Please see the

reconciliation below of TCE Rate to net revenues from vessels, the

most directly comparable U.S. GAAP measure.

6 This guidance is based on certain assumptions

and there can be no assurance that these TCE rate estimates, or

projected utilization will be realized. TCE rate estimates include

certain floating (index) to fixed rate conversions concluded in

previous periods. For vessels on index-linked T/Cs, the TCE rate

realized will vary with the underlying index, and for the purposes

of this guidance the BCI and BPI daily rates assumed for the

remaining operating days of the quarter for index-linked T/Cs are

equal to the average FFA rates of $20,400 and $15,930,

respectively, based on the curve as of February 16, 2024. Spot

estimates are provided using the load-to-discharge method of

accounting. The rates quoted are for days currently contracted.

Increased ballast days at the end of the quarter will reduce the

additional revenues that can be booked based on the accounting

cut-offs and therefore the resulting TCE rate will be reduced

accordingly.

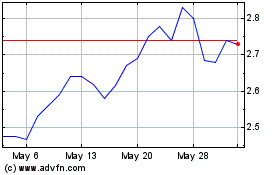

United Maritime (NASDAQ:USEA)

Historical Stock Chart

From Oct 2024 to Nov 2024

United Maritime (NASDAQ:USEA)

Historical Stock Chart

From Nov 2023 to Nov 2024