UTStarcom (the Company) (NASDAQ: UTSI), a global telecommunications

infrastructure provider, today reported its unaudited financial

results for the six months and full year ended December 31, 2023,

and provided a business update.

Business Update

- 5G transport network

portfolio progress. In 2023, UTStarcom continued its

cooperation with some mobile operators in China on the development

of a next generation disaggregated 5G transport network solution.

Following the successful lab testing with China Unicom Research

Institute that the Company passed earlier in 2023, UTStarcom

successfully completed field trials and interoperability tests by

the end of 2023. UTStarcom continued development of Hardware

platforms to support the vision of China Telecom Research Institute

for the next gen 5G transport network. The Company was also

actively working in 2H 2023 on the development of new access

products in the SkyFlux CPT product line to address the growing

demand in Chinese market for this type of products.

- Cooperation with a Mobile

Network Operator customer in Europe. UTStarcom received

additional orders including a mobile transport network expansion

order in 2H 2023 as well as post-sale technical support service

orders. The Company continued working on certain new product

developments to better address the needs of the customer for its

network expansion expected in 2024.

- India broadband expansion

orders. UTStarcom received orders for the expansion of its

IMS (IP Multimedia Subsystem) and SSTP (Signaling Transfer

Point) broadband core platforms from its key customers in

India. This includes the expansion of hardware and software of the

SSTP (Signaling Transfer Point) platform in 2H 2023.

- Post-sale support services

to customers globally. The Company received several

post-sale support orders and continued providing technical support

and maintenance services to its customers around the world for

various platforms in operation including NetRing PTN, SyncRing,

IMS, SSTP, etc.

- China market

exploration. In 2H 2023, the Company continued to explore

new segment of Chinese market opportunities related to Smart Cities

and Digital Construction in China, such as Smart Street Light,

Smart Agriculture, etc.

UTStarcom’s Chief Executive Officer Mr. Hua Li

commented, “Our results for the second half and full year 2023 were

within expectation. We have made some progress with our business

partners in China to implement network disaggregation solutions,

and we expect to see results in the coming years.”

Second Half and Full Year 2023 Financial

Results (Unaudited)

|

Summary of 2H 2023 Key Financials (Unaudited) |

|

|

2H 2023 |

2H 2022 |

Y/Y Change |

|

Revenue |

$9.2 |

$6.6 |

39.4% |

|

Gross Profit |

$2.6 |

$1.3 |

100.0% |

|

Operating Expenses |

$5.4 |

$2.9 |

86.2% |

|

Operating Loss |

($2.8) |

($1.6) |

($1.2) |

|

Net Loss |

($2.0) |

($3.3) |

$1.3 |

|

Basic EPS |

($0.22) |

($0.37) |

$0.15 |

|

Cash Balance (including Restricted Cash) |

$59.6 |

$66.9 |

-10.9% |

|

Summary of Full Year 2023 Key Financials

(Unaudited) |

|

|

2023 |

2022 |

Y/Y Change |

|

Revenue |

$15.8 |

$14.1 |

12.1% |

|

Gross Profit |

$4.4 |

$2.7 |

63.0% |

|

Operating Expenses |

$11.2 |

$7.1 |

57.7% |

|

Operating Loss |

($6.8) |

($4.4) |

($2.4) |

|

Net Loss |

($4.0) |

($5.0) |

$1.0 |

|

Basic EPS |

($0.44) |

($0.55) |

$0.11 |

|

Cash Balance (including Restricted Cash) |

$59.6 |

$66.9 |

-10.9% |

* Dollar comparisons are used where percentage

comparisons are not meaningful. * All amounts are in U.S. Dollars

millions except for Earnings Per Share (EPS)

Total Revenues

Six months ended December 31, 2023

Total revenues for the second half of 2023 were

$9.2 million, compared to $6.6 million in the corresponding period

in 2022.

- Net equipment sales for the second

half of 2023 were $3.6 million, an increase of 314.1% from $0.9

million in the corresponding period in 2022. The increase was

mainly due to increased revenue from customers in India.

- Net services sales for the second

half of 2023 were $5.6 million, a decrease of 0.9% from $5.7

million in the corresponding period in 2022.

Twelve months ended December 31, 2023

2023 total revenues were $15.8 million, an

increase of 12.1% from $14.1 million in 2022.

- 2023 net equipment sales were $4.6

million, an increase of 101.1% from $2.3 million in the

corresponding period in 2022. The increase was mainly due to

increased revenue from customers in India.

- 2023 net services sales were $11.2

million, a decrease of 5.2% from $11.8 million in 2022. The

decrease was mainly due to the completion of current projects and

no new major projects in India.

Gross Profit

Six months ended December 31, 2023

Gross profit was $2.6 million, or 27.8% of net

sales, for the second half of 2023, compared to $1.3 million, or

20.4% of net sales, in the corresponding period in 2022.

- Equipment gross profit for the

second half of 2023 was $0.8 million, compared to negative $0.3

million in the corresponding period in 2022. Equipment gross margin

for the second half of 2023 was 21.0%, compared to negative 31.5%

for the corresponding period in 2022. The improved gross margin was

attributed to a higher equipment revenue in 2023.

- Service gross profit for the second

half of 2023 was $1.8 million, compared to $1.6 million in the

corresponding period in 2022. Service gross margin for the second

half of 2023 was 32.2%, compared to 28.3% for the corresponding

period in 2022.

Twelve months ended December 31, 2023

2023 gross profit was $4.4 million, or 27.9% of

net sales, compared to $2.7 million, or 19.0% of net sales, in

2022.

- 2023 equipment gross profit was

$0.9 million, compared to negative $0.6 million in 2022. 2023

equipment gross margin was 20.2%, compared to negative 27.0% in

2022. The improved gross margin was attributed to a higher

equipment revenue in 2023.

- 2023 service gross profit was $3.5

million, compared to $3.3 million in 2022. 2023 service gross

margin was 31.0%, compared to 27.9% in 2022.

Operating Expenses

Six months ended December 31, 2023

Operating expenses for the second half of 2023

were $5.4 million, compared to $2.9 million in the corresponding

period in 2022.

- Selling, general and administrative

(“SG&A”) expenses for the second half of 2023 were $2.4

million, compared to $0.8 million in the corresponding period in

2022. SG&A was higher in the second half of 2023 due to less

reversal of allowance for credit loss associated with aged

receivables from our India customer, and the one-off lease

exemption recorded in 2022 that did not recur in 2023.

- Research and development

(“R&D”) expenses for the second half of 2023 were $3.0 million,

compared to $2.1 million in the corresponding period in 2022. The

increase reflected the different stages of 5G product

development.

Twelve months ended December 31, 2023

2023 operating expenses were $11.2 million,

compared to $7.1 million in 2022.

- 2023 SG&A expenses were $5.3

million, compared to $2.3 million in 2022. The increase was mainly

attributable to less reversal of allowance for credit loss

associated with aged receivables from our India customer, and the

one-off lease exemption recorded in 2022 that did not recur in

2023.

- 2023 research and development

expenses were $5.9 million, compared to $4.8 million in 2022. The

increase reflected the different stages of 5G product

development.

Operating Loss

Operating loss for the second half of 2023 was

$2.8 million, compared to $1.6 million in the corresponding period

in 2022.

Full year 2023 operating loss was $6.8 million,

compared to $4.4 million in 2022.

Interest Income, Net

Net interest income for the second half of 2023

was $1.3 million, compared to $1.3 million in the corresponding

period in 2022.

Full year 2023 net interest income was $2.1

million, compared to $2.2 million in 2022. The decrease was mainly

due to lower interest income in India.

Other Income (Expenses), Net

Net other income for the second half of 2023 was

$0.1 million, compared to net other expense $2.3 million in the

corresponding period in 2022. Other income for the second half of

2023 was mainly a foreign exchange gain resulting from appreciation

of the U.S. dollar against the Japanese Yan.

Full year 2023 net other income was $2.0

million, compared to net other expense of $0.7 million in 2022.

Other income for 2023 was mainly a foreign exchange gain resulting

from appreciation of the U.S. dollar against the Japanese Yan.

Net Loss

Net loss attributable to shareholders for the

second half of 2023 was $2.0 million, compared to $3.3 million in

the corresponding period in 2022. Basic net loss per share for the

second half of 2023 was $0.22, compared to $0.37 for the

corresponding period in 2022.

Full year 2023 net loss attributable to

shareholders was $4.0 million, compared to $5.0 million in 2022.

2023 basic net loss per share was $0.44, compared to $0.55 in

2022.

Cash Flow

Cash used in operating activities in the second

half of 2023 was $0.7 million, cash used in investing activities

was nil, and cash provided by financing activities was nil. As of

December 31, 2023, UTStarcom had cash, cash equivalents and

restricted cash of $59.6 million.

About UTStarcom Holdings

Corp.

UTStarcom is committed to helping network

operators offer their customers the most innovative, reliable and

cost-effective communication services. UTStarcom offers high

performance advanced equipment optimized for the most rapidly

growing network functions, such as mobile backhaul, metro

aggregation and broadband access. UTStarcom has operations and

customers around the world, with a special focus on Japan, India

and China. UTStarcom was founded in 1991 and listed its shares on

the Nasdaq Market in 2000 (symbol: UTSI). For more information

about UTStarcom, please visit http://www.utstar.com.

Forward-Looking Statements

This press release includes forward-looking

statements, including statements regarding the Company’s strategic

initiatives and the Company’s business outlook. These statements

are forward-looking in nature and subject to risks and

uncertainties that may cause actual results to differ materially

and adversely from the Company’s current expectations. These

include risks and uncertainties related to, among other things, the

effect of the COVID-19 pandemic on the Company’s business, changes

in the financial condition and cash position of the Company,

changes in the composition of the Company’s management and their

effect on the Company, the Company’s ability to realize anticipated

results of operational improvements and benefits of the divestiture

transaction, the ability to successfully identify and acquire

appropriate technologies and businesses for inorganic growth and to

integrate such acquisitions, the ability to internally innovate and

develop new products, assumptions the Company makes regarding the

growth of the market and the success of the Company’s offerings in

the market and the Company’s ability to execute its business plan

and manage regulatory matters. The risks and uncertainties also

include the risk factors identified in the Company’s latest annual

report on Form 20-F and current reports on Form 6-K as filed with

the Securities and Exchange Commission. The Company is in a period

of strategic transition and the conduct of its business is exposed

to additional risks as a result. All forward-looking statements

included in this press release are based upon information available

to the Company as of the date of this press release, which may

change and the Company assumes no obligation to update any such

forward-looking statements.

For investor and media inquiries, please

contact:

UTStarcom Holdings Corp. Tel: +86 571 8192 8888

Ms. Shelley Jiang, Investor Relations Email: utsi-ir@utstar.com/

Shelleyjiang@utstar.com /

|

UTStarcom Holdings Corp. Unaudited

Condensed Consolidated Balance Sheets |

|

|

|

|

December 31, |

|

December 31, |

|

|

2023 |

|

2022 |

|

|

(In thousands) |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

49,966 |

|

$ |

54,517 |

|

Notes receivable, net |

|

490 |

|

|

138 |

|

Accounts receivable, net |

|

8,380 |

|

|

11,867 |

|

Inventories and deferred costs |

|

886 |

|

|

1,322 |

|

Short-term restricted cash |

|

7,117 |

|

|

9,862 |

|

Prepaid and other current assets |

|

3,712 |

|

|

4,095 |

|

Total current assets |

|

70,551 |

|

|

81,801 |

|

Long-term assets: |

|

|

|

|

Property, plant and equipment, net |

|

575 |

|

|

604 |

|

Operating lease right-of-use assets, net |

|

2,649 |

|

|

2,969 |

|

Long-term restricted cash |

|

2,562 |

|

|

2,480 |

|

Other long-term assets |

|

1,349 |

|

|

1,376 |

|

Total long-term assets |

|

7,135 |

|

|

7,429 |

|

Total assets |

$ |

77,686 |

|

$ |

89,230 |

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

7,959 |

|

$ |

12,974 |

|

Customer advances |

|

226 |

|

|

123 |

|

Deferred revenue |

|

72 |

|

|

79 |

|

Income tax payable |

|

8,876 |

|

|

8,349 |

|

Operating lease liabilities, current |

|

1,184 |

|

|

1,228 |

|

Other current liabilities |

|

5,436 |

|

|

6,098 |

|

Total current liabilities |

|

23,753 |

|

|

28,851 |

|

Long-term liabilities: |

|

|

|

|

Operating lease liabilities, non-current |

|

1,660 |

|

|

1,894 |

|

Long-term deferred revenue and other liabilities |

|

1,049 |

|

|

1,021 |

|

Total liabilities |

|

26,462 |

|

|

31,766 |

|

|

|

|

|

|

Total equity |

|

51,224 |

|

|

57,464 |

|

Total liabilities and equity |

$ |

77,686 |

|

$ |

89,230 |

|

UTStarcom Holdings Corp. Unaudited

Condensed Consolidated Statements of Operations |

|

|

|

|

|

|

|

|

|

|

Six months ended December 31, |

|

|

Twelve months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(In thousands, except per share data) |

|

Net sales |

|

$ |

9,239 |

|

|

$ |

6,560 |

|

|

$ |

15,753 |

|

|

$ |

14,052 |

|

|

Cost of net sales |

|

|

6,669 |

|

|

|

5,220 |

|

|

|

11,362 |

|

|

|

11,385 |

|

|

Gross profit |

|

|

2,570 |

|

|

|

1,340 |

|

|

|

4,391 |

|

|

|

2,667 |

|

|

|

|

|

27.8 |

% |

|

|

20.4 |

% |

|

|

27.9 |

% |

|

|

19.0 |

% |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

2,424 |

|

|

|

773 |

|

|

|

5,316 |

|

|

|

2,292 |

|

|

Research and development |

|

|

3,007 |

|

|

|

2,148 |

|

|

|

5,881 |

|

|

|

4,762 |

|

|

Total operating expenses |

|

|

5,431 |

|

|

|

2,921 |

|

|

|

11,197 |

|

|

|

7,054 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(2,861 |

) |

|

|

(1,581 |

) |

|

|

(6,806 |

) |

|

|

(4,387 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

1,264 |

|

|

|

1,342 |

|

|

|

2,130 |

|

|

|

2,154 |

|

|

Other income (expense), net |

|

|

112 |

|

|

|

(2,303 |

) |

|

|

2,023 |

|

|

|

(706 |

) |

|

Loss before income taxes |

|

|

(1,485 |

) |

|

|

(2,542 |

) |

|

|

(2,653 |

) |

|

|

(2,939 |

) |

|

Income tax expense |

|

|

(518 |

) |

|

|

(780 |

) |

|

|

(1,362 |

) |

|

|

(2,063 |

) |

|

Net loss attributable to UTStarcom Holdings Corp. |

|

$ |

(2,003 |

) |

|

$ |

(3,322 |

) |

|

$ |

(4,015 |

) |

|

$ |

(5,002 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to UTStarcom Holdings

Corp.—Basic |

|

$ |

(0.22 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.55 |

) |

|

Weighted average shares outstanding—Basic |

|

|

9,116 |

|

|

|

9,093 |

|

|

|

9,113 |

|

|

|

9,056 |

|

|

UTStarcom Holdings Corp. Unaudited

Condensed Consolidated Statements of Cash Flows |

|

|

|

|

|

Six months ended December 31, |

|

|

Twelve months ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(In thousands) |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,003 |

) |

|

$ |

(3,322 |

) |

|

$ |

(4,015 |

) |

|

$ |

(5,002 |

) |

|

Depreciation |

|

|

113 |

|

|

|

100 |

|

|

|

229 |

|

|

|

206 |

|

|

Recovery of credit losses |

|

|

(317 |

) |

|

|

(1,667 |

) |

|

|

(1,315 |

) |

|

|

(3,465 |

) |

|

Stock-based compensation expense |

|

|

110 |

|

|

|

264 |

|

|

|

293 |

|

|

|

603 |

|

|

Net loss on disposal of assets |

|

|

- |

|

|

|

(2 |

) |

|

|

(25 |

) |

|

|

(2 |

) |

|

Gain on release of tax liability due to expiration of the statute

of limitations |

|

|

(10 |

) |

|

|

(10 |

) |

|

|

(21 |

) |

|

|

(21 |

) |

|

Lease amortization |

|

|

584 |

|

|

|

249 |

|

|

|

1,200 |

|

|

|

994 |

|

|

Deferred income taxes |

|

|

- |

|

|

|

1,135 |

|

|

|

— |

|

|

|

1,135 |

|

|

Changes in operating assets and liabilities |

|

|

820 |

|

|

|

6,681 |

|

|

|

(866 |

) |

|

|

12,829 |

|

|

Net cash provided by (used in) operating activities |

|

|

(703 |

) |

|

|

3,428 |

|

|

|

(4,520 |

) |

|

|

7,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions to property, plant and equipment |

|

|

— |

|

|

|

(174 |

) |

|

|

(182 |

) |

|

|

(250 |

) |

|

Net cash used in investing activities |

|

|

— |

|

|

|

(174 |

) |

|

|

(182 |

) |

|

|

(250 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

— |

|

|

|

20 |

|

|

|

4 |

|

|

|

20 |

|

|

Repurchase of ordinary shares |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13 |

) |

|

Net cash provided by financing activities |

|

|

— |

|

|

|

20 |

|

|

|

4 |

|

|

|

7 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

(213 |

) |

|

|

(872 |

) |

|

|

(2,516 |

) |

|

|

(6,451 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

|

(916 |

) |

|

|

2,402 |

|

|

|

(7,214 |

) |

|

|

583 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

|

60,561 |

|

|

|

64,457 |

|

|

|

66,859 |

|

|

|

66,276 |

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

59,645 |

|

|

$ |

66,859 |

|

|

$ |

59,645 |

|

|

$ |

66,859 |

|

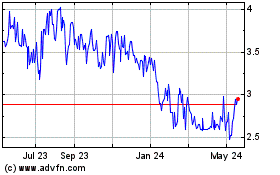

UTStarcom (NASDAQ:UTSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

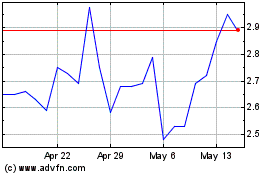

UTStarcom (NASDAQ:UTSI)

Historical Stock Chart

From Jan 2024 to Jan 2025