Visteon Completes Sale of Its Swansea, UK, Operation; Provides Restructuring and Improvement Plan Update

July 07 2008 - 1:56PM

PR Newswire (US)

VAN BUREN TOWNSHIP, Mich., July 7, 2008 /PRNewswire/ -- Visteon

Corporation (NYSE:VC) has completed the sale of its Swansea, United

Kingdom, operation to Linamar Corporation, a Canadian-based auto

parts manufacturer. The Swansea sale represents a significant

milestone in Visteon's effort to address non-core facilities and

improve its financial performance in connection with its three-year

improvement plan. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) "We are

making solid progress in addressing the financial performance of

our UK operations and this is an important step in that process,"

said Donald J. Stebbins, Visteon president and chief executive

officer. "This sale is the result of significant efforts to find a

viable alternative for the chassis operations at the Swansea plant,

which are not aligned with Visteon's core product groups." The

Swansea operation, Visteon's largest operation in the UK, generated

negative gross margin of approximately $40 million on sales of

approximately $80 million during 2007. The company transferred

certain Swansea-related assets to a newly created and wholly-owned

entity whose shares were acquired by Linamar for nominal cash

consideration. Visteon expects to record losses approximating $50

million in connection with this transaction, of which approximately

$15 million is expected to be reimbursed from the restructuring

escrow account. In addition to the sale of Swansea, in the second

quarter of 2008 Visteon also completed the planned closure of two

non-core fuel tank facilities in Germany and ceased production at

its operation in Bedford, Indiana, USA. These actions bring the

number of completed actions to 23 of 30 previously identified

restructuring actions under Visteon's improvement plan.

Furthermore, Visteon has previously announced its intention to

close its fuel tank facility in Missouri early in the third quarter

of 2008, after which only six restructuring actions will remain.

Visteon continues to take additional actions to improve its cost

structure. In June, the company announced its intention to close

its interiors facility in Durant, Mississippi, USA and consolidate

production into other existing facilities. The company has also

taken steps to address its capital structure and reduce its near

term debt maturities. In June, Visteon repurchased $344 million in

aggregate principal amount of its senior notes due in 2010 and

issued $206 million in aggregated principal amount of new senior

notes due in 2016. "Our significant restructuring efforts have

resulted in fundamental improvements in our global operations as we

continue to focus on our core products," Stebbins said. "We have

been focused on implementing our restructuring actions on schedule

and accelerating our plan wherever possible. Although the

automotive industry is facing very difficult times in North

America, this region represents less than 30 percent of Visteon's

total sales. Production decreases by North American automakers are

being largely offset by growth in other regions of the world,

particularly in Asia. Our diversification by customer and

geography, coupled with our improvement actions, has allowed

Visteon to continue to improve its financial performance during the

first half of 2008, despite the difficult North American market.

This improved financial performance will be discussed during

Visteon's conference call announcing our second quarter results."

Visteon Corporation is a leading global automotive supplier that

designs, engineers and manufactures innovative climate, interior,

electronic and lighting products for vehicle manufacturers, and

also provides a range of products and services to aftermarket

customers. With corporate offices in Van Buren Township, Mich.

(U.S.); Shanghai, China; and Kerpen, Germany; the company has

facilities in 26 countries and employs approximately 40,000 people.

Forward-looking Information This press release contains

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are not guarantees of future results and conditions but

rather are subject to various factors, risks and uncertainties that

could cause our actual results to differ materially from those

expressed in these forward-looking statements, including general

economic conditions, changes in interest rates and fuel prices; the

automotive vehicle production volumes and schedules of our

customers, and in particular Ford's vehicle production volumes;

work stoppages at our customers; our ability to satisfy our future

capital and liquidity requirements and comply with the terms of our

existing credit agreements and indentures; the financial distress

of our suppliers, or other significant suppliers to our customers,

and possible disruptions in the supply of commodities to us or our

customers due to financial distress or work stoppages; our ability

to timely implement, and realize the anticipated benefits of

restructuring and other cost-reduction initiatives, including our

multi-year improvement plan, and our successful execution of

internal performance plans and other productivity efforts; the

timing and expenses related to restructurings, employee reductions,

acquisitions or dispositions; increases in raw material and energy

costs and our ability to offset or recover these costs; the effects

of reorganization and/or restructuring plans announced by our

customers; the effect of pension and other post-employment benefit

obligations; increases in our warranty, product liability and

recall costs; the outcome of legal or regulatory proceedings to

which we are or may become a party; as well as those factors

identified in our filings with the SEC (including our Annual Report

on Form 10-K for the fiscal year ended Dec. 31, 2007). We assume no

obligation to update these forward-looking statements.

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO

http://photoarchive.ap.org/ DATASOURCE: Visteon Corporation

CONTACT: Media, Julie Fream, +1-734-710-7250, , or Jonna

Christensen, 44-1268-701094, , or Investors, Derek Fiebig,

+1-734-710-5800, , all of Visteon Corporation Web site:

http://www.visteon.com/

Copyright

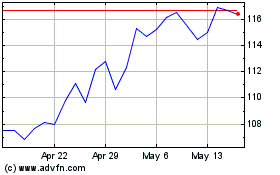

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

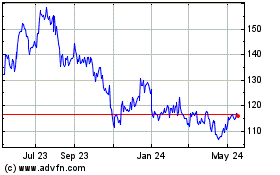

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024