Visteon Corporation (NASDAQ: VC) today reported first quarter

financial results. Highlights include:

- Net sales of $933 million

with a return to positive

growth-over-market1

- Net income of $42

million

- Adjusted EBITDA of $102

million or 10.9%

of sales

- Operating cash flow of $69 million and adjusted free

cash flow of $34 million

- Launched 26 new products across 14 OEMs

- Won $1.4 billion in new business, including over $400

million of displays wins

- Net cash of $175 million at quarter end

Visteon reported net sales of $933 million

compared to $967 million in the first quarter of the prior year.

The decline in net sales was primarily due to lower recoveries

resulting from improved semiconductor supply in the first quarter

of 2024 and 1% lower customer vehicle production. Visteon's sales

outperformed customer vehicle production volumes by 2%1, driven by

the ramp up of recent product launches and continued growth of our

electrification products.

Gross margin in the first quarter was $119

million, and net income attributable to Visteon was $42 million, or

$1.50 per diluted share. Adjusted EBITDA, a non-GAAP measure as

defined below, was $102 million, an increase of $3 million compared

to the prior year. The increase in adjusted EBITDA reflects the

favorable impact of strong operational performance and ongoing cost

and commercial discipline, partially offset by the timing of

engineering recoveries and an unfavorable foreign exchange impact.

Adjusted EBITDA margin was 10.9% of sales, an increase of 70 basis

points compared to the prior year.

The company won $1.4 billion in new business in

the first quarter, continuing to position Visteon as a leader in

the digitalization of the cockpit. First quarter wins included over

$400 million of displays wins, including dual 12" displays for a

European commercial vehicle OEM, a 10" cross-carline display for a

European OEM, and an 8" ultra-thin OLED rear seat monitor for a

German luxury OEM. Additional wins in the quarter included a 12"

digital cluster with a Japanese OEM, demonstrating further momentum

with a recently added customer, and a SmartCore™ program win with a

domestic Chinese OEM for a premium brand. We continue to diversify

and expand into adjacent markets with over $300 million of wins for

the two-wheeler and commercial vehicle markets in the quarter.

Visteon’s products launched on 26 vehicle models

across 14 OEMs in the first quarter. These product launches

continue to build the foundation for Visteon's ongoing market

outperformance. Key new launches included a digital cluster, a

center display, and audio infotainment on the Ford Puma for Europe,

a digital cluster on the Honda e:NS2 electric vehicle for several

Asian markets including China, and a SmartCore™ program on Scania

commercial vehicles, providing another example of our success in

the commercial vehicle market.

For the first three months of 2024, cash

provided by operations was $69 million and capital expenditures

were $37 million. Adjusted free cash flow, a non-GAAP financial

measure as defined below was $34 million. The company ended the

first quarter of 2024 with cash of $507 million and debt of $332

million, representing a net cash position of $175 million.

Visteon repurchased $20 million of shares in the

first quarter of 2024 under the $300 million share repurchase

authorization announced in March 2023.

“Our first quarter results highlight our

continued progress on addressing the megatrends of digitalization

and electrification that are rapidly changing the automotive

industry. I am very proud of our continued operational execution

and launching a high number of new products across the globe to

support our customers and deliver near-term growth,” said President

and CEO Sachin Lawande. "We are also strengthening our future with

another strong quarter of new business wins across our digital

cockpit products while further diversifying into adjacent end

markets."

Visteon is maintaining its full-year 2024

guidance and anticipates sales in the range of $4.0 to $4.2

billion, adjusted EBITDA in the range of $470 to $500 million, and

adjusted free cash flow in the range of $155 to $185 million.

About

Visteon

Visteon is advancing mobility through innovative

technology solutions that enable a software-defined and electric

future. With next-generation digital cockpit and electrification

products, Visteon leverages the strength and agility of its global

network with a local footprint to deliver a cleaner, safer and more

connected vehicle experience. Headquartered in Van Buren Township,

Michigan, Visteon operates in 17 countries worldwide, recorded

approximately $3.95 billion in annual sales and booked $7.2 billion

of new business in 2023. Learn more at investors.visteon.com/.

Conference Call and

Presentation

Today, Thursday, April 25, at 9 a.m. ET, the

company will host a conference call for the investment community to

discuss the quarter’s results and other related items. The

conference call is available to the general public via a live audio

webcast.

The dial-in numbers to participate in the call

are:

U.S./Canada: 1-888-330-2508 Outside U.S./Canada:

1-240-789-2735 Conference ID: 8897485

(Call approximately 10 minutes before the start

of the conference.)

The conference call and live audio webcast,

related presentation materials and other supplemental information

will be accessible in the Investors section of Visteon’s

website.

Use of Non-GAAP Financial Information

Because not all companies use identical

calculations, adjusted EBITDA, adjusted net income, adjusted EPS,

free cash flow and adjusted free cash flow used throughout this

press release may not be comparable to other similarly titled

measures of other companies.

In order to provide the forward-looking non-GAAP

financial measures for full-year 2024, the company provides

reconciliations to the most directly comparable GAAP financial

measures on the subsequent slides. The provision of these

comparable GAAP financial measures is not intended to indicate that

the company is explicitly or implicitly providing projections on

those GAAP financial measures, and actual results for such measures

are likely to vary from those presented. The reconciliations

include all information reasonably available to the company at the

date of this press release and the adjustments that management can

reasonably predict.

Forward-looking Information

This press release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. The words "will," "may," "designed to,"

"outlook," "believes," "should," "anticipates," "plans," "expects,"

"intends," "estimates," "forecasts" and similar expressions

identify certain of these forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions but rather are subject to various factors, risks and

uncertainties that could cause our actual results to differ

materially from those expressed in these forward-looking

statements, including, but not limited to:

- continued and future impacts of the

geopolitical conflicts and related supply chain disruptions,

including but not limited to the conflicts in the middle east,

Russia and East Asia and the possible the imposition of

sanctions;

- significant or prolonged shortage

of critical components from our suppliers, including but not

limited to semiconductors, and particularly those who are our sole

or primary sources;

- failure of the Company’s joint

venture partners to comply with contractual obligations or to exert

undue influence or pressure in China;

- our ability to avoid or continue to

operate during a strike, or partial work stoppage or slow down at

any of our principal customers;

- conditions within the automotive

industry, including (i) the automotive vehicle production volumes

and schedules of our customers, (ii) the financial condition of our

customers and the effects of any restructuring or reorganization

plans that may be undertaken by our customers, including work

stoppages at our customers, and (iii) possible disruptions in the

supply of commodities to us or our customers due to financial

distress, work stoppages, natural disasters or civil unrest;

- our ability to satisfy future

capital and liquidity requirements; including our ability to access

the credit and capital markets at the times and in the amounts

needed and on terms acceptable to us; our ability to comply with

financial and other covenants in our credit agreements; and the

continuation of acceptable supplier payment terms;

- our ability to access funds

generated by foreign subsidiaries and joint ventures on a timely

and cost-effective basis;

- general economic conditions,

including changes in interest rates and fuel prices; the timing and

expenses related to internal restructurings, employee reductions,

acquisitions or dispositions and the effect of pension and other

post-employment benefit obligations;

- disruptions in information

technology systems including, but not limited to, system failure,

cyber-attack, malicious computer software (malware including

ransomware), unauthorized physical or electronic access, or other

natural or man-made incidents or disasters;

- increases in raw material and

energy costs and our ability to offset or recover these costs;

increases in our warranty, product liability and recall costs or

the outcome of legal or regulatory proceedings to which we are or

may become a party;

- changes in laws, regulations,

policies or other activities of governments, agencies and similar

organizations, domestic and foreign, that may tax or otherwise

increase the cost of, or otherwise affect, the manufacture,

licensing, distribution, sale, ownership or use of our products or

assets; and

- those factors identified in our

filings with the SEC (including our Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, as updated by our

subsequent filings with the Securities and Exchange

Commission).

Caution should be taken not to place undue

reliance on our forward-looking statements, which represent our

view only as of the date of this release, and which we assume no

obligation to update. The financial results presented herein are

preliminary and unaudited; final financial results will be included

in the company's Quarterly Report on Form 10-Q for the fiscal

quarter ended March 31, 2024. New business wins and re-wins do not

represent firm orders or firm commitments from customers, but are

based on various assumptions, including the timing and duration of

product launches, vehicle production levels, customer price

reductions and currency exchange rates.

Follow Visteon:

https://www.linkedin.com/company/visteon https://twitter.com/visteon https://www.facebook.com/VisteonCorporation https://www.youtube.com/user/Visteonhttps://www.instagram.com/visteon/ https://mp.weixin.qq.com/?lang=en_US https://m.weibo.cn/u/6605315328 http://i.youku.com/u/UNDgyMjA1NjUxNg==?spm=a2h0k.8191407.0.0

|

|

|

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(LOSS) (In millions except per share amounts)

(Unaudited) |

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

Net sales |

$ |

933 |

|

|

$ |

967 |

|

|

Cost of sales |

|

(814 |

) |

|

|

(857 |

) |

|

Gross margin |

|

119 |

|

|

|

110 |

|

|

Selling, general and administrative expenses |

|

(52 |

) |

|

|

(52 |

) |

|

Restructuring, net |

|

(2 |

) |

|

|

(1 |

) |

|

Interest expense, net |

|

— |

|

|

|

(3 |

) |

|

Equity in net income (loss) of non-consolidated affiliates |

|

(4 |

) |

|

|

(5 |

) |

|

Other income, net |

|

2 |

|

|

|

3 |

|

|

Income (loss) before income taxes |

|

63 |

|

|

|

52 |

|

|

Provision for income taxes |

|

(19 |

) |

|

|

(14 |

) |

|

Net income (loss) |

|

44 |

|

|

|

38 |

|

|

Less: Net (income) loss attributable to non-controlling

interests |

|

(2 |

) |

|

|

(4 |

) |

|

Net income (loss) attributable to Visteon Corporation |

$ |

42 |

|

|

$ |

34 |

|

|

|

|

|

|

|

Comprehensive income |

$ |

29 |

|

|

$ |

53 |

|

|

Less: Comprehensive (income) loss attributable to non-controlling

interests |

|

(1 |

) |

|

|

(3 |

) |

|

Comprehensive income (loss) attributable to Visteon

Corporation |

$ |

28 |

|

|

$ |

50 |

|

|

|

|

|

|

|

Basic earnings (loss) per share attributable to Visteon

Corporation |

$ |

1.52 |

|

|

$ |

1.21 |

|

|

|

|

|

|

|

Diluted earnings (loss) per share attributable to Visteon

Corporation |

$ |

1.50 |

|

|

$ |

1.18 |

|

|

|

|

|

|

|

Average shares outstanding (in millions) |

|

|

|

|

Basic |

|

27.6 |

|

|

|

28.2 |

|

|

Diluted |

|

28.0 |

|

|

|

28.7 |

|

|

|

|

|

|

|

|

|

|

| VISTEON

CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (In millions) |

| |

| |

(Unaudited) |

|

|

| |

March

31, |

|

December

31, |

|

|

2024 |

|

2023 |

|

ASSETS |

|

|

|

|

Cash and equivalents |

$ |

504 |

|

|

$ |

515 |

|

| Restricted

cash |

|

3 |

|

|

|

3 |

|

| Accounts

receivable, net |

|

652 |

|

|

|

666 |

|

| Inventories,

net |

|

342 |

|

|

|

298 |

|

| Other

current assets |

|

129 |

|

|

|

134 |

|

| Total

current assets |

|

1,630 |

|

|

|

1,616 |

|

| |

|

|

|

| Property and

equipment, net |

|

415 |

|

|

|

418 |

|

| Intangible

assets, net |

|

87 |

|

|

|

90 |

|

| Right-of-use

assets |

|

120 |

|

|

|

109 |

|

| Investments

in non-consolidated affiliates |

|

30 |

|

|

|

35 |

|

| Deferred tax

assets - non-current |

|

378 |

|

|

|

384 |

|

| Other

non-current assets |

|

79 |

|

|

|

75 |

|

| Total

assets |

$ |

2,739 |

|

|

$ |

2,727 |

|

| |

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

| Short-term

debt |

$ |

18 |

|

|

$ |

18 |

|

| Accounts

payable |

|

566 |

|

|

|

551 |

|

| Accrued

employee liabilities |

|

84 |

|

|

|

99 |

|

| Current

lease liability |

|

31 |

|

|

|

30 |

|

| Other

current liabilities |

|

239 |

|

|

|

233 |

|

| Total

current liabilities |

|

938 |

|

|

|

931 |

|

| |

|

|

|

| Long-term

debt, net |

|

314 |

|

|

|

318 |

|

| Employee

benefits non-current |

|

156 |

|

|

|

160 |

|

| Non-current

lease liability |

|

89 |

|

|

|

79 |

|

| Deferred tax

liabilities - non-current |

|

32 |

|

|

|

31 |

|

| Other

non-current liabilities |

|

76 |

|

|

|

85 |

|

| |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock |

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

1,350 |

|

|

|

1,356 |

|

|

Retained earnings |

|

2,316 |

|

|

|

2,274 |

|

|

Accumulated other comprehensive loss |

|

(268 |

) |

|

|

(254 |

) |

|

Treasury stock |

|

(2,350 |

) |

|

|

(2,339 |

) |

| Total

Visteon Corporation stockholders’ equity |

|

1,049 |

|

|

|

1,038 |

|

|

Non-controlling interests |

|

85 |

|

|

|

85 |

|

| Total

equity |

|

1,134 |

|

|

|

1,123 |

|

| Total

liabilities and equity |

$ |

2,739 |

|

|

$ |

2,727 |

|

| |

|

|

|

|

|

|

|

|

VISTEON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (In

millions) (Unaudited) |

|

|

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

2023 |

|

OPERATING |

|

|

|

|

Net income |

$ |

44 |

|

|

$ |

38 |

|

|

Adjustments to reconcile net income to net cash provided from (used

by) operating activities: |

|

|

|

|

Depreciation and amortization |

|

22 |

|

|

|

29 |

|

|

Non-cash stock-based compensation |

|

10 |

|

|

|

8 |

|

|

Equity in net loss/(income) of non-consolidated affiliates, net of

dividends remitted |

|

4 |

|

|

|

5 |

|

|

Other non-cash items |

|

3 |

|

|

|

(2 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

3 |

|

|

|

(13 |

) |

|

Inventories |

|

(51 |

) |

|

|

(5 |

) |

|

Accounts payable |

|

37 |

|

|

|

(59 |

) |

|

Other assets and other liabilities |

|

(3 |

) |

|

|

(20 |

) |

|

Net cash provided from (used by) operating activities |

|

69 |

|

|

|

(19 |

) |

|

INVESTING |

|

|

|

|

Capital expenditures, including intangibles |

|

(37 |

) |

|

|

(21 |

) |

|

Other |

|

— |

|

|

|

1 |

|

|

Net cash used by investing activities |

|

(37 |

) |

|

|

(20 |

) |

|

FINANCING |

|

|

|

|

Short-term debt, net |

|

— |

|

|

|

3 |

|

|

Principal repayment of term debt facility |

|

(4 |

) |

|

|

— |

|

|

Dividends paid to non-controlling interests |

|

— |

|

|

|

(8 |

) |

|

Repurchase of common stock |

|

(20 |

) |

|

|

— |

|

|

Stock based compensation tax withholding payments |

|

(7 |

) |

|

|

— |

|

|

Net cash used by financing activities |

|

(31 |

) |

|

|

(5 |

) |

|

Effect of exchange rate changes on cash |

|

(12 |

) |

|

|

8 |

|

|

Net decrease in cash, equivalents, and restricted cash |

|

(11 |

) |

|

|

(36 |

) |

|

Cash, equivalents, and restricted cash at beginning of the

period |

|

518 |

|

|

|

523 |

|

|

Cash, equivalents, and restricted cash at end of the period |

$ |

507 |

|

|

$ |

487 |

|

| |

|

|

|

|

|

|

|

|

VISTEON CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (In

millions except per share amounts) (Unaudited) |

| |

Adjusted

EBITDA: Adjusted EBITDA is presented as a

supplemental measure of the Company's performance that management

believes is useful to investors because the excluded items may vary

significantly in timing or amounts and/or may obscure trends useful

in evaluating and comparing the Company's operating activities

across reporting periods. The Company defines adjusted EBITDA as

net income attributable to the Company adjusted to eliminate the

impact of depreciation and amortization, provision for (benefit

from) income taxes, non-cash stock-based compensation expense, net

interest expense, net income attributable to non-controlling

interests, net restructuring expense, equity in net (income)/loss

of non-consolidated affiliates, gain on non-consolidated affiliate

transactions, and other gains and losses not reflective of the

Company's ongoing operations. Because not all companies use

identical calculations, this presentation of adjusted EBITDA may

not be comparable to similarly titled measures of other

companies.

|

|

Three Months Ended |

|

Estimated |

|

|

March 31, |

|

Full Year |

|

Visteon: |

2024 |

|

2023 |

|

2024 |

|

Net income attributable to Visteon Corporation |

$ |

42 |

|

|

$ |

34 |

|

|

$ |

220 |

|

|

Depreciation and amortization |

|

22 |

|

|

|

29 |

|

|

|

105 |

|

|

Provision for (benefit from) income taxes |

|

19 |

|

|

|

14 |

|

|

|

80 |

|

|

Non-cash, stock-based compensation expense |

|

10 |

|

|

|

8 |

|

|

|

35 |

|

|

Interest expense, net |

|

— |

|

|

|

3 |

|

|

|

5 |

|

|

Net income (loss) attributable to non-controlling interests |

|

2 |

|

|

|

4 |

|

|

|

20 |

|

|

Restructuring, net |

|

2 |

|

|

|

1 |

|

|

|

5 |

|

|

Equity in net (income) loss of non-consolidated affiliates |

|

4 |

|

|

|

5 |

|

|

|

10 |

|

|

Other |

|

1 |

|

|

|

1 |

|

|

|

5 |

|

|

Adjusted EBITDA |

$ |

102 |

|

|

$ |

99 |

|

|

$ |

4852 |

|

|

|

|

|

|

|

|

Adjusted EBITDA is not a recognized term under

U.S. GAAP and does not purport to be a substitute for net income as

an indicator of operating performance or cash flows from operating

activities as a measure of liquidity. Adjusted EBITDA has

limitations as an analytical tool and is not intended to be a

measure of cash flow available for management's discretionary use,

as it does not consider certain cash requirements such as interest

payments, tax payments and debt service requirements. In addition,

the Company uses adjusted EBITDA (i) as a factor in incentive

compensation decisions, (ii) to evaluate the effectiveness of the

Company's business strategies, and (iii) because the Company's

credit agreements use similar measures for compliance with certain

covenants.

|

VISTEON CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (In

millions except per share amounts) (Unaudited) |

| |

Free Cash Flow and Adjusted Free Cash

Flow: Free cash flow and adjusted free cash flow are

presented as supplemental measures of the Company's liquidity that

management believes are useful to investors in analyzing the

Company's ability to service and repay its debt. The Company

defines free cash flow as cash flow provided from operating

activities less capital expenditures, including intangibles. The

Company defines adjusted free cash flow as cash flow provided from

operating activities less capital expenditures, including

intangibles as further adjusted for restructuring related payments.

Because not all companies use identical calculations, this

presentation of free cash flow and adjusted free cash flow may not

be comparable to other similarly titled measures of other

companies.

|

|

Three Months Ended |

|

Estimated |

|

|

March 31, |

|

Full Year |

|

Visteon: |

2024 |

|

2023 |

|

2024 |

|

Cash provided from (used by) operating activities |

$ |

69 |

|

|

$ |

(19 |

) |

|

$ |

305 |

|

|

Capital expenditures, including intangibles |

|

(37 |

) |

|

|

(21 |

) |

|

|

(145 |

) |

|

Free cash flow |

$ |

32 |

|

|

$ |

(40 |

) |

|

$ |

160 |

|

|

Restructuring related payments |

|

2 |

|

|

|

3 |

|

|

|

10 |

|

|

Adjusted free cash flow |

$ |

34 |

|

|

$ |

(37 |

) |

|

$ |

1703 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Free cash flow and adjusted free cash flow are

not recognized terms under U.S. GAAP and do not purport to be a

substitute for cash flows from operating activities as a measure of

liquidity. Free cash flow and adjusted free cash flow have

limitations as analytical tools as they do not reflect cash used to

service debt and do not reflect funds available for investment or

other discretionary uses. In addition, the Company uses free cash

flow and adjusted free cash flow (i) as factors in incentive

compensation decisions and (ii) for planning and forecasting future

periods.

|

VISTEON CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (In

millions except per share amounts) (Unaudited) |

| |

Adjusted Net Income and Adjusted

Earnings Per Share: Adjusted net income and adjusted

earnings per share are presented as supplemental measures that

management believes are useful to investors in analyzing the

Company's profitability, providing comparability between periods by

excluding certain items that may not be indicative of recurring

business operating results. The Company believes management and

investors benefit from referring to these supplemental measures in

assessing company performance and when planning, forecasting and

analyzing future periods. The Company defines adjusted net income

as net income attributable to Visteon adjusted to eliminate the

impact of restructuring expense, loss on divestiture, gain on

non-consolidated affiliate transactions, other gains and losses not

reflective of the Company's ongoing operations and related tax

effects. The Company defines adjusted earnings per share as

adjusted net income divided by diluted shares. Because not all

companies use identical calculations, this presentation of adjusted

net income and adjusted earnings per share may not be comparable to

other similarly titled measures of other companies.

|

|

Three Months Ended |

|

|

March 31, |

|

|

2024 |

|

2023 |

|

Net income attributable to Visteon |

$ |

42 |

|

|

$ |

34 |

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share: |

|

|

|

|

|

|

|

|

Net income attributable to Visteon |

$ |

42 |

|

|

$ |

34 |

|

|

Average shares outstanding, diluted |

|

28.0 |

|

|

|

28.7 |

|

|

Diluted earnings per share |

$ |

1.50 |

|

|

$ |

1.18 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income and adjusted earnings per

share: |

|

|

|

|

|

|

|

|

Net income attributable to Visteon |

$ |

42 |

|

|

$ |

34 |

|

|

Restructuring, net |

|

2 |

|

|

|

1 |

|

|

Other, including tax effects of adjustments |

|

1 |

|

|

|

1 |

|

|

Adjusted net income |

$ |

45 |

|

|

$ |

36 |

|

|

Average shares outstanding, diluted |

|

28.0 |

|

|

|

28.7 |

|

|

Adjusted earnings per share |

$ |

1.61 |

|

|

$ |

1.25 |

|

|

|

|

|

|

Adjusted net income and adjusted earnings per

share are not recognized terms under U.S. GAAP and do not purport

to be a substitute for profitability. Adjusted net income and

adjusted earnings per share have limitations as analytical tools as

they do not consider certain restructuring and transaction-related

payments and/or expenses. In addition, the Company uses adjusted

net income and adjusted earnings per share for internal planning

and forecasting purposes.

________________________ 1 Visteon Y/Y sales growth (ex. FX and

net pricing) compared to production for Visteon Customers weighted

on Visteon sales contribution. 2 Based on mid-point of the range of

the Company's financial guidance. 3 Based on mid-point of the range

of the Company's financial guidance.

Visteon Contacts:

Media:

Media@Visteon.com

Investors:

Ryan Wentling

investor@visteon.com

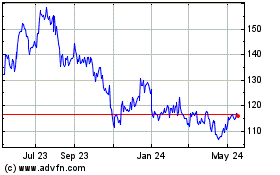

Visteon (NASDAQ:VC)

Historical Stock Chart

From Nov 2024 to Dec 2024

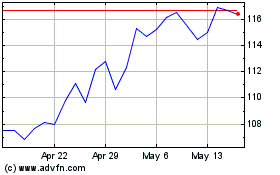

Visteon (NASDAQ:VC)

Historical Stock Chart

From Dec 2023 to Dec 2024